12 January 2023 Morning Session Analysis

US Dollar’s bear continues ahead of CPI data.

The Dollar Index which traded against a basket of six major currencies seesawed near its 7-month lows as the market participants still awaiting for the announcement of US inflation report. At this juncture, the US Consumer Price Index (CPI) YoY was widely expected to drop from the previous reading, and the economist speculation has given a 6.5%, lower than the prior of 7.1%. On the other hand, the dovish speech from Fed member was putting further pressure on the US Dollar. According to The New York Time, Susan M. Collins, the president of the Federal Reserve Bank of Boston claimed on Wednesday that she was inclined toward 25 basis point hikes in the February meeting. She deemed that smaller hike of interest rate would likely to provide more spaces for them to access the incoming data before decision-making. Nonetheless, she also reiterated that it was data-dependent over the rate hike decision. Thus, on-the-horizon CPI data would likely to have a significant impact on the future direction of the FX market. As of writing, the Dollar Index edged down by 0.01% to 102.98.

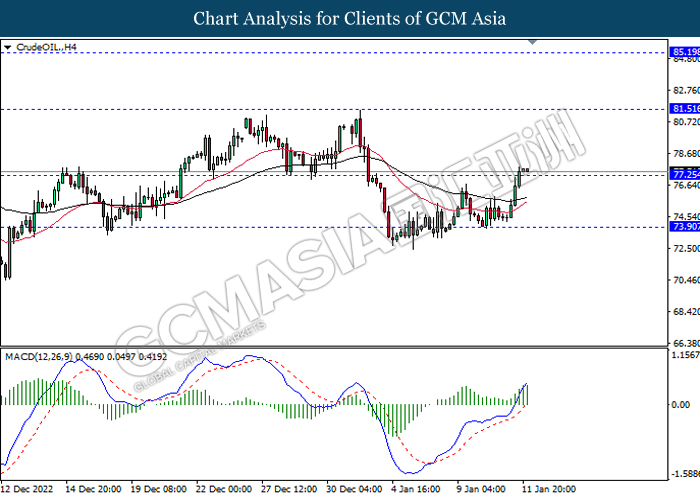

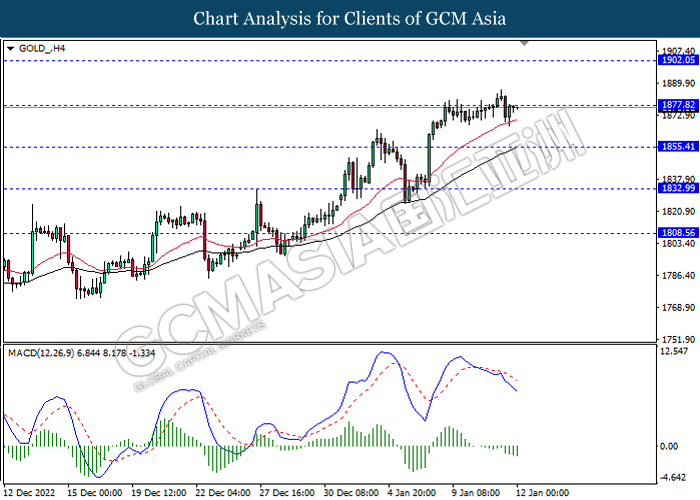

In the commodity market, the crude oil price depreciated by 0.05% to $77.70 per barrel as of writing following the rising of oil inventories. According to EIA, the US Crude Oil Inventories increased by 18.962M barrels, exceeding the market expectation. In addition, the gold price appreciated by 0.03% to $1875.81 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Core CPI (MoM) (Dec) | 0.20% | 0.30% | – |

| 21:30 | USD – CPI (MoM) (Dec) | 0.10% | 0.10% | – |

| 21:30 | USD – CPI (YoY) (Dec) | 7.10% | 6.50% | – |

| 21:30 | USD – Initial Jobless Claims | 204K | 220K | – |

Technical Analysis

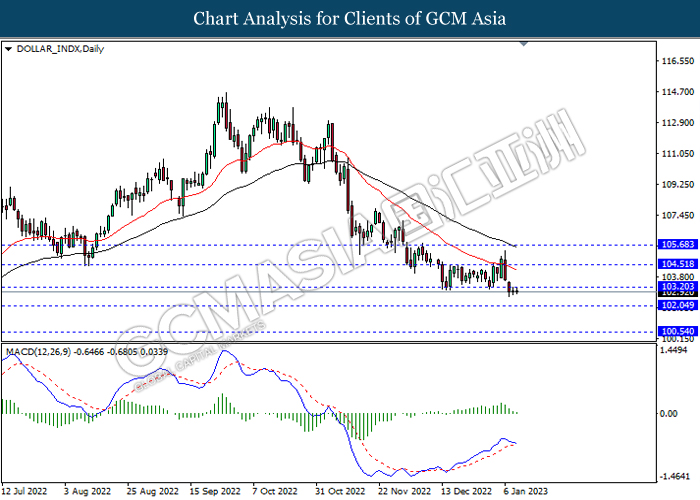

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.20, 104.50

Support level: 102.05, 100.55

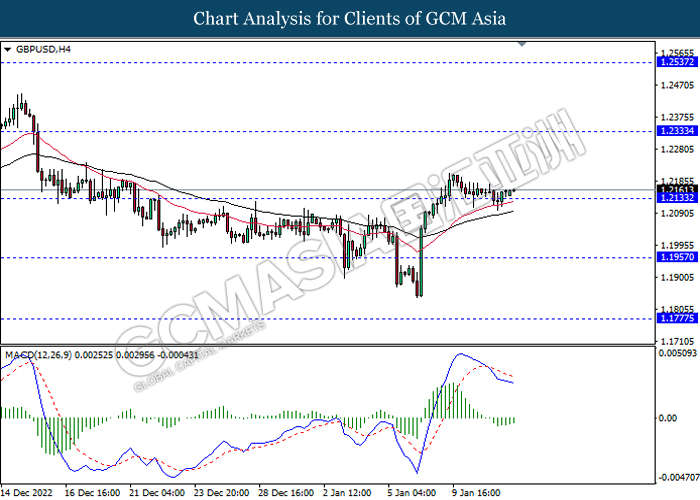

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2335, 1.2535

Support level: 1.2135, 1.1955

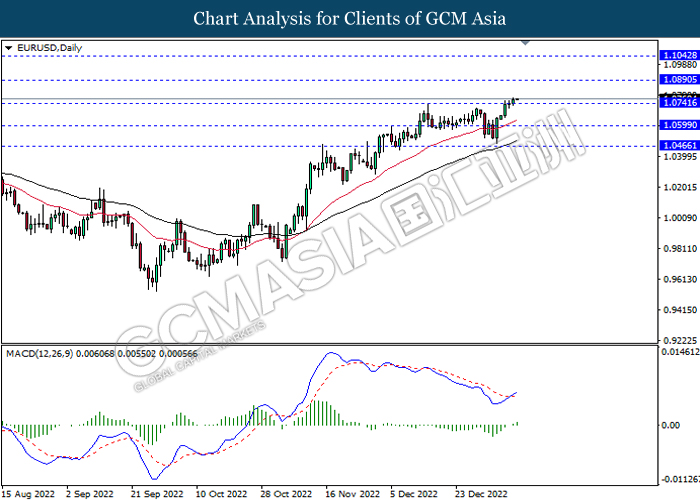

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0890, 1.1040

Support level: 1.0740, 1.0600

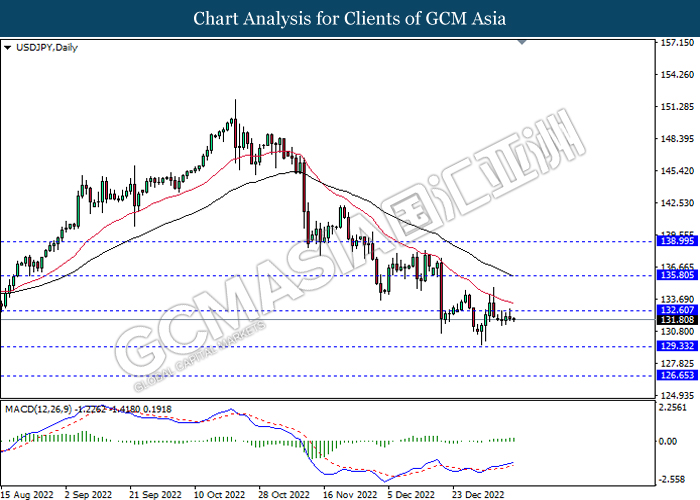

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 129.35, 126.65

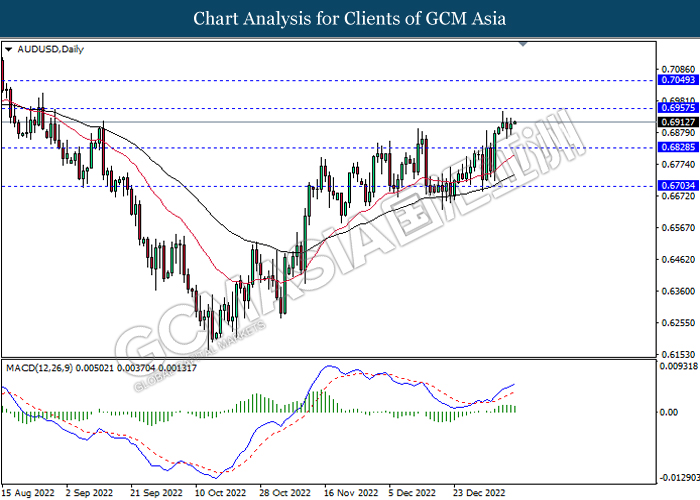

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6955, 0.7050

Support level: 0.6830, 0.6705

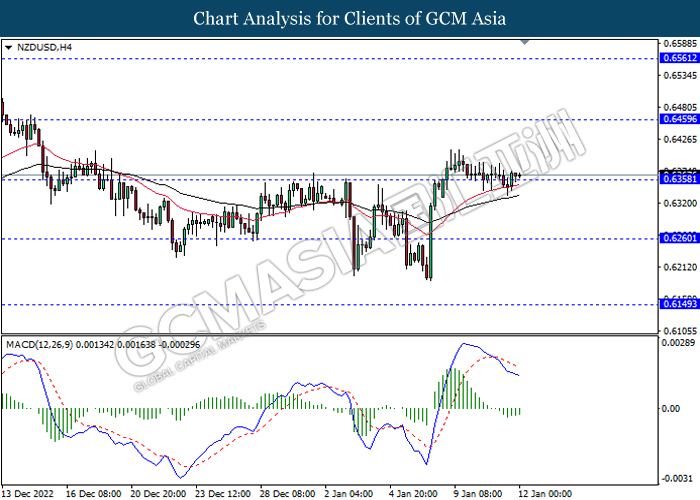

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6460, 0.6560

Support level: 0.6360, 0.6260

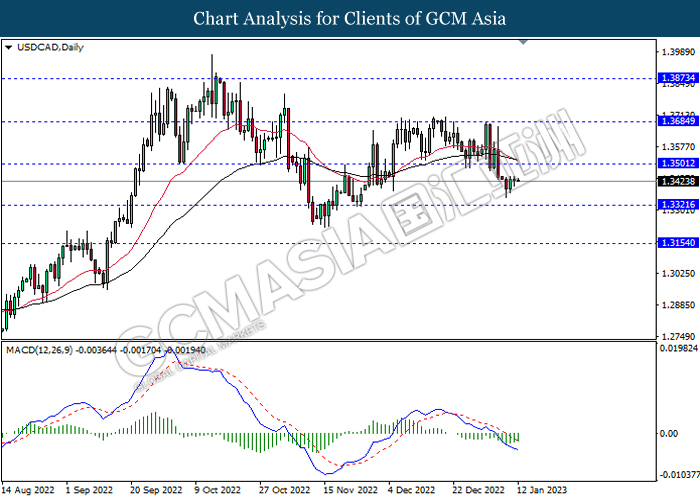

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher ad technical correction.

Resistance level: 1.3500, 1.3685

Support level: 1.3320, 1.3155

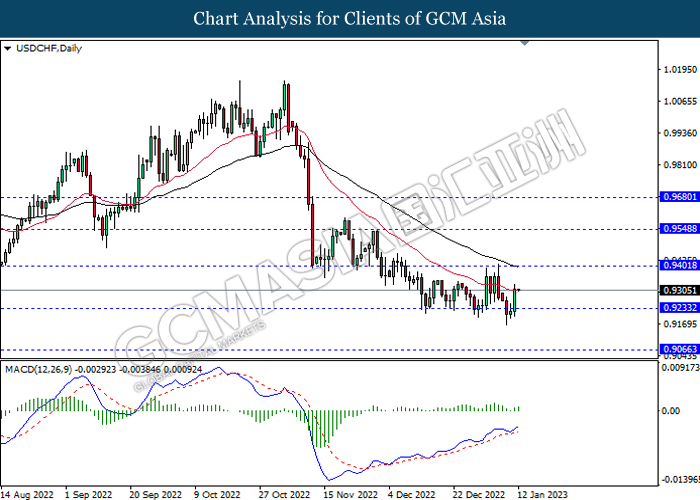

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9550

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 81.50, 85.20

Support level: 77.25, 73.90

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1877.80, 1902.05

Support level: 1855.40, 1833.00