22 February 2023 Morning Session Analysis

US Dollar rallied, buoyed by positive economic data.

The Dollar Index which traded against a basket of six major currencies recorded some earnings on yesterday following the upbeat economic data has been unleashed. According to Markit, the US Services Purchasing Managers Index (PMI) notched up from the previous reading of 46.8 to 50.5, exceeding the consensus forecast of 47.2. Besides, the US S&P Global Composite Purchasing Managers Index (PMI) had raised for the second time in a row. Both data was showing a figures that above 50, indicating the expansion in the US economy sector. Prior to that, robust economic data on retail sales and employment has been released, suggesting a strong start of the US economy at the beginning of the year. With that, the US central bank would likely to keep increasing interest rate to tame inflation. However, the gains experienced by US Dollar was limited after the Russia President delivered a warning to the Western countries. According to Reuters, Russia President Vladimir Putin claimed on Tuesday that the country was suspending a landmark nuclear arms control treaty, and the new strategic systems had been put on combat duty. As of writing, the Dollar Index appreciated by 0.32% to 104.11.

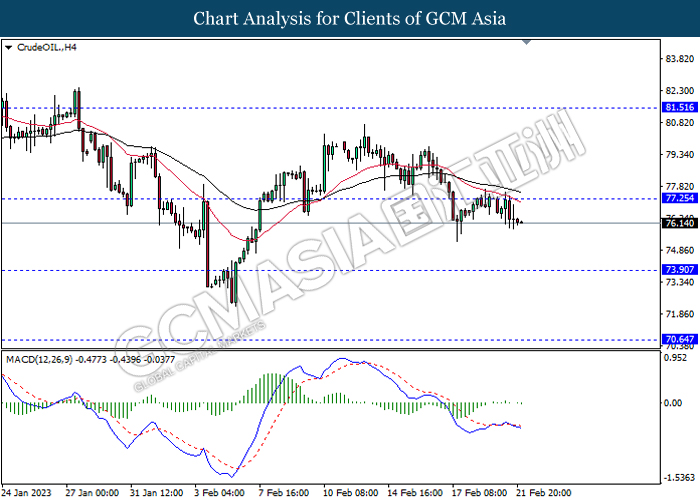

In the commodity market, the crude oil price edged up by 0.07% to $76.25 per barrel as of writing. Though, the oil price slumped on yesterday over the rising fears about aggressive rate hike from Fed, which might threatening global economy. In addition, the gold price rose by 0.03% to $1835.09 per troy ounce as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

10:00 NZD RBNZ Rate Statement

10:00 NZD RBNZ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | EUR – German CPI (YoY) (Feb) | 8.7% | 8.7% | – |

| 17:00 | EUR – German Ifo Business Climate Index (Feb) | 90.2 | 91.4 | – |

Technical Analysis

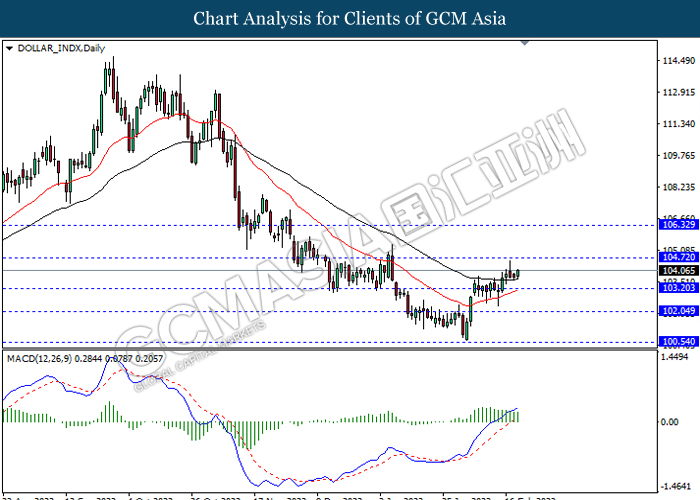

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.70, 106.30

Support level: 103.20, 102.05

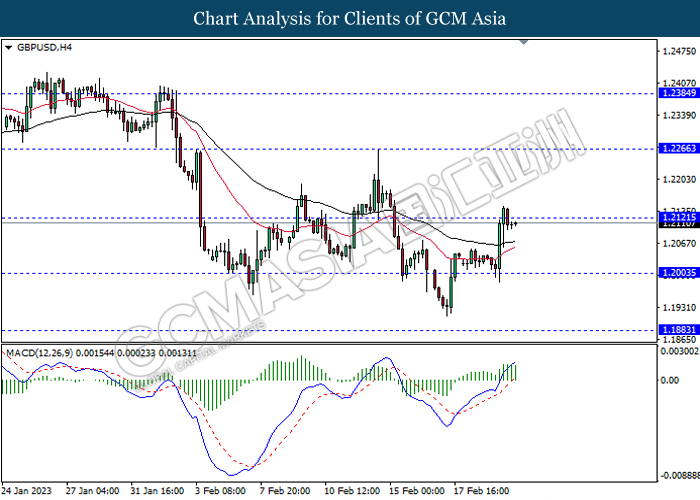

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2120, 1.2265

Support level: 1.2005, 1.1885

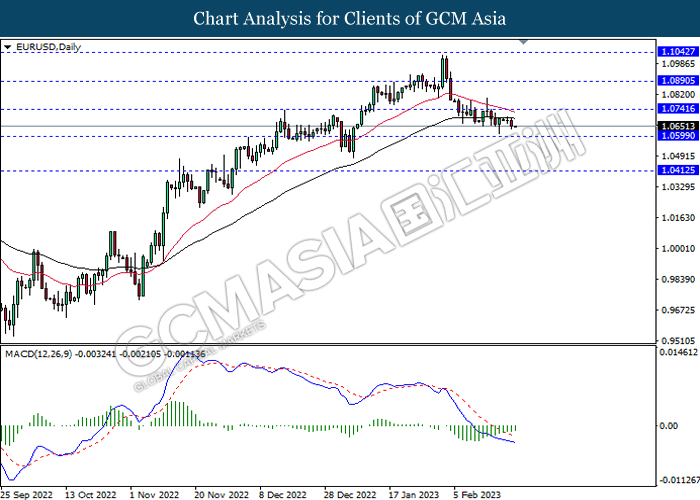

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0740, 1.0890

Support level: 1.0600, 1.0410

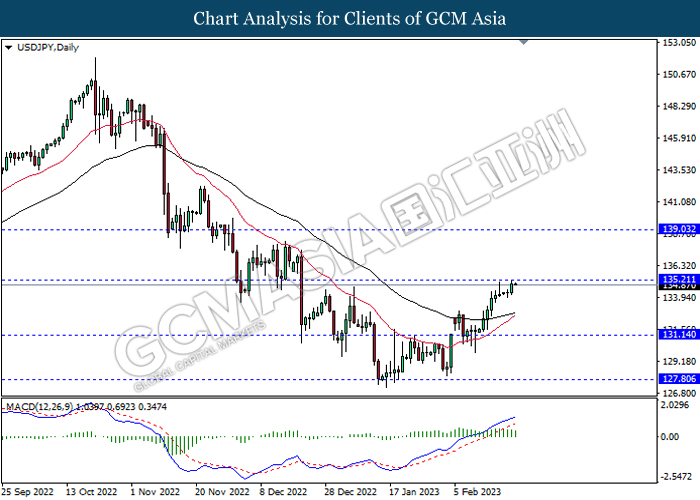

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

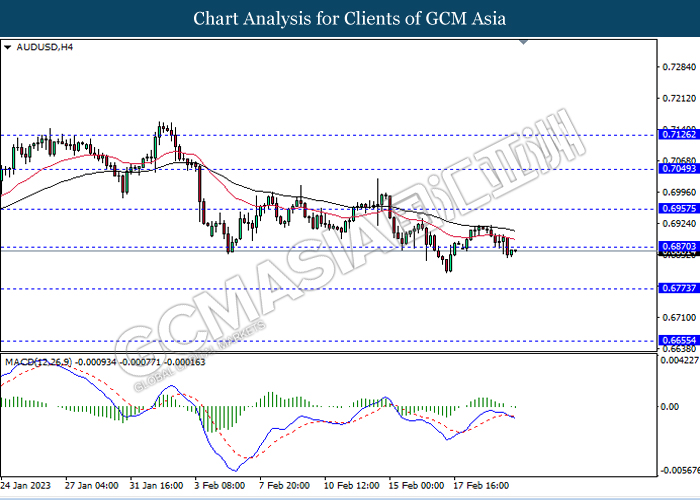

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6655

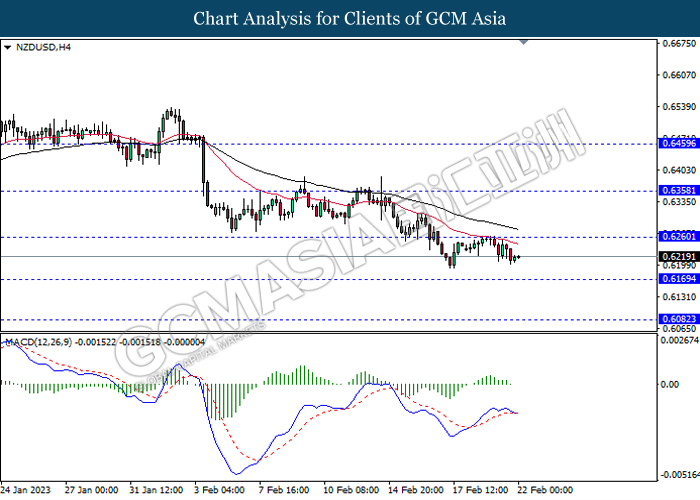

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6260, 0.6360

Support level: 0.6170, 0.6080

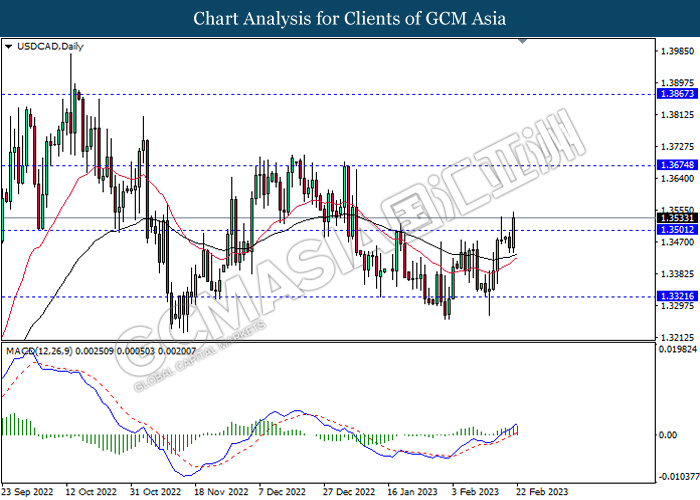

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3320

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9400, 0.9590

Support level: 0.9235, 0.9065

CrudeOIL, H4: Crude oil price was traded lower following retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 77.25, 81.50

Support level: 73.90, 70.65

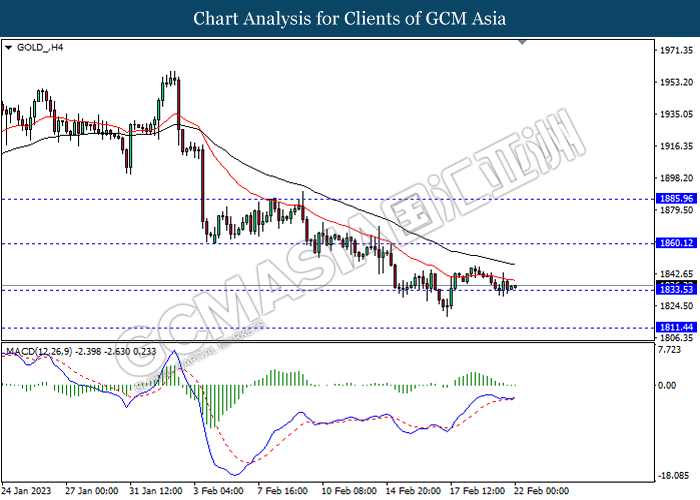

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45