5 January 2023 Afternoon Session Analysis

Aussie dived as China Covid infections might be under-reported.

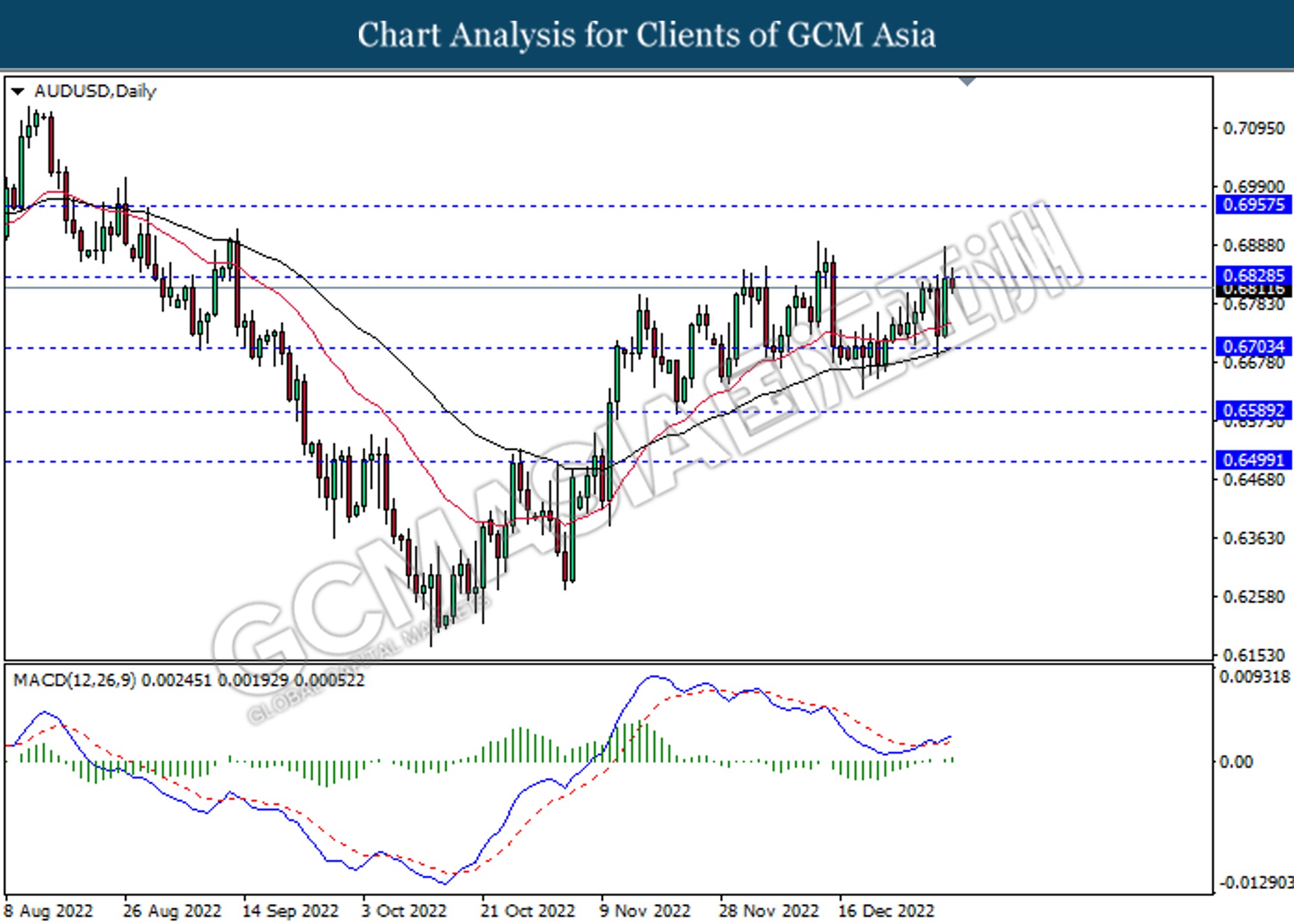

The AUD/USD, one of the China-proxy currency plunged on yesterday over the rising concerns on surging Covid-19 cases in China. According to Reuters, World Health Organization (WHO) officials claimed on Wednesday that the infection of Covid-19 in China would likely to be under-represented. China reported five new COVID deaths for Tuesday, bringing the official death toll to 5,258, very low by global standards. In fact, the data from China has reported that filled hospitals and overwhelmed some funeral house when China government decided to ease its ‘zero-Covid’ restriction. It has led to growing global unease about the accuracy of China’s reporting of the Covid data while giving the hints which the lockdowns might be executed again. With such background, the market optimism toward China economic progression would likely to be dragged down, as well as the Australia might suffer from the economy downturn since China was the major trading partner with Australia. As of writing, the AUDUSD depreciated by 0.25% to 0.6815.

In the commodities market, the crude oil price rose by 1.07% to $73.62 per barrel as of writing after the sharp decline throughout overnight trading session following the rising of API crude oil stock. On the other hand, the gold price appreciated by 0.10% to $1854.90 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Dec) | 48.2 | 48.2 | – |

| 17:30 | GBP – Services PMI (Dec) | 48.8 | 48.8 | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Dec) | 127K | 127K | – |

| 21:30 | USD – Initial Jobless Claims | 225K | 225K | – |

Technical Analysis

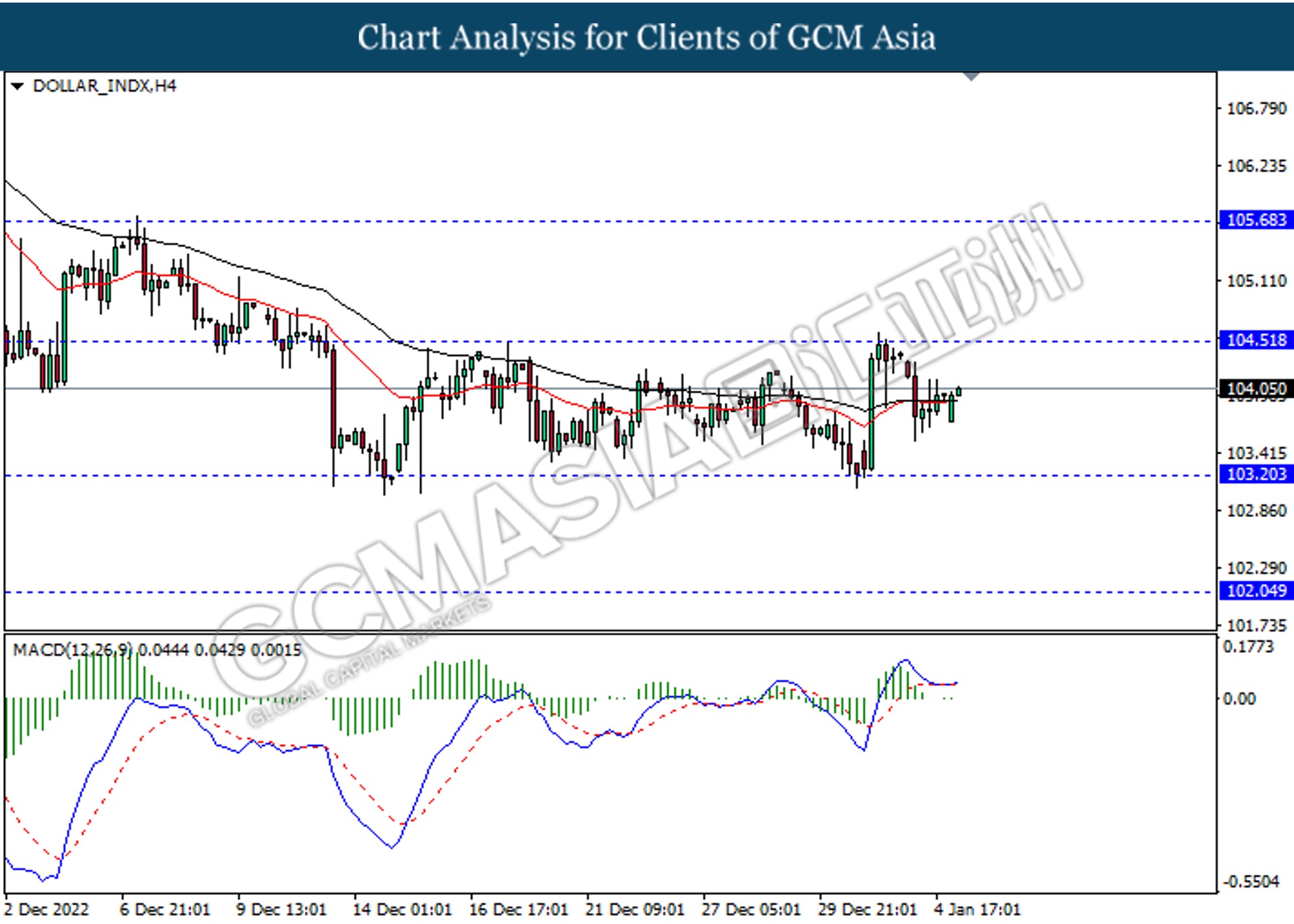

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.50, 105.70

Support level: 103.20, 102.05

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2135, 1.2335

Support level: 1.1955, 1.1775

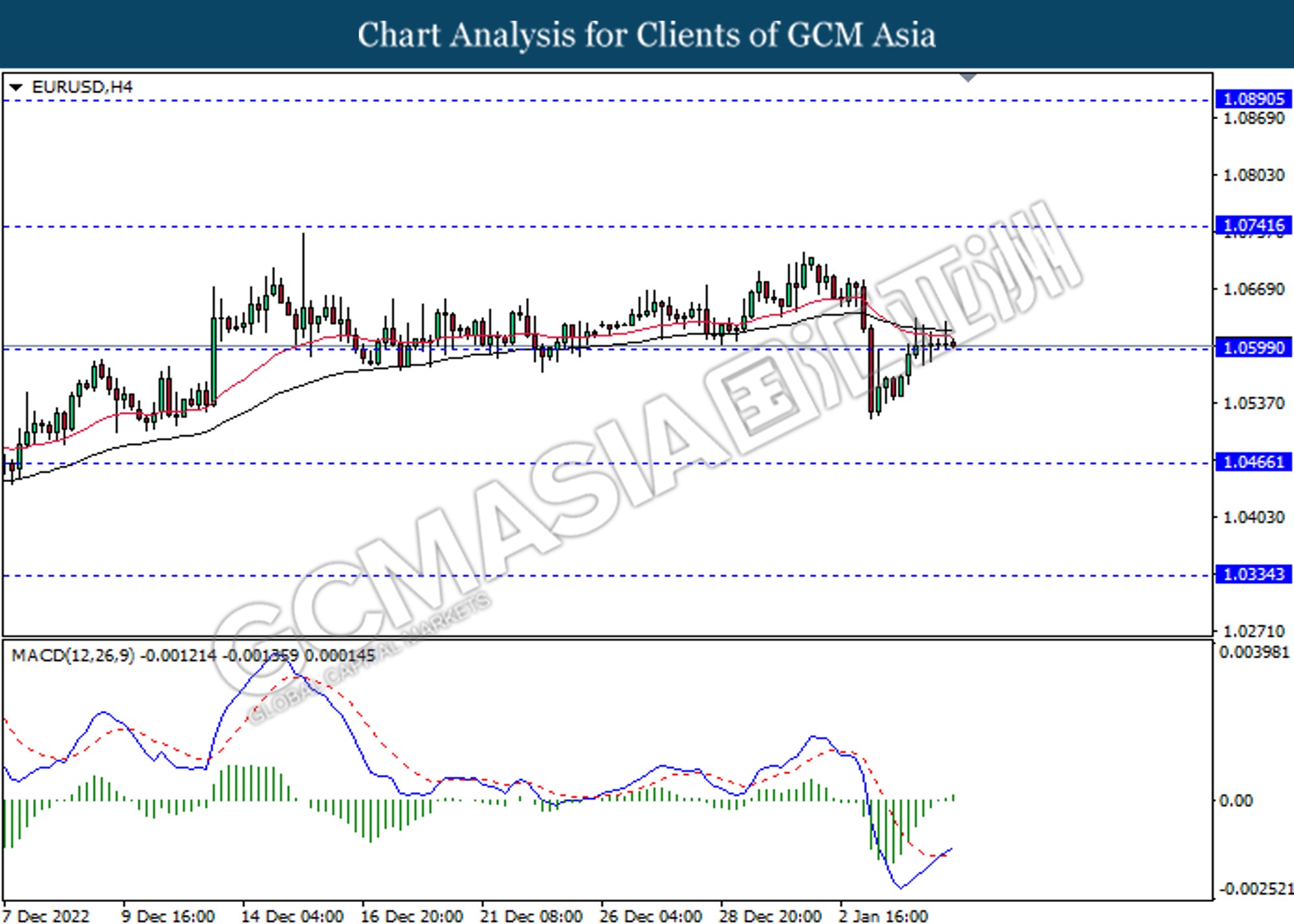

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

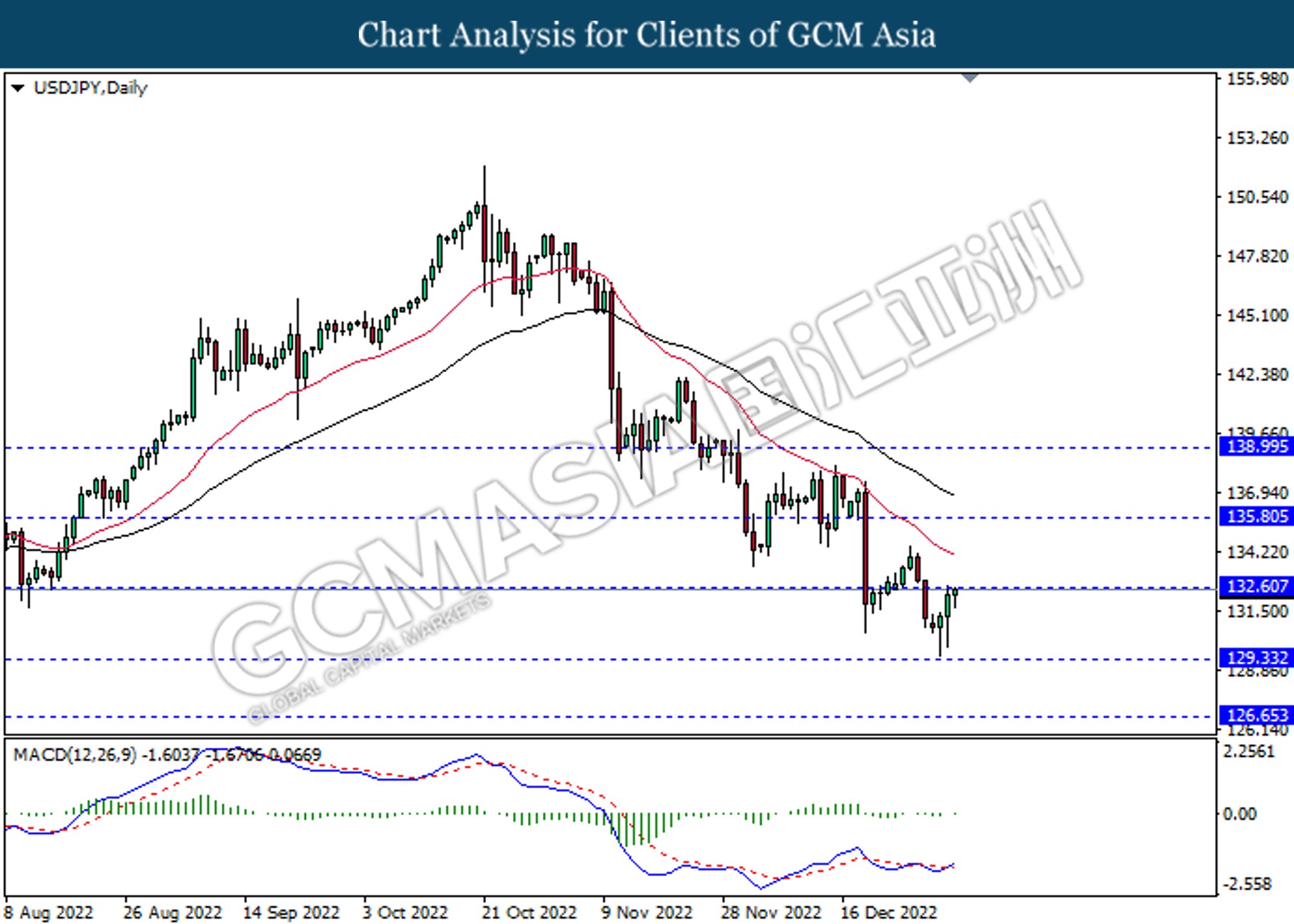

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains. If successfully breakout the resistance level.

Resistance level: 0.6830, 0.6955

Support level: 0.6705, 0.6590

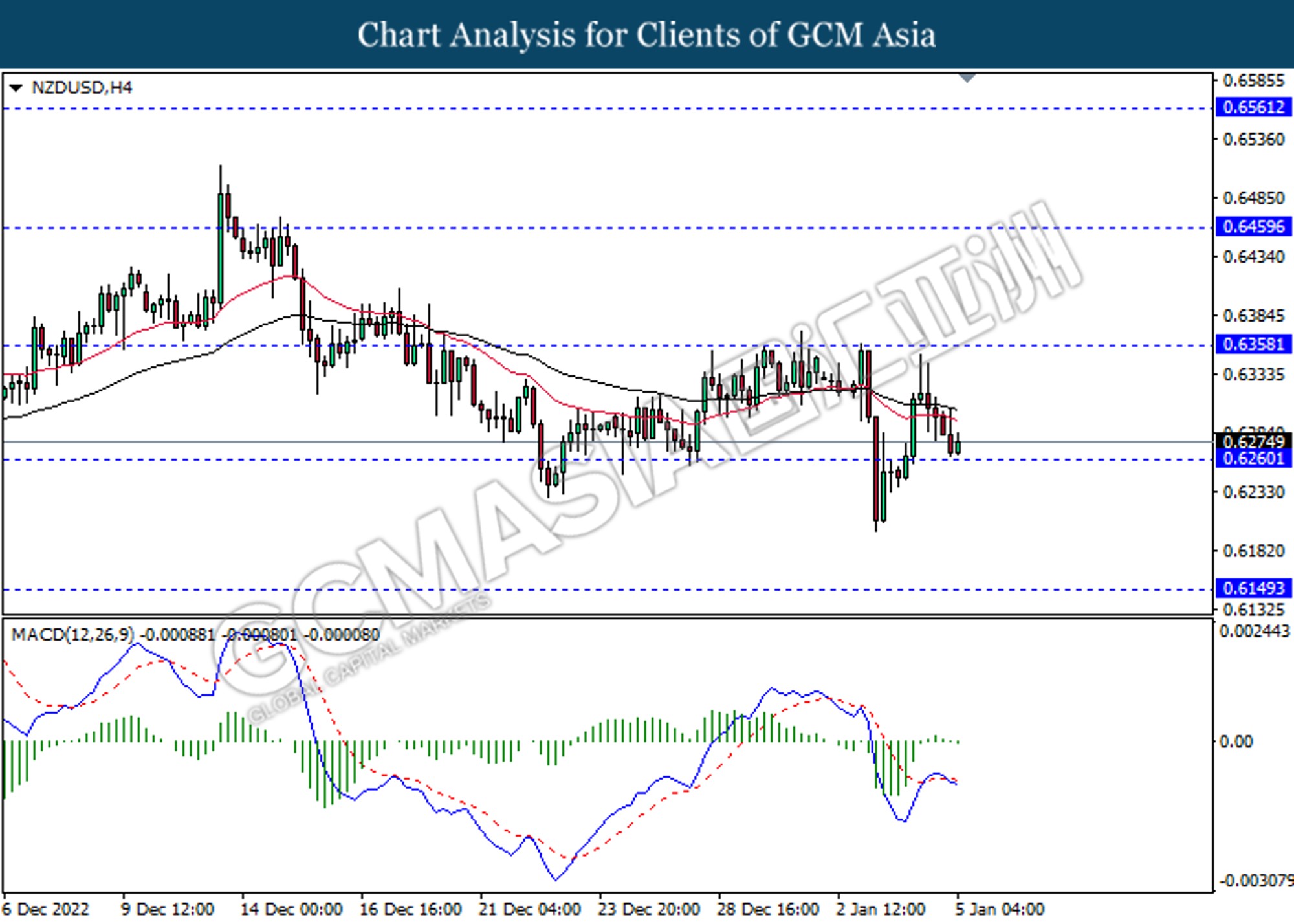

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6150

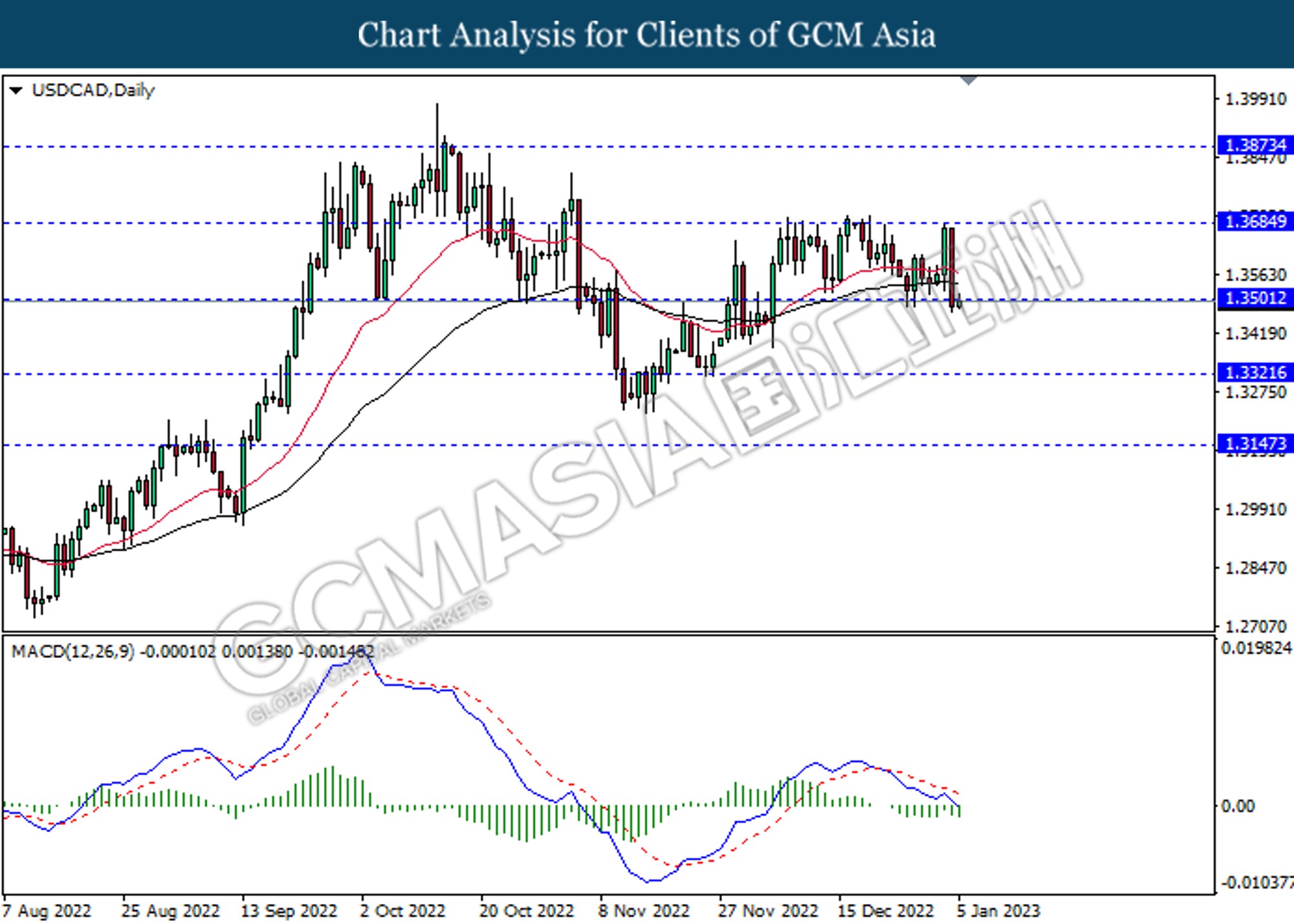

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

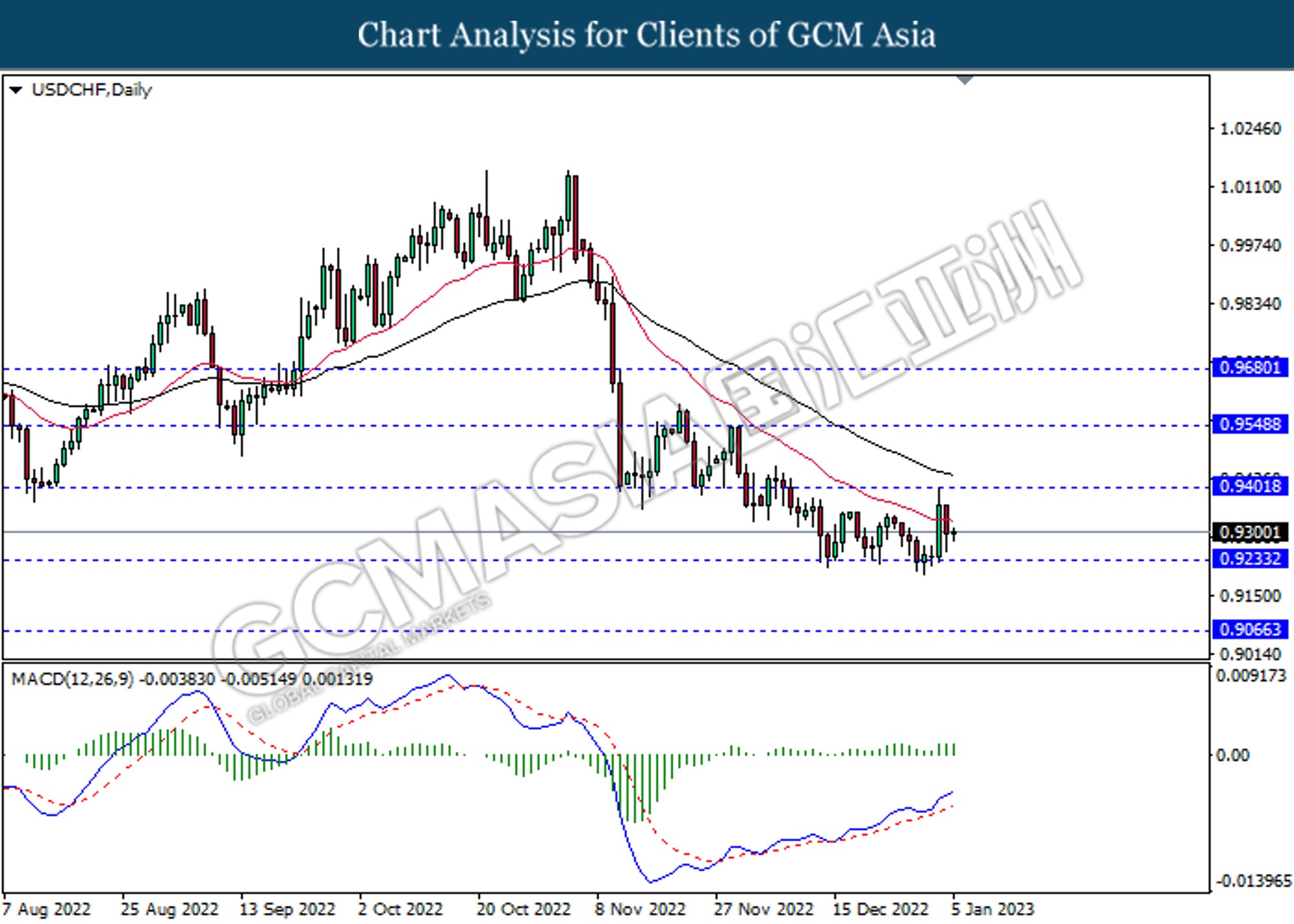

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

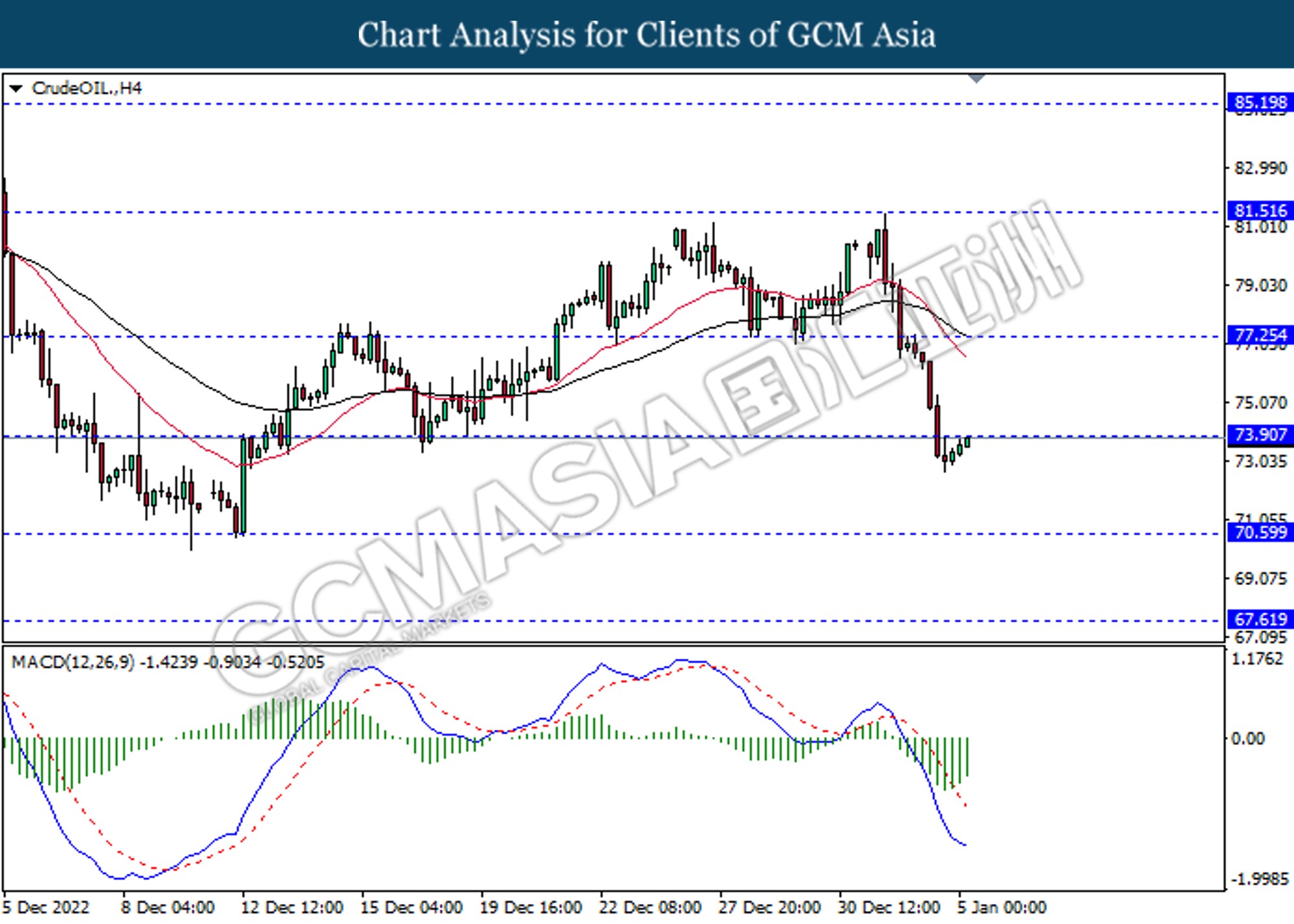

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 73.90, 77.25

Support level: 70.60, 67.60

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1855.40, 1877.80

Support level: 1833.00, 1808.55