20 February 2023 Morning Session Analysis

US dollar slumps ahead of Washington’s Birthday Holiday.

The dollar index, which is traded against a basket of six major currencies, lost its ground after hitting the highest level since the beginning of January as investors restructured their portfolio holdings while eyeing on further action from the Federal Reserve (Fed). Last week, several of the Federal Reserve members signaled an aggressive rate hike plan should be carried out going forward in order to cool down the persistent-high inflation. Such comments came after the inflation-related data, which included Consumer Price Index (CPI) and Producer Price Index (PPI) showed an unexpected rise on a month-to-month basis. With such a backdrop, the CME FedWatch Tool shows that the probability of an aggressive rate hike of 50 basis points has risen from the prior week’s reading’s 9.2% to 18.1% as of today, whereas the probability of a 25 basis point lingers near the level of 81.9%. Nonetheless, the focus the majority of investors are gathered on the upcoming crucial financial event and economic data, such as the FOMC Meeting Minutes and Gross Domestic Product (GDP), to scrutinize the future action of the Fed. As a side note, US markets will be closed today amid Washington’s Birthday Holiday. Thus, the liquidity may be low, and the movements are expected to be relatively minor. As of writing, the dollar index dropped by -0.02 to 103.90.

In the commodities market, crude oil prices were up by 0.02% to $76.35 per barrel after dropping sharply during Friday’s trading session amid the market concern over the Fed’s future action on tackling still-high inflation. Besides, gold prices edged up by 0.05% to $1843.50 per troy ounce as the US dollar sank into the red sea.

Today’s Holiday Market Close

Time Market Event

All Day CAD Family Day

All Day USD Washington’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

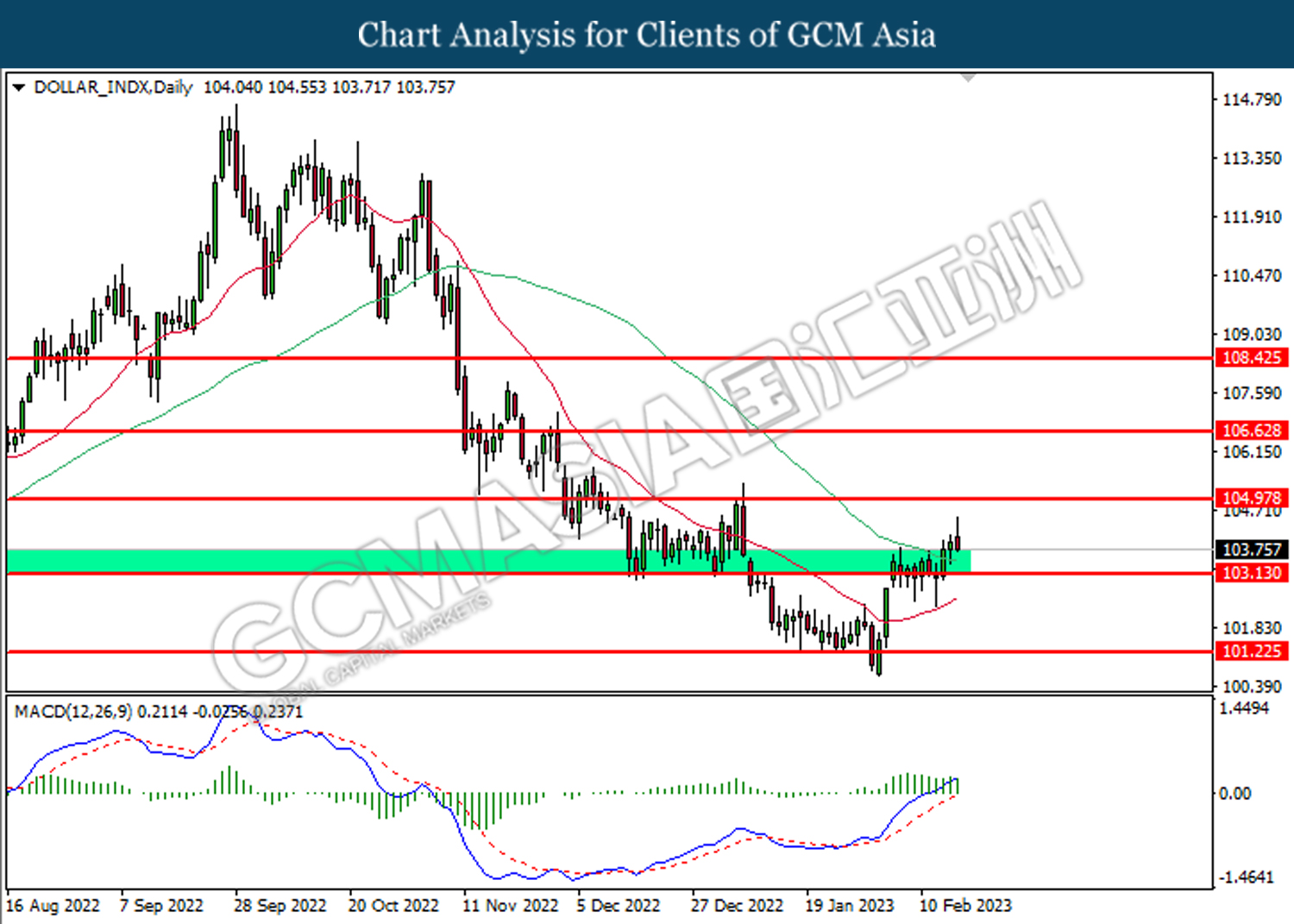

DOLLAR_INDX, Daily: Dollar index was traded higher following a prior breakout above the previous resistance level at 103.15. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

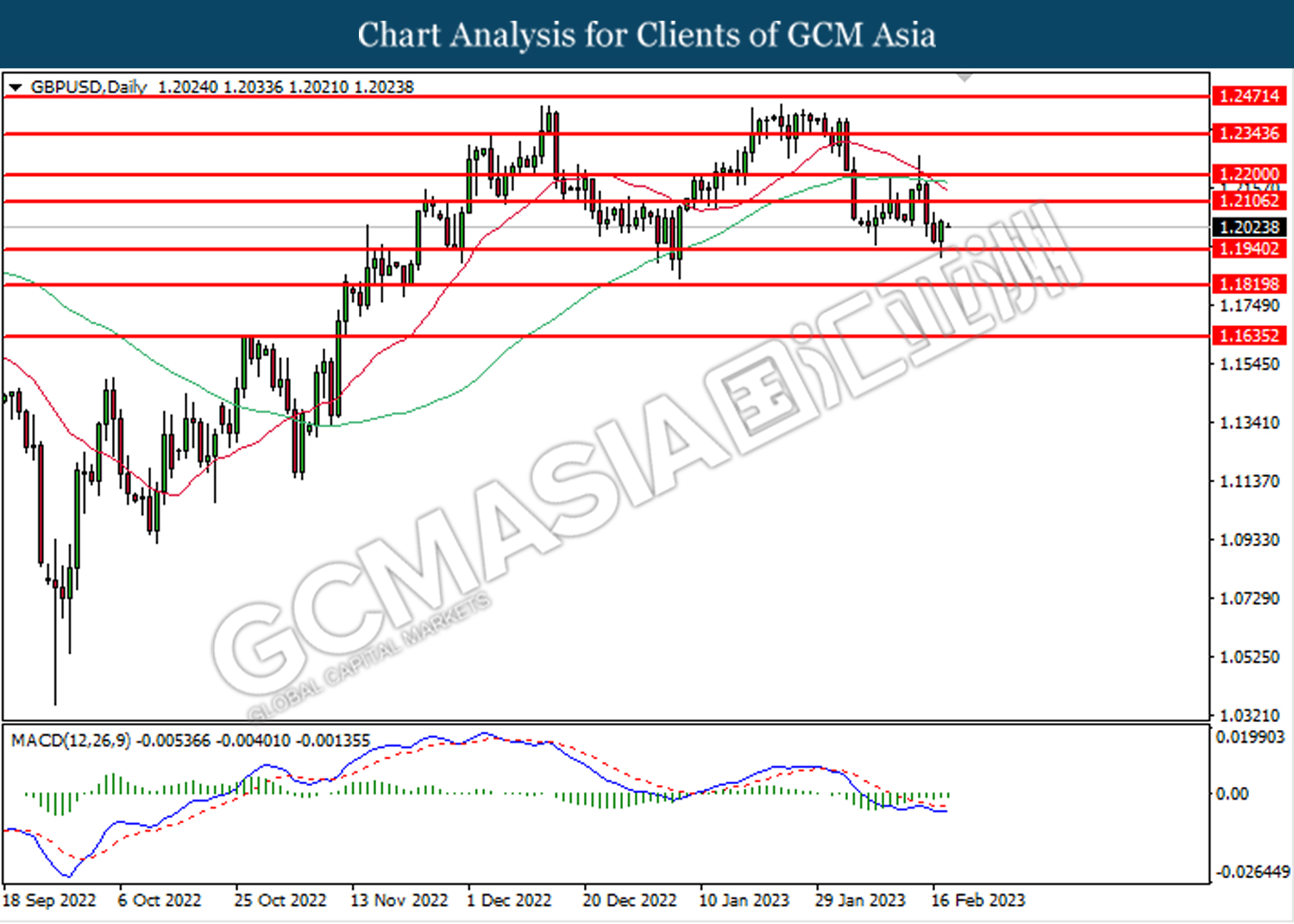

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

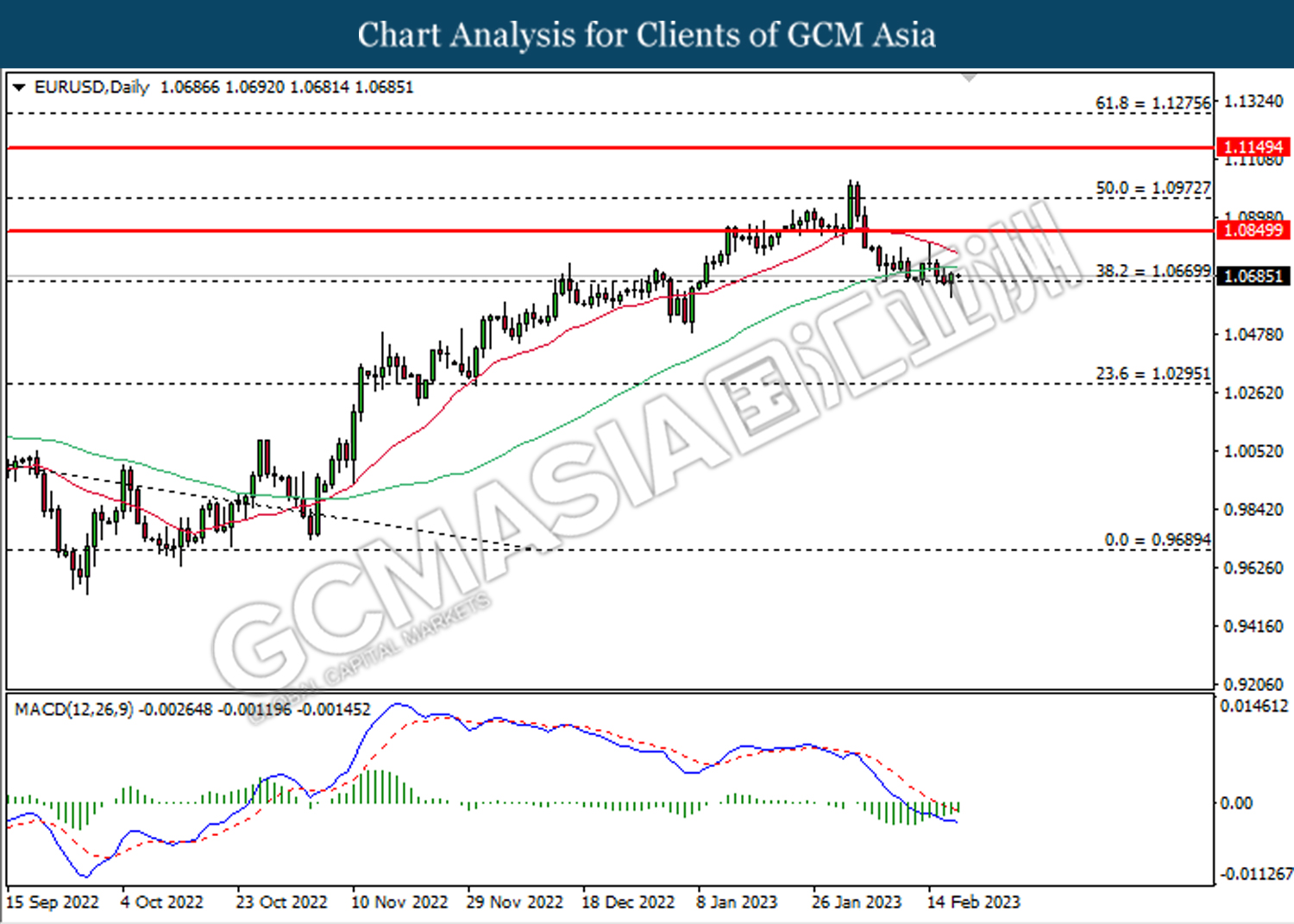

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0670. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0850.

Resistance level: 1.0850, 1.0975

Support level: 1.0670, 1.0295

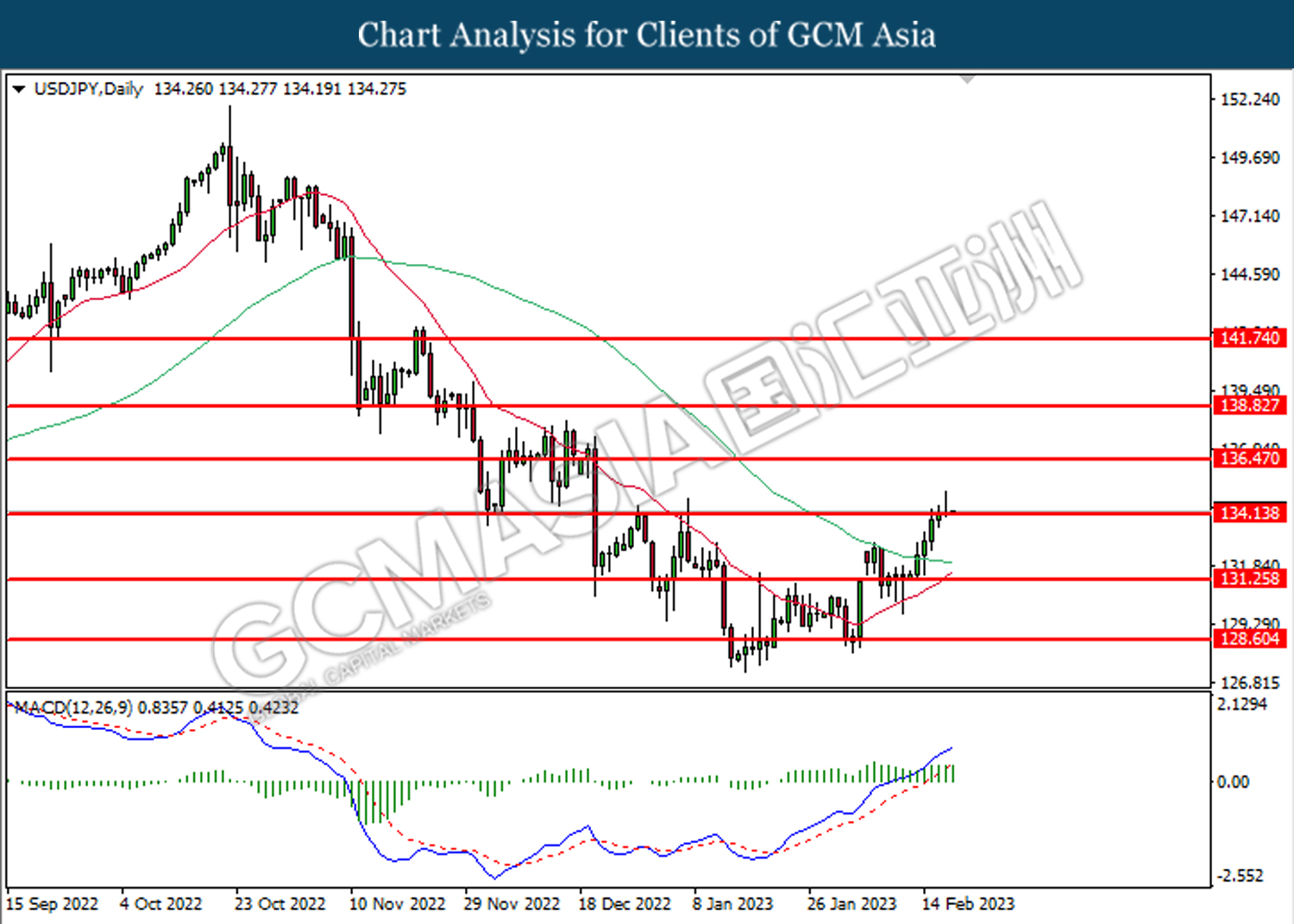

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 134.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 134.15, 136.45

Support level: 131.25, 128.60

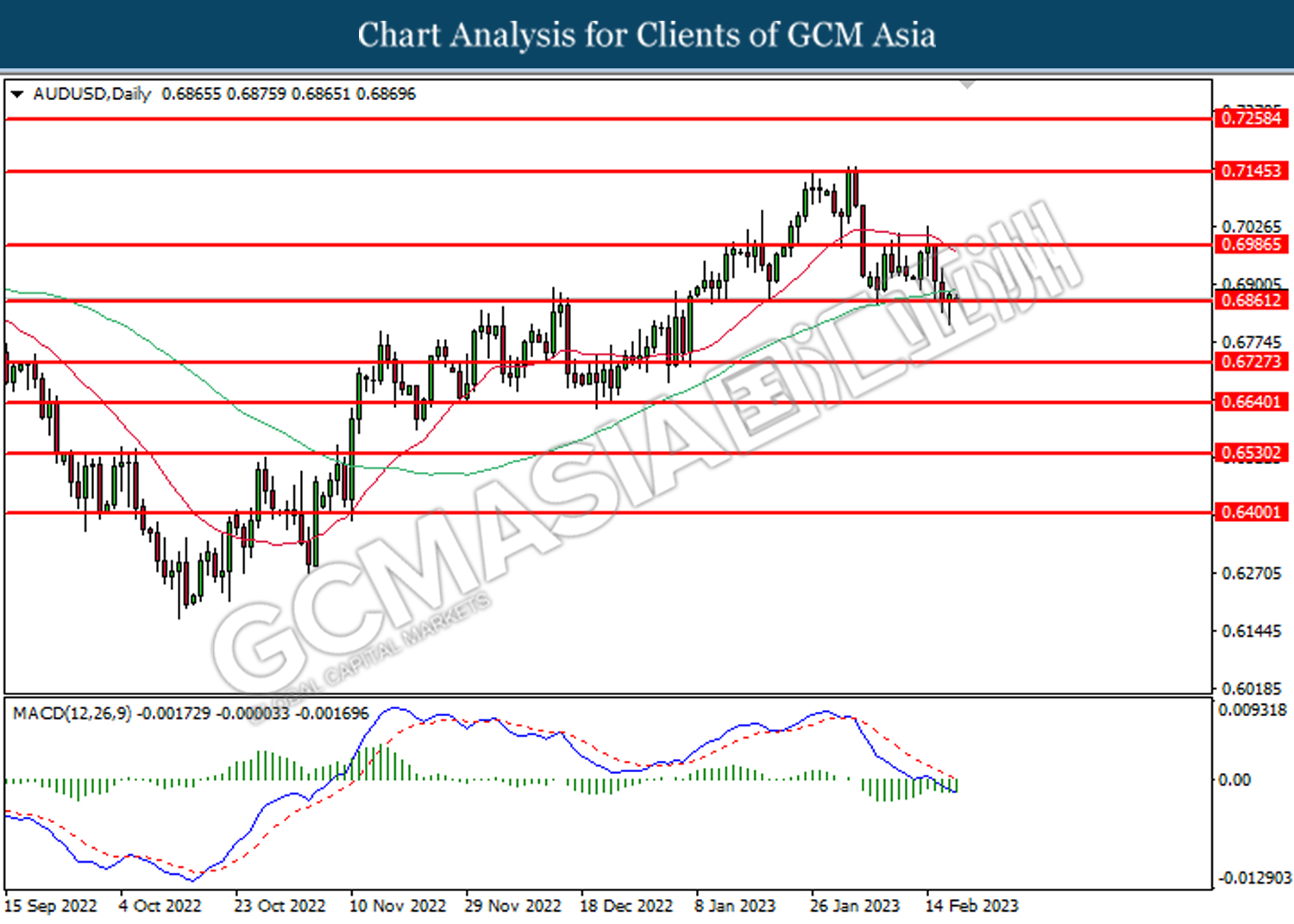

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6985, 0.7145

Support level: 0.6860, 0.6725

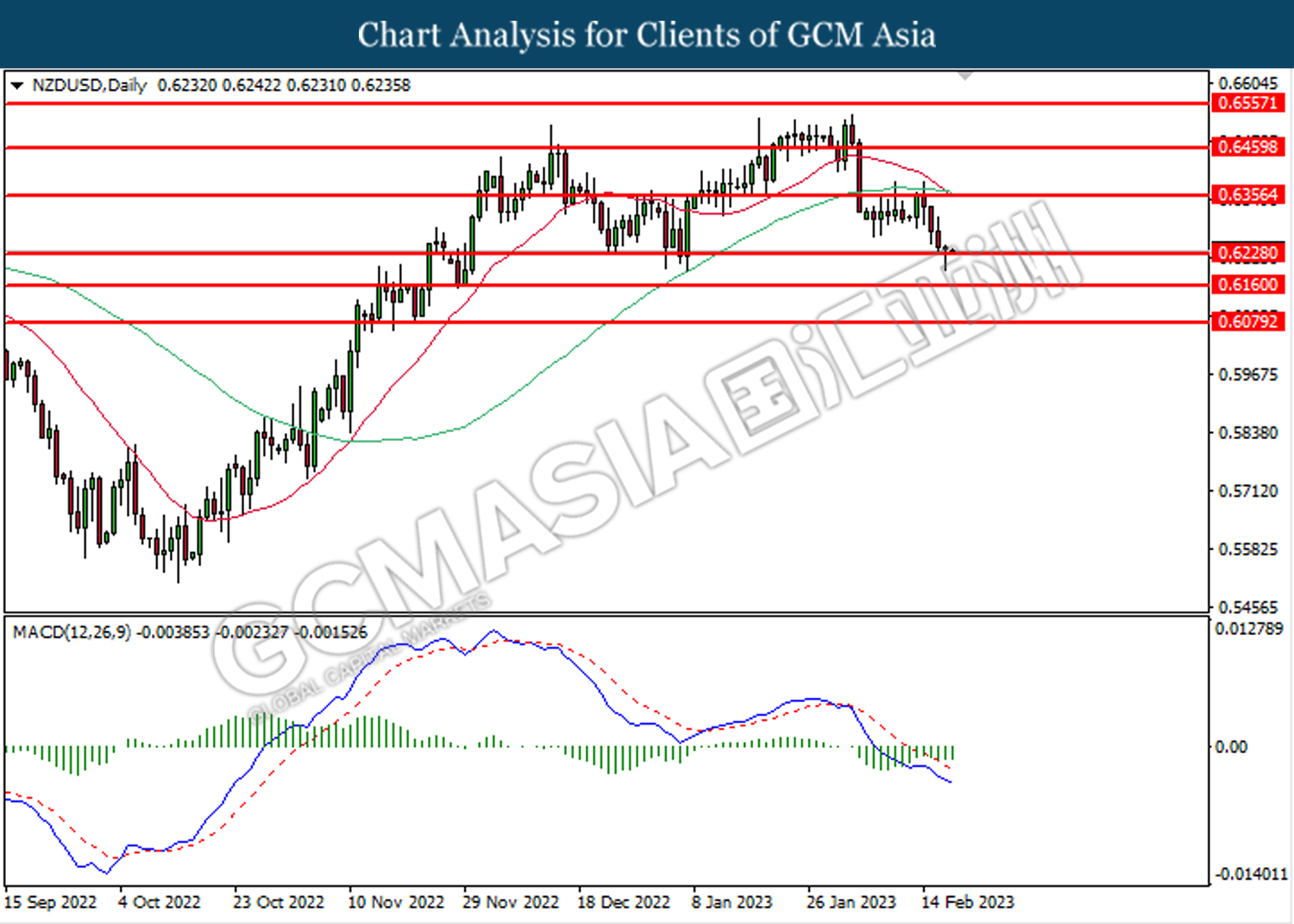

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6230. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6355, 0.6460

Support level: 0.6230, 0.6160

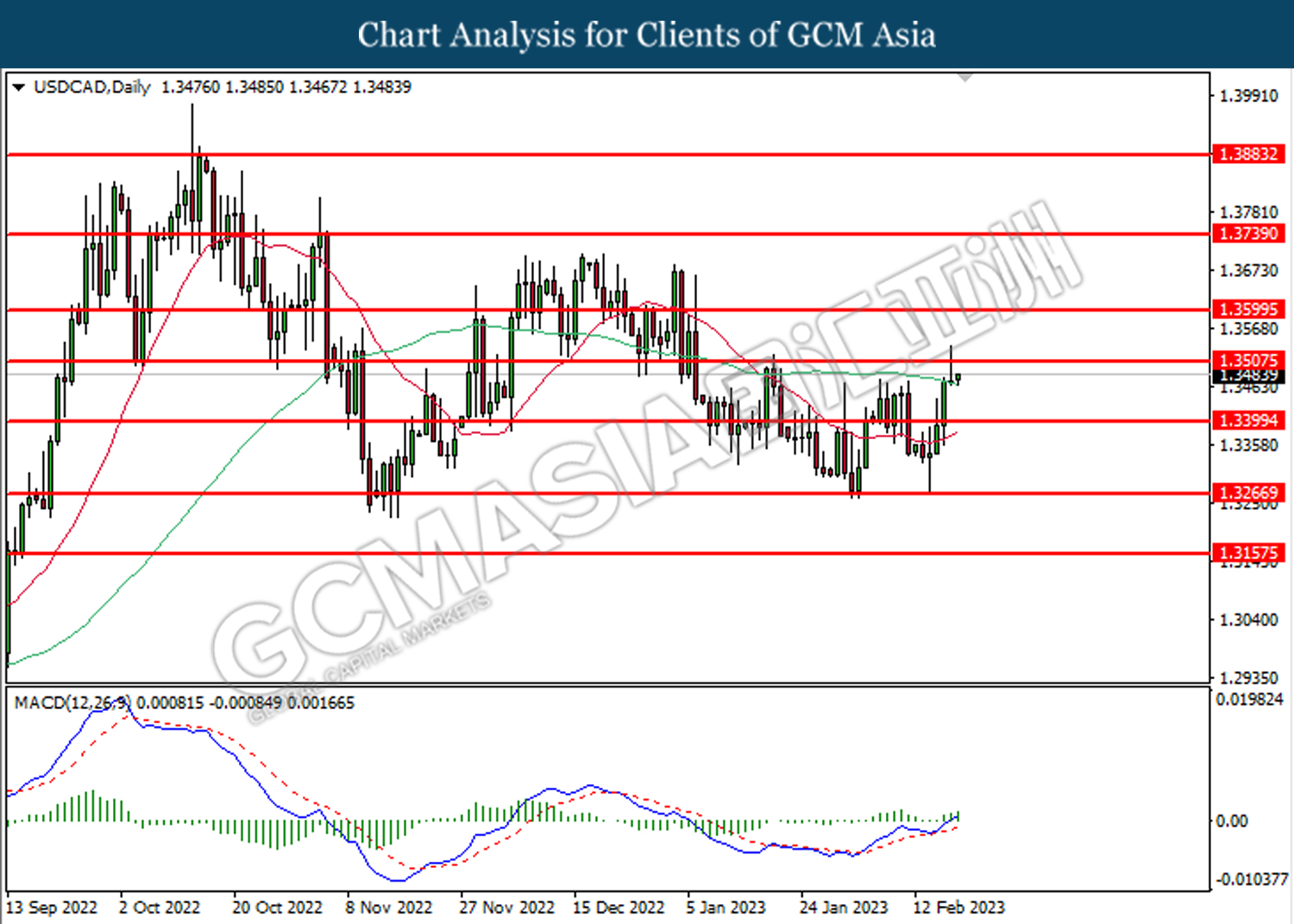

USDCAD, Daily: USDCAD was traded higher while currently testing near the resistance level at 1.3505. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3505, 1.3600

Support level: 1.3400, 1.3265

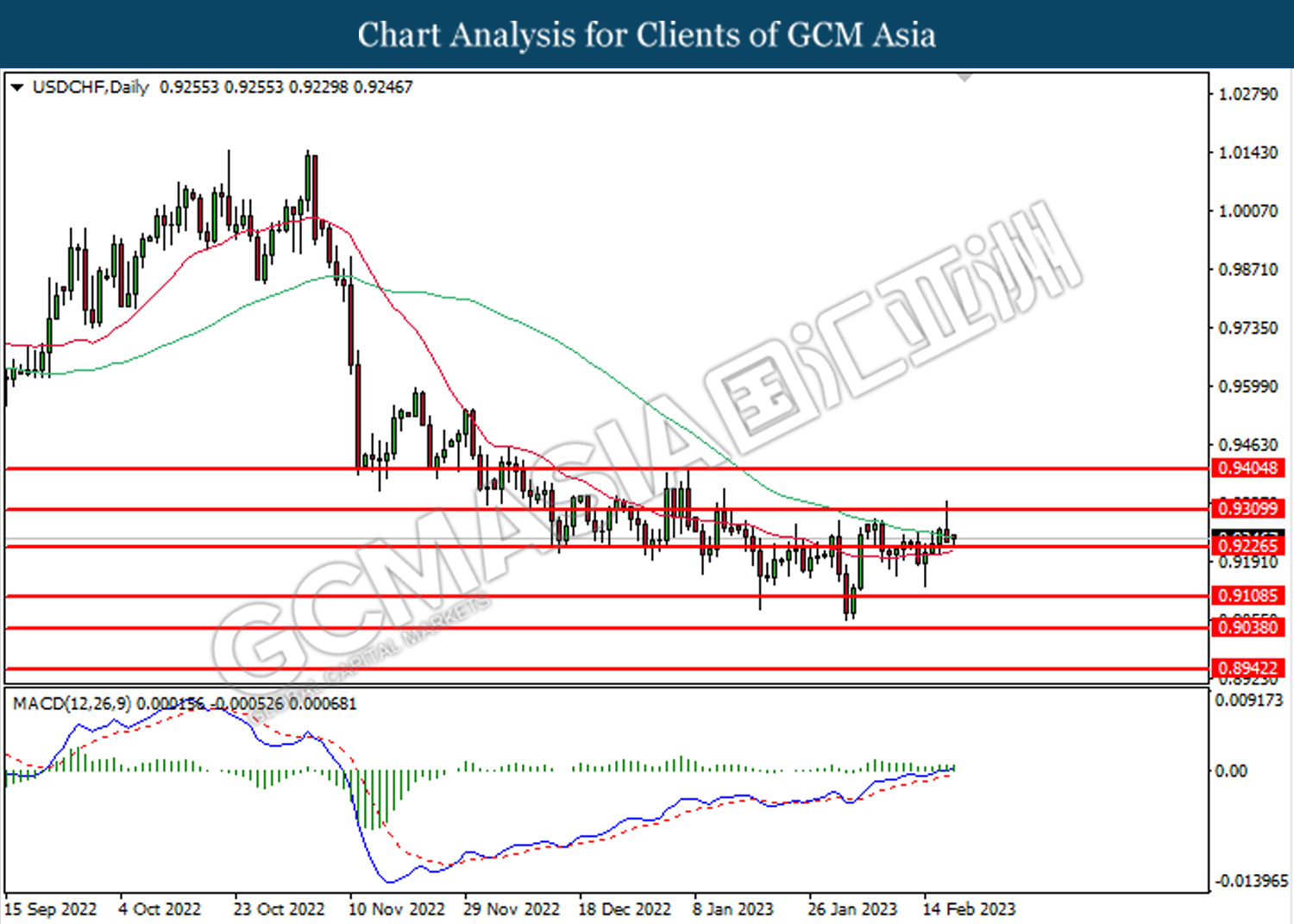

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9310, 0.9405

Support level: 0.9225, 0.9110

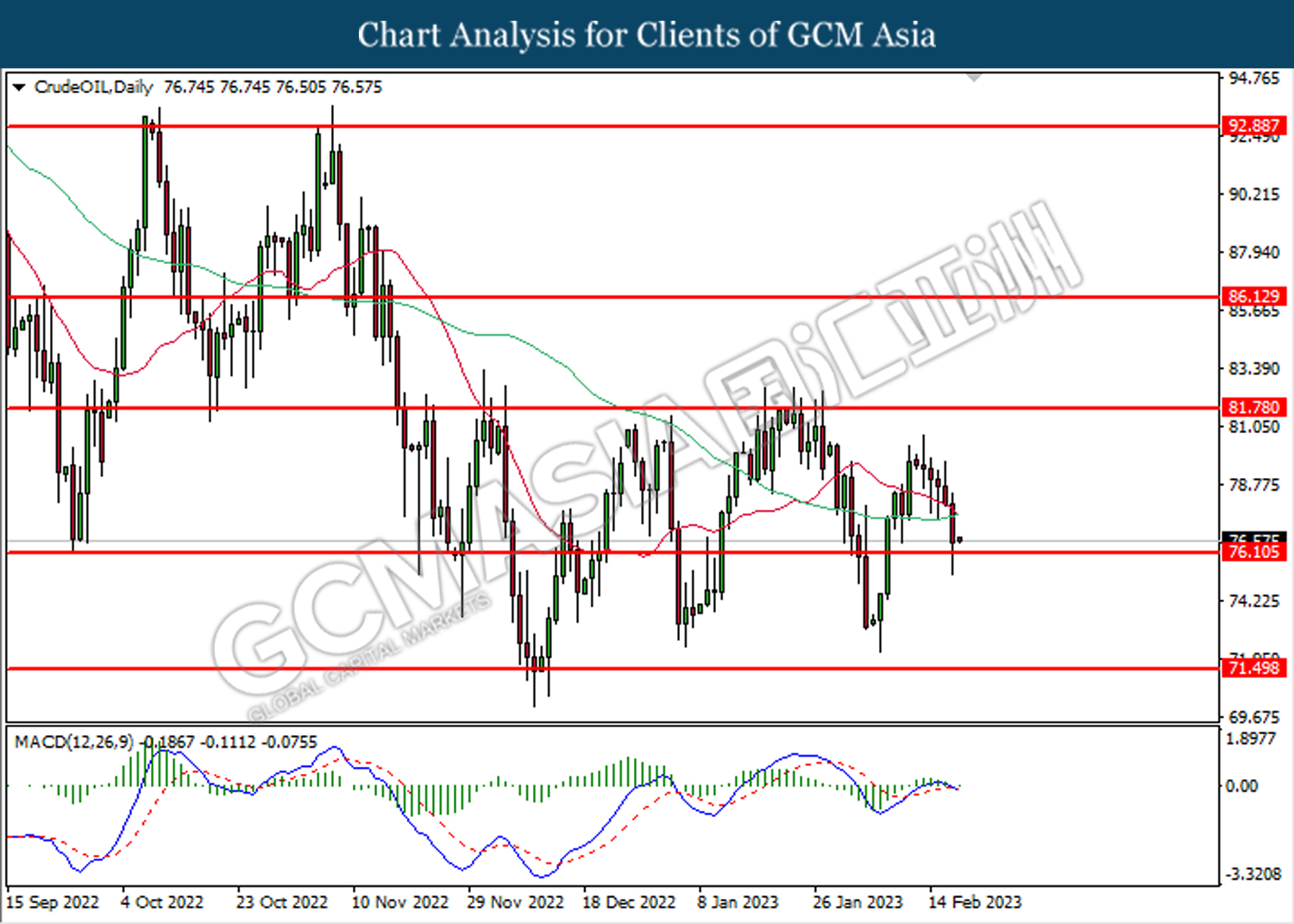

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

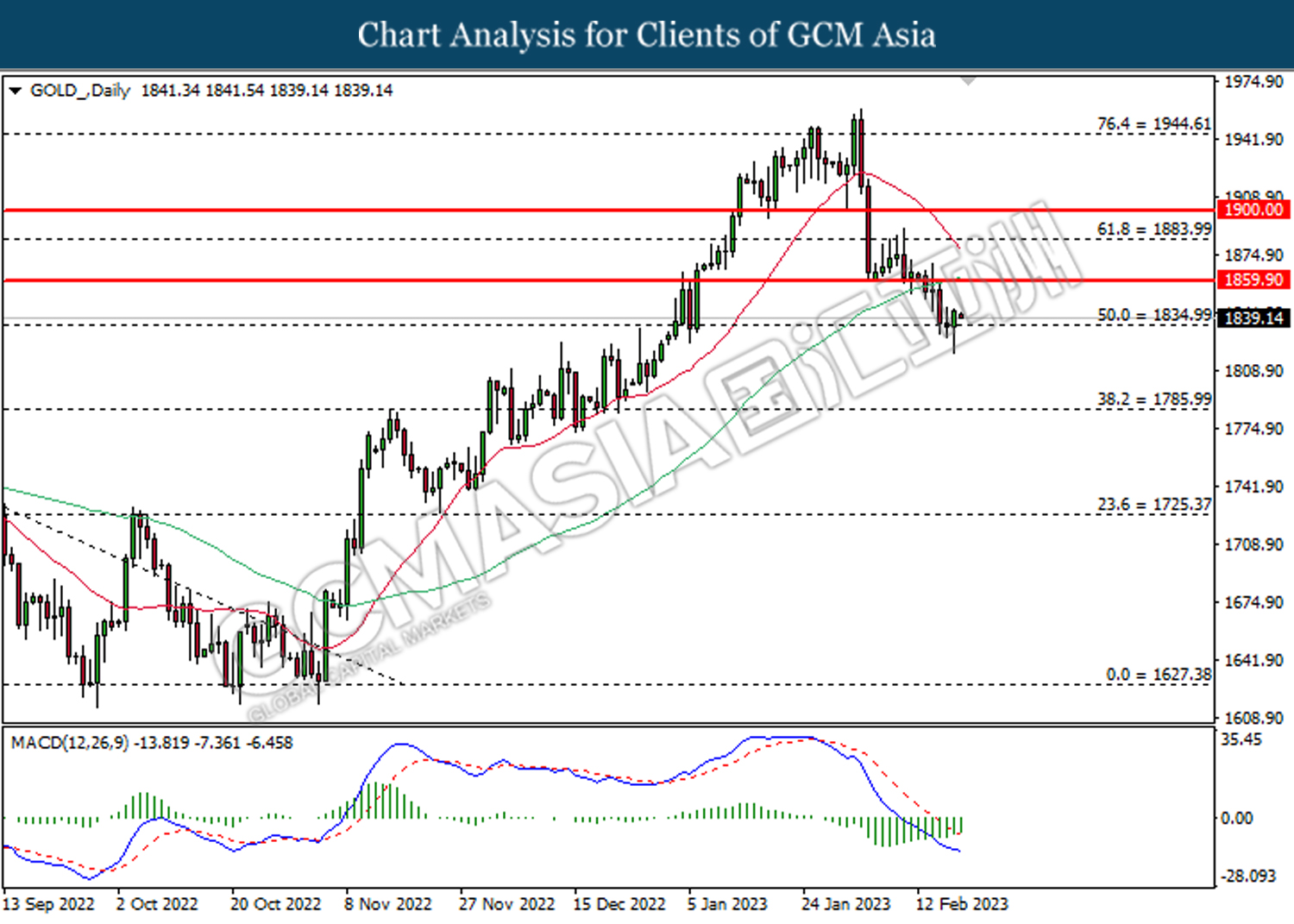

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1835.00 MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1859.90, 1884.00

Support level: 1835.00, 1786.00