11 January 2023 Morning Session Analysis

Greenback recorded gains as Fed hinted for further rate hikes.

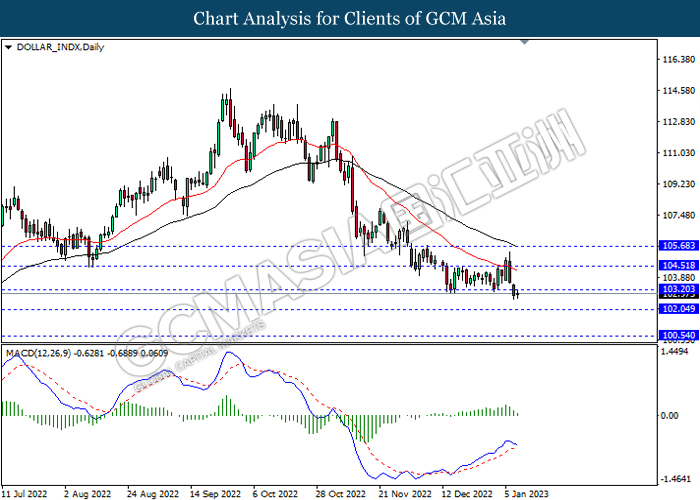

The Dollar Index which gauge its value with the six major currencies rose significantly on yesterday after the Fed Chairman released its speech. According to CNBC, Fed Chairman Jerome Powell had reiterated the significance of rate hikes in the current time basis, even the step taken by Fed would likely to be unpopular. In the speech, Jerome Powell claimed that the central bank was raising interest rate in order to slow down the economy. However, he emphasized that price stability was the footstone of a healthy economy and provides the citizens with immeasurable benefits over time. The remarks echoed those from other Fed members, including San Francisco Fed President Mary Daly and Atlanta Fed President Raphael Bostic, who endorsed the Fed to keep its cash rates higher for longer time. Though, with investors still skeptical about the Fed’s rate hikes plan as well as the investors are highly eyeing on-the-horizon CPI data in Thursday, the gains experienced by US Dollar was limited. As of writing, the Dollar Index raised by 0.28% to 103.02

In the commodity market, the crude oil price depreciated by 0.27% to $74.50 per barrel as of writing following the rising of crude oil inventories. According to API, the US API Weekly Crude Oil Stock increased by 14.865M barrels, far higher than the consensus speculation. On the other hand, the gold price dropped by 0.01% to $1876.76 per troy ounce as of writing over the slightly rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.694M | – | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.20, 104.50

Support level: 102.05, 100.55

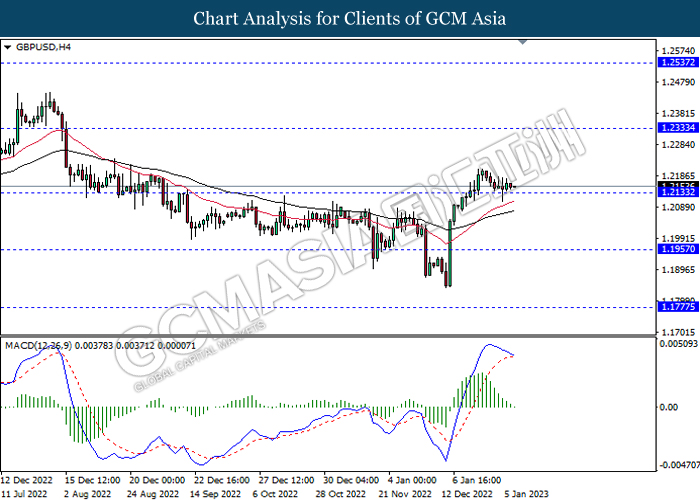

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

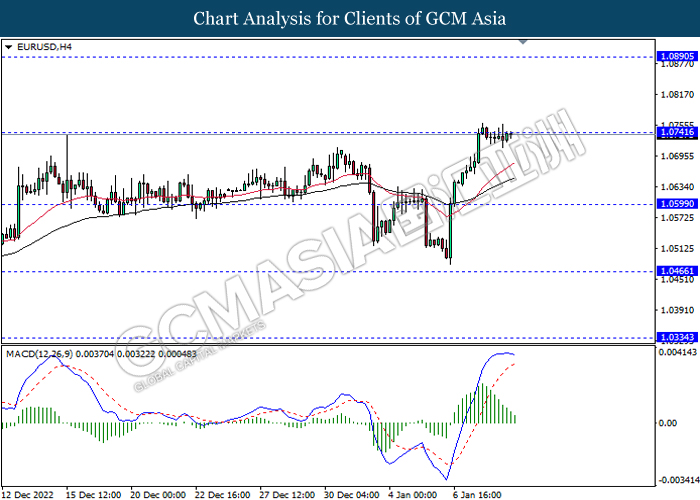

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0465

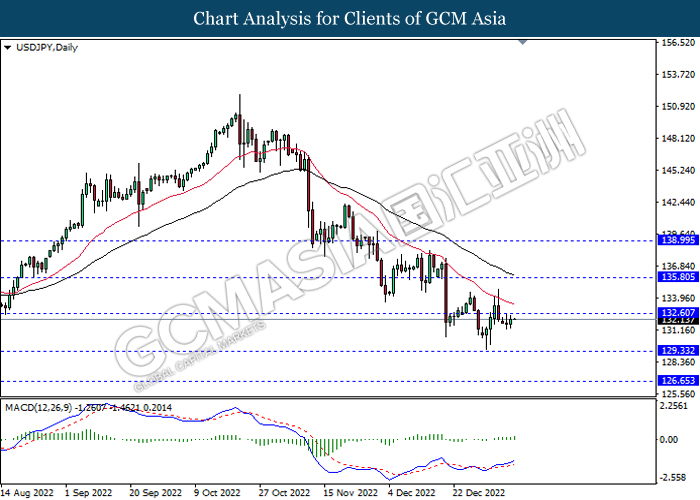

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successful breakout the resistance level.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

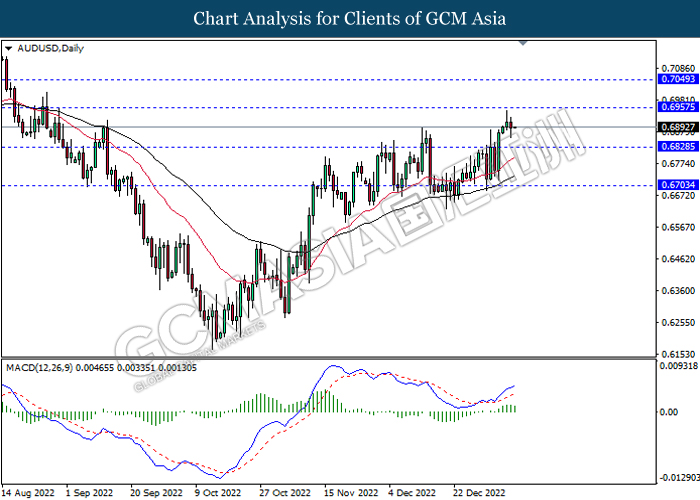

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

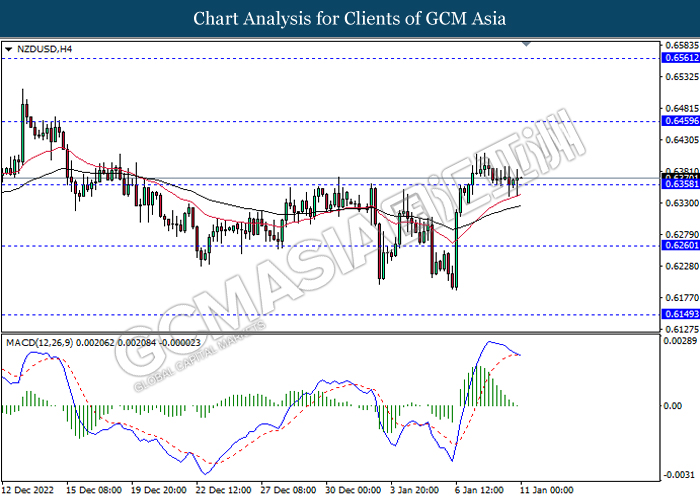

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

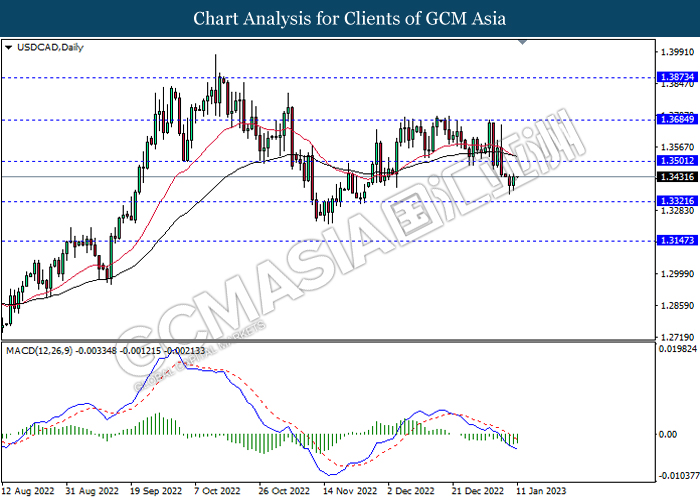

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher ad technical correction.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3145

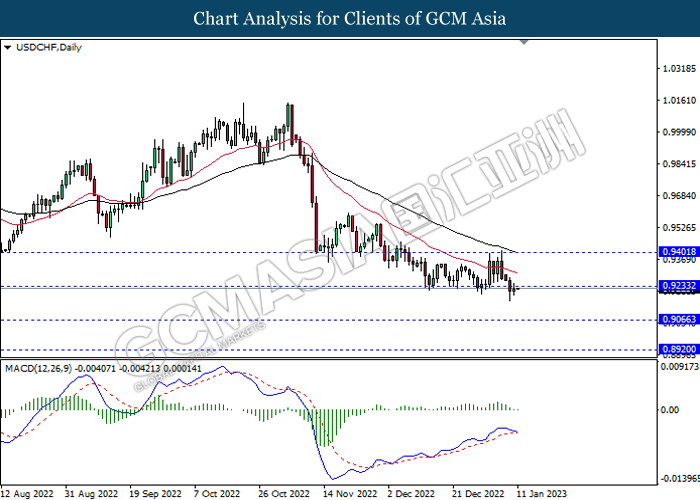

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

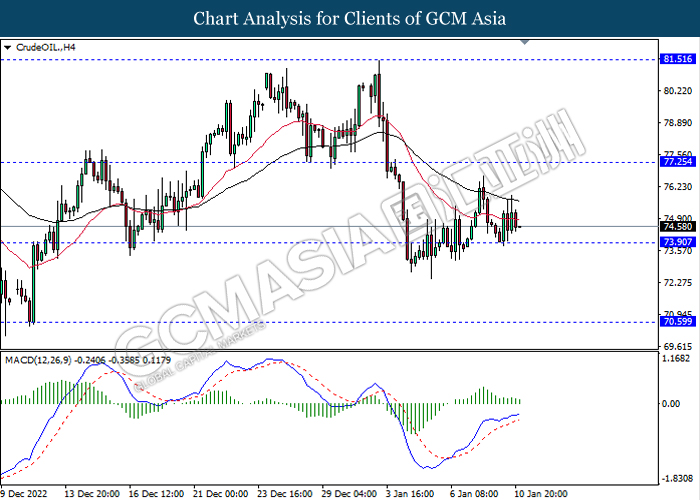

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.60

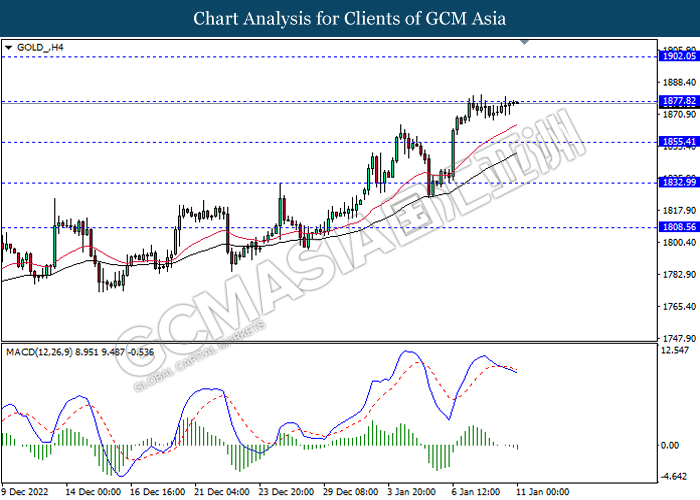

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00