10 March 2023 Afternoon Session Analysis

Japanese Yen dive as interest rate remains unchanged.

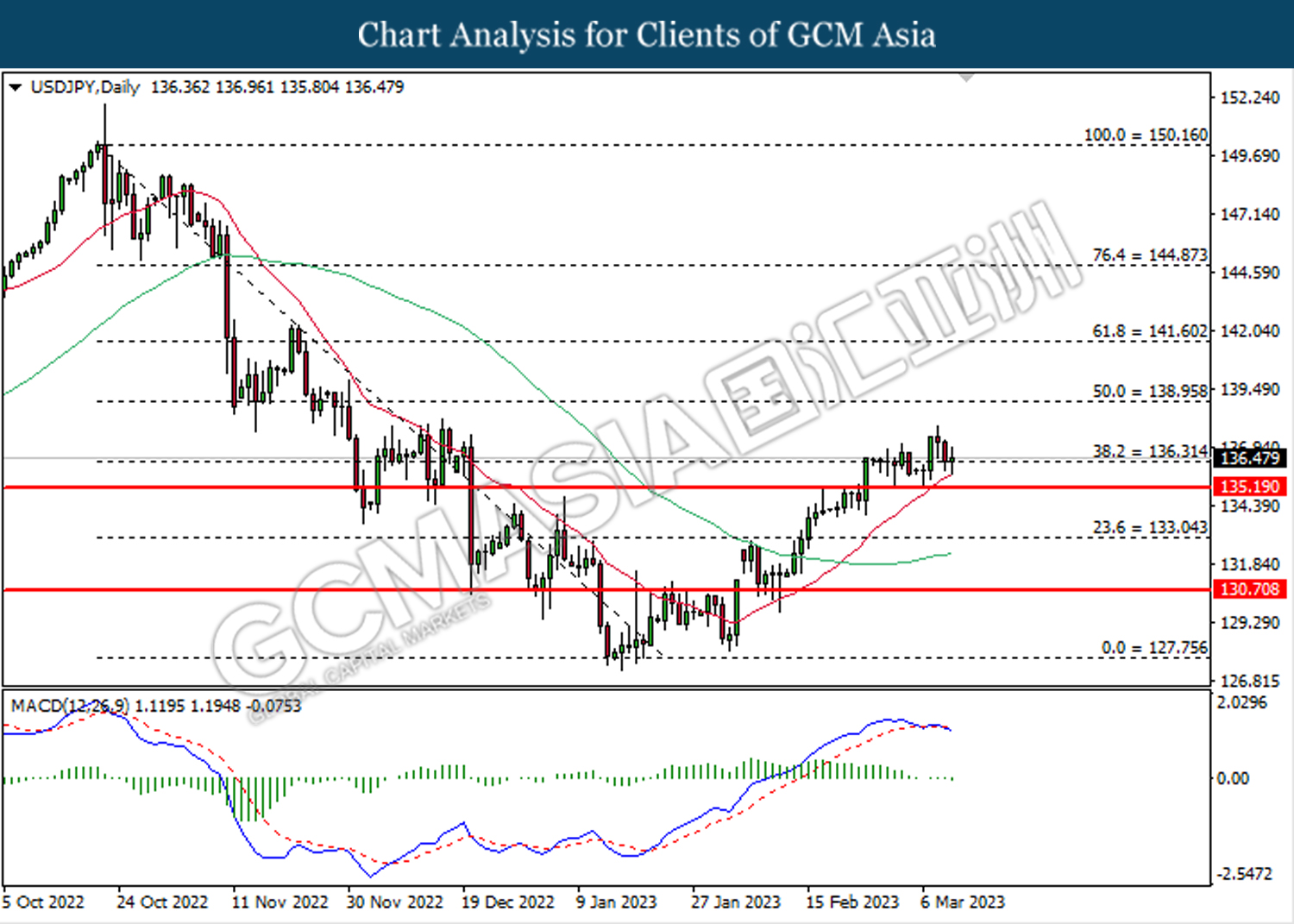

The Japanese Yen, which is majorly traded by global investors, plummeted significantly after the Bank of Japan (BoJ) decided to hold its interest rate at the negative territory unchanged at -0.10%. In the early meeting, the board of members agreed to maintain its ultra-easing monetary policy while vowing to purchase the necessary amount of Japanese Government Bonds (JGBs) to support the economy. However, market participants see some light at the end of the tunnel as BoJ revealed that the Japan’s economy has started to picking up, and it is expected to recover strongly from the pandemic and constraints of supply. On top of that, BoJ also admitted that their expectations over the inflationary pressure are rising, while the Core CPI is hovering near the level at 4%. Nonetheless, the rising inflationary expectations did not triggered a large buying momentum in the Japanese Yen market as the majority investors are foreseeing the next BoJ Governor to have no major changes on the ultra-easing monetary policy. As of writing, the pair of USD/JPY rose 0.24% to 136.45.

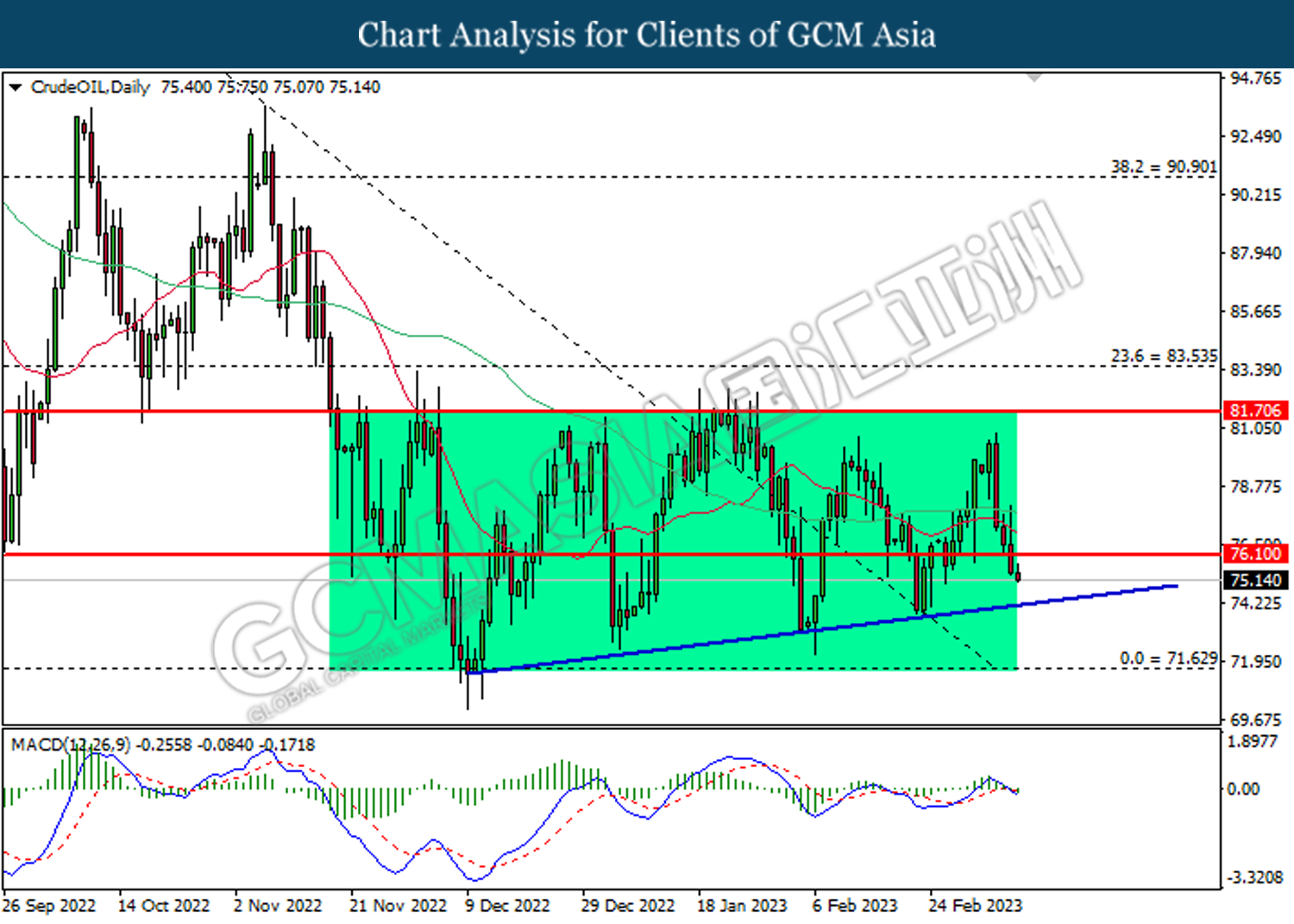

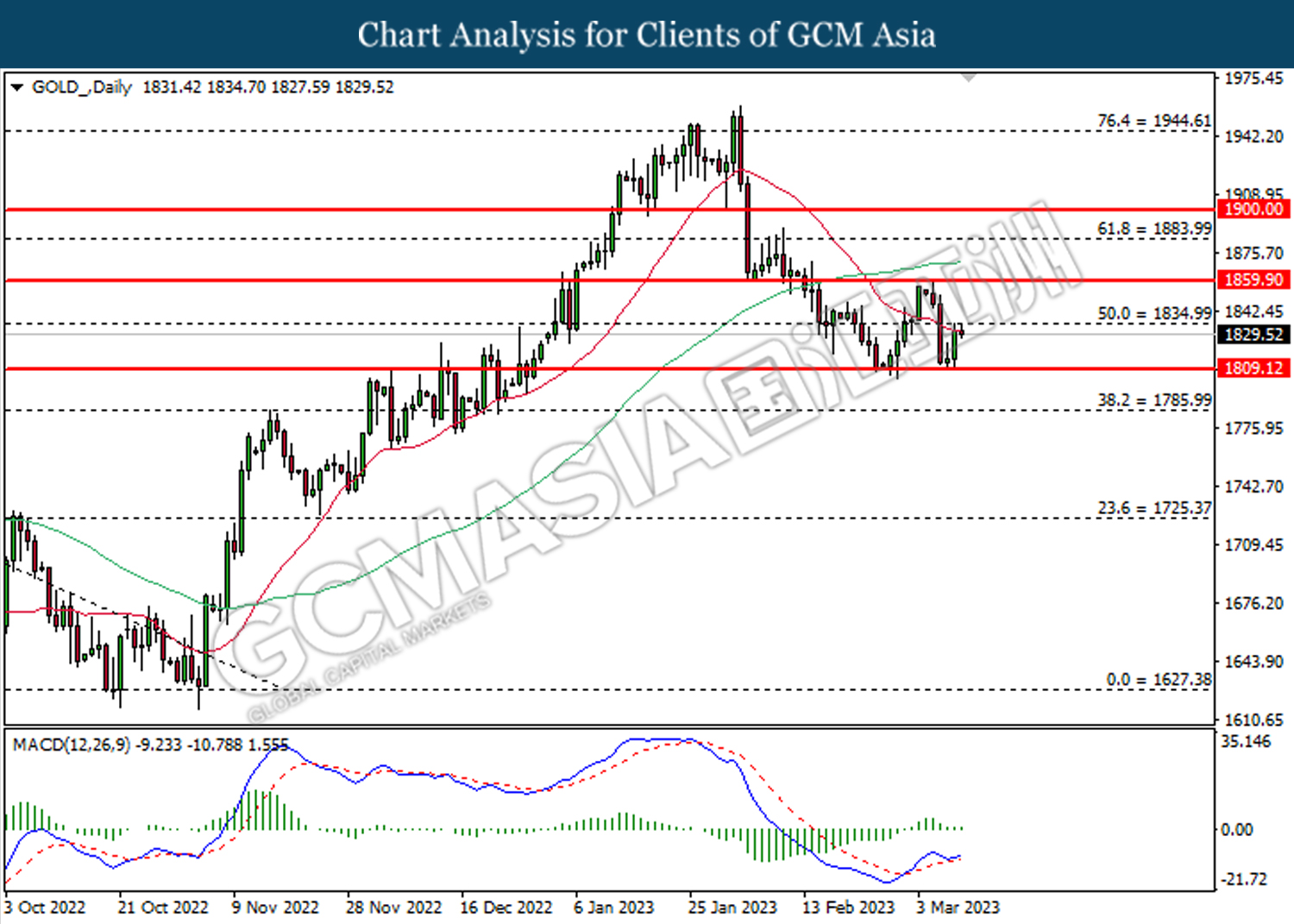

In the commodities market, crude oil prices edged down -0.52% to $75.15 per barrel as the rising expectation over the aggressive rate hike plan in US trimmed the appeal of oil products. Besides, gold prices edged down -0.10% to $1829.15 per troy ounce following the release of downbeat Initial Jobless Claims.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:00 | GBP – GDP (MoM) (Jan) | -0.50% | 0.10% | – |

| 15:00 | GBP – Manufacturing Production (MoM) (Jan) | 0.00% | -0.20% | – |

| 15:00 | GBP – Monthly GDP 3M/3M Change (Jan) | -0.30% | -0.10% | – |

| 15:00 | EUR – German CPI (YoY) (Feb) | 8.70% | 8.70% | – |

| 21:30 | USD – Nonfarm Payrolls (Feb) | 517K | 200K | – |

| 21:30 | USD – Unemployment Rate (Feb) | 3.40% | 3.40% | – |

| 21:30 | CAD – Employment Change (Feb) | 150.0K | 10.0K | – |

Technical Analysis

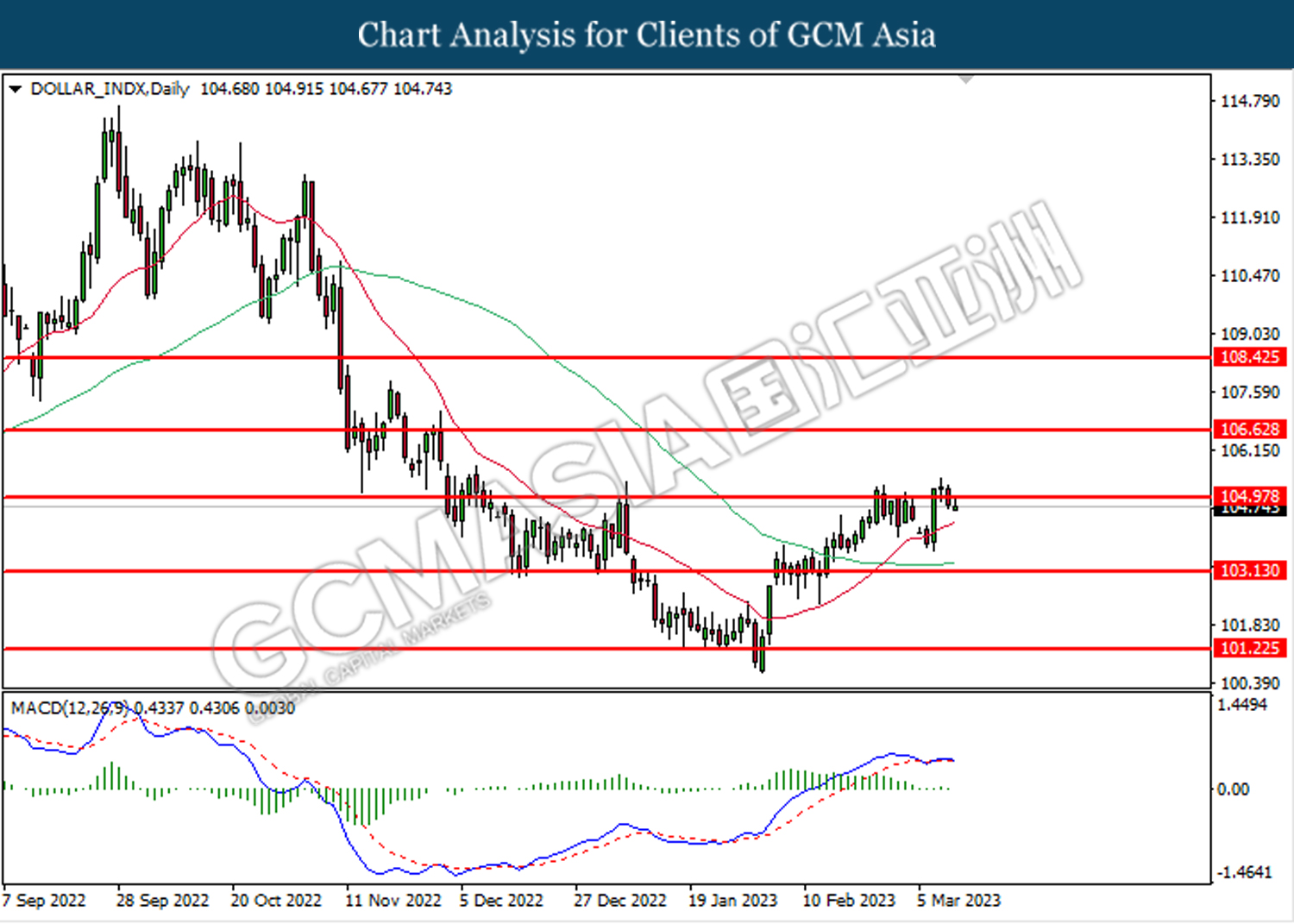

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

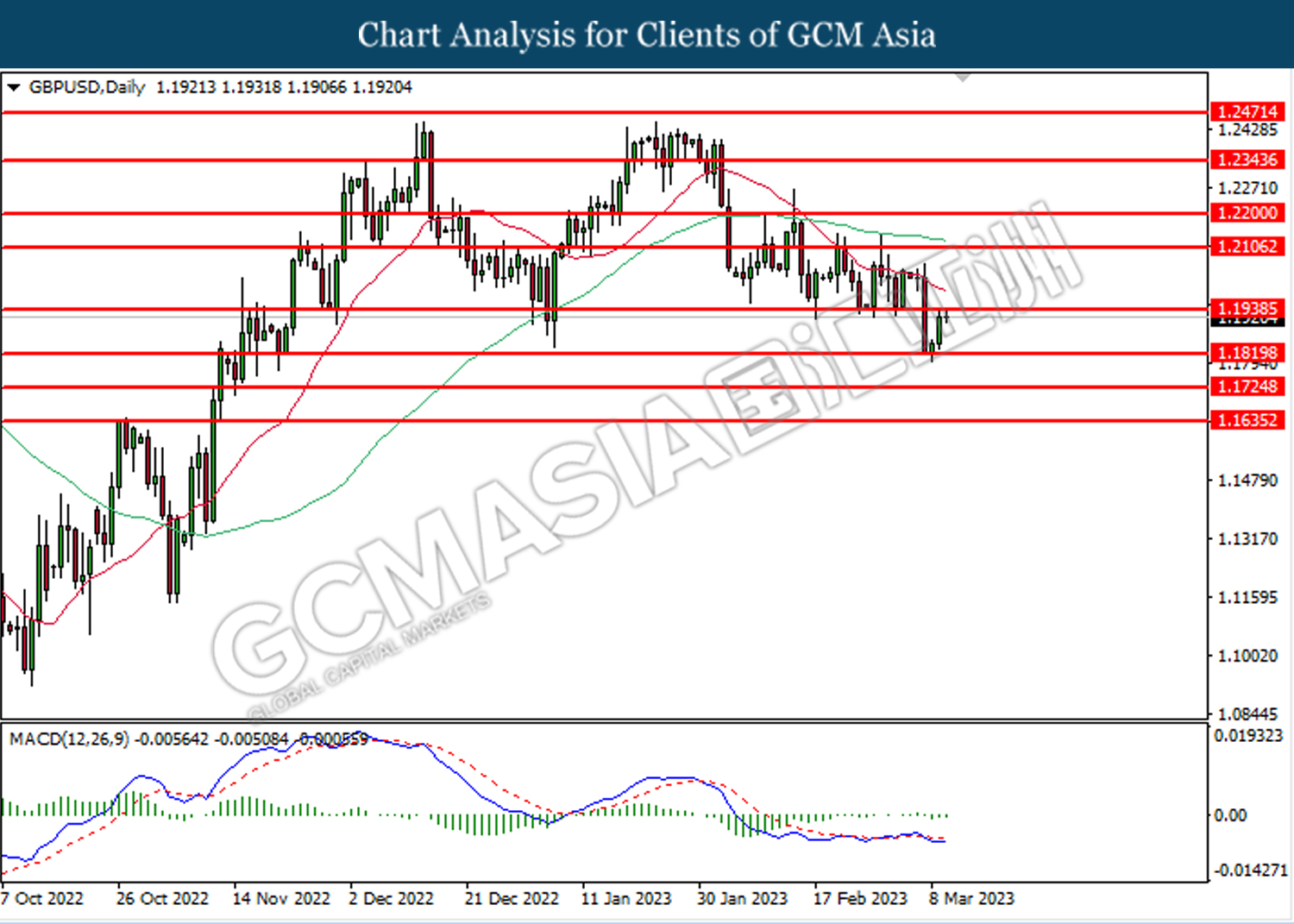

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1940, 1.2105

Support level: 1.1820, 1.1725

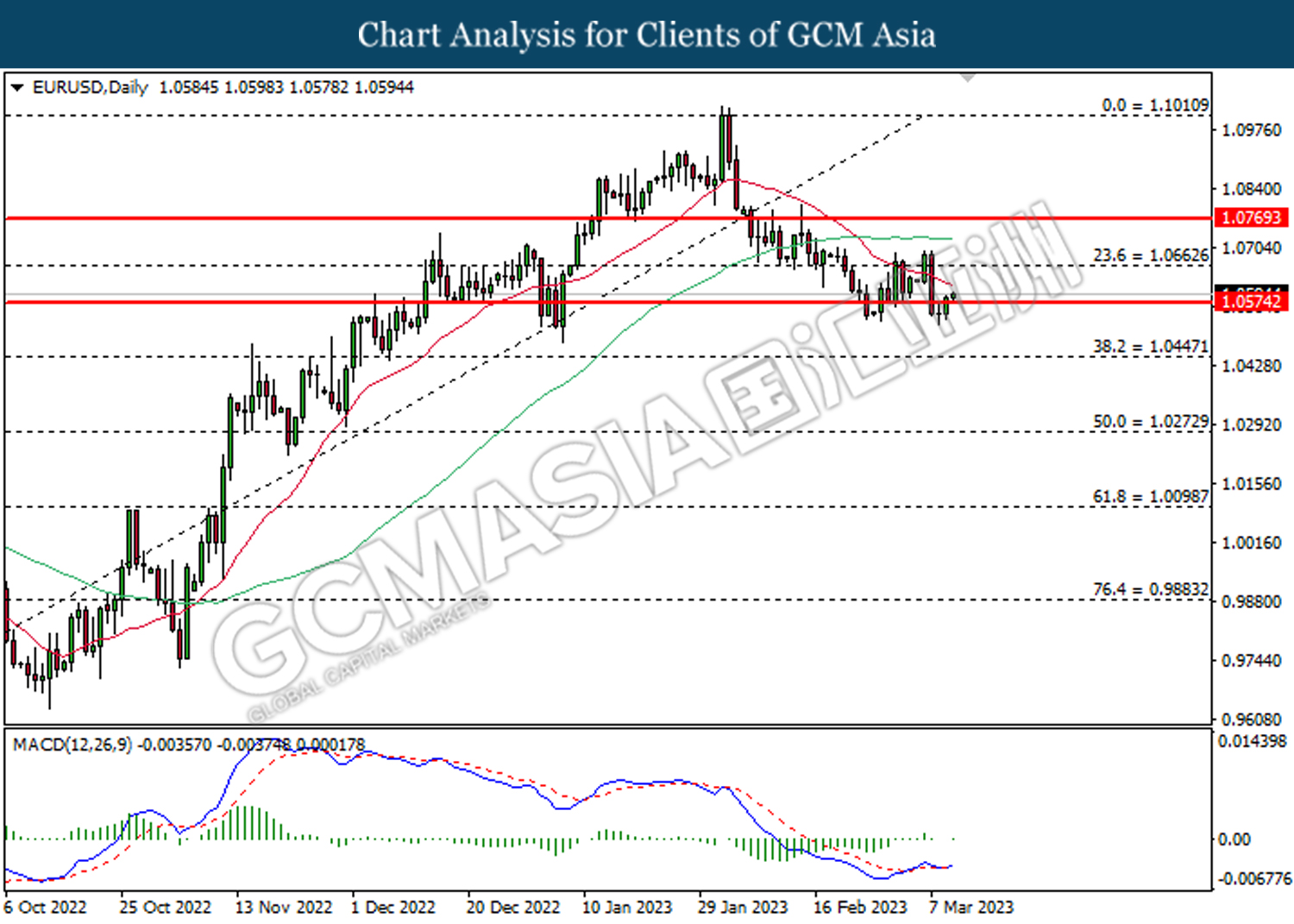

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0575. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0665.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.30. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

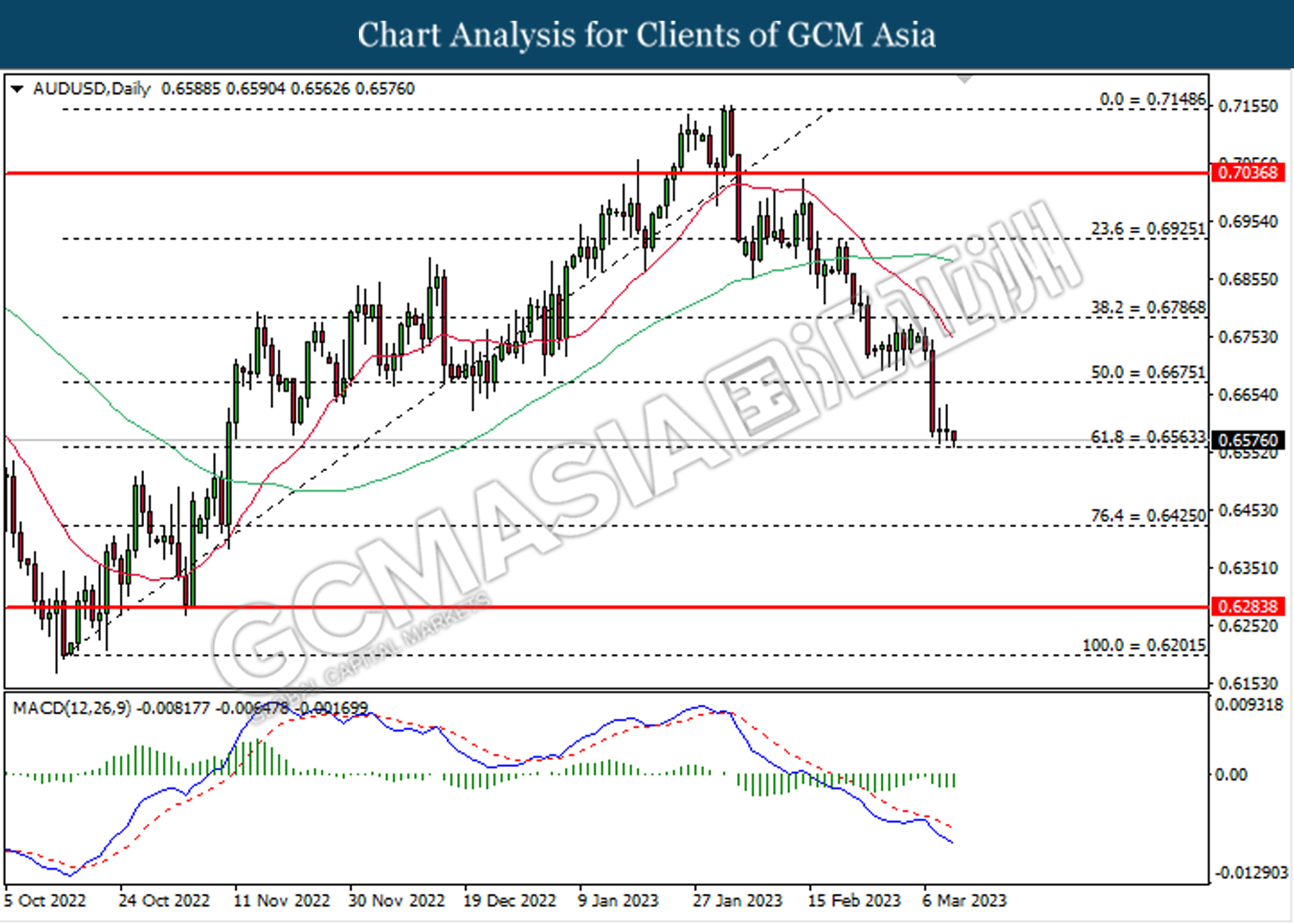

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6565. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

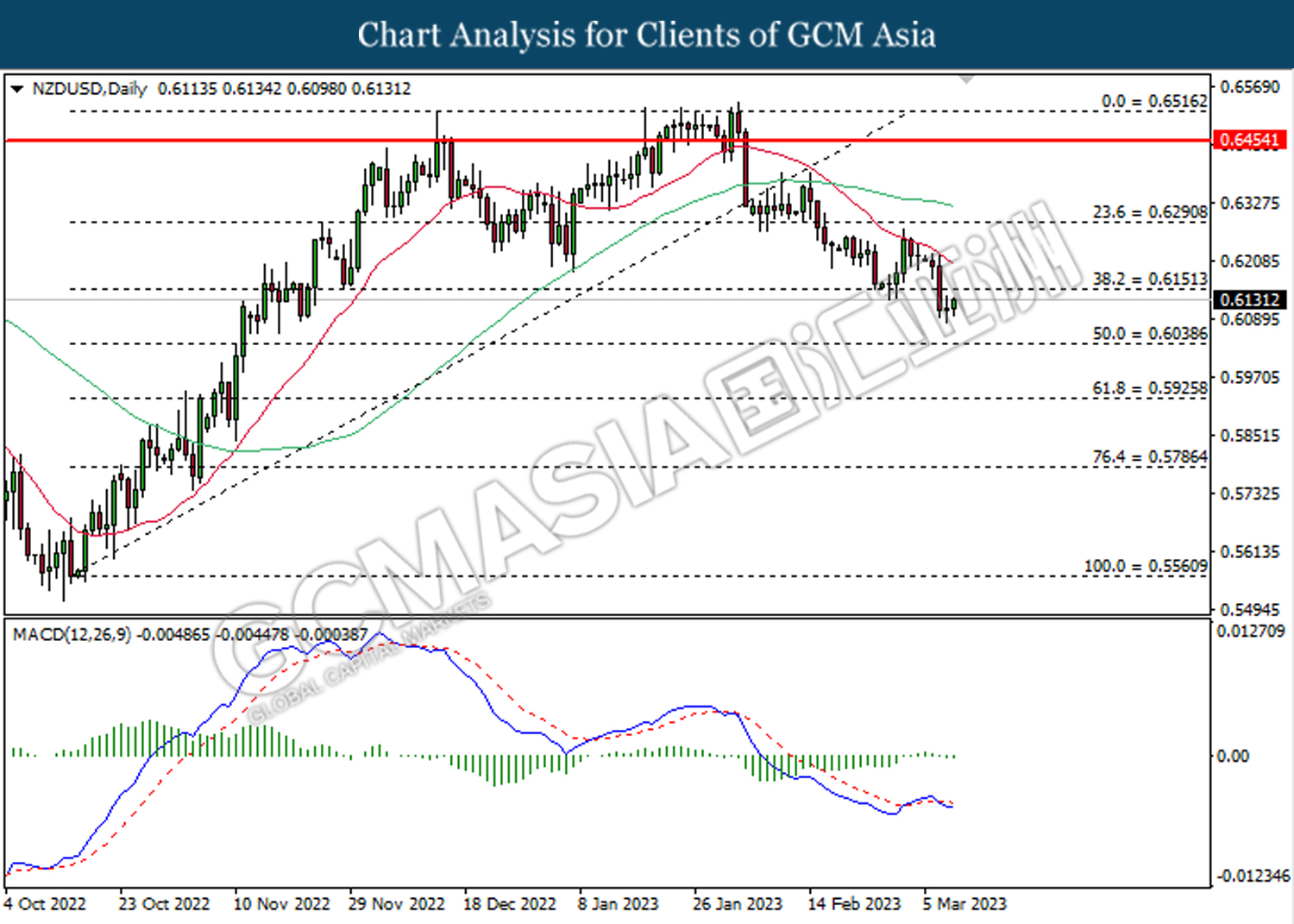

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6150. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

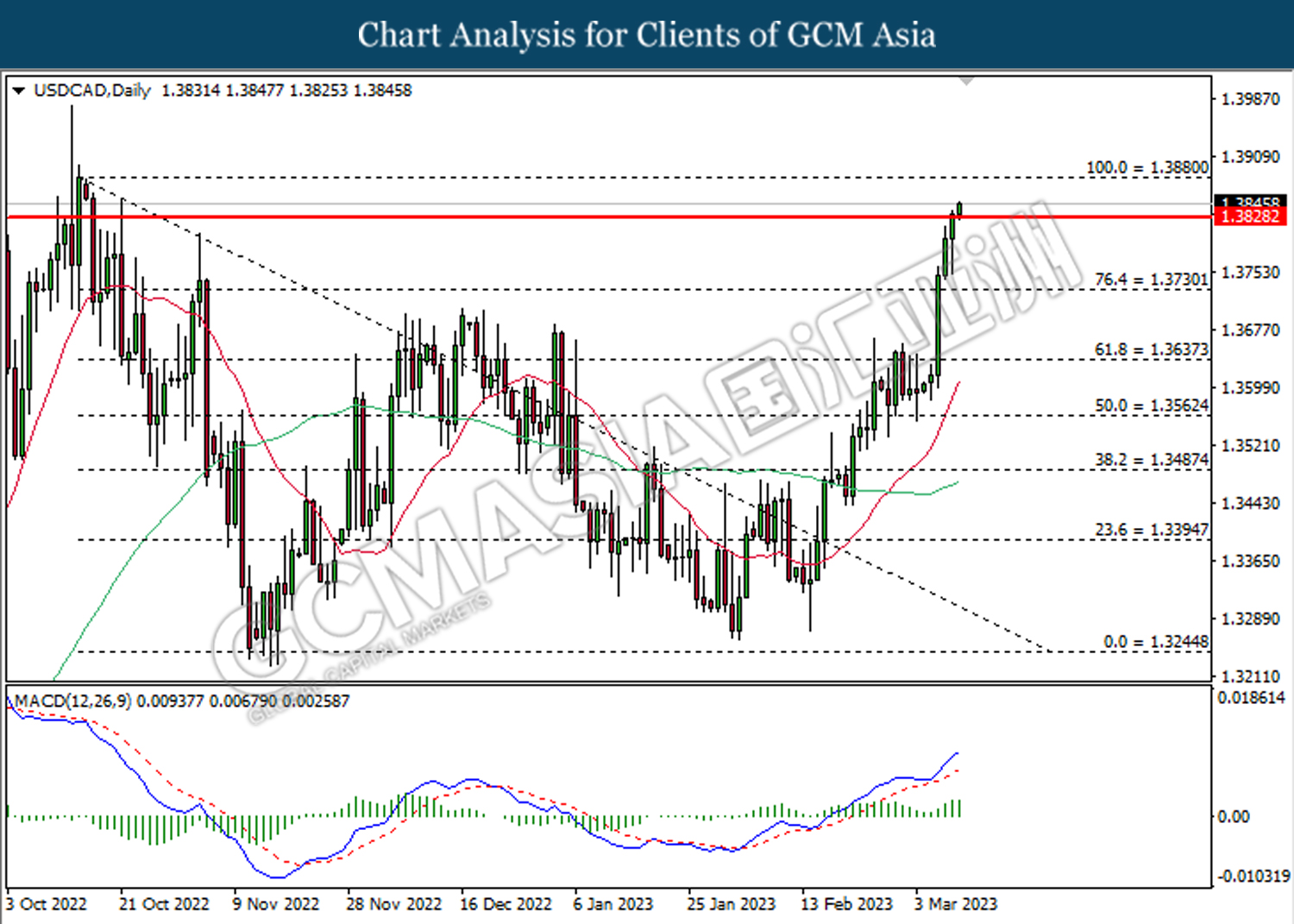

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3830. MACD which illustrated bullish bias momentum suggests the pair to extend its gains toward the resistance level at 1.3880.

Resistance level: 1.3880, 1.4000

Support level: 1.3830, 1.3730

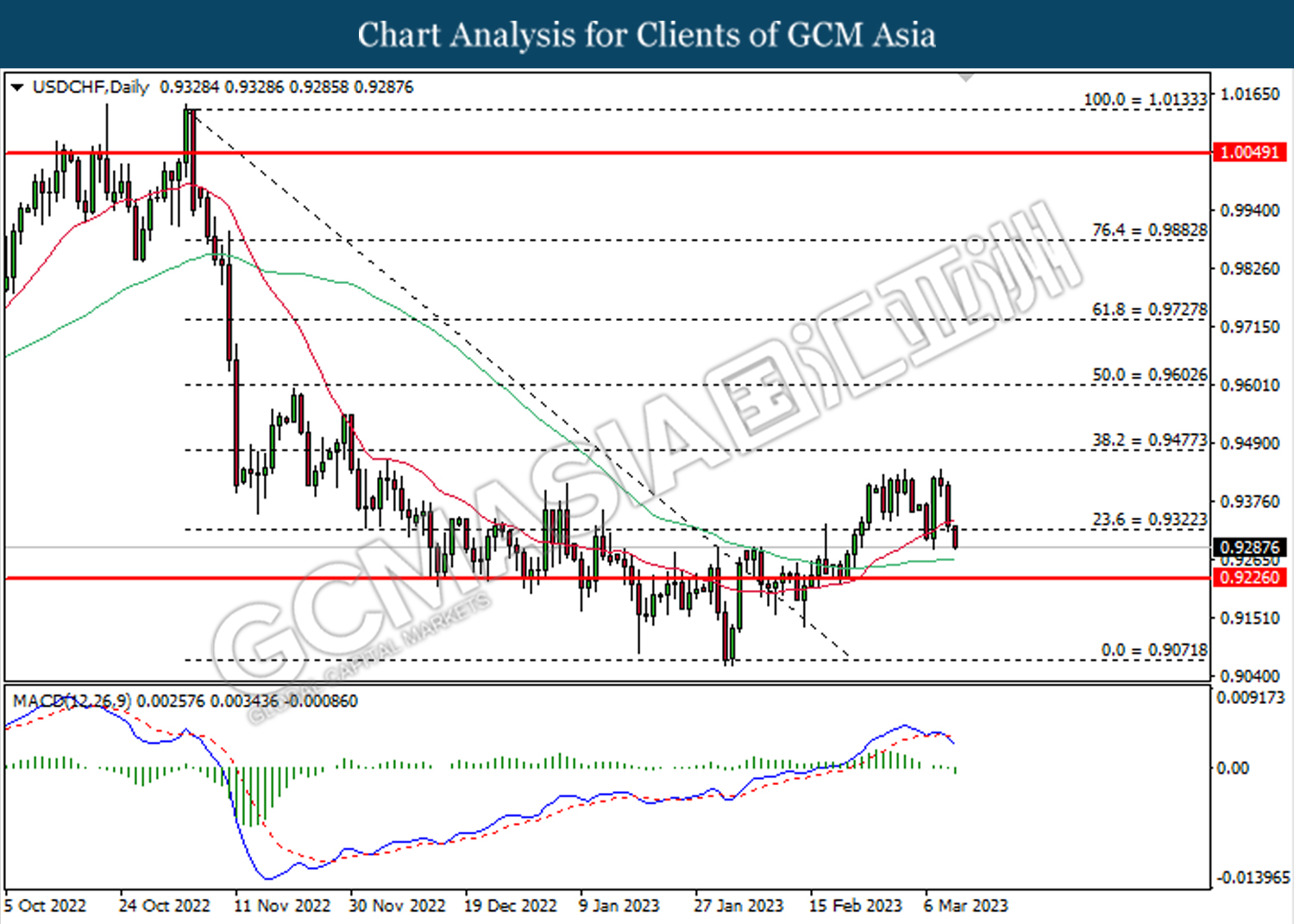

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9320. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9225.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.65.

Resistance level: 76.10, 81.70

Support level: 71.65, 66.10

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1835.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1835.00.

Resistance level: 1835.00, 1859.90

Support level: 1809.10, 1786.00