27 December 2022 Afternoon Session Analysis

Yen depreciated as the spiking inflation keep menacing Japan economy.

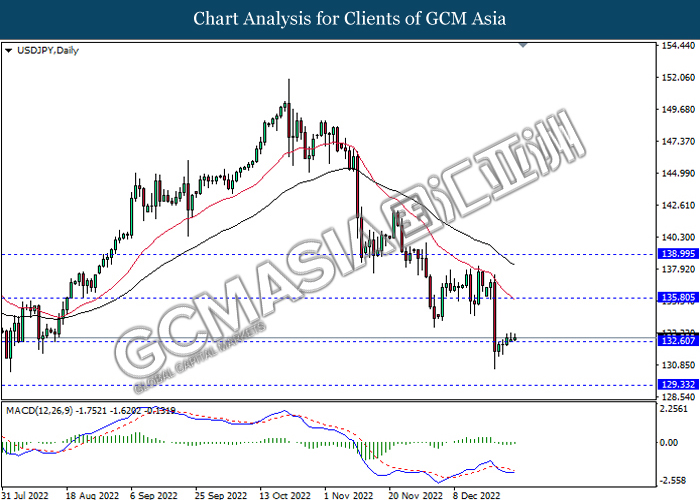

The USD/JPY, which widely traded by global investors jumped on Tuesday after the downbeat economic data has been released. The Japan Retail Sales YoY for November has notched down from the previous reading of 4.4% to 2.6%, missing the consensus forecast of 3.7%. The sales fell from the previous month with price increases in daily necessities weighing on Japanese households as the nation’s core consumer inflation hit a fresh 40-year high, which threatening the consumption power in the Japan. With that, it stoked a shift of sentiment toward safe-haven assets such as US Dollar. Though, the gains experienced by USD/JPY was limited following the easing inflationary risk in the US. Last week, the US Core Personal Consumption Expenditure (PCE) Price Index has decreased from the previous figures, whereas the pace of aggressive rate hikes progress would likely to be scaled back. Thus, it dragged down the appeal of US Dollar. As of now, the movement of FX market was expected to be slower as the market was lack of catalyst. As of writing, the USD/JPY edged up by 0.04% to 132.91.

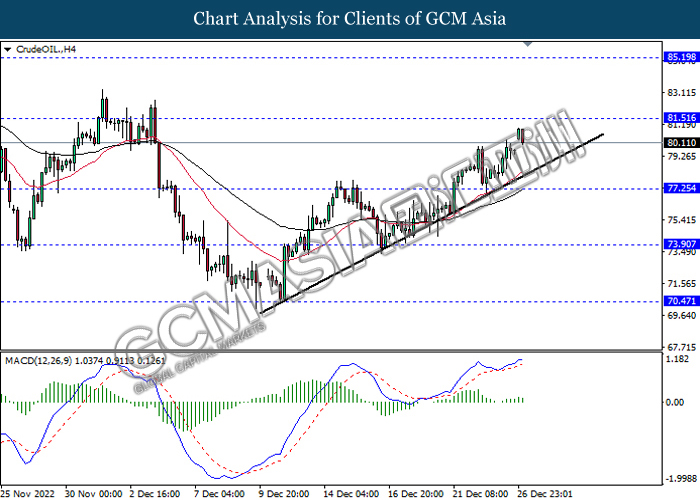

In the commodities market, the crude oil price appreciated by 0.69% to $80.11 per barrel as of writing following the lowered inflation risk in the US has dialed up the demand of this black commodity. On the other hand, the gold price rose by 0.47% to $1805.32 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP Christmas

All Day NZD Christmas

All Day AUD Christmas

All Day CAD Christmas

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

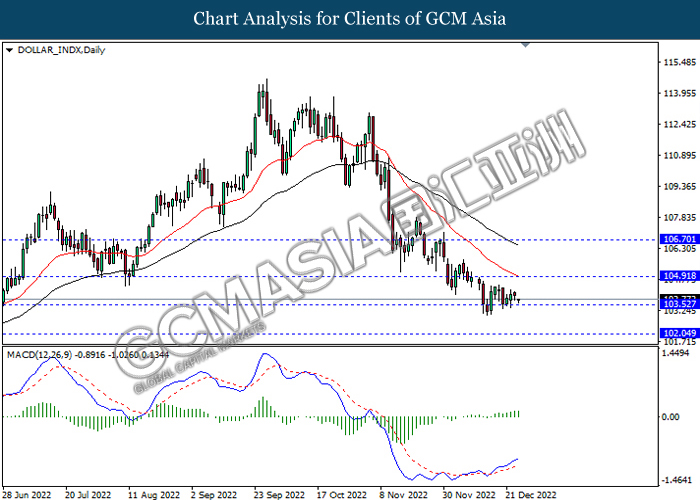

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.90, 106.70

Support level: 103.50, 102.05

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.80, 139.00

Support level: 132.60, 129.35

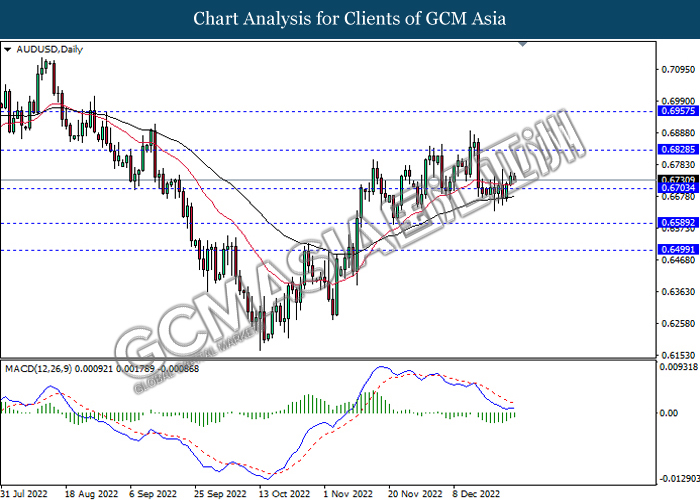

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

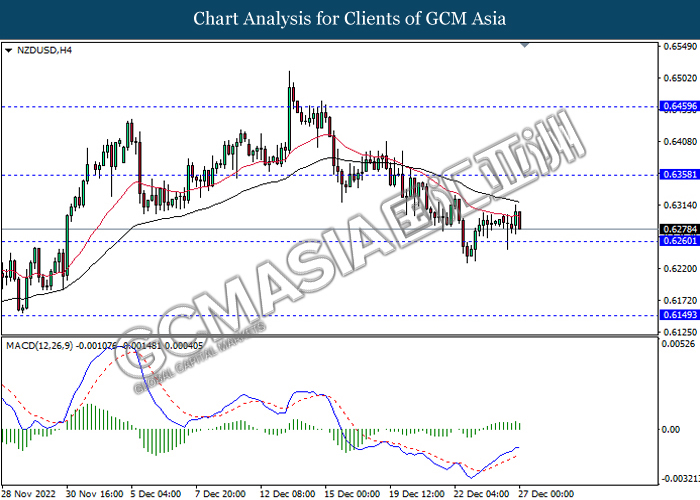

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

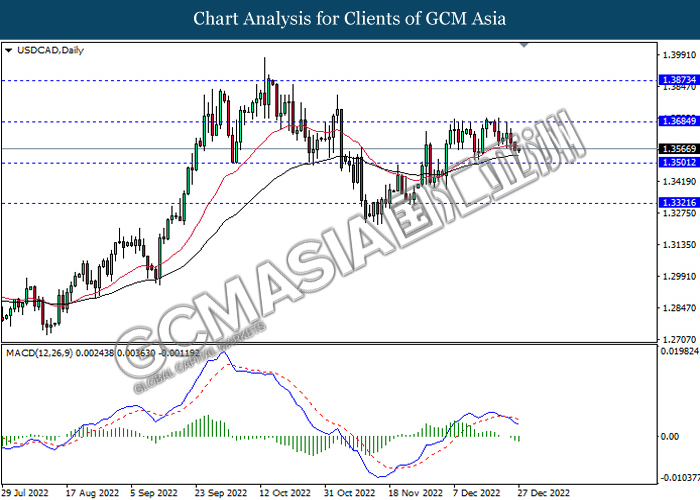

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3685, 1.3875

Support level: 1.3500, 1.3320

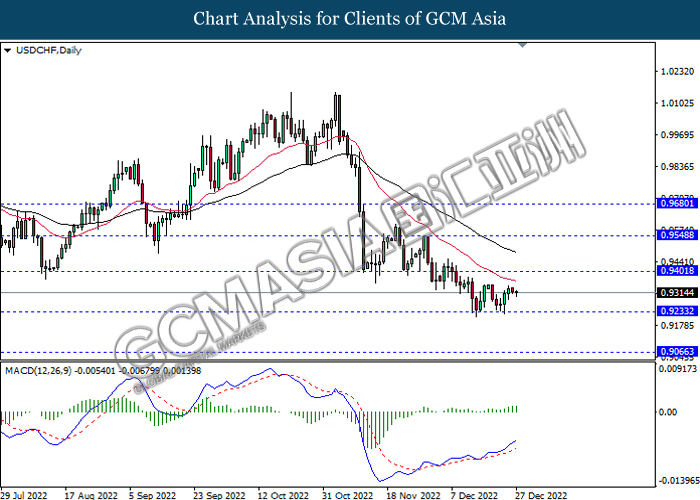

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1808.55, 1833.00

Support level: 1783.50, 1756.05