01 March 2023 Afternoon Session Analysis

AUD slipped after inflation eased in January.

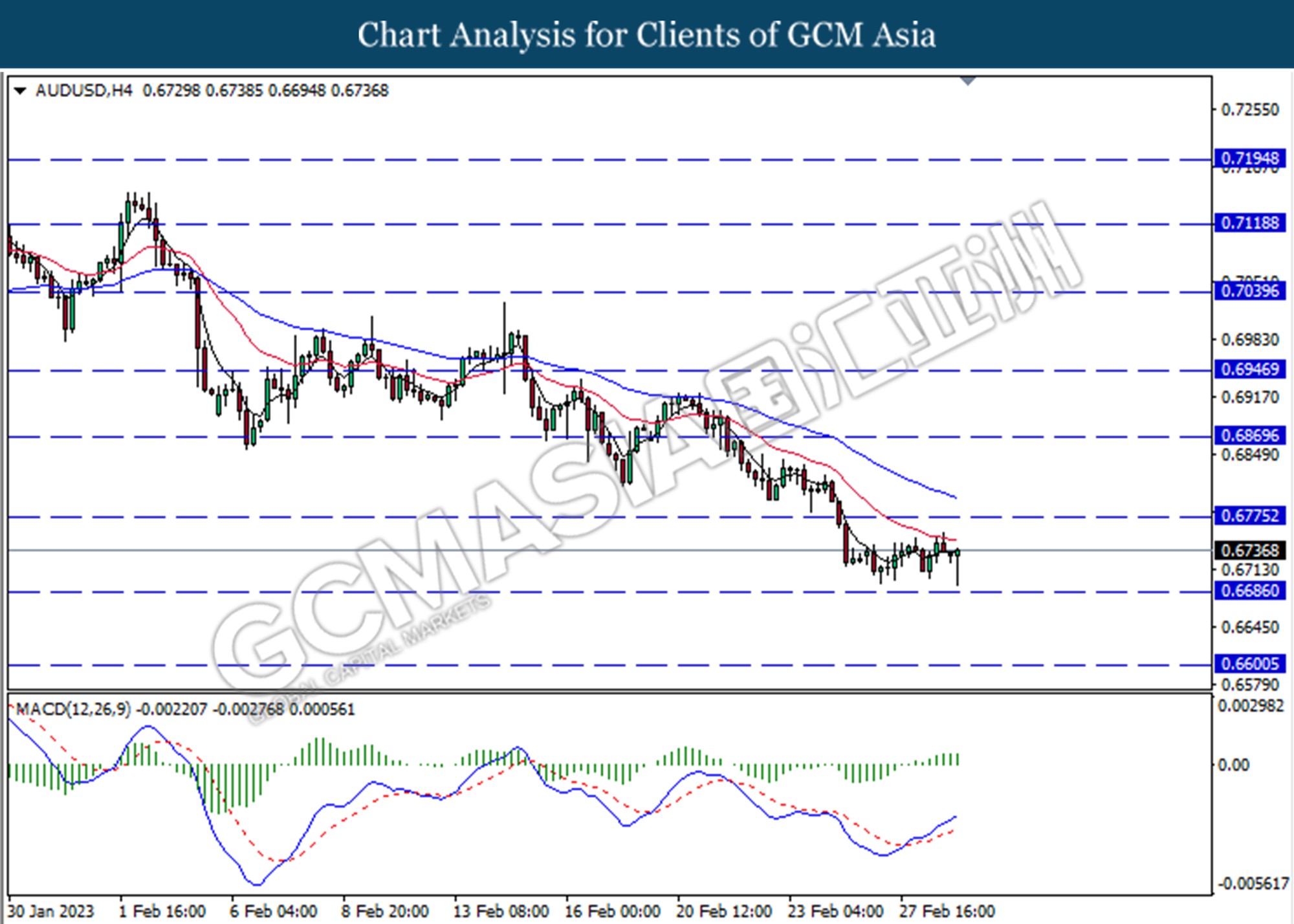

The Australian dollar was facing selling pressure due to mixed economic data that had been released. The AUD/USD pair was lingering below the level of 0.6775 as inflation eased in January and growth in the gross domestic product (GDP) slowed in December. The consumer price index (CPI) was at 7.4%, which is the second-highest annual increase, but it was still lower than the market’s expectations at 8.1% and December’s reading of 8.4%. The decrease in food and fuel prices in January contributed to the lower reading, but this was offset by the appreciation in housing price. An increase in interest rates and rising rents caused the appreciation in mortgage prices. Additionally, the Australian Gross Domestic Product (GDP) grew by 0.5%, lesser than market expectation on a monthly basis, while on an annual basis, it grew by 2.7%, in line with the market expectation. Slow growth in economic conditions reduced the economic headroom for RBA to keep hiking its interest rate. As a result, the pair of AUD/USD declined after the release of the downbeat CPI and GDP data. However, the massive sell-off in the Aussie market was largely offset by the China’s optimistic economic data that was released this morning. According to the China Federations of Logistics, the Manufacturing PMI stood at 52.6, well above the market expectation at 50.5, while the services PMI stood at 56.3, beating the market expectation of 55.0. The AUD was boosted by China positive economic data, reviving the Aussie dollar from the brink of collapse. As of writing, the AUD/USD rose by 0.28% to $0.6745.

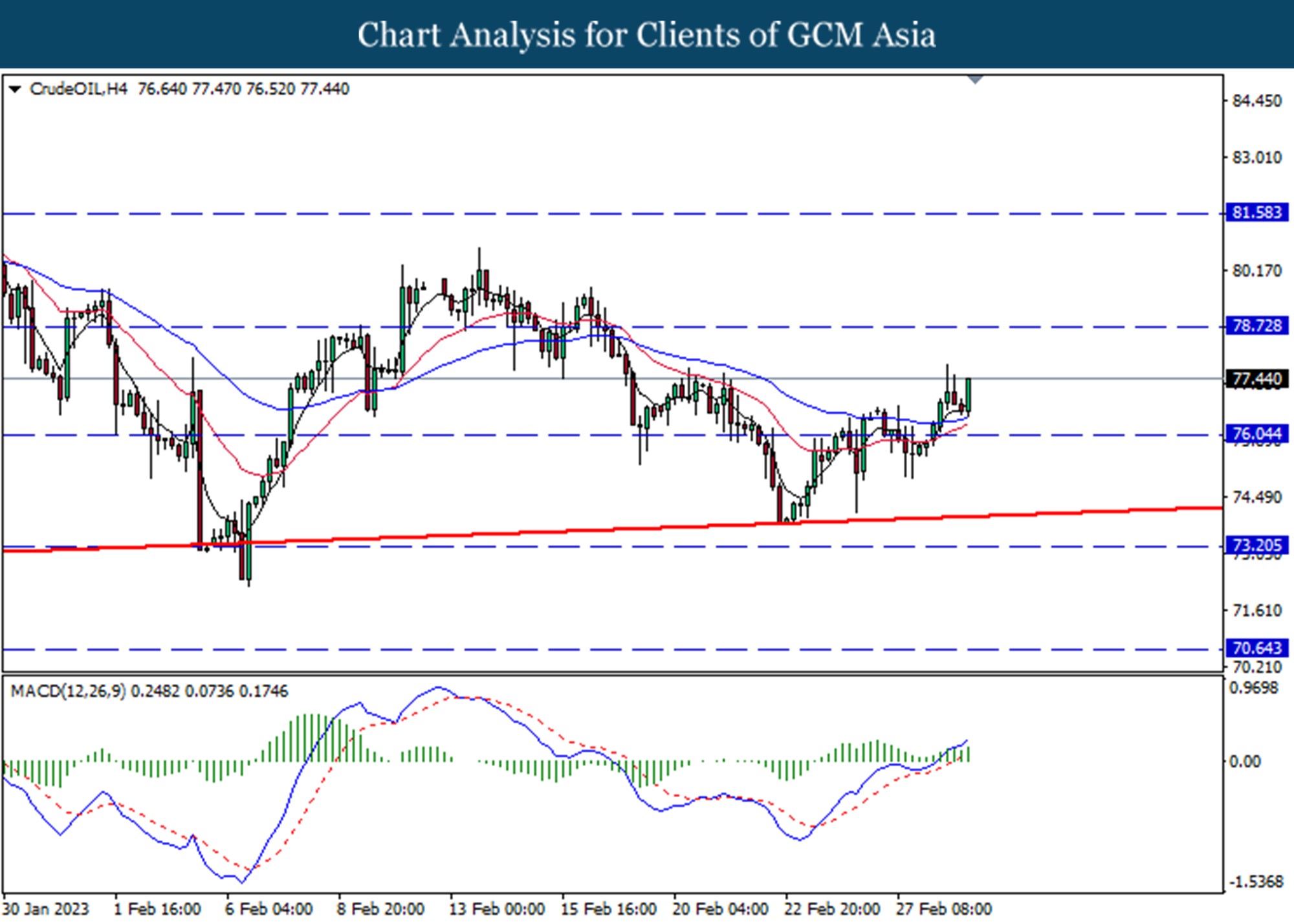

In the commodities market, crude oil prices were traded up by 0.55% to $77.47 per barrel as China optimistic economic condition outweighed the rising crude oil inventories in the US. Besides, gold prices appreciated by 0.03% to $1837.25 per troy ounce as the US CB consumer Confidence fell below market expectations.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 46.5 | 46.5 | – |

| 16:55 | EUR – German Unemployment Change | -15K | 9K | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 49.2 | 49.2 | – |

| 21:00 | EUR – German CPI (YoY) (Feb) | 8.7% | 8.7% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 47.4 | 48.0 | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 7.648M | 0.440M | – |

Technical Analysis

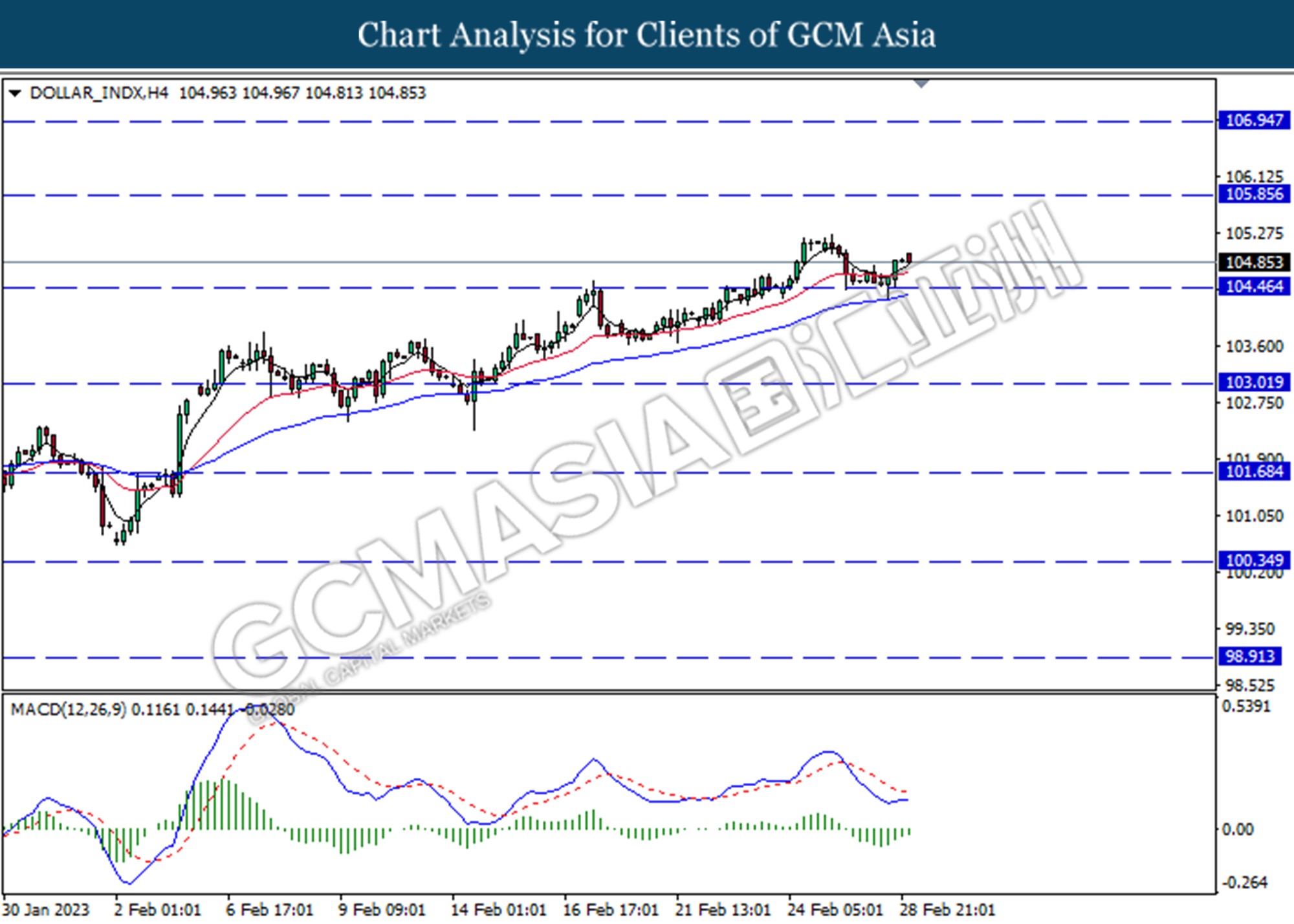

DOLLAR_INDX, H4: Dollar index was traded lower following the prior rebound from the support level at 104.45. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 105.85.

Resistance level: 105.85, 106.95

Support level: 104.45, 103.00

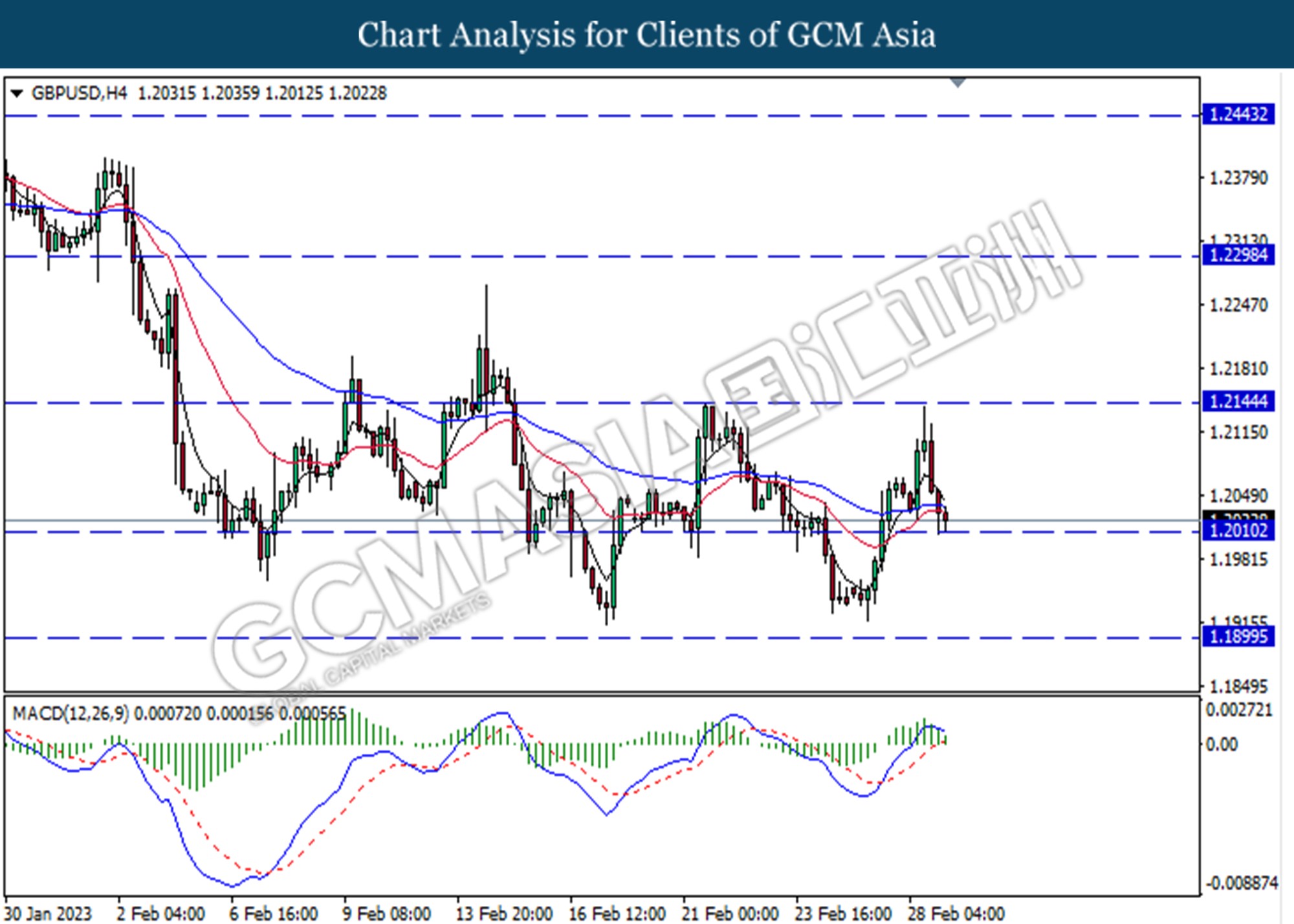

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the resistance level at 1.2145. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2010.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

EURUSD, H4: EURUSD was traded lower following a prior retracement from the resistance level at 1.0635. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

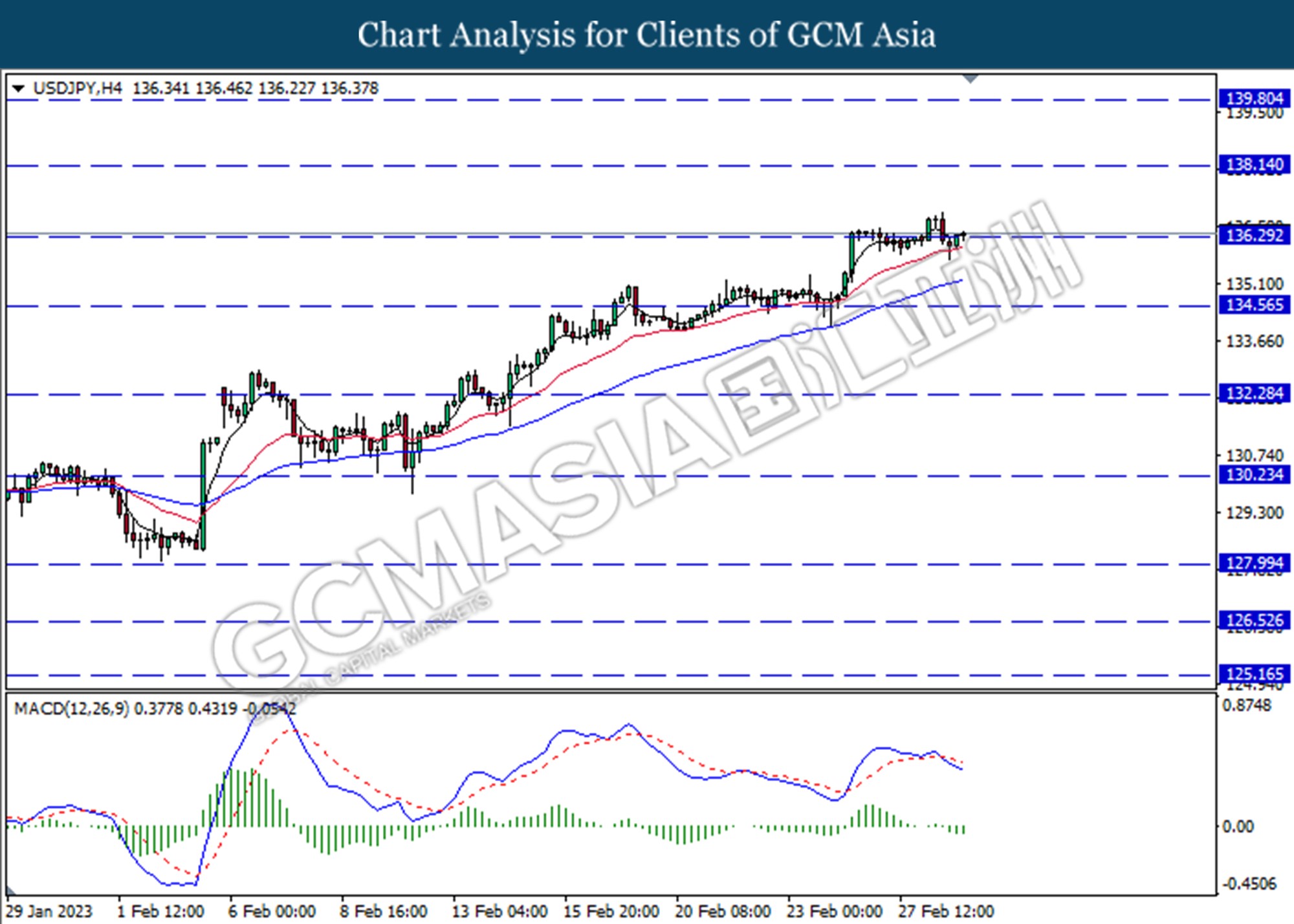

USDJPY, H4: USDJPY was traded higher following a break above the previous resistance level at 136.30. However, MACD which illustrated bearish momentum suggest the pair to undergo technical correction in the short term.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6775.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

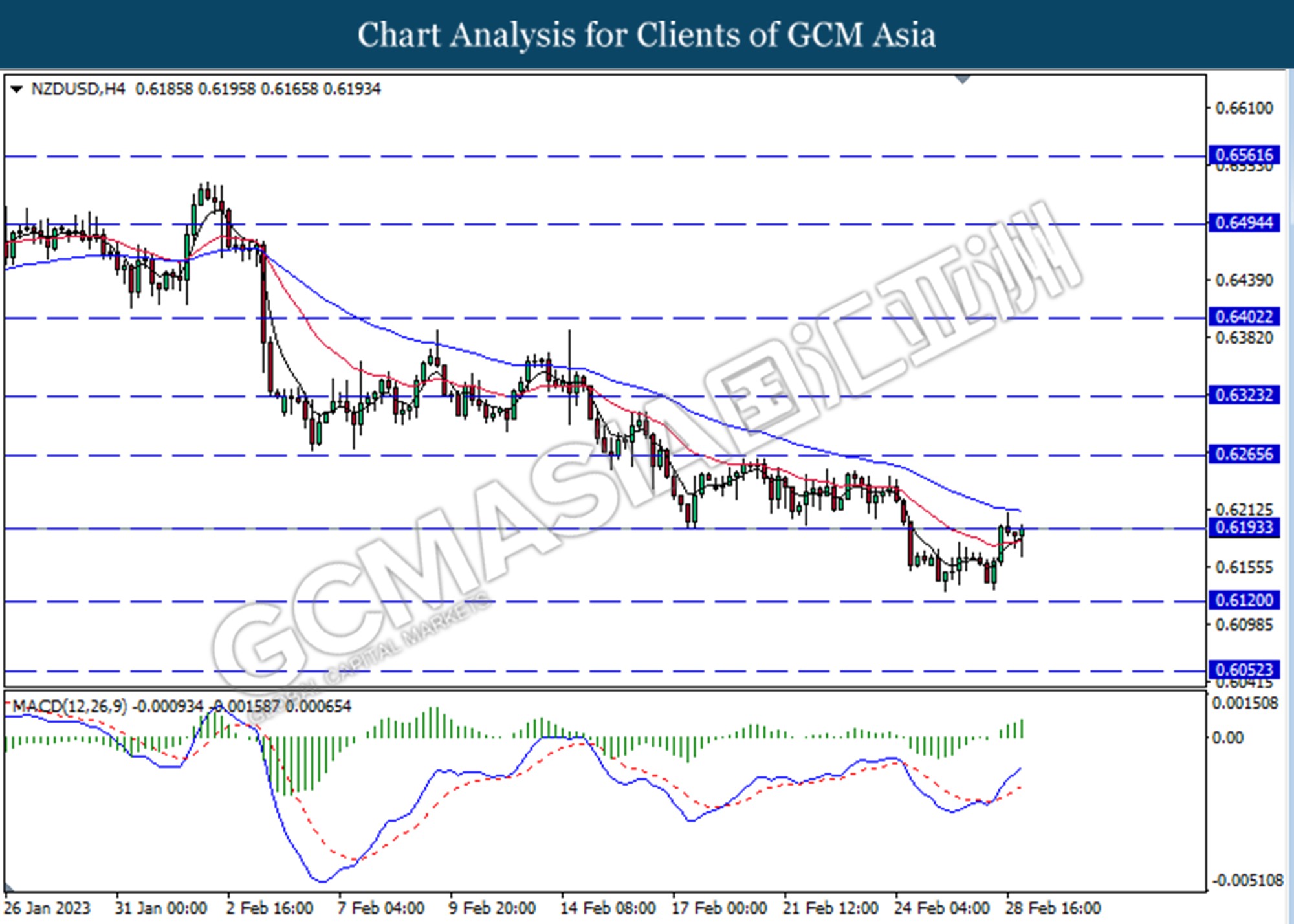

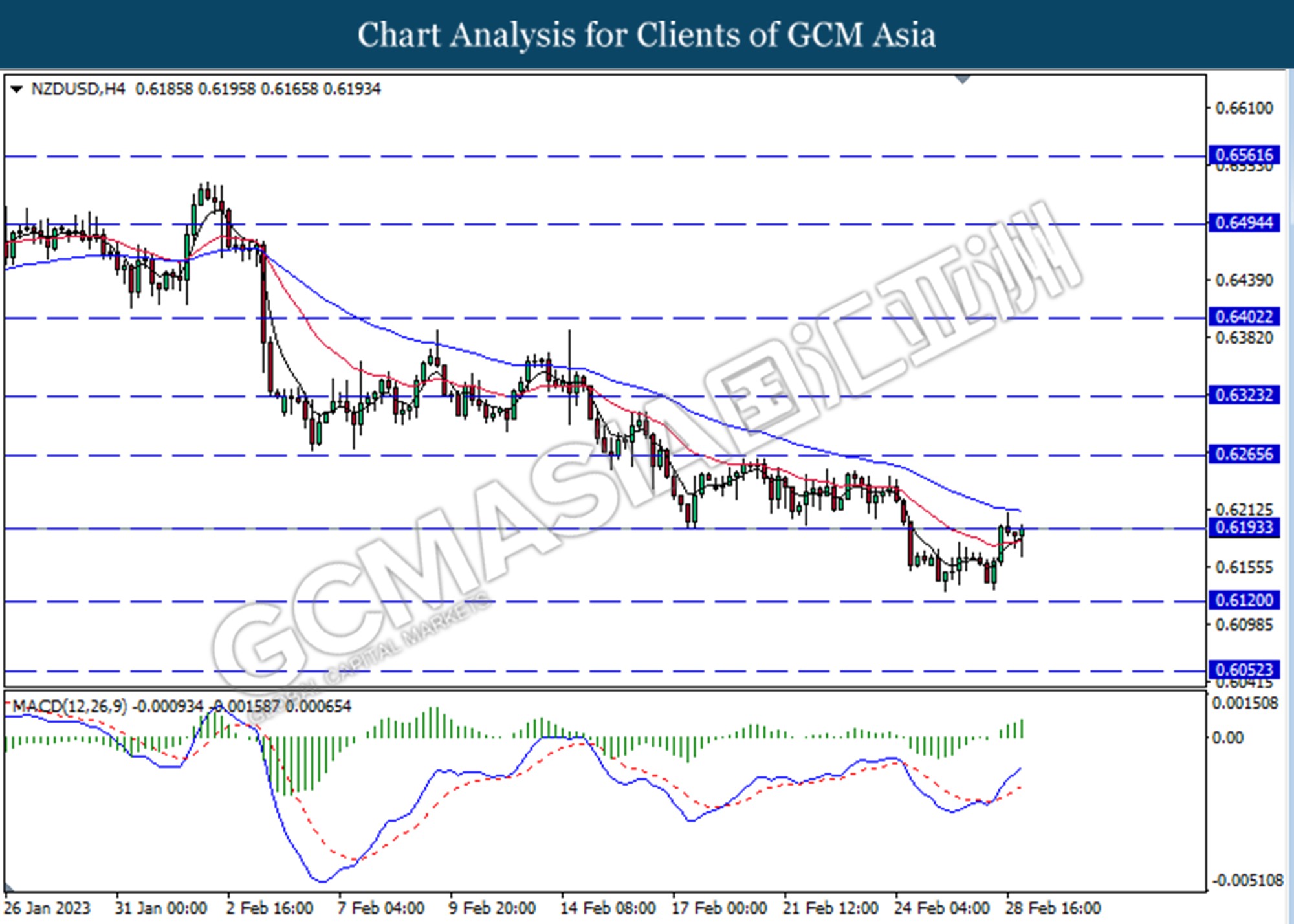

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6195. MACD which illustrated increasing in bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3560. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 1.3685.

Resistance level: 1.3685, 1.3785

Support level: 1.3515, 1.3420

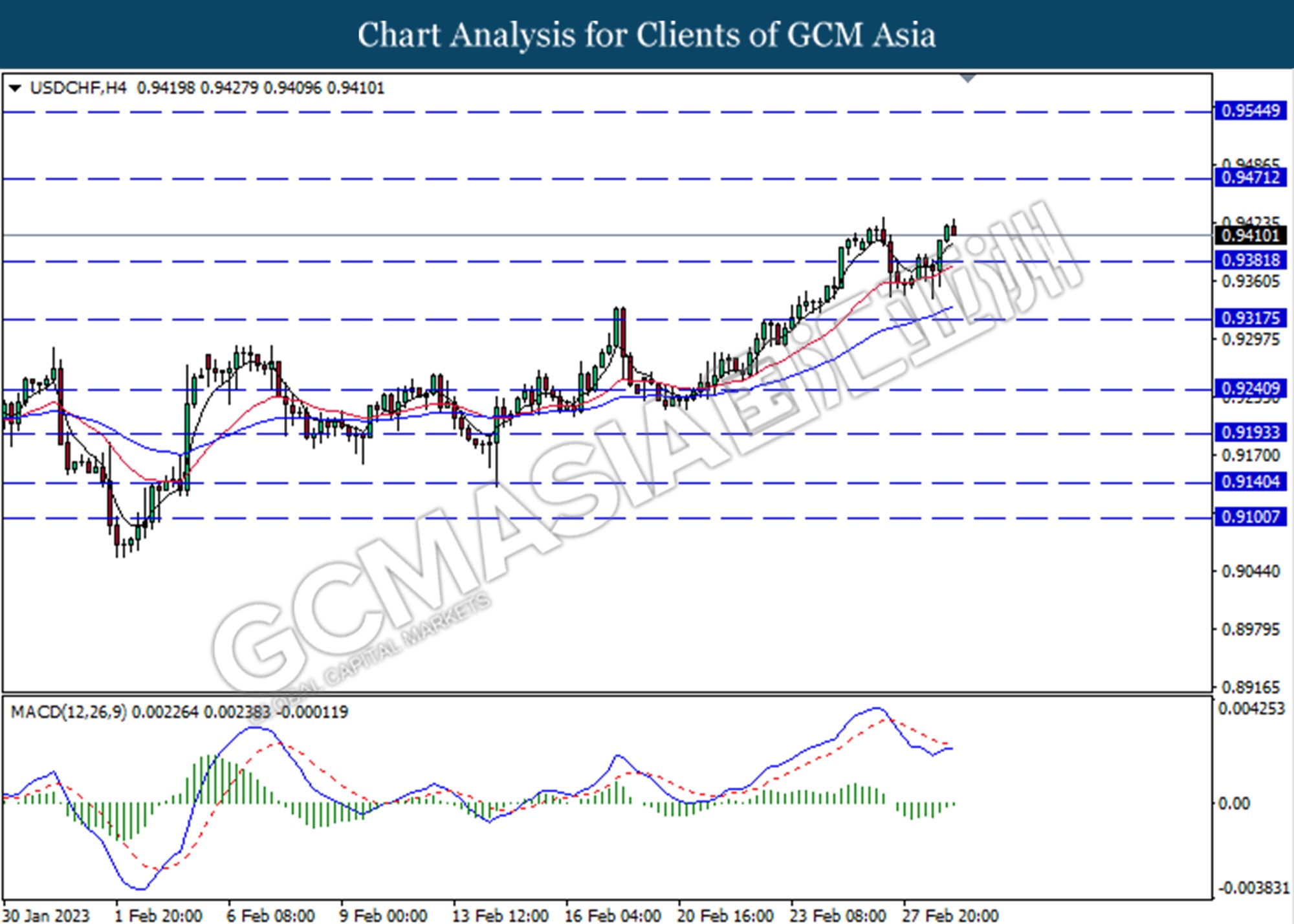

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9380. MACD which illustrated bullish momentum suggest the pair to extend its gains toward the resistance level at 0.9470.

Resistance level: 0.9470, 0.9550

Support level: 0.9380, 0.9320

CrudeOIL, H4: Crude oil price was traded higher following a rebound from a lower level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

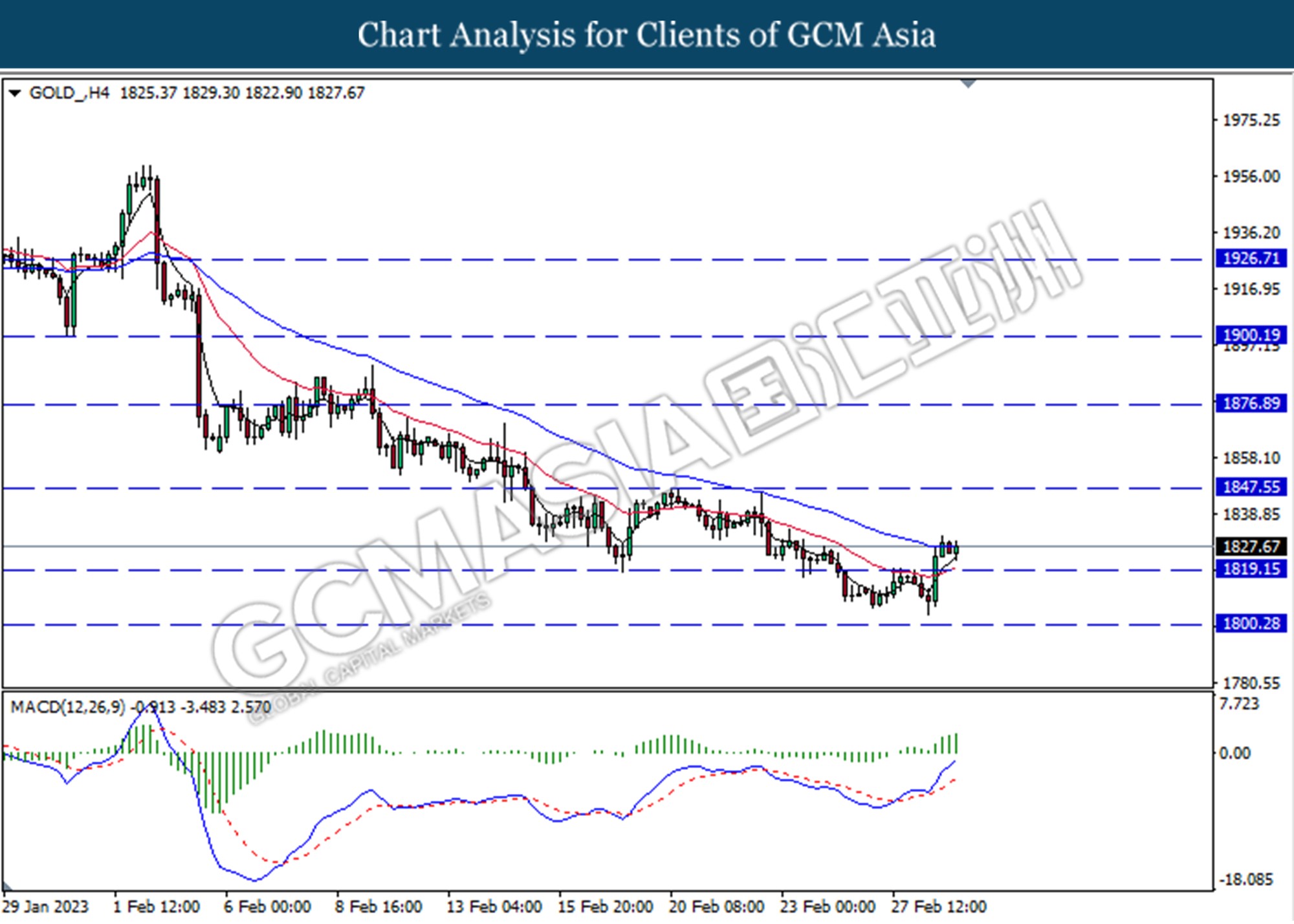

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 1819.15. MACD which illustrated increasing bullish momentum suggests the commodity to extend its gains toward the resistance level at 1847.55.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1800.30