09 March 2023 Afternoon Session Analysis

Canadian dollar plunged as BoC maintains its interest rate unchanged.

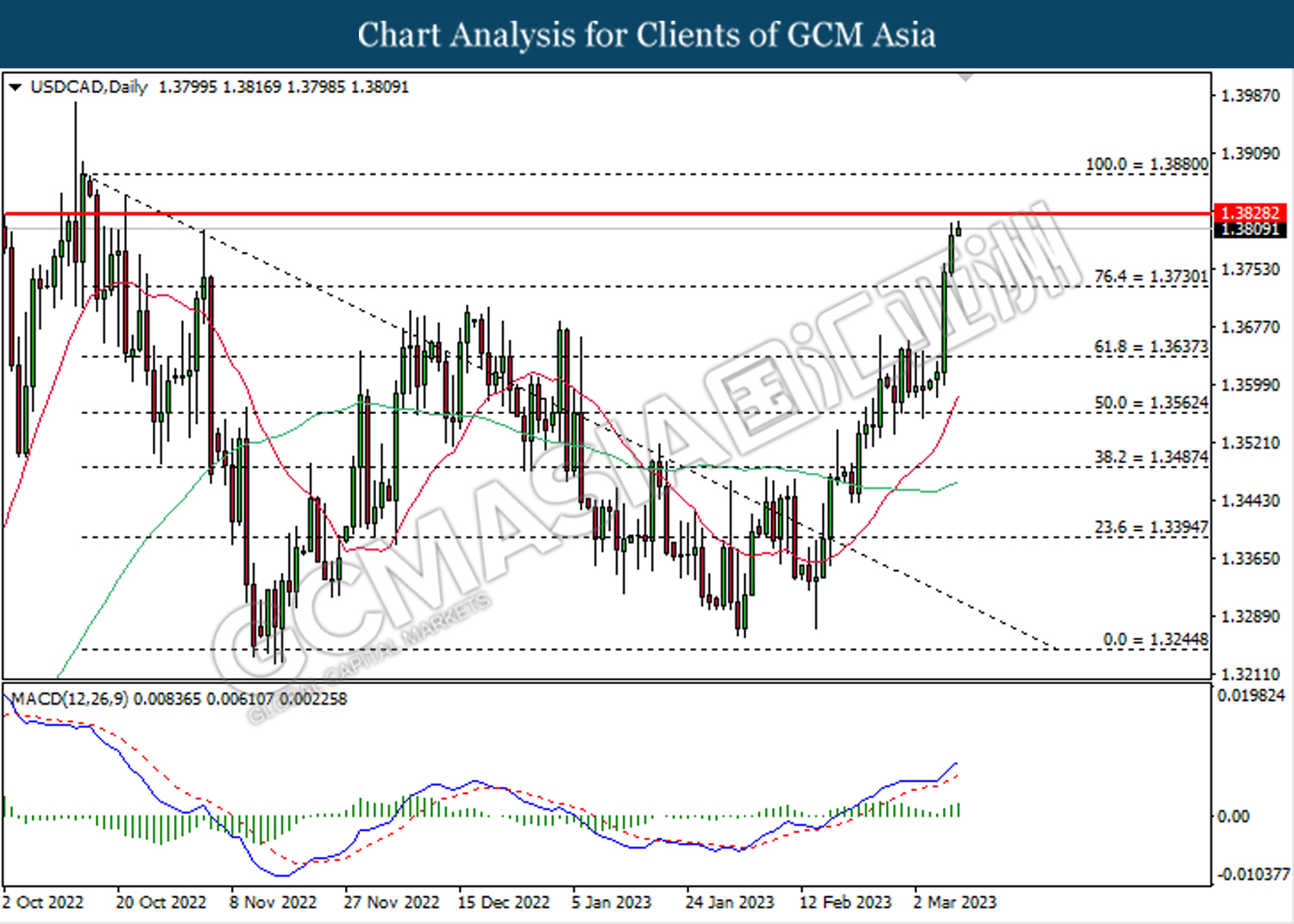

The Canadian dollar, which is majorly traded by the global investors, plummeted after the Bank of Canada (BoC) decided to hold its cash rate unchanged at the current level. In yesterday BoC meeting, the board of members unanimously agreed to hold its interest rate at 4.50%, in line with the consensus forecast despite the Fed’s cash rate has not seen any sign of pausing in anytime soon. After a series of rate hike since last year, the BoC has finally stop to hike its rate for the first time, citing the inflation figure is on the right pace of deceleration while heading toward their target of 2.0%. According to the Statistics Canada, the nation’s CPI printed a reading of 5.9%, weaker than the prior month reading’s 6.3%, while also far lower than the consensus forecast at 6.1%. With the backdrop of pausing rate hike, the market participants see an obvious policy’s divergence between the US and Canada, reacting to it accordingly by rushing into the pair of USD/CAD. As of writing, the pair of USD/CAD rose 0.04% to 1.3810.

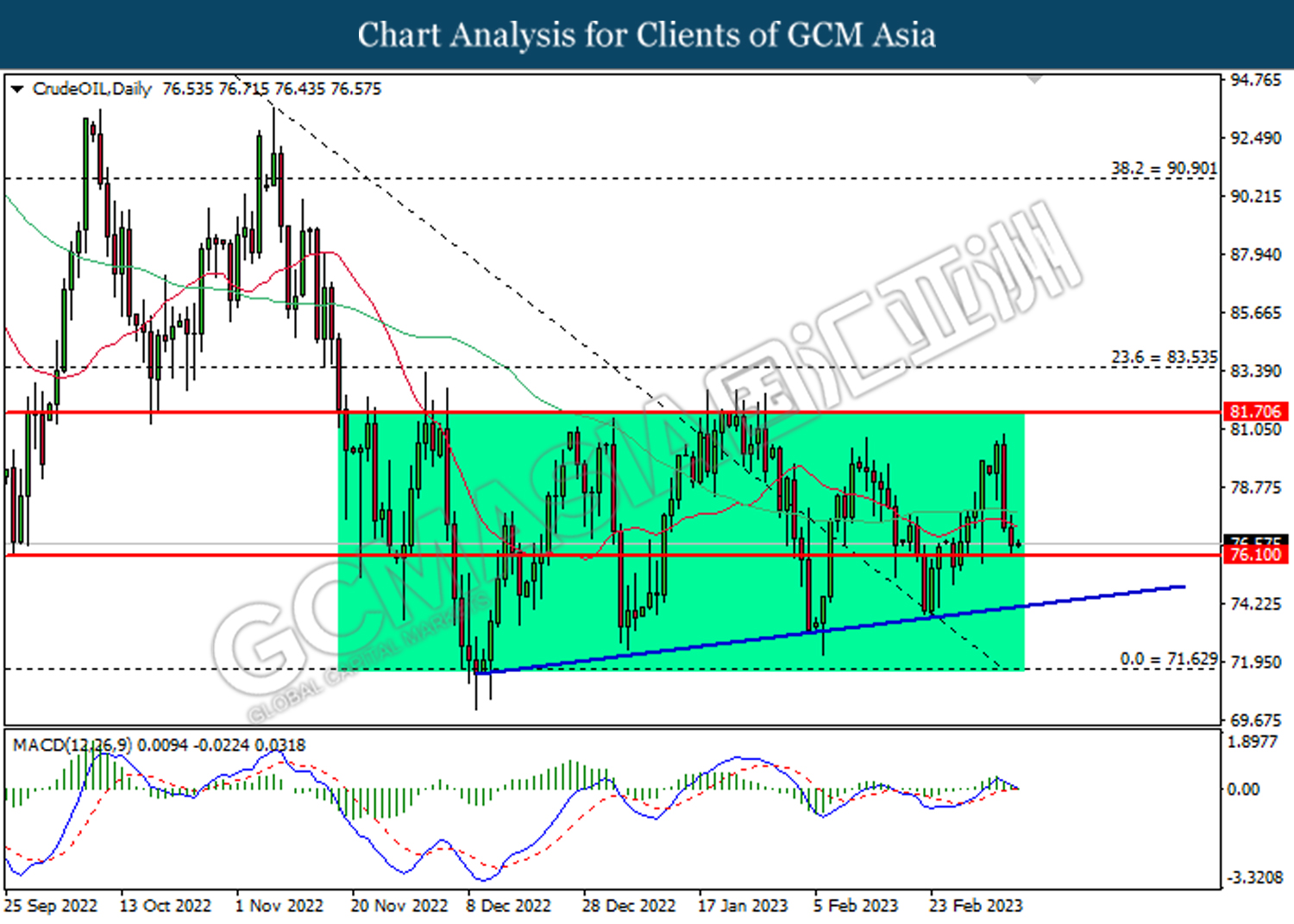

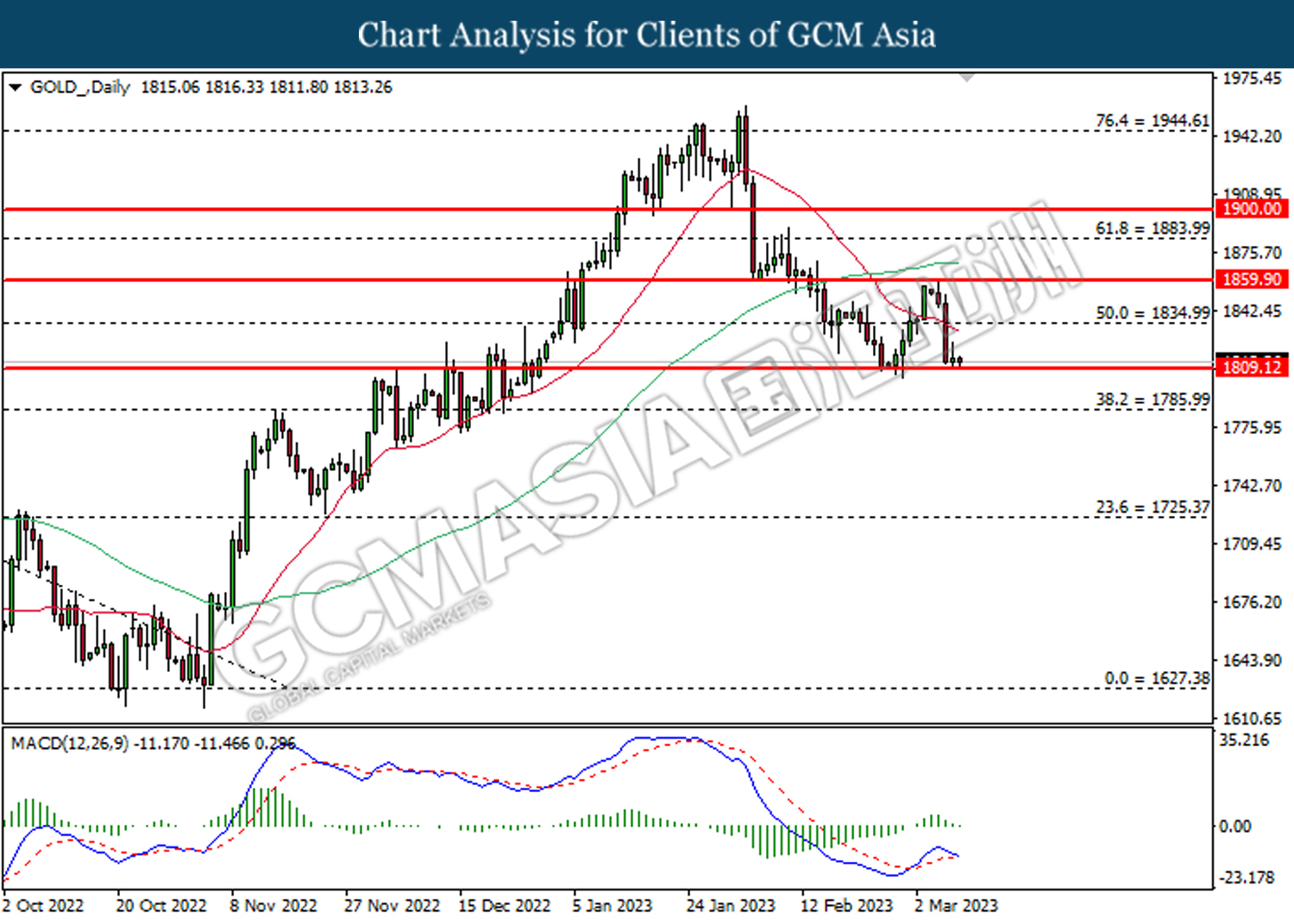

In the commodities market, crude oil prices edged up 0.20% to $76.55 per barrel after extending its losses yesterday amid the further rally in US dollar market. Besides, gold prices edged down -0.04% to $1813.05 per troy ounce amid the dollar index strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 21:30 | USD – Initial Jobless Claims | 190K | 195K | – |

Technical Analysis

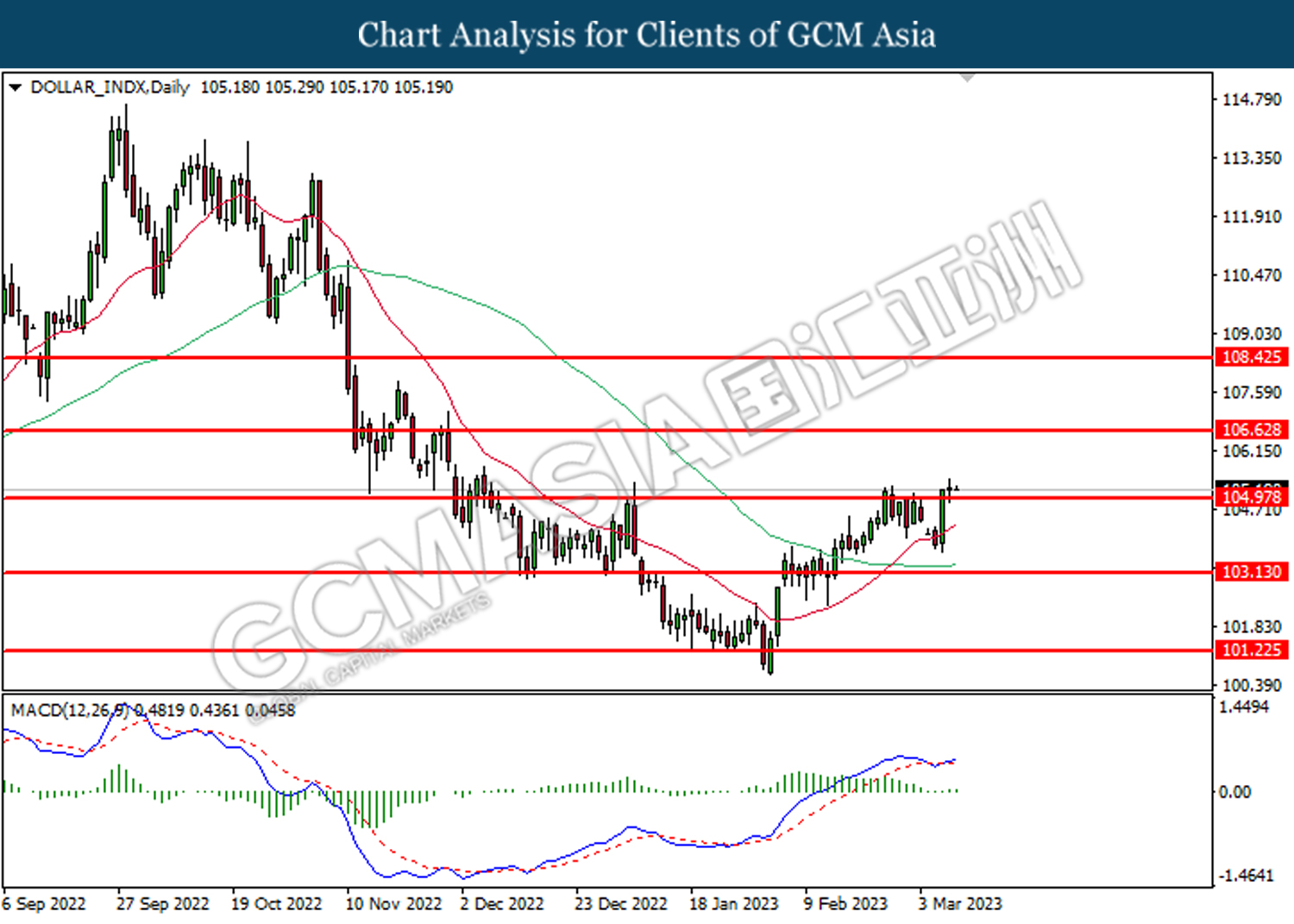

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior breakout above the previous resistance level at 105.00. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 106.65.

Resistance level: 106.65, 108.45

Support level: 105.00, 103.15

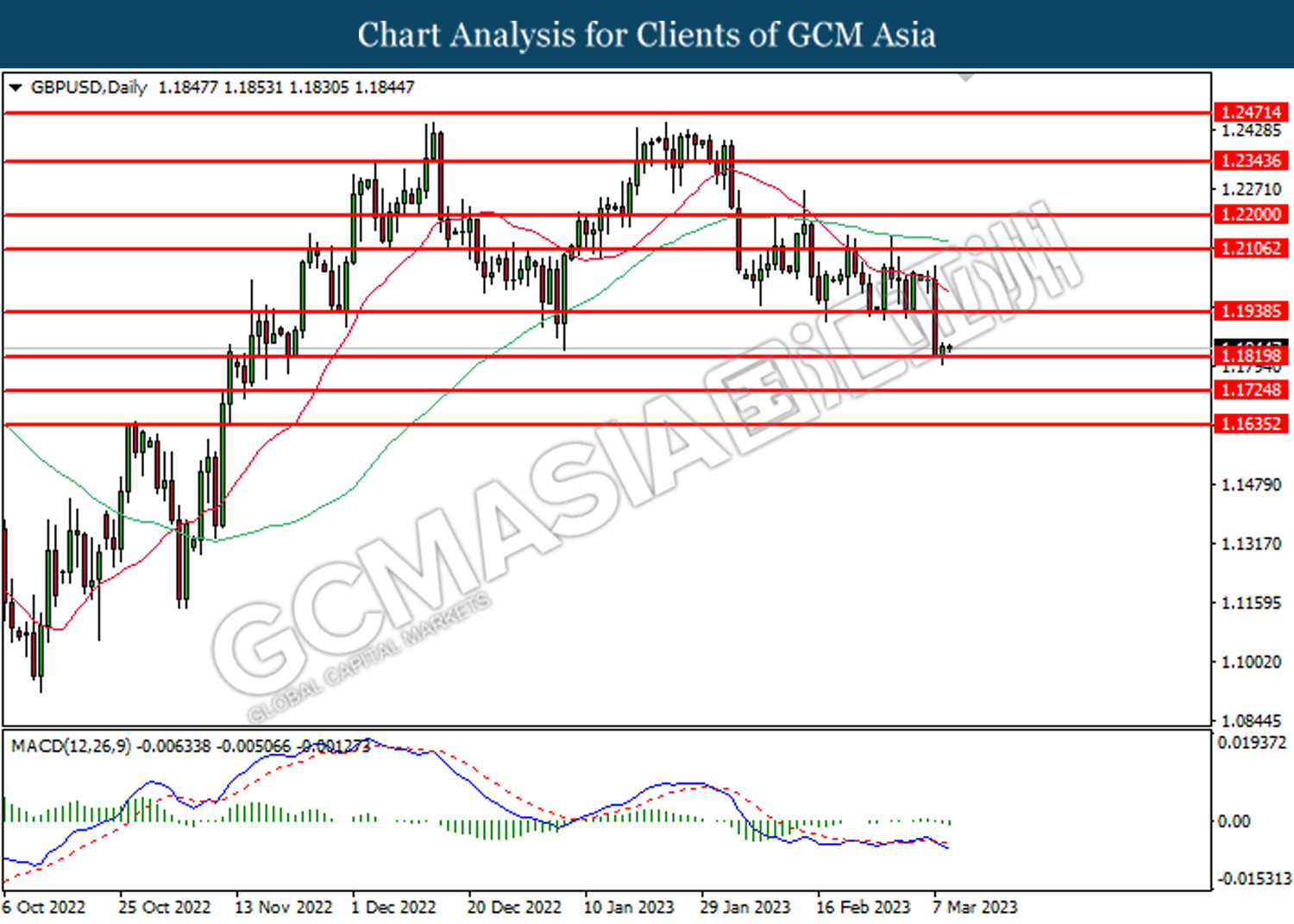

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.1820. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1940, 1.2105

Support level: 1.1820, 1.1725

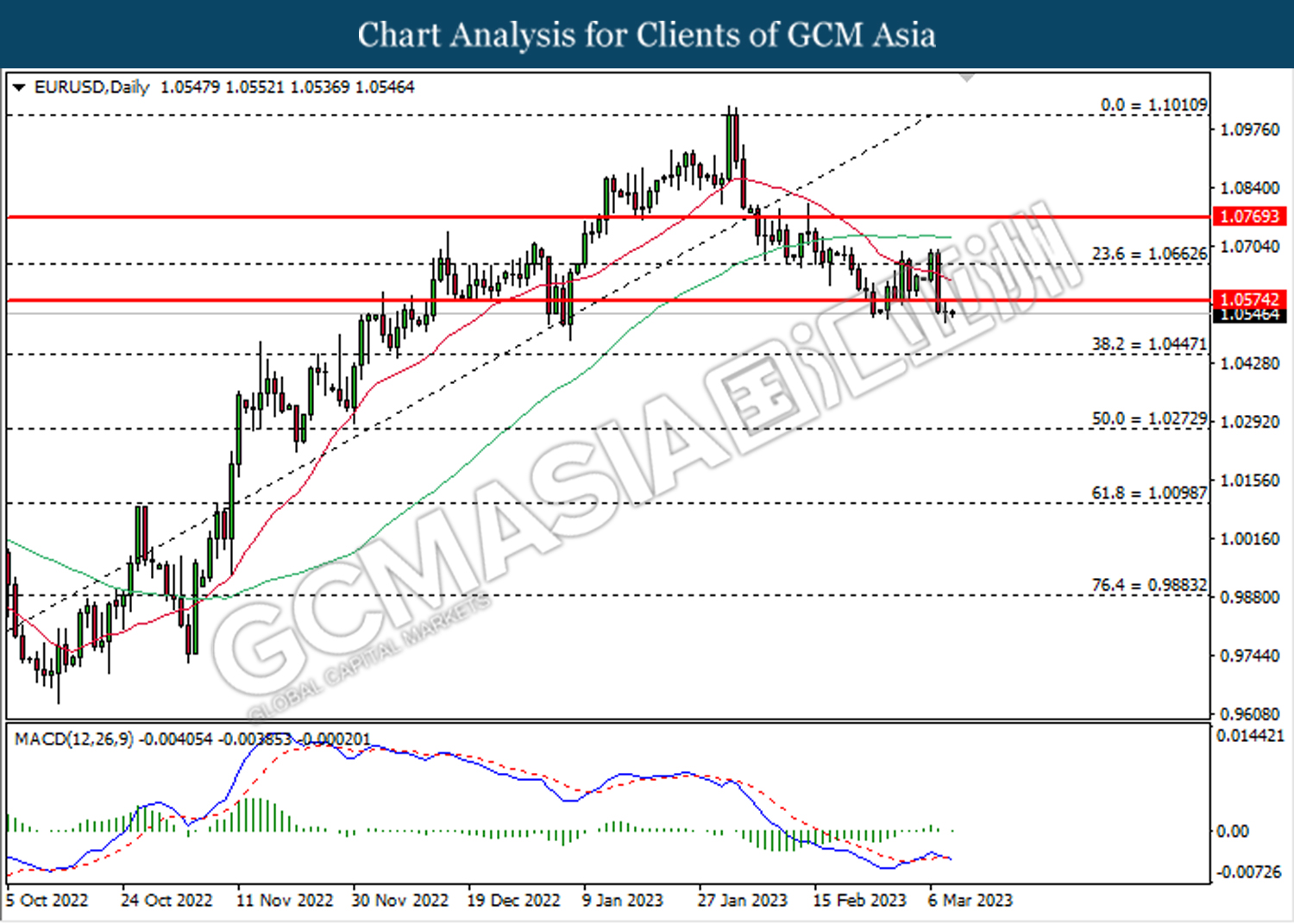

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0445.

Resistance level: 1.0575, 1.0665

Support level: 1.0445, 1.0275

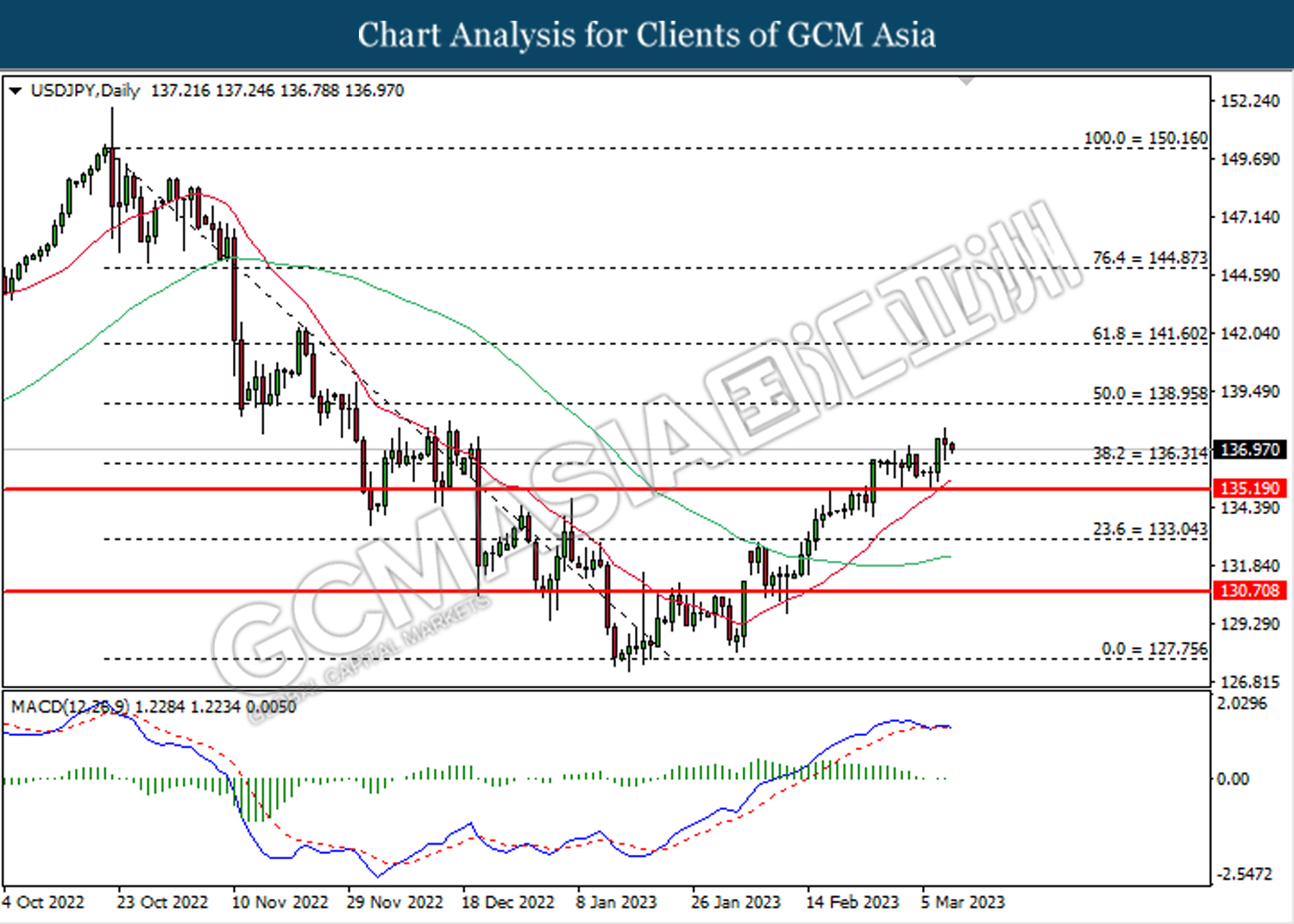

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 136.30. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

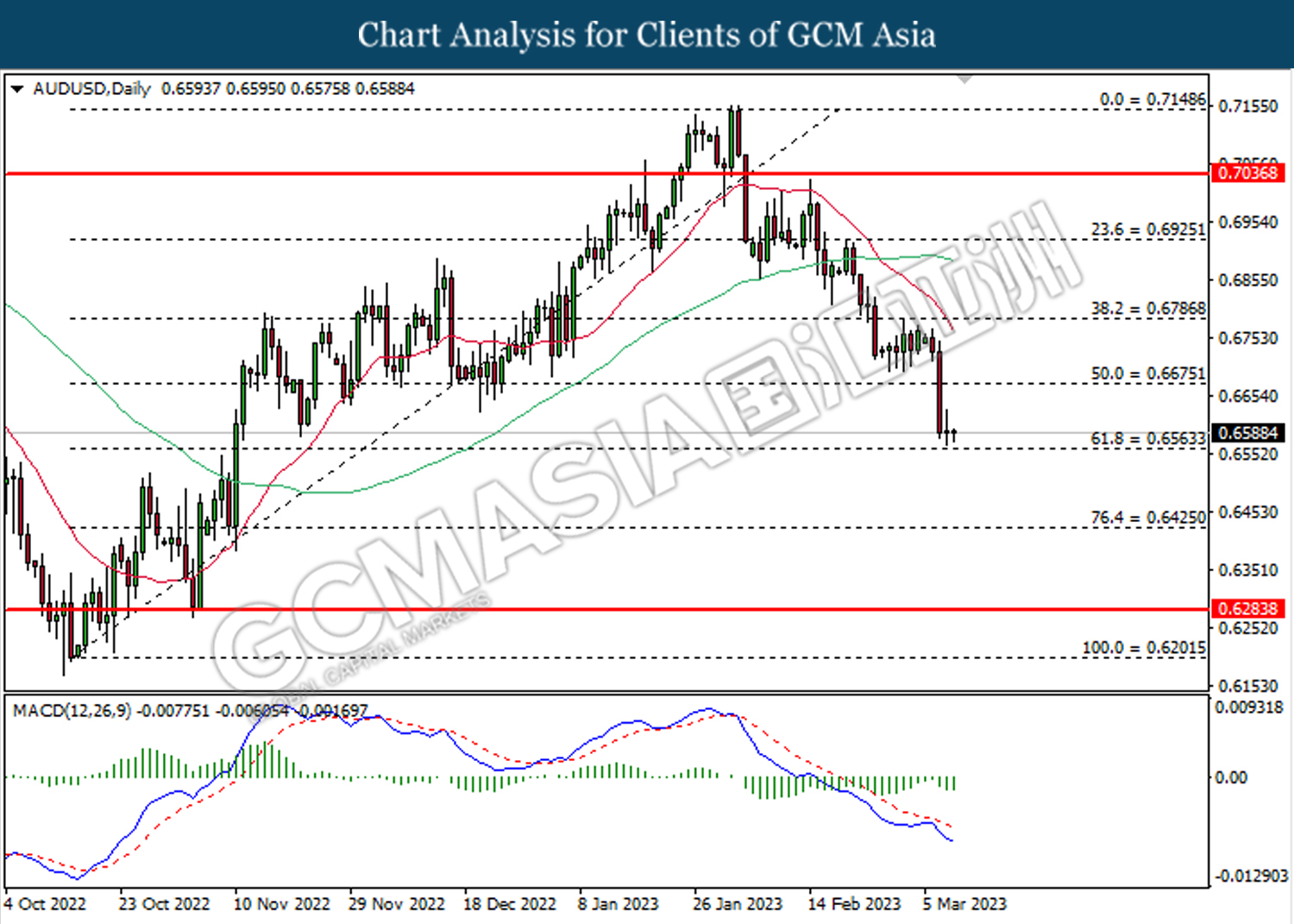

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

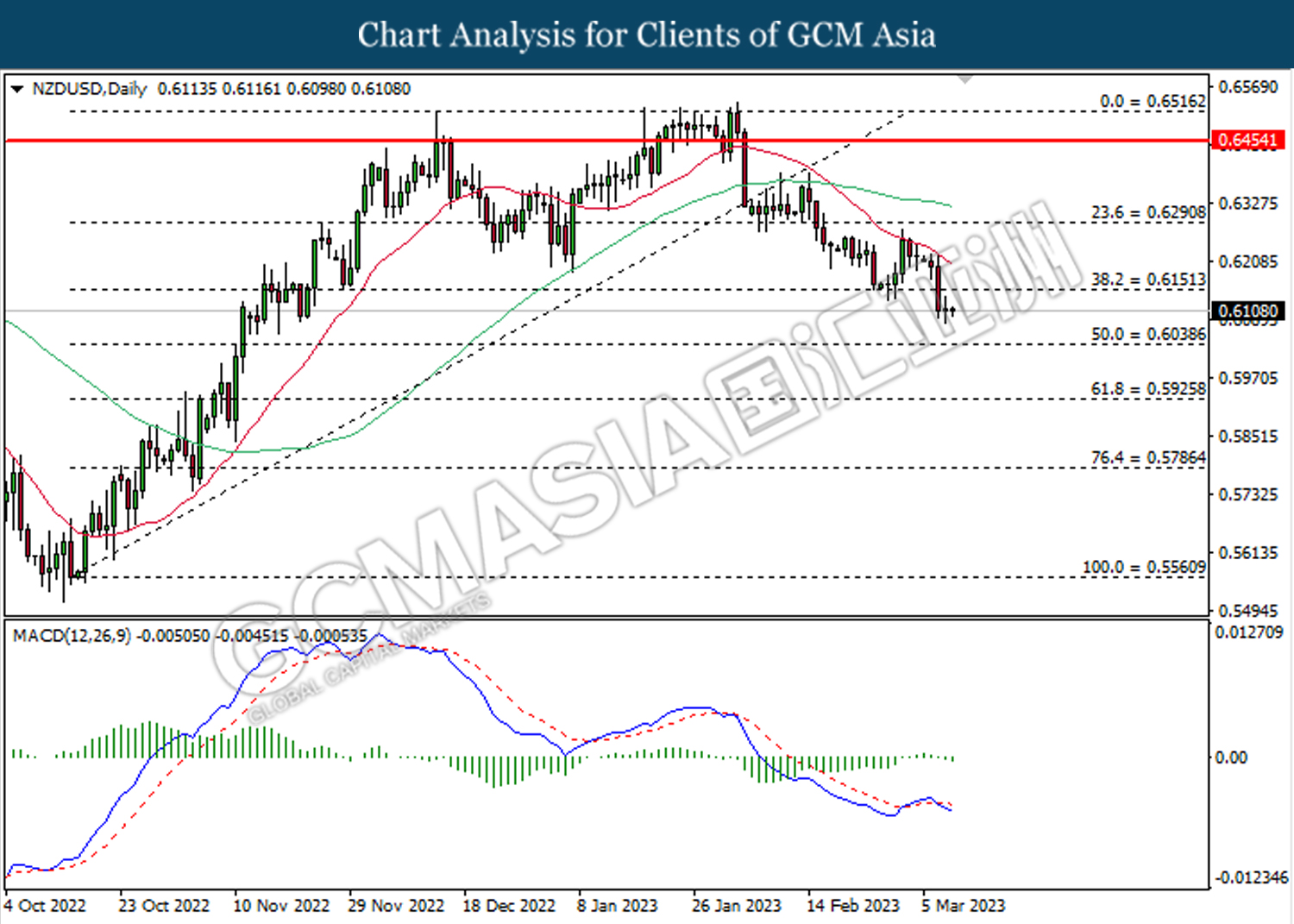

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3730. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3830.

Resistance level: 1.3830, 1.3880

Support level: 1.3730, 1.3635

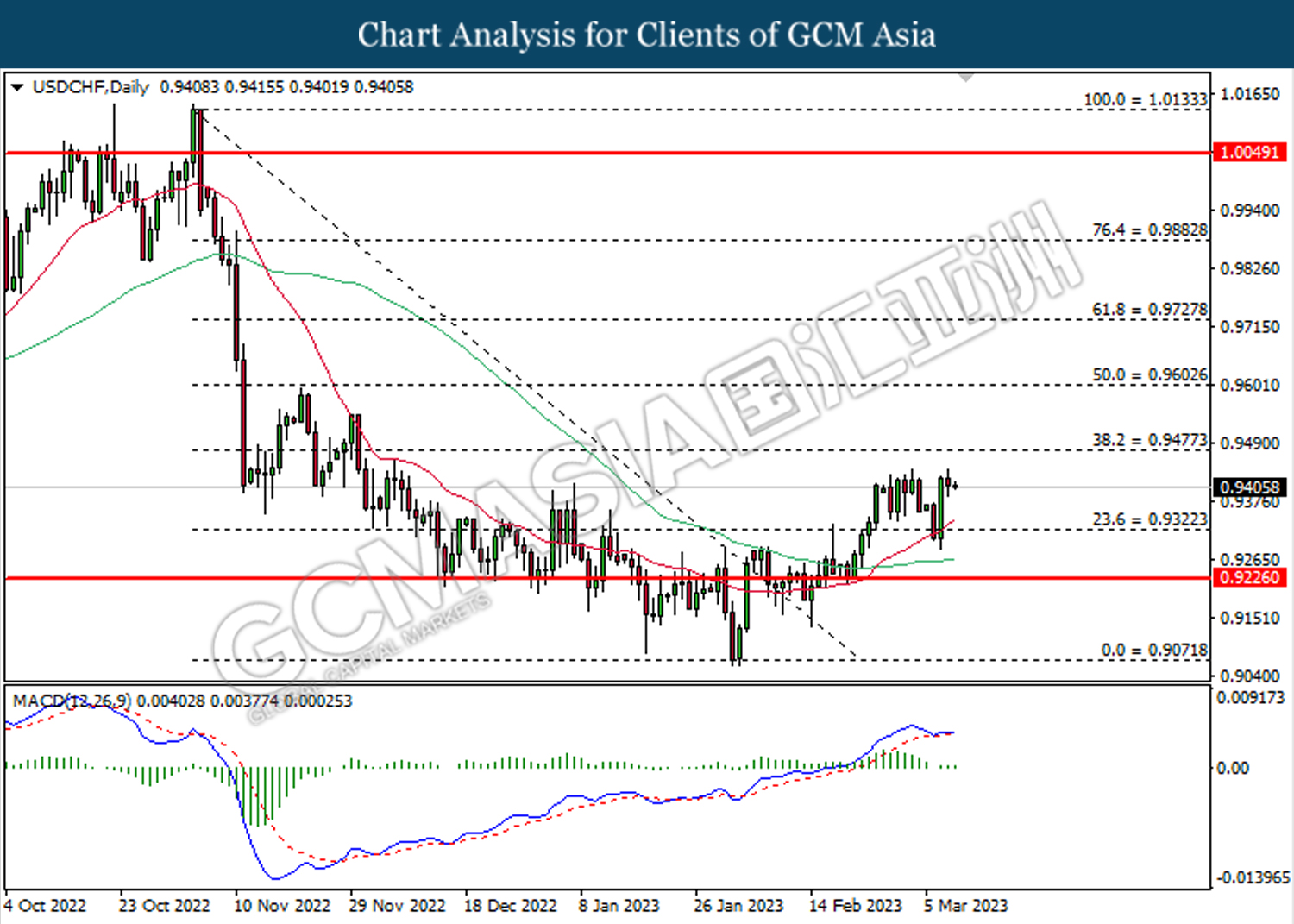

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.9320. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9475.

Resistance level: 0.9475, 0.9605

Support level: 0.9320, 0.9225

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 81.70. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 76.10.

Resistance level: 81.70, 83.55

Support level: 76.10, 71.65

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1809.10. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1835.00, 1859.90

Support level: 1809.10, 1786.00