08 February 2023 Afternoon Session Analysis

Euro rebound ahead of Germany CPI release.

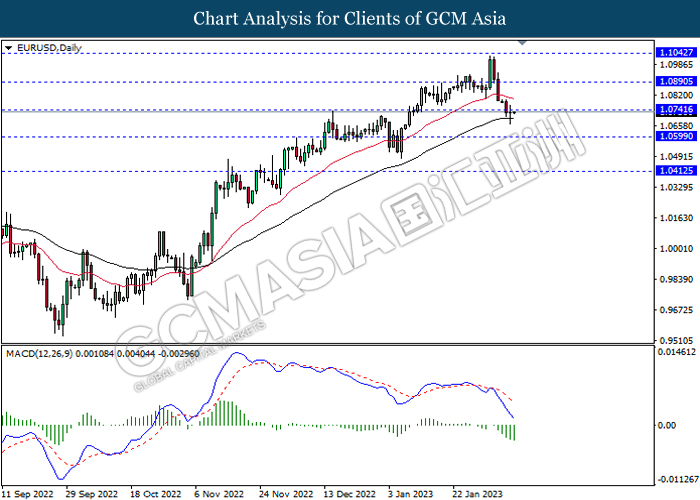

The Euro, which is traded globally as the mainstream of currency, rebounded from the lower level ahead of Germany’s CPI release. The previous month’s German CPI yearly reading stood at 8.6% while the investors predicted the upcoming Jan CPI will grow by 0.3% to 8.9%. A positive reading prediction from the economic data attracted investors’ demand for more Euro as the market increases the expectation for an ECB rate hike. As the ECB target a 2% inflation rate across all Europe countries while Germany is still far away from the target rate, it is likely that the ECB will increase the interest rate aggressively in the upcoming monetary policy decision. Besides, previous services PMI data released by Markit Economics interpreted that the German economy was recovering from the bottom and it increased the space that ECB will continue for a more aggressive rate hike. At the same time, the reversal trend of the Euro is also supported by the weakening of the dollar index aftermath of Jerome Powell’s less-hawkish comment. As of writing, the EUR/USD appreciated 0.08% to $1.0732.

In the commodities market, crude oil price gained 0.21% to $77.31 per barrel as the US API data showed that the US crude oil inventories reduced throughout the week, pushing the oil price to a higher level. Besides, gold prices tipped by 0.23% to $1889.45 per troy ounce after the Fed’s chairman eased the rate hike concerns.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.140M | 2.457M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggests the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.55

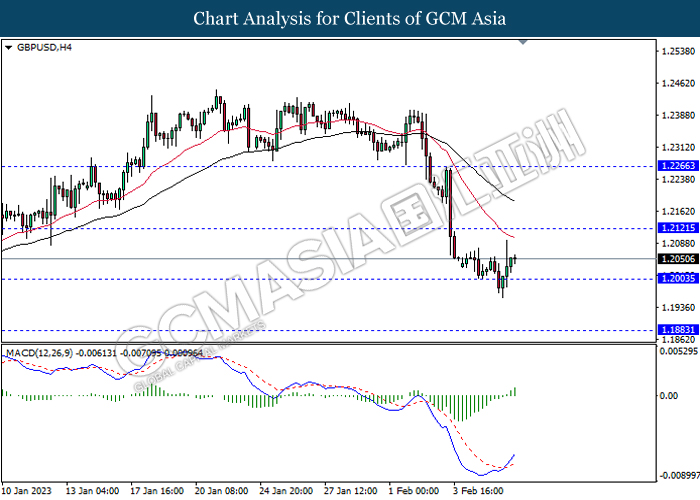

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the support level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

EURUSD, Daily: EURUSD was traded lower following a prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

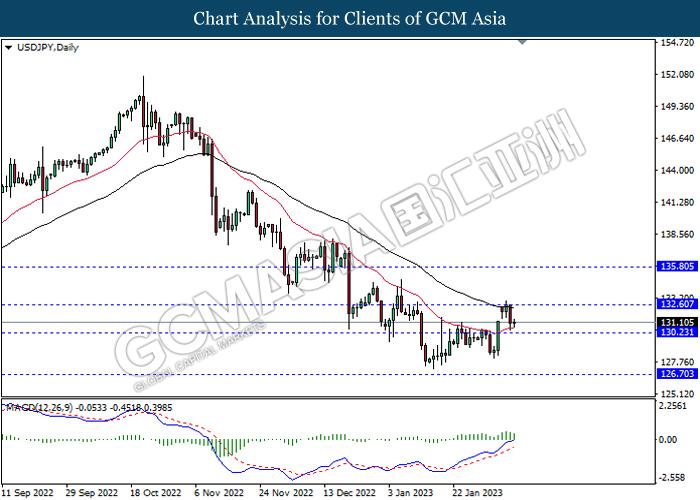

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses.

Resistance level: 132.60, 135.80

Support level: 130.25, 126.70

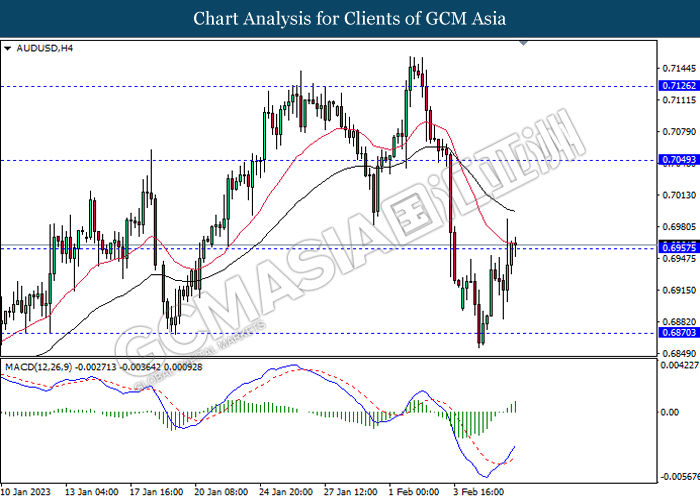

AUDUSD, H4: AUDUSD was traded higher following the prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains.

Resistance level: 0.7050, 0.7125

Support level: 0.6955, 0.6870

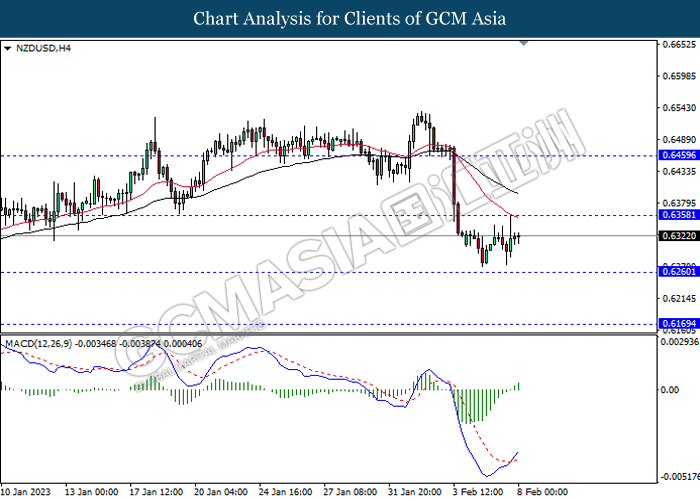

NZDUSD, H4: NZDUSD was traded lower following a prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggests the pair to be traded higher as a technical correction.

Resistance level: 0.6360, 0.6460

Support level: 0.6260, 0.6170

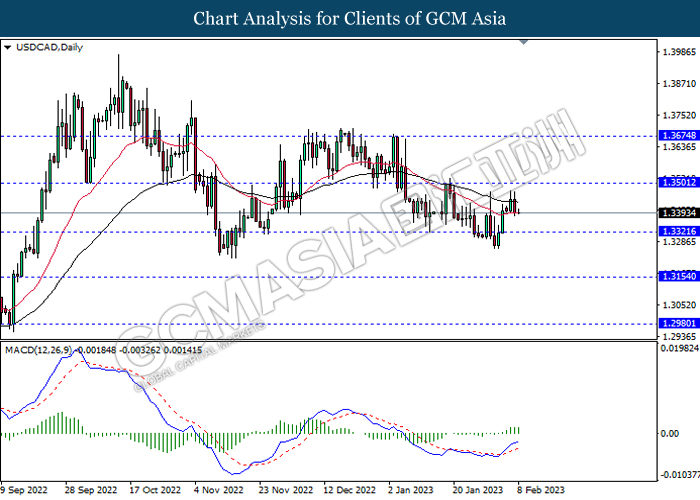

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggests the pair to be traded lower as technical correction.

Resistance level: 1.3500, 1.3675

Support level: 1.3320, 1.3155

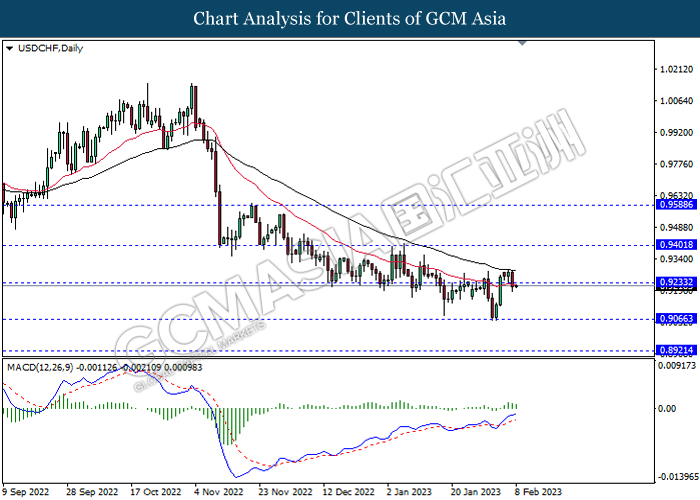

USDCHF, Daily: USDCHF was traded lower following a prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses.

Resistance level: 0.9235, 0.9400

Support level: 0.9065, 0.8920

CrudeOIL, H4: Crude oil price was traded lower following the prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggests the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

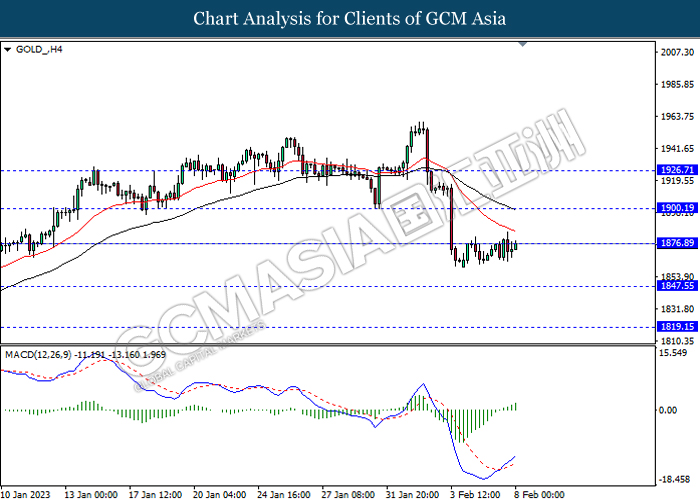

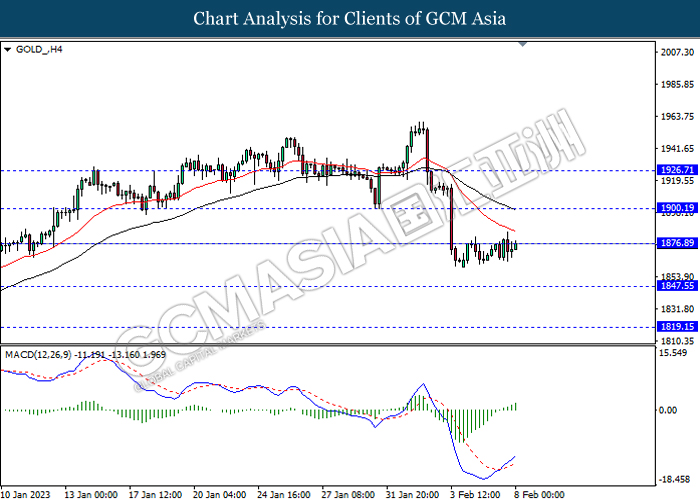

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15