28 February 2023 Afternoon Session Analysis

Aussie appreciated after upbeat retails sales data.

The Aussie, as one of the major traded currencies globally, experienced some gains during the Asia market opening amid upbeat economic data announced. The monthly reading of the retail sales data pinned at 1.9%, higher than the market consensus at 1.5%, according to the Australian Bureau of Statistics. The strong data was driven by a recovery in the non-food sector after sharp losses last month, as consumers shifted spending patterns with the backdrop of high inflation. Therefore, retail sales slumped in December as consumers took advantage of November’s Black Friday discounts. Besides, Australia’s inflation remained tight at around 30 years high, and investors forecast a higher inflation figure in the coming months. These factors gave the Reserve Bank of Australia (RBA) more room to hike the interest rates further. However, the gains of the Aussie were limited by the stronger dollar. Investors are expecting more aggressive rate hikes from the Fed after a series of positive US economic data were released. As of writing, the AUD/USD traded down by -0.08% to $0.6728.

In the commodities market, crude oil prices were traded up by 0.24% to $75.92 per barrel as investors awaited the economic data from China. Besides, gold prices were traded down by -0.26% amid heightening investor’s concerns over rising interest rates and anticipation of key US economic readings.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.1% | 0.1% | – |

| 23:00 | USD – CB Consumer Confidence (Feb) | 107.1 | 108.5 | – |

Technical Analysis

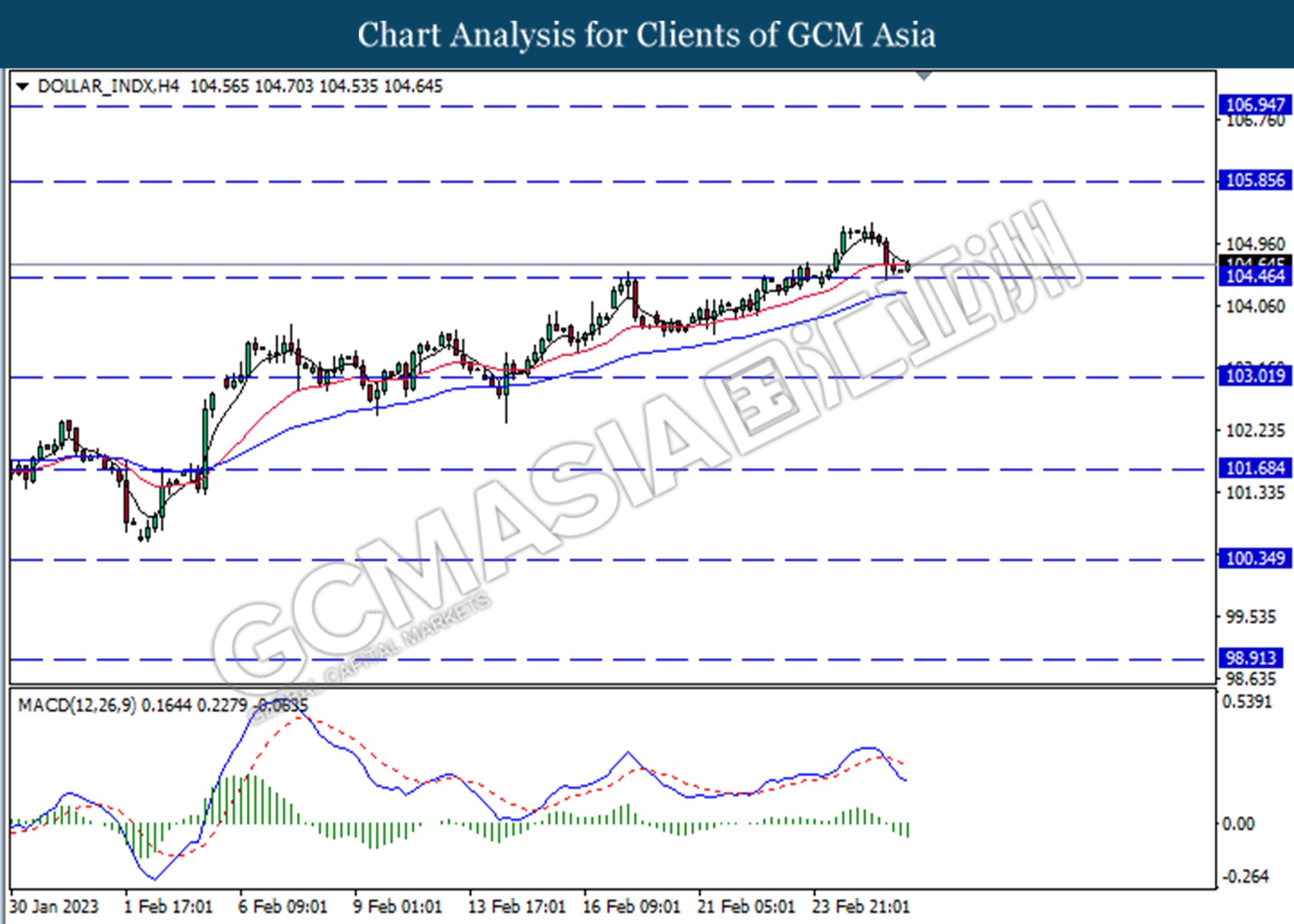

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bullish momentum suggests the index to extend its losses toward the support level at 104.45.

Resistance level: 105.85, 106.95

Support level: 103.50,103.00

GBPUSD, H4: GBPUSD was traded higher following the prior break above from the previous resistance level at 1.2010 MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 1.2145.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated bullish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

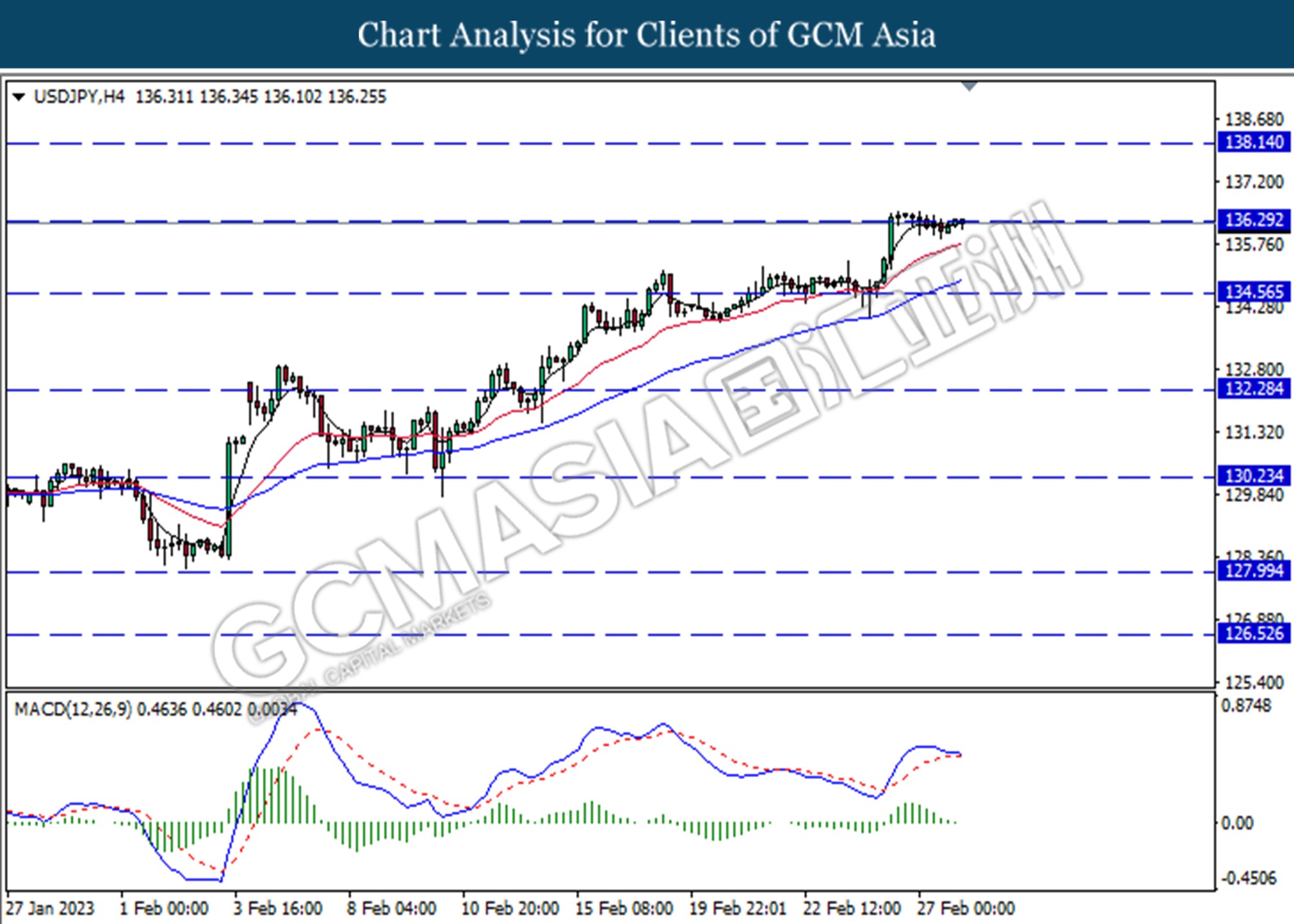

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 136.30. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 136.30, 138.15

Support level: 134.60, 132.30

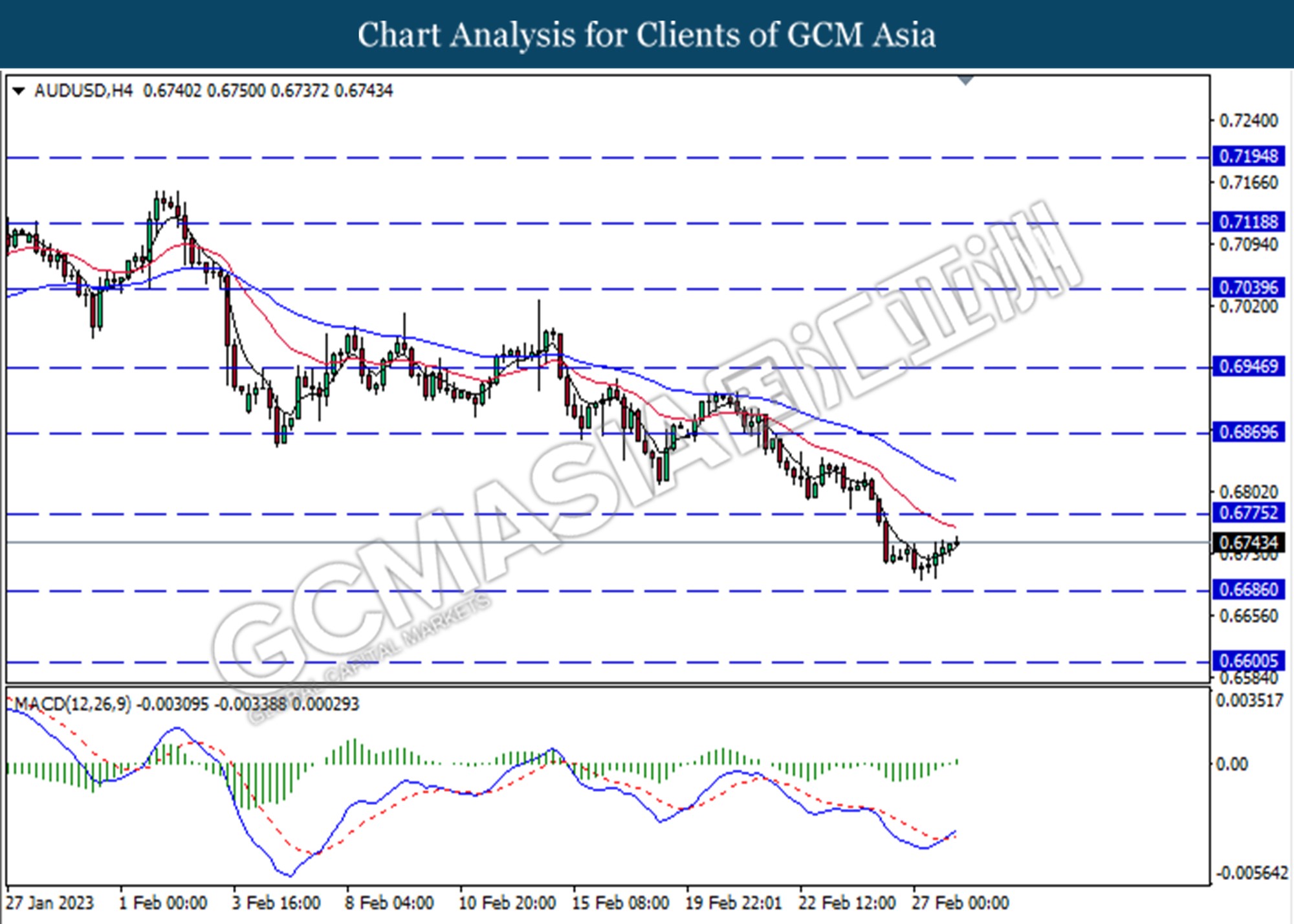

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 0.6775

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

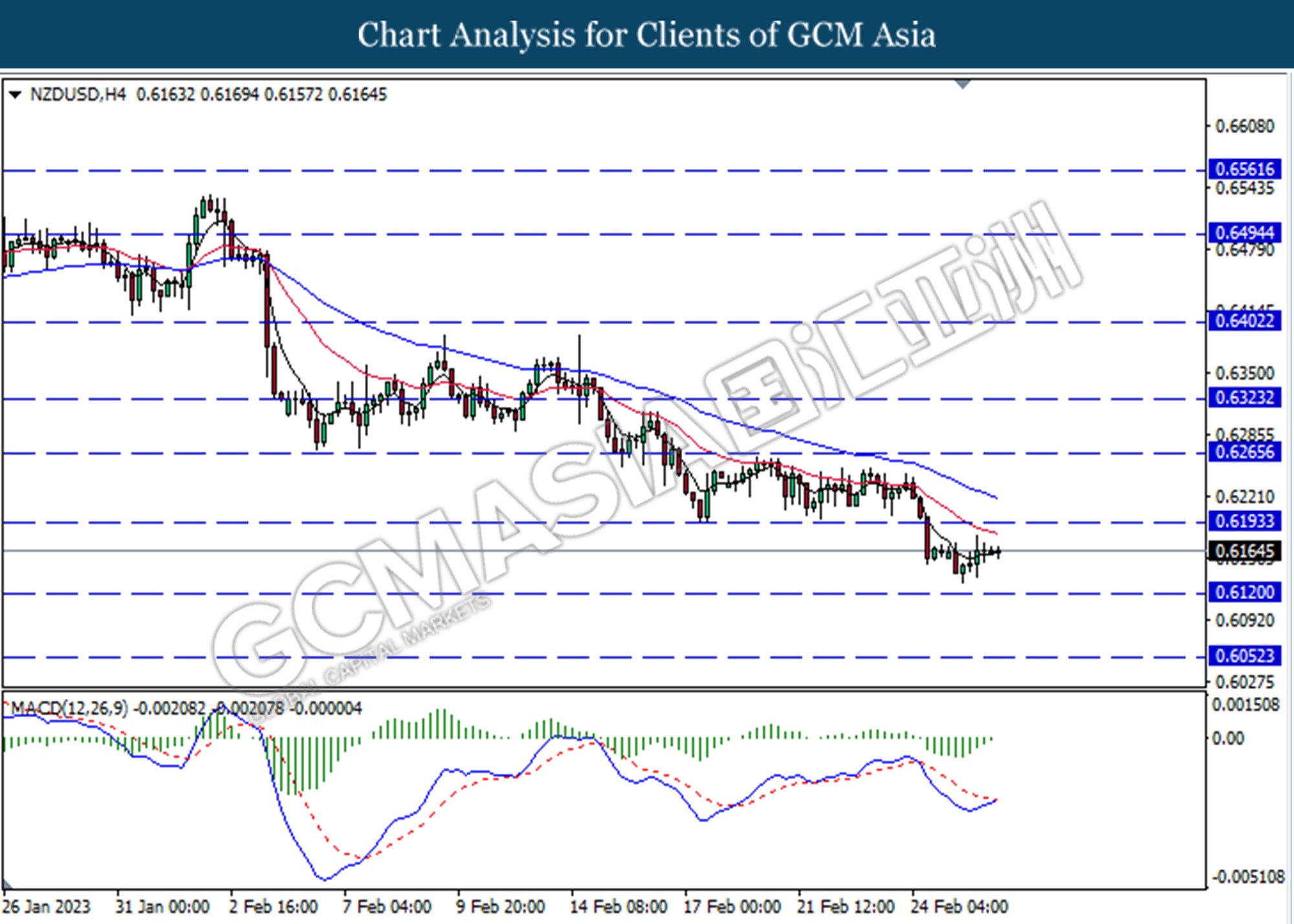

NZDUSD, H4: NZDUSD was traded higher following a rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

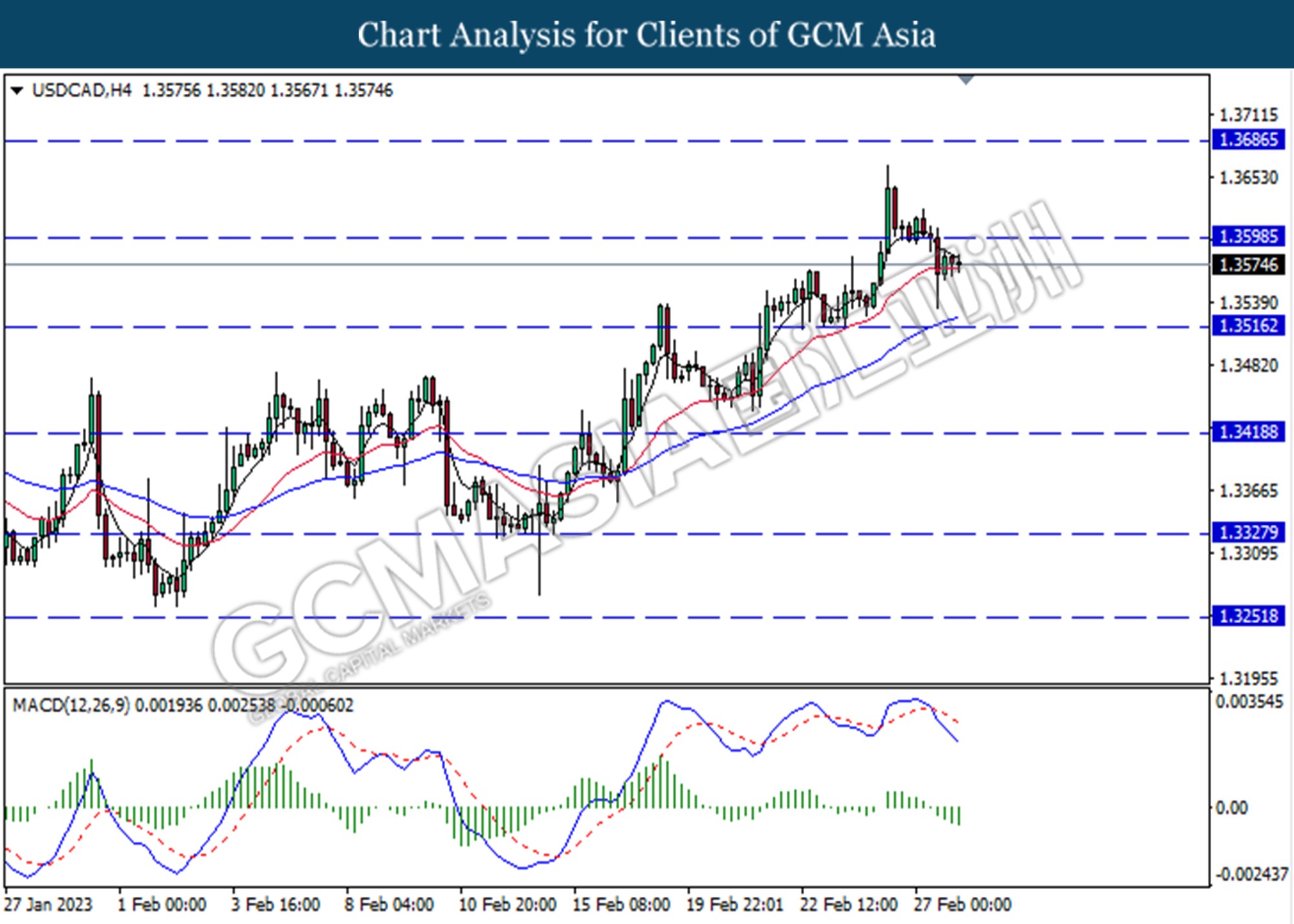

USDCAD, H4: USDCAD was traded lower following the prior break below from the previous support level at 1.3600. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

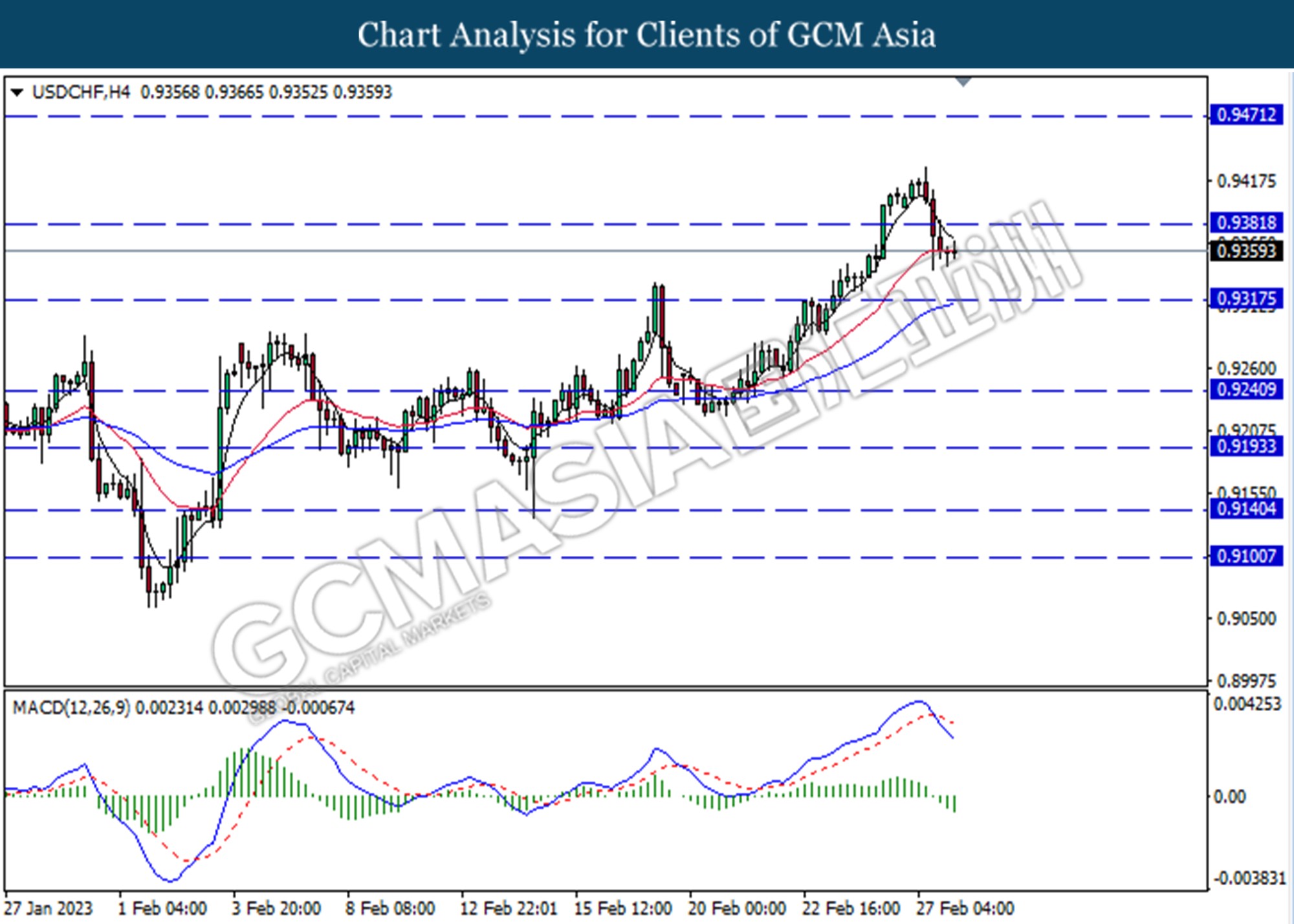

USDCHF, H4: USDCHF was traded lower following the prior break below the previous support level at 0.9380. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9320.

Resistance level: 0.9380, 0.9470

Support level: 0.9320, 0.9240

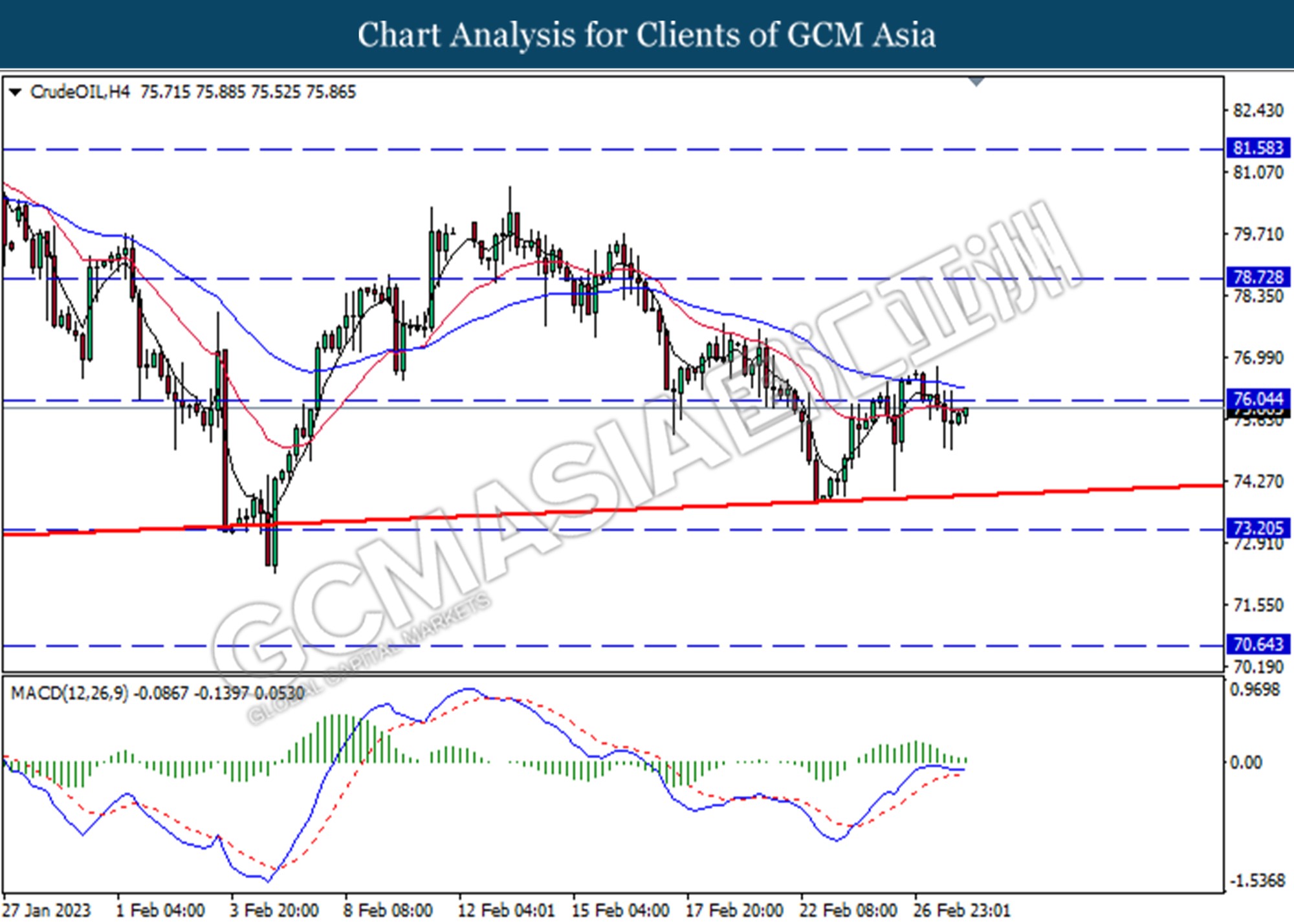

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo a technical rebound in short term.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

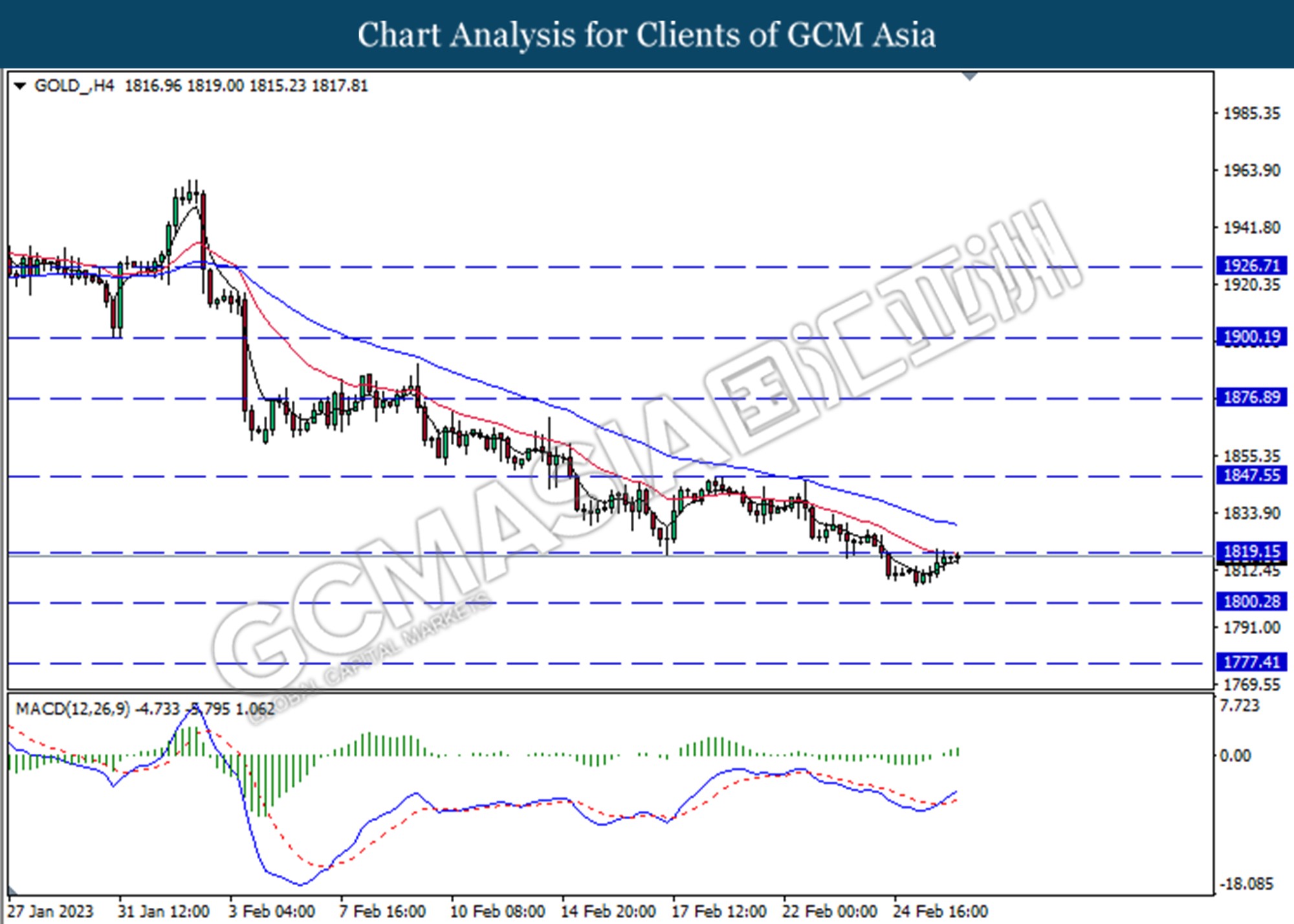

GOLD_, H4: Gold price was traded higher while currently testing for the resistance level at 1819.15. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains if successfully breaks above the resistance level.

Resistance level: 1819.15, 1847.55

Support level: 1800.28, 1777.40