23 July 2018 Weekly Analysis

GCMAsia Weekly Report: July 23 – 27

Market Review (Forex): July 16 – 20

US Dollar

Greenback tumbles further last Friday following US President Donald Trump accusation on China and European Union over the manipulation of currencies and interest rates. Dollar index fell 0.71% against a basket of six major peers while closing the week at 94.48.

Subsequent to the latest tit-for-tat in trade war between US and other major economies, President Trump came under the spotlight again after accusing China and European Union of manipulation their interest rates and currency exchange rate. Following his comment, Chinese yuan plunged to its lowest level in a year while bullish bets on the greenback was reduced due to higher risk aversion in the market.

According to news outlet Reuters, Treasury Secretary Steven Mnunchin said last Friday that the US is closely monitoring whether China has manipulated their foreign exchange rate. The Treasury’s next semi-annual FX policy report will detail further measures taken by the government that may impose designation upon China as one of the currency manipulators.

The latest “currency war” saga has sparked market unrest as investors has yet to recover from the major “trade war” between the States and Beijing. According to analysts, the greenback may likely to continue its bearish momentum for the time being as investors digest Trump’s latest accusation, backing out of long dollar position for the time being.

USD/JPY

Pair of USD/JPY plunged 0.88%, ended the week around 111.47 following higher demand for safe-haven assets.

EUR/USD

Euro gained 0.67% to $1.1721 against the US dollar. Large selloff on the greenback was evoked following Trump’s accusation of currency manipulation in the FX market.

GBP/USD

Pound sterling rose 0.89%, closing the week above the threshold of 1.3000 at around $1.3130 against the greenback.

Market Review (Commodities): July 16 – 20

GOLD

Gold price extended its recovery from its prior session low as market demand for safe-haven asset arises following US President Donald Trump accusation of currency manipulation in the FX market. Price of the yellow metal rose 0.73% or $8.93 to $1,231.77 a troy ounce.

Risk aversion among market participants was catalyzed after Trump accuses EU and China of manipulating their FX rates by adjusting their interest rates. In addition, gold price receives further bullish support after Trump took to Twitter to express his concern about a stronger US dollar which he said, “may take away our big competitive edge”.

Crude Oil

Crude oil price settled higher on Friday, supported by a weaker dollar and signs of US output tightening in the United States. Price of the black commodity rose 0.07%, closing the week at around $69.47 per barrel.

According to oilfield services firm Baker Hughes, the number of active oil drilling rigs in the US fell by 5 to ta total of 858. The report has recorded its first weekly decline in nearly a month, pointing towards signs of supply tightening from the US.

In addition, the report was released at a time when investors continue to weigh the prospect of global oil shortage following Saudi Arabia’s pledge to restrict their daily crude output. According to OPEC Governor Adeeb Al-Aama, he expects crude exports from Saudi Arabia to fell by 100,000 barrels per day in August as it limits excess production.

Similarly, crude oil prices were also supported by a weaker dollar following US President Donald Trump’s accusation upon EU and China over FX manipulation and recent dissatisfaction over the Federal Reserve’s rate hike plans.

Weekly Outlook: July 23 – 27

For the week ahead, investors will place their attention European Central Bank monetary policy meeting as it may provide further signals with regards to future monetary policy stance.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: July 23 – 27

| Monday, July 23 |

Data CAD – Wholesale Sales (MoM) (May) USD – Existing Home Sales (Jun)

Events N/A

|

| Tuesday, July 24 |

Data EUR – German Manufacturing PMI (Jul) EUR – Manufacturing PMI (Jul) EUR – Markit Composite PMI (Jul) EUR – Services PMI (Jul) USD – Manufacturing PMI (Jul) USD – Services PMI (Jul)

Events N/A

|

| Wednesday, July 25 |

Data CrudeOIL – API Weekly Crude Oil Stock NZD – Employment Change (QoQ) (Q2) AUD – CPI (QoQ) (Q2) EUR – German Ifo Business Climate Index GBP – Gross Mortgage Approvals USD – New Home Sales (Jun) CrudeOIL – Crude Oil Inventories

Events N/A

|

| Thursday, July 26 |

Data EUR – GfK German Consumer Climate (Aug) EUR – Deposit Facility Rate EUR – ECB Marginal Lending Facility EUR – ECB Interest Rate Decision (Jul) USD – Core Durable Goods Orders (MoM) (Jun) USD – Initial Jobless claims USD – Goods Trade Balance (Jun)

Events EUR – ECB Press Conference

|

|

Friday, July 27

|

Data JPY – Tokyo Core CPI (YoY) (Jul) USD – GDP (QoQ) (Q2) USD – GDP Price Index (QoQ) (Q2) USD – Michigan Consumer Sentiment (Jul) CrudeOIL – US Baker Hughes Oil Rig Count

Events N/A

|

Technical Weekly Outlook: July 23 – 27

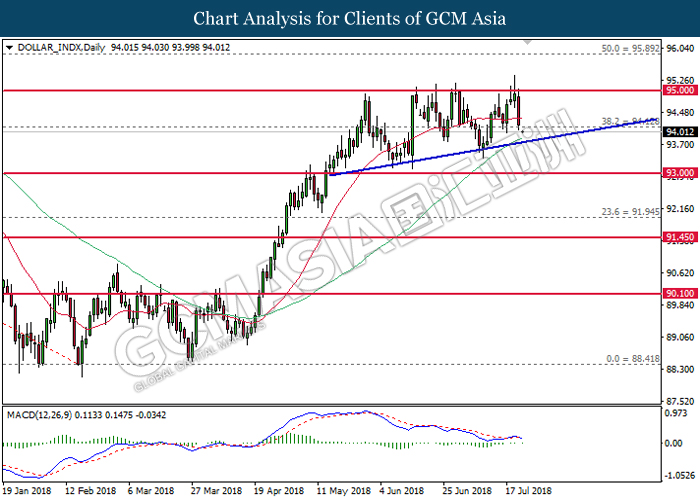

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retrace from the strong resistance at 95.00. MACD histogram which illustrate bearish signal suggests the index to advance further down in short-term, towards the bottom level of ascending triangle.

Resistance level: 94.10, 95.00

Support level: 93.00, 91.95

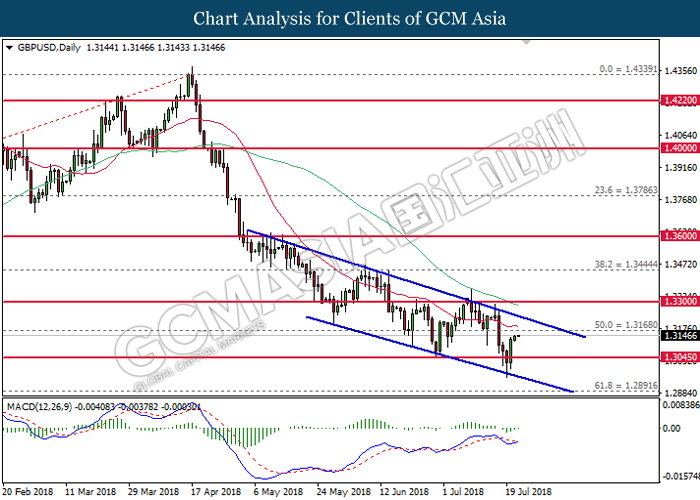

GBPUSD

GBPUSD, Daily: GBPUSD remains traded within a descending channel following prior rebound from the bottom level. MACD histogram which illustrate diminishing downward momentum suggests the pair to extend its gains in short-term, towards the upper level of the channel.

Resistance level: 1.3170, 1.3300

Support level: 1.3040, 1.2890

USDJPY

USDJPY, Daily: USDJPY plunged sharply following prior failure to break the resistance level at 113.30. MACD histogram which has formed a bearish signal suggests the pair to extend its losses after successfully breaking the ascending trendline and support near 111.00.

Resistance level: 112.10, 113.30

Support level: 111.00, 110.50

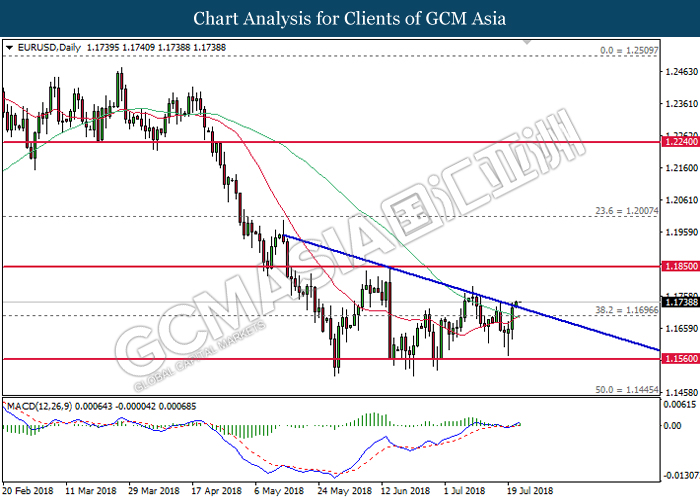

EURUSD

EURUSD, Daily: EURUSD was traded higher following prior breakout from the top level of descending triangle. Recent price action while coupled with MACD which illustrate bullish signal suggests the pair to extend its gains, towards the direction of next target near 1.1850.

Resistance level: 1.1850, 1.2000

Support level: 1.1700, 1.1560

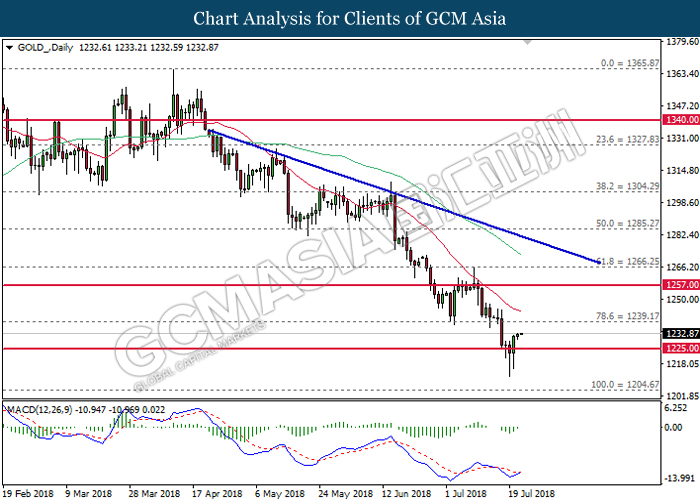

GOLD

GOLD_, Daily: Gold price extended gains following prior rebound near the support level at 1225.00. MACD histogram which illustrate positive divergence signal suggests the commodity price to advance further up in short-term, towards the next target near 1239.20.

Resistance level: 1239.20, 1257.00

Support level: 1225.00, 1204.70

Crude Oil

CrudeOIL, Daily: Crude oil price pared its losses following prior rebound from the support level near 66.40. MACD histogram which illustrate diminishing downward momentum suggests the commodity price to extend its gains after breaking the resistance of 68.40.

Resistance level: 68.40, 70.45

Support level: 66.40, 64.10