15 March 2023 Morning Session Analysis

Greenback seesawed as CPI in-line with expectation.

The dollar index, which traded against a basket of six major currencies, experienced huge fluctuations following the release of the long-waited CPI data. According to the US Bureau of Labor Statistics, the Fed’s preferred inflation gauge – Consumer Price Index (CPI) dropped sharply from the prior month reading at 6.4% to 6.0%, in line with the consensus expectation. Excluding the volatile items such as food and energy prices, the US Core CPI came in at 0.5%, higher than the consensus forecast at 0.4%. With that, it added conundrum of Fed on whether they should keep rising the interest rate in order to tame the persistent price pressures or hold back on tightening monetary policy further following the recent banking turmoil. Prior to the headline CPI report, majority of the investors bet that the Fed might consider pausing its rate hike plan as the collapse of Silicon Valley Bank (SVB) and Signature Bank exacerbated the risk of recession in the US. However, the still-high inflation figure paved the way for a restrictive monetary policy. Nonetheless, the final decision of the Fed would be revealed in next week’s policy meeting. As of writing, the dollar index rose 0.08% to 103.65.

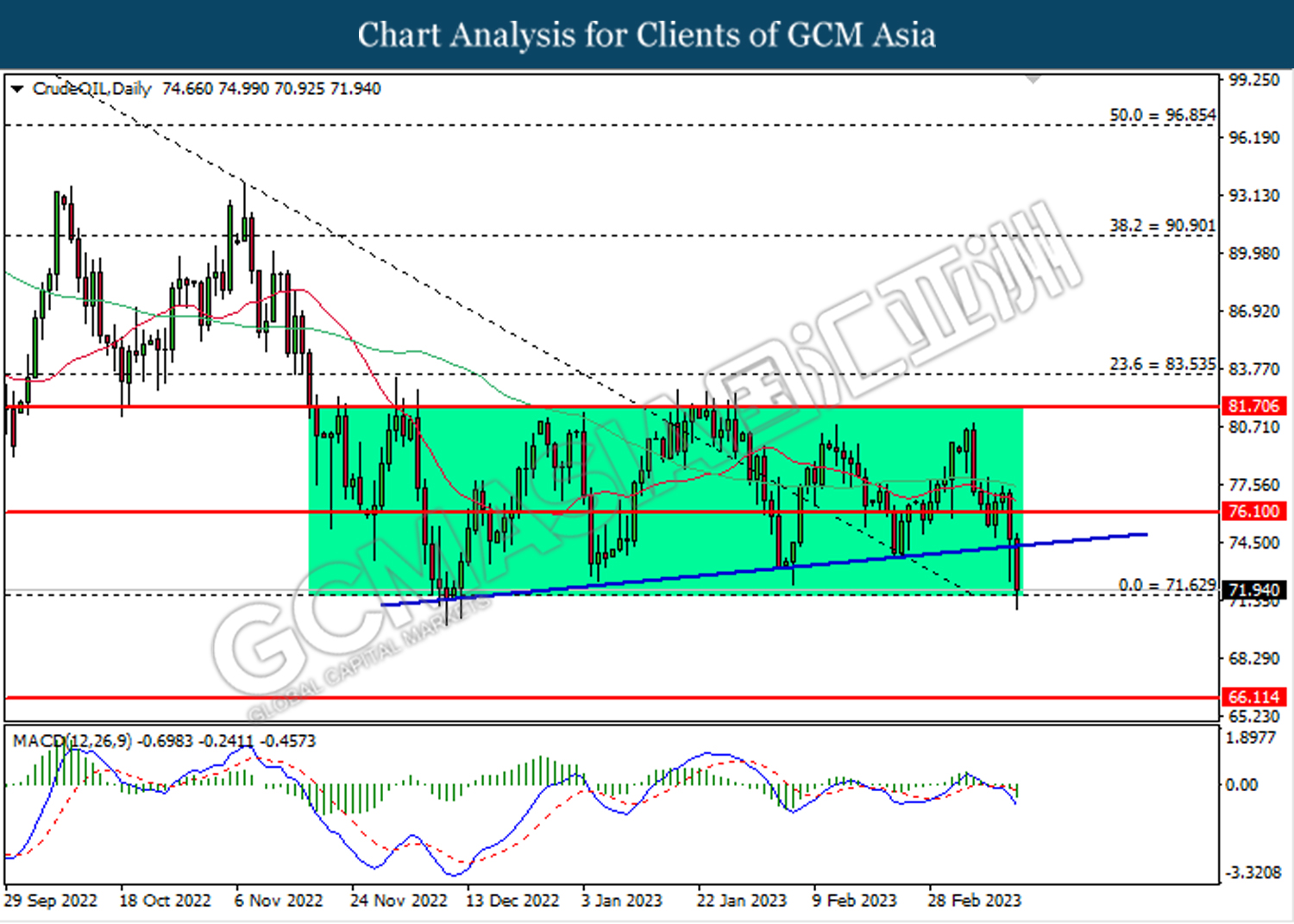

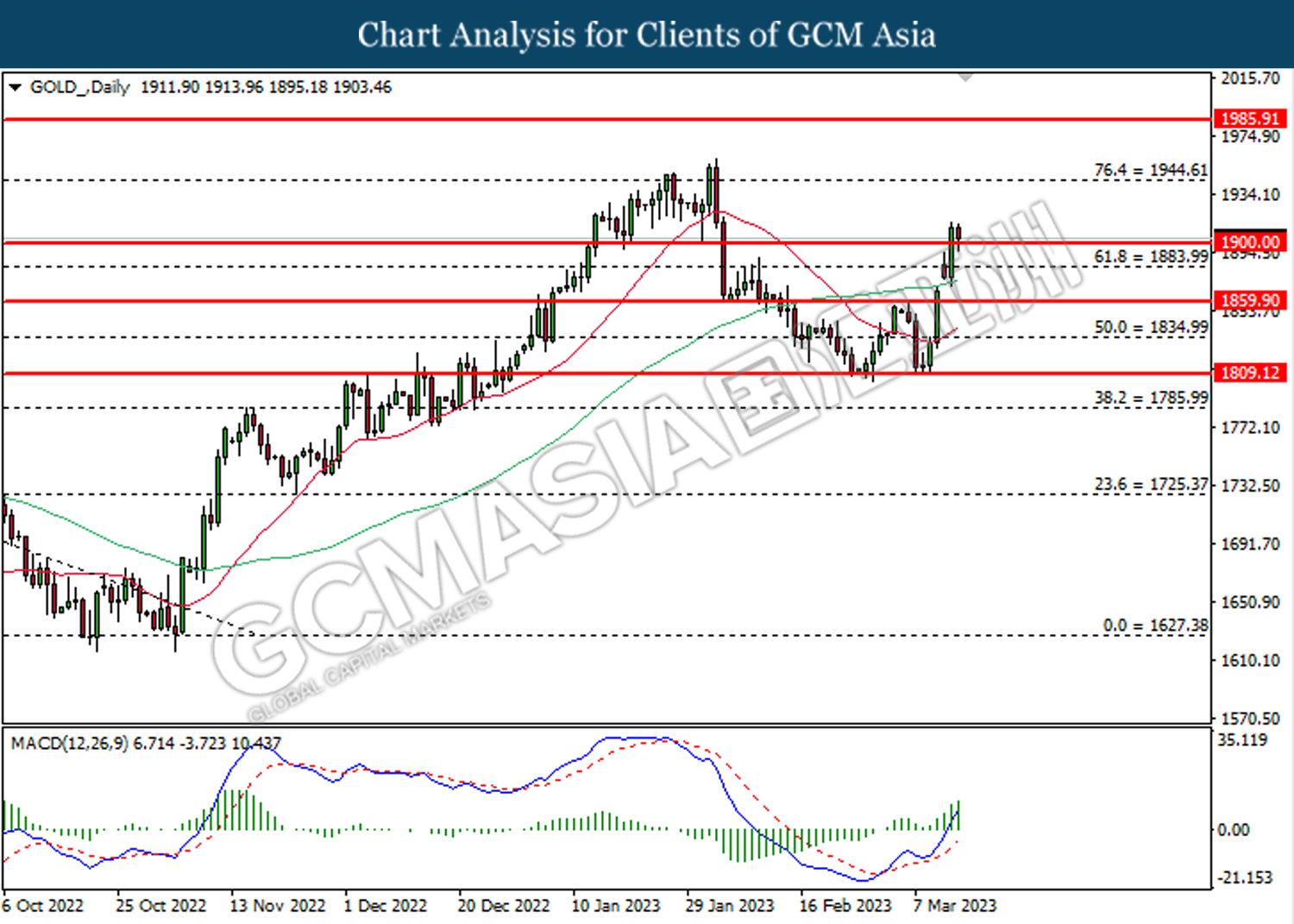

In the commodities market, crude oil prices were down by -0.10% to $71.00 per barrel as the US banking turmoil continued to weigh on the oil demand’s prospect. Besides, gold prices dipped -0.02% to $1904.20 per troy ounce as the US dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

17:00 CrudeOIL IEA Monthly Report

20:30 GBP Spring Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Feb) | 2.3% | -0.1% | – |

| 20:30 | USD – PPI (MoM) (Feb) | 0.7% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Feb) | 3.0% | -0.3% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.694M | 0.555M | – |

Technical Analysis

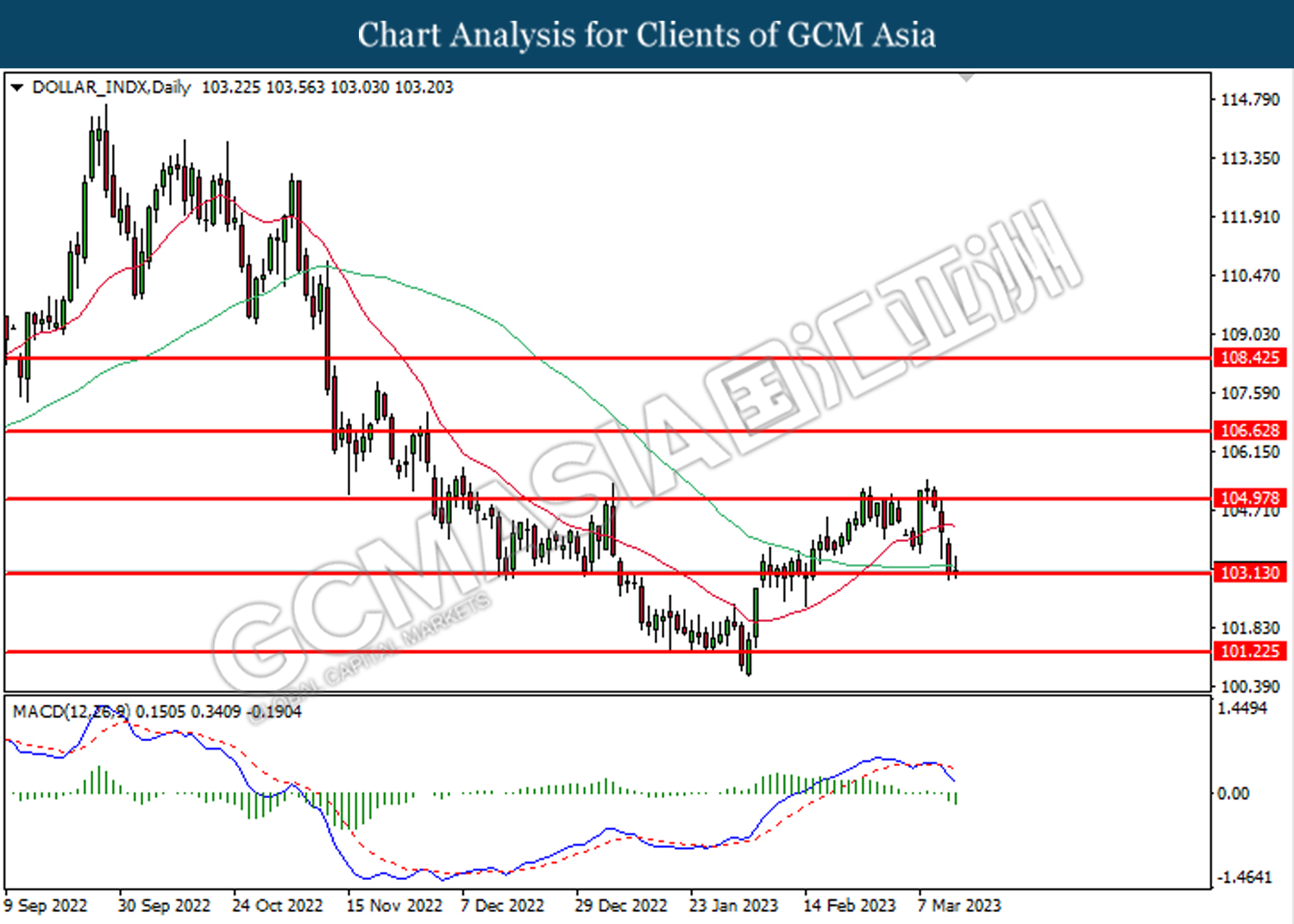

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.15. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

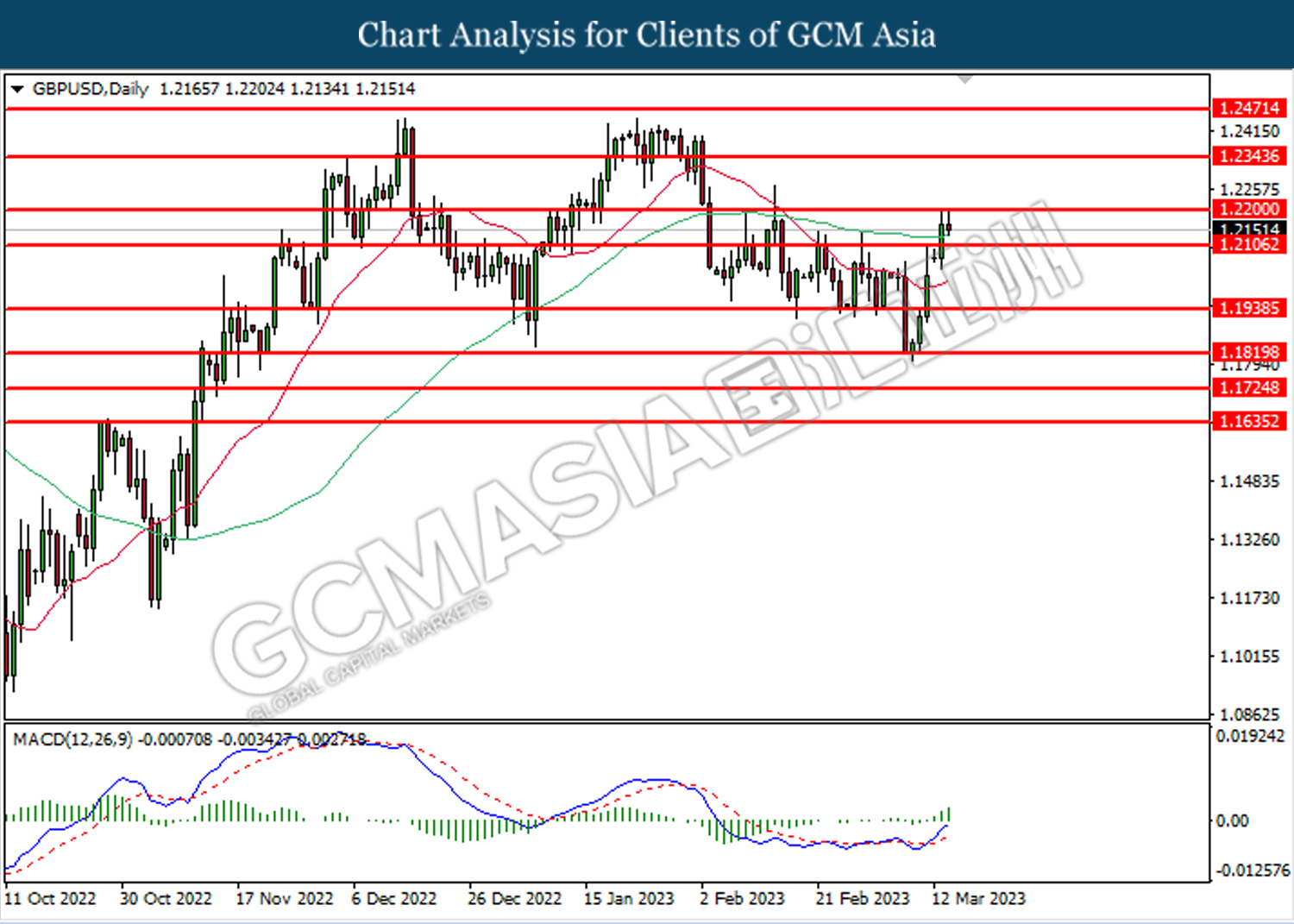

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2200. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

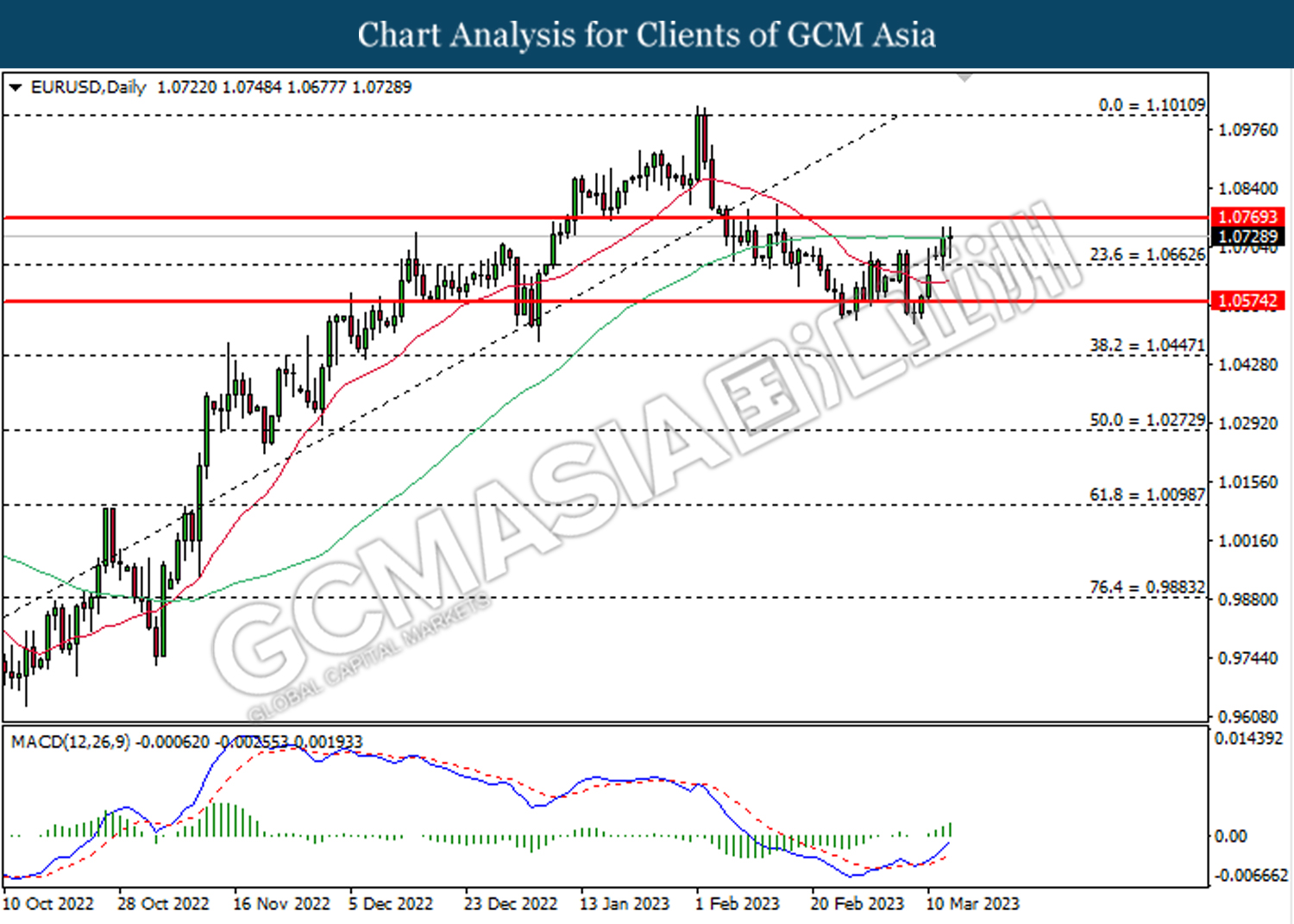

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0665. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.1010

Support level: 1.0665, 1.0575

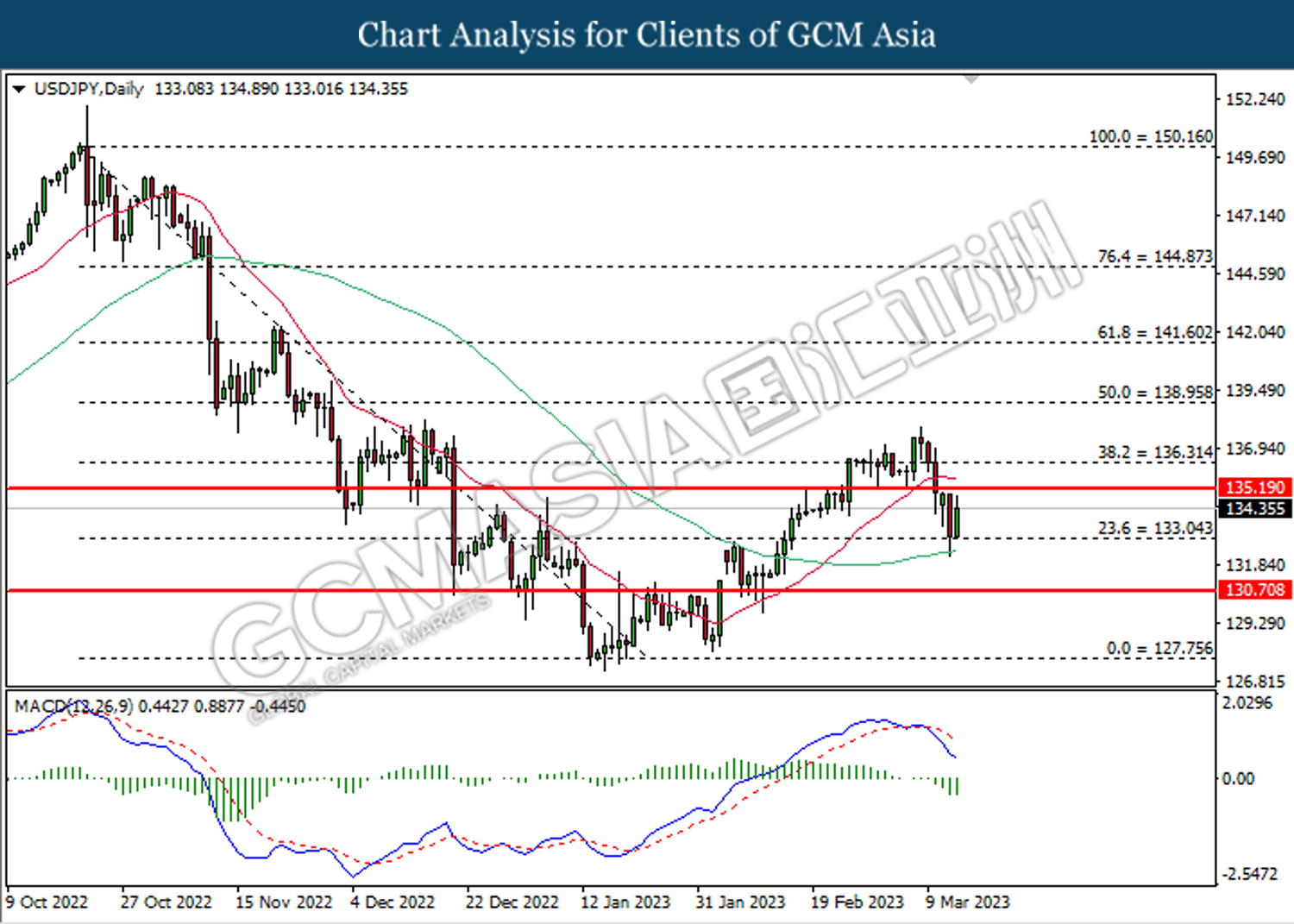

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 133.05. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

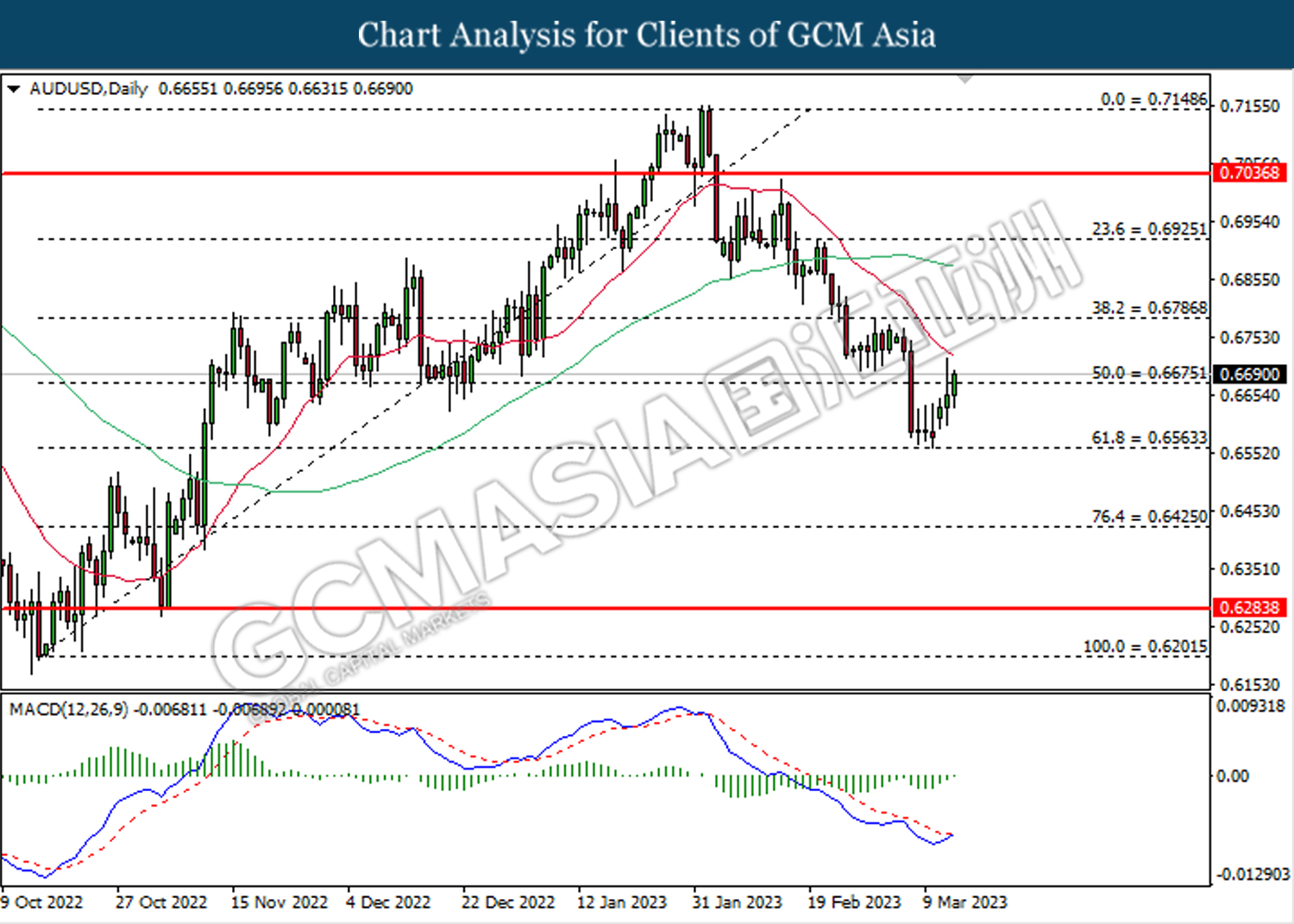

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

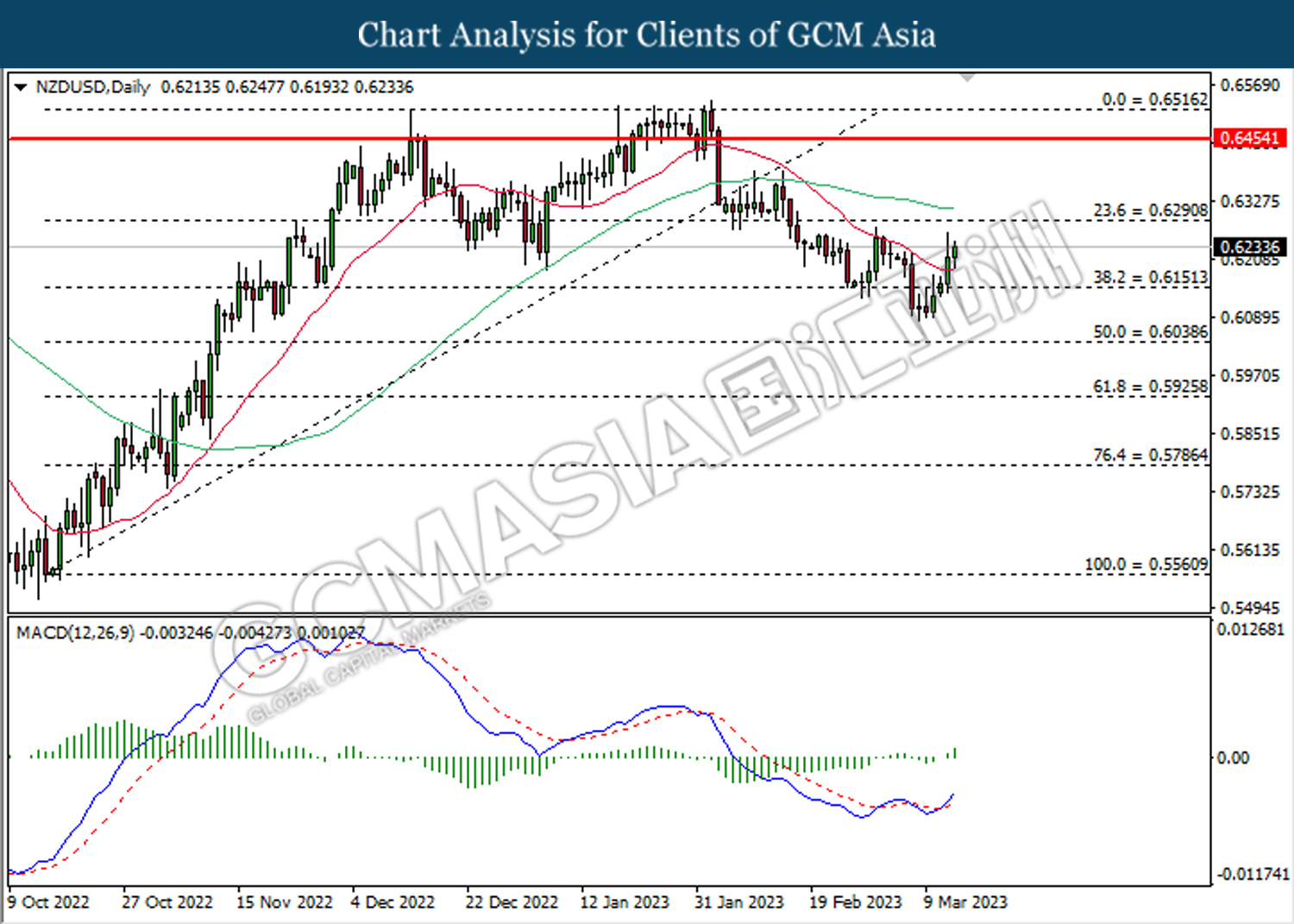

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

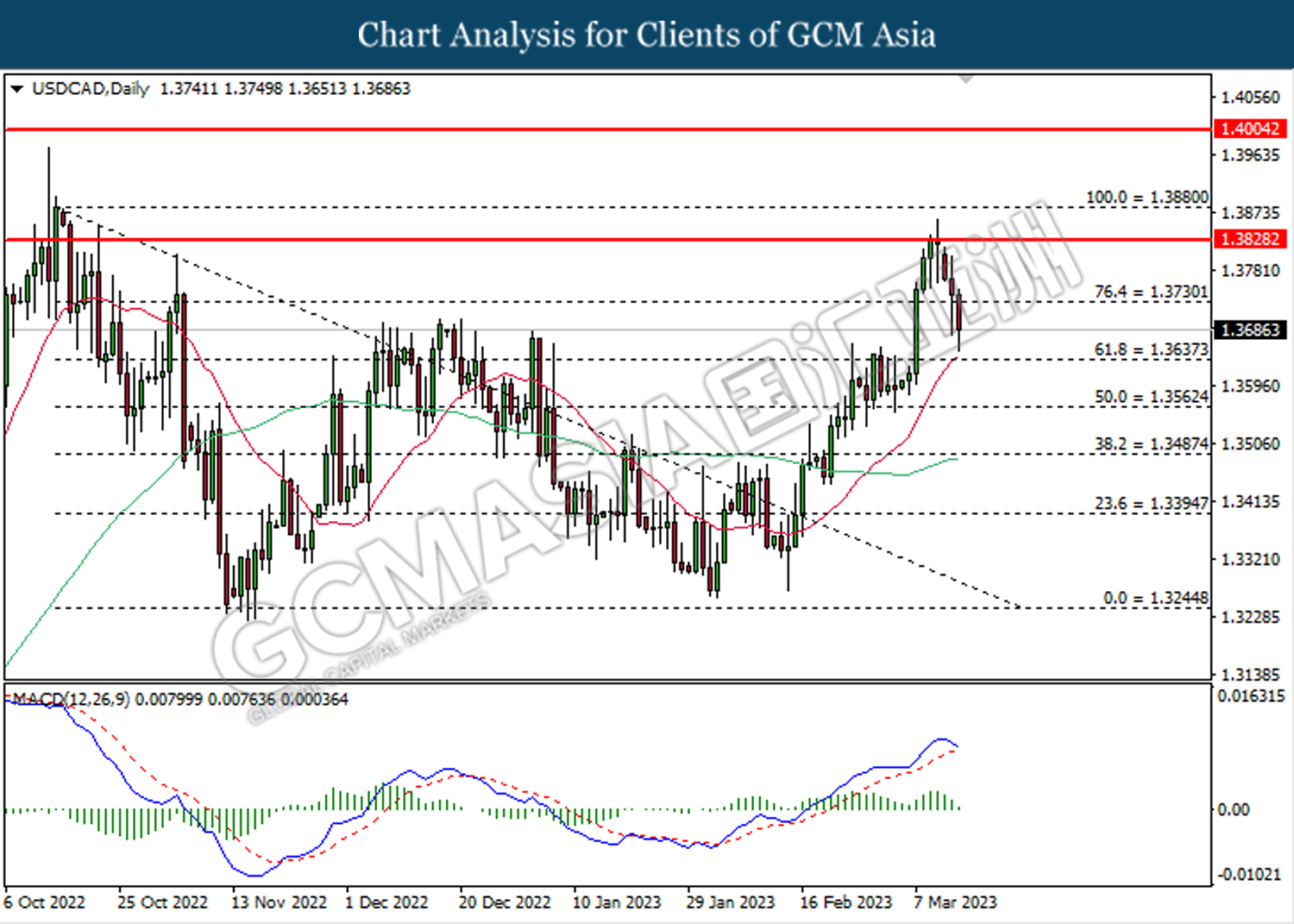

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3730. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3635.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

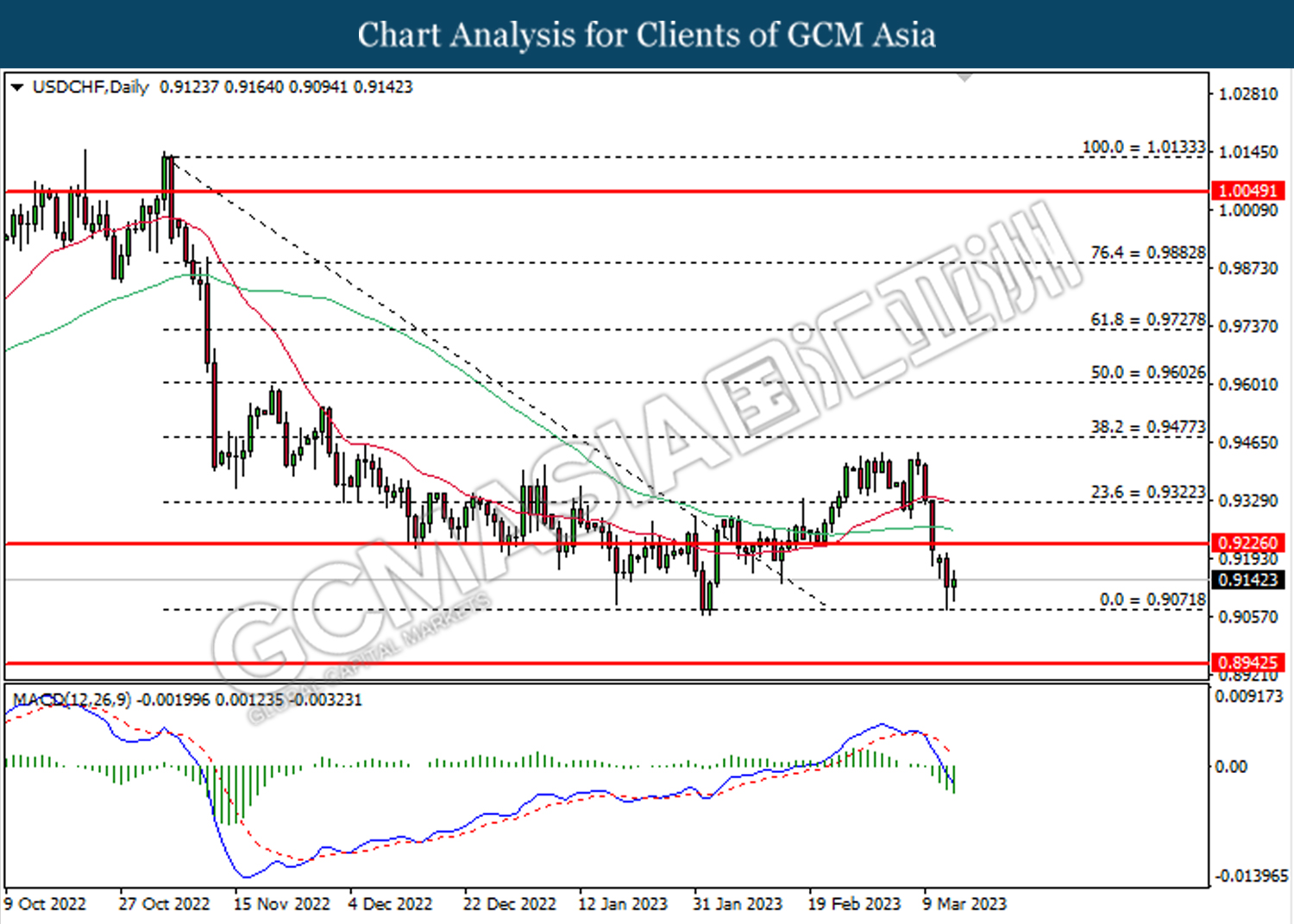

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.9225. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9070.

Resistance level: 0.9225, 0.9325

Support level: 0.9070, 0.8945

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 71.65. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 76.10, 81.70

Support level: 71.65, 66.10

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1900.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00