28 February 2023 Morning Session Analysis

Dollar rally cools as risk appetites improve.

The dollar index, which traded against a basket of six major currencies, gave up some gains after hitting its highest level since the beginning of Jan 2022 as the market risk appetite recovered. Yesterday, the dollar index lost its ground after UK Prime Minister Rishi Sunak has finally come into a consensus with EU on some pending issue around Northern Ireland. A deal has been signed by the supreme leaders from the both nation after a decisive breakthrough since Brexit. In short, the deal is included with the framework of safeguarding trade flows within the UK, protecting Northern Ireland’s place within the UK and so on. Despite, the exact details about the deal is not available at the moment, but it is promised to be announced sooner or later. With the deal has been sealed, it boosted the positive sentiment in both the Euro and Pound market amid brighter economic prospect. On top of that, the market participants looked past the yesterday’s economic data while paying their attentions over the upcoming ISM data. As of writing, the dollar index dropped by -0.54% to 104.65.

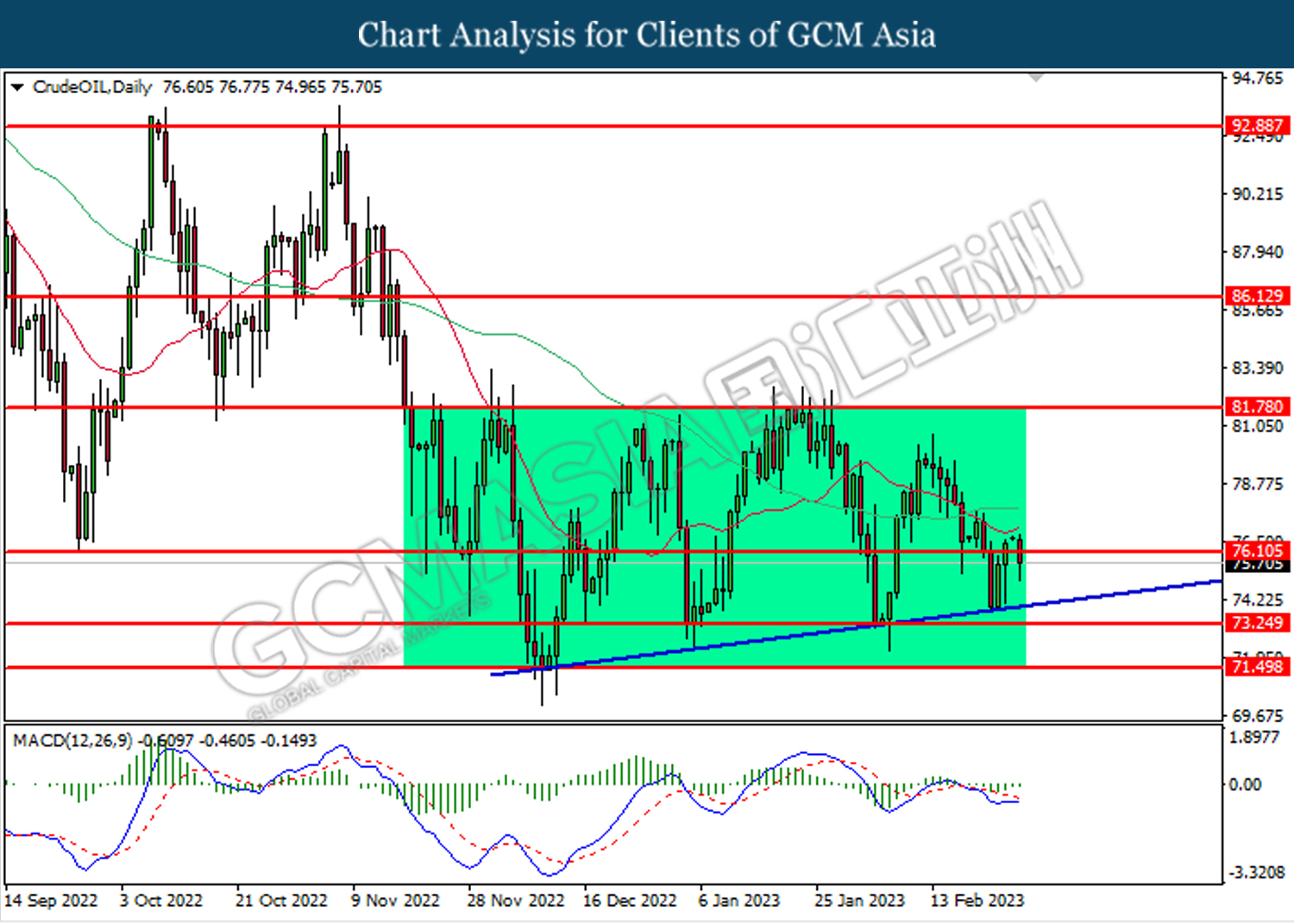

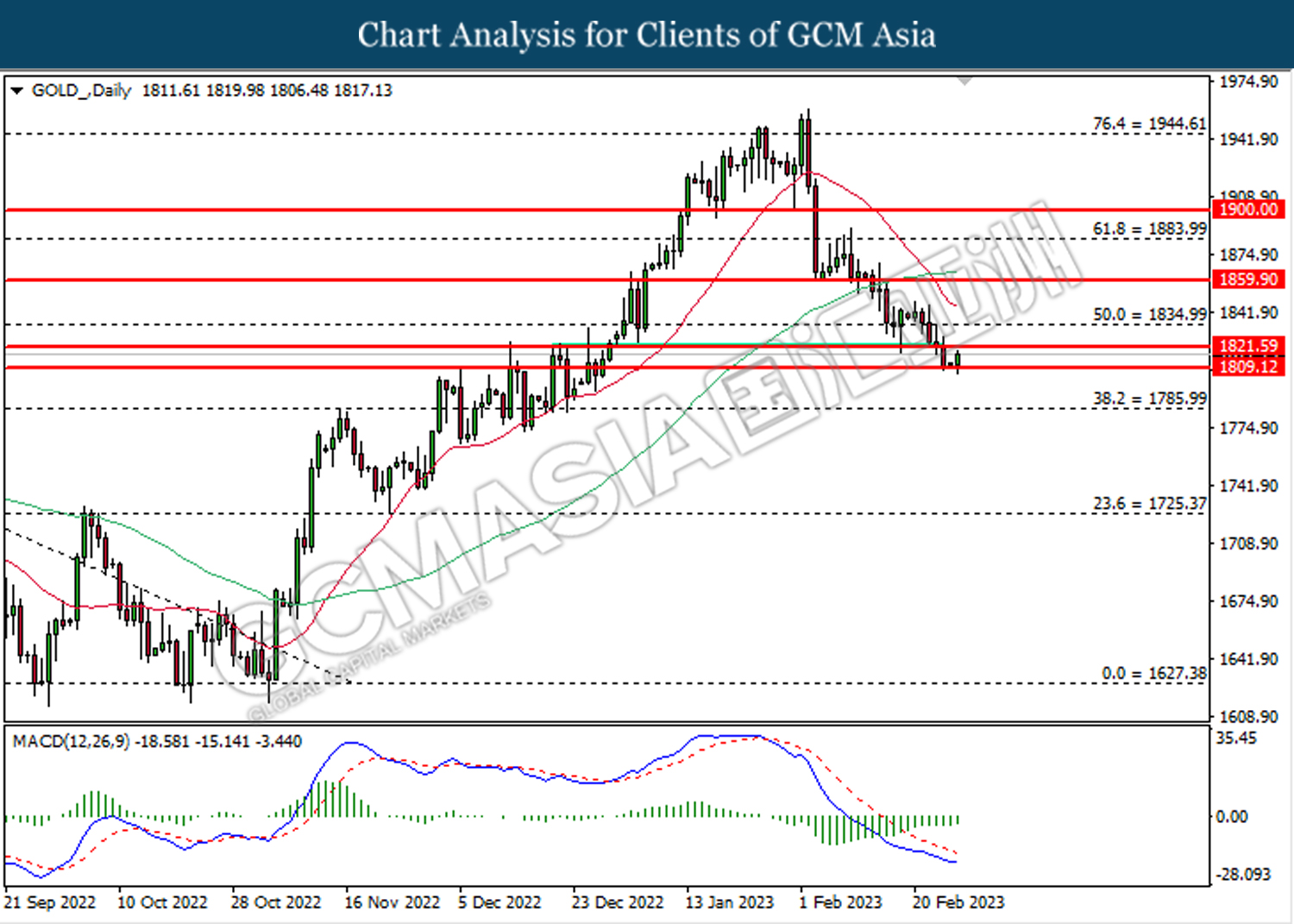

In the commodities market, crude oil prices slid by -0.94% to $75.60 per barrel as recent strong economic data increased the likelihood of aggressive rate hike in the future, which dampened the outlook of oil demand. Besides, gold prices rose by 0.31% to $1817.30 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.1% | 0.1% | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 107.1 | 108.5 | – |

Technical Analysis

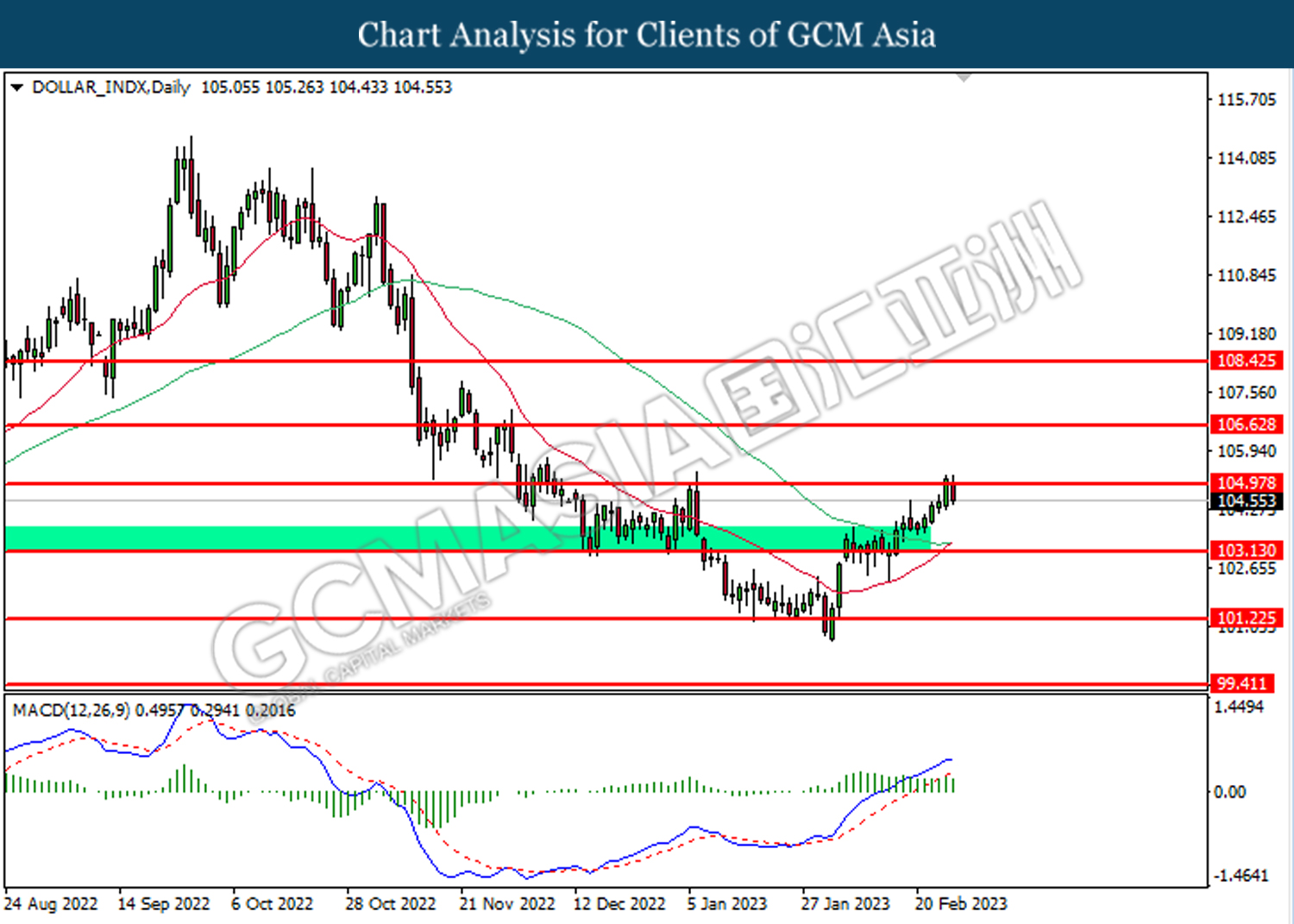

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

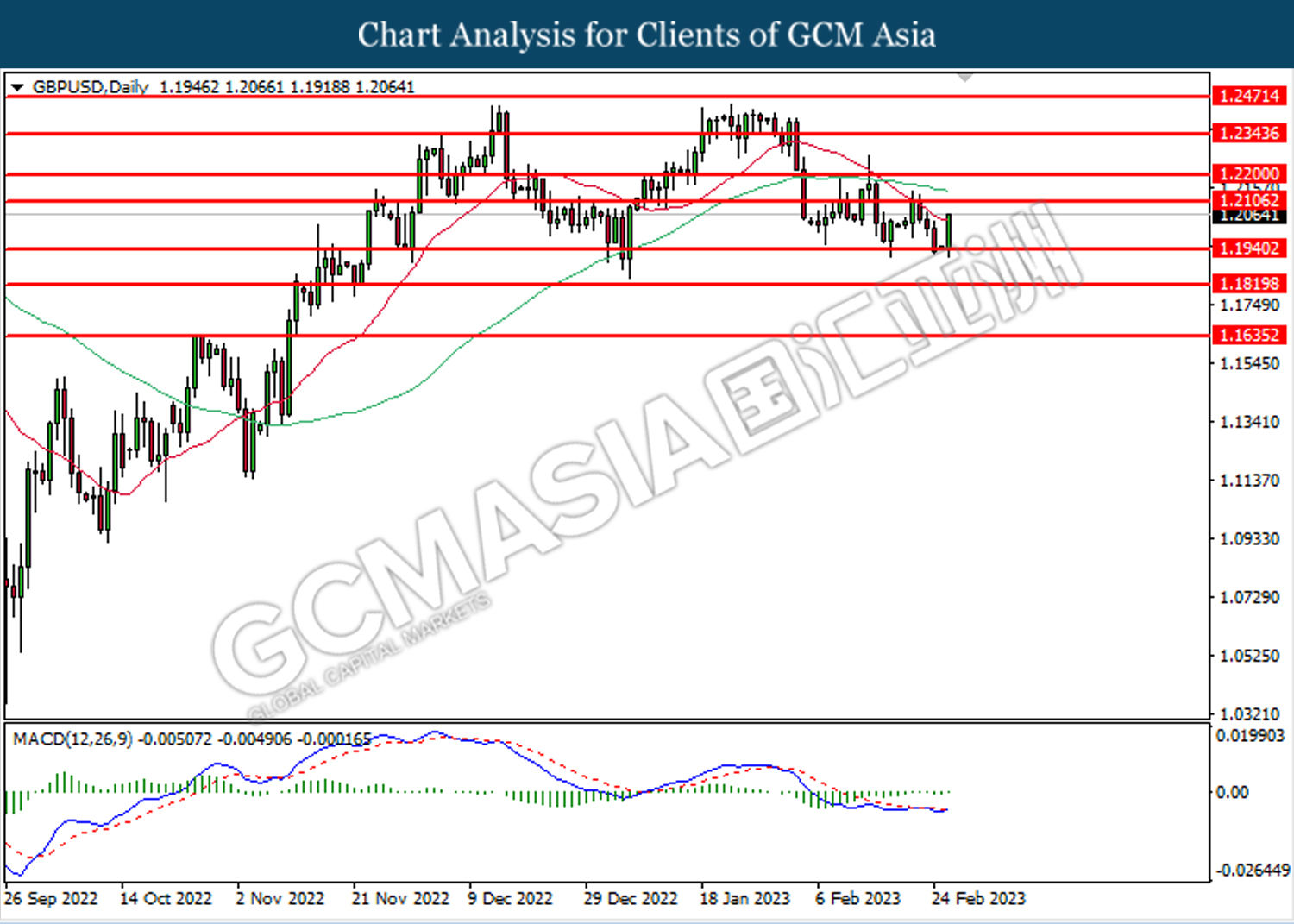

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

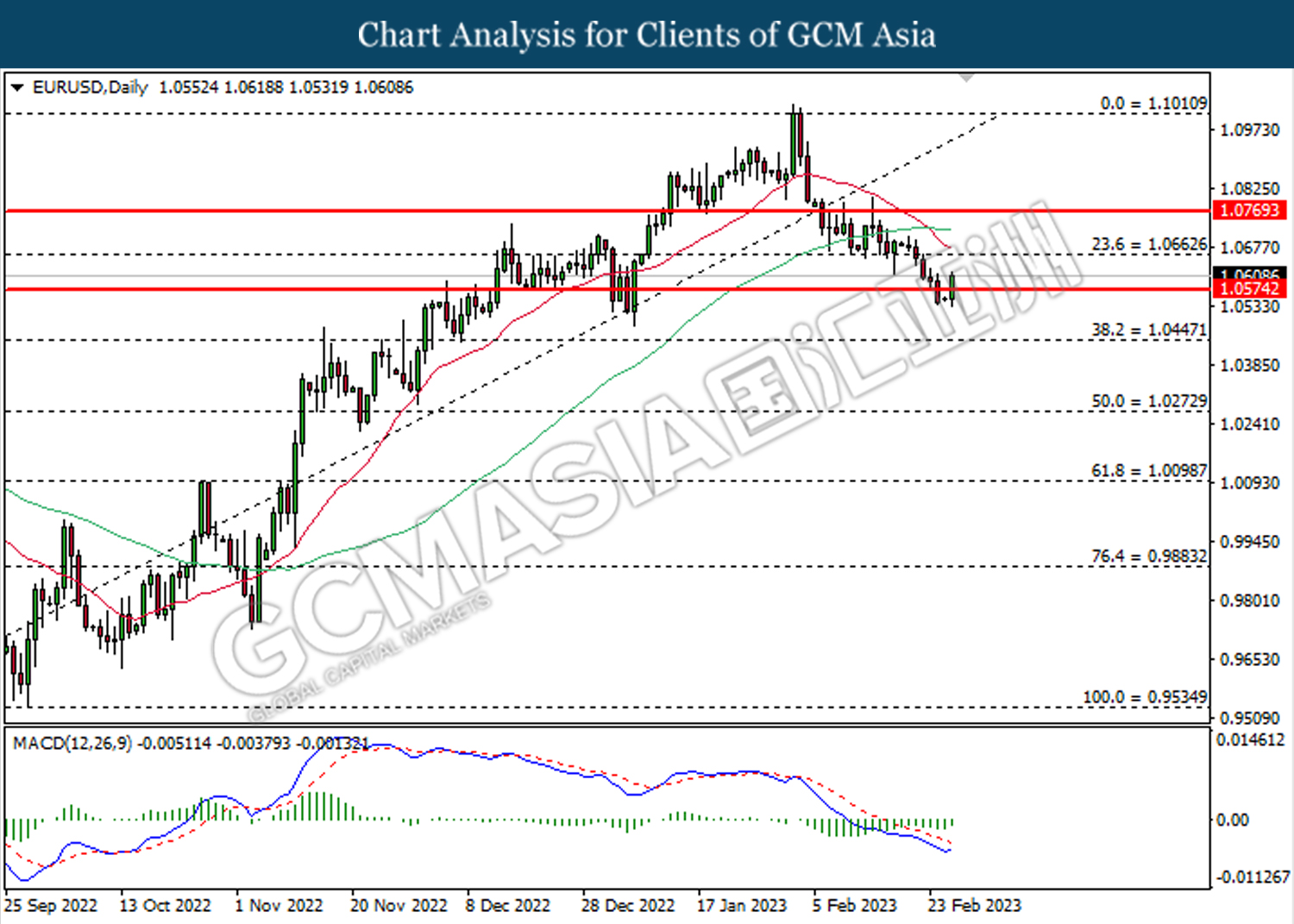

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the lower. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0665.

Resistance level: 1.0665, 1.0770

Support level: 1.0445, 1.0275

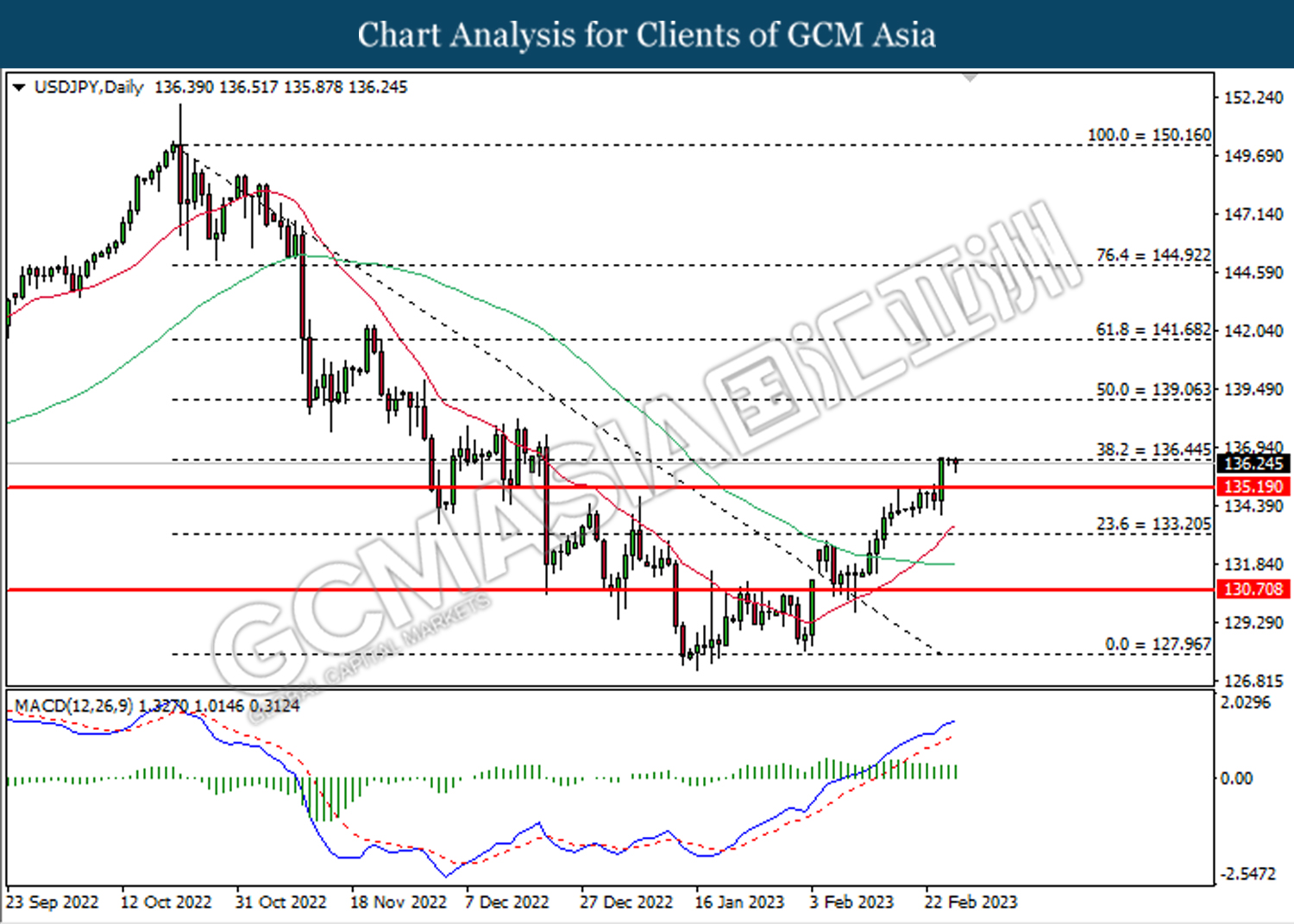

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

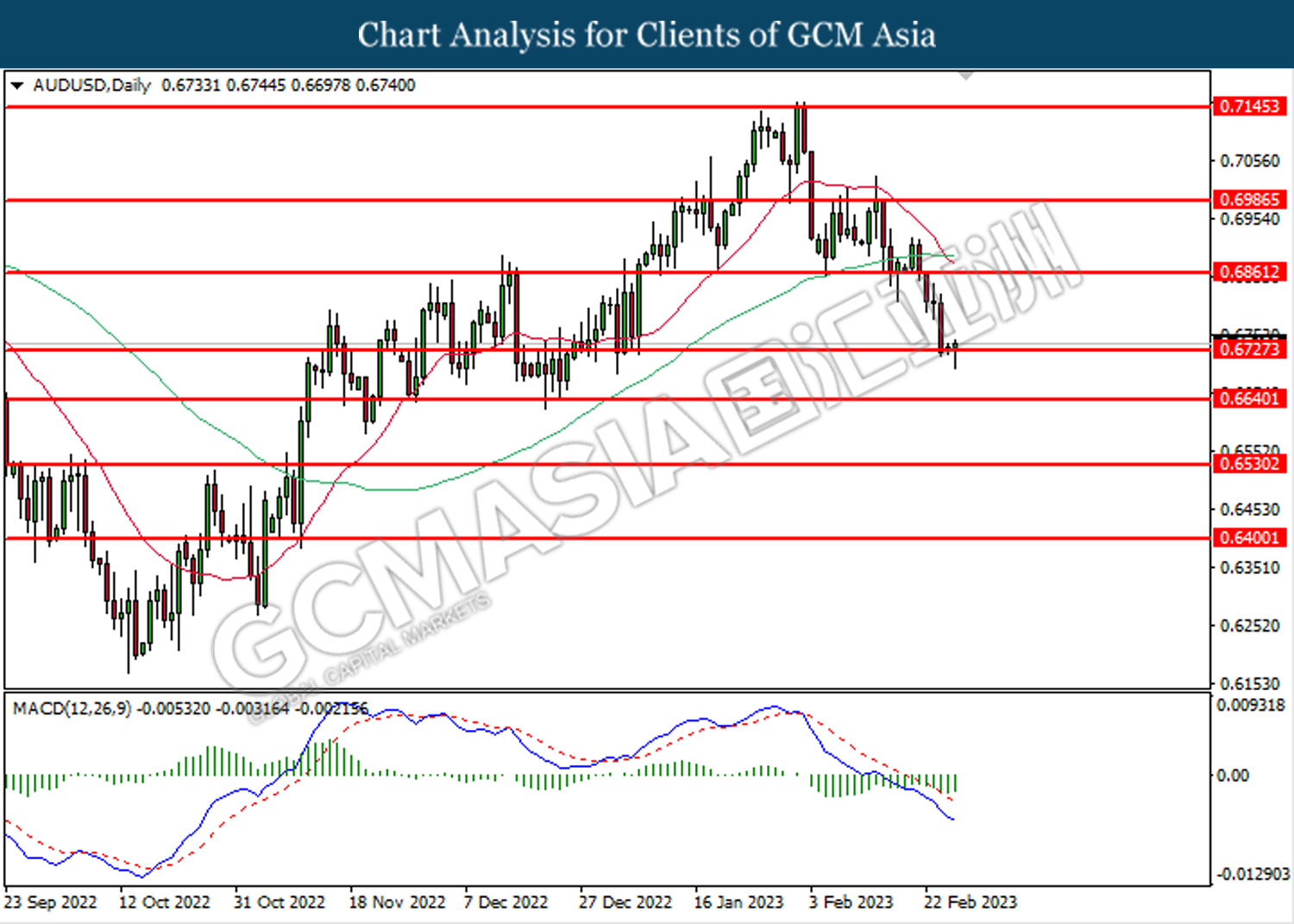

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

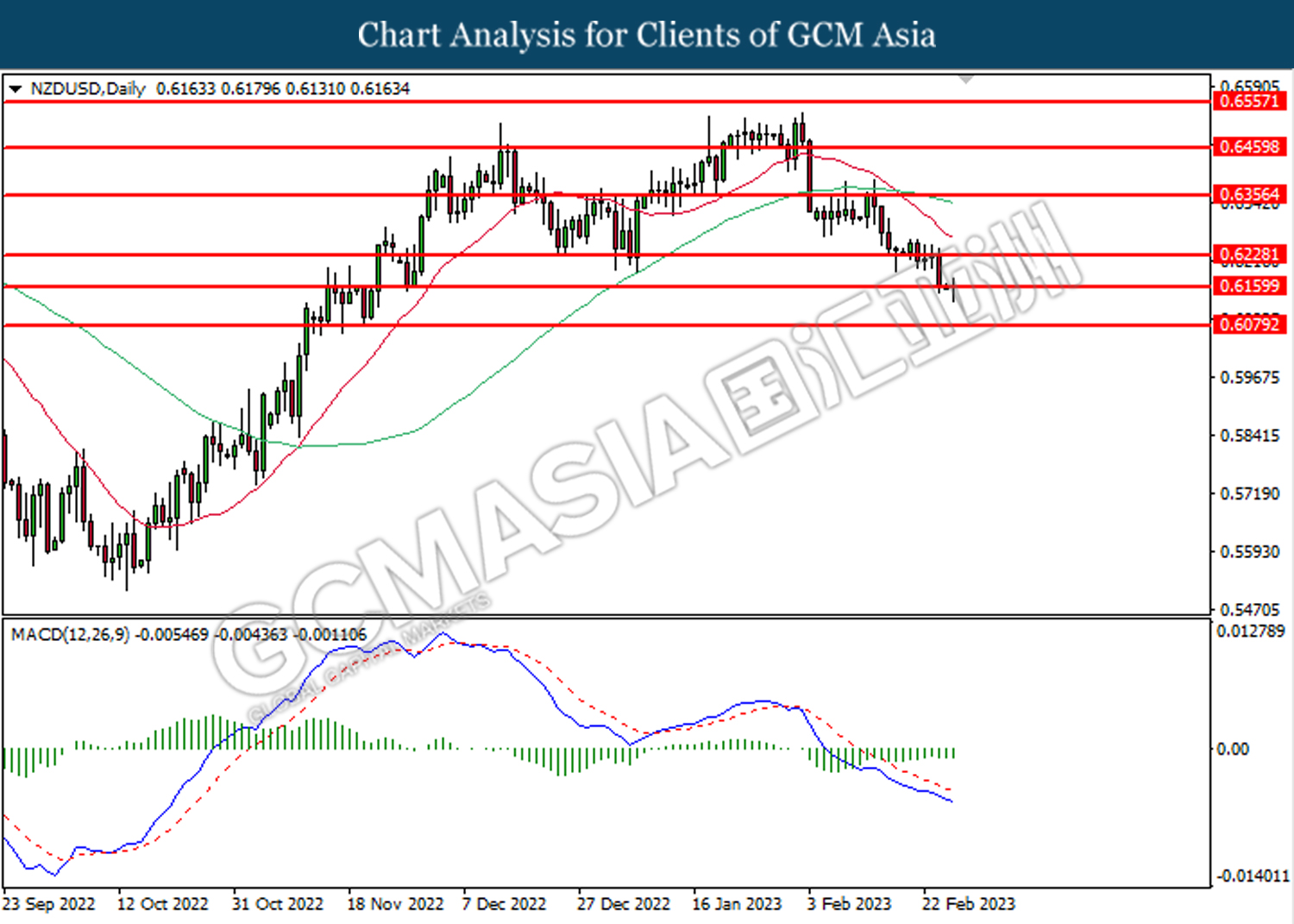

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6160. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

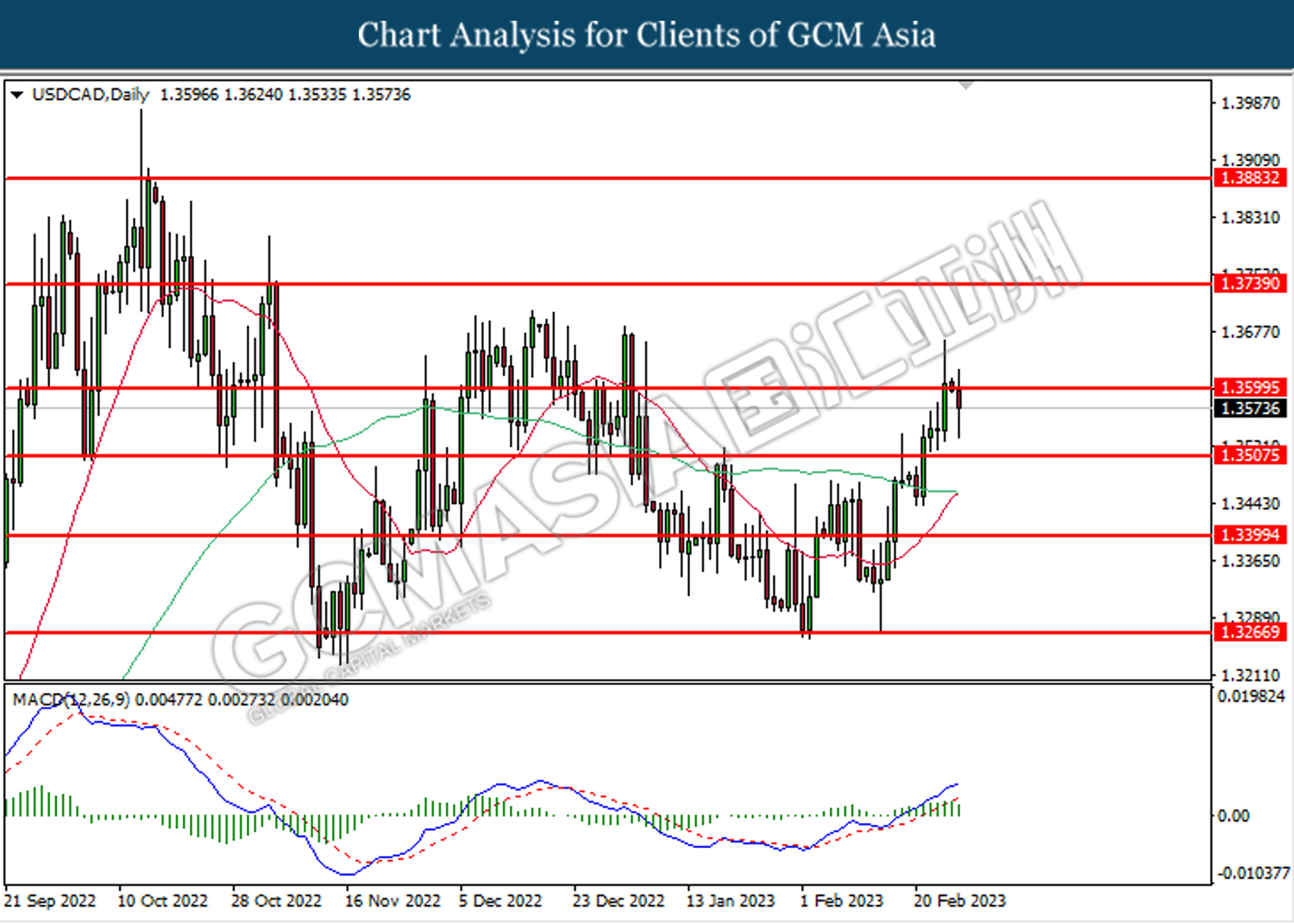

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3505.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

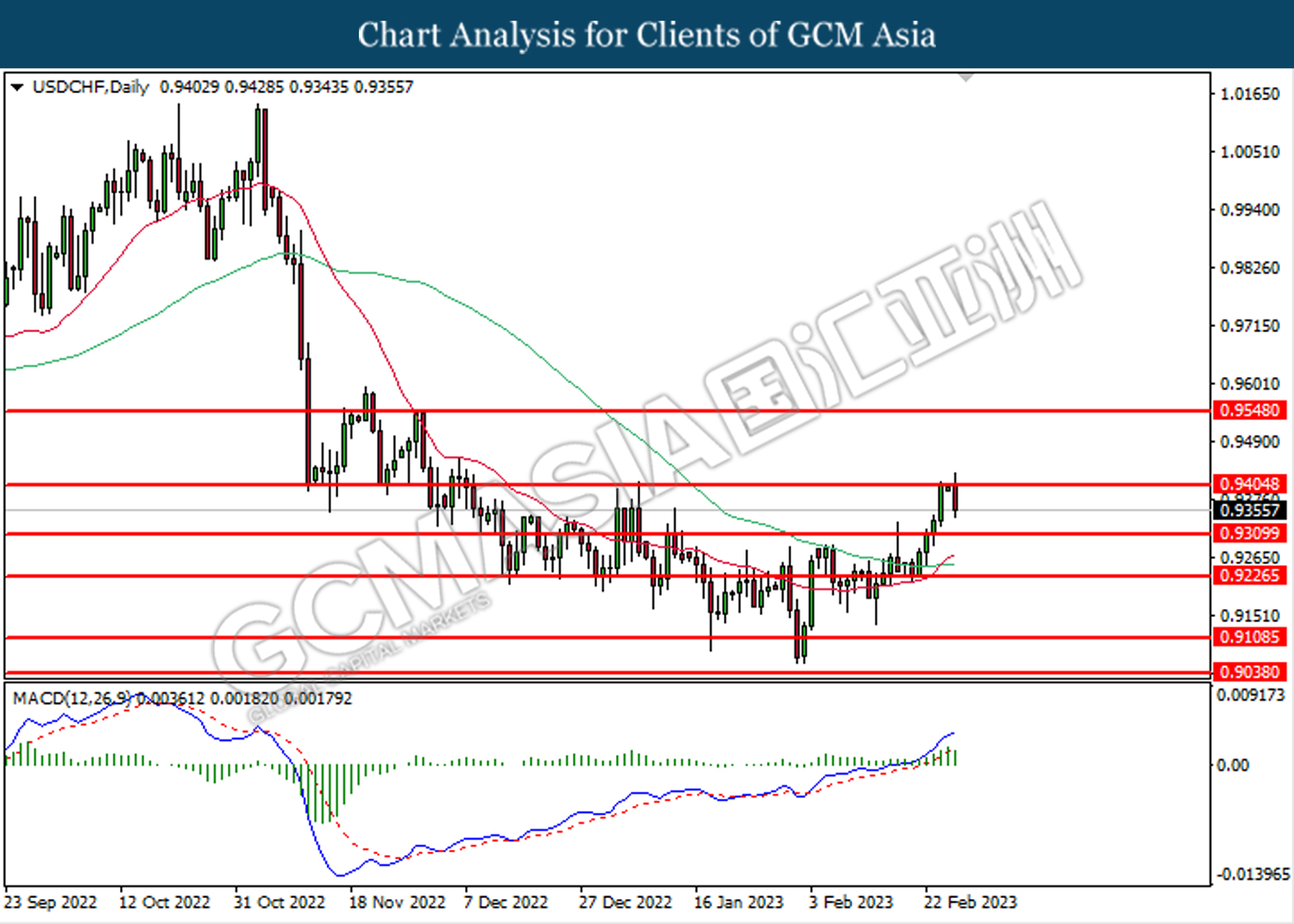

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9310.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 76.10. However, MACD which illustrated diminishing bearish momentum suggest the commodity to undergo technical rebound in short term.

Resistance level: 81.80, 86.15

Support level: 76.10, 73.25

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1809.10. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1821.60.

Resistance level: 1821.60, 1835.00

Support level: 1786.00, 1725.35