03 March 2023 Afternoon Session Analysis

Headline inflation unable to keep euro from slipping.

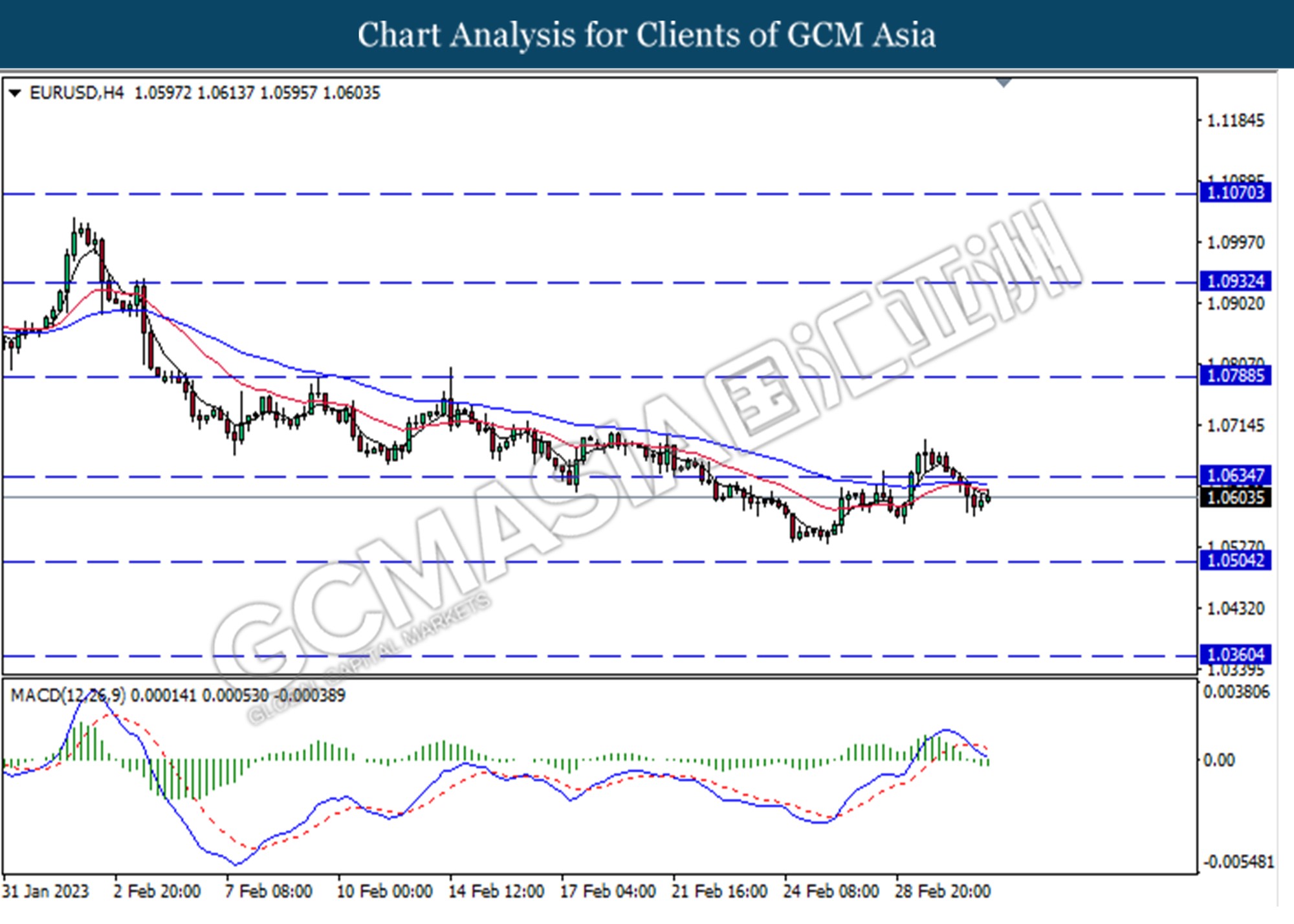

The EUR/USD, as one of the most traded currencies by global investors, was penalized by the rising inflation and unemployment rate. Yesterday, the headline inflation of the eurozone slightly reduced by -0.1% to 8.5%, yet higher than the market expectation at 8.2%. At the same time, the core CPI of the Eurozone increased by 0.3% to 5.6% from 5.3%, well above the European Central Bank (ECB) target of 2%. With such a backdrop, an aggressive rate hike would likely be carried out in the upcoming meeting. On Thursday, ECB President Christine Lagarde warned that inflation in the Eurozone remained high, and another 50 basis points of interest rate hikes may be needed to take the inflation back to its target of 2%. Nevertheless, the expectation of an aggressive rate hike by the ECB is unable to keep the euro from slipping as investor expects the Europe economy to enter into stagflation in the future. The EU labor market remains vulnerable with an unemployment rate at 6.7%, pointing to a slowdown in the eurozone economy. As of writing, the EUR/USD was traded up by 0.07% to $1.0603 after a massive sell-off by investors in the previous trading session.

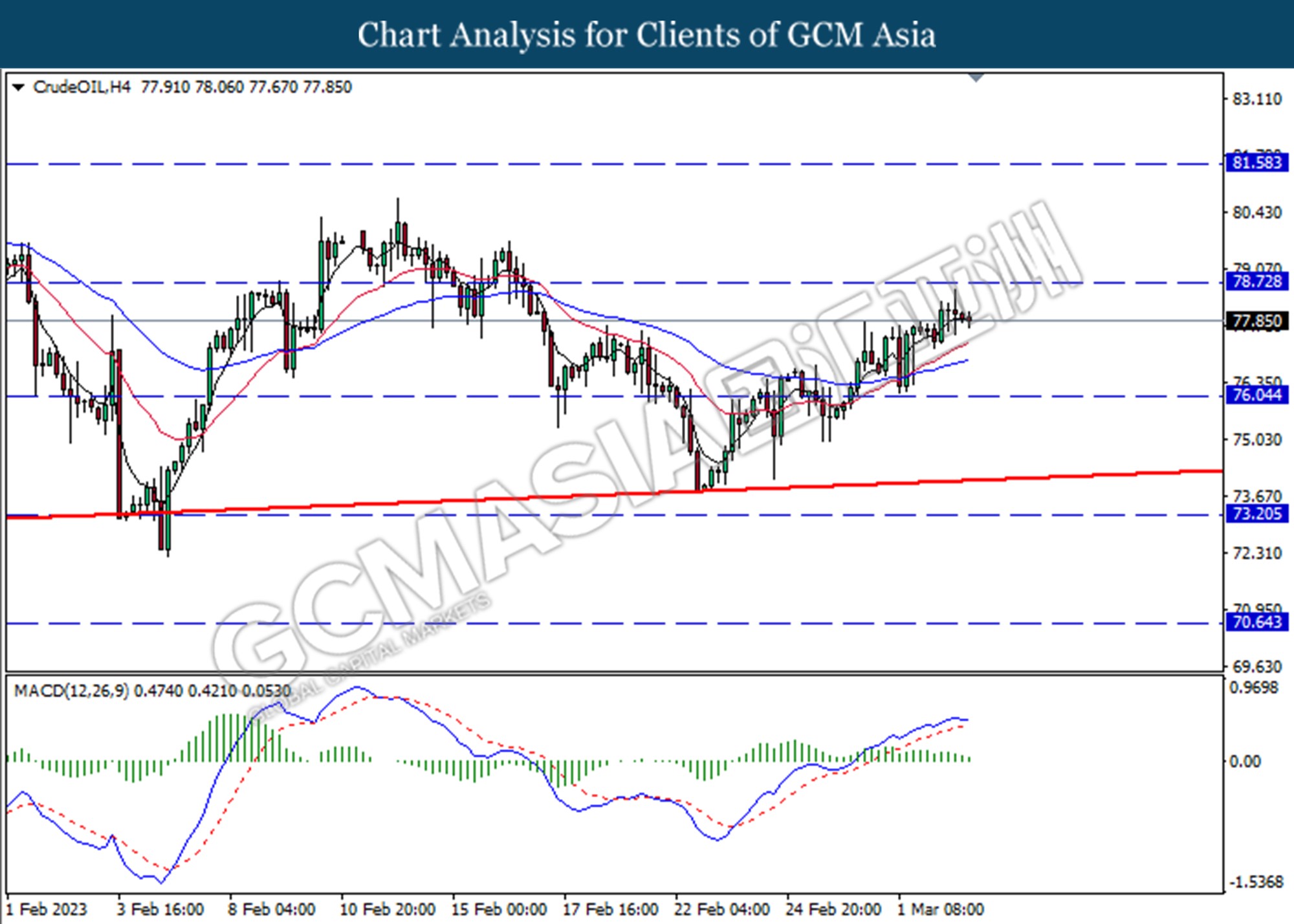

In the commodities market, crude oil prices depreciated by -0.37% to $77.87 per barrel as investors awaited for more cues from the US services PMI data. Besides, gold prices edged up by 0.21% to $1844.30 per troy ounce amid the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Composite PMI (Feb) | 53.0 | 53.0 | – |

| 17:30 | GBP – Services PMI (Feb) | 53.3 | 53.3 | – |

| 23:00 | USD – ISM Non-Manufacturing PMI (Feb) | 55.2 | 54.5 | – |

Technical Analysis

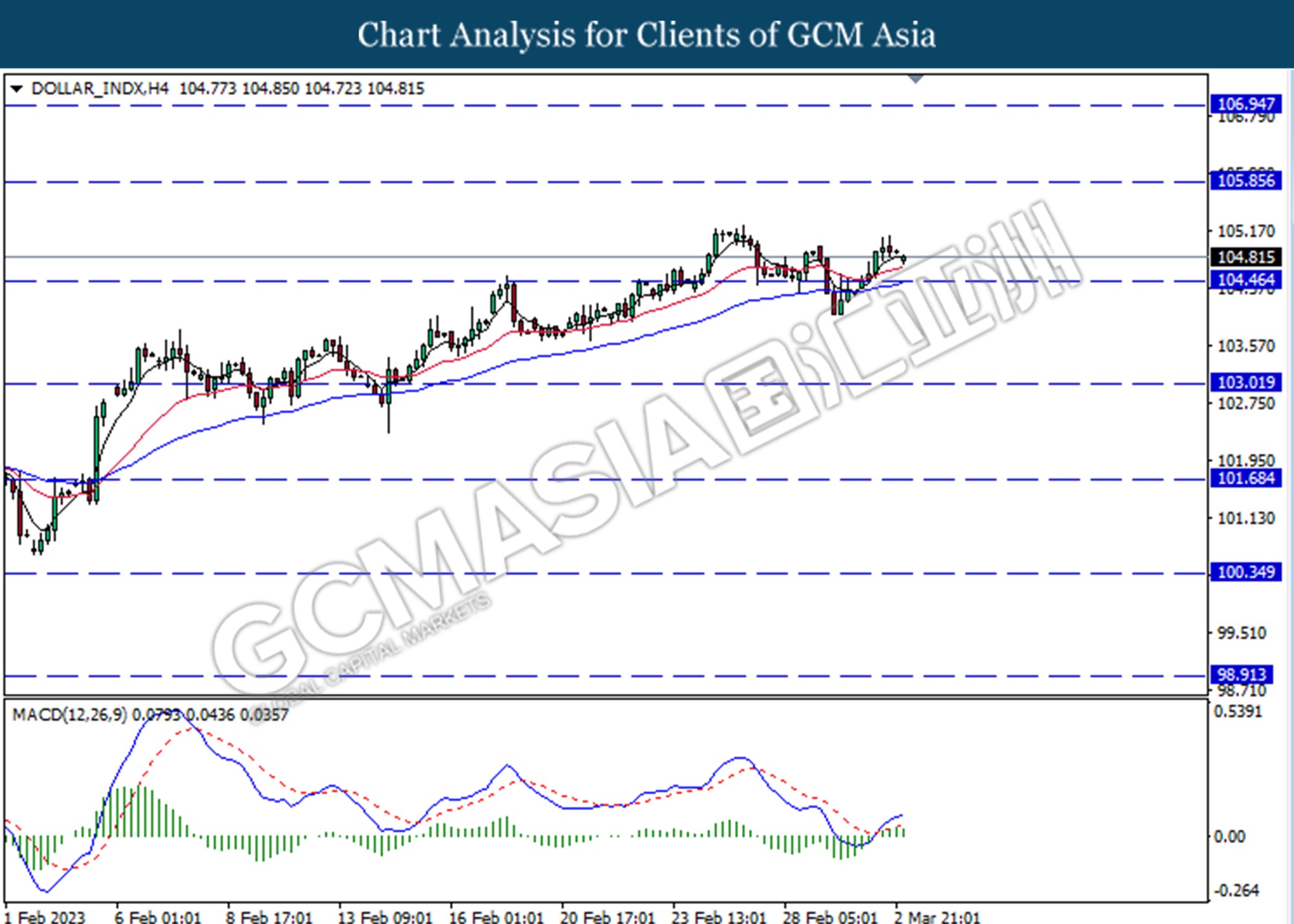

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extend its losses toward support level at 104.45

Resistance level: 105.85, 106.95

Support level: 104.45, 103.00

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2010

Resistance level: 1.2010, 1.2145

Support level: 1.1.1900, 1.1760

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo a technical rebound in the short term.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

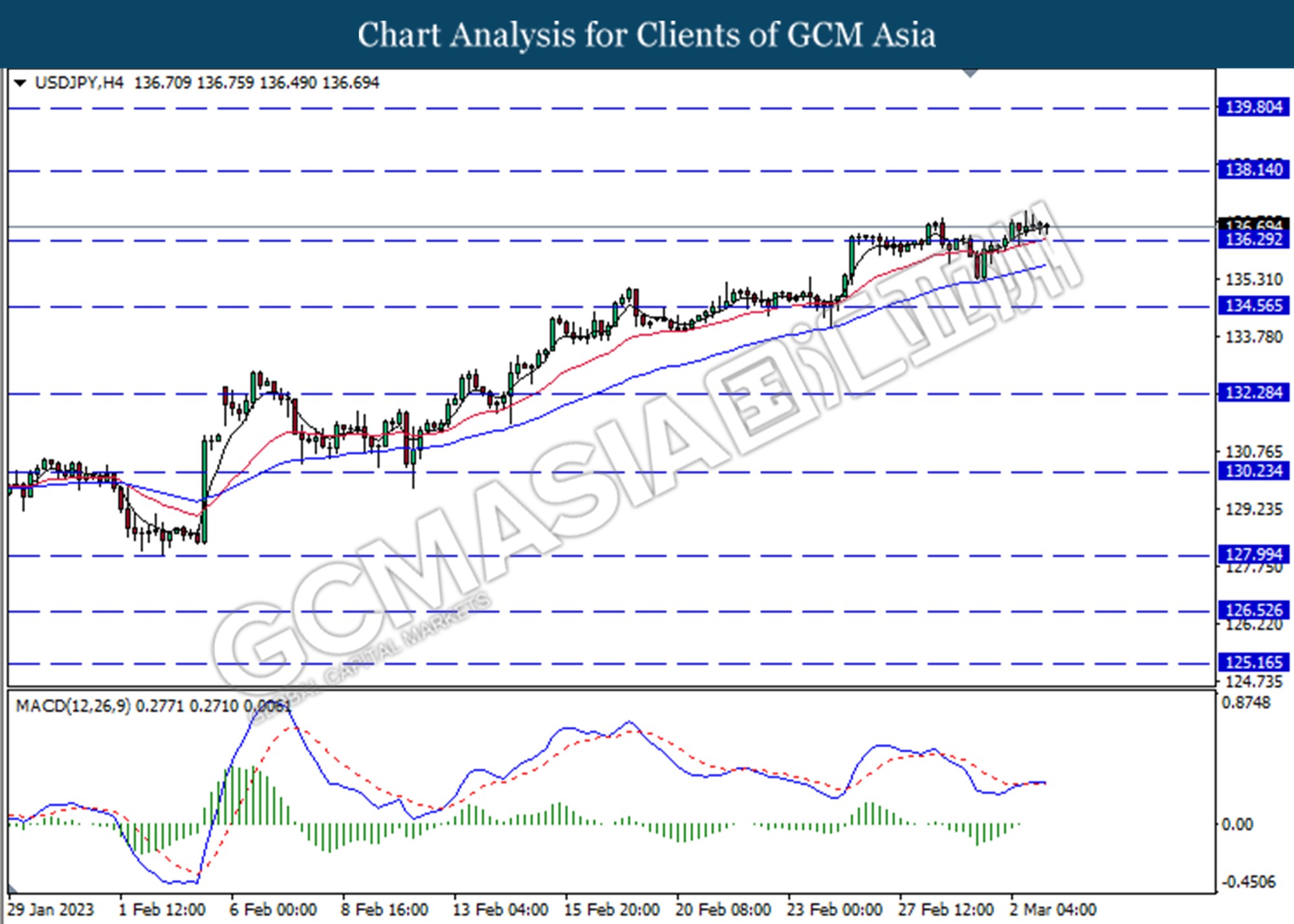

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair to traded lower as technical correction.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

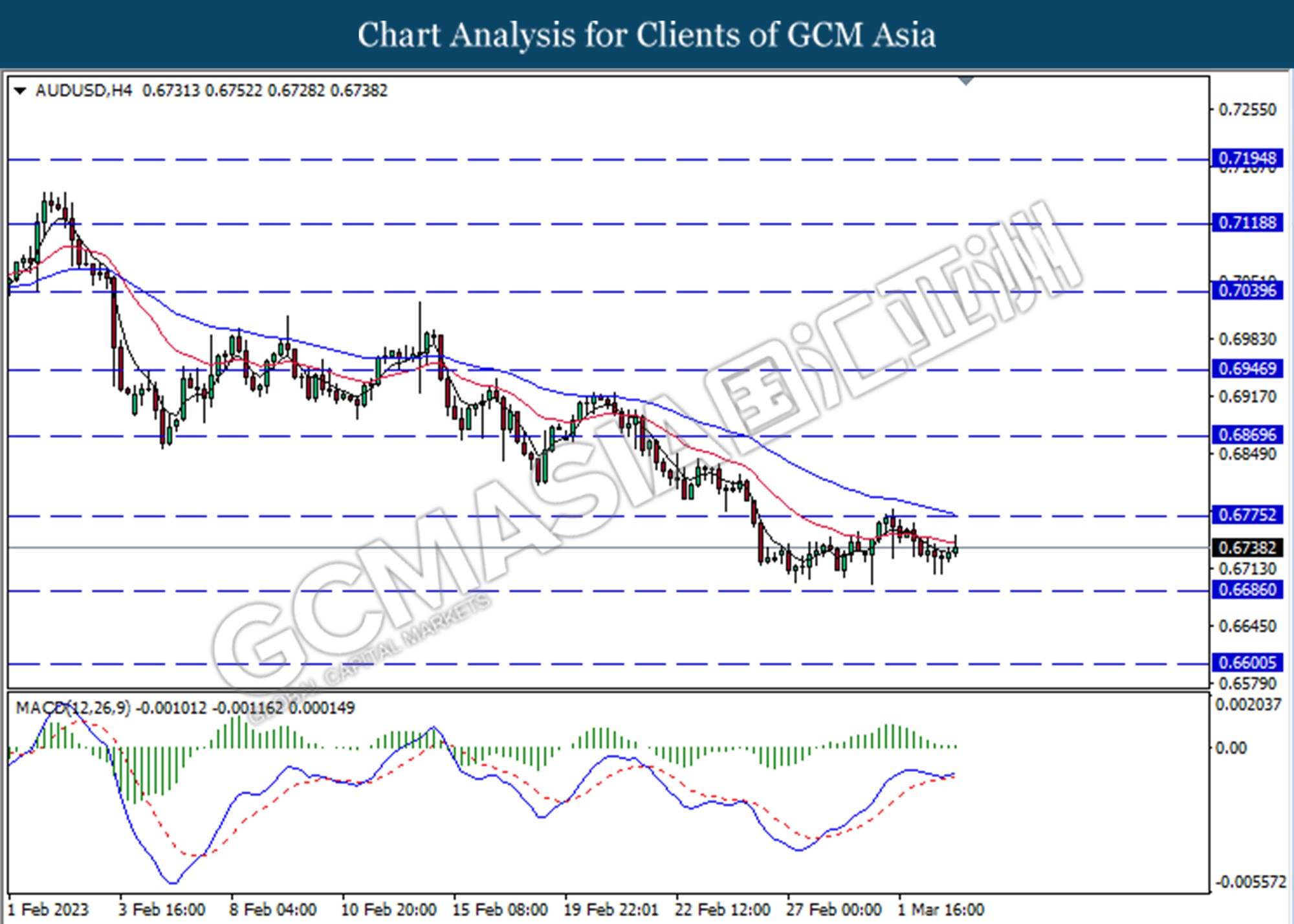

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo a technical correction in the short term.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

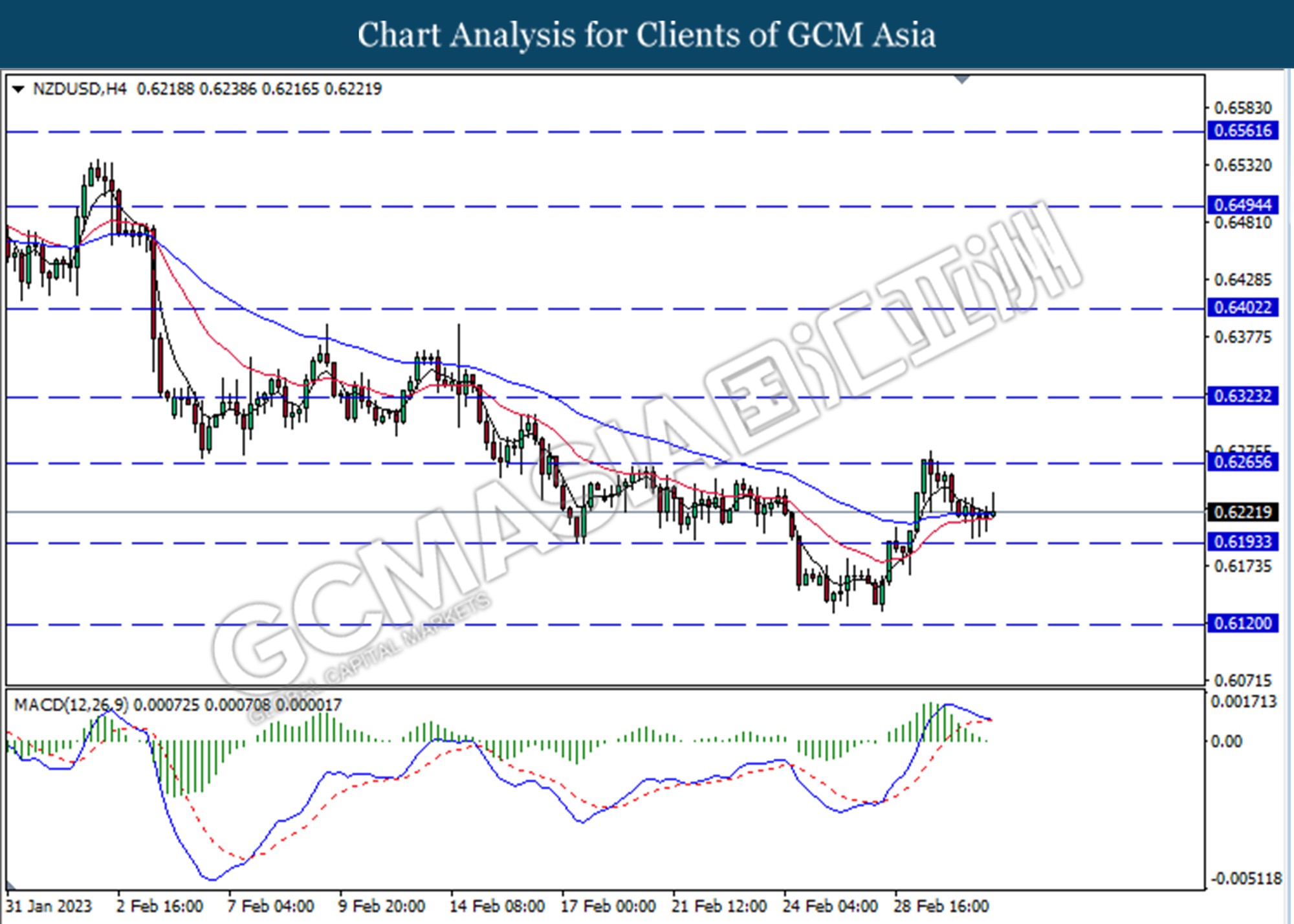

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair to undergo a technical rebound in short term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

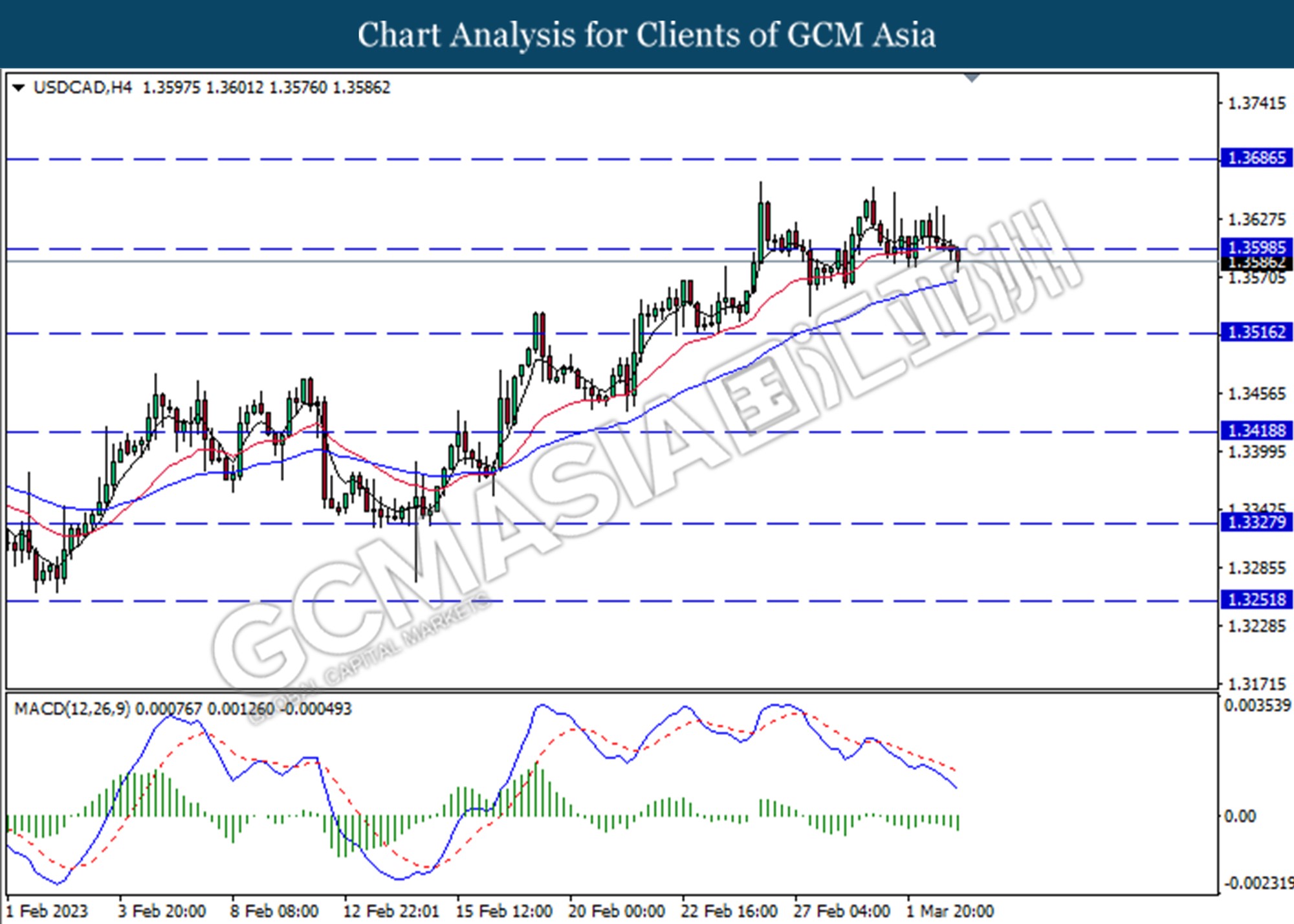

USDCAD, H4: USDCAD was traded lower following the prior breakout below the previous support level at 1.3600. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 1.3515.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

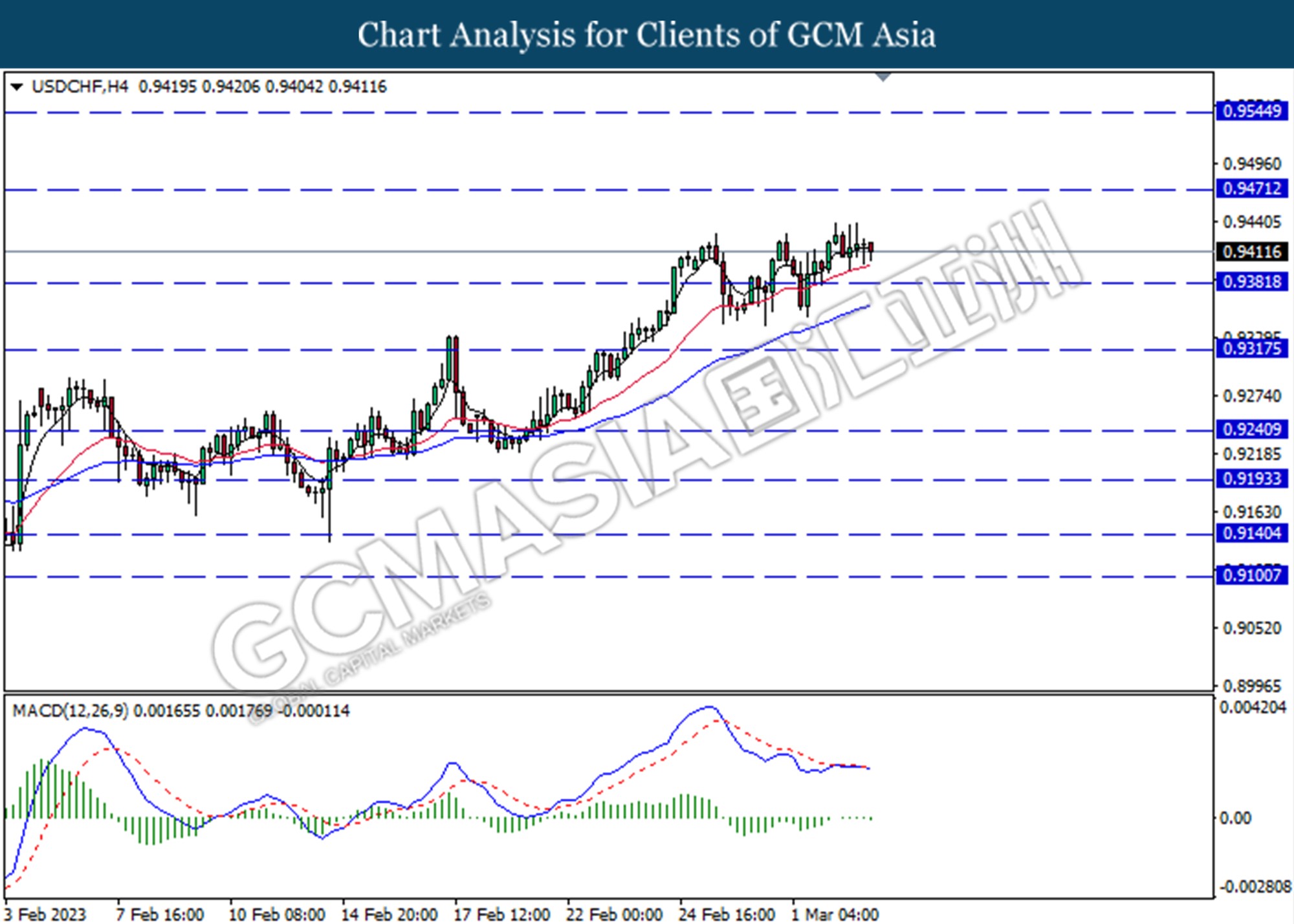

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.9380.

Resistance level: 0.9470, 0.9545

Support level: 0.0.9380, 0.9320

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the next support level.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

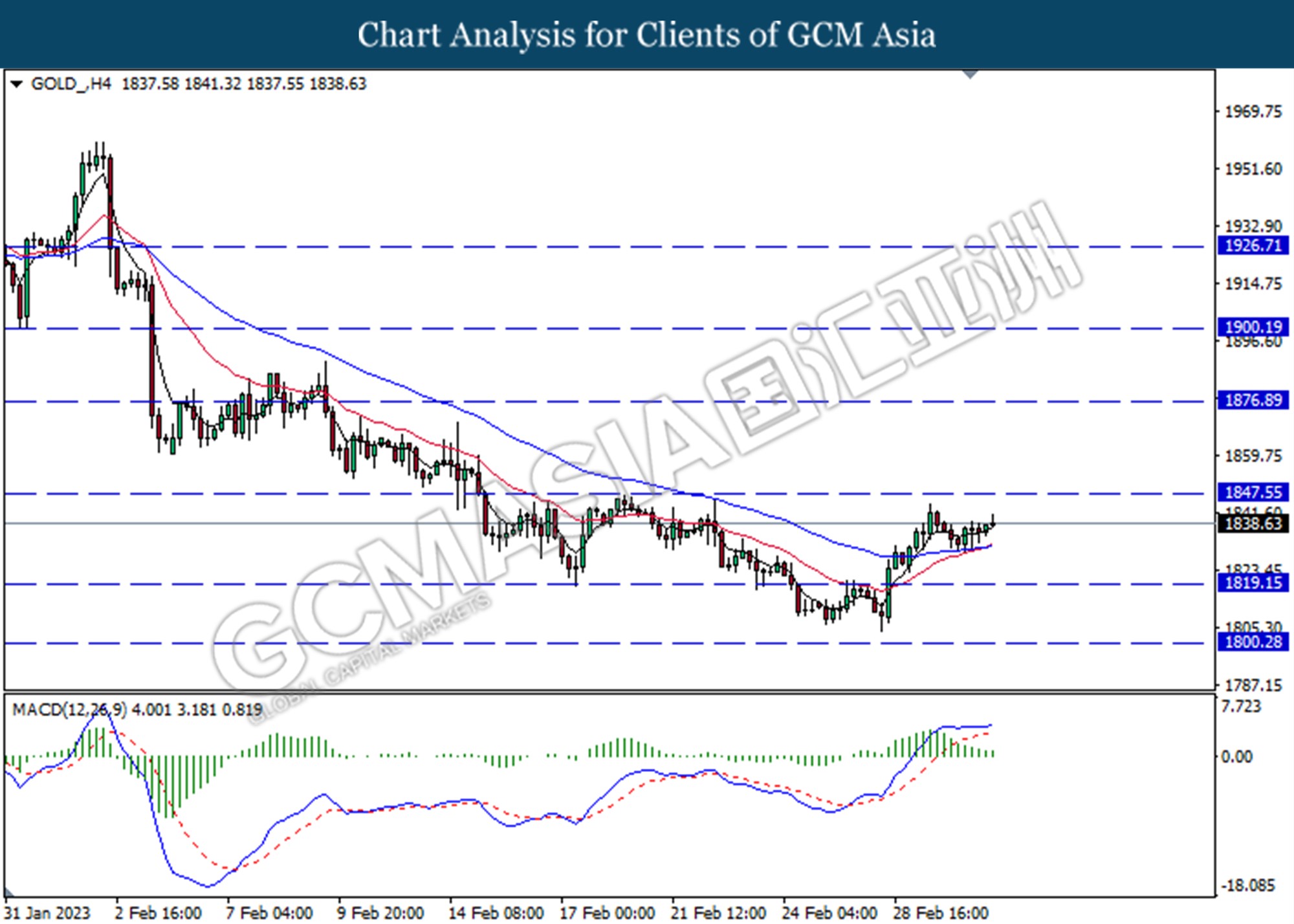

GOLD_, H4: Gold price was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its gains toward the resistance level at 1847.55.

Resistance level: 1847.55, 1876.90

Support level: 1819.15, 1800.30