23 February 2023 Afternoon Session Analysis

NZD rose amid RBNZ aggressive rate hike.

The kiwi dollar, as a highly traded currency by the global investor, rebounded after the Reserve Bank of New Zealand’s aggressive rate hike by 50 basis points to 4.75%. According to the RBNZ’s monetary policy statement, the country’s annual inflation stood at 7.2% and is still far away from the central bank target rate of 2%. The board mentioned that the CPI inflation was slightly lower than expected in December 2022, but a higher interest rate is needed to ensure the inflationary pressure eases further. In addition, severe storms across the North islands have disrupted a variety of industries and infrastructures, causing the issue of supply shortages and upward price pressure, and inflation is likely to stay high as a result. Moreover, the 3.4% unemployment rate for the last quarter indicated that the country has a strong labor market while experiencing accelerating growth in household incomes. With that, it will lead to higher household consumption, which will likely cause inflation in New Zealand to remain at a high level for an extended period of time. However, the rebound of the Kiwi was slightly offset by the hawkish statement announced by the Fed. According to the FOMC meeting minutes, Fed officials signaled further tightening of monetary policy. As of writing, the NZD/USD rose 0.47% to $0.6246.

In the commodity market, the crude oil price rose by 0.51% to $74.33 per barrel amid the potential for a deeper oil supply cut by Russia, which amounted to 500k barrels per day. In addition, the gold price depreciated by -0.22% to $1837.40 per troy ounce as of writing amid pressure from the dollar’s strength.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Jan) | 8.5% | 8.6% | – |

| 21:30 | USD – GDP (QoQ) (Q4) | 2.9% | 2.9% | – |

| 21:30 | USD – Initial Jobless Claims | 194K | 200K | – |

Technical Analysis

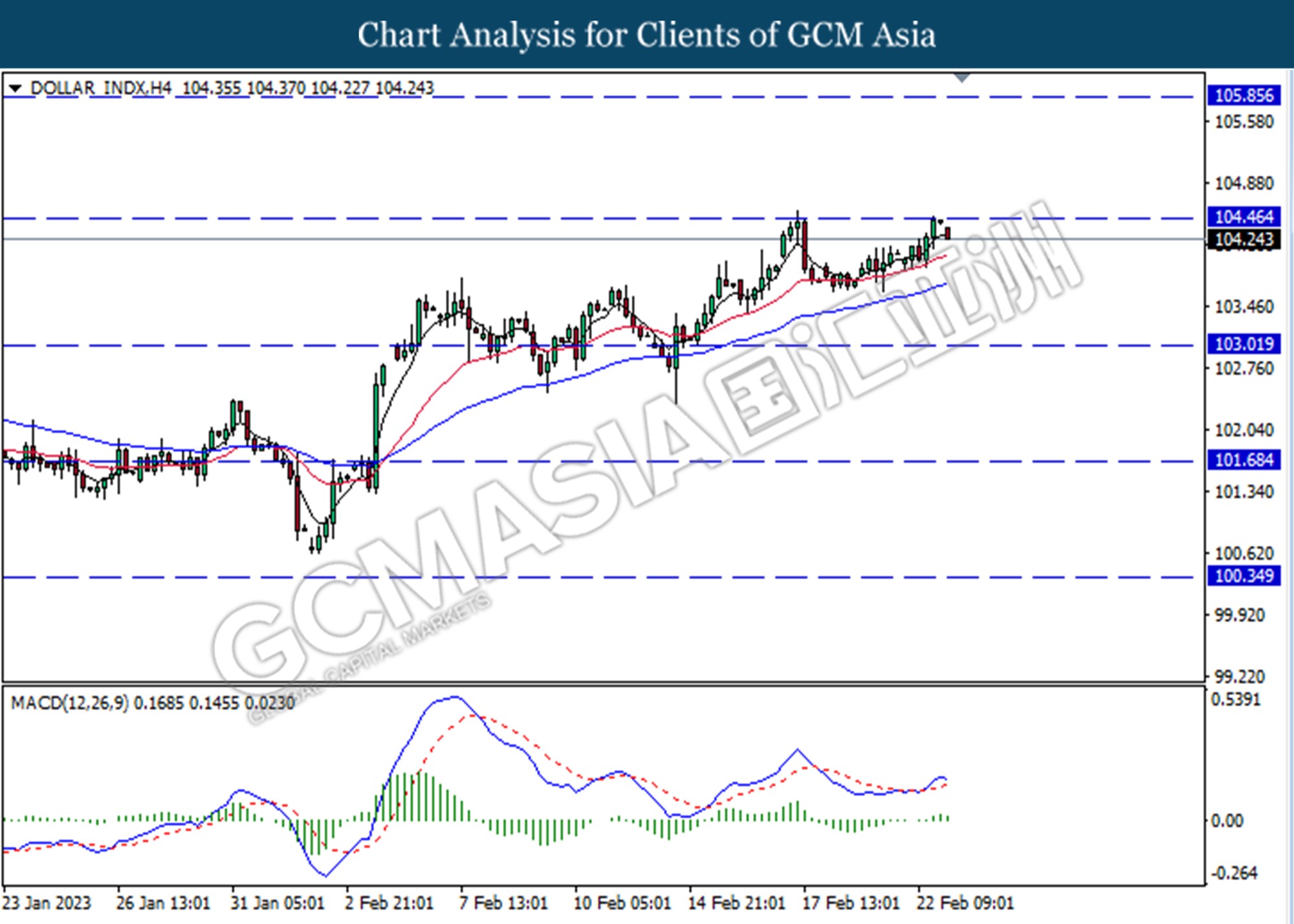

DOLLAR_INDX, H4: Dollar index was traded lower following a prior retracement from the resistance level at 104.45. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

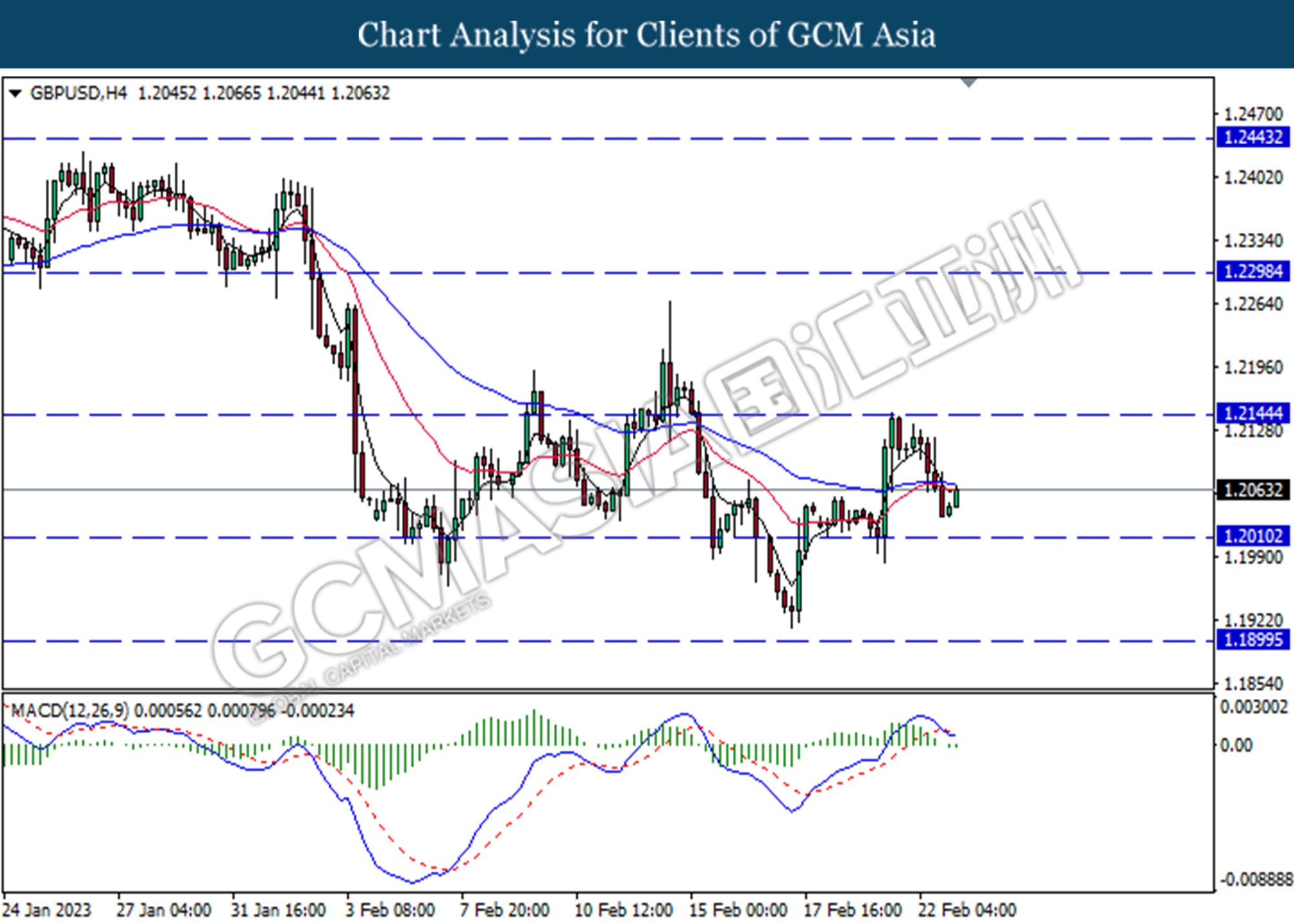

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded higher following a rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.0635

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

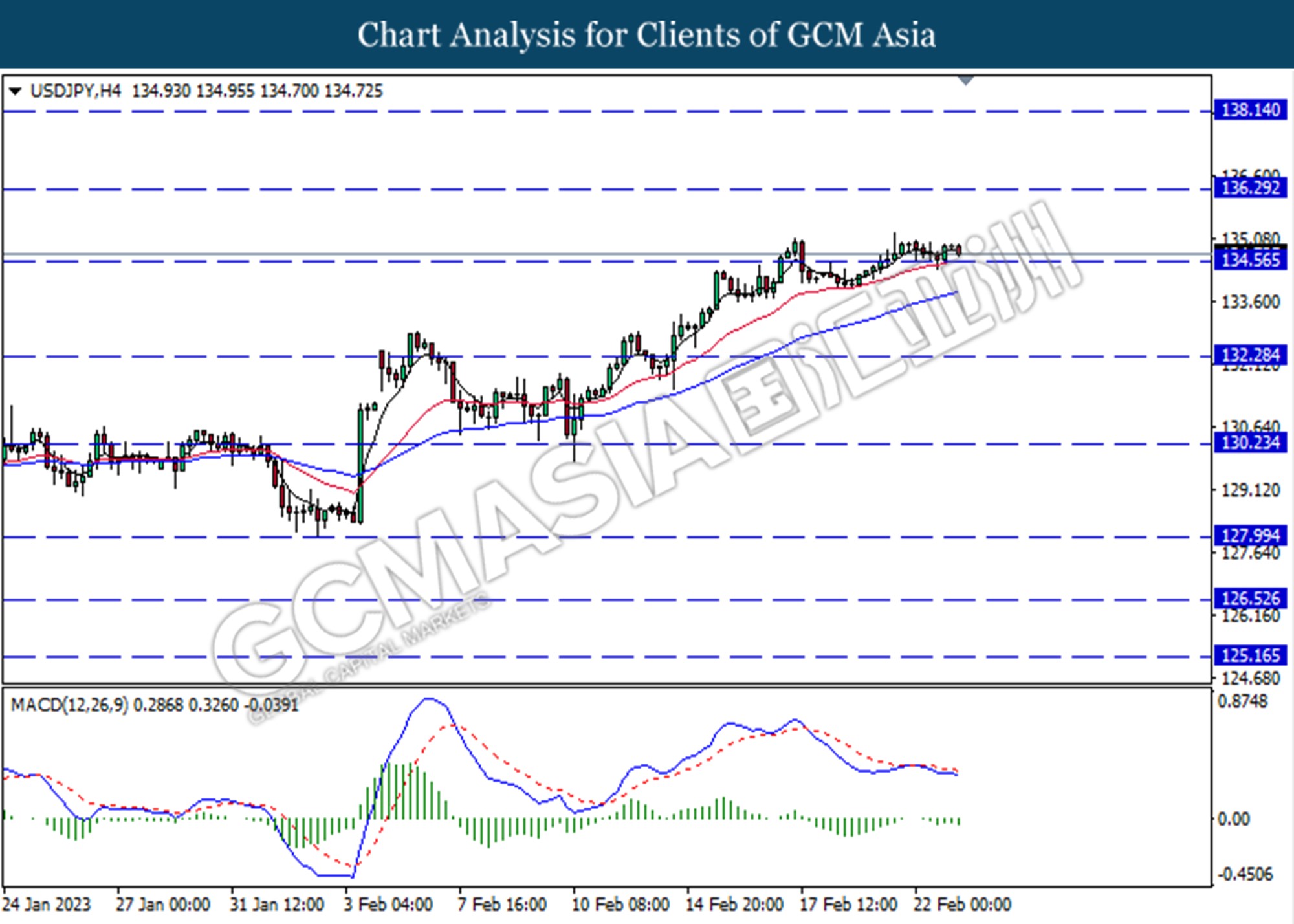

USDJPY, H4: USDJPY was traded higher following a rebound from the support level. However, MACD which illustrated increasing bearish momentum suggests the pair to be traded lower as technical correction.

Resistance level: 136.30, 138.15

Support level: 130.25, 134.55

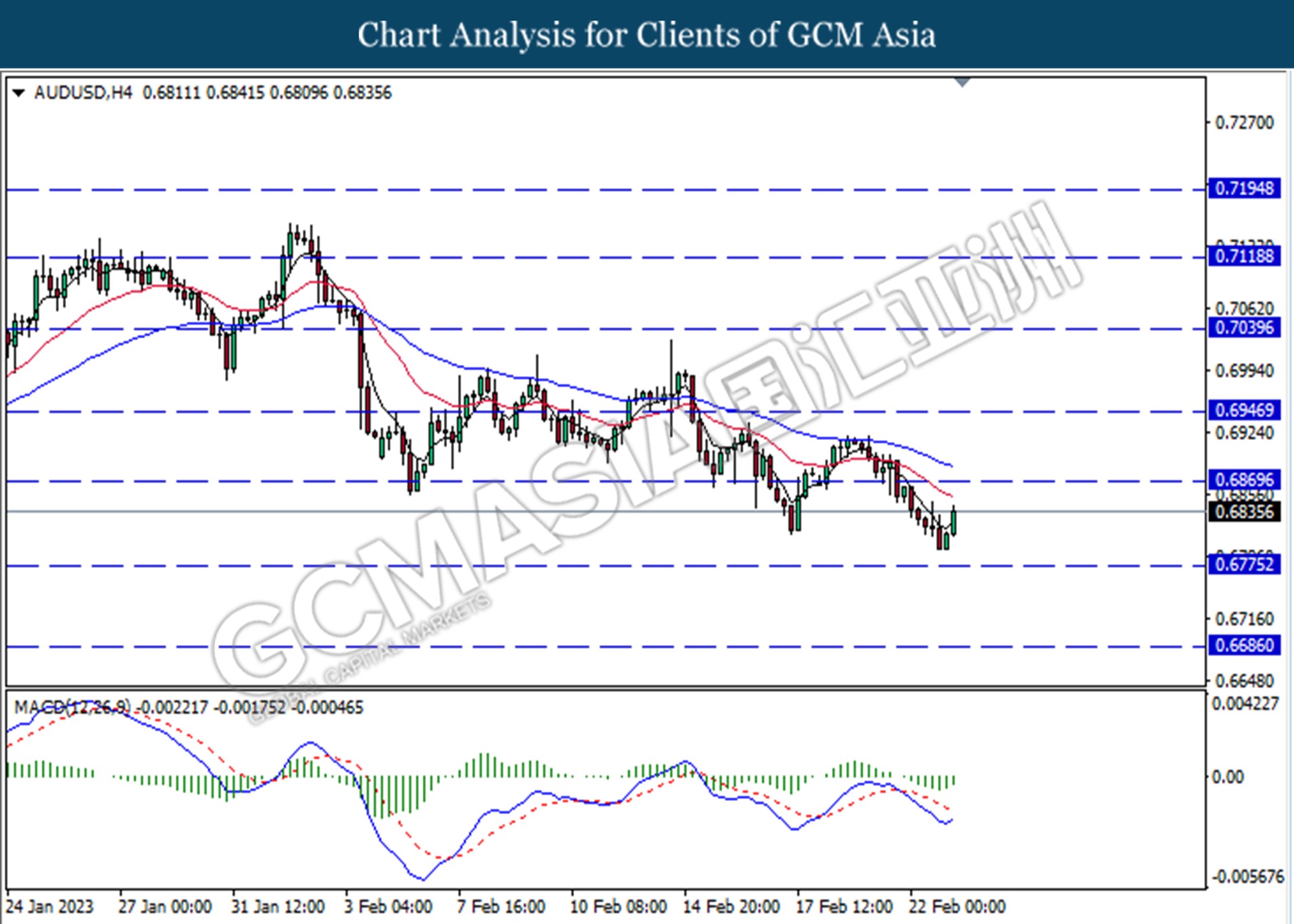

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains towards the resistance level at 0.6870.

Resistance level: 0.6870, 0.6955

Support level: 0.6775, 0.6685

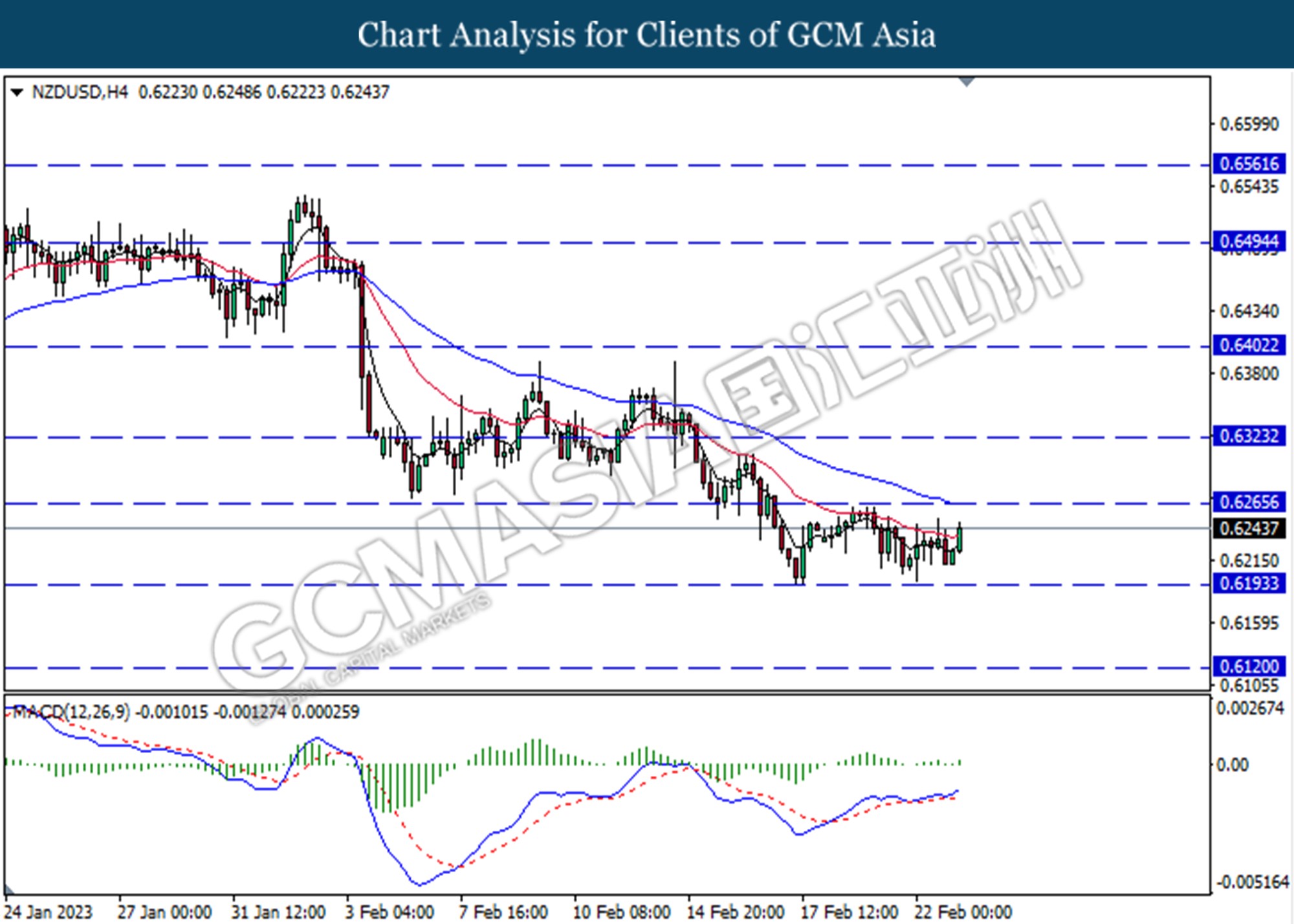

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

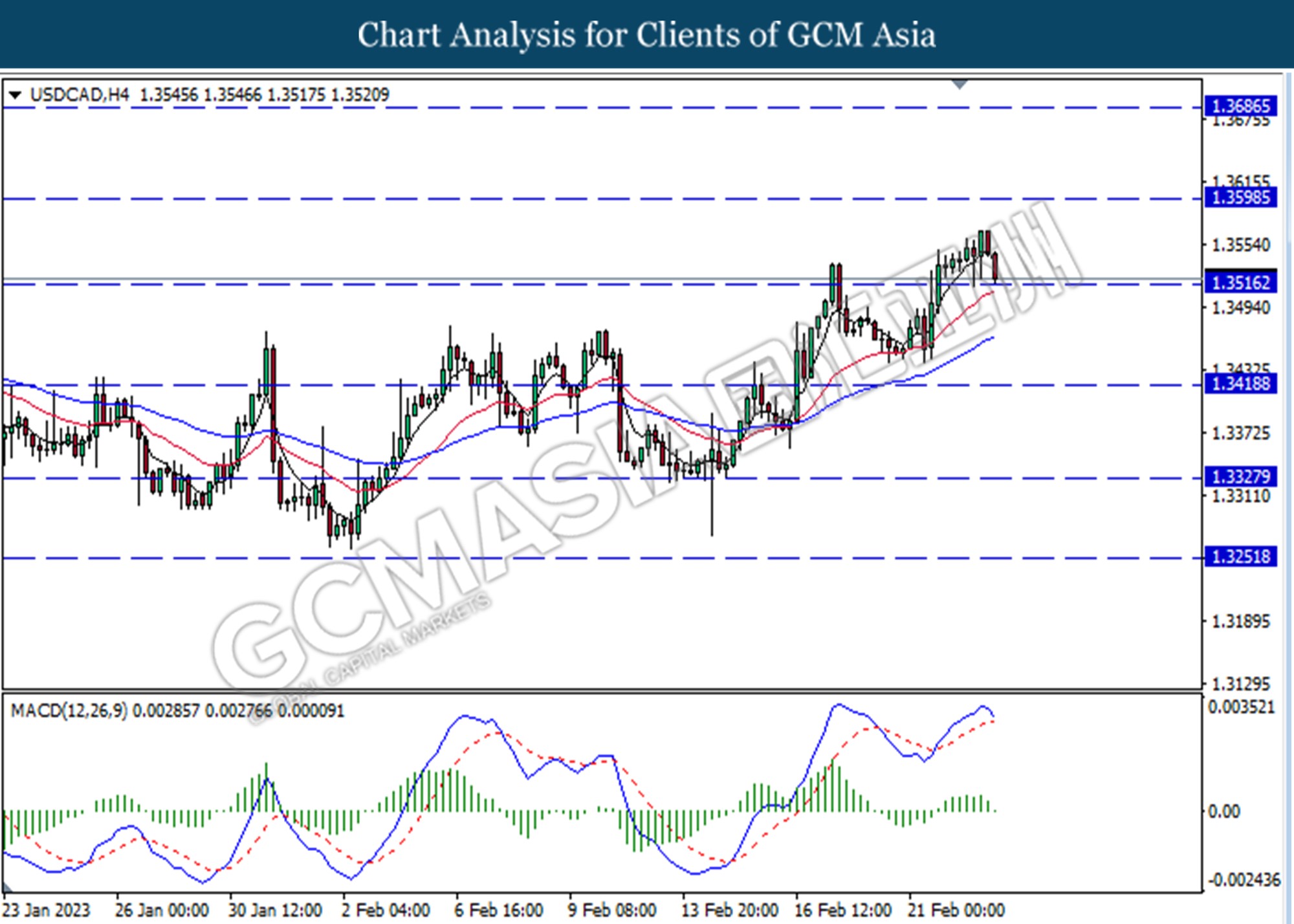

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3515. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses if it successfully breaks below the support level.

Resistance level: 1.3560, 1.3685

Support level: 1.3420, 1.3330

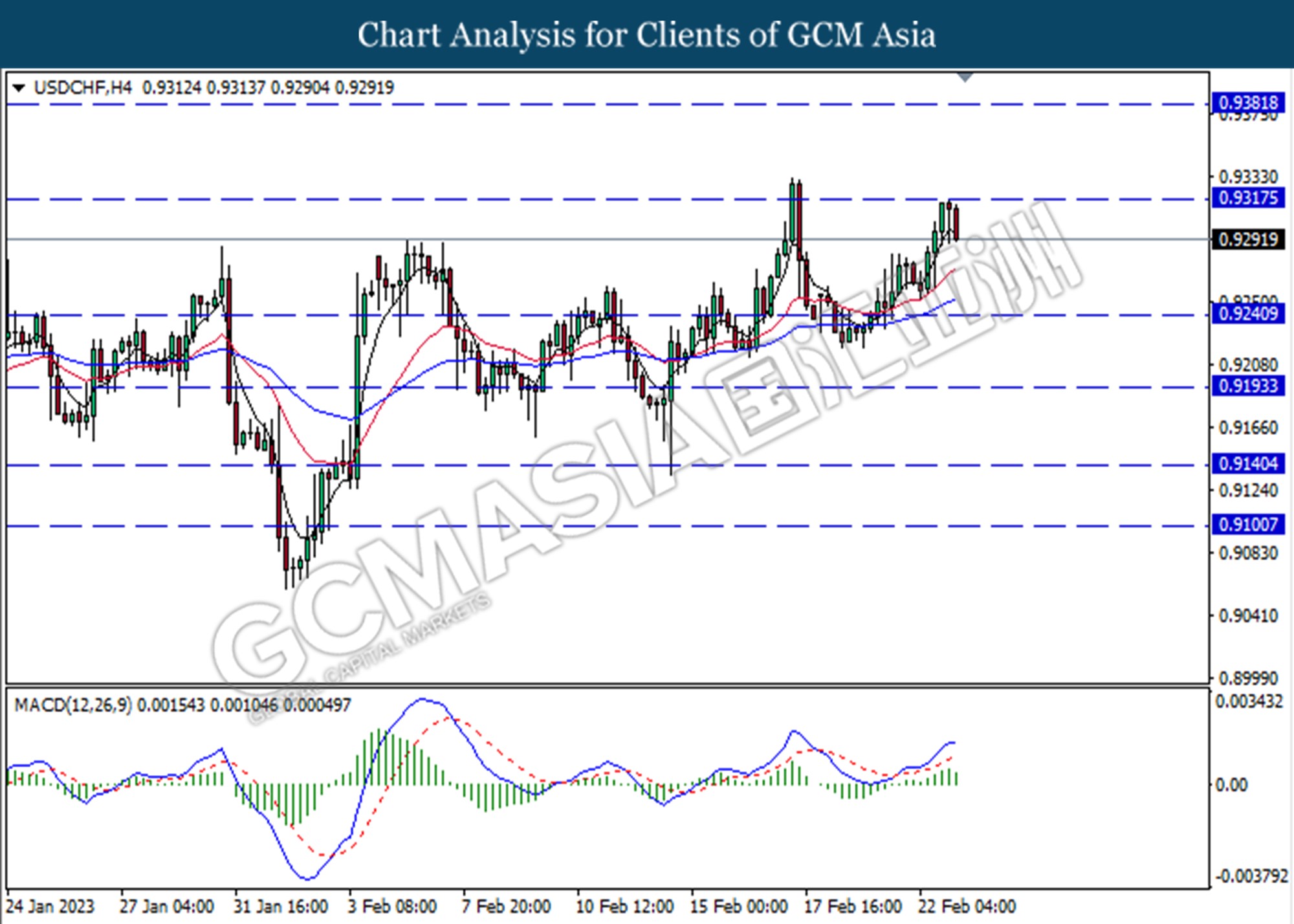

USDCHF, H4: USDCHF was traded lower following a prior retracement from the resistance level at 0.9320. MACD which illustrated decreasing bullish momentum suggests the pair to extend its losses toward the support level at 0.9240.

Resistance level: 0.9320, 0.9380

Support level: 0.9240, 0.9195

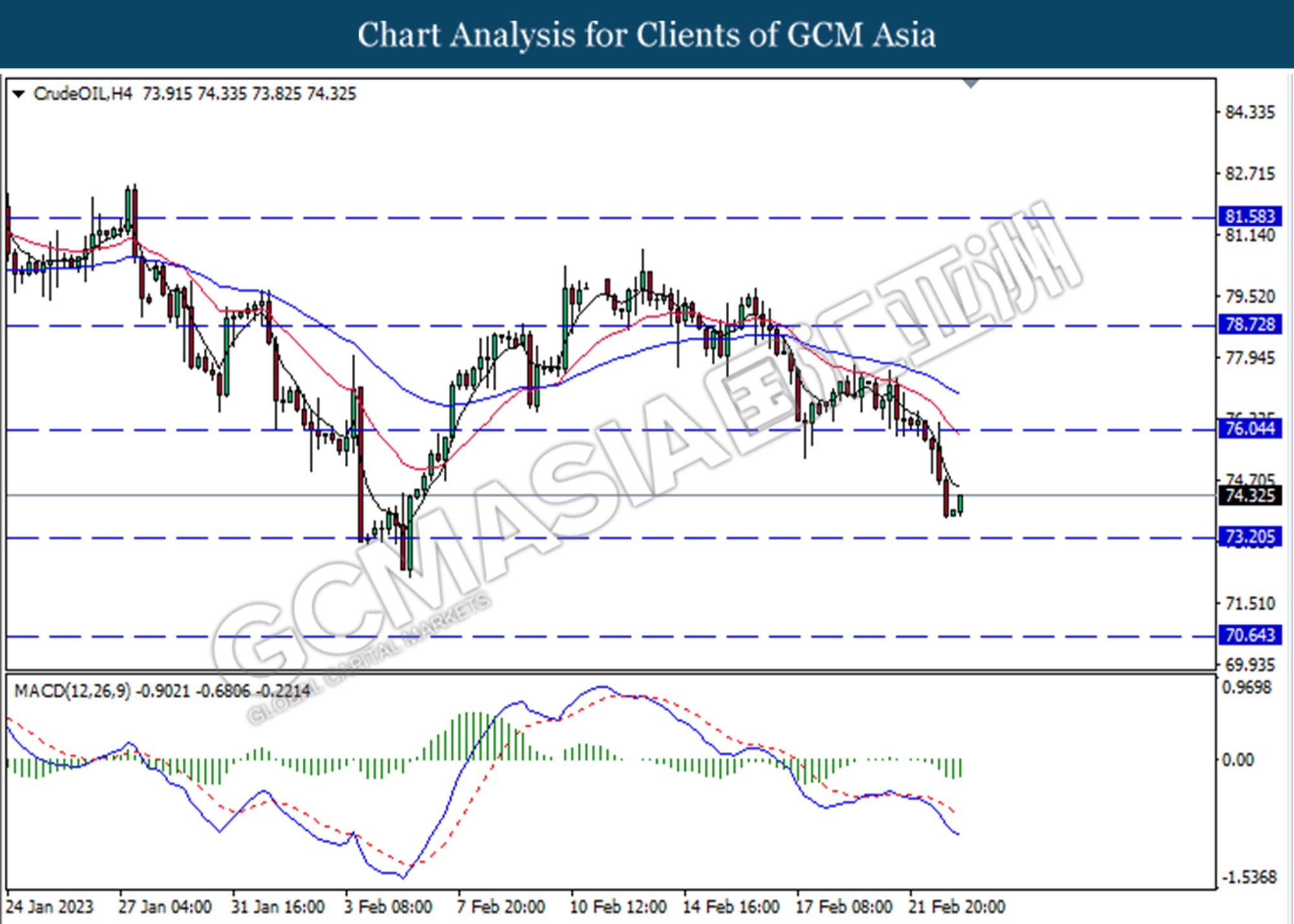

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the commodity to extend its gains toward the resistance level at 76.05

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

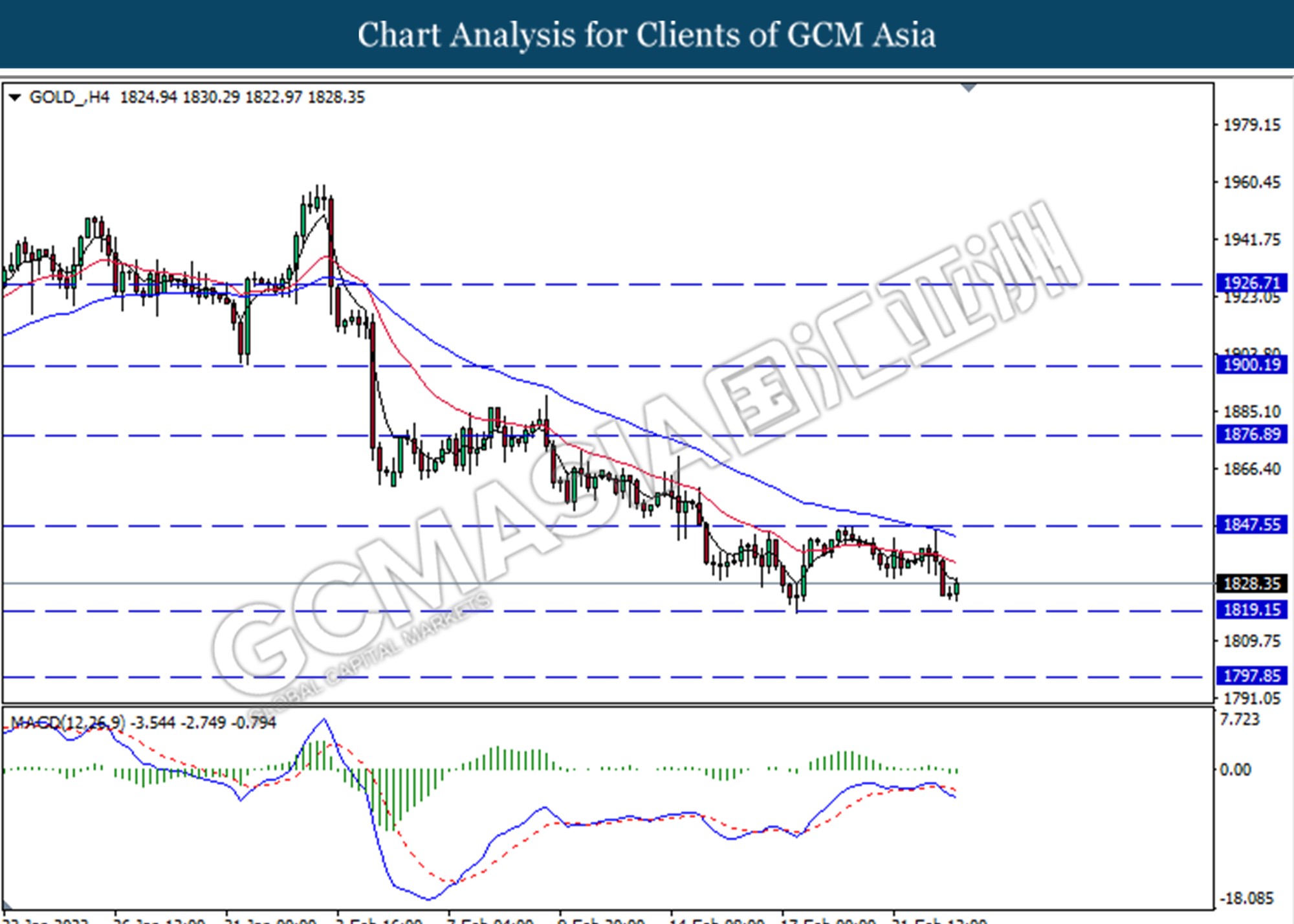

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the commodity to trade lower as a technical correction.

Resistance level: 1860.10, 1885.95

Support level: 1833.55, 1811.45