9 March 2023 Morning Session Analysis

US Dollar climbed as optimistic labor report unleashed.

The Dollar Index which traded against a basket of six major currencies retreated some gains on yesterday after a sharp rise on Tuesday following the hawkish statement from Fed Chairman Jerome Powell, due to investors were awaiting the announcement of employment data. After that, the Dollar Index extended its gains as the optimistic employment data has been unleashed. The US ADP Nonfarm Employment Change notched up from the previous reading of 119K to 242K, exceeding the consensus forecast of 200K. Besides, the US JOLTs Job Openings had also printed a better-than-expected result, which came in at the reading of 10.824M, higher than the 10.500M forecast. Both crucial data has shown a resilient labor market, while it provided more rooms for Fed to raise its rate higher. On the other hand, the Federal Reserve Chair Jerome Powell reiterated his speech on Wednesday that higher interest rate hikes would likely to be needed, but the size of hike was data-dependent. However, the gains in the dollar were modest on yesterday because the market had already got the message. As of writing, the Dollar Index appreciated by 0.06% to 105.66.

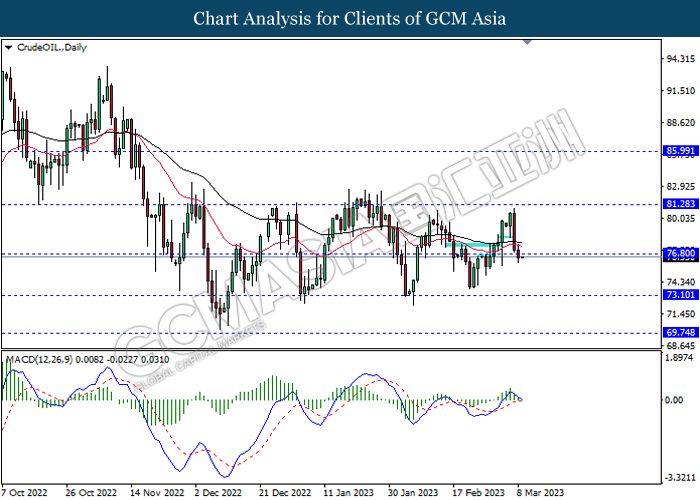

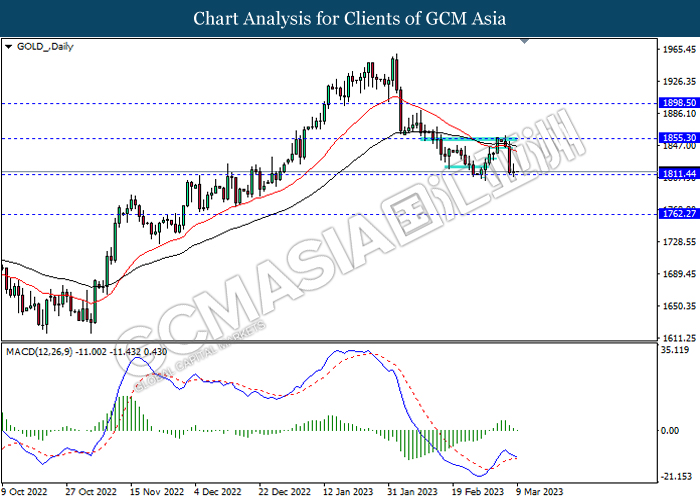

In the commodity market, the crude oil price rose by 0.09% to $76.56 per barrel as of writing following the crude oil inventories has decreased over the market expectation. In addition, the gold price appreciated by 0.05% to $1811.44 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 190K | 195K | – |

Technical Analysis

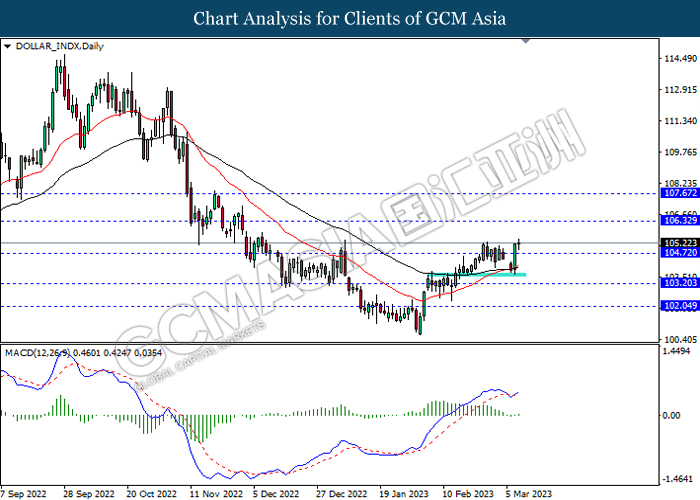

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 106.30, 107.65

Support level: 104.70, 103.20

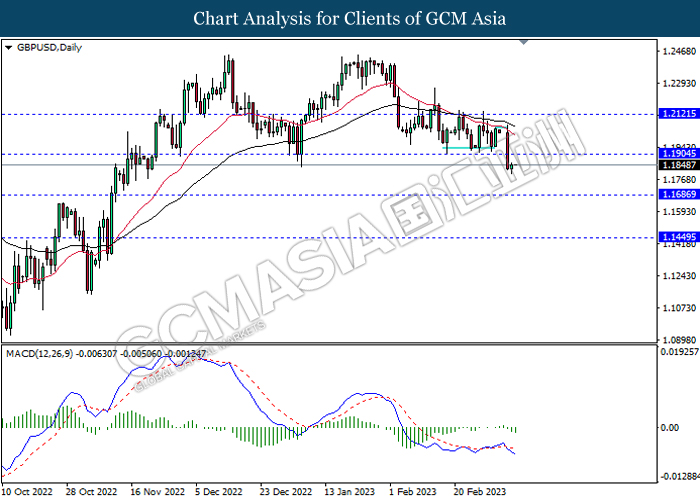

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1905, 1.2120

Support level: 1.1685, 1.1450

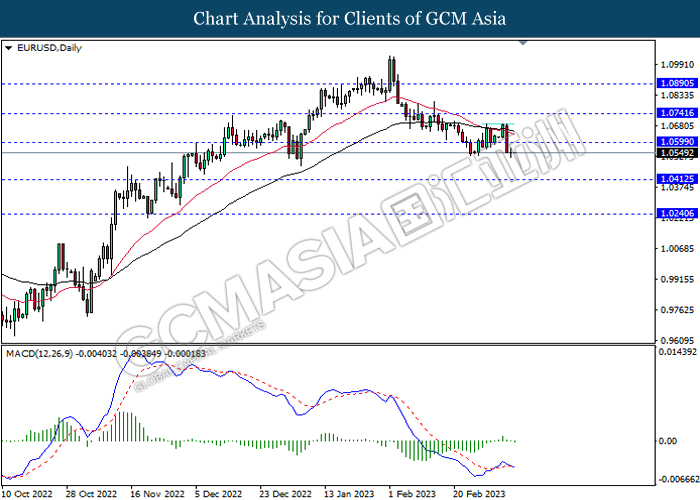

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0600, 1.0740

Support level: 1.0410, 1.0240

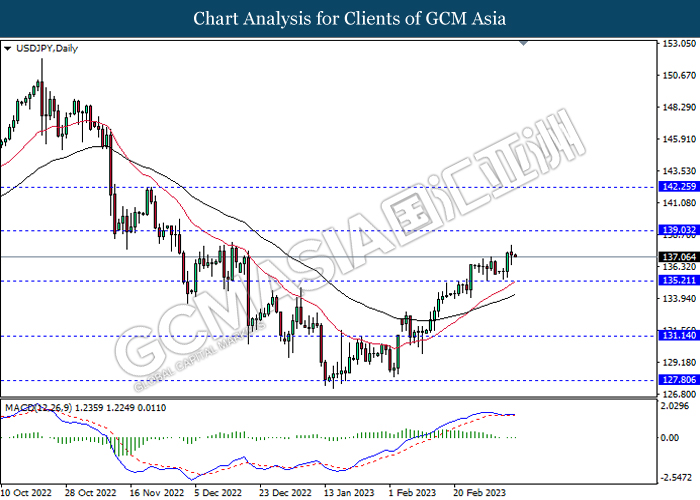

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.05, 142.25

Support level: 135.20, 131.15

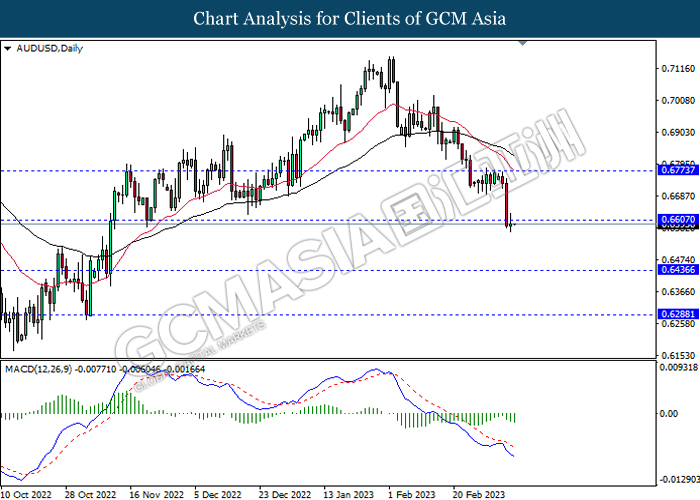

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6605, 0.6775

Support level: 0.6435, 0.6290

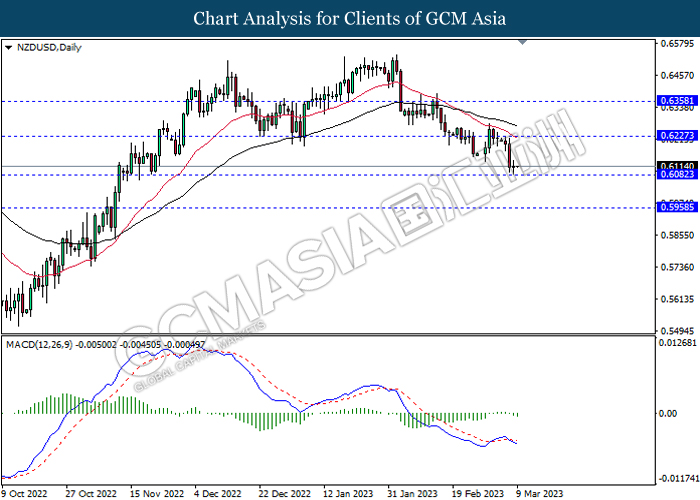

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

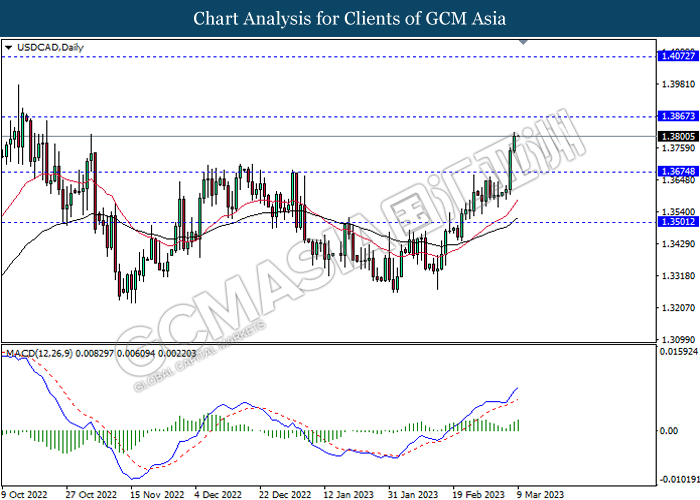

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3865, 1.4070

Support level: 1.3675, 1.3500

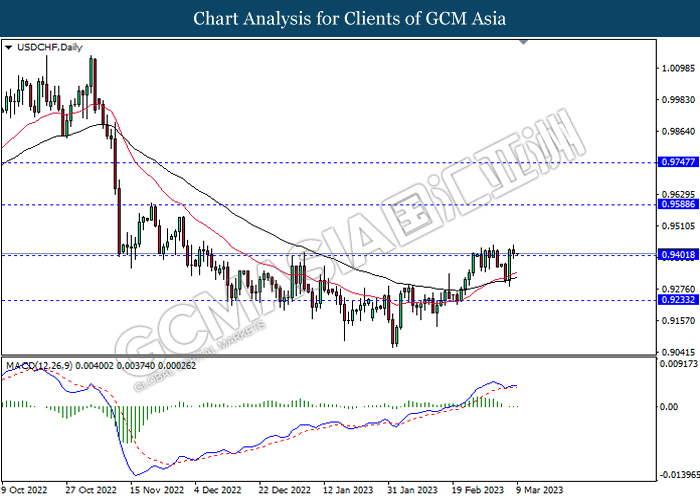

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9590, 0.9745

Support level: 0.9400, 0.9235

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 76.80, 81.30

Support level: 73.10, 69.75

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1855.30, 1898.50

Support level: 1811.45, 1762.25