13 February 2023 Morning Session Analysis

US dollar climbs ahead inflation report.

The dollar index, which is traded against a basket of six major currencies, surged as investors remain cautious ahead of a blockbuster inflation report later this week. Two weeks before, the Federal Reserve adjusted their interest rate upward by 25 basis points, as widely expected. It is noteworthy to highlight that Fed Chairman Jerome Powell has finally admitted that inflation has started to ease, and the disinflationary process has begun especially in the goods sector. Nonetheless, Jerome Powell commented that there is still a long way to bring down the inflationary pressures, with a hint of more rate hikes in the future. Besides, the dollar index preserved its strength following the release of the Michigan consumer sentiment report. According to the University of Michigan, the US consumer sentiment revived further from the preliminary reading at 64.9 to 66.4 in the month of February, hitting the highest level in 13 months’ time. The better-than-expected sentiment in the US was mainly driven by the persistent tight labor market, where it reduced the market fears over the likelihood of a recession in the country. At this juncture, most of the investors are paying their attention over the upcoming inflation report to scrutinize the rate hike path of the Federal Reserve. Unexpected inflation figures would trigger large volatility in the market, causing uncertainty over the financial market. As of writing, the dollar index rose by 0.35% to 103.60.

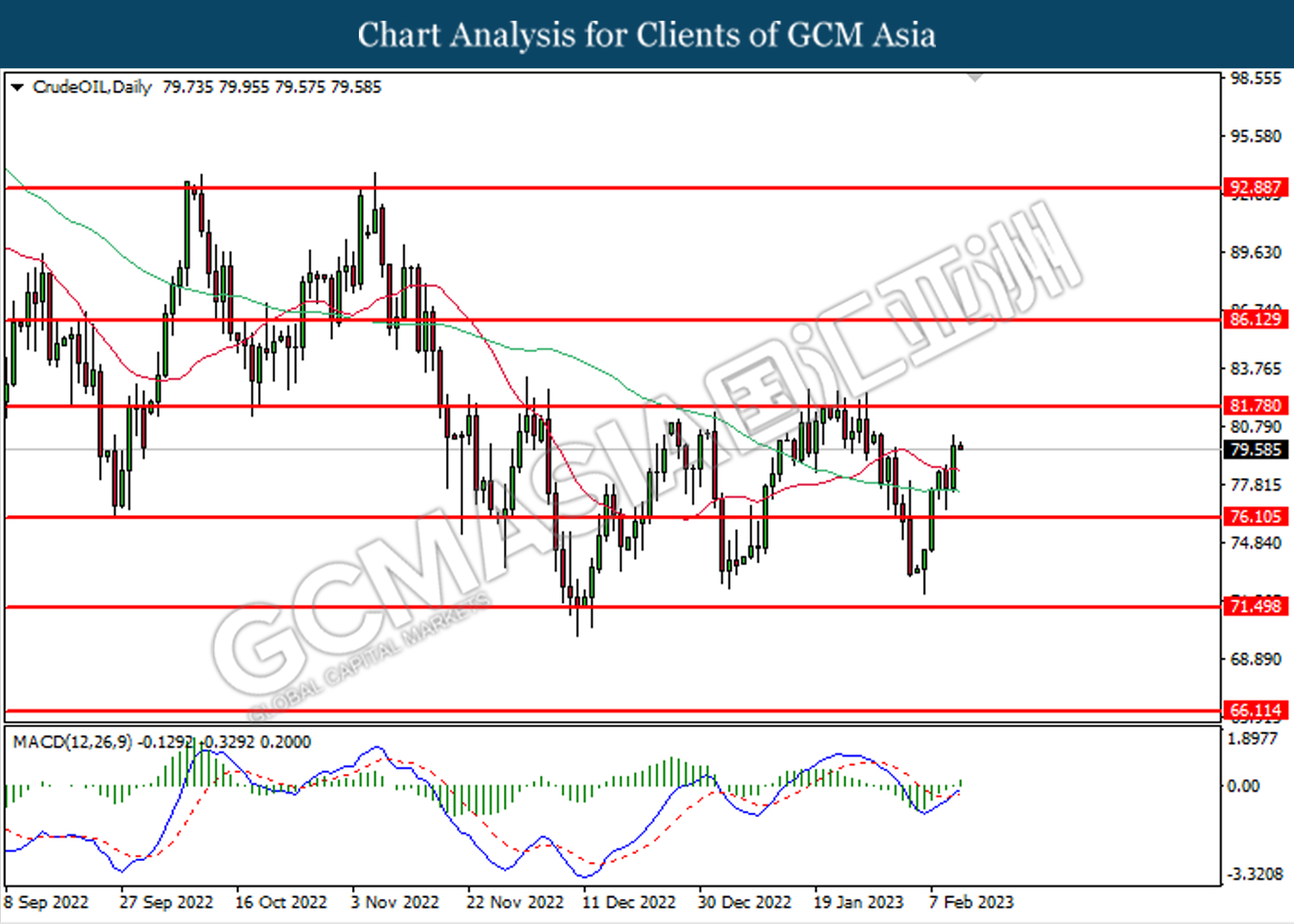

In the commodities market, crude oil prices were up by 0.05% to $79.70 per barrel as Russia planned to reduce the oil production by 500k barrels per day last Friday. The retaliatory action was coming after the price cap sanction from the western countries against Russia. Besides, gold prices edged down -0.02% to $1865.90 per troy ounce amid weakness in the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

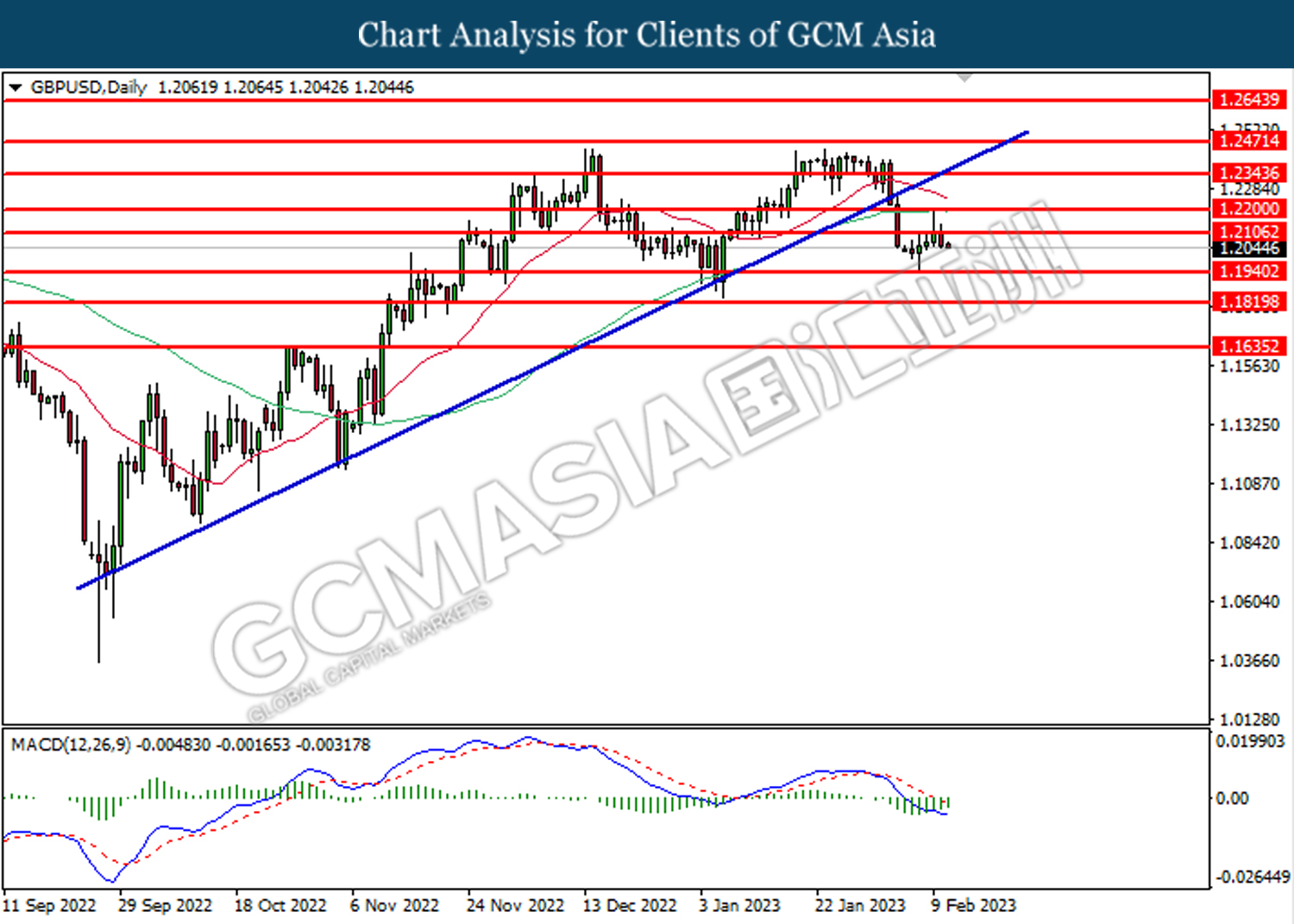

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.2105. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo short-term technical correction.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

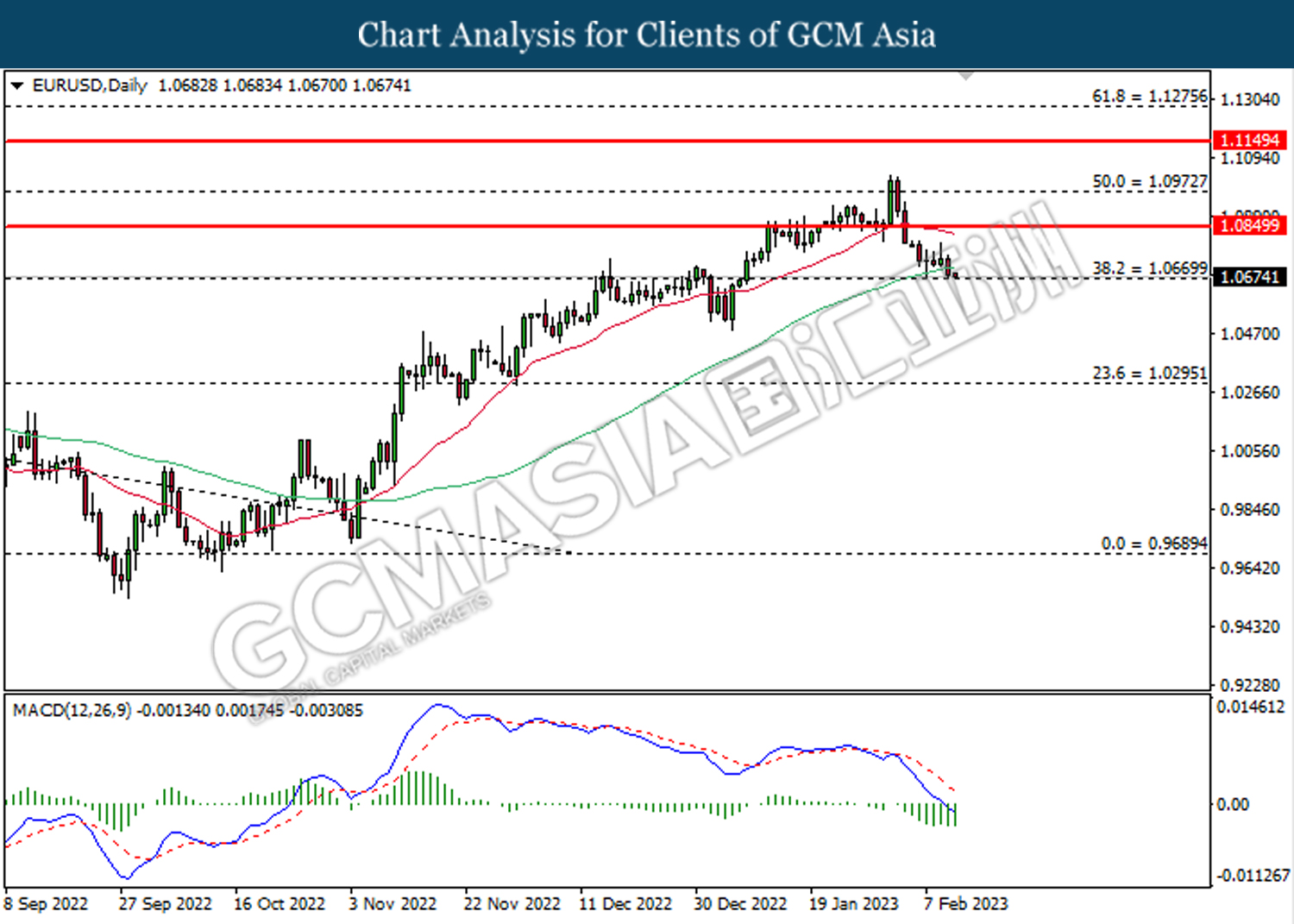

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0670. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

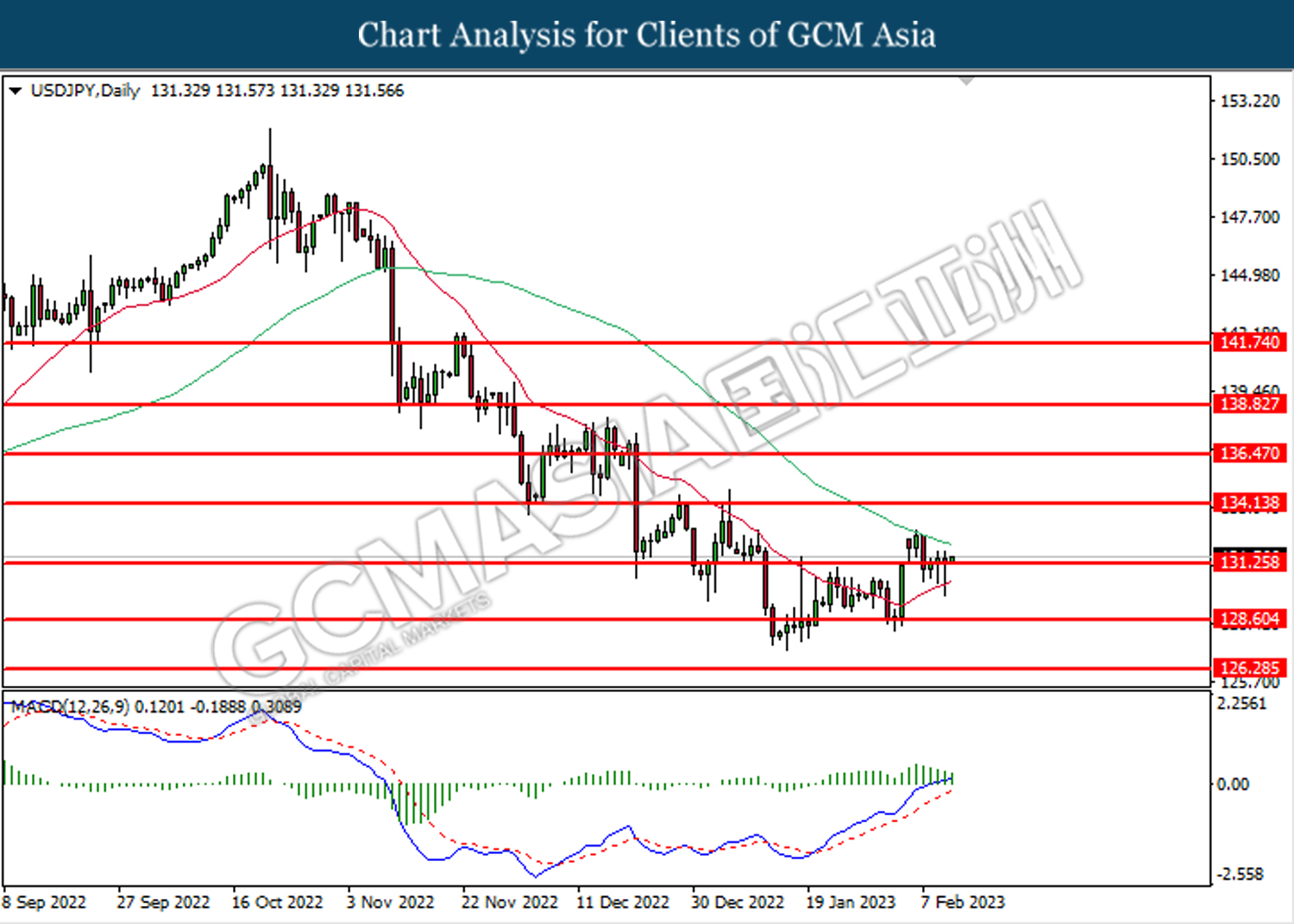

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 131.25. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

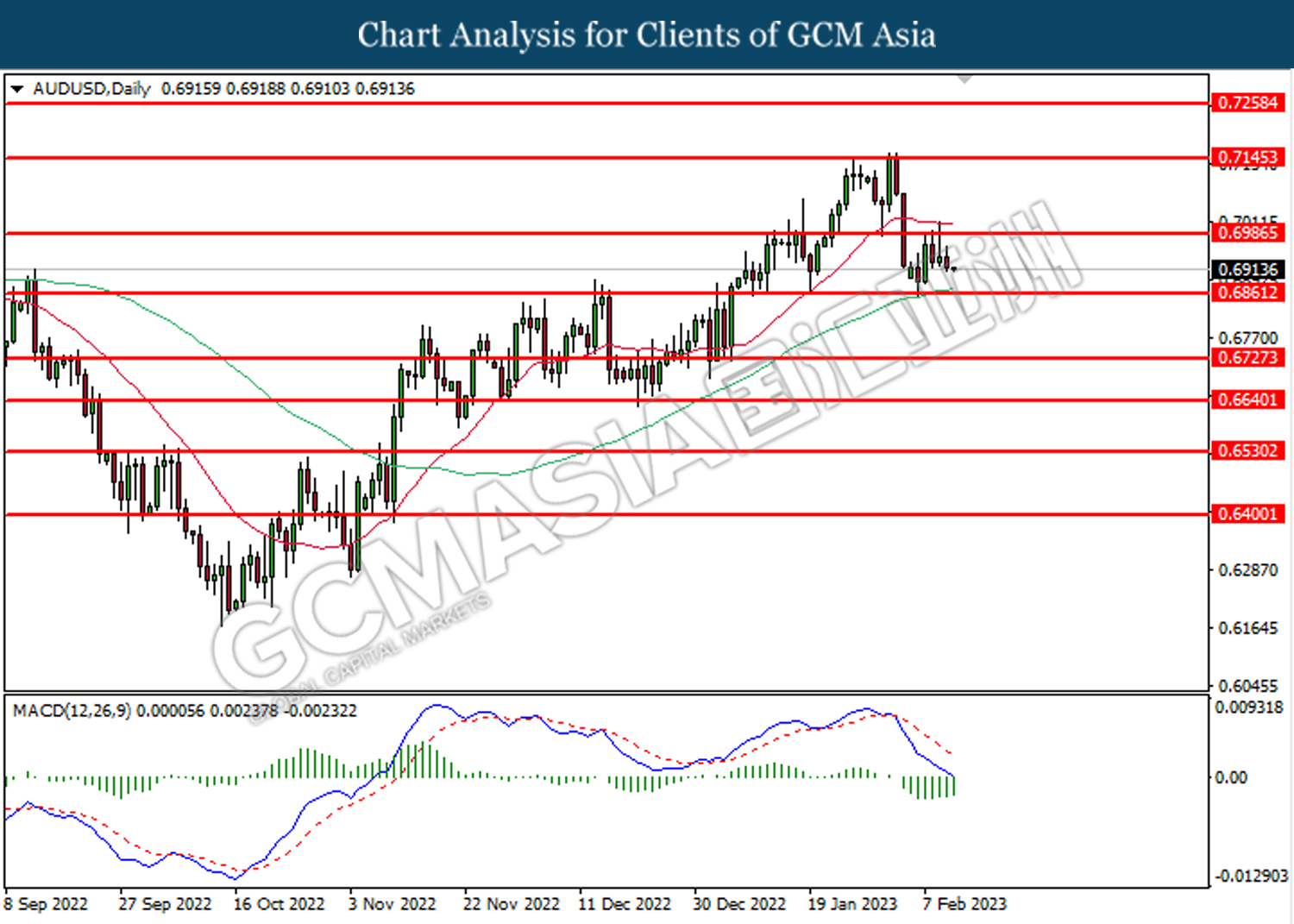

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6985. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6860.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

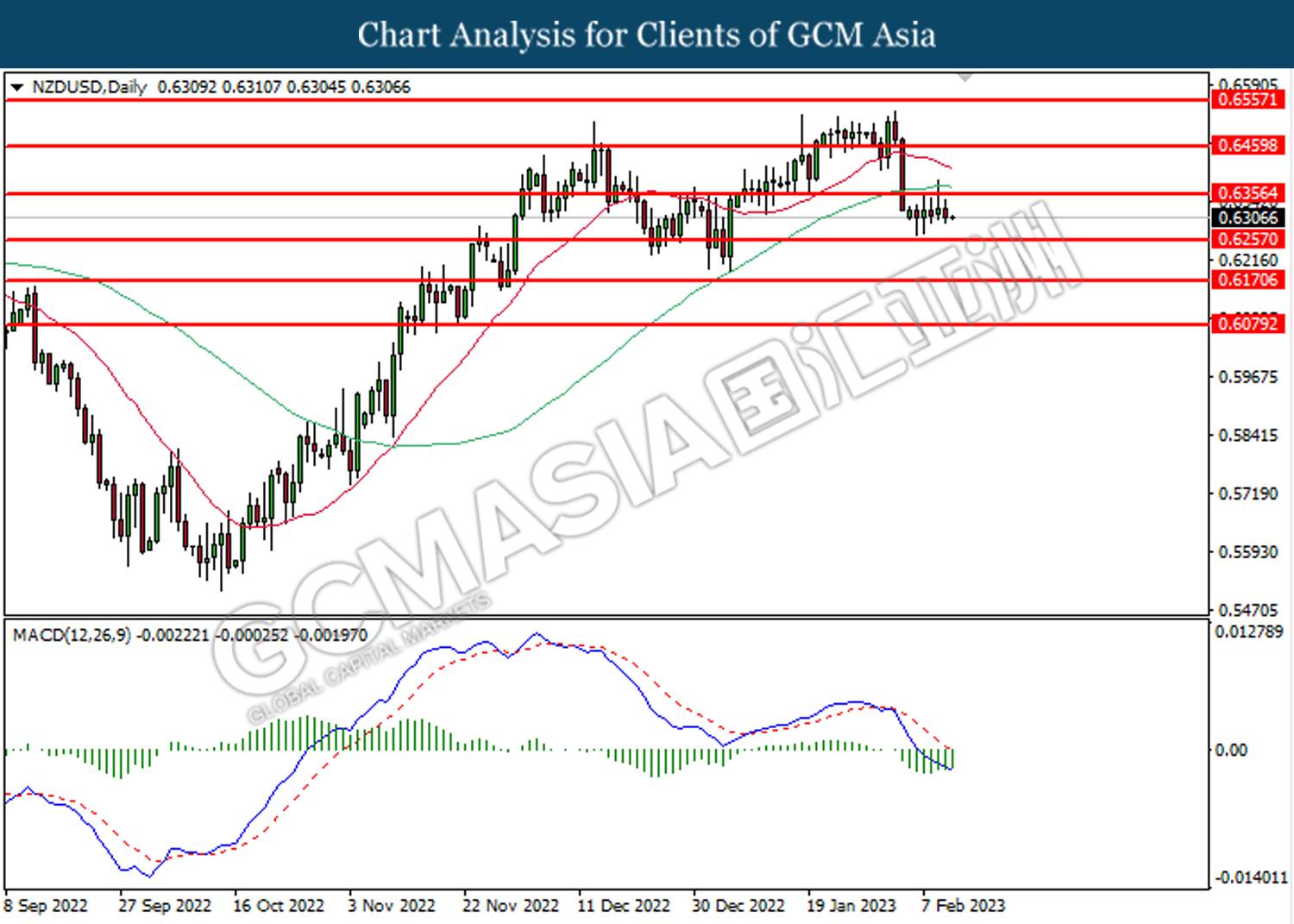

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6355.

Resistance level: 0.6355, 0.6460

Support level: 0.6255, 0.6170

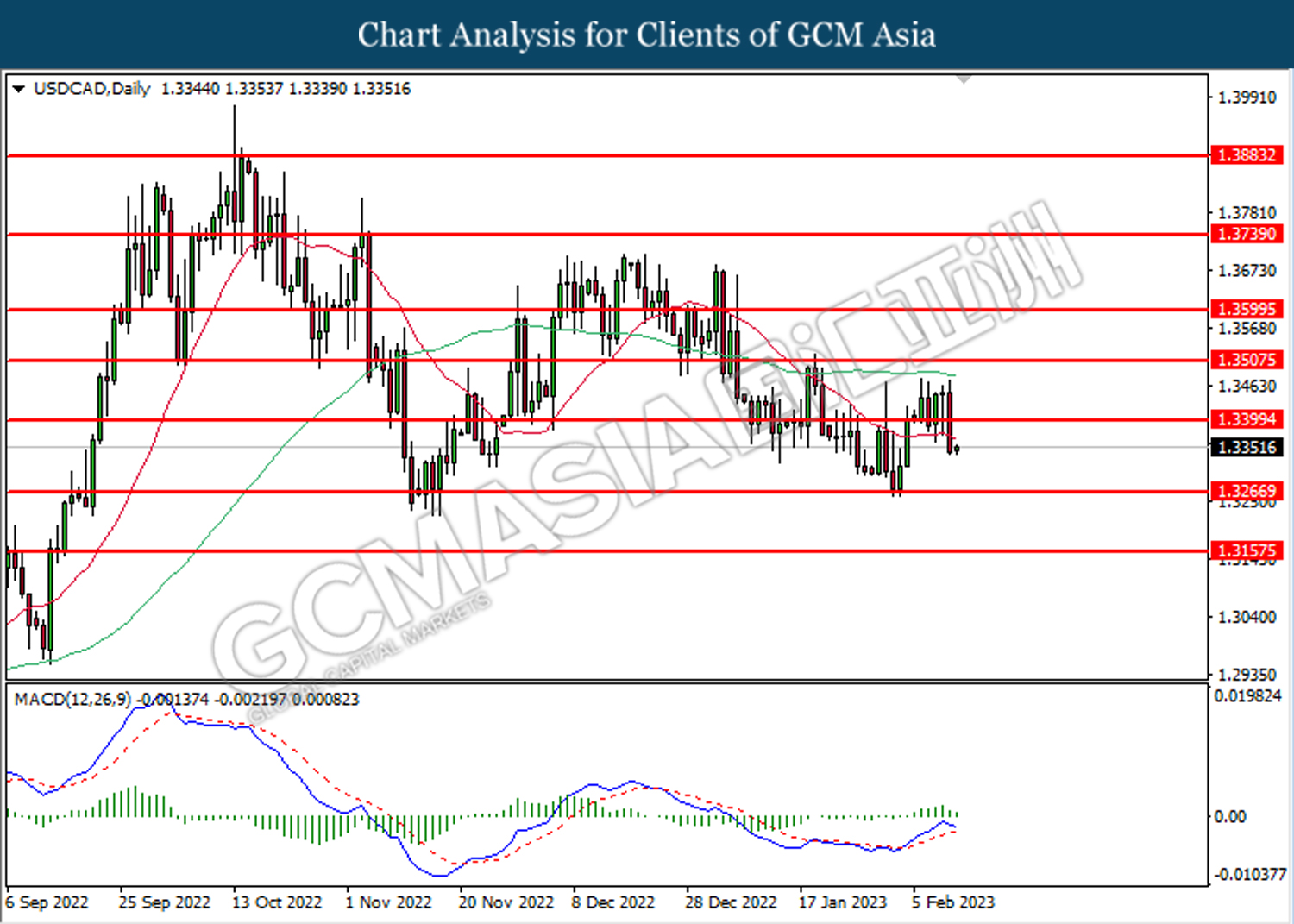

USDCAD, Daily: USDCAD was traded lower following a prior breakout below the previous support level at 1.3400. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

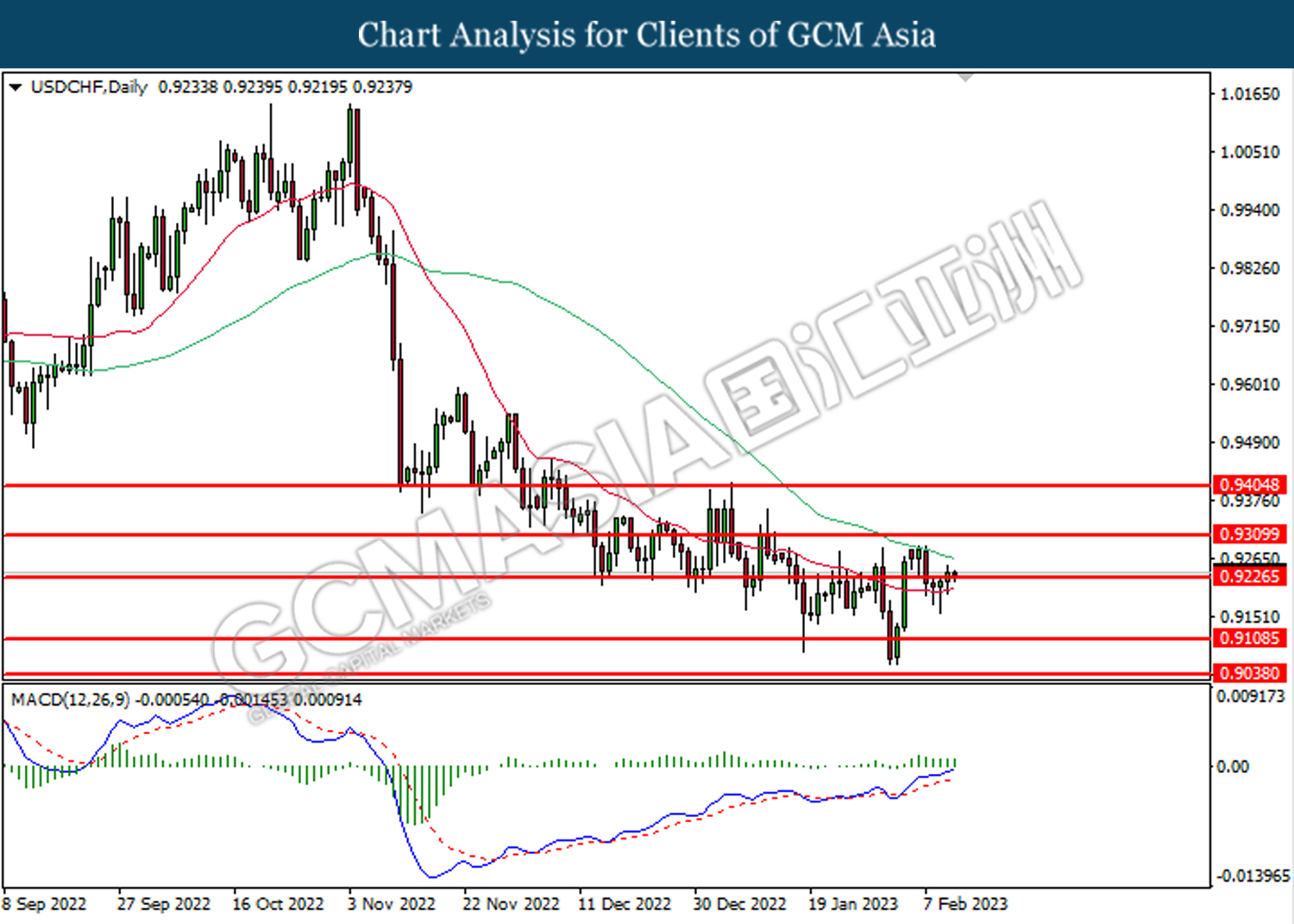

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9225. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

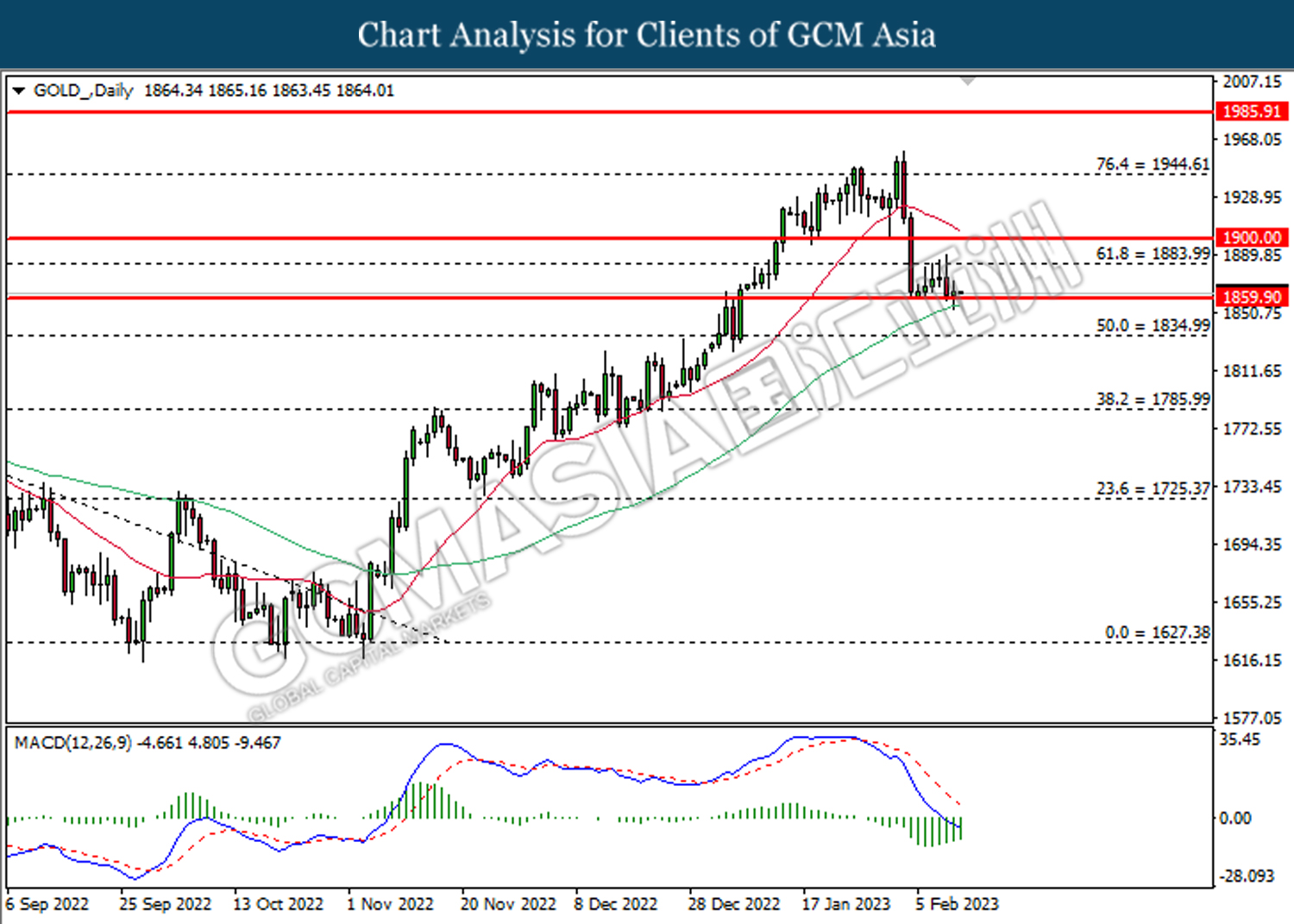

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1859.90. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1884.00, 1900.00

Support level: 1859.90, 1835.00