16 January 2023 Morning Session Analysis

Bear continued to control the US Dollar market.

The dollar index, which traded against a basket of mainstream currencies, extended its losses as the massive sell-off activity continued during the last trading session in last week. Prior to that, the US Bureau of Labor Statistic released the long-waited inflation figure on Thursday. To reiterate, the data came in at a weaker pace as compared to the prior month’s reading, mirroring a further ease of inflation in the month of December. With that, it heralds a further tapering in the Fed’s tightening monetary policy stance, leading to a higher chance of only 25 basis-point rate hike in the upcoming meeting. According to the CME FedWatch Tool, the likelihood of a 25-basis point rate hike surged further to the level at 94.2%, whereas the odds of 50 basis point of rate hike was only 5.8%. On the other side, although US Michigan Consumer Sentiment for January printed a stronger-than-expected result, but the US Dollar market sentiment still overshadowed by the prospect of less aggressive rate hike. As of writing, the dollar index dropped -0.06% to 102.20.

In the commodities market, crude oil prices rose by 0.02% to $80.00 per barrel as the depreciation of US dollar caused the dollar-denominated crude oil cheaper for foreign buyer, driving up the demand of oil. Besides, gold prices edged up by 0.05% to $1920.15 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

All Day USD Martin Luther King, Jr. Day

Today’s Highlight Events

Time Market Event

23:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – German ZEW Economic Sentiment (Jan) | -23.3 | -15.5 | – |

Technical Analysis

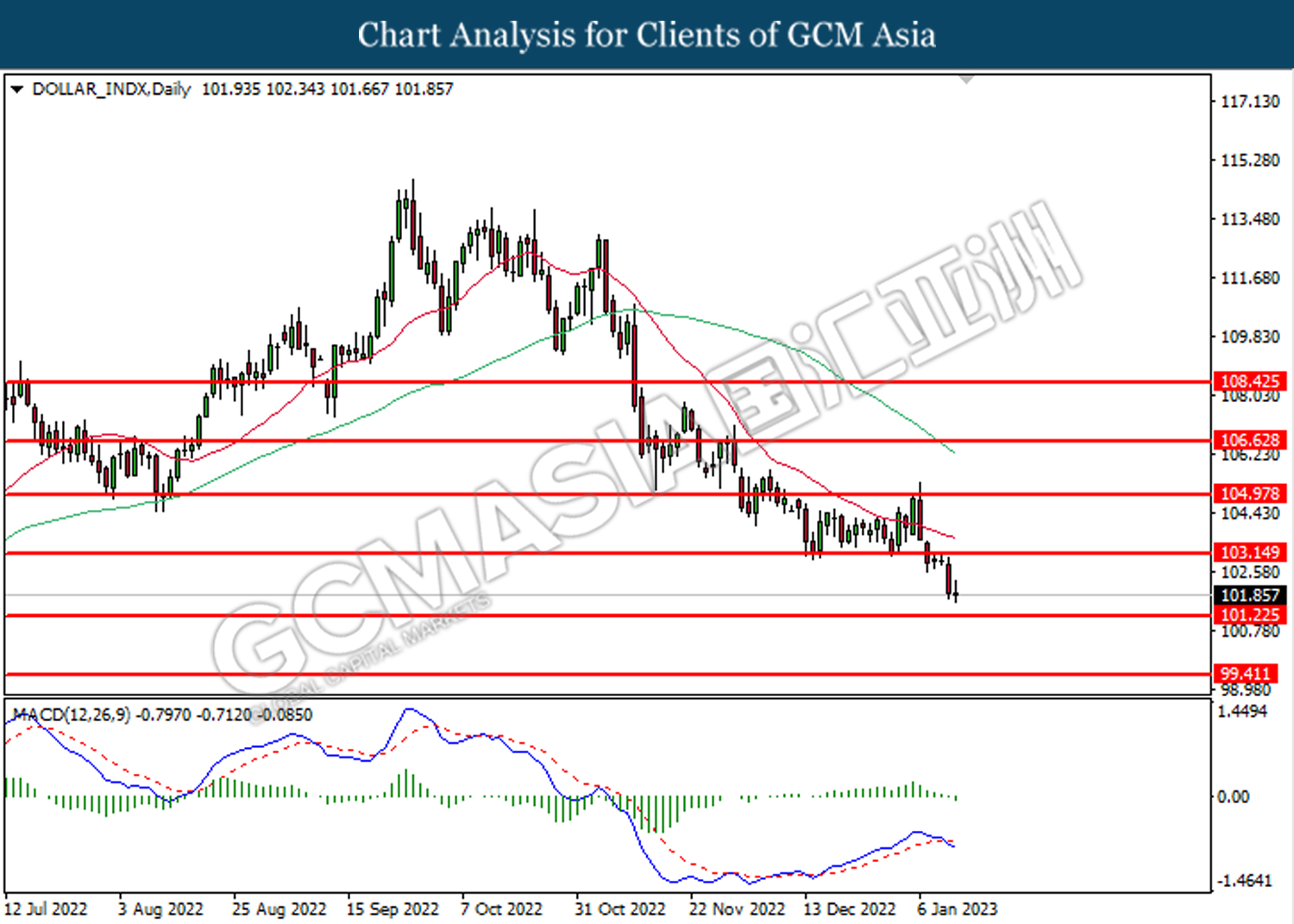

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 101.25.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

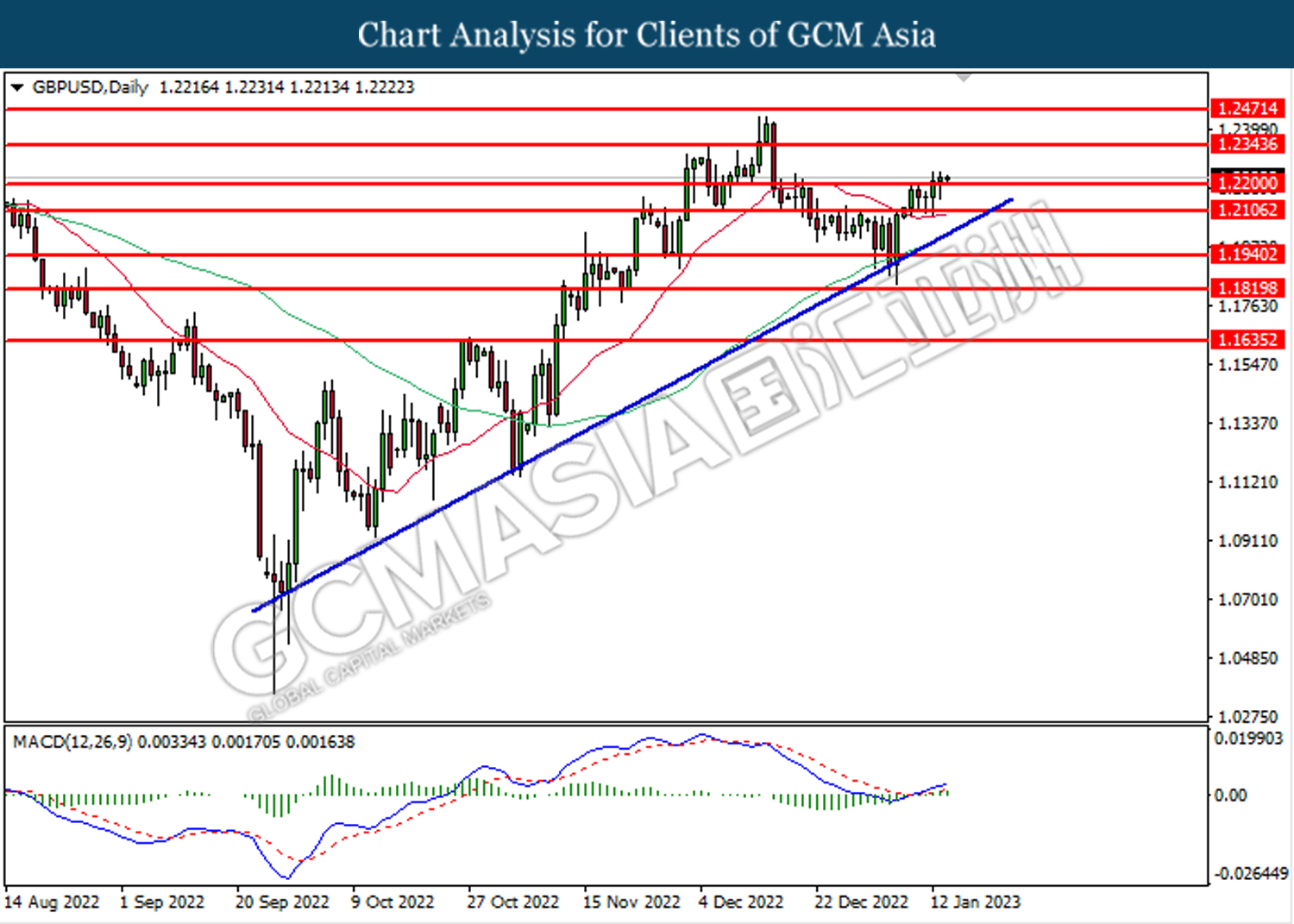

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2345.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

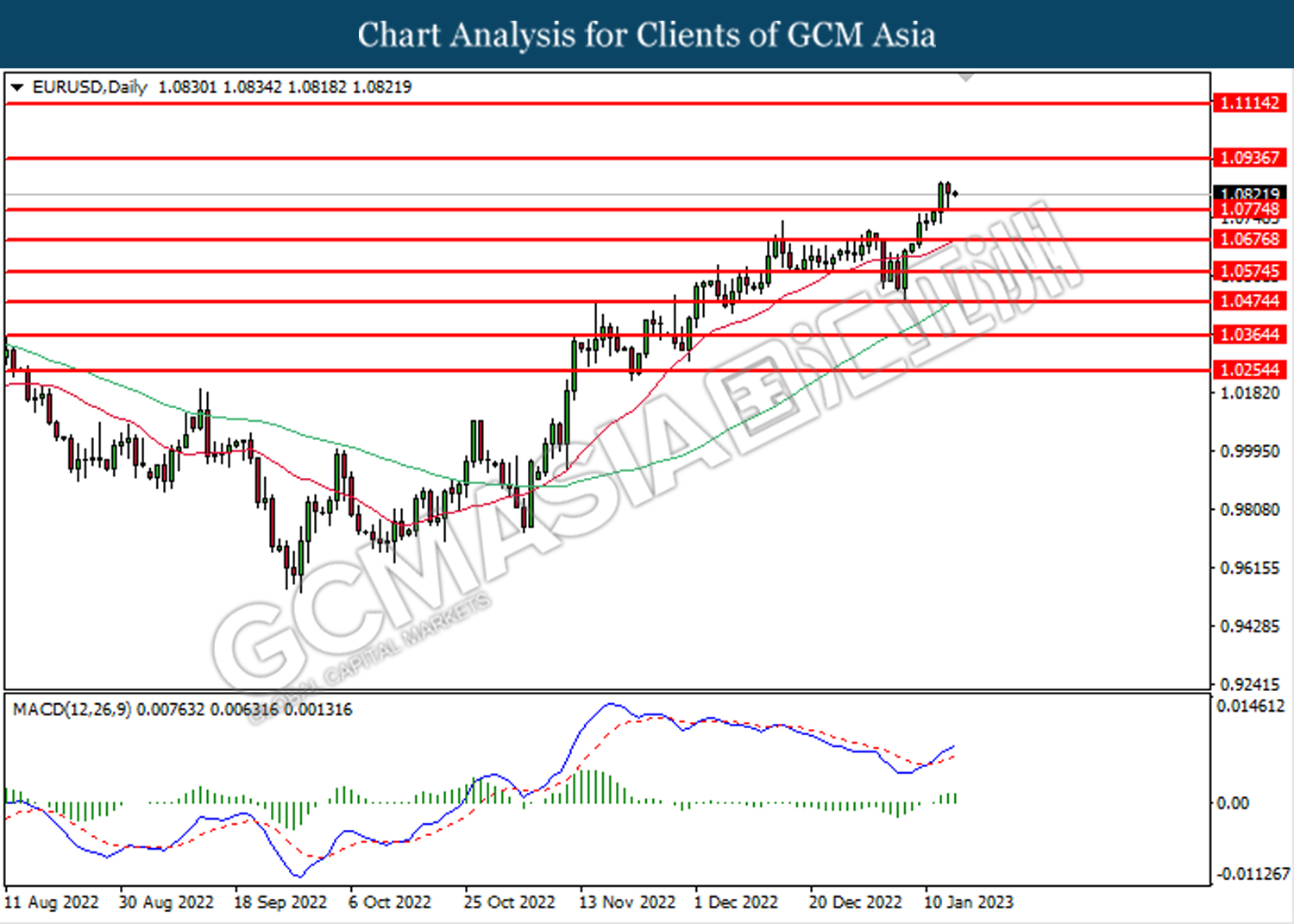

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level at 1.0775. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0935.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

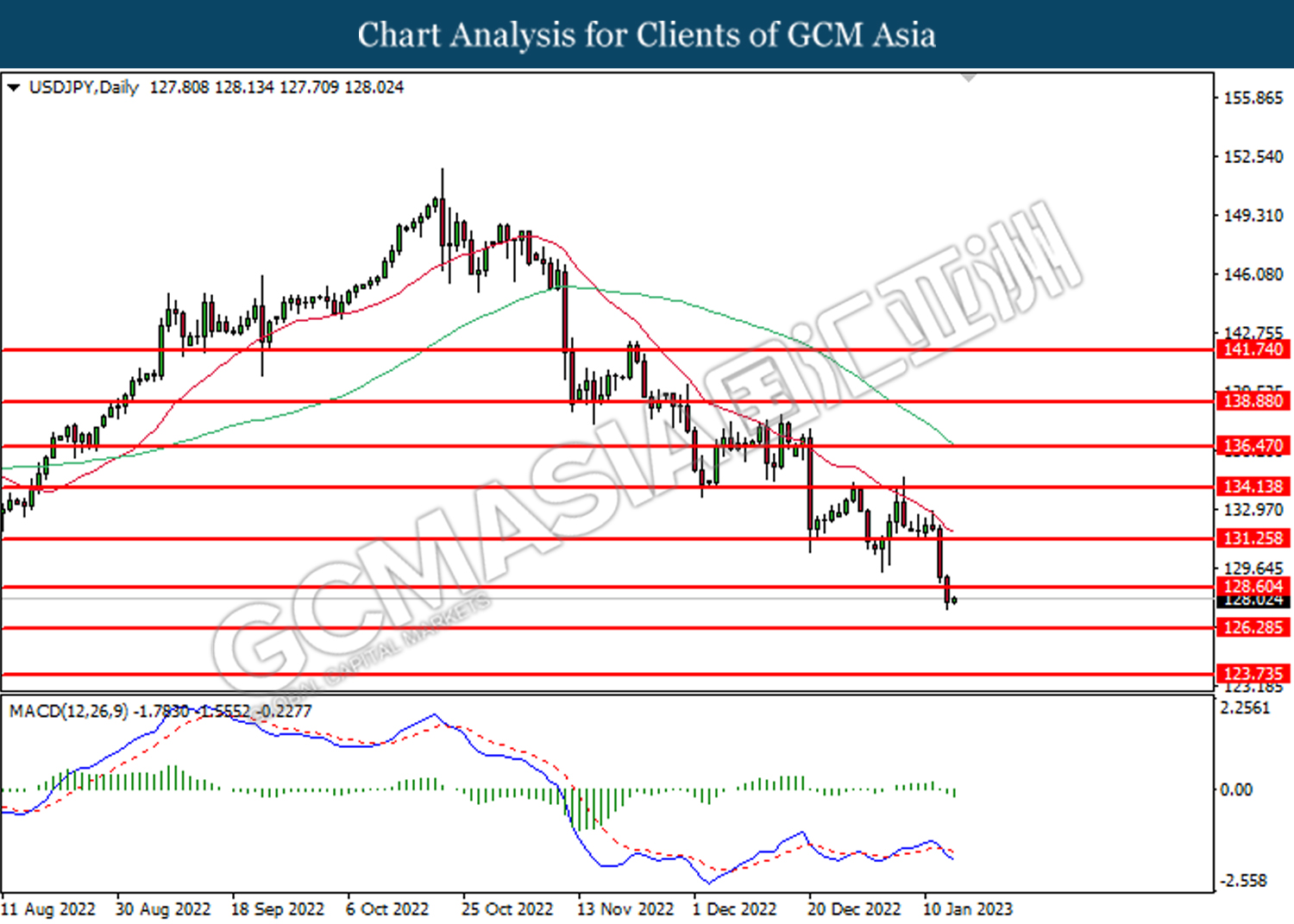

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the support level at 128.60. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 126.30.

Resistance level: 128.60, 131.25

Support level: 126.30, 123.75

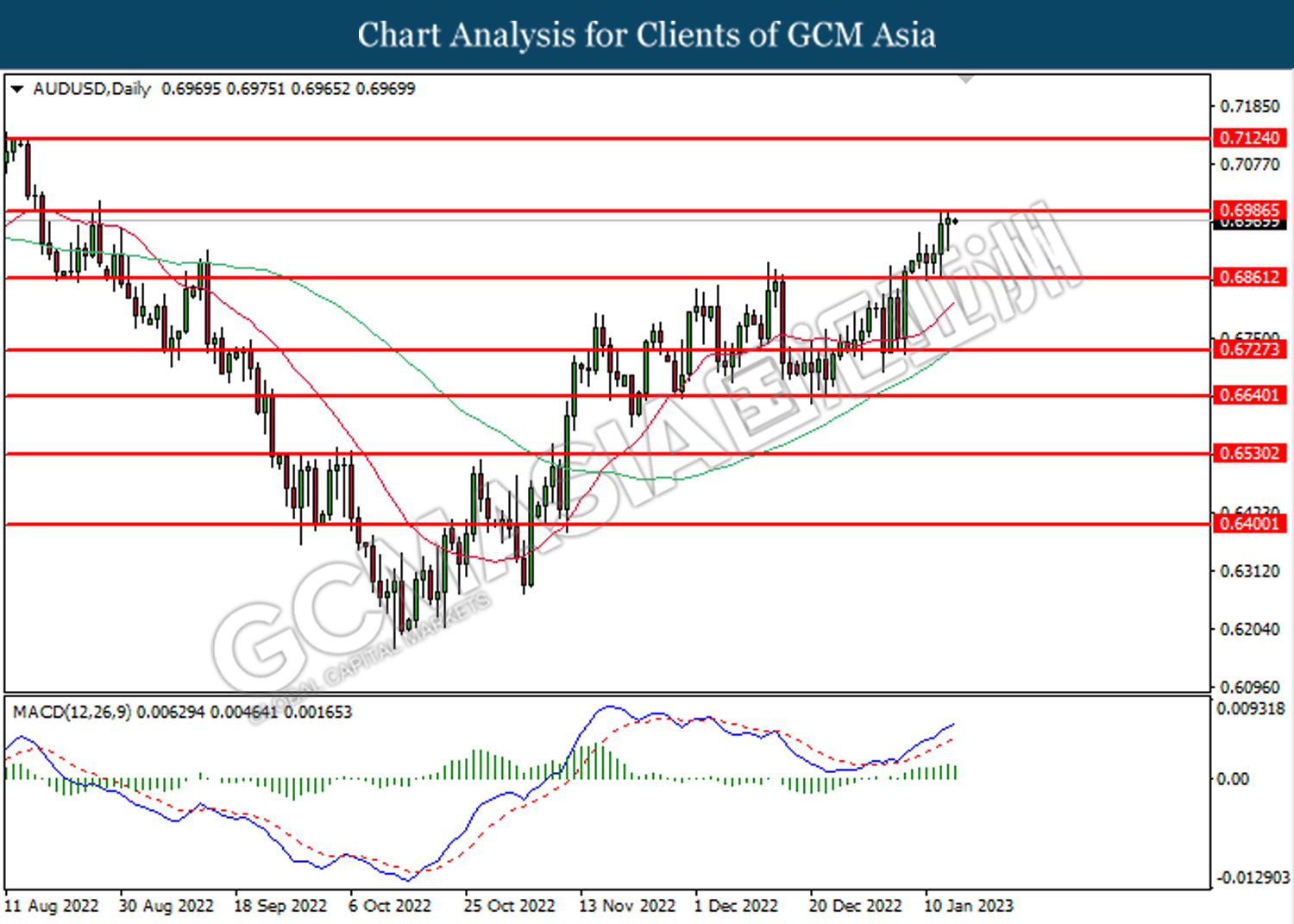

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6985. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6985, 0.7125

Support level: 0.6860, 0.6725

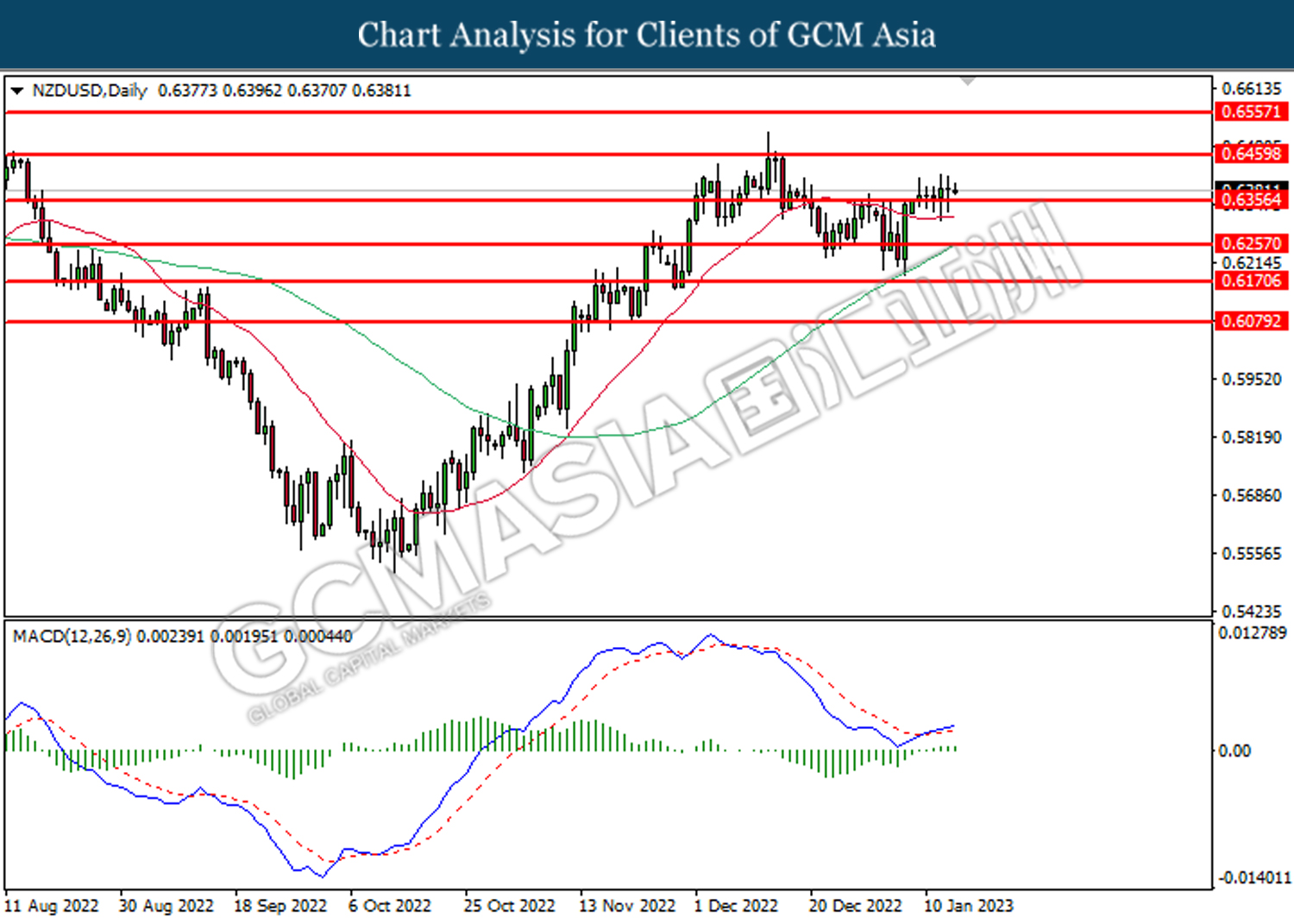

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6355. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6460.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

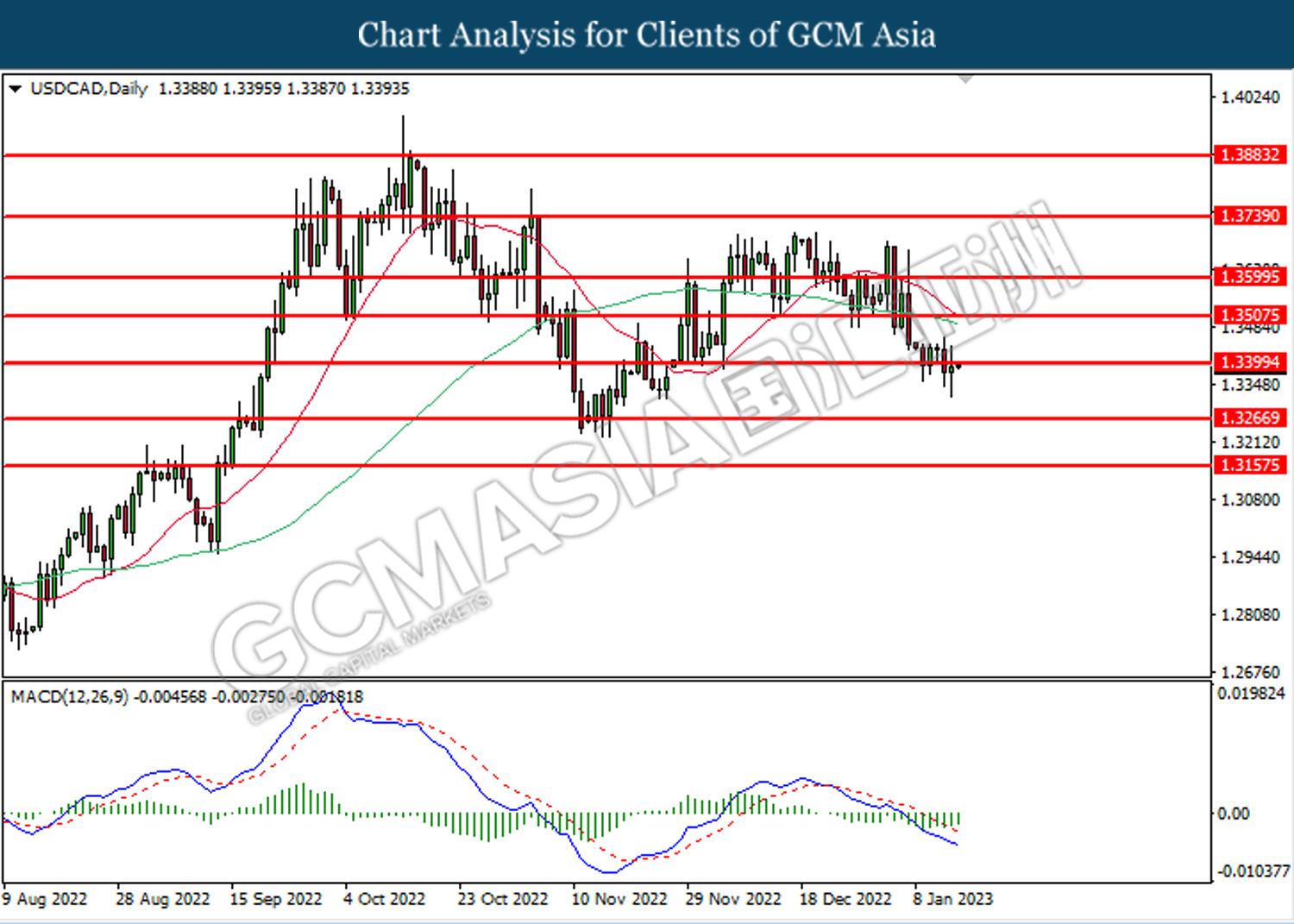

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3400. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

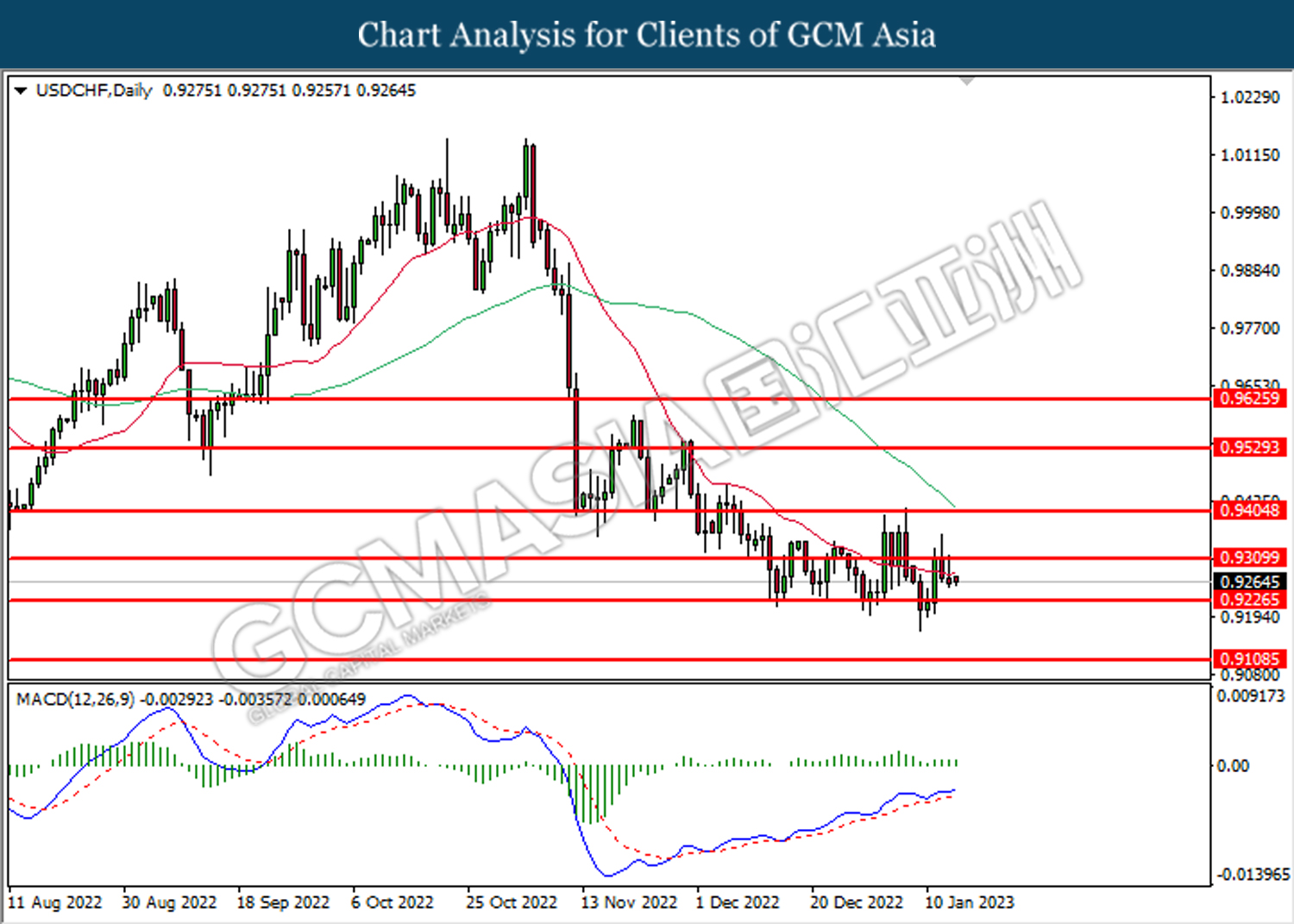

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9310. However, MACD which illustrated bullish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

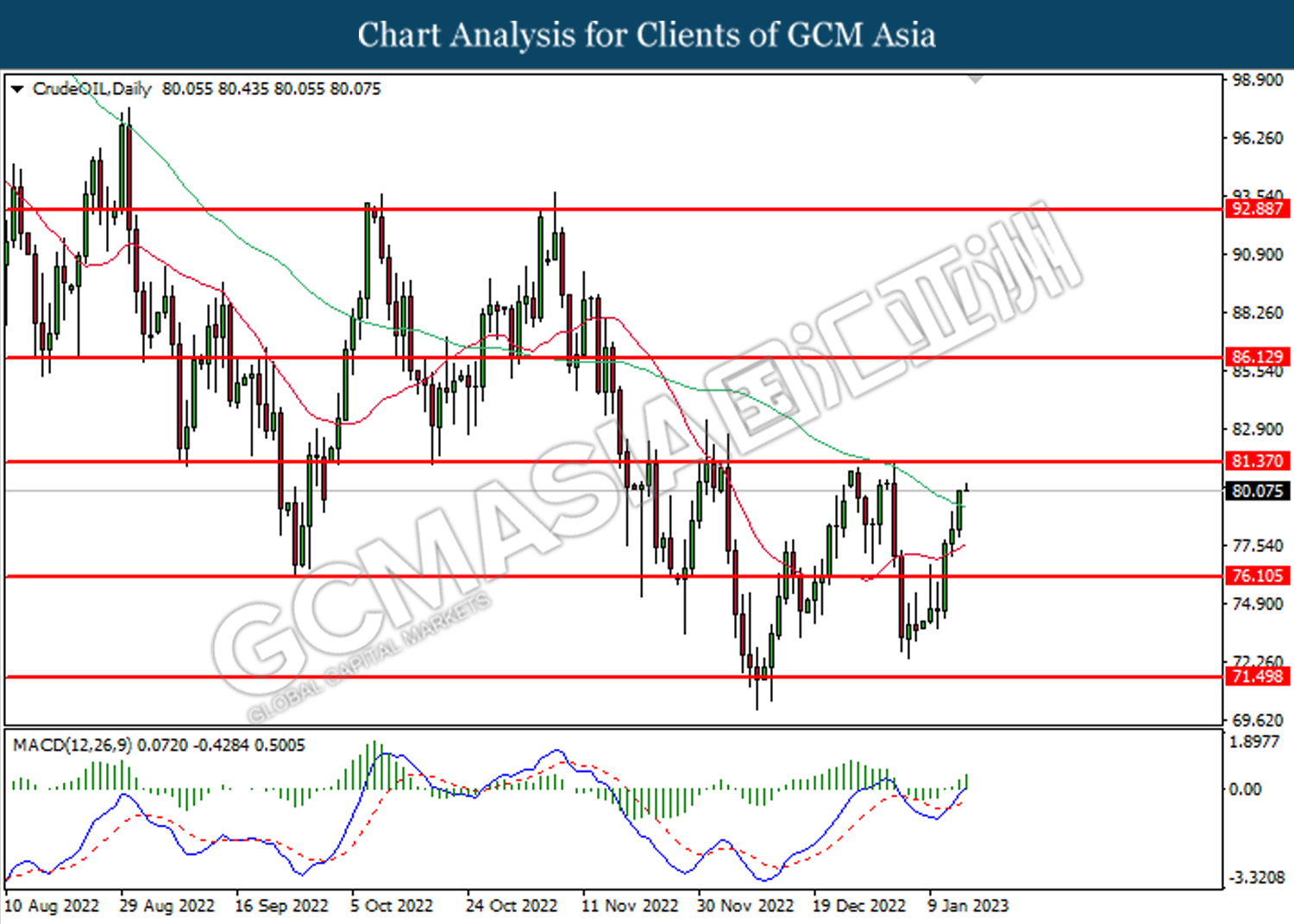

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 81.35.

Resistance level: 81.35, 86.15

Support level: 76.10, 71.50

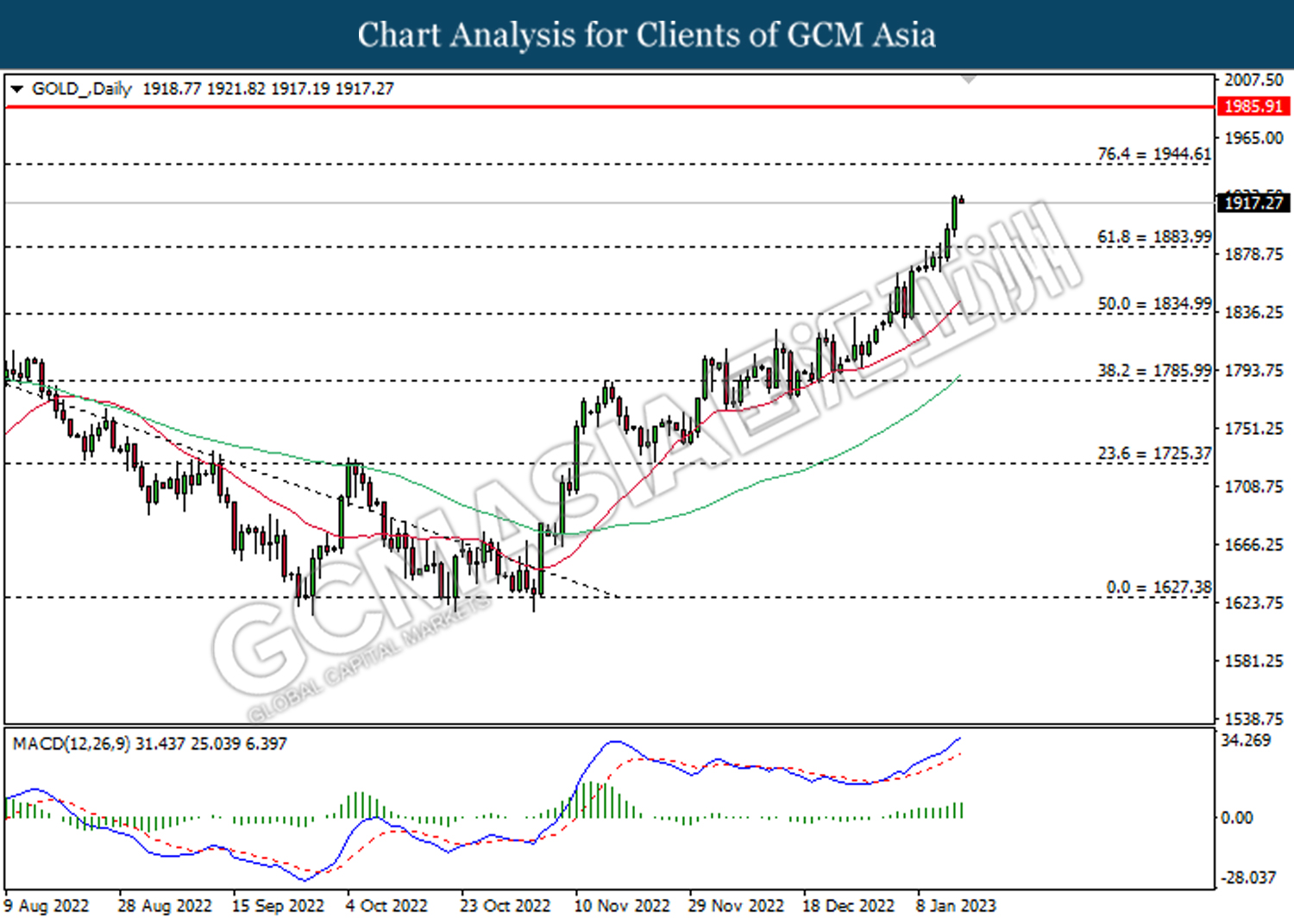

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1884.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1884.00, 1835.00