13 March 2023 Afternoon Session Analysis

Sterling rose after mixed economic data.

The Pound Sterling, one of the most traded currencies by global investors, rebounded from the November 2022 lows after mixed economic data was released. Data showed UK’s economy expanded 0.3% in January, out beat the market expectations of 0.1% growth. However, the manufacturing output in the UK showed contraction, where it came in at a reading lower than forecast, the Office for National Statistics announced. The gross domestic product growth of 0.3% was contributed by the start of the FIFA World Cup, which had supported consumption in the last quarter of 2022, but the manufacturing sector continues to shrink amid high inflation pressures and high energy prices. On the monetary policy front, the Bank of England (BoE) is expected to increase the cash rates by another 25 bps this month, an 11th consecutive rate hike, before the ending of tightening monetary policy. Besides, the reversal of the GBP/USD was also further boosted by the weakening position in the US dollar market after an unexpected increase in the US unemployment rate, and so increased the pressure on Fed to further tighten their monetary policy. As of writing, the GBP/USD edged up by 0.72% to $1.2117.

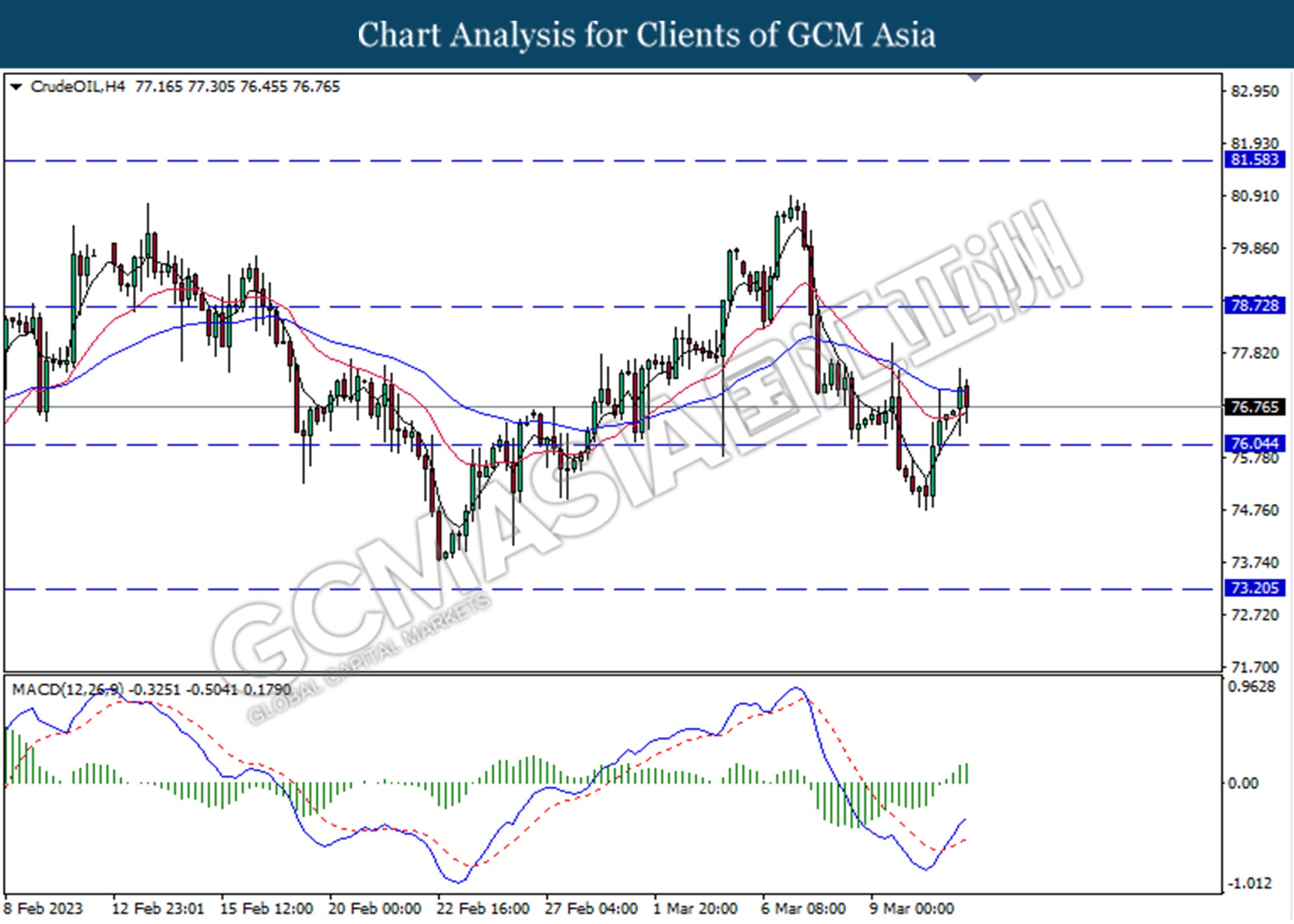

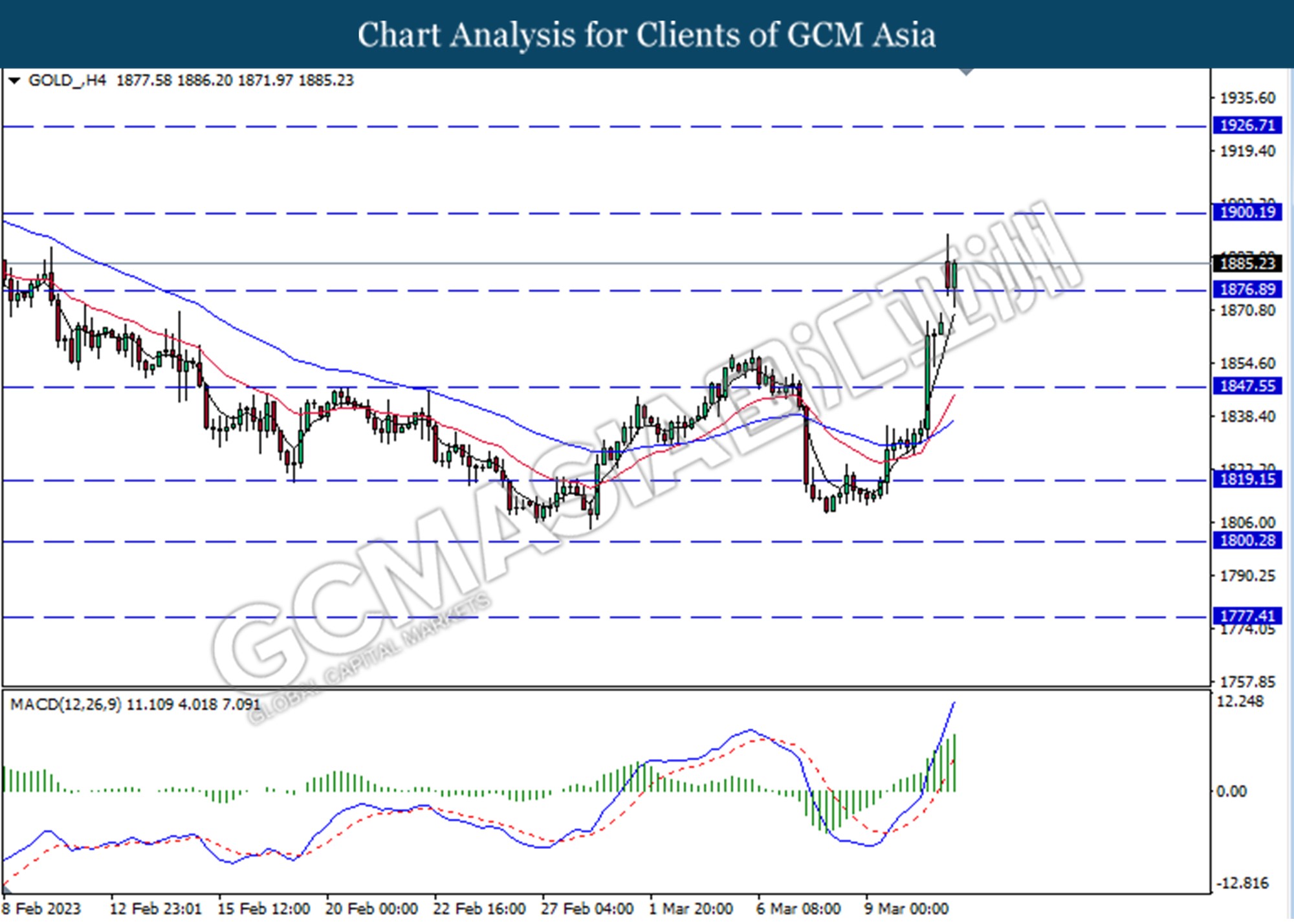

In the commodity market, the crude oil price appreciated by 0.44% to $77.03 per barrel as of writing following the banking crisis in the US has increased the expectation that Fed will soften its hawkish moves. On the other hand, the gold price rose by 1.01% to $1886.05 per troy ounce as of writing following the weakening of the US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

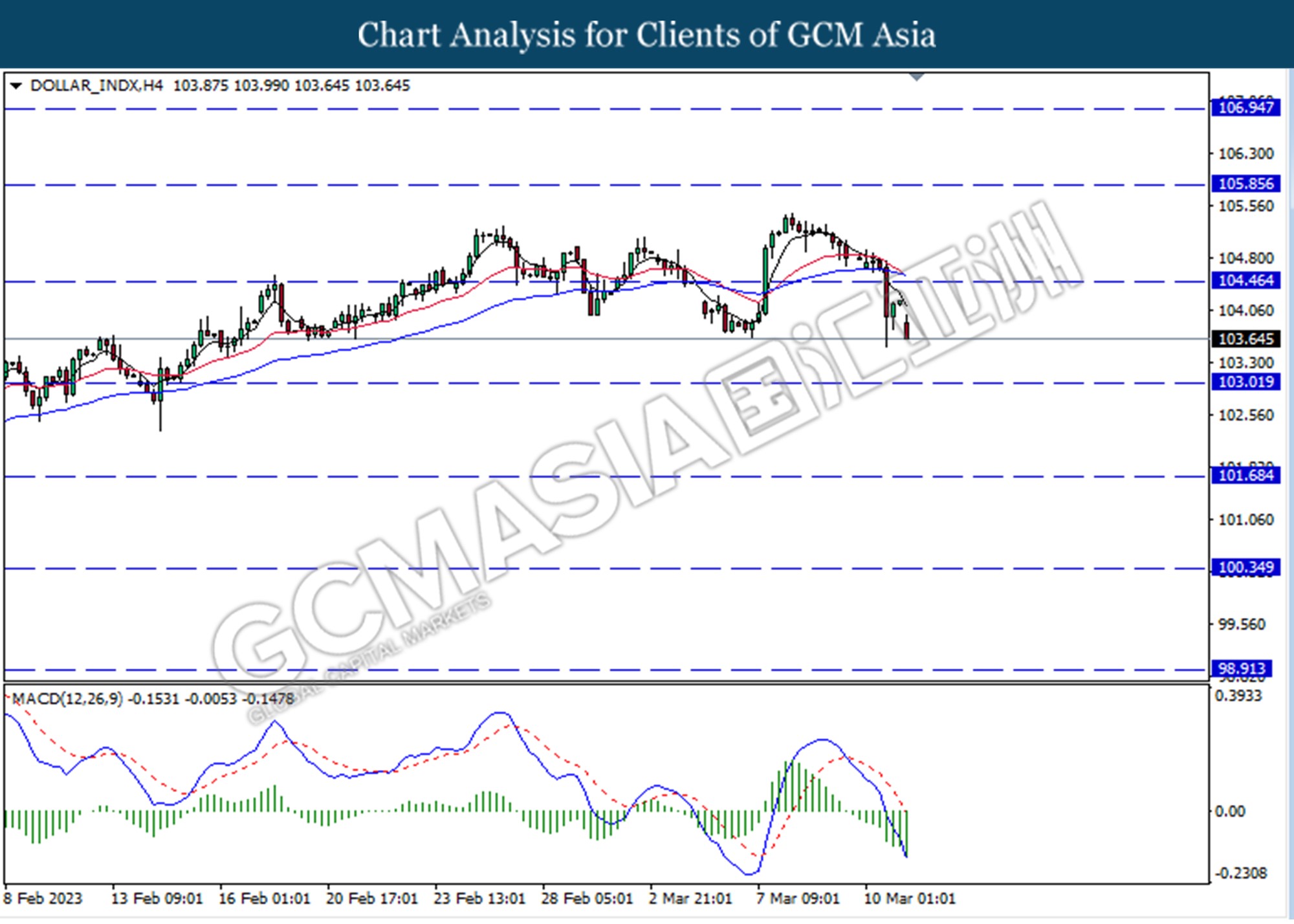

DOLLAR_INDX, H4: Dollar index was traded lower following a prior breakout below the previous support level at 104.45. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward the support level at 103.00.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

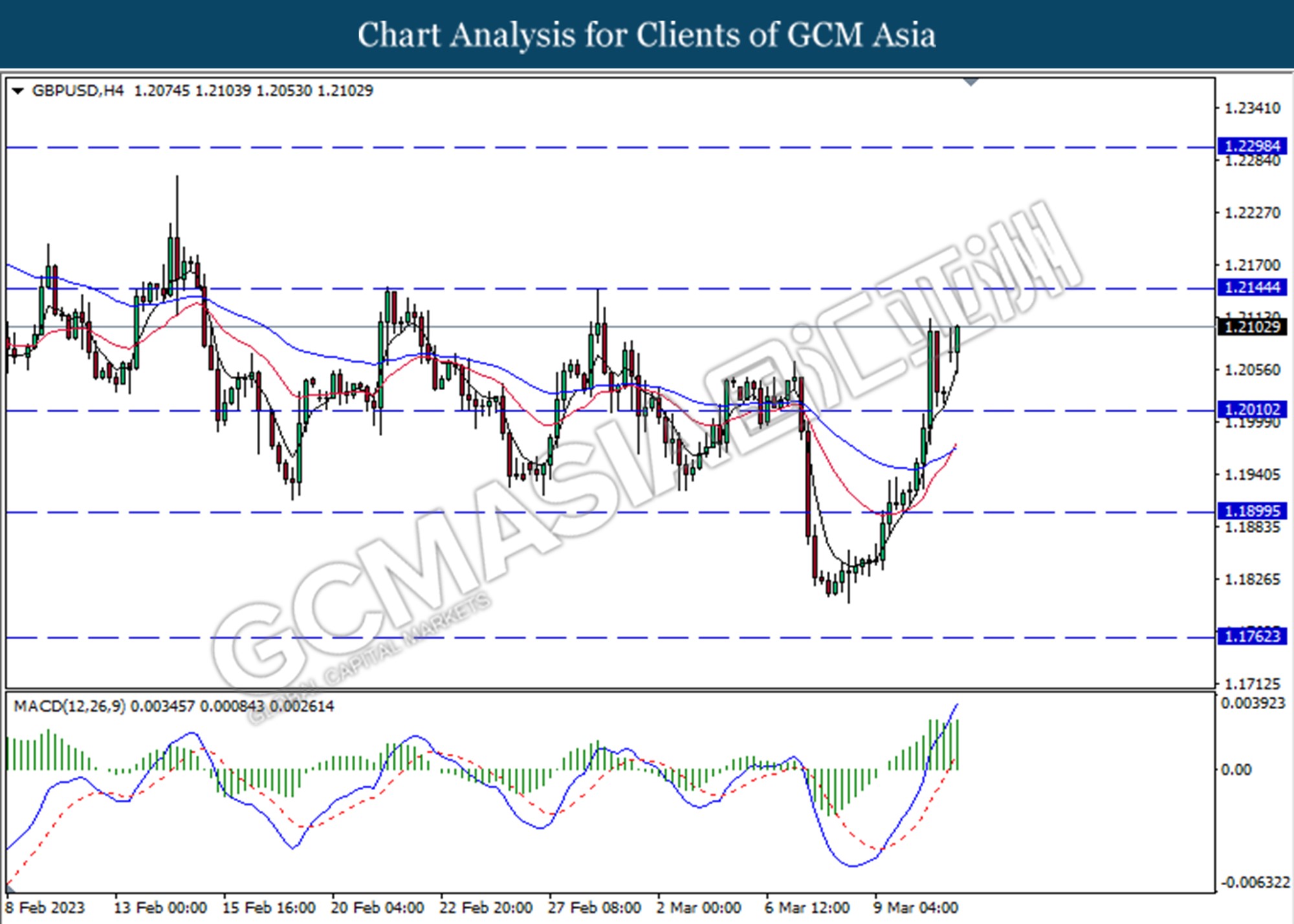

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.2145.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

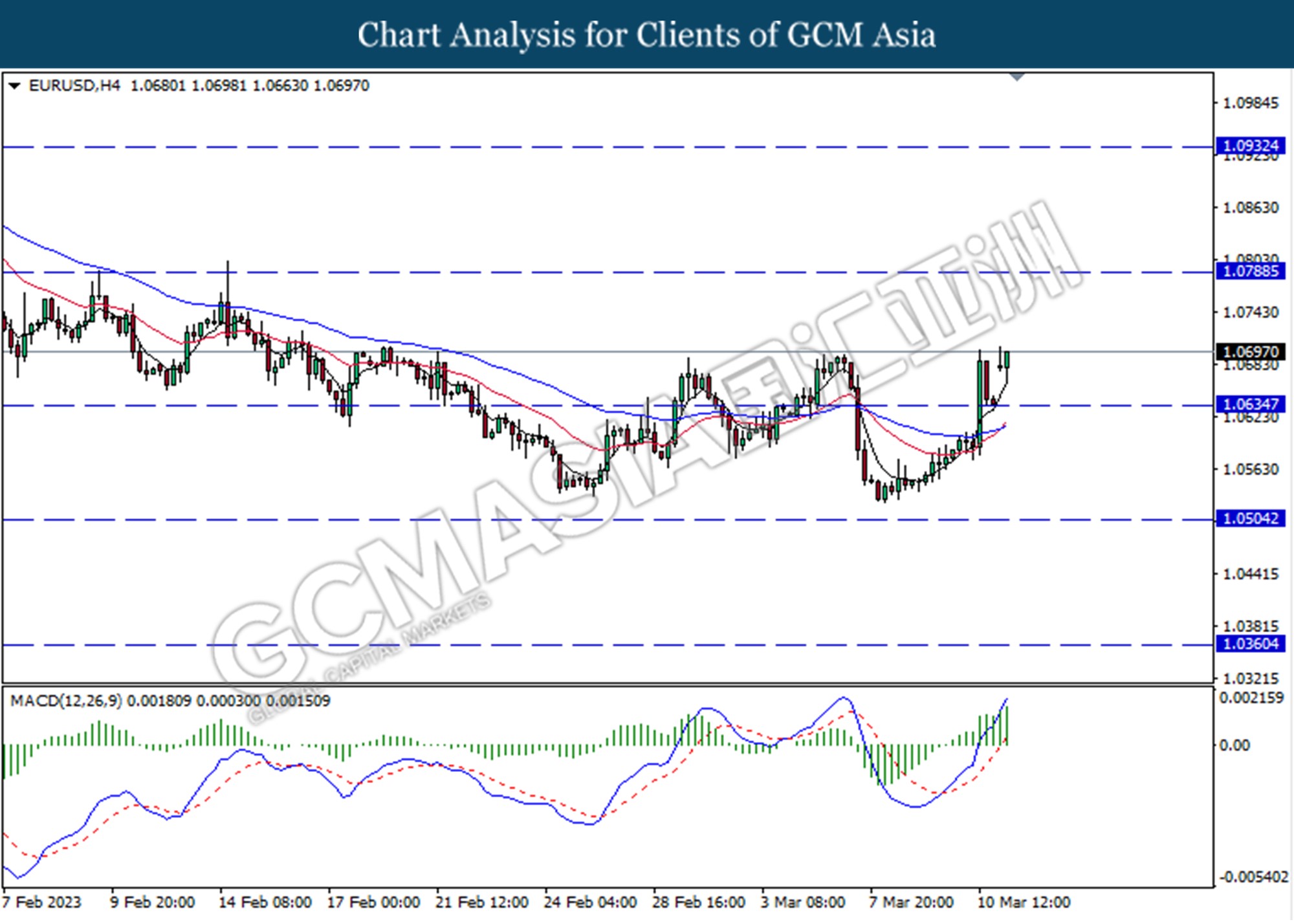

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level at 1.0635. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 1.0790

Resistance level: 1.0790, 1.0930

Support level: 1.0635, 1.0505

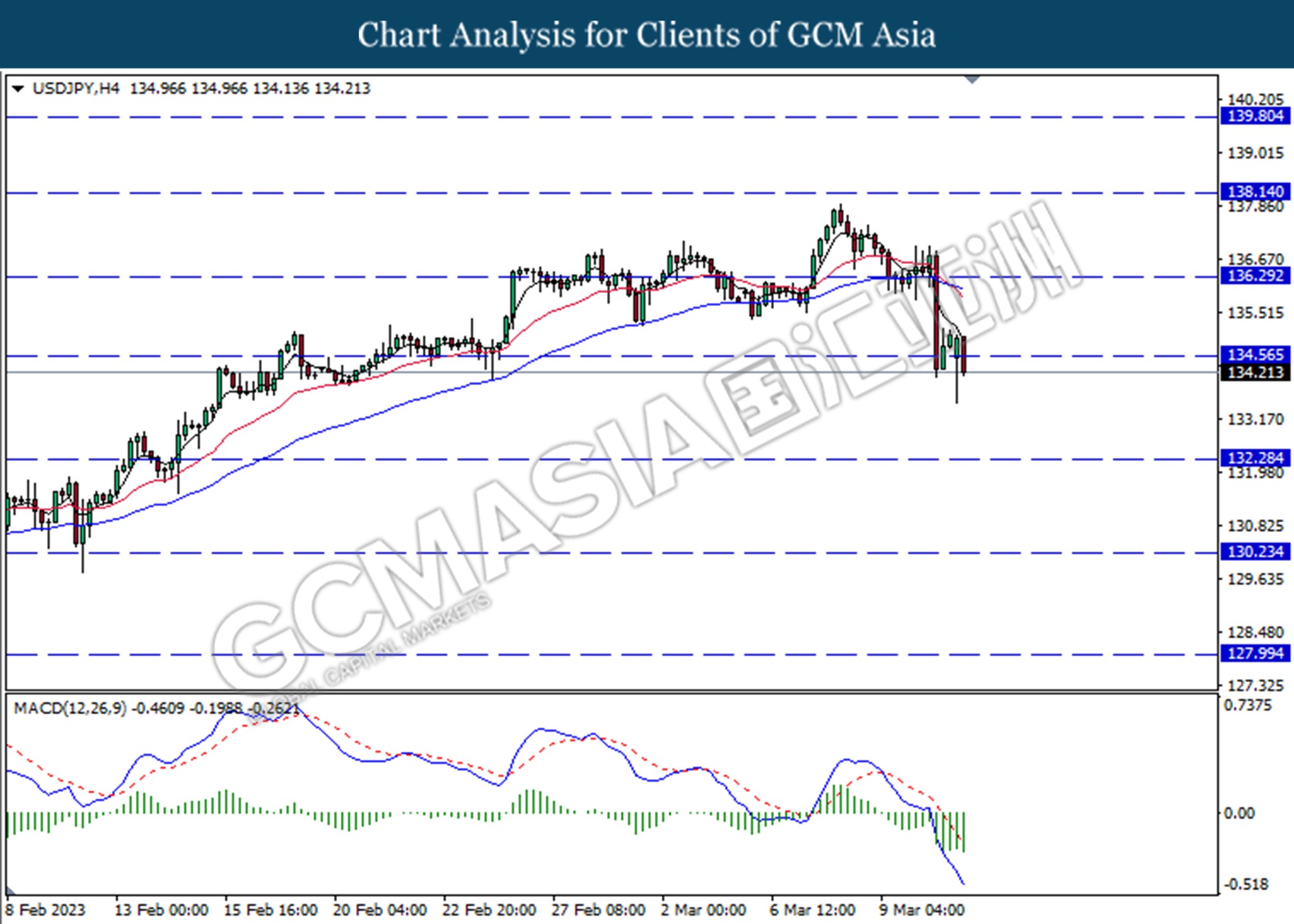

USDJPY, H4: USDJPY was traded lower following a prior breakout below the previous support level at 104.55. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 132.30

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

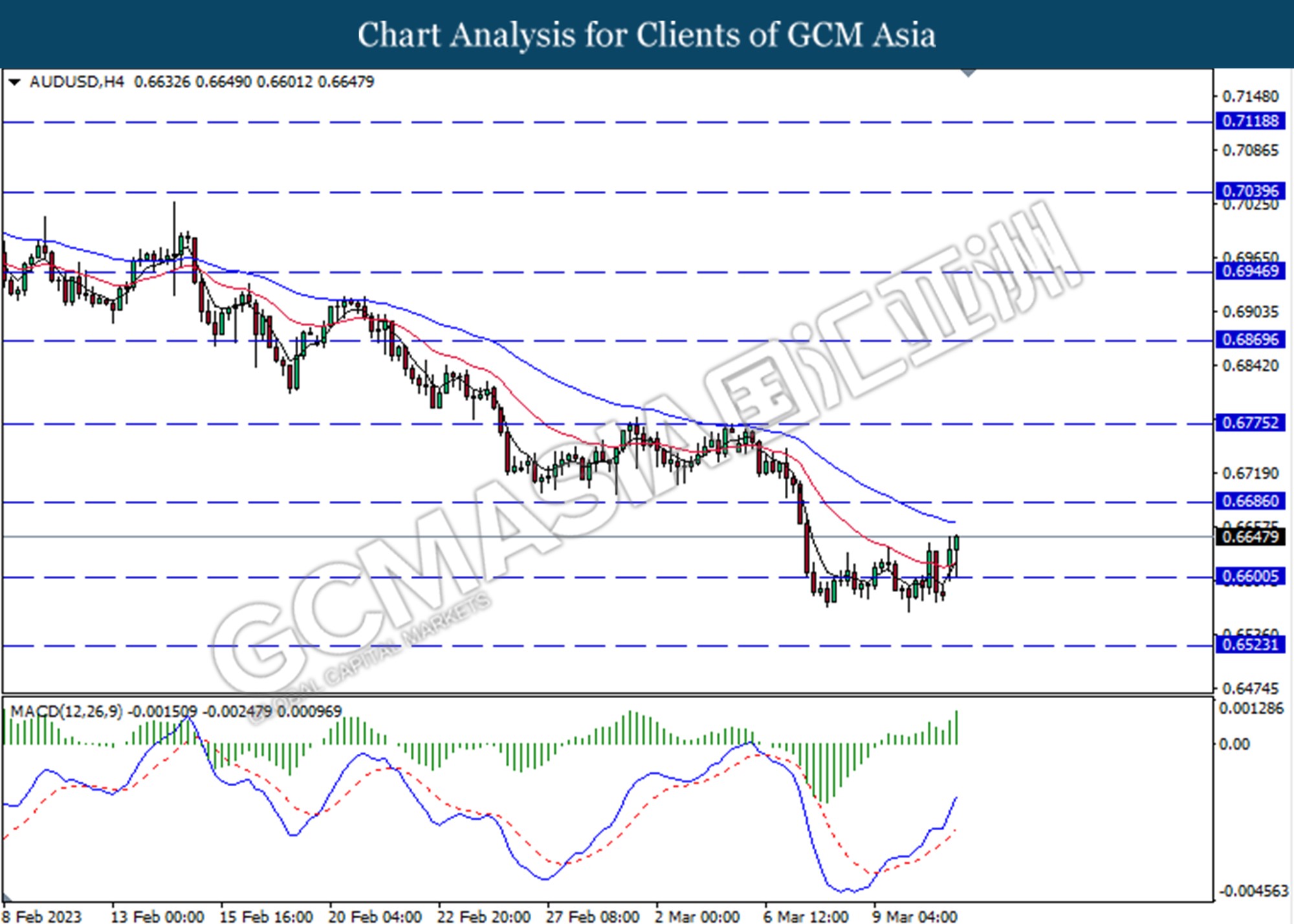

AUDUSD, H4: AUDUSD was traded higher following a prior rebound from the support level at 0.6600. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

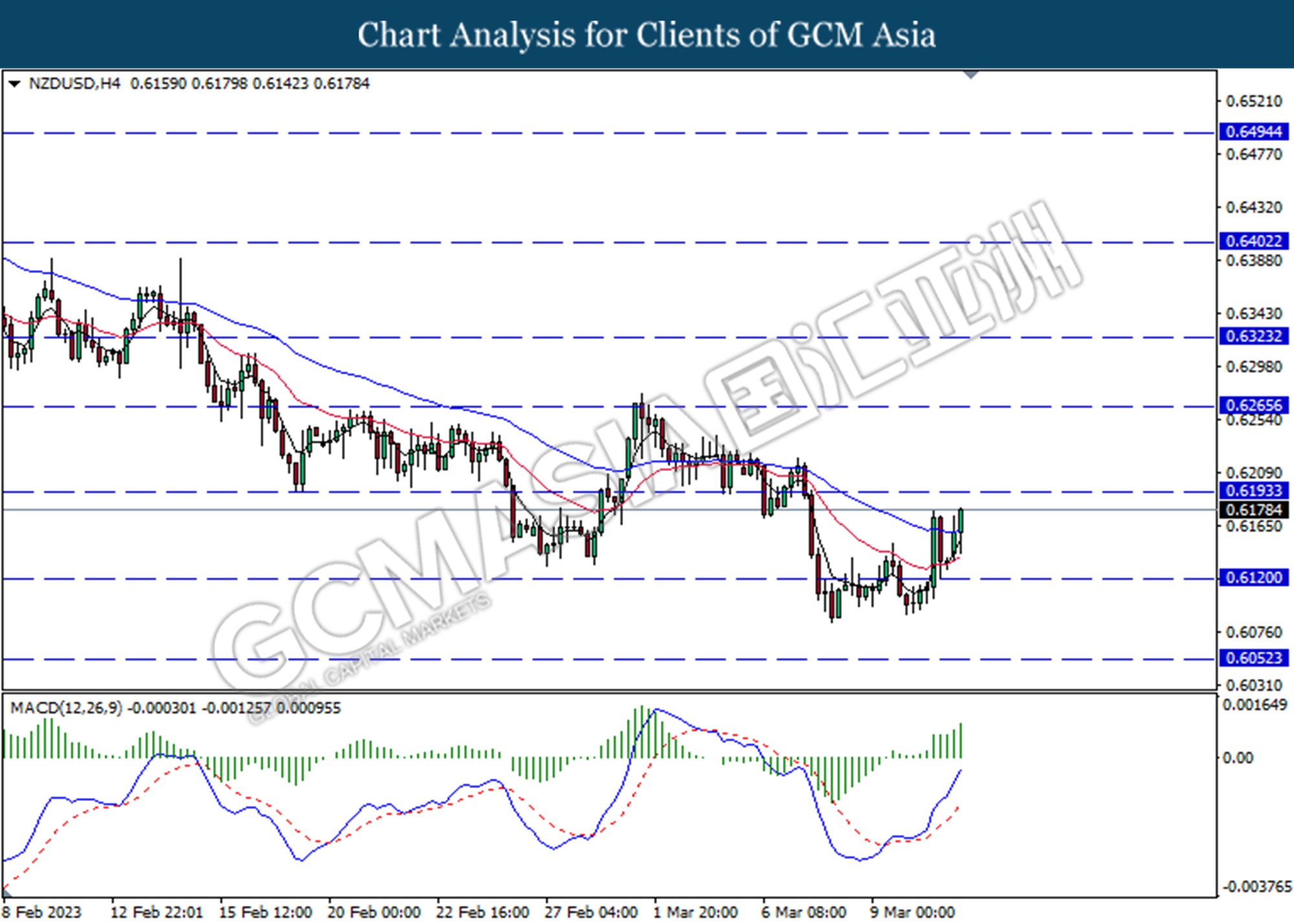

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

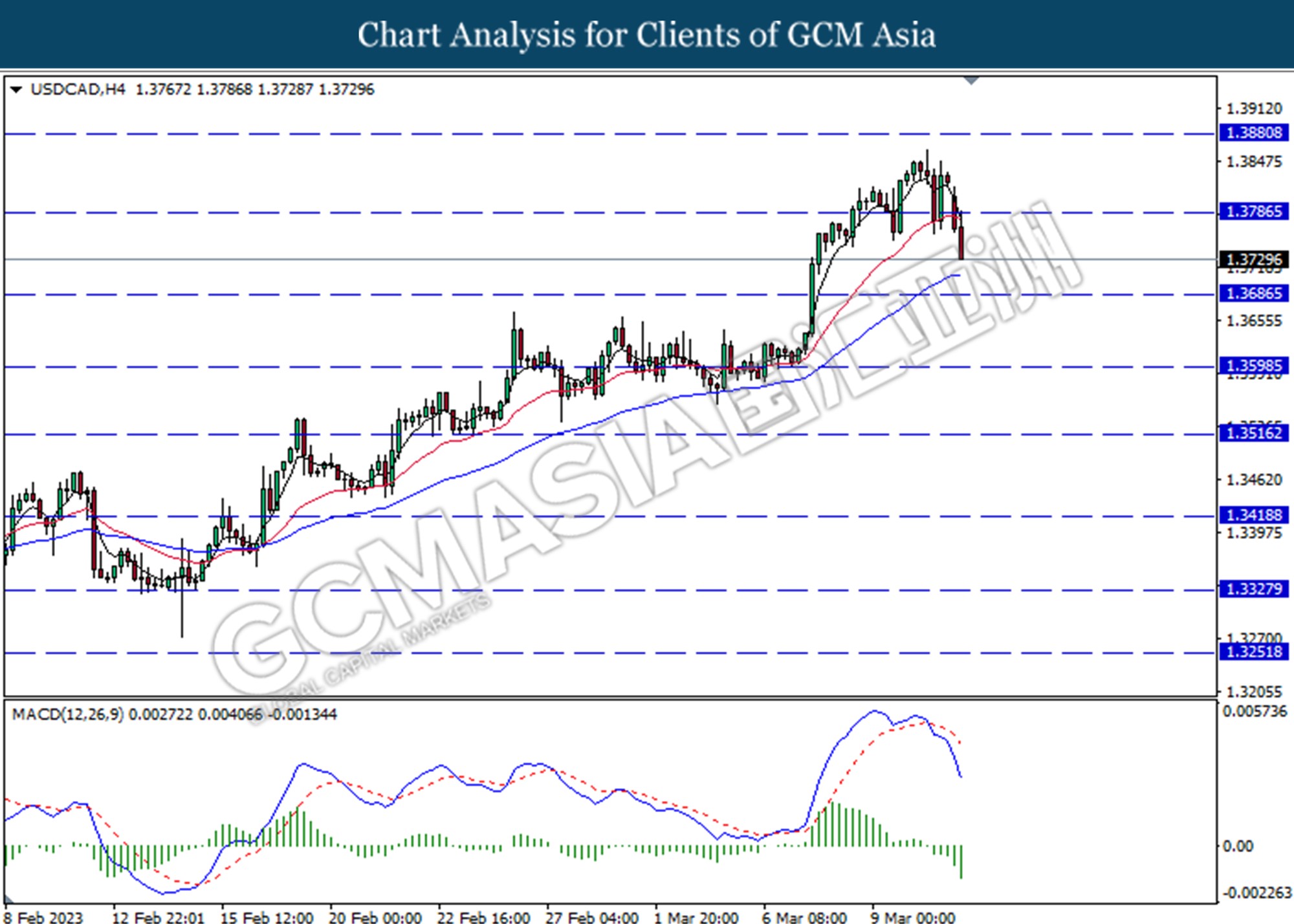

USDCAD, H4: USDCAD was traded lower following prior following a prior break below the previous support level at 1.3785. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 1.3685.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

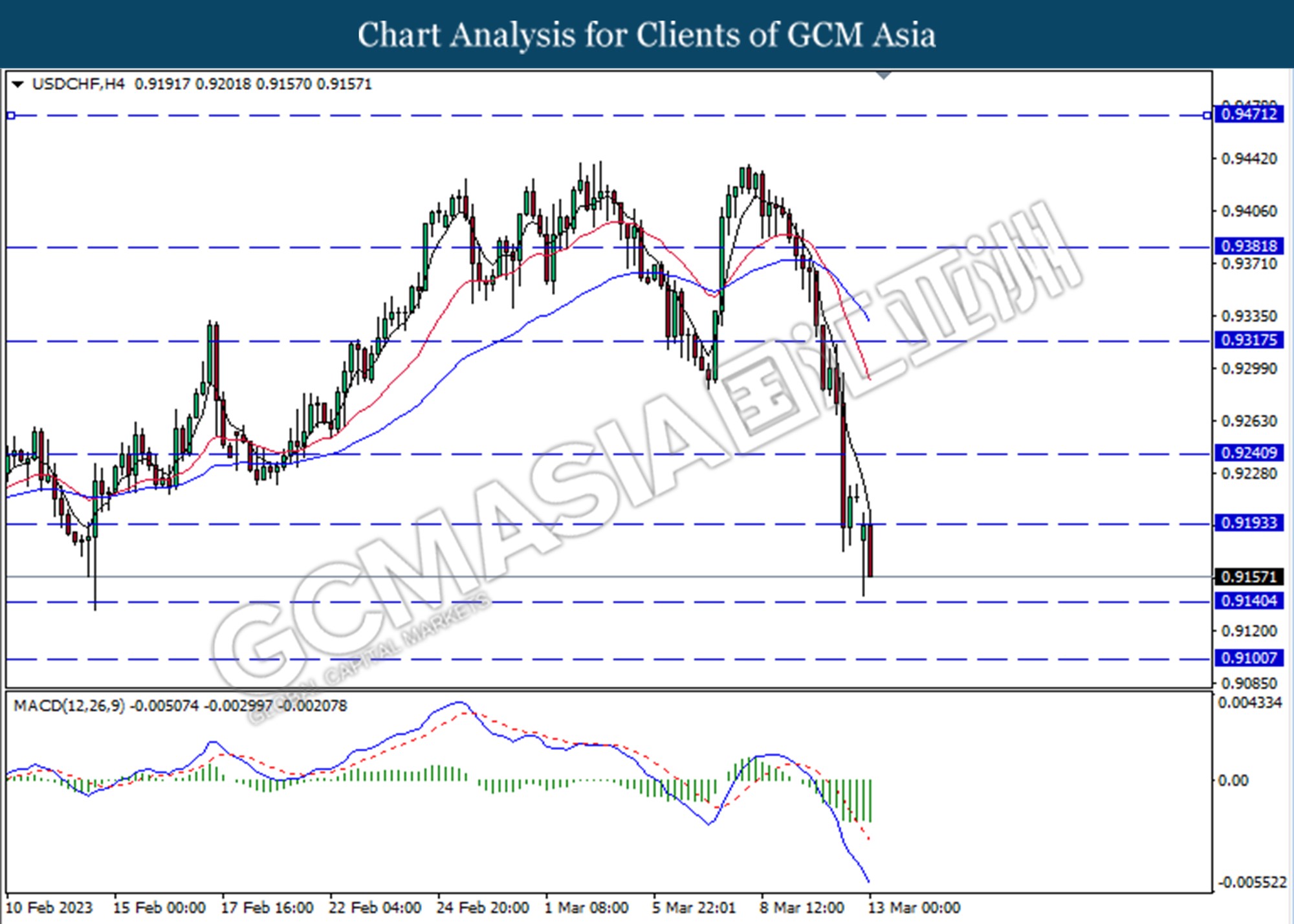

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9195. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward the support level at 0.9140.

Resistance level: 0.9195, 0.9240

Support level: 0.9140, 0.9100

CrudeOIL, H4: Crude oil price was traded higher following a prior breakout above the previous resistance level at 76.05. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains the resistance level at 78.70.

Resistance level: 78.70, 81.60

Support level: 76.05, 73.20

GOLD_, H4: Gold price was traded higher following prior rebound from the support level at 1876.90. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward the resistance level at 1900.20.

Resistance level: 1900.20, 1926.70

Support level: 1847.55, 1819.15