08 March 2023 Afternoon Session Analysis

Aussie plummeted amid dovish comment from Philip Lowe.

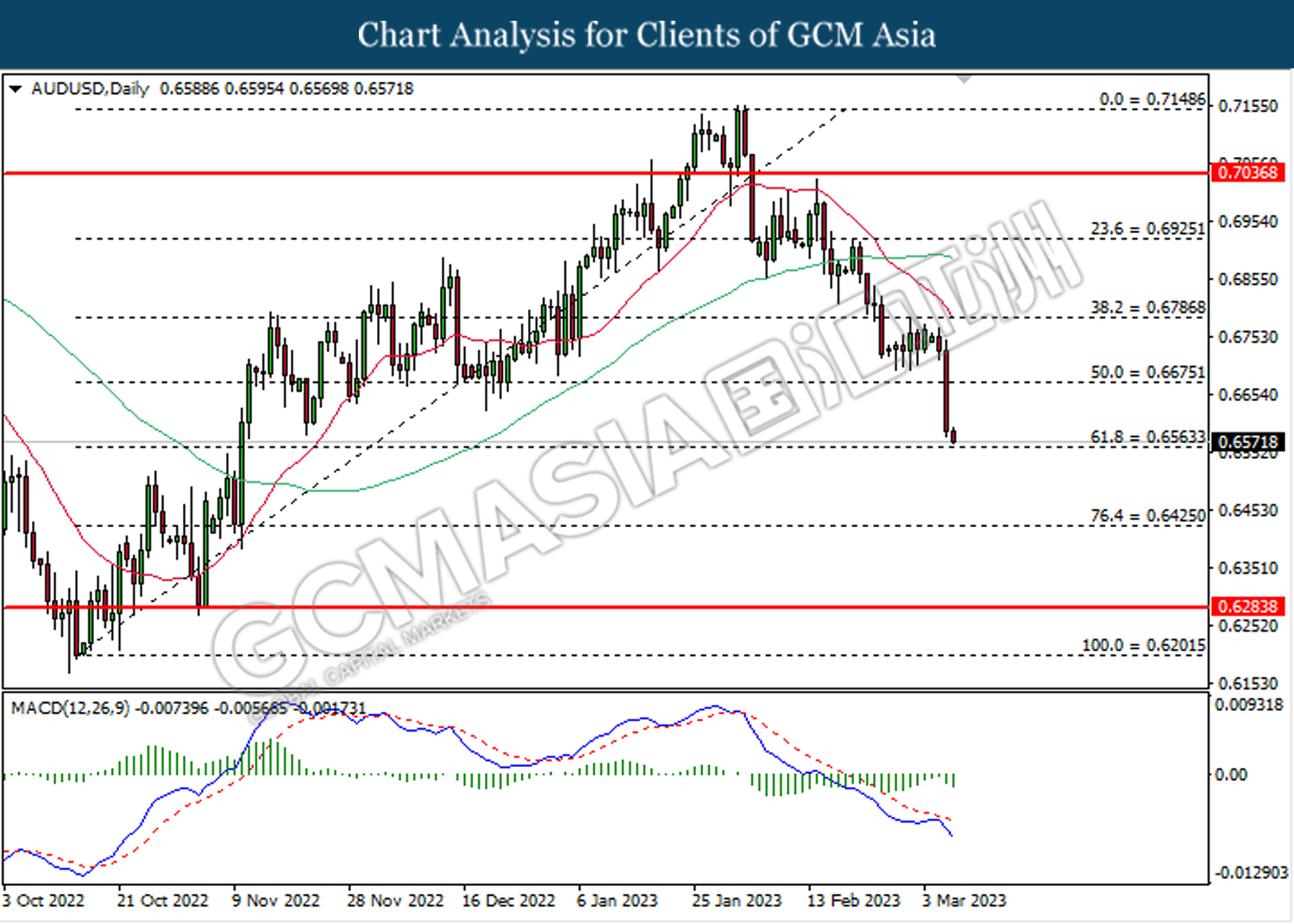

The Australian dollar, which is widely known as Aussie, has been plunging since yesterday morning as a series of negative news weighs on the market. In Tuesday’s RBA meeting, the board of members agreed to increase the cash rate by 25 basis points to 3.60%, as widely expected. Although the outlook of the global economies remains cloudy, the CPI data suggested that the inflation rate in Australia has peaked, whereby the prices of goods and services are expected to moderate shortly. With such a backdrop, the Governor of RBA, Lowe revealed that the current cash rate is close to the appropriate level for curbing inflation going forward. Hence, it signaled that they might pause the rate hike plan anytime soon, provided that the inflation shows no sign of exacerbation in the future. The Aussie dollar slumped with the looming pause in rate hikes as it was against the plans of other major central banks, which still favor aggressive rate hike plans to tackle the high inflation. As of writing, the pair of AUD/USD dipped by -0.05% to 0.6580.

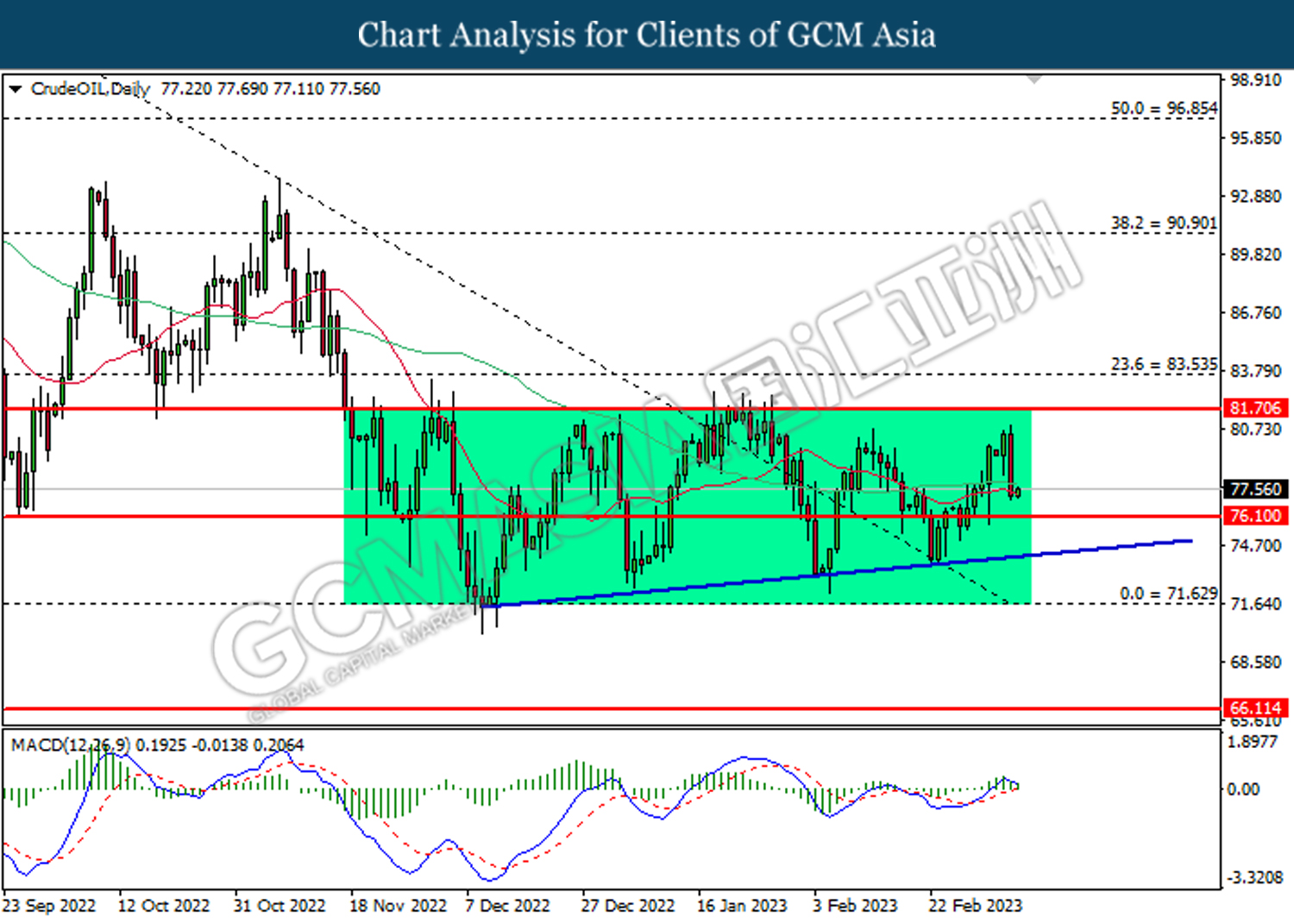

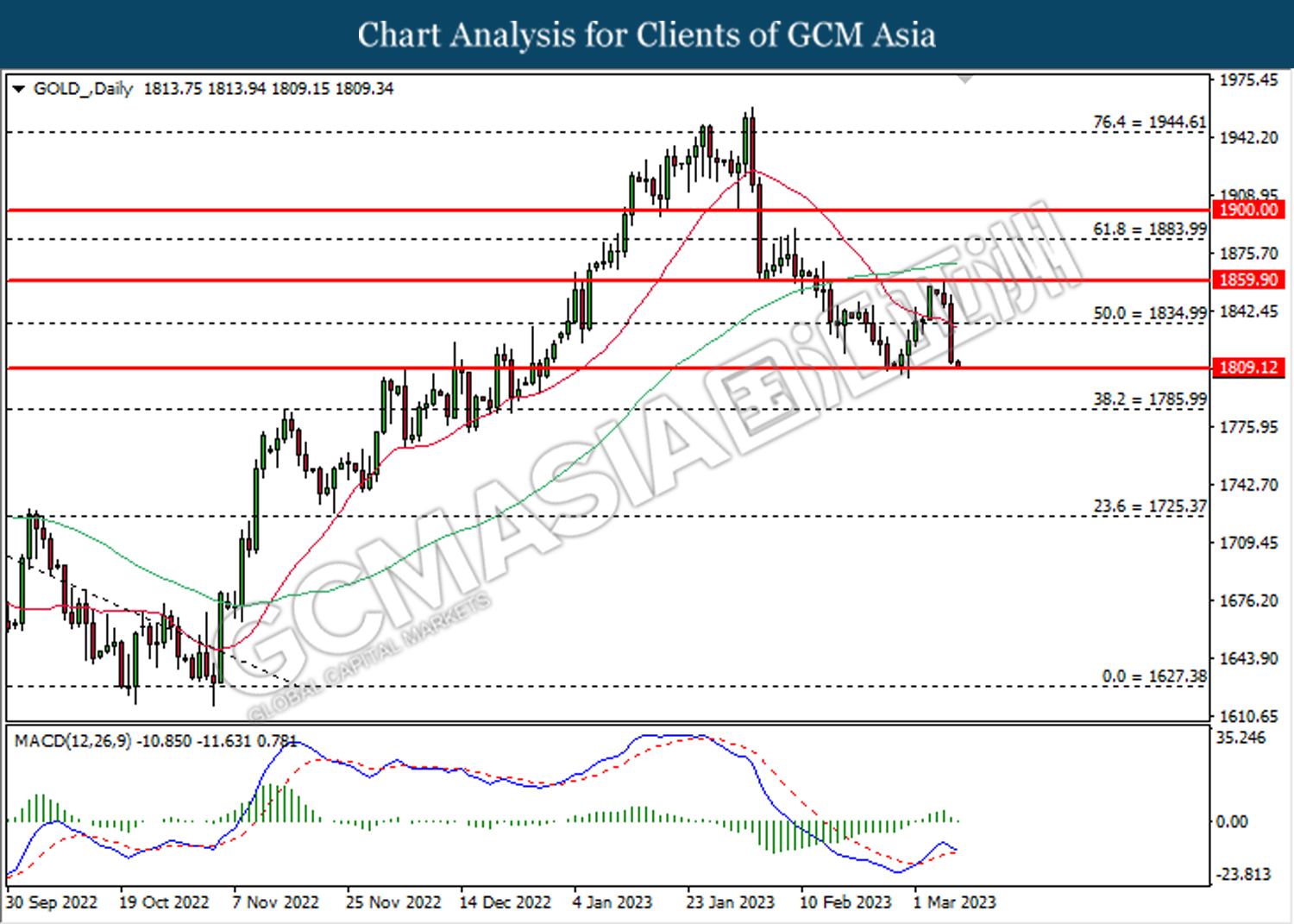

In the commodities market, crude oil prices jumped by 0.54% to $77.50 per barrel after plummeting by more than 3% during the previous trading session as the increase in dollar value urged the USD-denominated oil to become expensive. Besides, gold prices edged down -0.16% to $1810.25 per troy ounce following the hawkish statement from Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR ECB President Lagarde Speaks

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | 106K | 195K | – |

| 23:00 | USD – JOLTs Job Openings (Jan) | 11.012M | 10.600M | – |

| 23:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 1.165M | 0.395M | – |

Technical Analysis

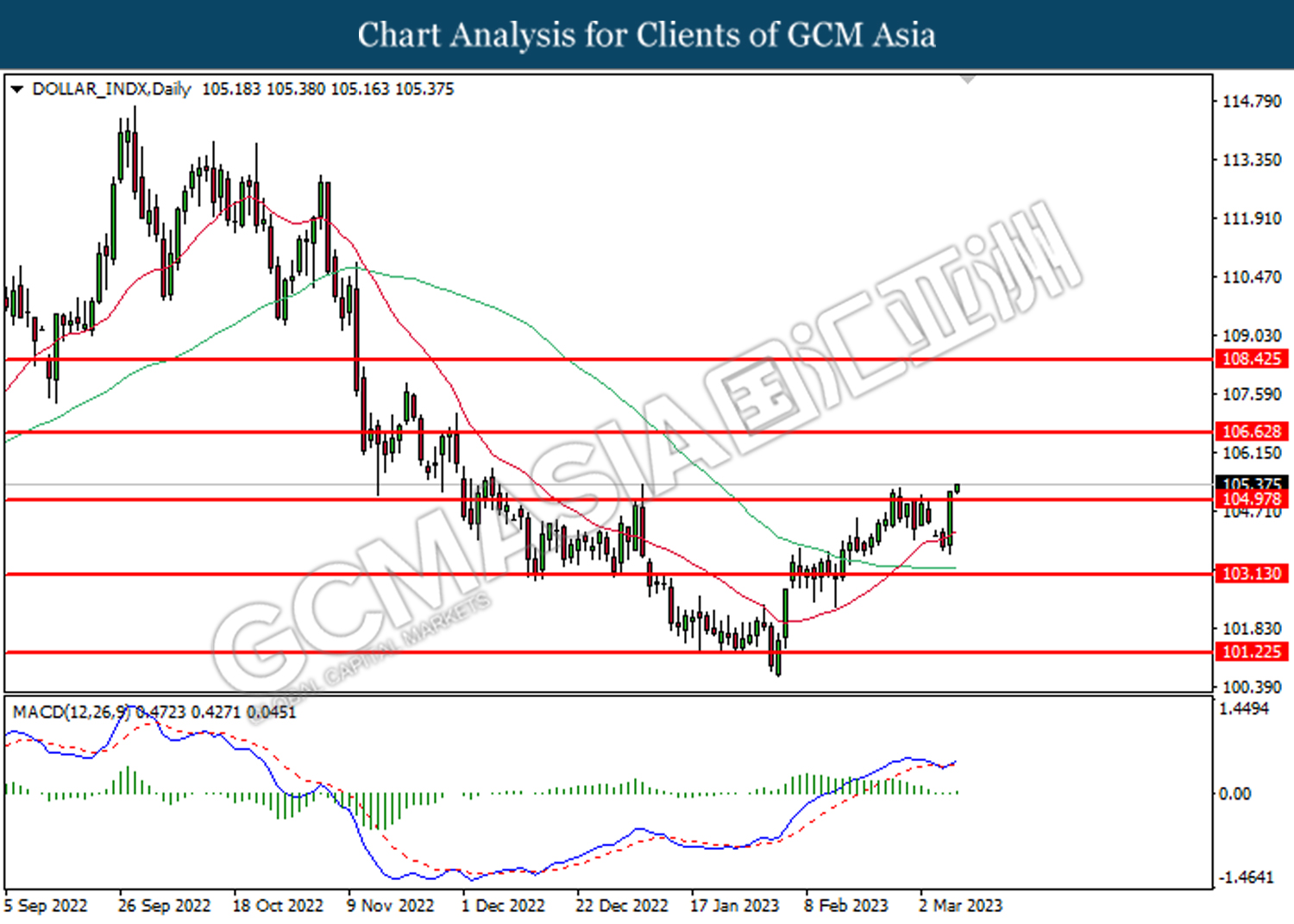

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 105.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 108.45

Support level: 105.00, 103.15

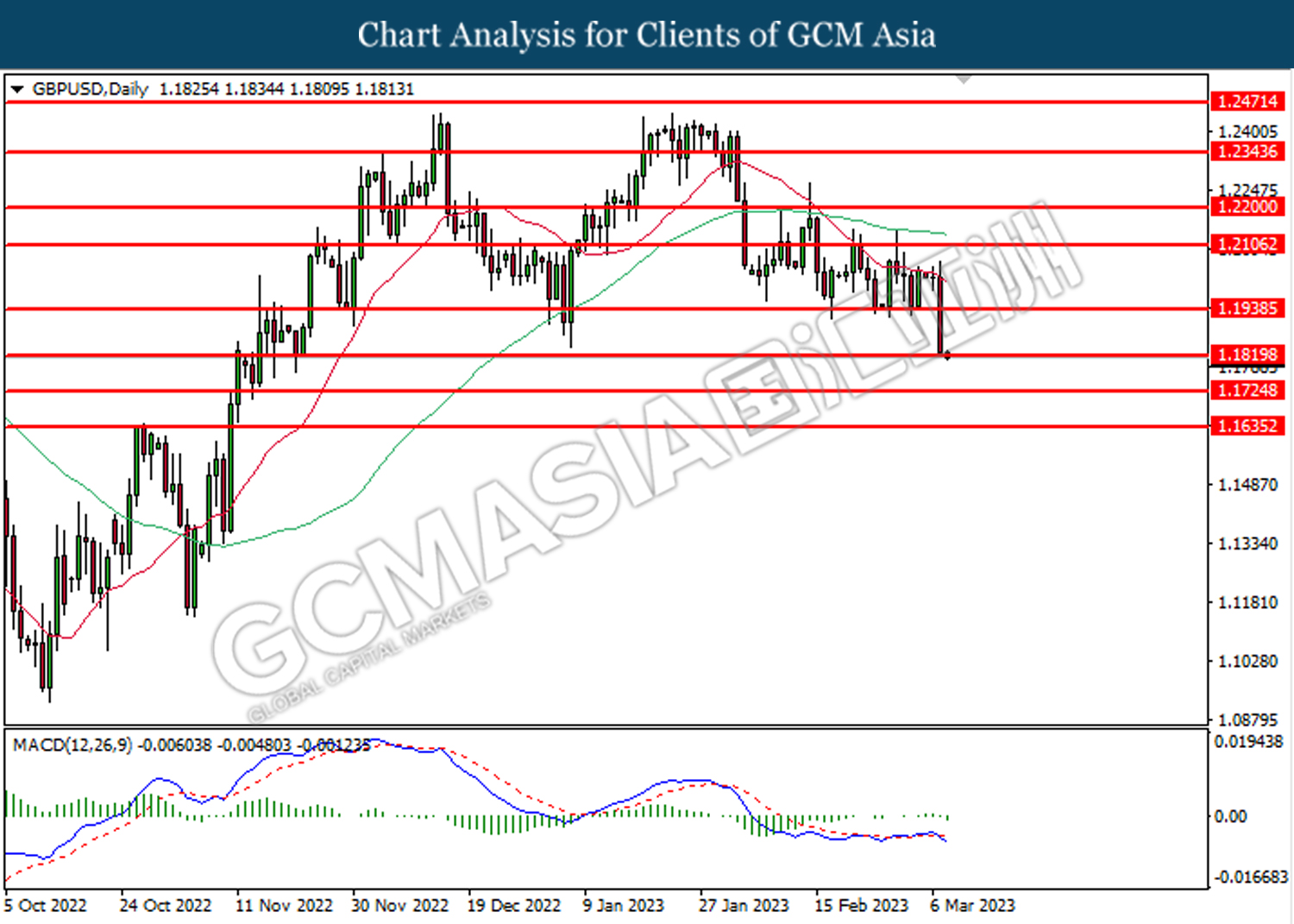

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1820. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1940, 1.2105

Support level: 1.1820, 1.1725

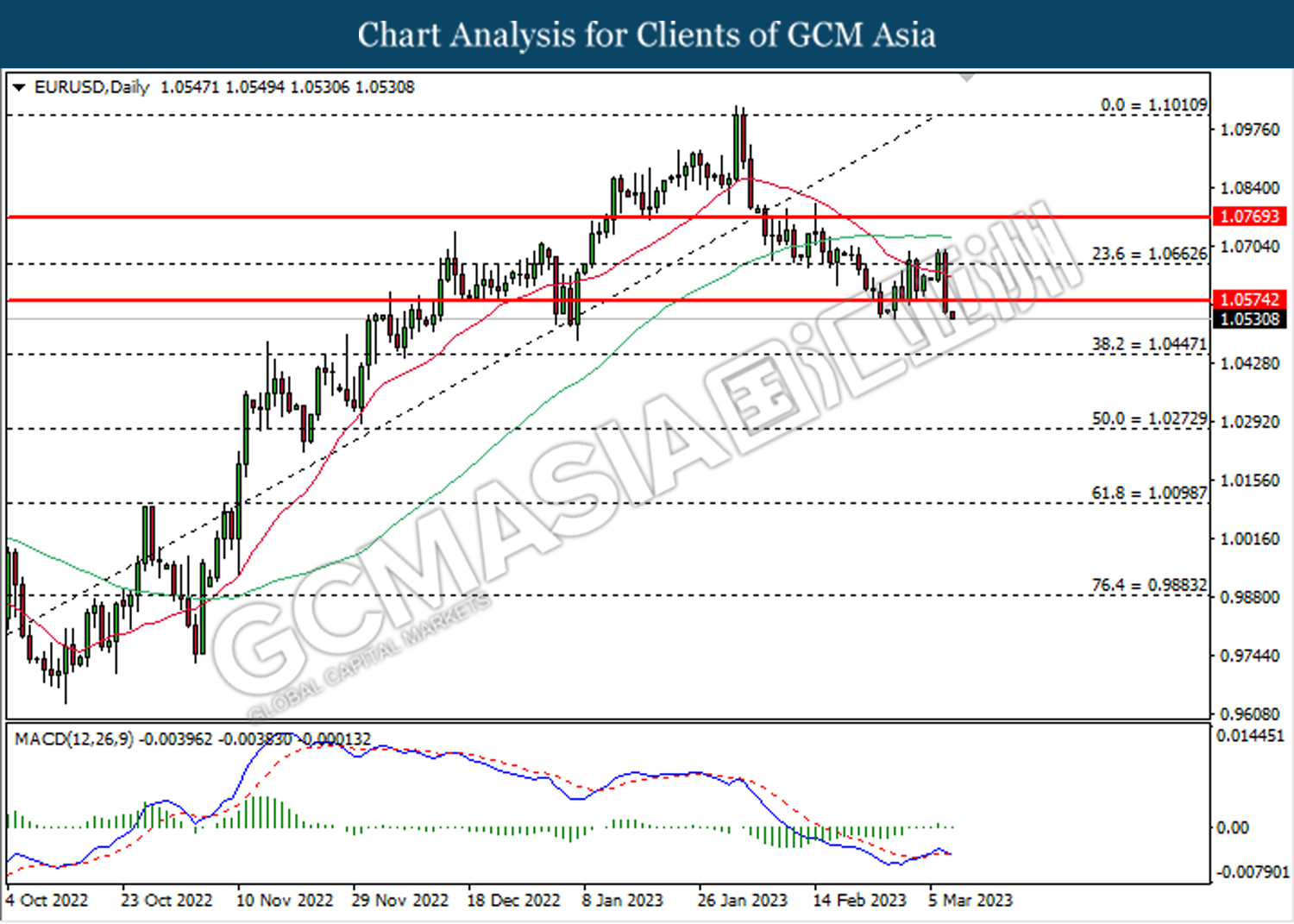

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0445.

Resistance level: 1.0575, 1.0665

Support level: 1.0445, 1.0275

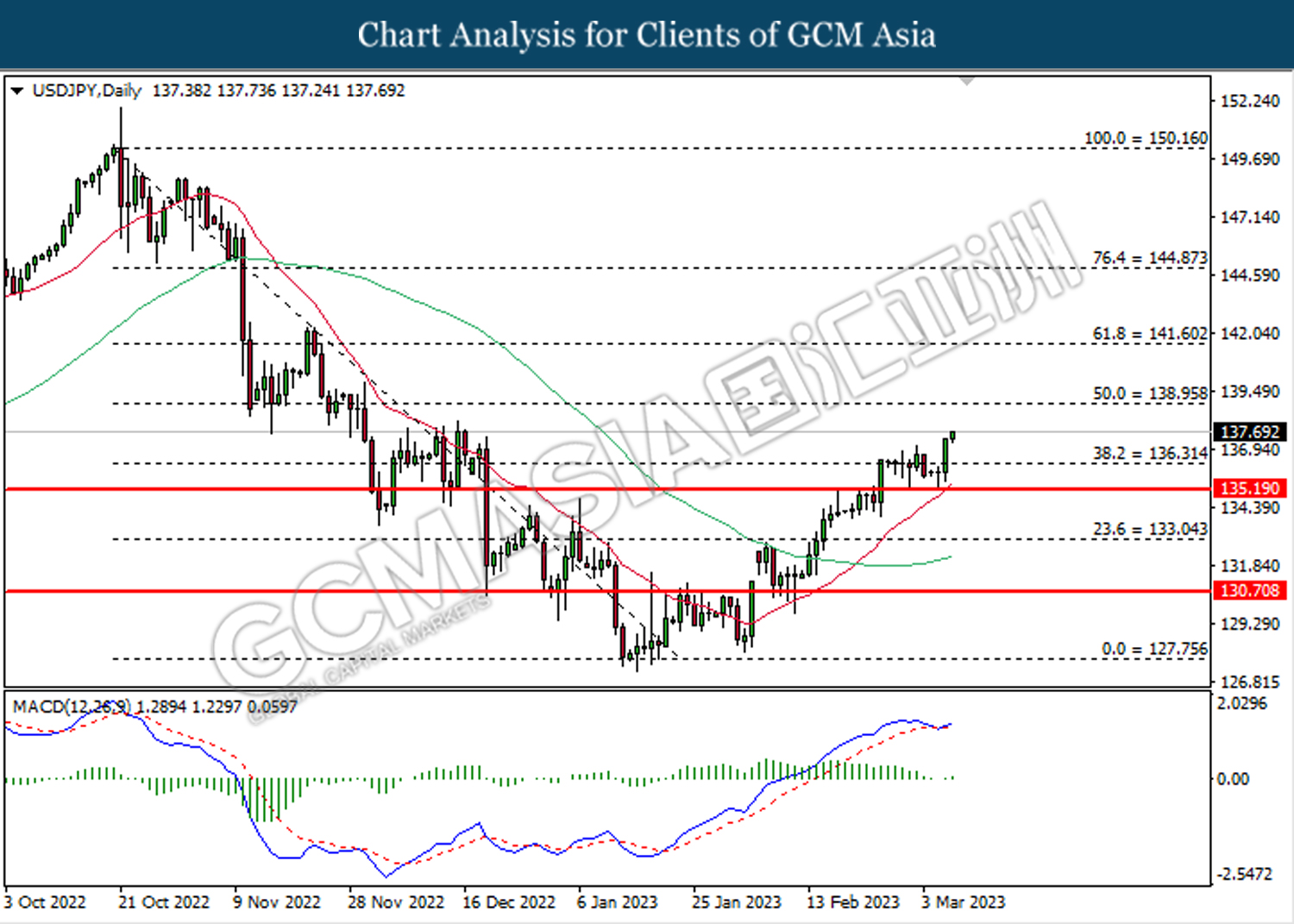

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 136.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.95.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

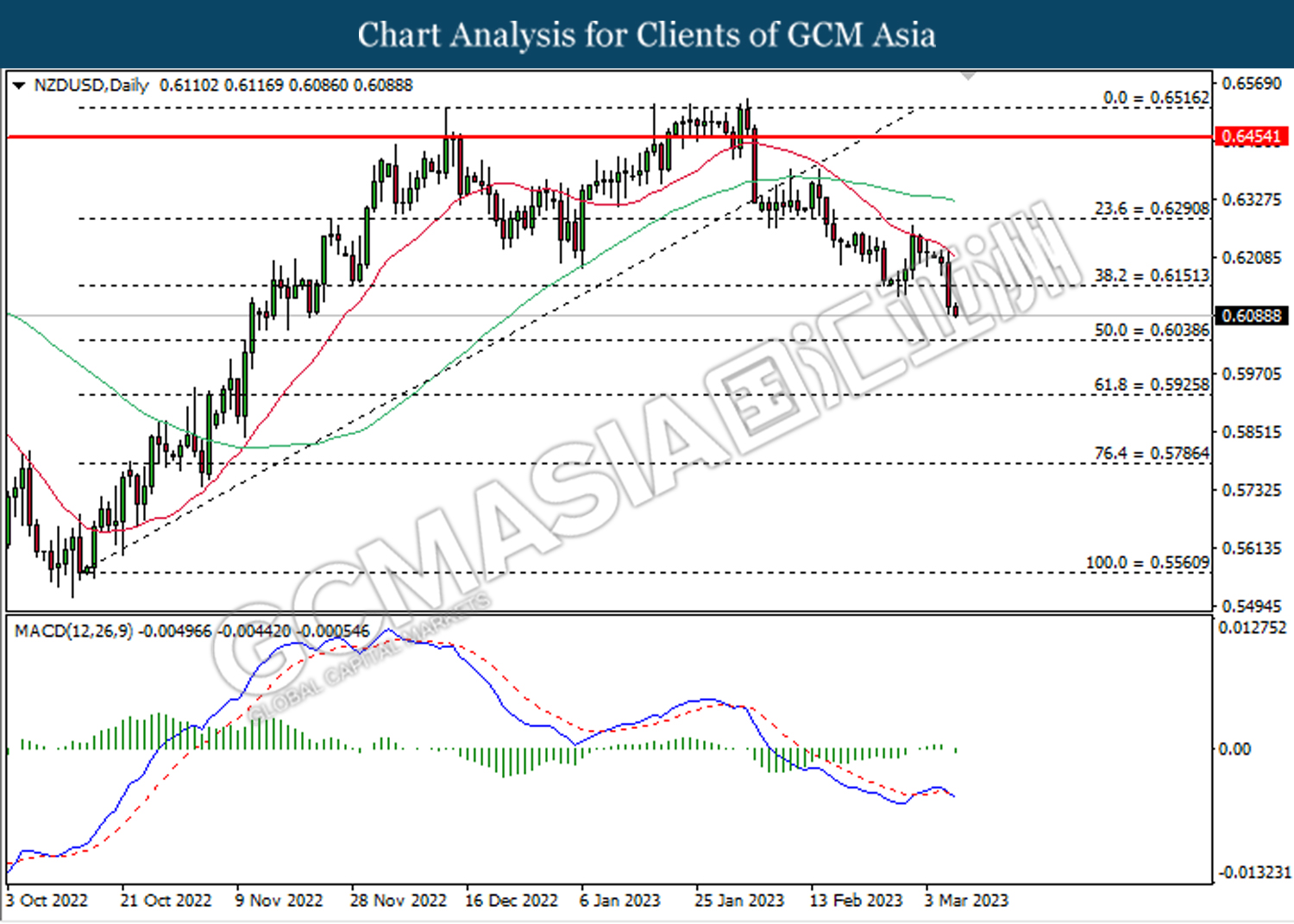

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

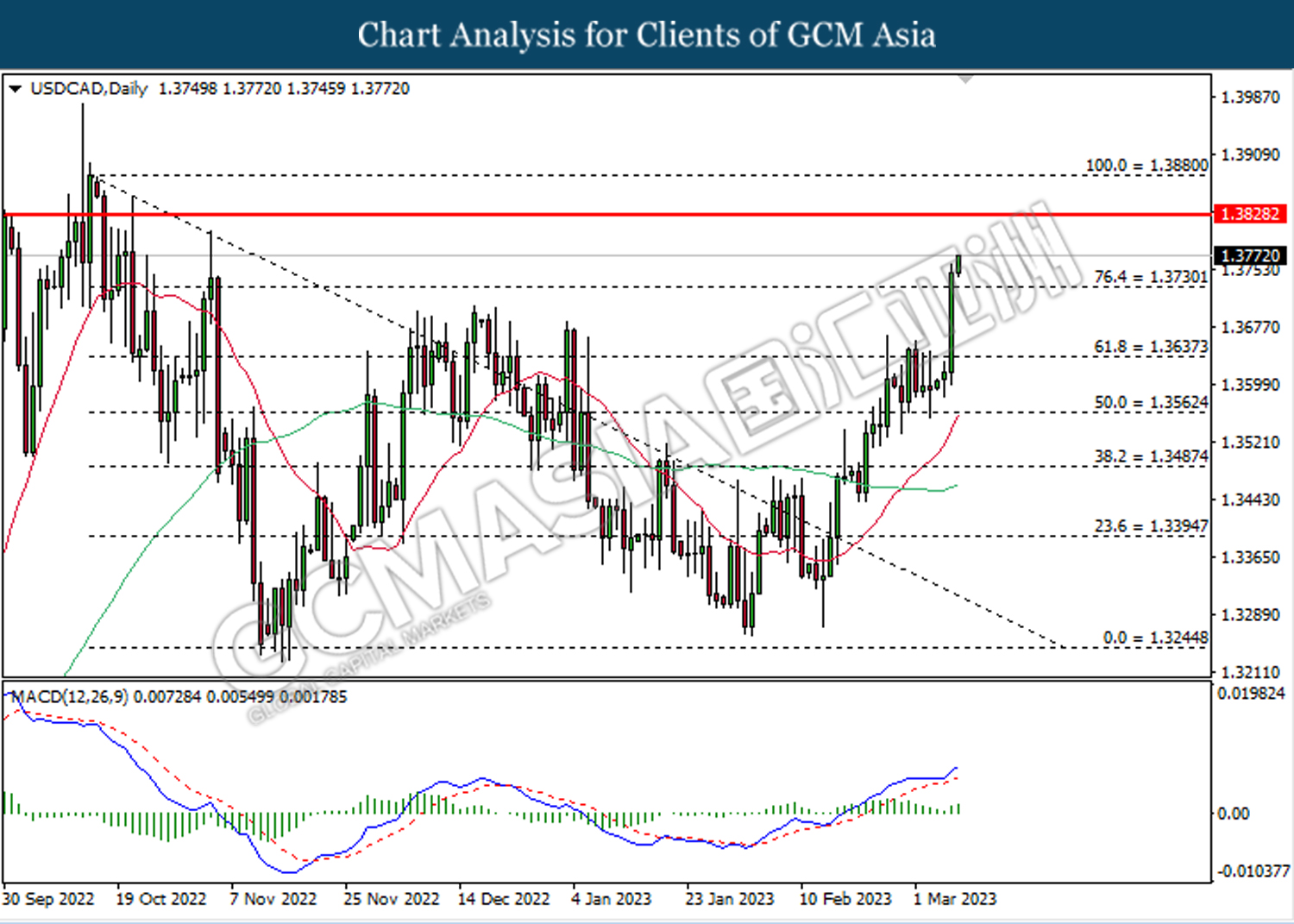

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3730. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3830.

Resistance level: 1.3830, 1.3880

Support level: 1.3730, 1.3635

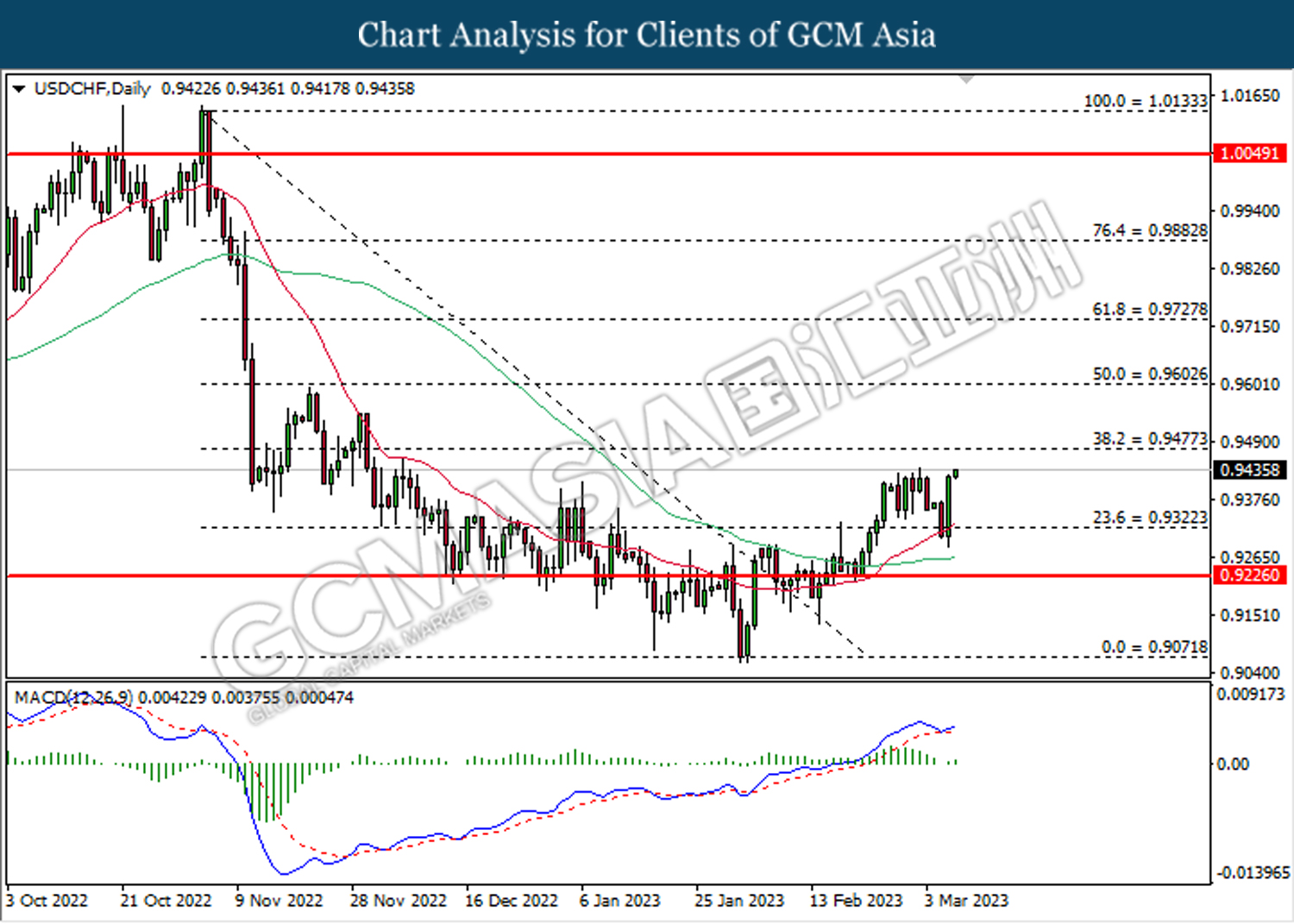

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.9320. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9475.

Resistance level: 0.9475, 0.9605

Support level: 0.9320, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 81.70. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.70, 83.55

Support level: 76.10, 71.65

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1809.10. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1835.00, 1859.90

Support level: 1809.10, 1786.00