13 February 2023 Afternoon Session Analysis

Loonies rose after a surprising labor data announcement.

The Canadian dollar, one of the most traded currencies by global traders, has shown a sign of improvement after a labor market data was announced last Friday. The CAD rose 0.8% against USD after the labor result was released. According to Statistics Canada, Canadian employment rose to 150k while the consensus forecast was just 15k, which showed a sharp increase in January. However, the January’s unemployment rate remained unchanged at 5, in line with the prior reading, but the reading was still lower than the forecast at 5.1%. All in all, the current labor market situation does not derail from the expected monetary policy outlook of the Bank of Canada (BoC), so it added some risk that BoC could further tighten the monetary policy going forward. Meanwhile, higher prices for oil, one of Canada’s main exports, also boosted the value of Lonnie. The oil prices settled higher as Russia announced a plan to reduce oil production by 500k barrels per day starting from next month. As of writing, the USD/CAD edged up 0.18% to $1.3369.

In the commodities market, crude oil prices were traded lower by -1.12% to $78.83 per barrel ahead of the crucial US inflation figure tomorrow. During the Asian trading hours, oil prices retreated from its high level as Russia was struggling to find oil buyers, particularly after the implementation of sanctions from the western countries. Besides, gold prices edged down -0.02% to $1874.15 per troy ounce amid weakness in the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

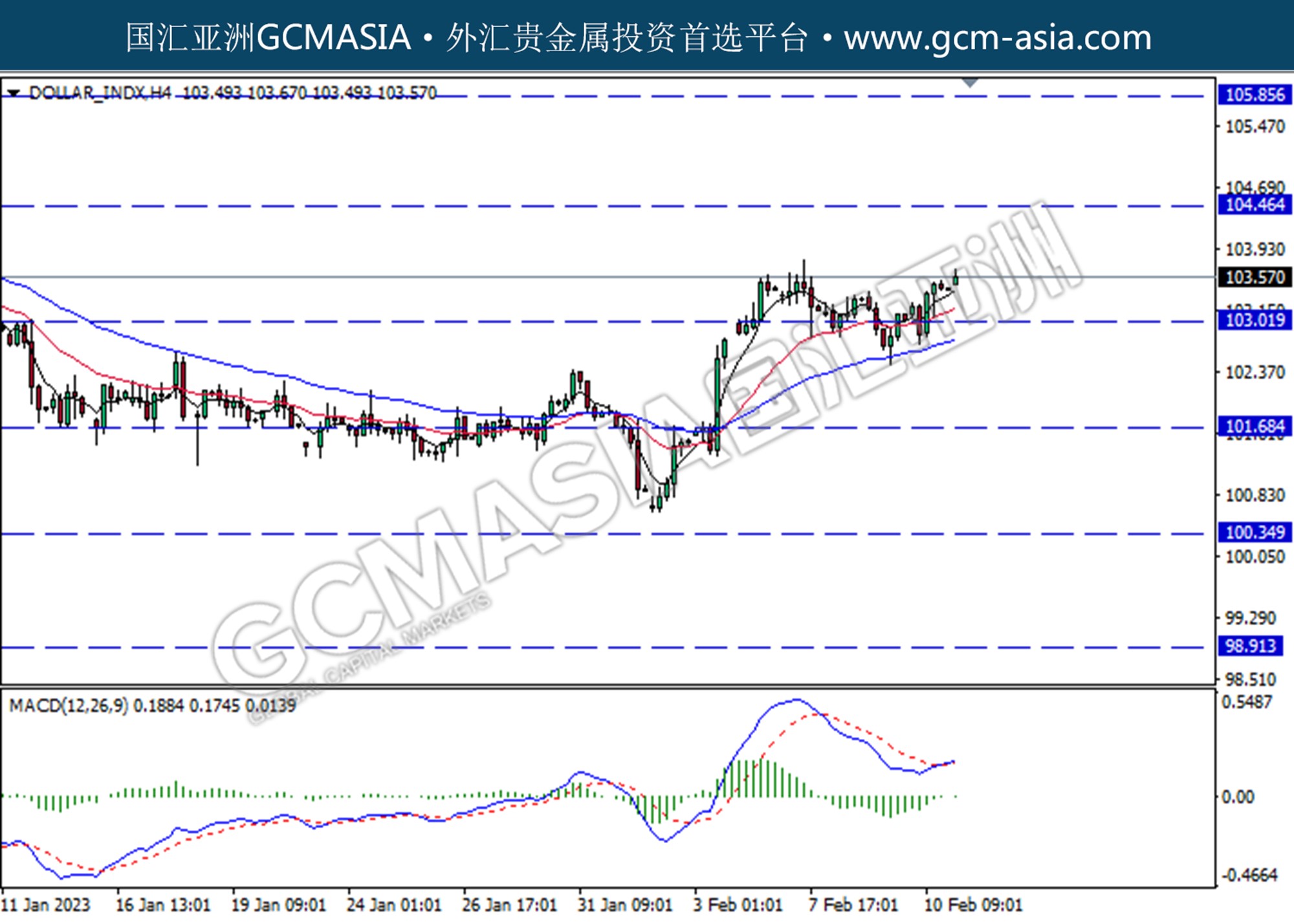

DOLLAR_INDX, H4: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 104.45.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

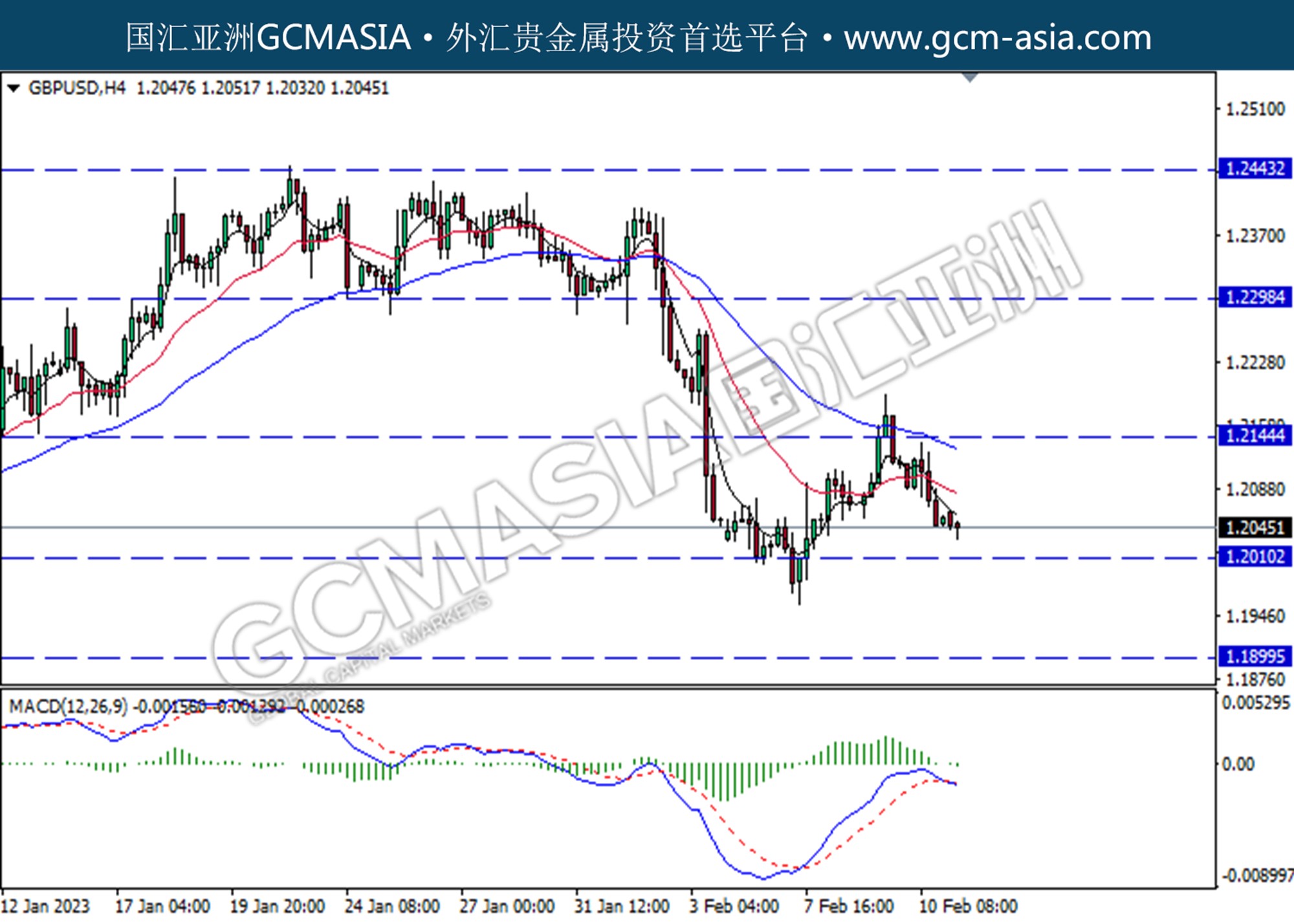

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the resistance level at 1.2145. MACD which illustrated bearish momentum suggests the pair extend its losses toward the support level at 1.2010.

Resistance level: 1.2145, 1.230

Support level: 1.2010,1.1900

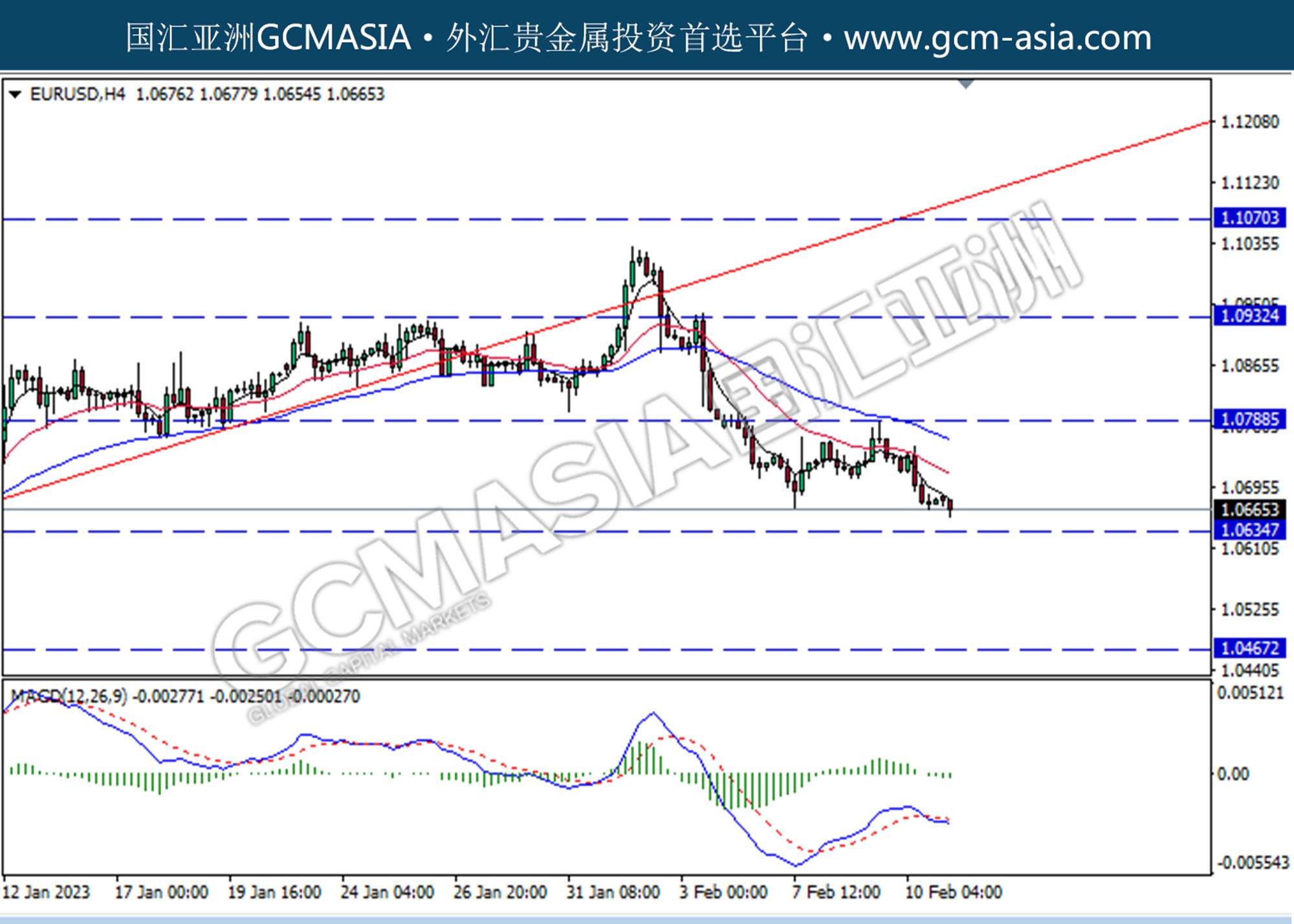

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.0790. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses towards the support level at 1.0635.

Resistance level: 1.0850, 1.0975

Support level: 1.0635, 1.0470

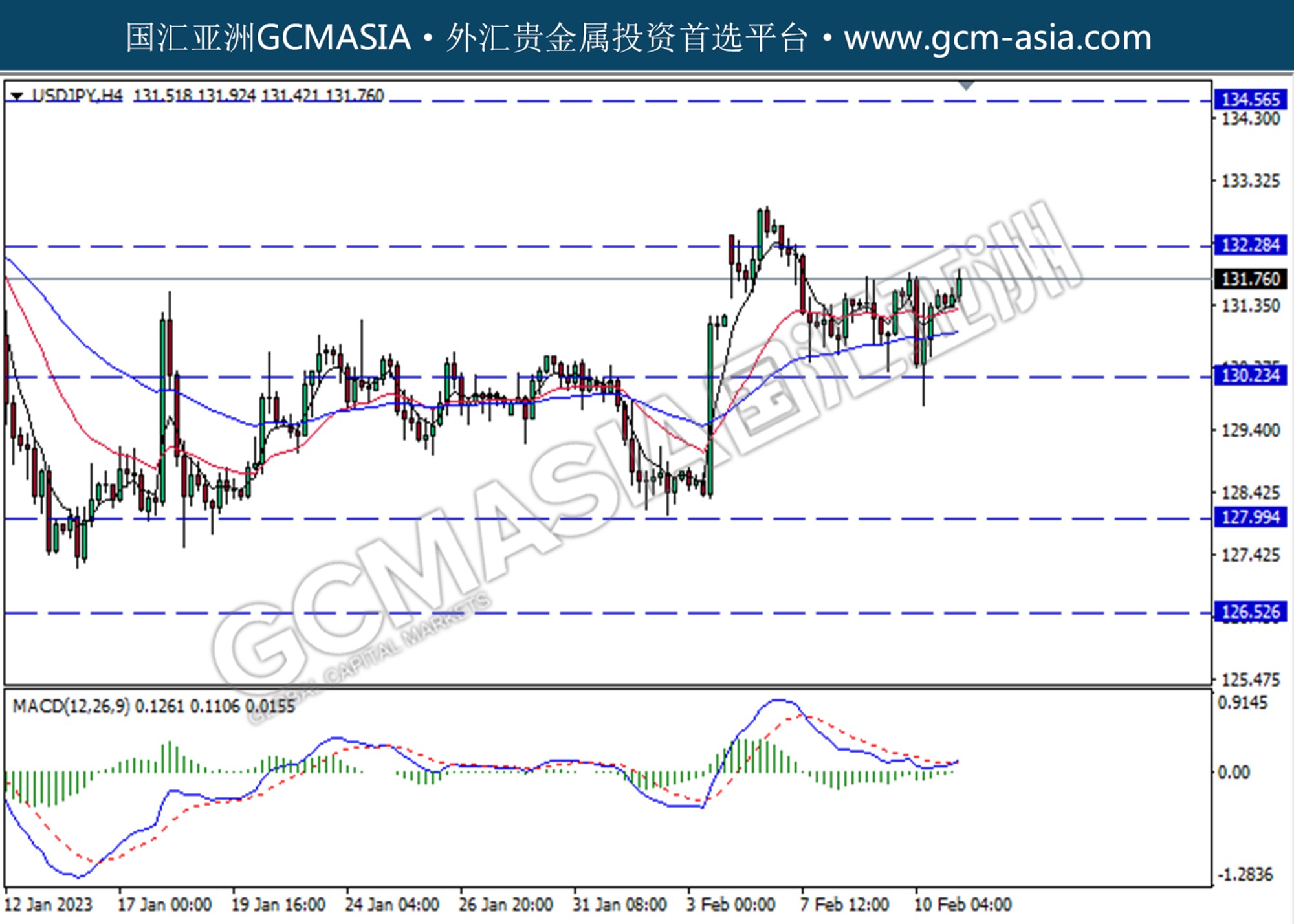

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 132.30

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

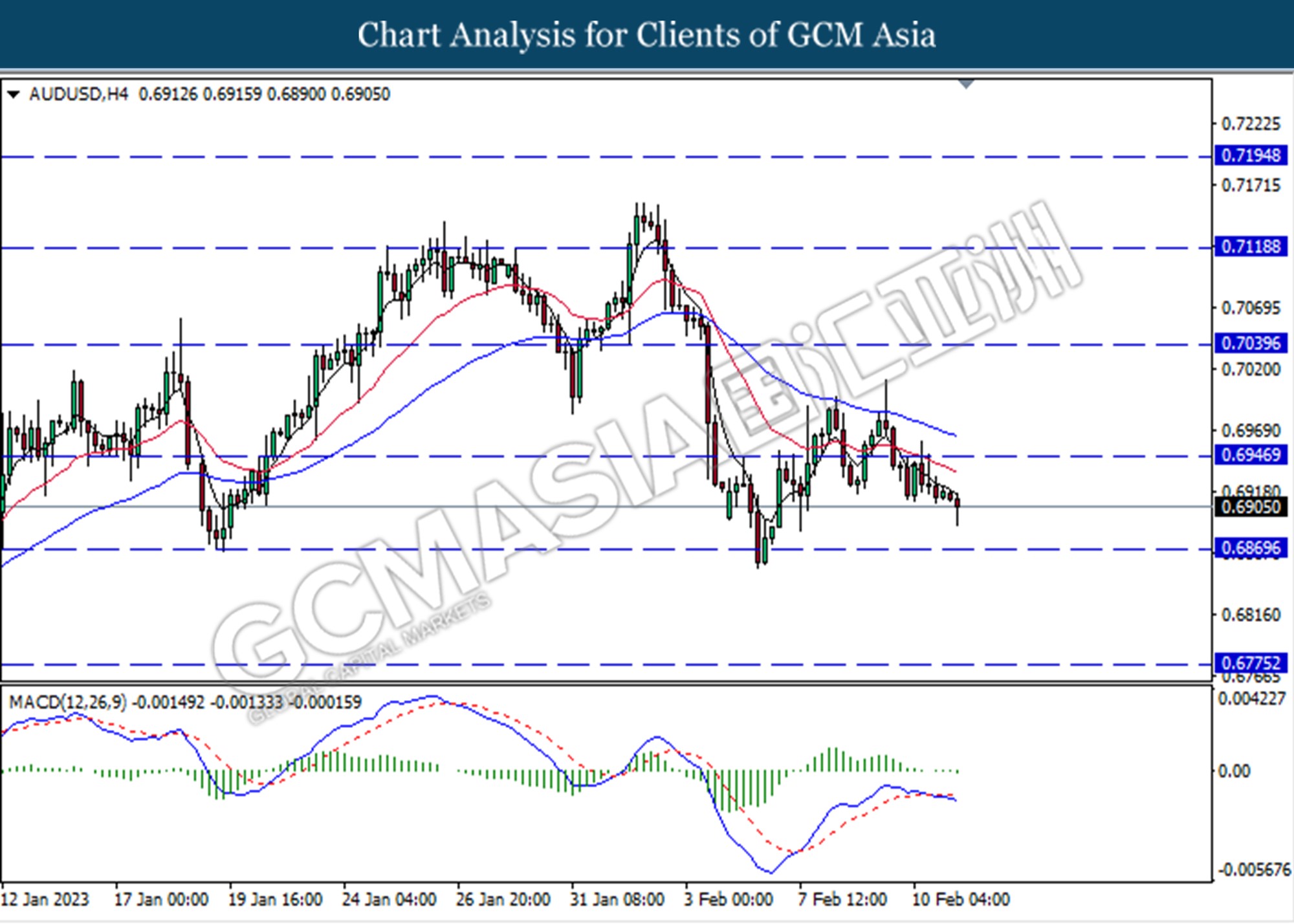

AUDUSD, H4: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6945. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 0.6870.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

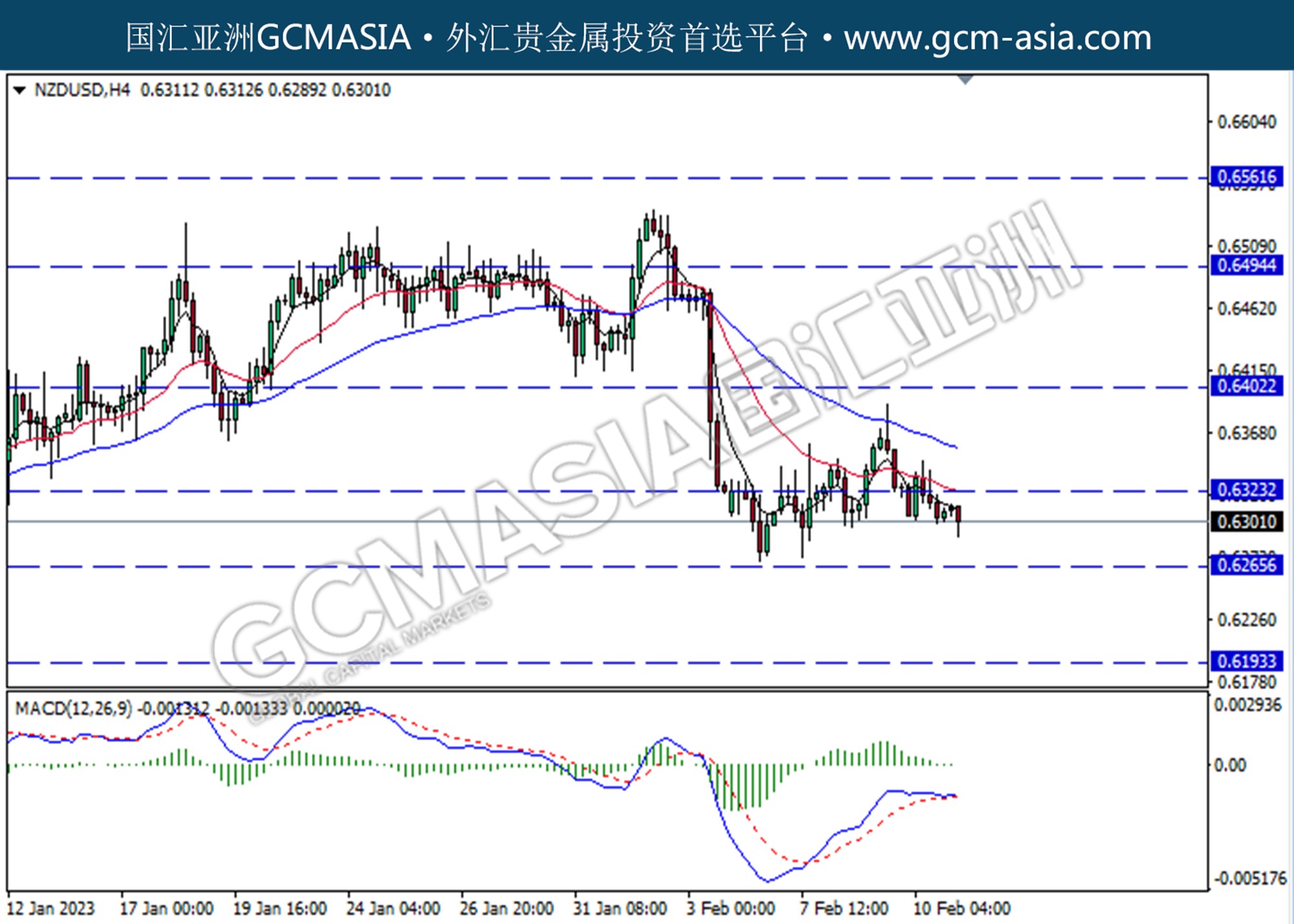

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6325. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6265

Resistance level: 0.6325, 0.6400

Support level: 0.6265, 0.6195

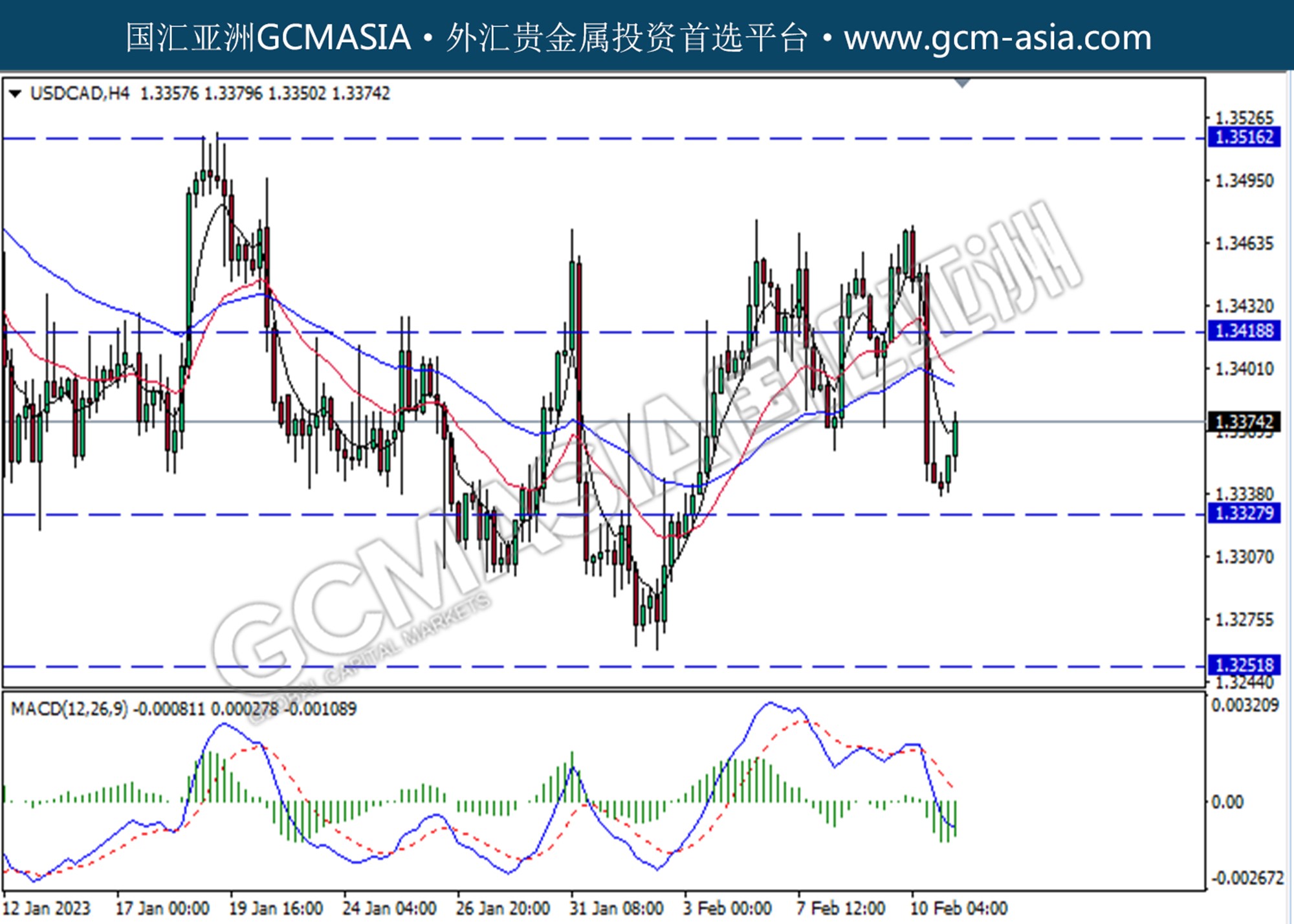

USDCAD, H4: USDCAD was traded higher following a rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

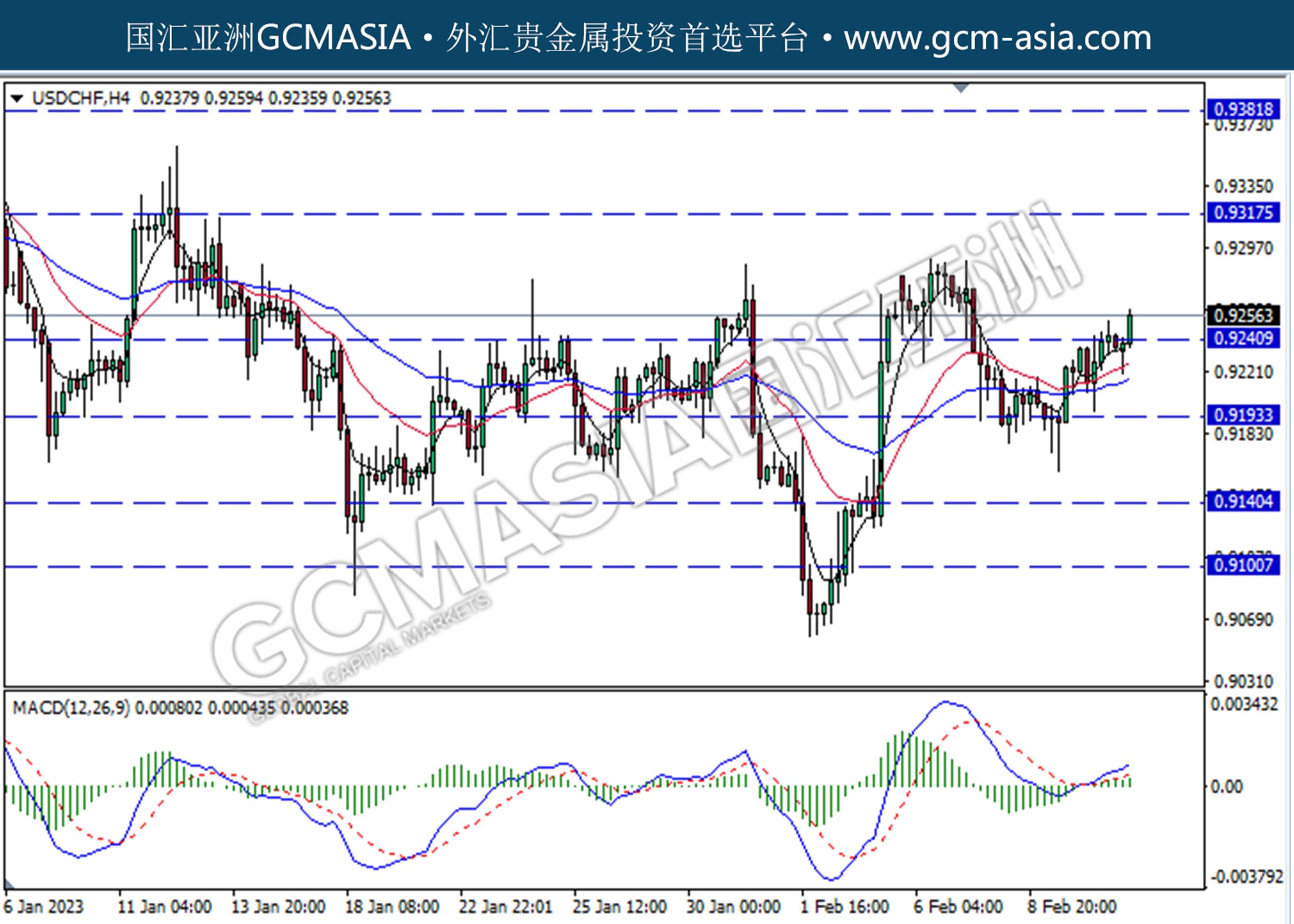

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9240. MACD which illustrated increasing in bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9320

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

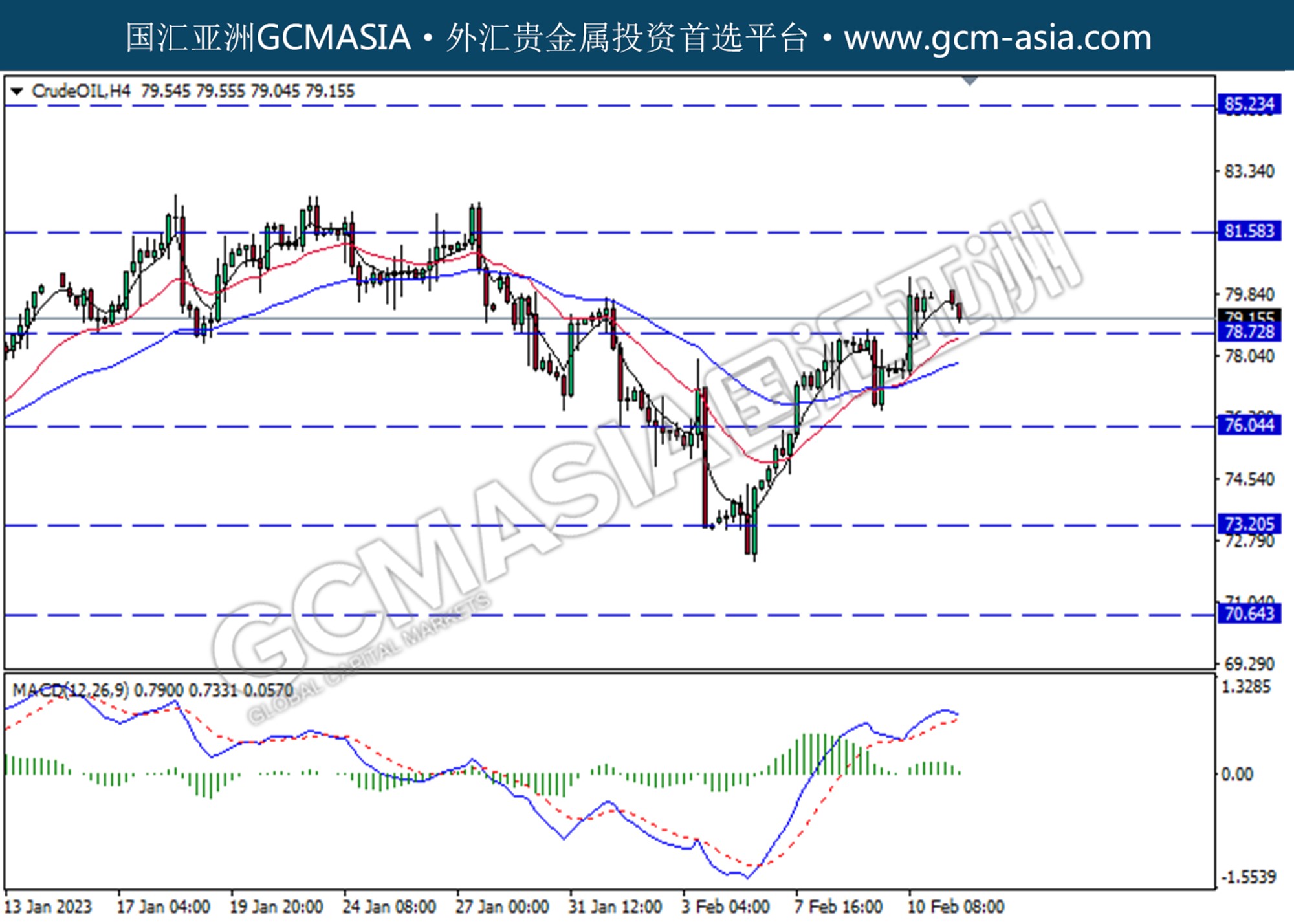

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 78.70.

Resistance level: 81.60,85.23

Support level: 78.70, 76.05

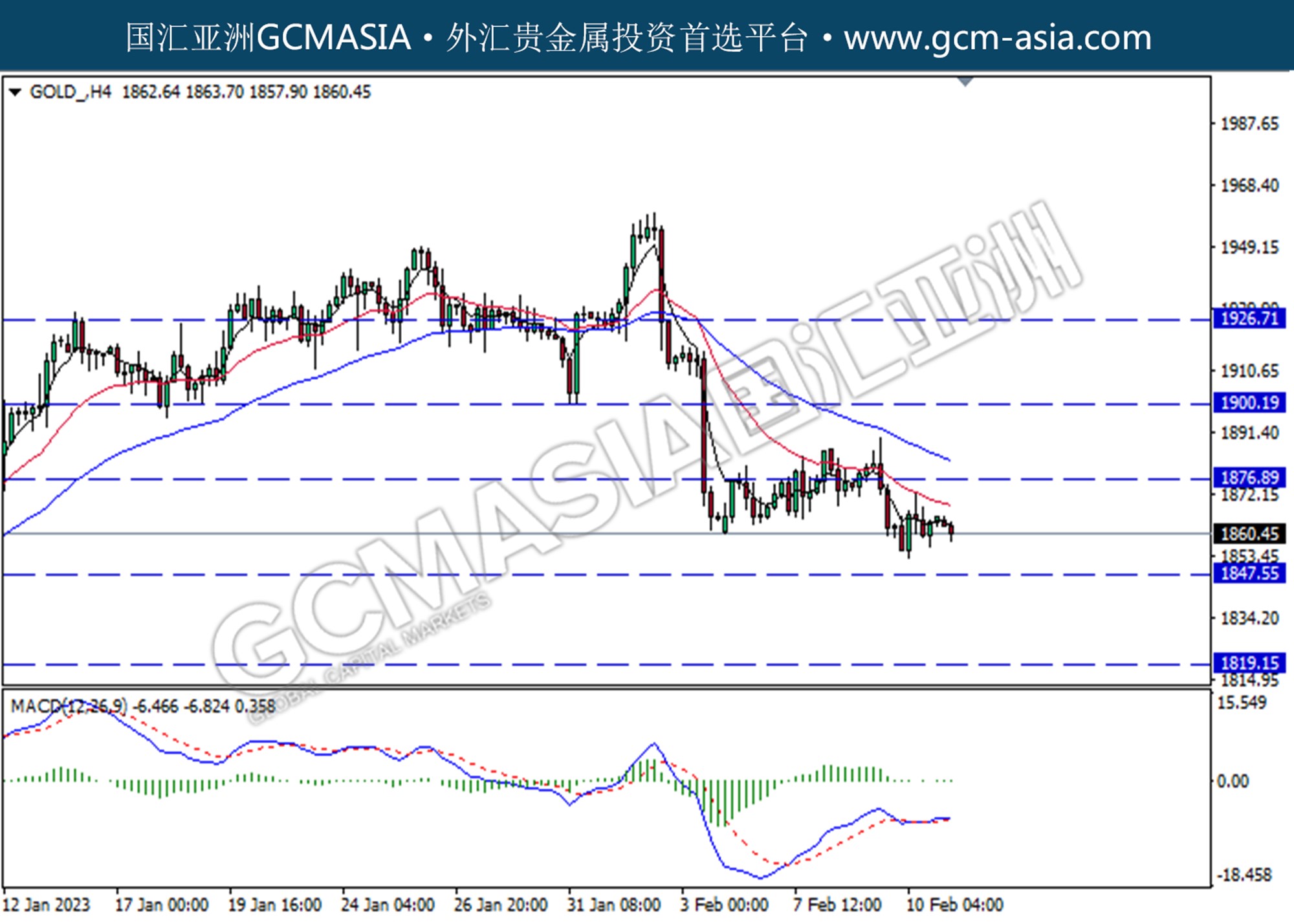

GOLD_, H4: Gold price was traded lower following a prior retracement from the resistance level at 1876.90. MACD which decreasing bullish momentum suggests the commodity to extend its losses toward the support level at 1847.55.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15