19 December 2022 Morning Session Analysis

US Dollar’s bull continued upon hawkish stance from Fed member.

The Dollar Index which traded against a basket of six major currencies extended its gains on Friday following the rising hopes upon the hawkish Fed speech. Last week, Federal Reserve decided to hike its interest rate by 50 basis points to 4.50%, as well as Fed Chairman Jerome Powell signaled that further rate hikes would be come through. On Friday, another Fed member, New York Fed President John Williams has reiterated the hawkish rhetoric, saying it remains possible the US central bank raises interest rates more than it currently expects next year. The Fed has projected the peak fed funds rate at 5.1%. On the economic data front, a series of downbeat data such as Manufacturing PMI, Services PMI, and S&P Global Composite PMI had below the expected reading, which indicates the contraction in the US private sector. With that, the Dollar Index has retreated some previous gains. However, the bearish economic data would be less likely to stop the Fed from hiking its rate, since the hawkish stance was declared. As of writing, the Dollar Index appreciated by 0.08% to 104.41.

In the commodities market, the crude oil price rose by 0.85% to $75.09 per barrel as of wirting following the officials claimed the US Energy Department will repurchase 3 million barrels of domestic crude oil for the Strategic Petroleum Reserve. On the other hand, the gold price edged up by 0.04% to $1791.50 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index (Dec) | 86.3 | 87.4 | – |

Technical Analysis

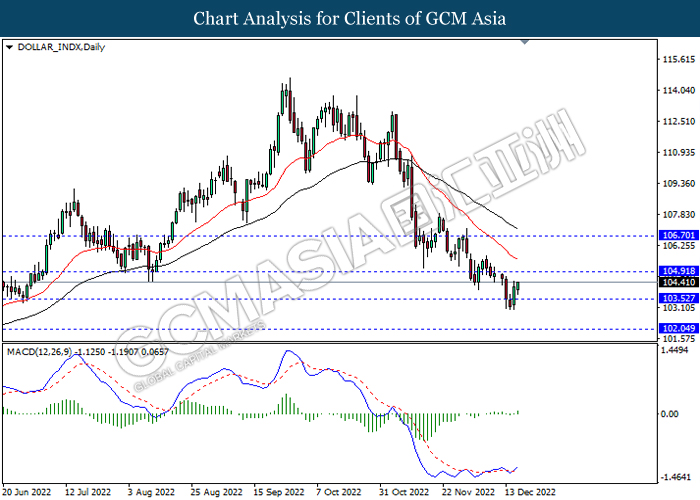

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

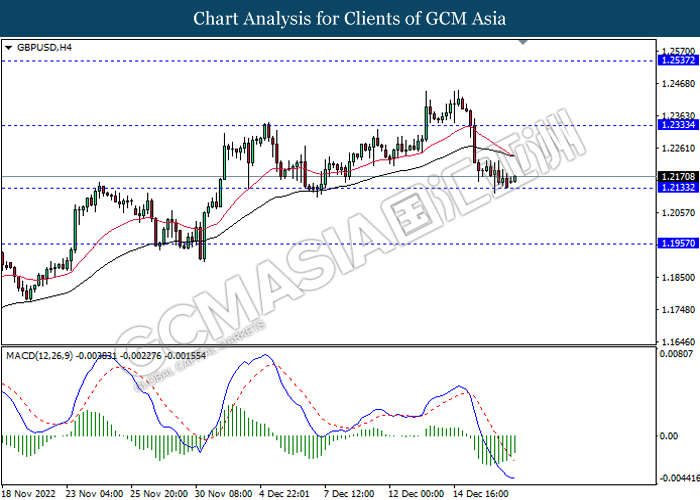

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

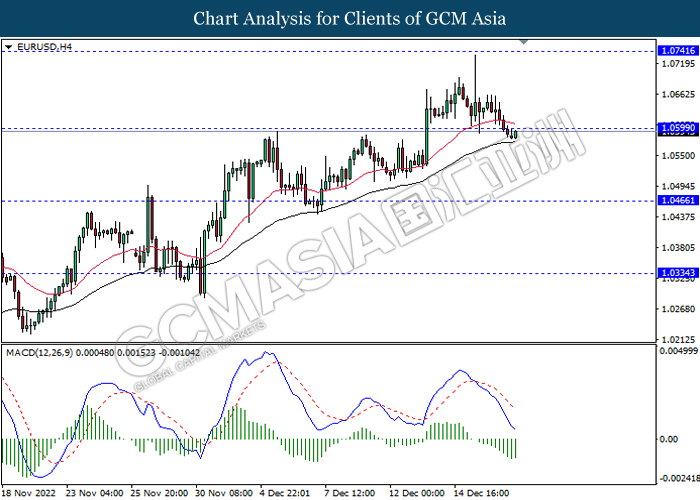

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0600, 1.0740

Support level: 1.0465, 1.0335

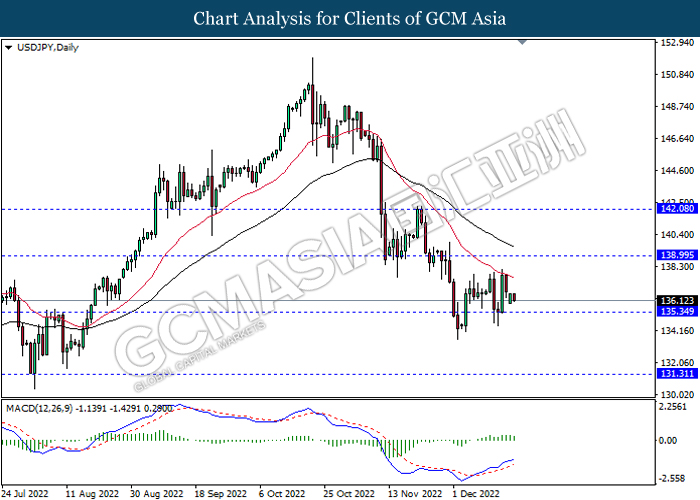

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 139.00, 142.10

Support level: 135.35, 131.30

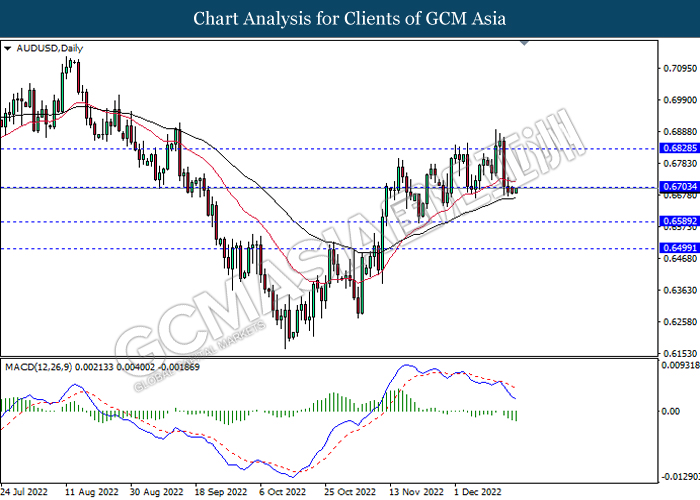

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6705, 0.6830

Support level: 0.6590, 0.6500

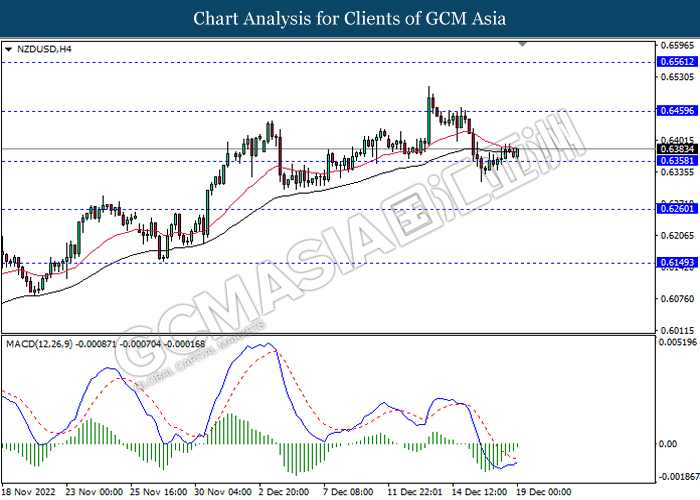

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

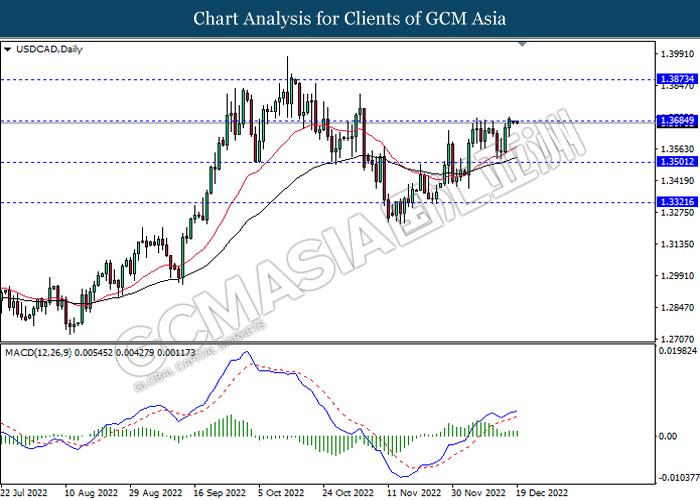

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

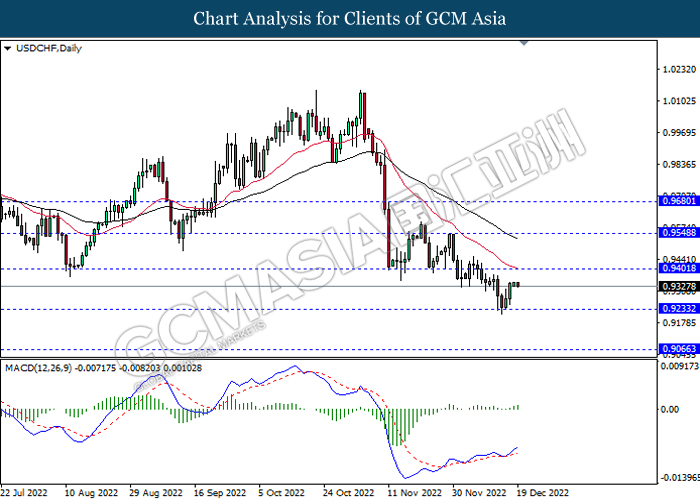

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.45

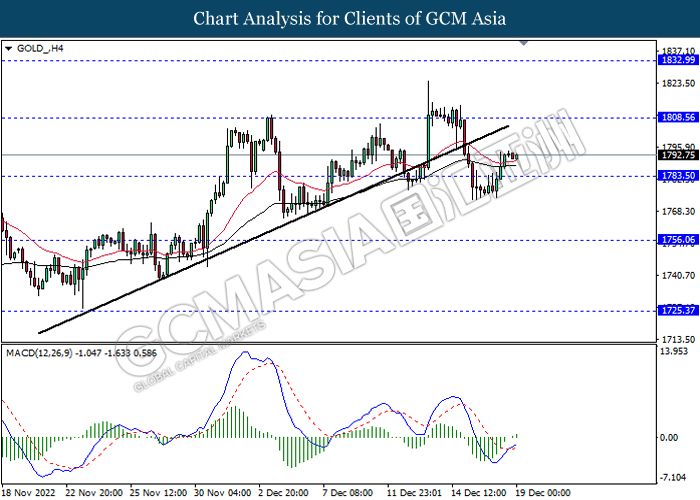

GOLD_, H4: Gold price was traded higher following prior breakout above the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity extend its gains.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05