15 December 2022 Morning Session Analysis

US Dollar dived despite Fed keeps hawkish tone.

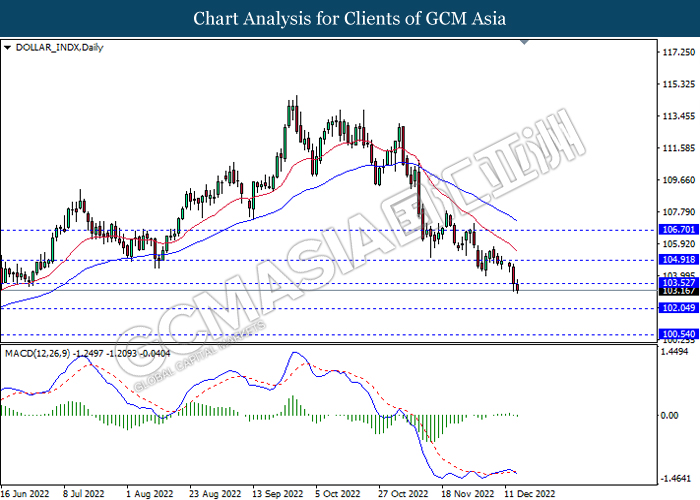

The Dollar Index which traded against basket of six major currencies dropped significantly despite the hawkish statement from Fed Chairman. According to Reuters, the Federal Reserve Chairman Jerome Powell claimed on FOMC Press Conference that the recent inflation data was not enough to change its outlook for inflation yet, although the CPI data has shown that the inflation risk in the US was cooling down. Besides, the US central bank’s projection of the target federal funds rate rising to 5.1% in 2023, which is slightly higher than investors expected heading into this week’s two-day policy meeting. With that, the Dollar Index has skyrocketed immediately after the speech has been unleashed. Nonetheless, the Dollar Index has remained its bearish movement, as market participants remain skeptical that the Federal Reserve will continue to raise interest rates aggressively. According to Fed Rate Monitor Tool, the likelihood of 25 basis point rate hike in the February meeting has reached 95%, whereas the chance of half a percentage point rate increase was about 5%. As of writing, the Dollar Index depreciated by 0.32% to 103.24.

In the commodities market, the crude oil price edged down by 0.14% to $77.17 per barrel as of writing following the Canada’s TC Energy Corp claimed that it expected to give an update on the Keystone pipeline restart later on Wednesday. On the other hand, the gold price eased by 0.06% to $1806.71 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

18:00 EUR EU Leaders Summit

20:00 GBP BoE MPC Meeting Minutes

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | CHF – SNB Interest Rate Decision (Q4) | 0.50% | 1.00% | – |

| 20:00 | GBP – BoE Interest Rate Decision (Dec) | 3.00% | 3.50% | – |

| 21:15 | EUR – Deposit Facility Rate (Dec) | 1.50% | 2.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 2.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Dec) | 1.50% | 2.50% | – |

| 21:30 | USD – Core Retail Sales (MoM) (Nov) | 1.3% | 0.2% | – |

| 21:30 | USD – Initial Jobless Claims | 230K | 230K | – |

| 21:30 | USD – Philadelphia Fed Manufacturing Index (Dec) | 4.50 | -1.00 | – |

| 21:30 | USD – Retail Sales (MoM) (Nov) | 1.3% | -0.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.50, 104.90

Support level: 102.05, 100.55

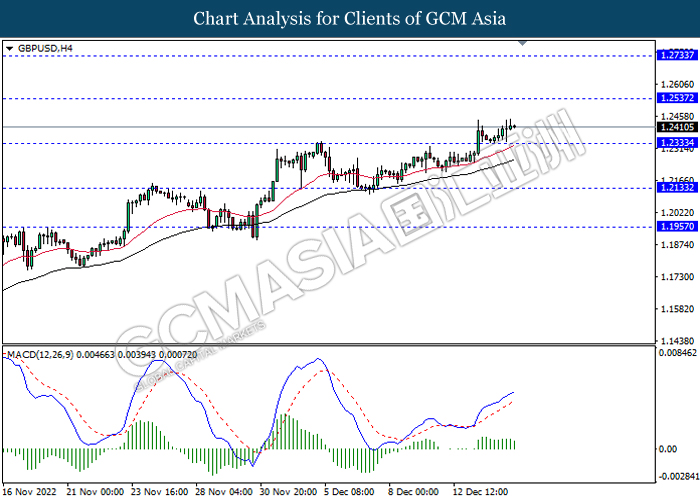

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2735

Support level: 1.2335, 1.2135

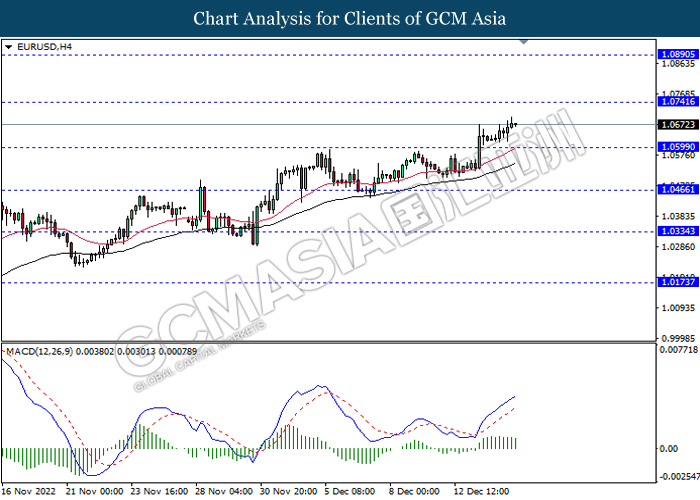

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

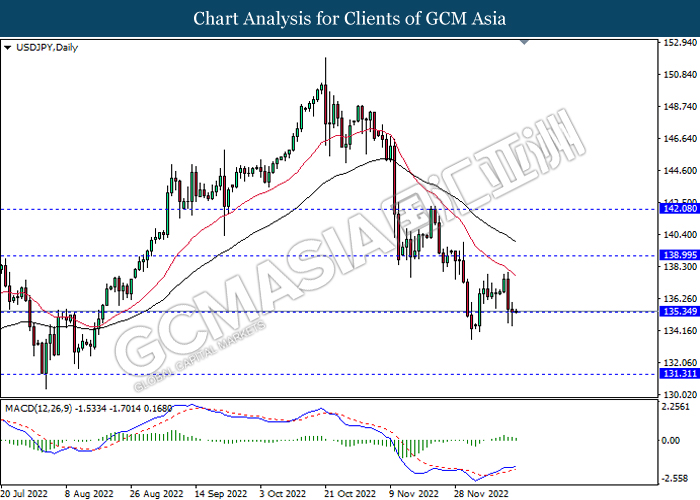

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

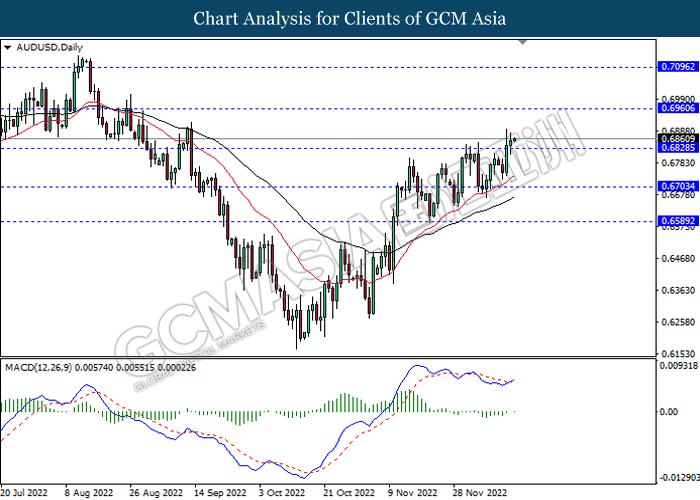

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6960, 0.7095

Support level: 0.6830, 0.6705

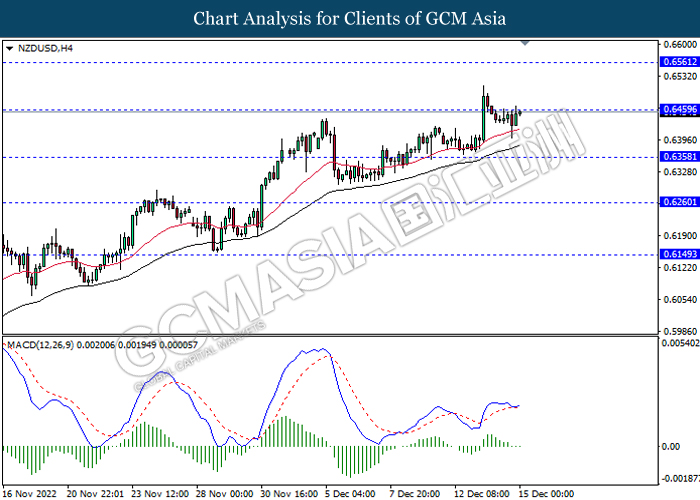

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

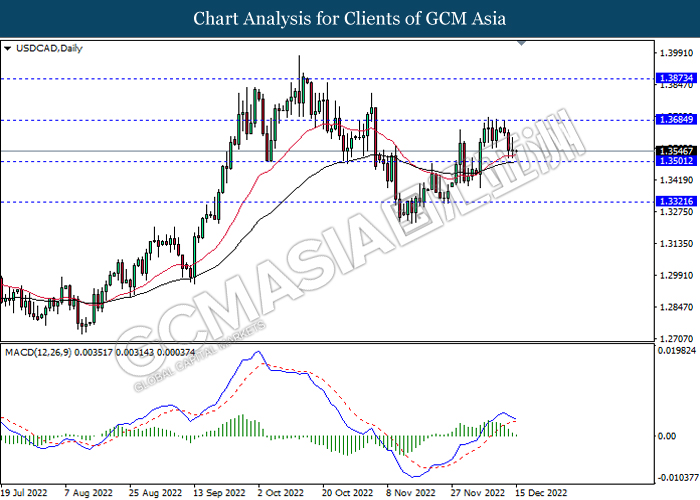

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

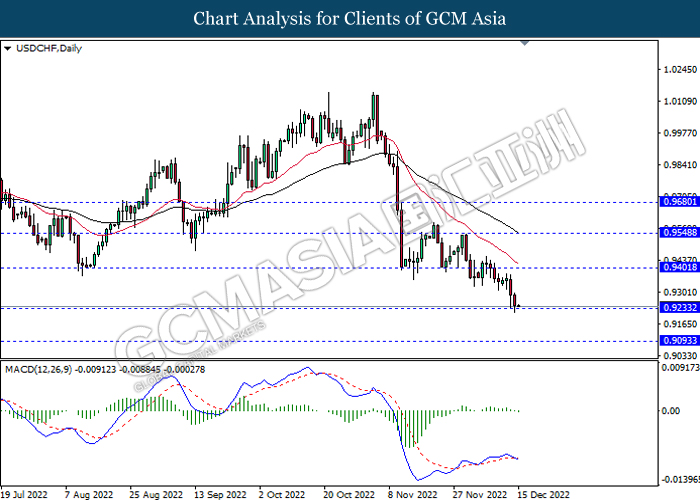

USDCHF, Daily: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9095

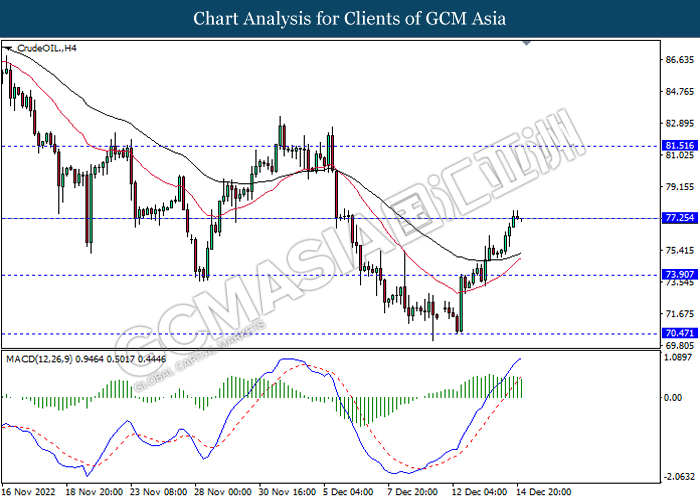

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

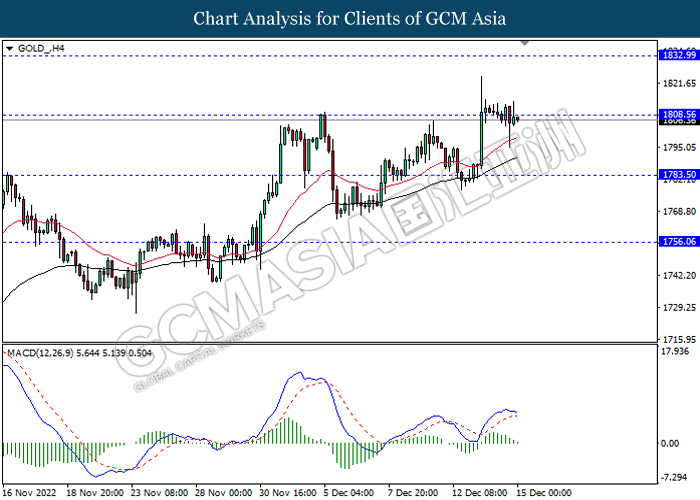

GOLD_, H4: Gold price was traded lower following prior breakout below the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05