20 December 2022 Morning Session Analysis

Greenback dipped amid upbeat German economic data.

The dollar index, which traded against a basket of six major currencies, lingered near the level of 104.00 after slipping slightly amid yesterday upbeat German economic data. According to the ifo Institute for Economic Research, the Germany Ifo Business Climate Index jumped from prior month reading of 86.4 to 88.6, beating the consensus forecast at 87.4. The stronger-than-expected reading showed some improvement in German business morale, lifting up the appeal of the single currency. However, the dark clouds are still circling the economic environment of the union as the challenges of high inflation and falling of demand persist. The market has seen some buying support on US Dollar as the market risk-off sentiment hyped as the end of the year approached. In the meantime, the investors are also waiting for further economic data and events to scrutinize the market direction while adjusting the weight proportion of their portfolio. As of writing, the dollar index edged up 0.04% to 104.65.

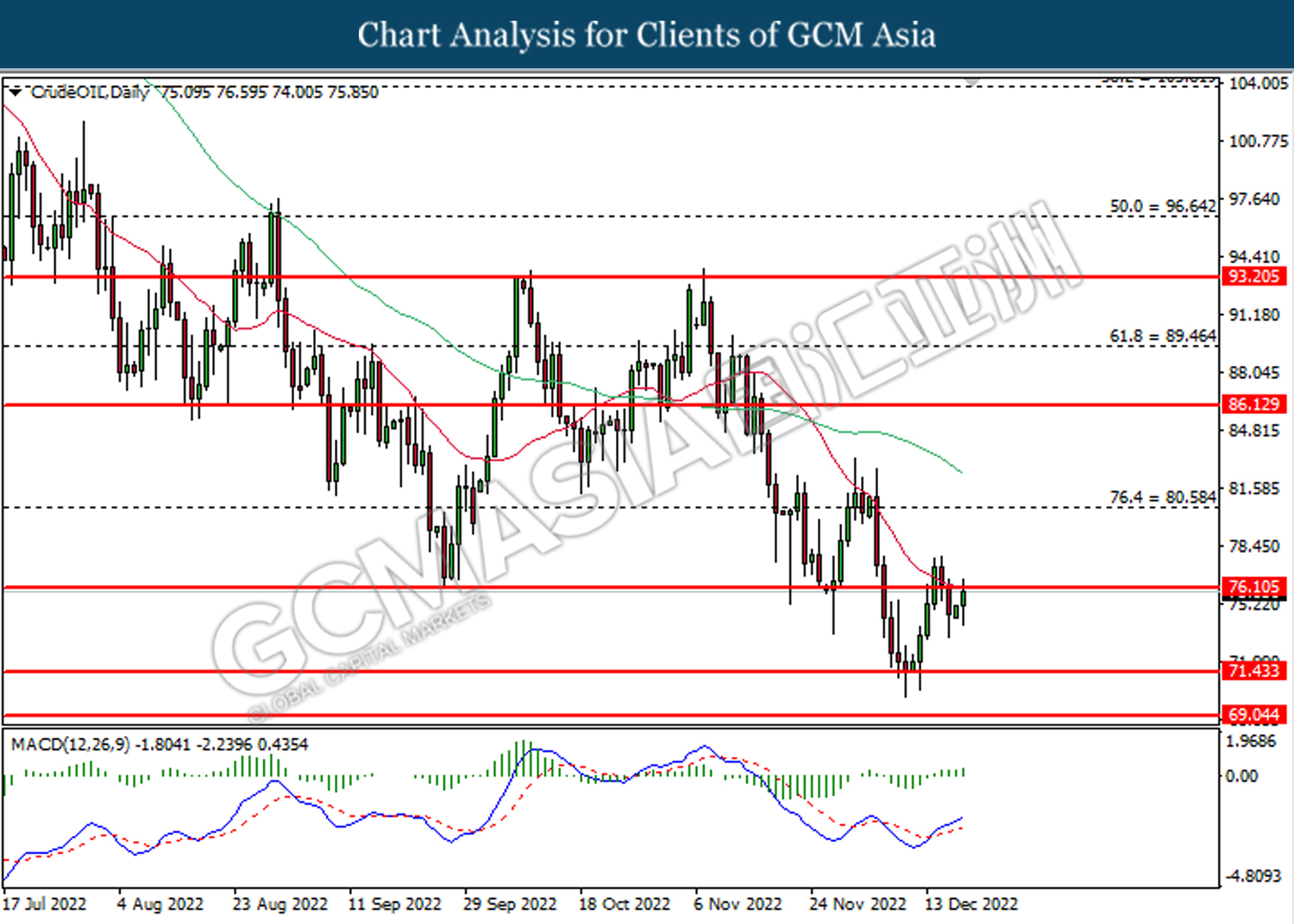

In the commodities market, crude oil prices up by 1.67% to $75.85 per barrel on hopes that the economic recovery of China would boost up the energy demand despite the headwind of high recession risk. Besides, gold prices depreciated by -0.31% to $1787.80 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

11:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 21:30 | USD – Building Permits (Nov) | 1.512M | 1.485M | – |

| 21:30 | CAD – Core Retail Sales (MoM) (Oct) | -0.7% | 1.4% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

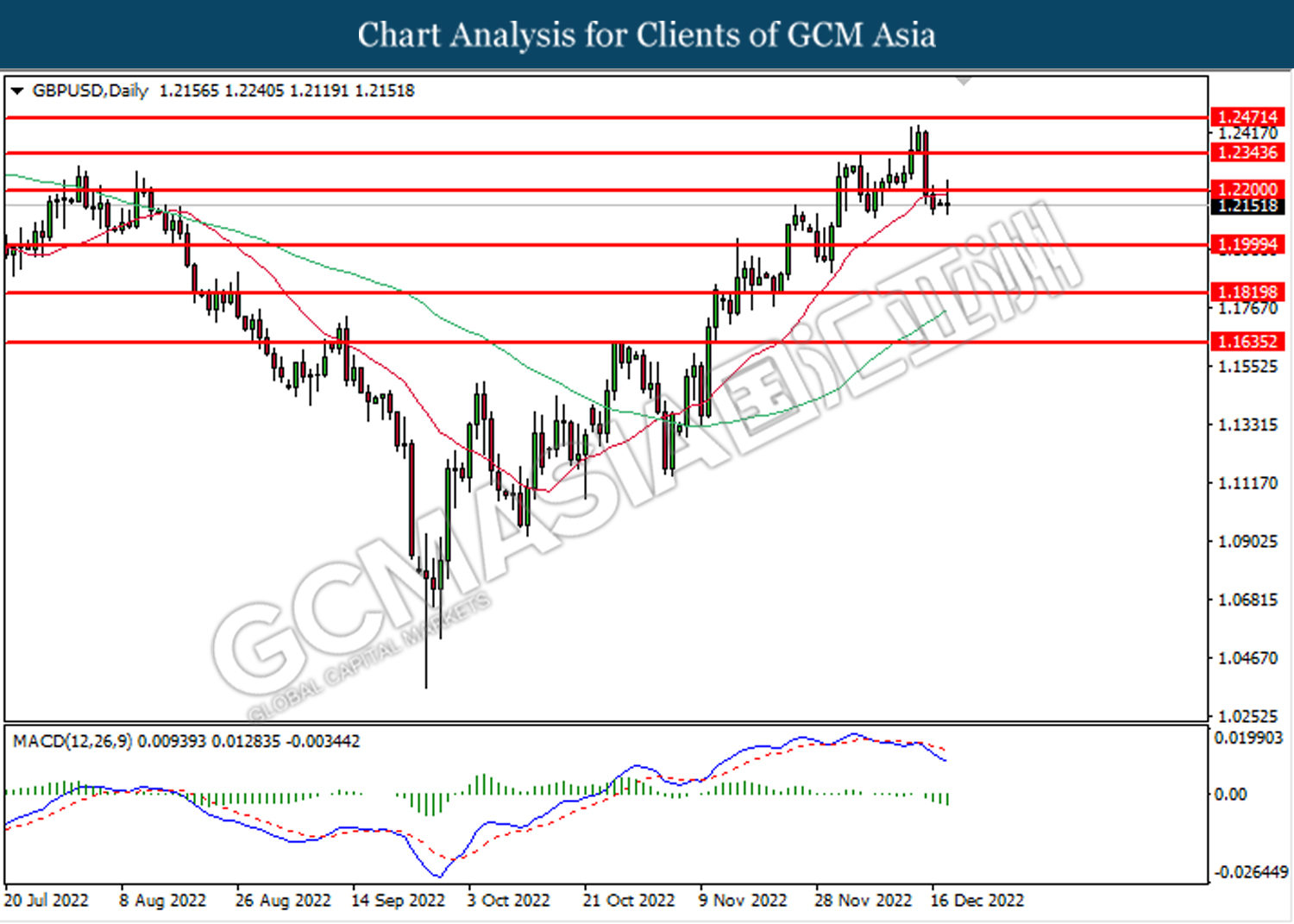

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.2200. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2000.

Resistance level: 1.2200, 1.2345

Support level: 1.2000, 1.1820

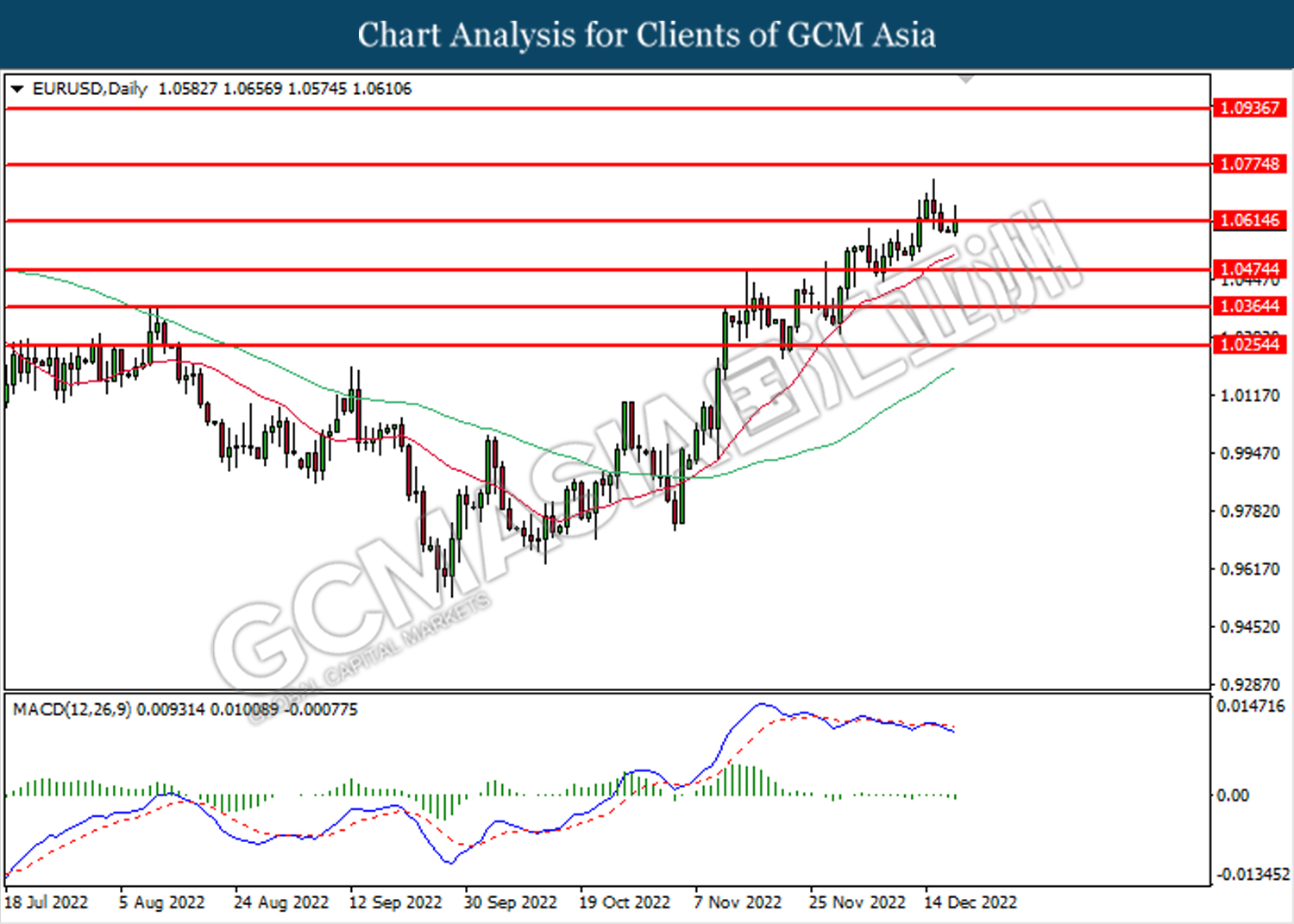

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0615. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical retracement in short term.

Resistance level: 1.0615, 1.0775

Support level: 1.0475, 1.0365

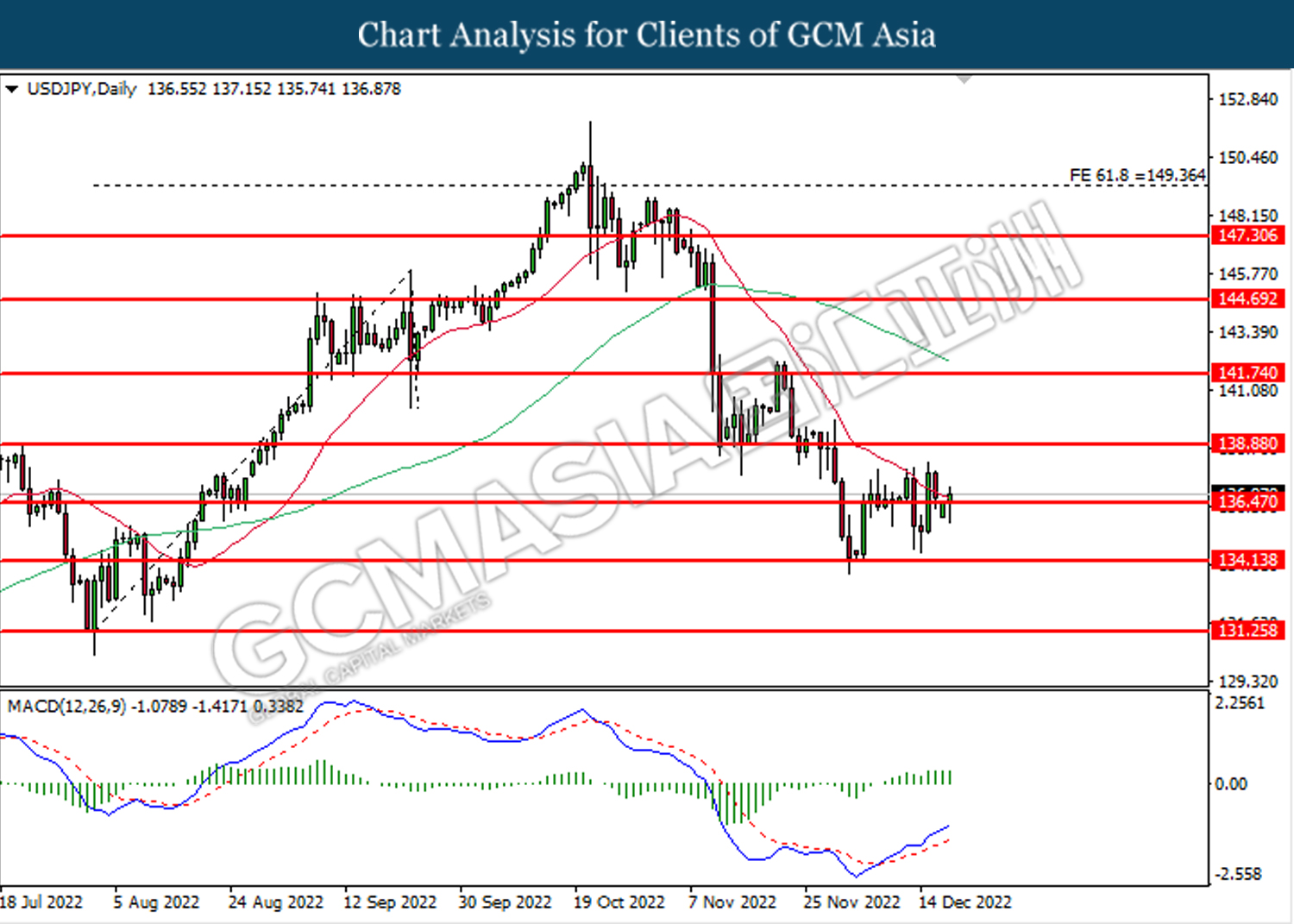

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 138.90

Support level: 134.15, 131.25

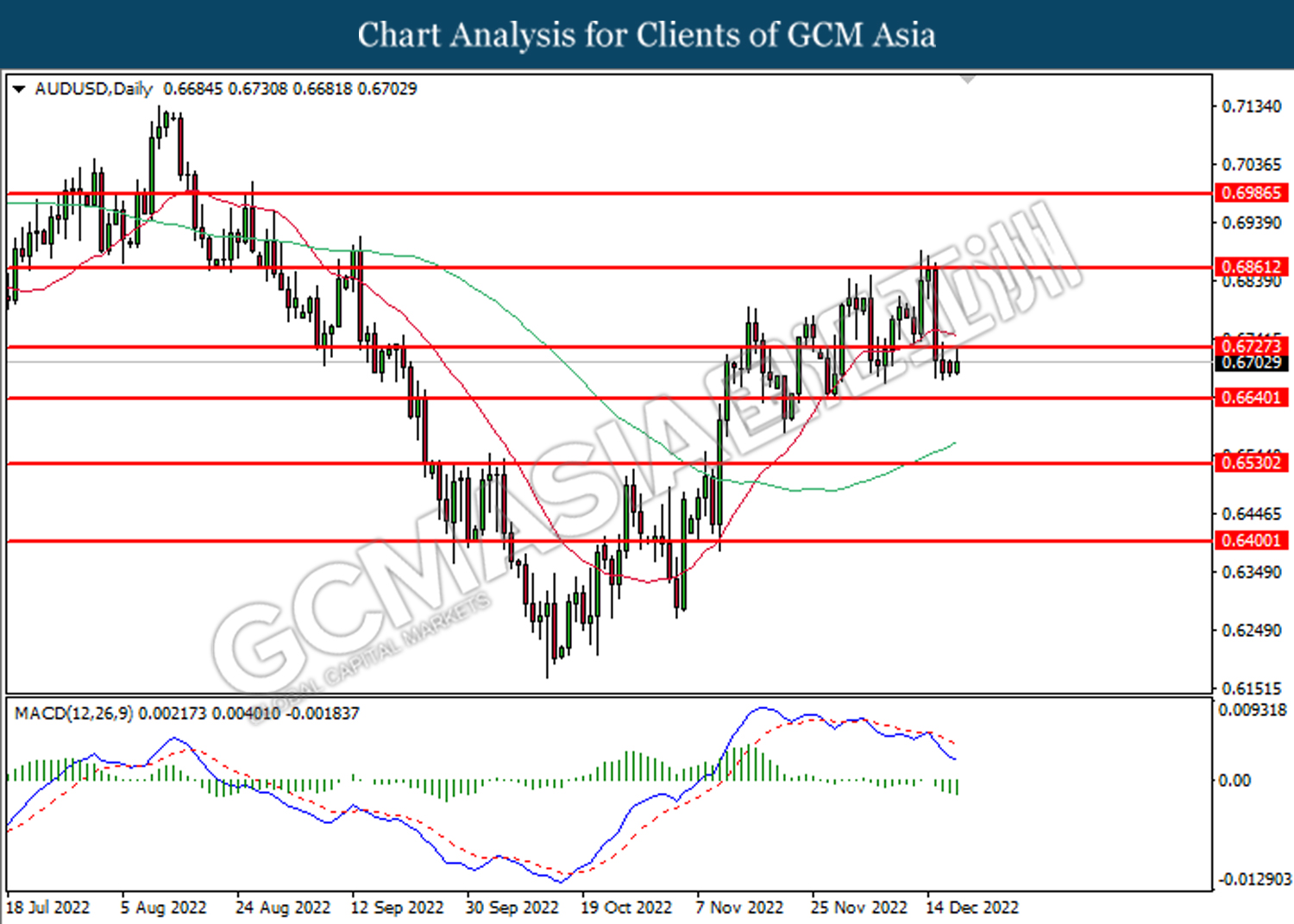

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6725. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.6725, 0.6860

Support level: 0.6640, 0.6530

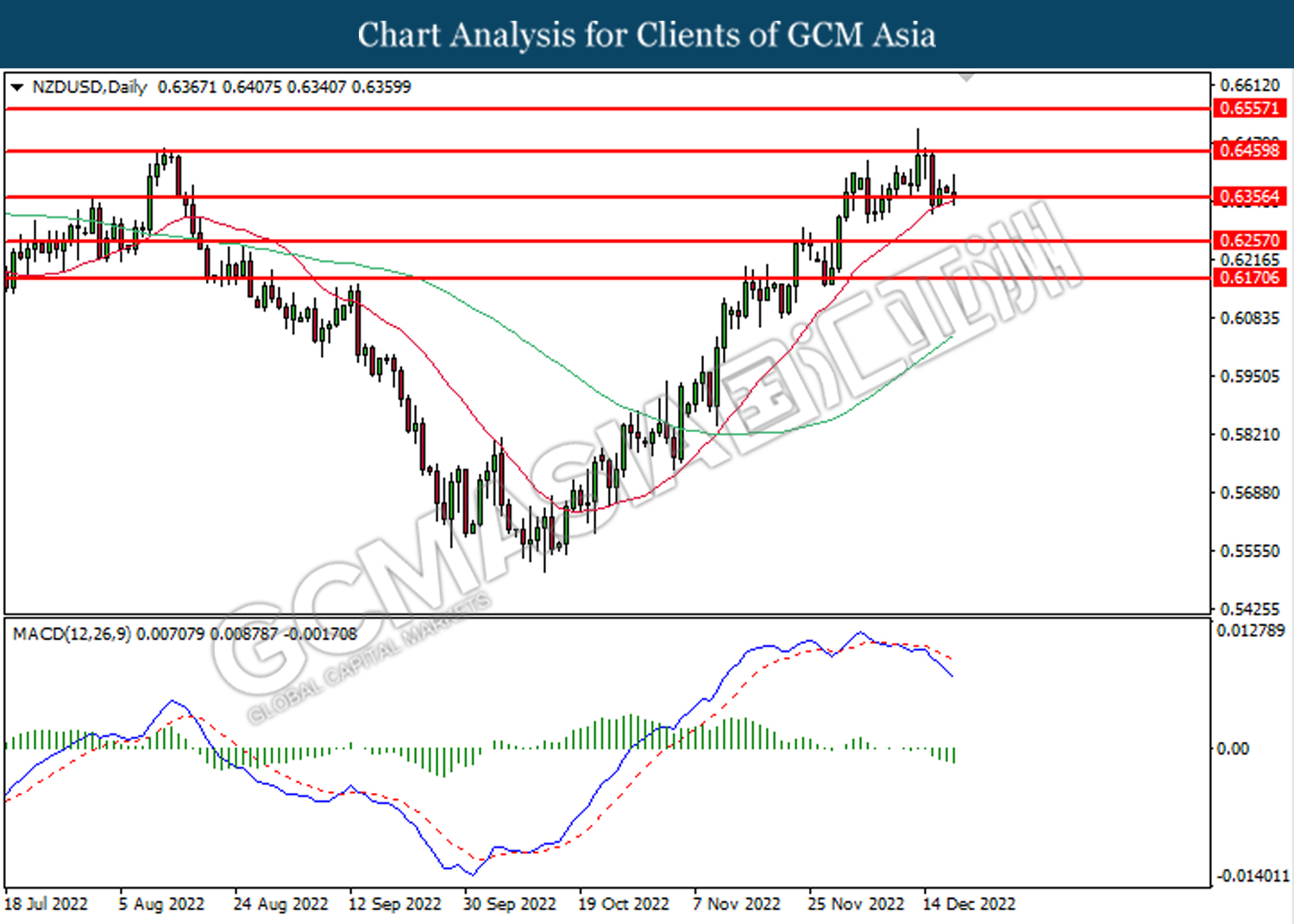

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6355. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

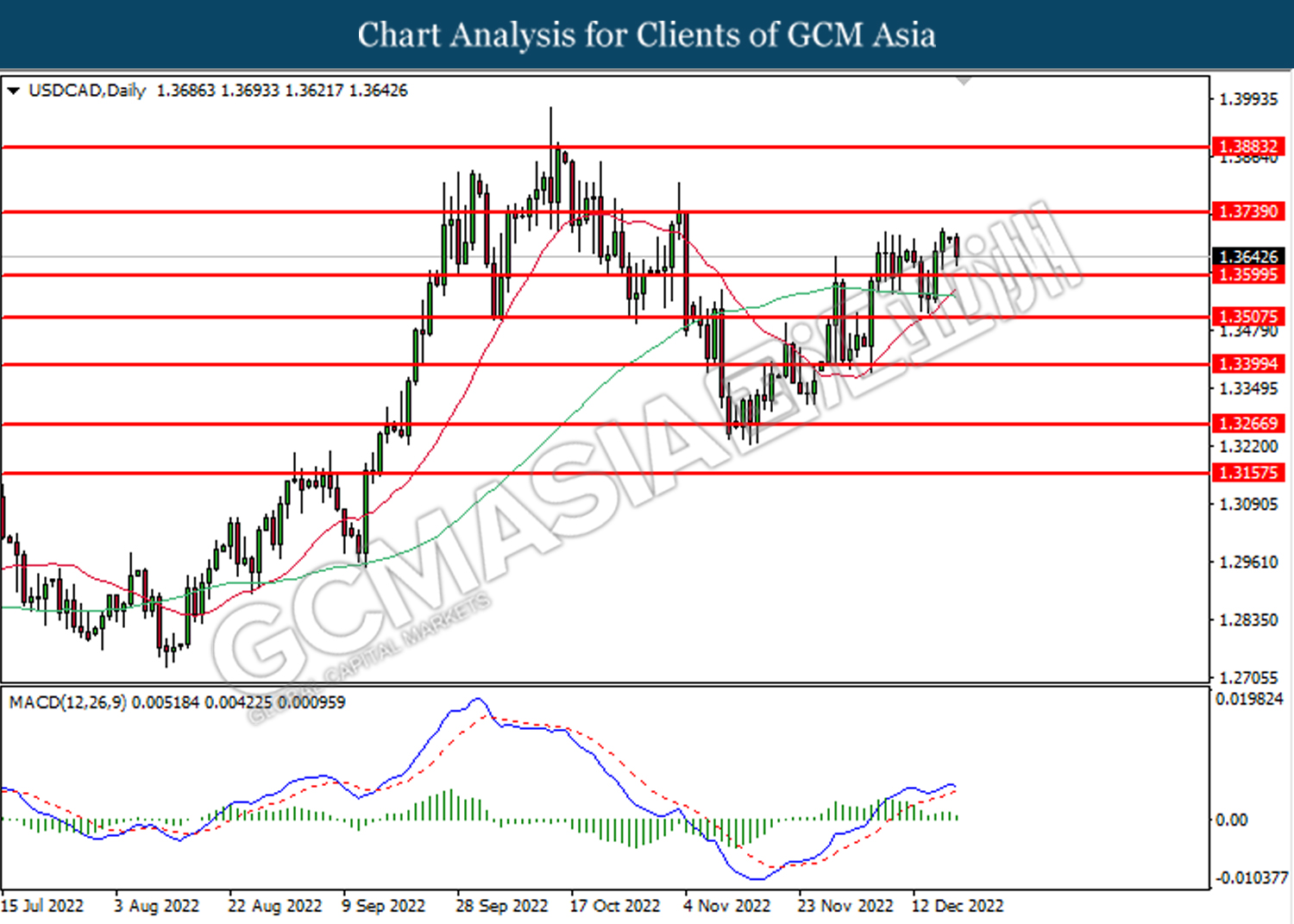

USDCAD, Daily: USDCAD was traded lower following prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3600.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

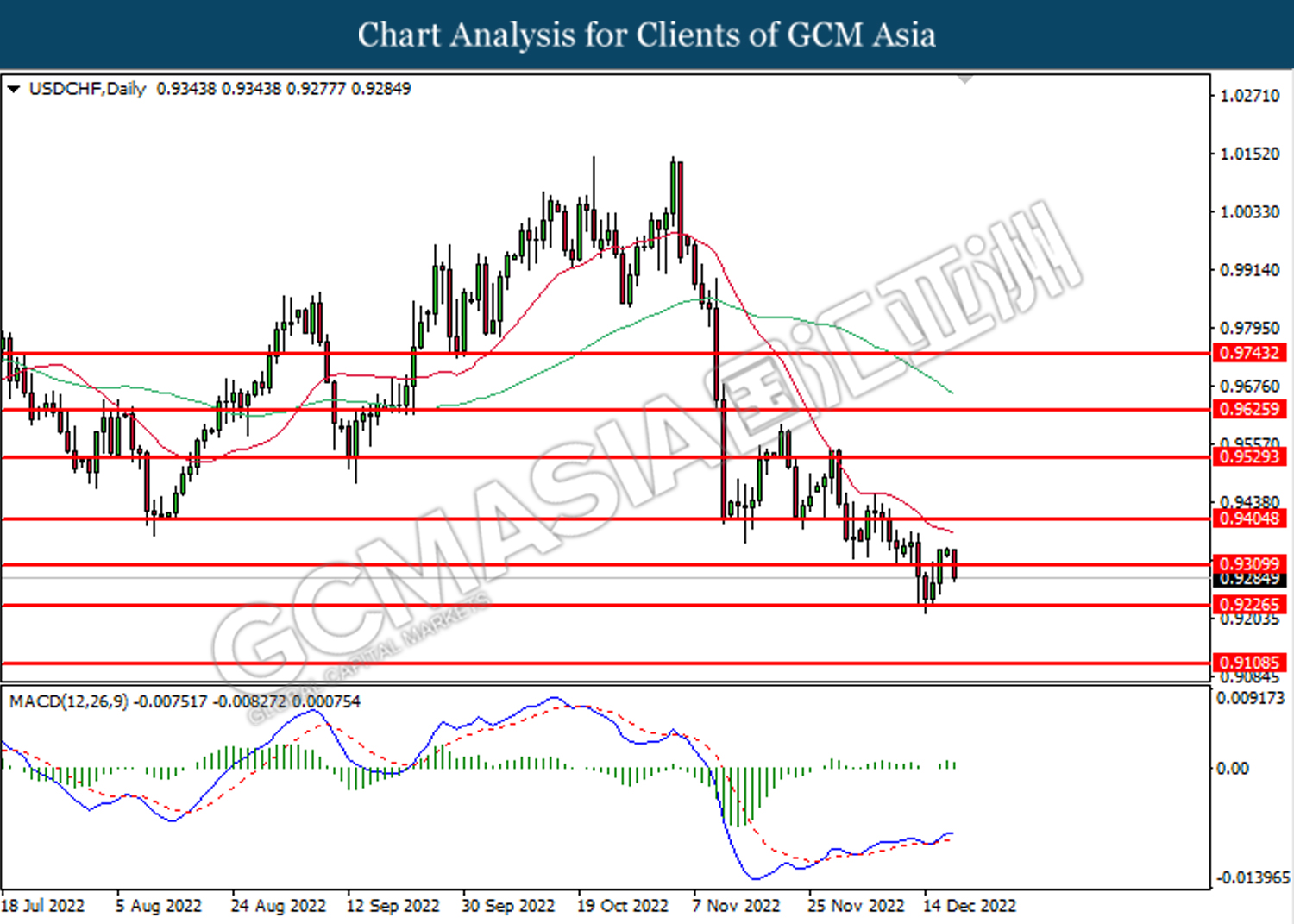

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9310. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 80.60

Support level: 71.45, 69.05

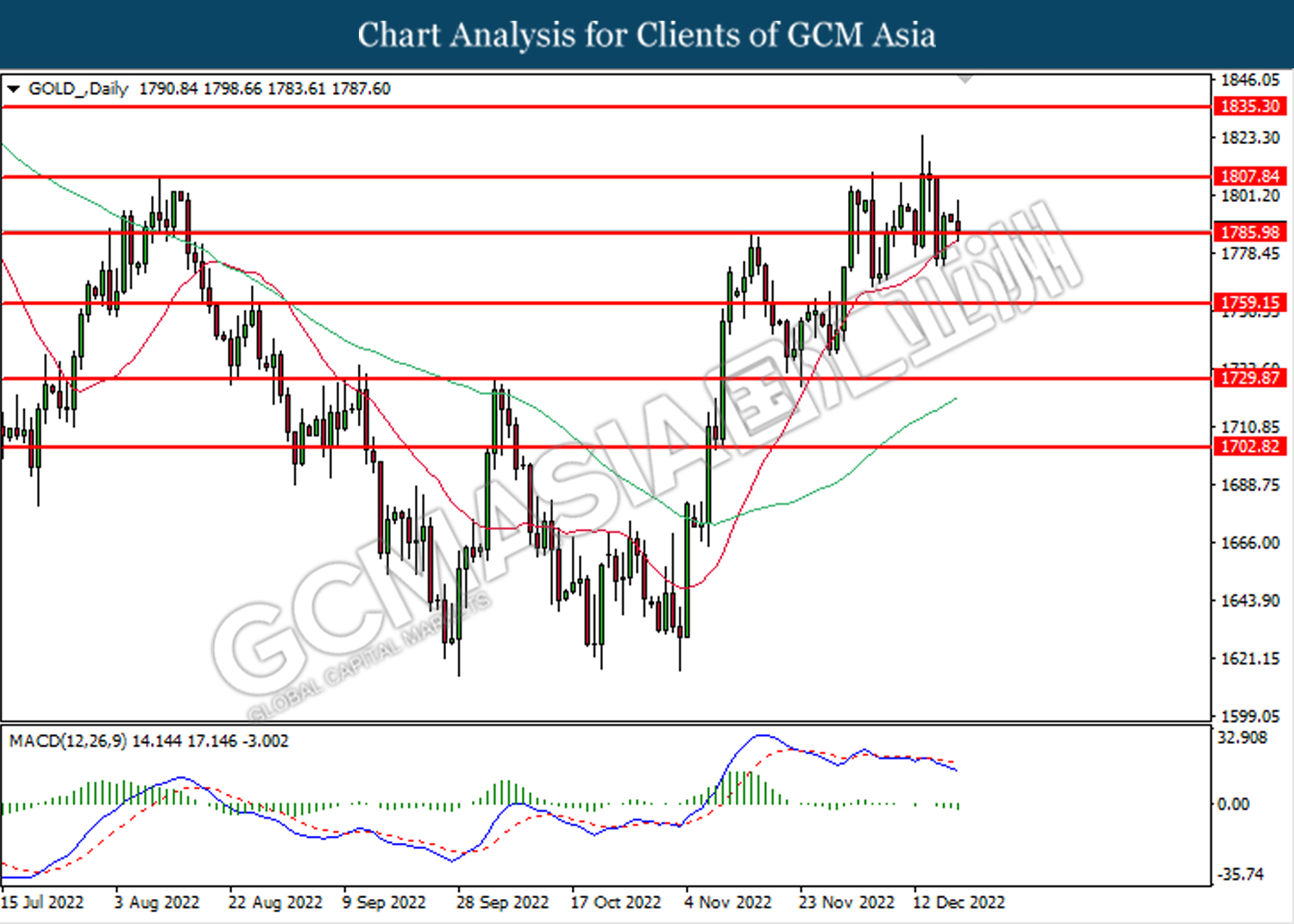

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1786.00. MACD which illustrated bearish bias momentum suggests the commodity to extend its gains after it successfully breakout below the support level at 1786.00.

Resistance level: 1807.85, 1835.30

Support level: 1786.00, 1759.15