18 June 2018 Weekly Analysis

GCMAsia Weekly Report: June 18 – 22

Market Review (Forex): June 11 – 15

Greenback ticks up slightly during late Friday trading albeit gains were capped following US imminent announcement of heft tariffs against Chinese imports. The dollar index rose 0.02% while closing the week at 94.79 against a basket of six major currencies.

Last Friday, US President Donald Trump reaffirmed that a 25% tariff will be announced and imposed upon a list of import goods from China and vowed to enact further tariffs if Beijing retaliates. His statement sparked fears among market participants as such measure would raise the prospect for trade war between the world’s two largest economies.

Initially, dollar slumped upon Trump’s affirmative signal albeit managed to regain some bullish closure following better-than-expected reading of Empire State Manufacturing Index and Michigan Consumer Sentiment.

Both data moves in tandem with US Federal Reserve’s projection last Thursday, citing robust economic growth and solid progression in household spending would warrant for a higher inflationary pressure in the future.

USD/JPY

Pair of USD/JPY ticked up 0.03% to 110.66 during late Friday trading.

EUR/USD

Euro rose 0.36% to $1.1610 against the greenback after experiencing a large selloff on Thursday following European Central Bank’s call to leave the interest rate unchanged until summer of 2019.

GBP/USD

Pair of GBP/USD extended gains by 0.11% while ended the week at $1.3277.

Market Review (Commodities): June 11 – 15

GOLD

Gold price extended its losses last Friday despite rising geopolitical and trade tension between US-China following higher prospect for a faster pace of rate hike by the US Federal Reserve. Price of the yellow metal plunged 1.72% while ended last week at $1,279.76 a troy ounce.

The safe haven asset came under pressure following Fed’s interest rate decision on Thursday whom suggested one additional rate hike for the remaining year of 2018 due to rising consumer prices and robust economic performance. In a rising interest rate environment, gold’s appeal as an alternative asset subsides as it fails to compete with higher interest-bearing assets such as bonds.

Crude Oil

Crude oil price plunged sharply on last Friday following further expansion of oil output in the United States while coupled with imminent production hike from OPEC and Russia. Price of the black commodity settled down 3.97%, ended the week at $64.25 per barrel.

According to the US oilfield services provider, Baker Hughes reported that US oil drilling rigs rose for fourth-consecutive week, up by 1 to a total of 863. The data comes in tandem with the report from Energy Information Administration last Wednesday which shows that US daily oil output extended its uptrend, currently standing at a record high of 10.9 million barrels per day.

In addition, crude oil price received extensive selling pressure after Russia Energy Minister Alexander Novak postulate to gradually increase oil production after having discussion with Saudi Arabia. The suggestion came as they pledge to offset diminished output from Venezuela and Iran which may subject to international sanctions bound to be imposed by the United States.

Weekly Outlook: June 18 – 22

For the week ahead, investors will pay attention to interest rate decision from the Bank of England as rising consumer prices continues to pressure the central bank to raise their rates further while Brexit risks continues to linger.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: June 18 – 22

| Monday, June 18 |

Data JPY – Trade Balance (May)

Events USD – FOMC Member Dudley Speaks USD – FOMC Member Duke Speaks

|

| Tuesday, June 19 |

Data AUD – Wespac Consumer Sentiment (Q2) USD – Building Permits (May)

Events USD – FOMC Member Bostic Speaks EUR – ECB President Draghi Speaks USD – FOMC Member Williams Speaks AUD – RBA Meeting Minutes

|

| Wednesday, June 20 |

Data CrudeOIL – API Weekly Crude Oil Stock GBP – CBI Industrial Trends Orders (Jun) USD – Existing Home Sales (May) CrudeOIL – Crude Oil Inventories CrudeOIL – Gasoline Inventories

Events USD – Fed Chair Powell Speaks EUR – ECB President Draghi Speaks

|

| Thursday, June 21 |

Data NZD – GDP (QoQ) (Q1) CHF – SNB Interest Rate Decision GBP – BoE Interest Rate Decision (Jun) USD – Philadelphia Fed Manufacturing Index (Jun) USD – Philly Fed Employment (Jun) USD – Initial Jobless Claims CAD – Wholesales Sales (MoM) (Apr)

Events CHF – SNB Monetary Policy Assessment CHF – SNB Press Conference CrudeOIL – OPEC Meeting

|

|

Friday, June 22

|

Data JPY – National Core CPI (YoY) (May) EUR – German Manufacturing PMI (Jun) EUR – German Services PMI (Jun) CAD – Core CPI (MoM) (May) CAD – Core Retail Sales (MoM) (Apr) CrudeOIL – US Baker Hughes Oil Rig Count

Events CrudeOIL – OPEC Meeting

|

Technical Weekly Outlook: June 18 – 22

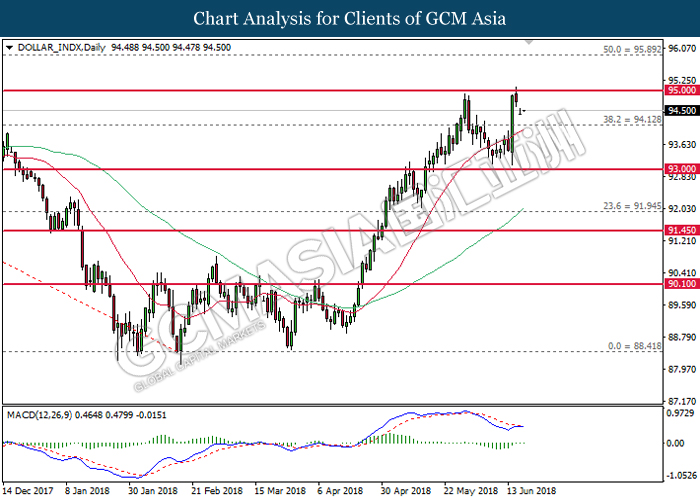

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the threshold of 95.00. Such retracement suggests the index to be traded lower in short-term as technical correction before extending its uptrend based on bullish signal from the MACD histogram.

Resistance level: 94.10, 95.00

Support level: 93.00, 91.95

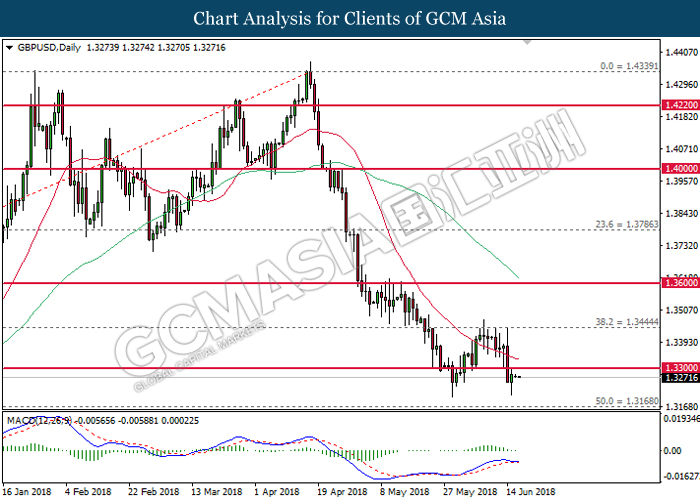

GBPUSD

GBPUSD, Daily: GBPUSD extended losses following prior breakout from the support level of 1.3300. MACD histogram which begins to form a death cross signal suggests the pair to extend its losses after breaking the strong support near 1.3170.

Resistance level: 1.3300, 1.3445

Support level: 1.3170, 1.3045

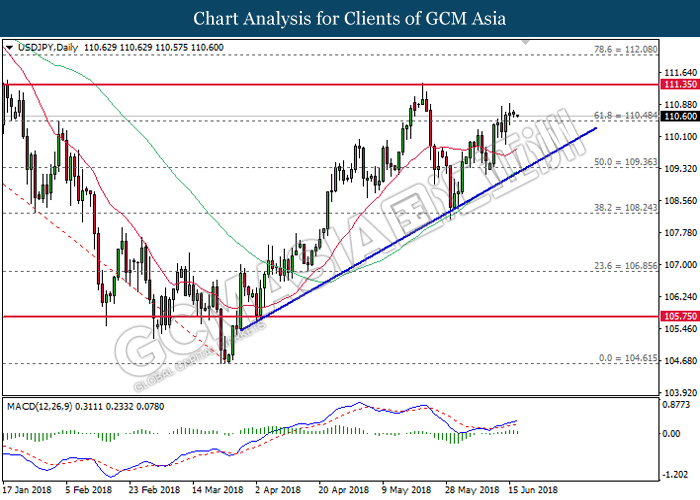

USDJPY

USDJPY, Daily: USDJPY was traded lower following prior retracement while currently testing near the support level at 110.50. Such retracement suggests the pair to be traded lower in short-term as technical correction before extending its bullish bias based on the current upward trendline and bullish signal from MACD histogram.

Resistance level: 111.35, 112.10

Support level: 110.50, 109.35

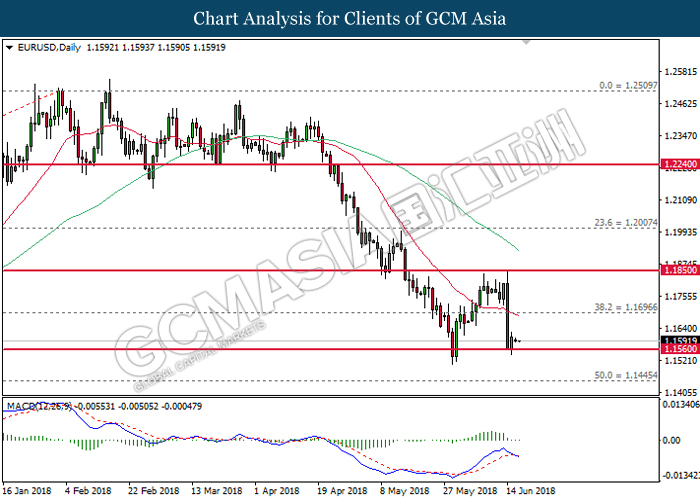

EURUSD

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level at 1.1850. MACD histogram which begins to form a death cross signal suggests the pair to extend its losses after closing below 1.1560.

Resistance level: 1.1700, 1.1850

Support level: 1.1560, 1.1445

GOLD

GOLD_, Daily: Gold price was traded higher after gaining some support near the threshold of 1275.00. Recent price action suggests the commodity price to be traded higher in short-term as technical correction before extending its losses based on the prior formation of death cross from MACD histogram.

Resistance level: 1285.95, 1304.30

Support level: 1275.00, 1266.25

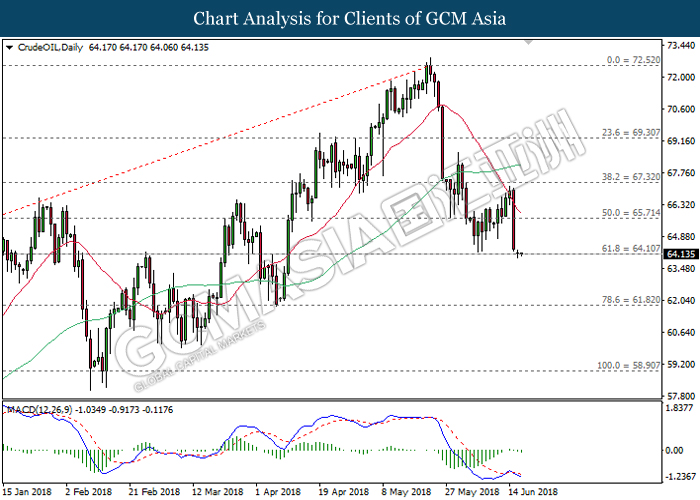

Crude Oil

CrudeOIL, Daily: Crude oil price extended losses following prior retracement from the resistance level at 67.35. MACD histogram which continues to illustrate bearish signal suggests the commodity price to advance further down after breaking the support of 64.10.

Resistance level: 65.70, 67.30

Support level: 64.10, 61.80