14 February 2023 Afternoon Session Analysis

The pound gained ahead of crucial labor data.

The pound sterling, as one of the most traded currencies by global investors, regained its luster ahead of the economic data release. According to UK National Statistics, the market estimation of the average earnings index is at 6.2%, slightly lower than the previous month’s reading. However, the UK claimant count change for Jan is expected to drop from the previous reading of 19.7k to 17.9k. Prior to that, both of the data showed that the UK was experiencing a loosening labor market condition during the month of Dec 2022, but it flipped the table over afterward. According to the data released by the Office for National Statistics, the unemployment rate stood at 3.5%, the lowest in the past 48 years. With that, investors become more optimistic about the upcoming labor data. Besides, the pound was also boosted by the weakening position of the dollar due to an expectation of a lower US Consumer Price Index (CPI) for January. Investors expect upcoming CPI data will slightly reduce by 0.2% to 6.2% on an annual basis, and the Fed will further loosen its tightening monetary policy. As of writing, the GBP/USD appreciated by 0.10% to $1.2147.

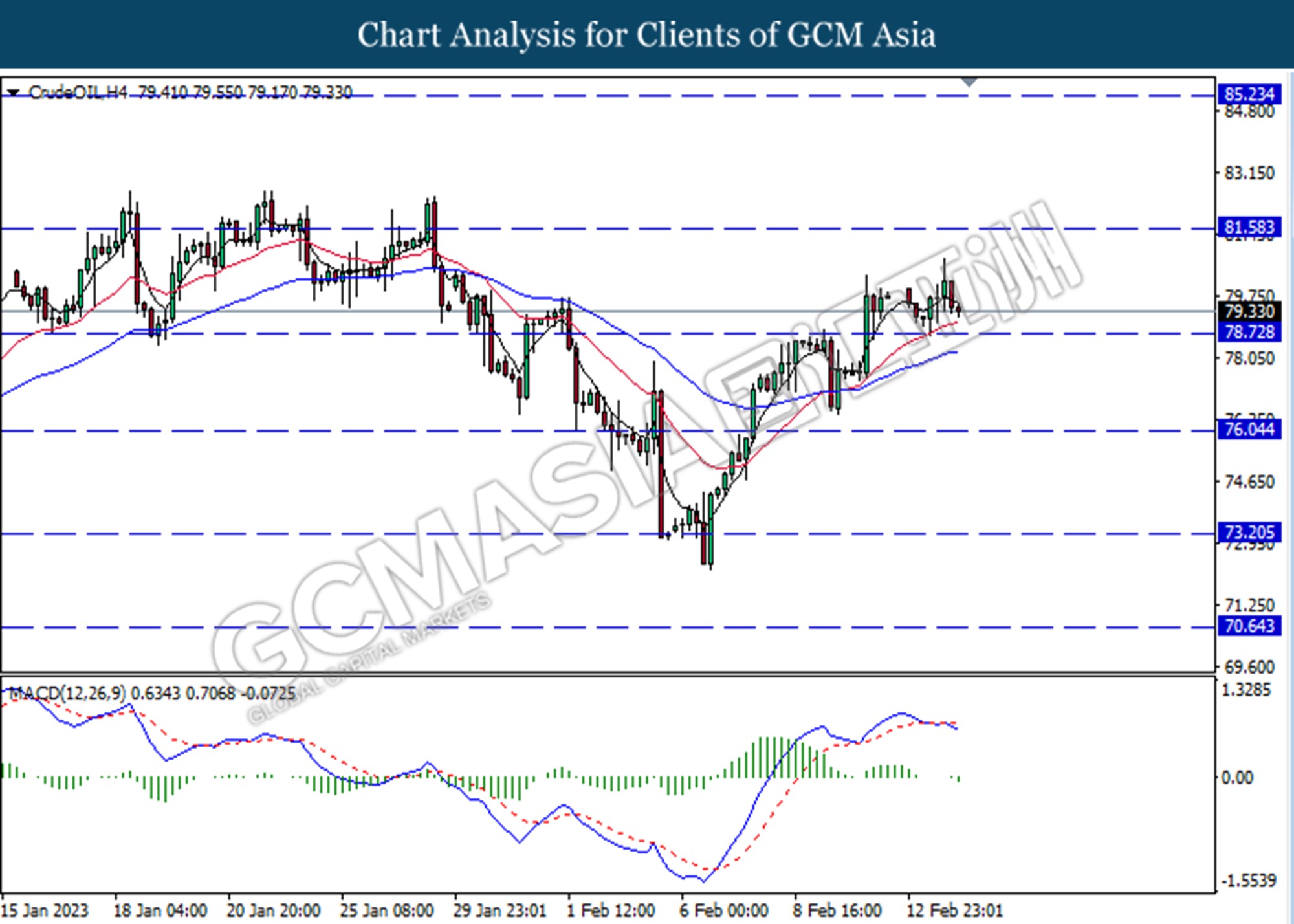

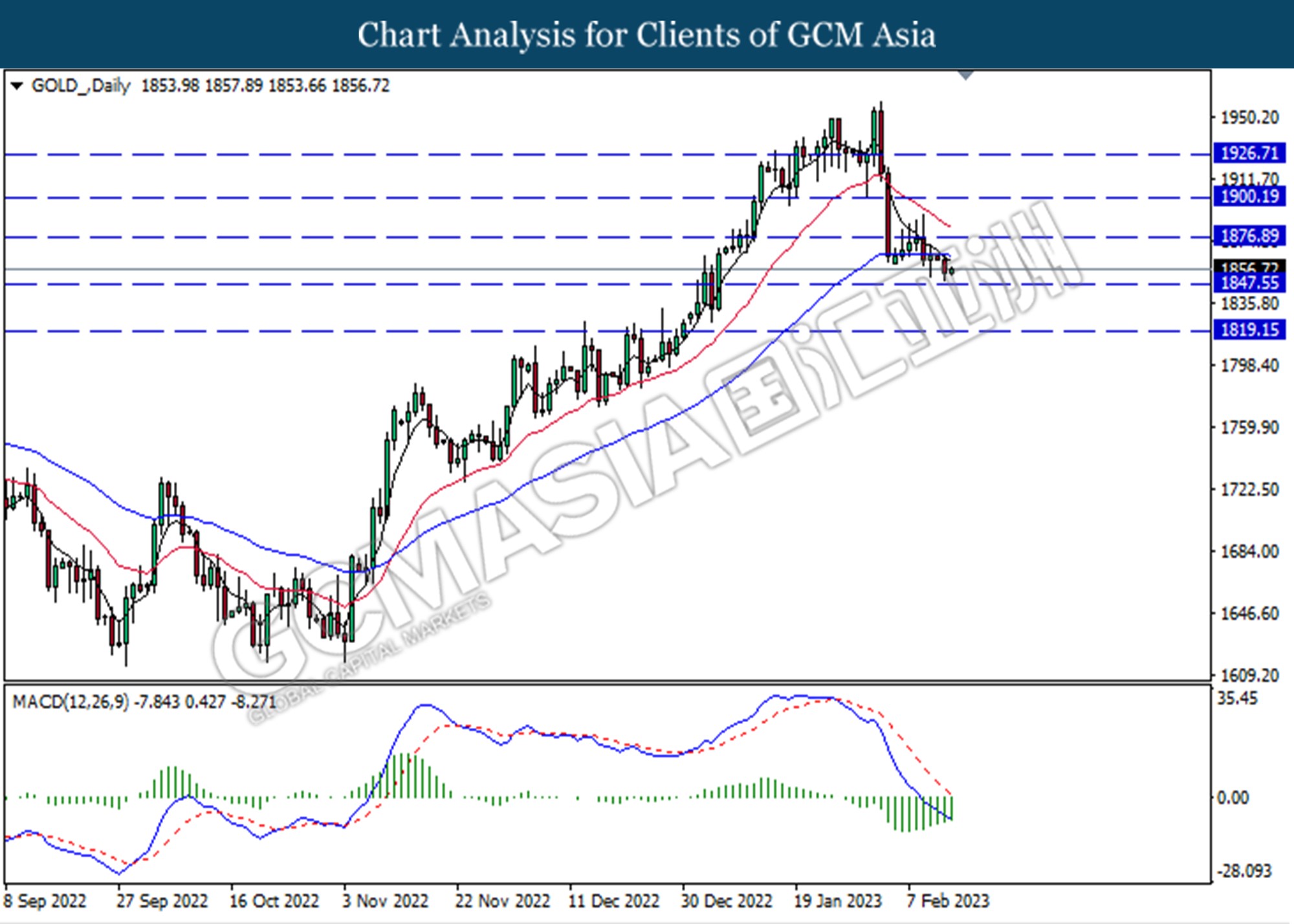

In the commodities market, crude oil prices were down by -0.94% to $79.39 per barrel amid the U.S. government’s said it would release crude oil from its Strategic Petroleum Reserve (SPR) as mandated by lawmakers. Besides, gold prices edged up 0.30% to $1869.15 per troy ounce ahead of the inflation report release.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – Average Earnings Index +Bonus (Dec) | 6.4% | 6.2% | – |

| 15:00 | GBP – Claimant Count Change (Jan) | 19.7K | 17.9K | – |

| 21:30 | USD – Core CPI (MoM) (Jan) | 0.4% | 0.4% | – |

| 21:30 | USD – CPI (YoY) (Jan) | 6.5% | 6.2% | – |

Technical Analysis

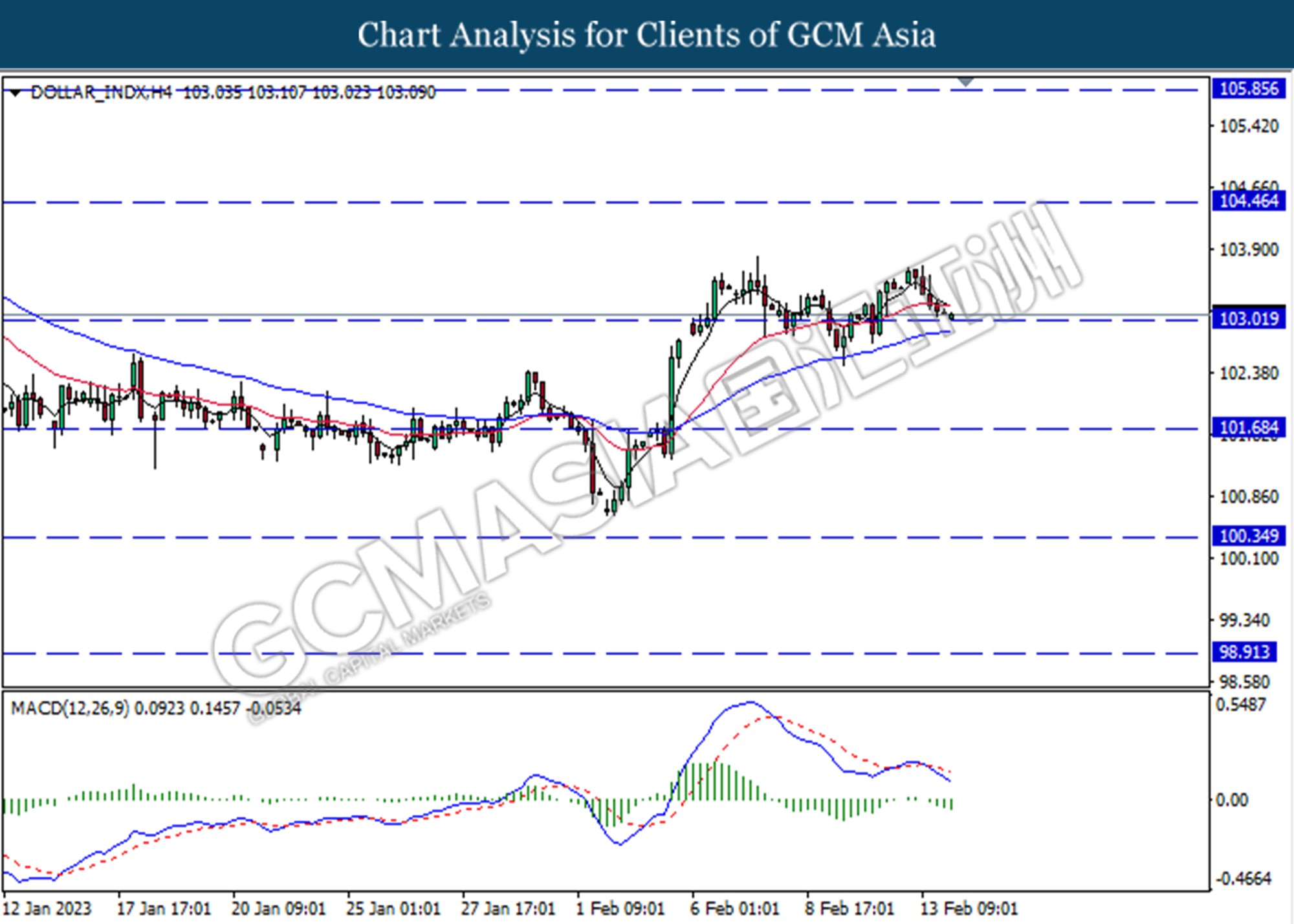

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 103.00. MACD which illustrated bearish momentum suggests the index to extend its losses after it successfully breakout the support level.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.35

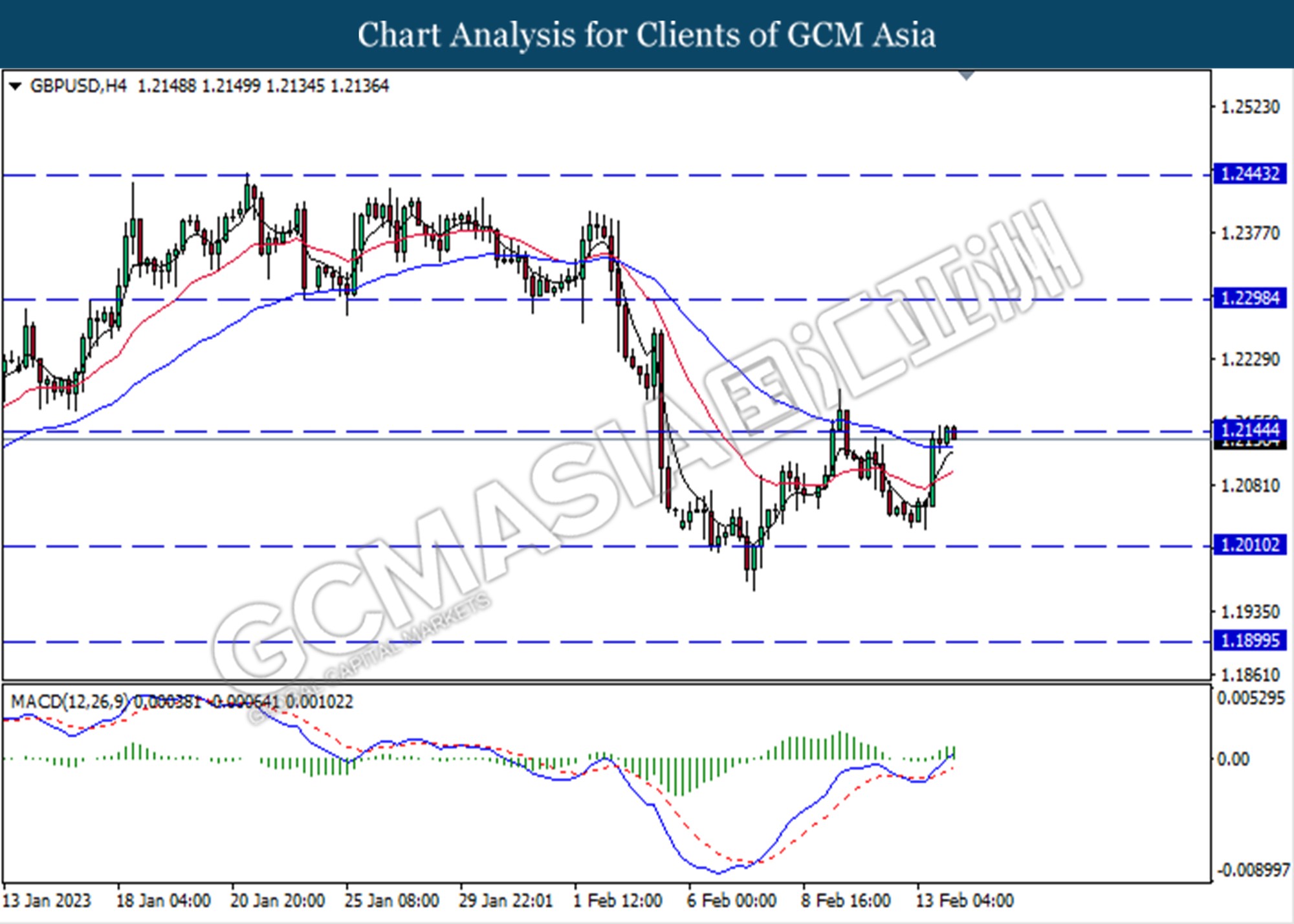

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2145. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2145, 1.2300

Support level: 1.2010,1.1900

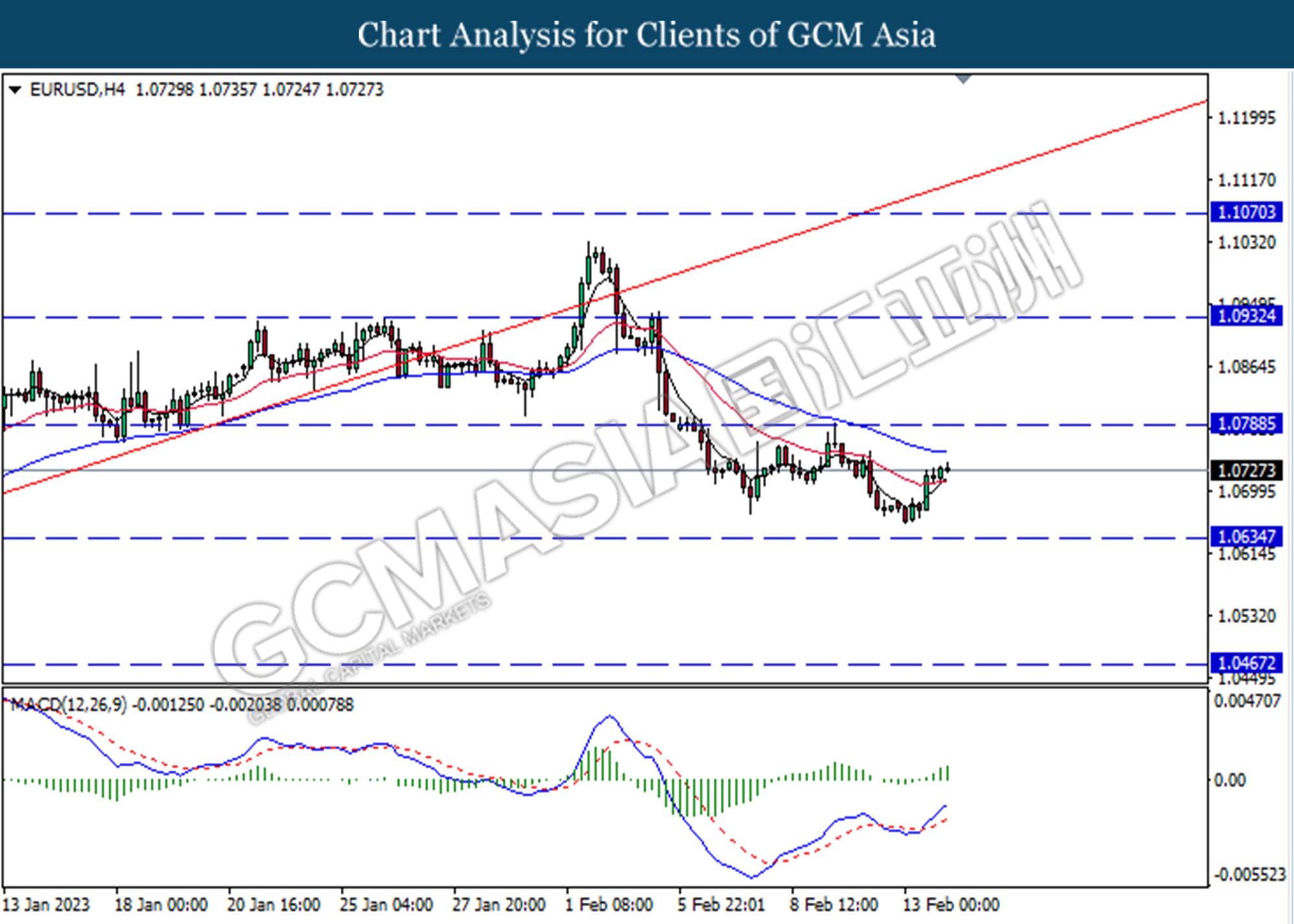

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.0790.

Resistance level: 1.0790,1.0900

Support level: 1.0635, 1.0470

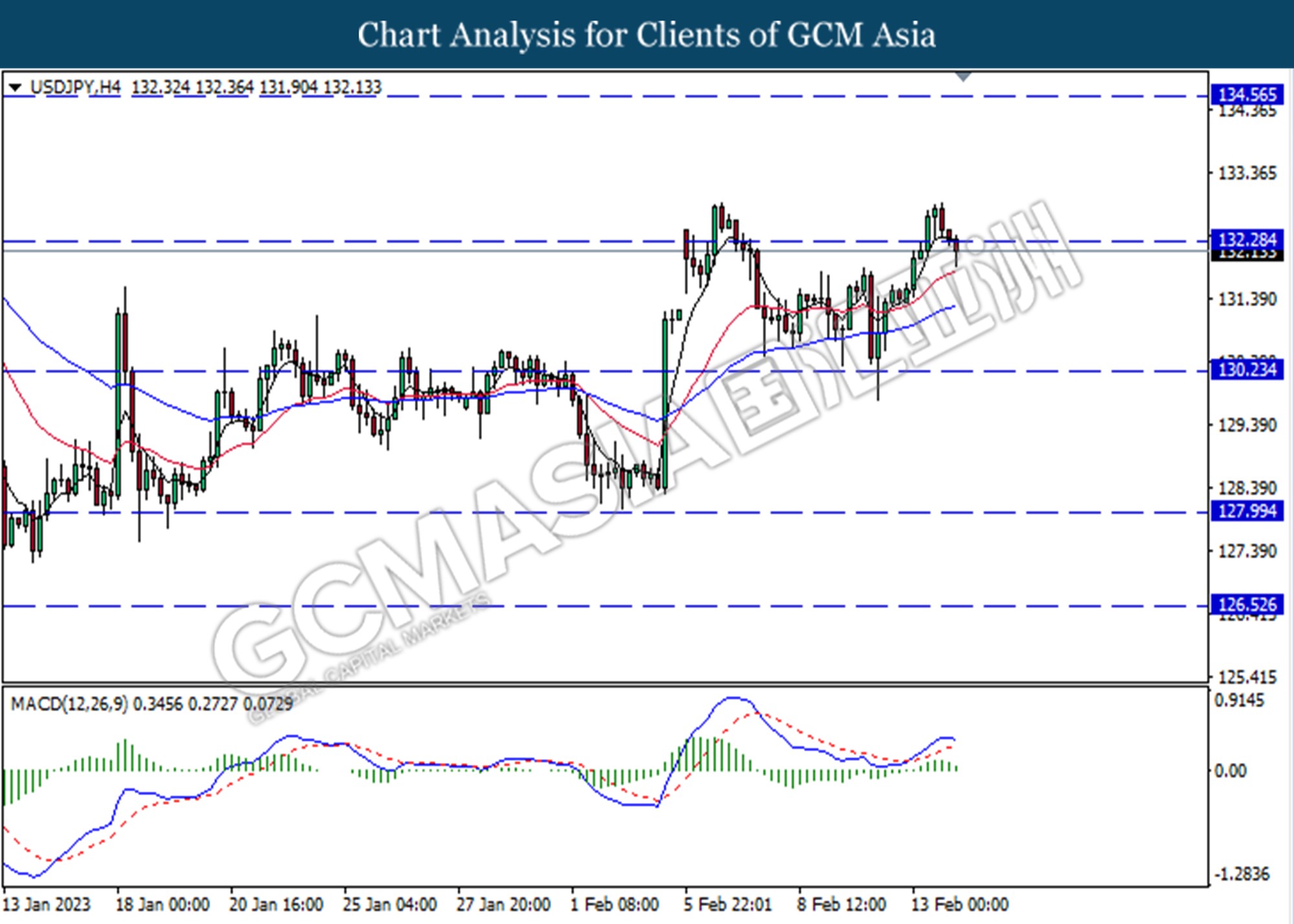

USDJPY, H4: USDJPY was traded lower following the prior breakout below the previous support level at 131.25. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward support level at 130.25.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

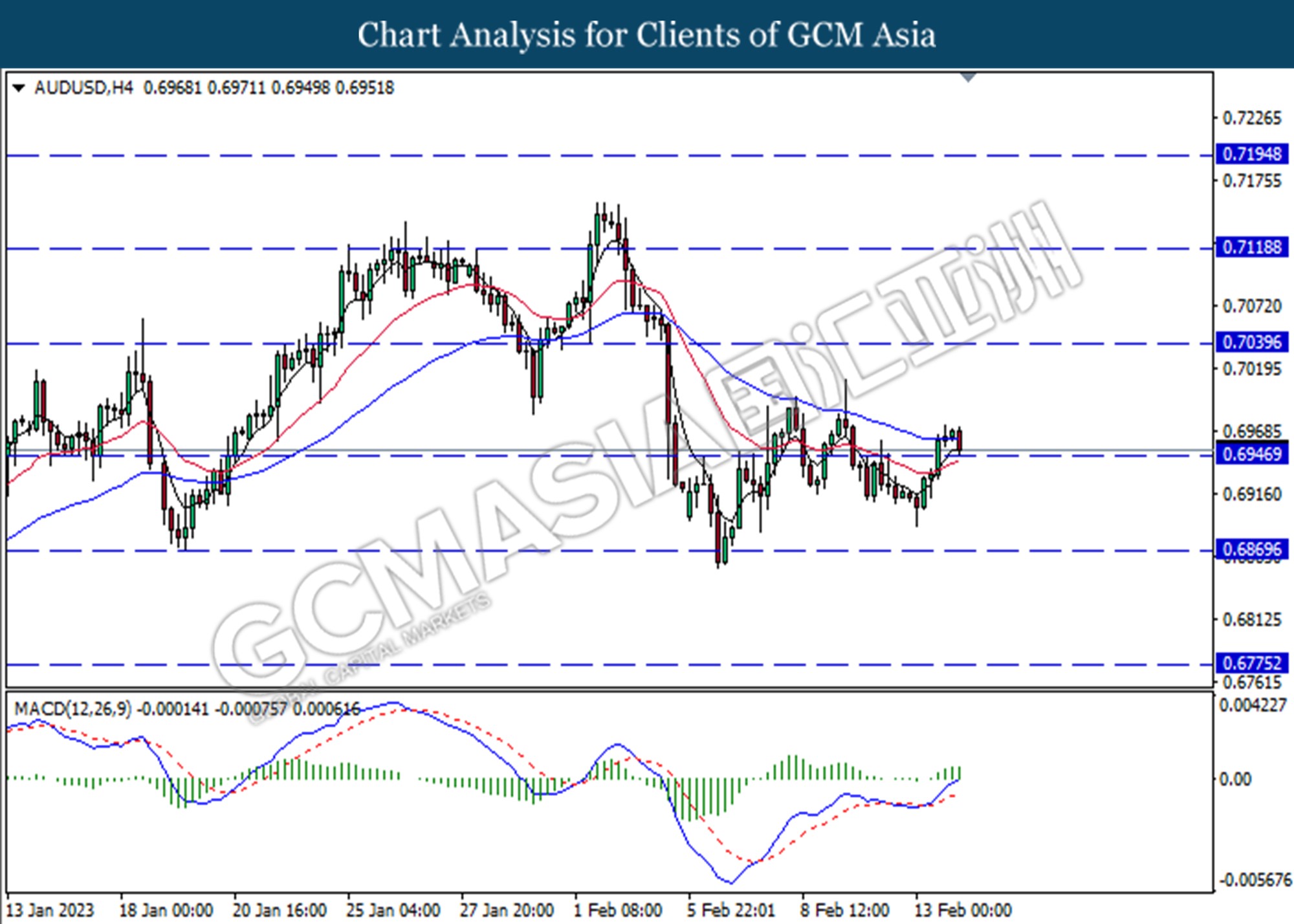

AUDUSD, H4: AUDUSD was traded lower while currently testing for the support level at 0.6945. MACD which illustrated increasing bullish momentum suggests the pair to undergo technical correction in short term.

Resistance level: 0.6945, 0.7040

Support level: 0.6870, 0.6775

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6325.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

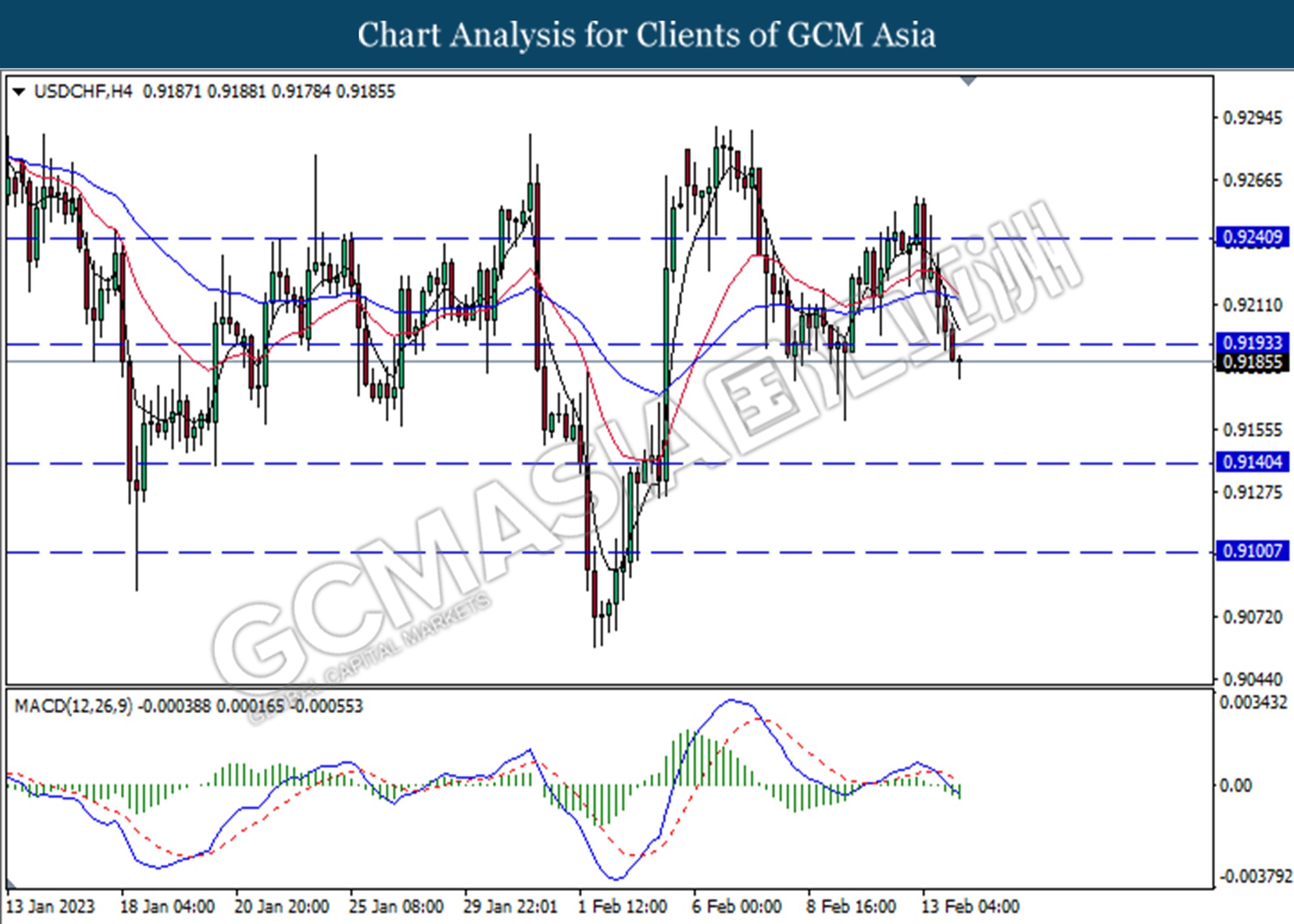

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.9195. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9140.

Resistance level: 0.9195, 0.9240

Support level: 0.9140, 0.9100

CrudeOIL, H4: Crude oil price was traded lower following a prior retracement from a higher level. MACD which illustrated bearish momentum suggests the commodity to extend its losses toward the support level at 78.70.

Resistance level: 81.60,85.23

Support level: 78.70, 76.05

GOLD_, Daily: Gold price was traded lower following a prior retracement from a higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity trade higher as a technical correction.

Resistance level: 1876.90, 1900.20

Support level: 1847.55, 1819.15