02 March 2023 Afternoon Session Analysis

EUR lifted after German inflation data.

The EUR/USD pair was lifted on Wednesday following the release of higher-than-expected German inflation data. According to the federal statistic agency Destatis’s data released on Wednesday, the German CPI annual reading held steady at 8.7%, similar to the reading in January. The high inflation figure was attributed to the rise in energy prices and tight labor market conditions in Germany. The labor market condition in German remained unchanged at 5.5%, but the number of unemployed people increased by 2k, lower than the market expectation of 9k. In addition, inflation in France and Spain rose to 6.2% and 6.1% respectively, due to rising energy prices. The inflation remained at a high level, and well above the European Central Bank’s (ECB) 2% target. Therefore, the euro strengthened with the expectation that ECB will continue tightening its monetary policy, such as hiking its interest rate further by 50 basis points. Apart from this, investors are focusing on Eurozone February’s inflation data, which will be published by Eurostat later today. At this point of time, investors expect the reading will slow down to 8.2%, lower than the previous reading’s 8.6%. As of writing, the EUR/USD slipped by -0.14% to $1.0650 as investors awaited more cues from the upcoming inflation figure.

In the commodities market, crude oil prices edged down by 0.01% to $77.69 per barrel as crude oil prices rebounded on China’s optimistic economic data released yesterday. Besides, gold prices edged down by -0.33% to $1839.25 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Feb) | 8.6% | 8.2% | – |

| 21:30 | USD – Initial Jobless Claims | 192K | 197K | – |

Technical Analysis

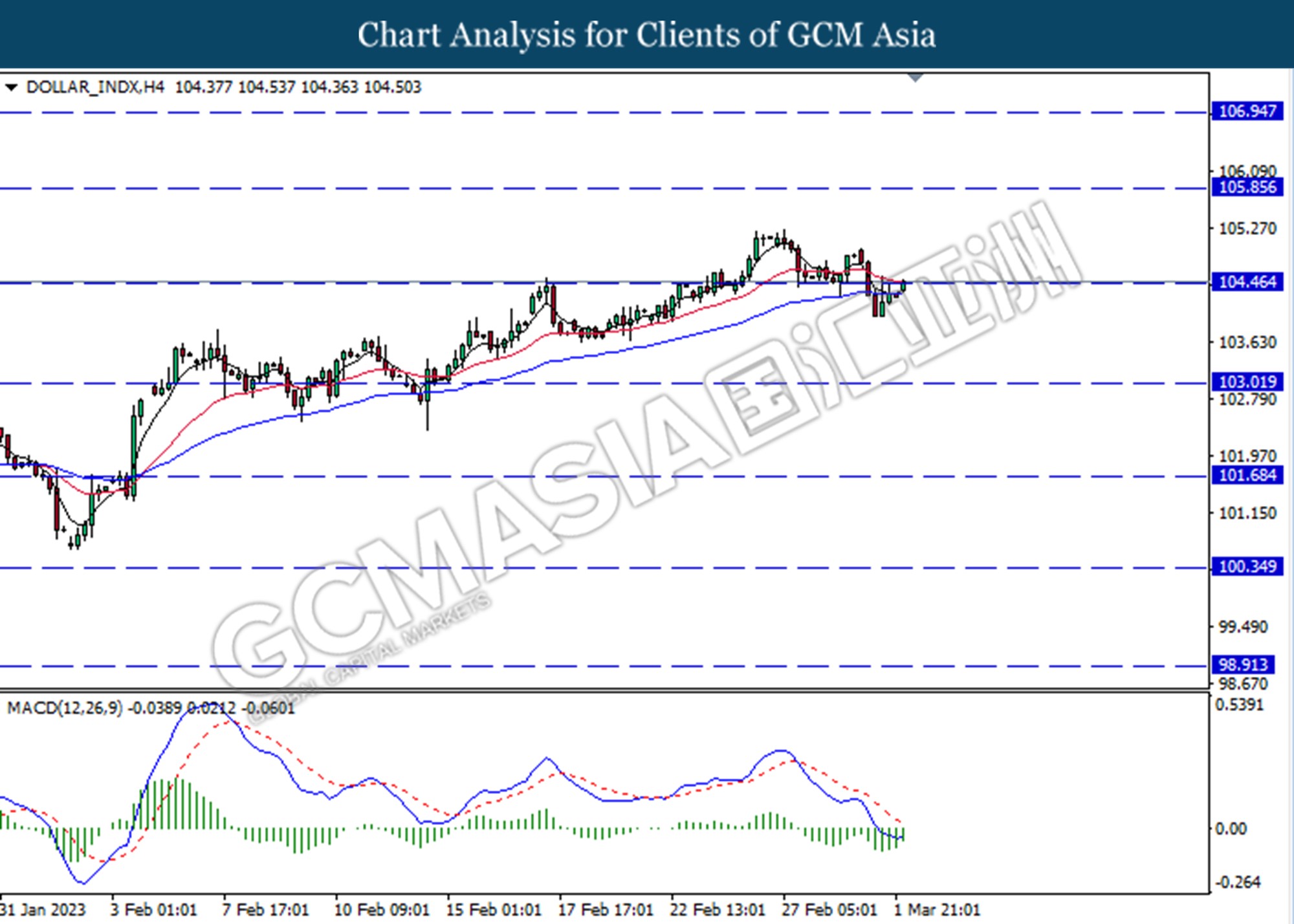

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing for the resistance level at 104.45. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains if successfully breaks above the resistance level.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

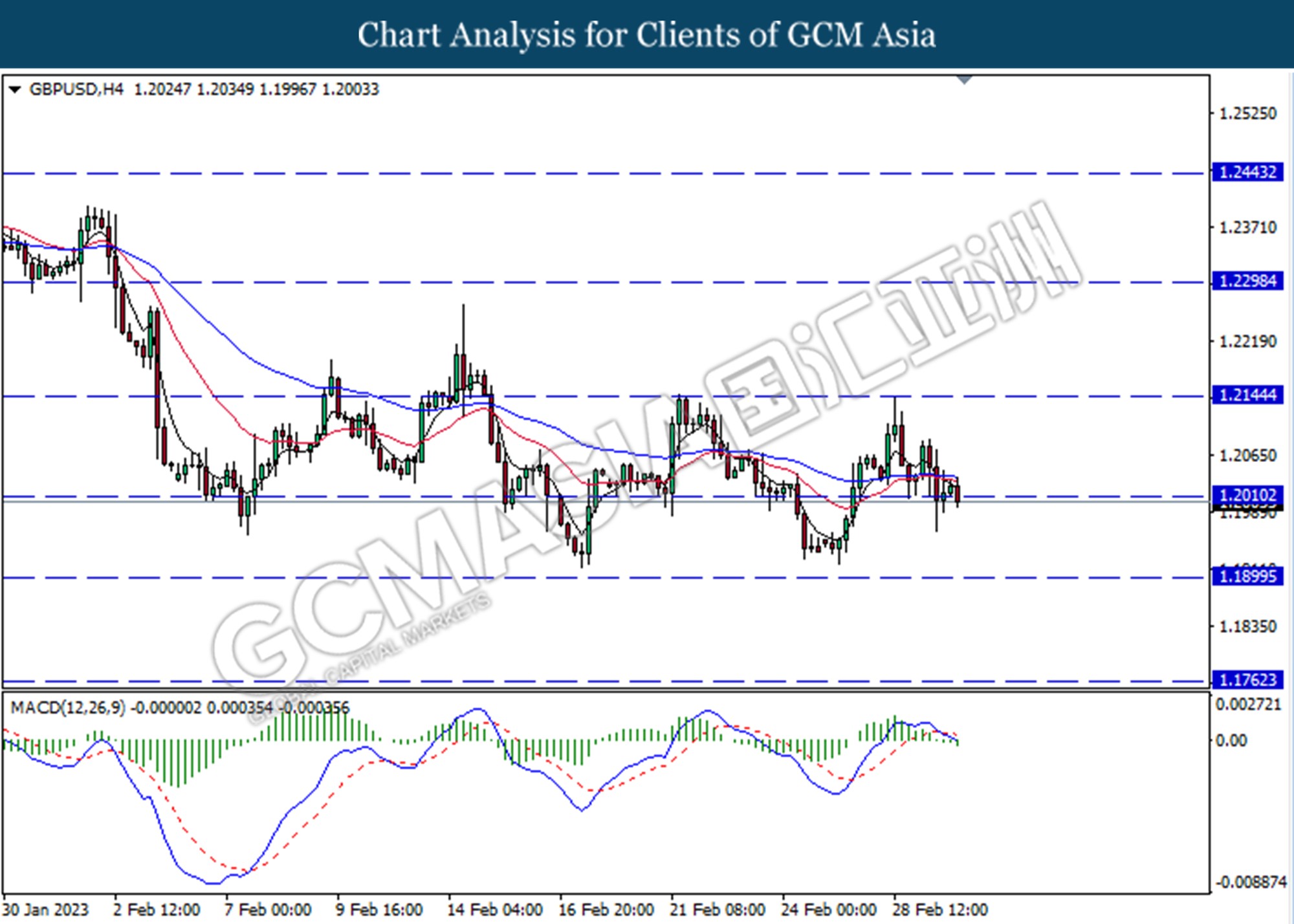

GBPUSD, H4: GBPUSD was traded lower following the prior break below from the previous support level at 1.2010. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2010, 1.2145

Support level: 1.1900, 1.1760

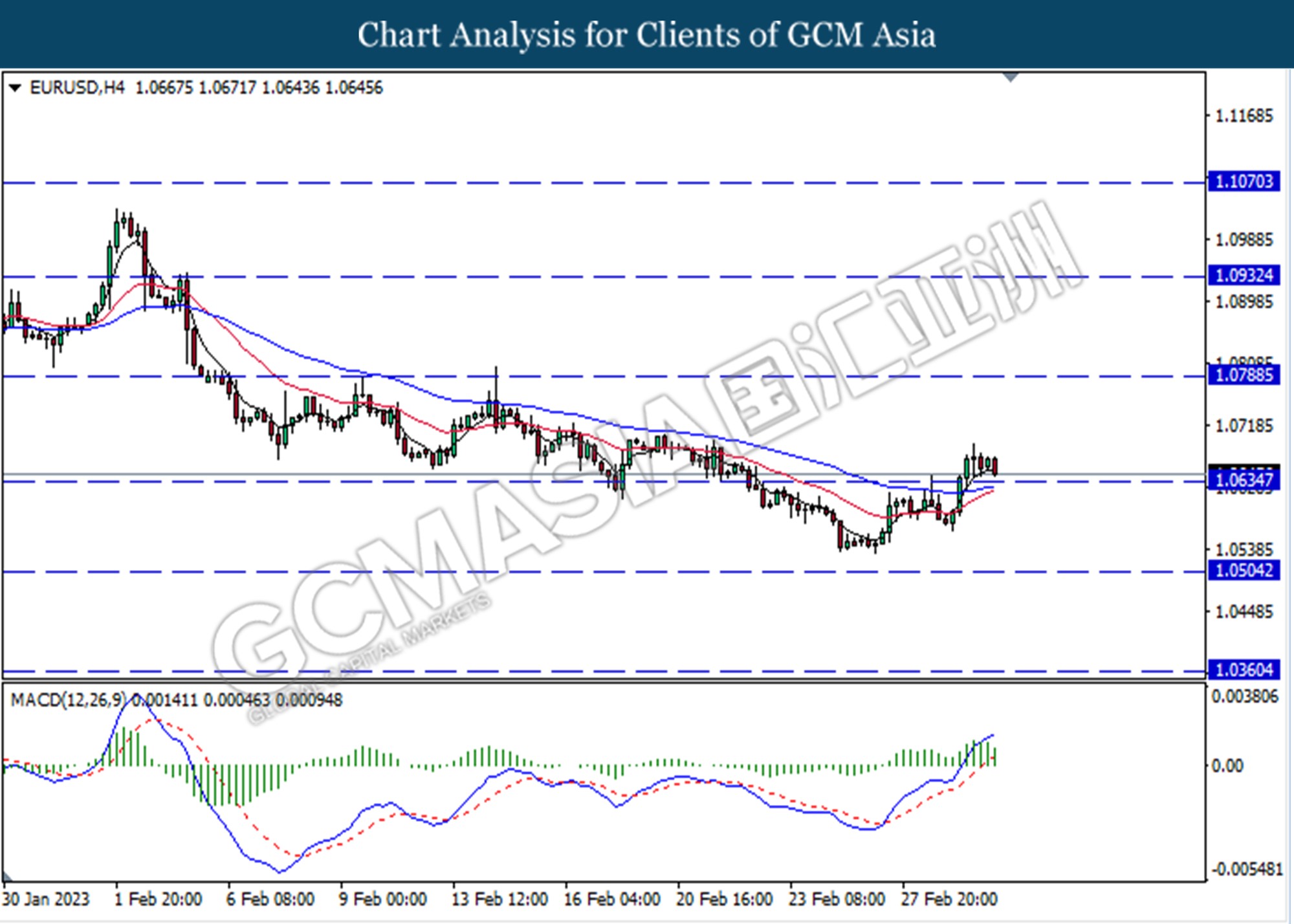

EURUSD, H4: EURUSD was traded lower following a prior retracement from a higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 136.30. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

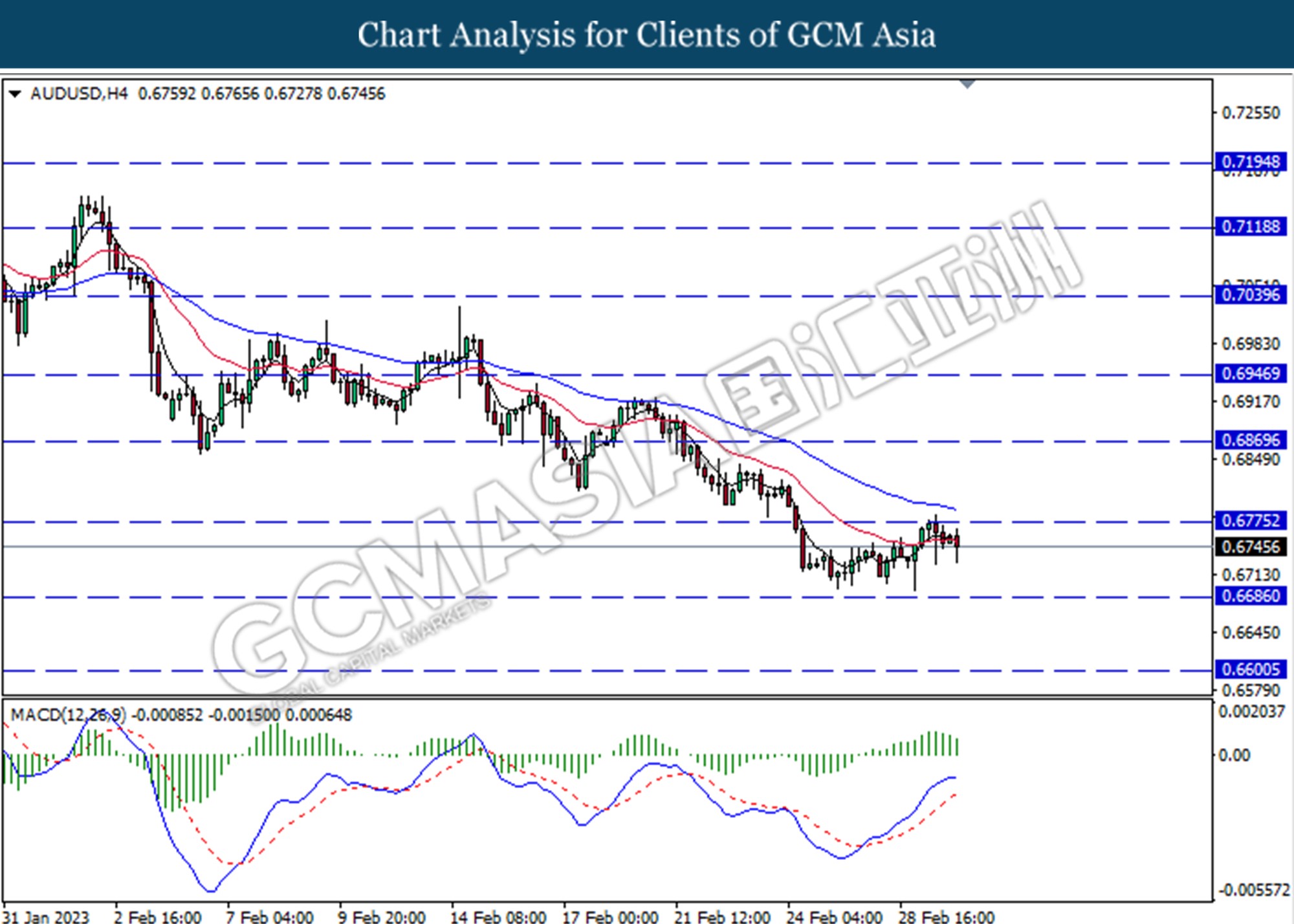

AUDUSD, H4: AUDUSD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6685

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

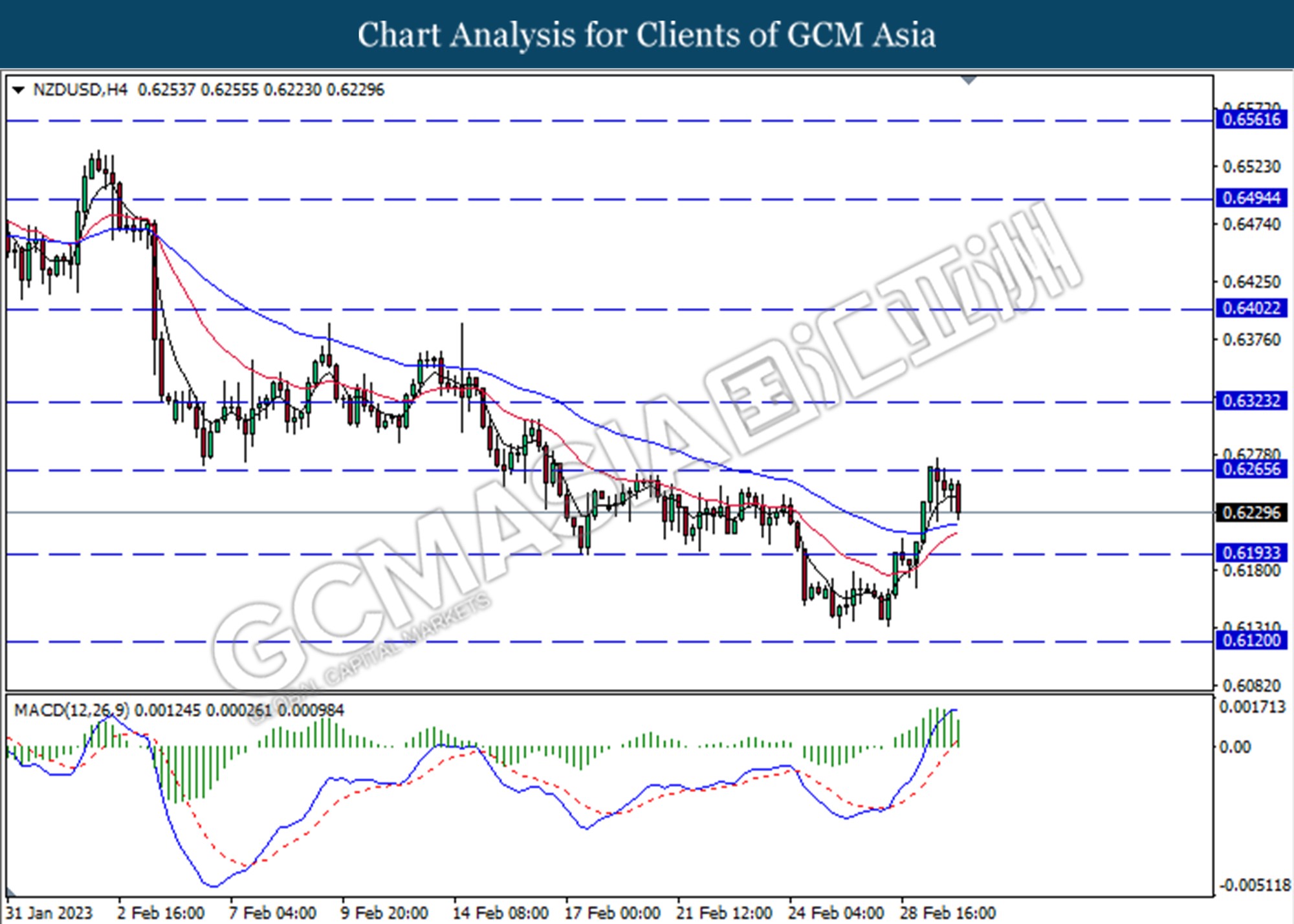

NZDUSD, H4: NZDUSD was traded lower following a prior retracement from the resistance level at 0.6265. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 0.6195.

Resistance level: 0.6265, 0.6325

Support level: 0.0.6195, 0.6120

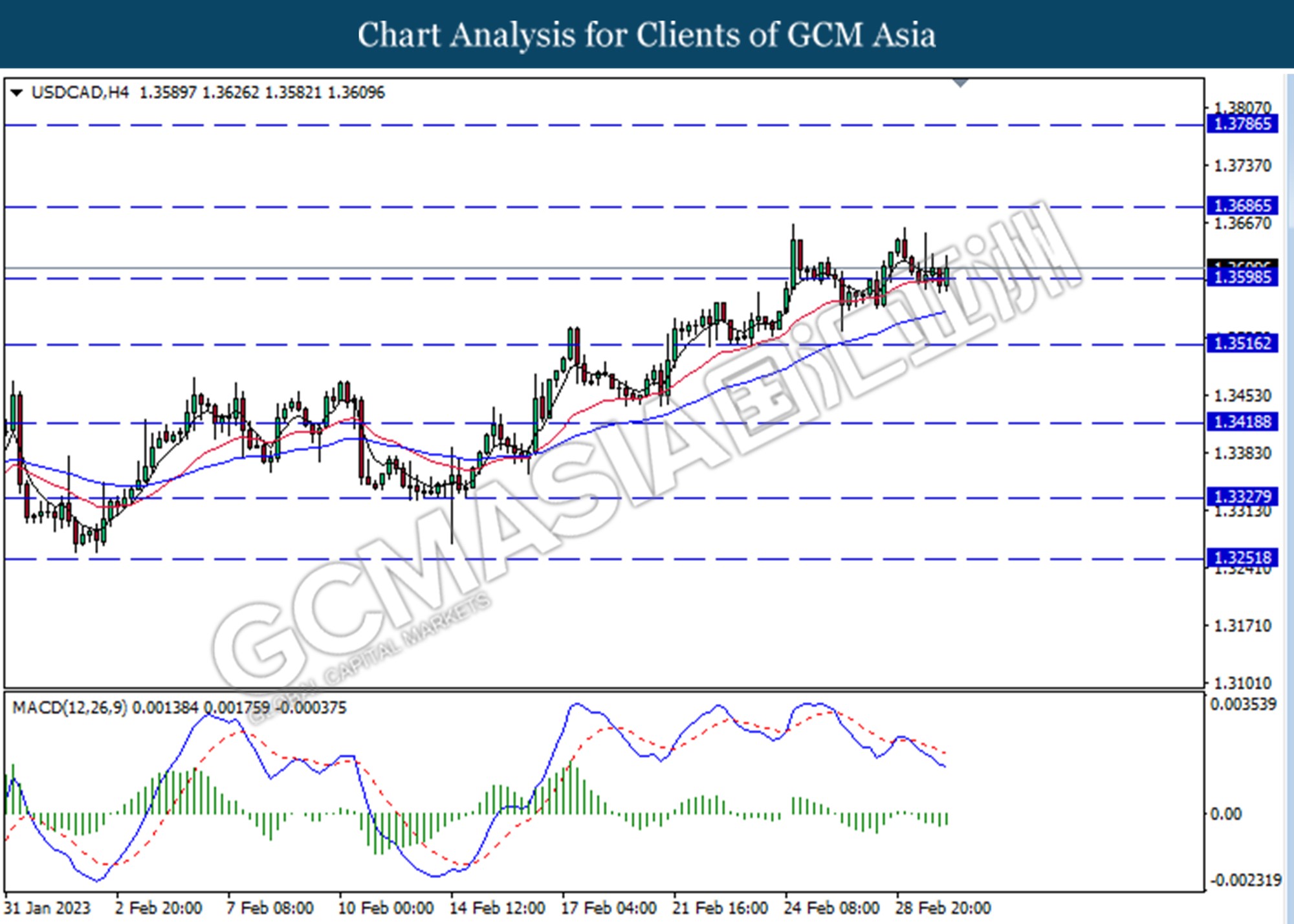

USDCAD, H4: USDCAD was traded higher following a prior break above the previous resistance level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3685.

Resistance level: 1.3685, 1..3785

Support level: 1.3600, 1.3515

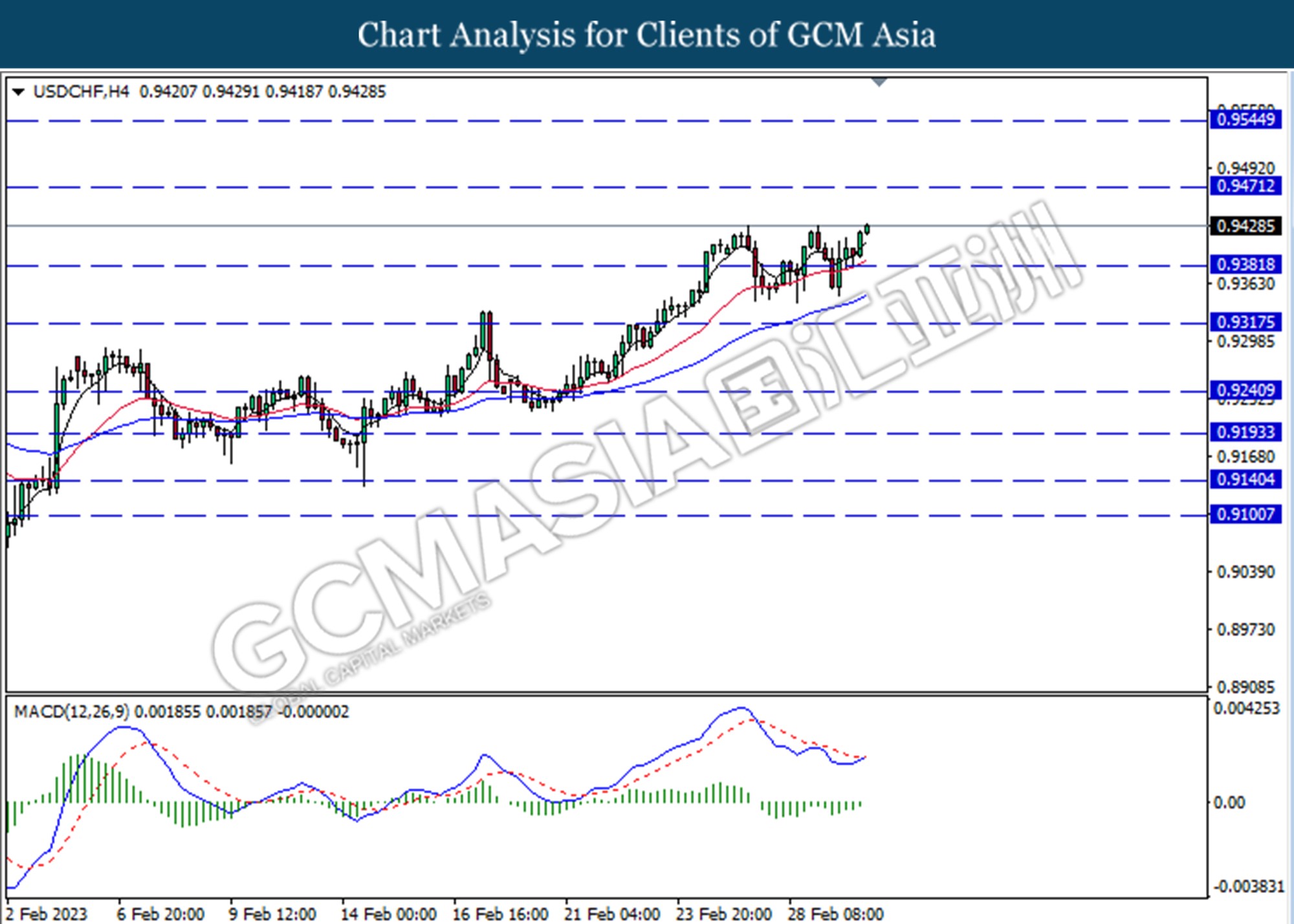

USDCHF, H4: USDCHF was traded higher following a prior break above the previous resistance level at 0.9380. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 0.9470.

Resistance level: 0. 9470, 0.9545

Support level: 0.0.9380, 0.9320

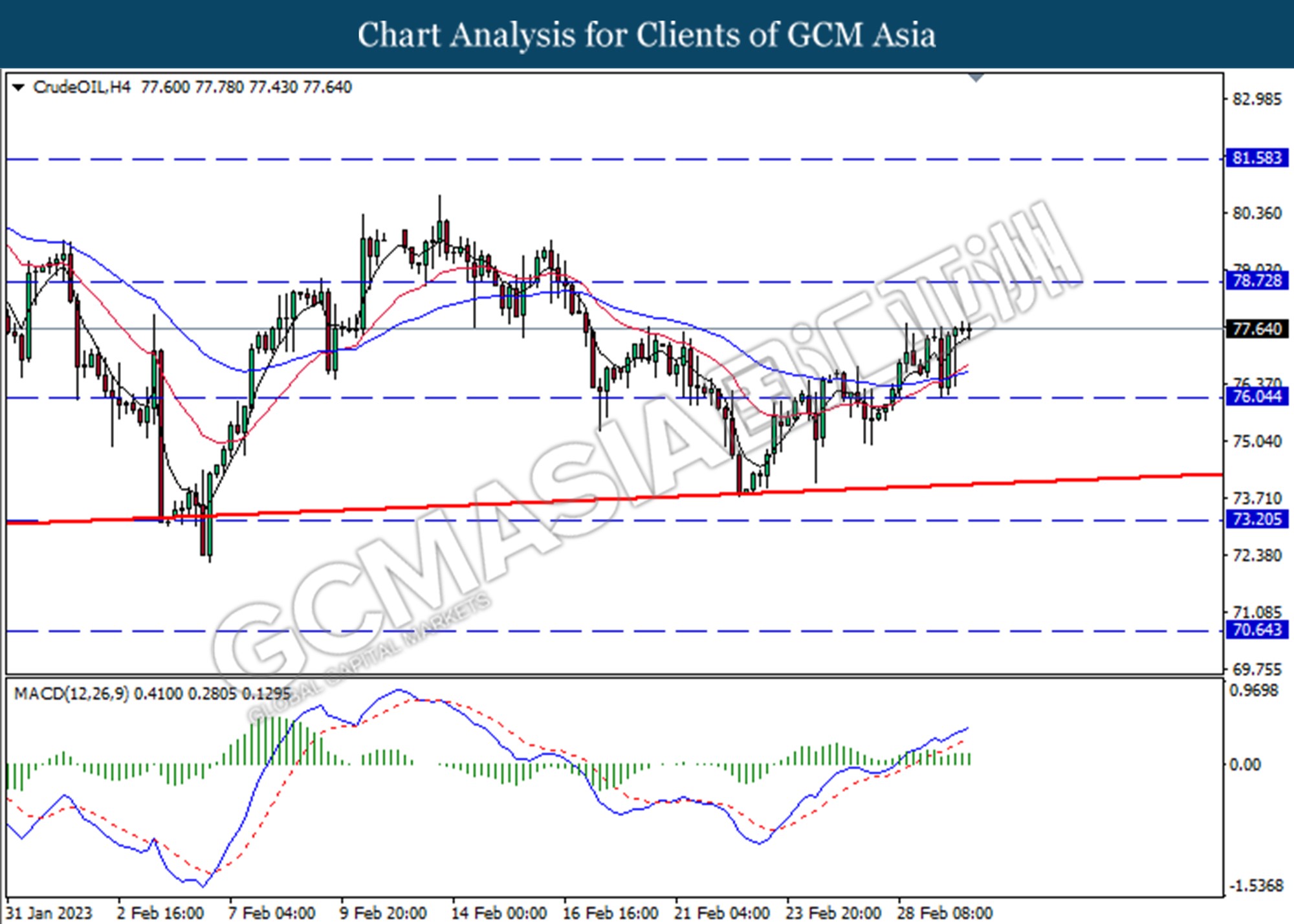

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the support level at 76.05. MACD which illustrated bullish bias suggests the commodity to extend its gains toward the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

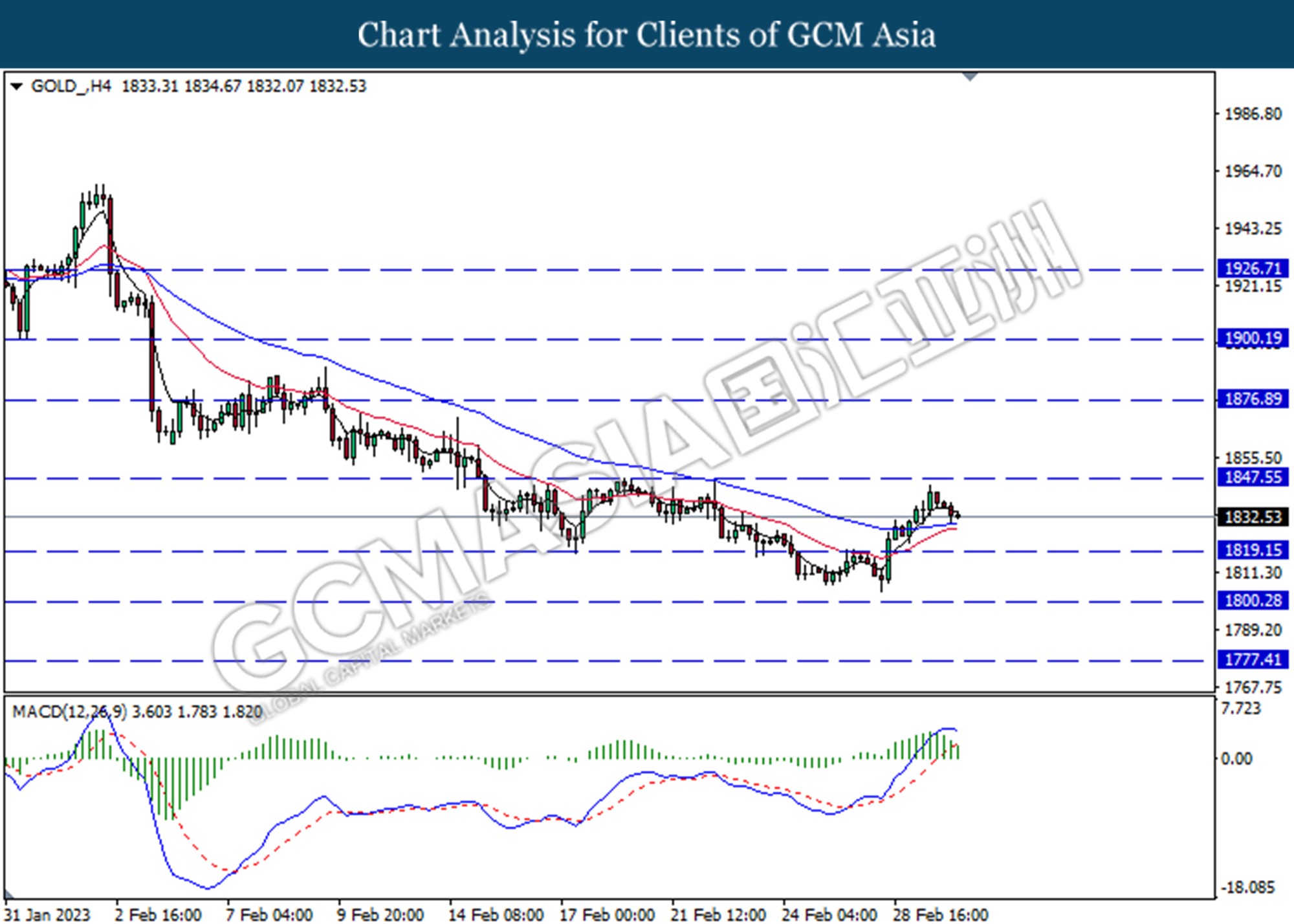

GOLD_, H4: Gold price was traded lower following a prior retracement from the resistance level at 1847.55. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1819.15.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1800.30