16 March 2023 Morning Session Analysis

US dollar surged as Credit Suisse renewed European bank worries.

The dollar index, which traded against a basket of six major currencies, revived from the tremendous sell-off which started last Wednesday as Credit Suisse led the Europe bank rout in renewed SVB fallout. In the early European trading session, the banking sector fell sharply in overall, led by Credit Suisse. A day ago, Credit Suisse acknowledged “material weakness” in its financial reporting, highlighting that the group failed to identify potential risks to financial statements. Prior to the revelations, the bank had delayed the publication of the annual report. As a matter of fact, the material weakness of the financial report did not really trigger a large sell-off in the market. However, the European stock market tumbled after the largest investor – Saudi National Bank (SNB) revealed today it would not buy more shares in the Swiss bank on regulatory grounds. As of now, the SNB holds a bank stake of 9.88% in Credit Suisse. A more than 10% shareholding by the SNB would cause new rules to kick in, whether it be by the Saudi regulator or the European regulator, or the Swiss regulator. With the prospect of no more extra cash would be pumped in by the largest backer, the market fears over the banking sector in the European market heightened, urging investors to run away from the euro financial market. As of writing, the dollar index rose 1.11% to 104.75.

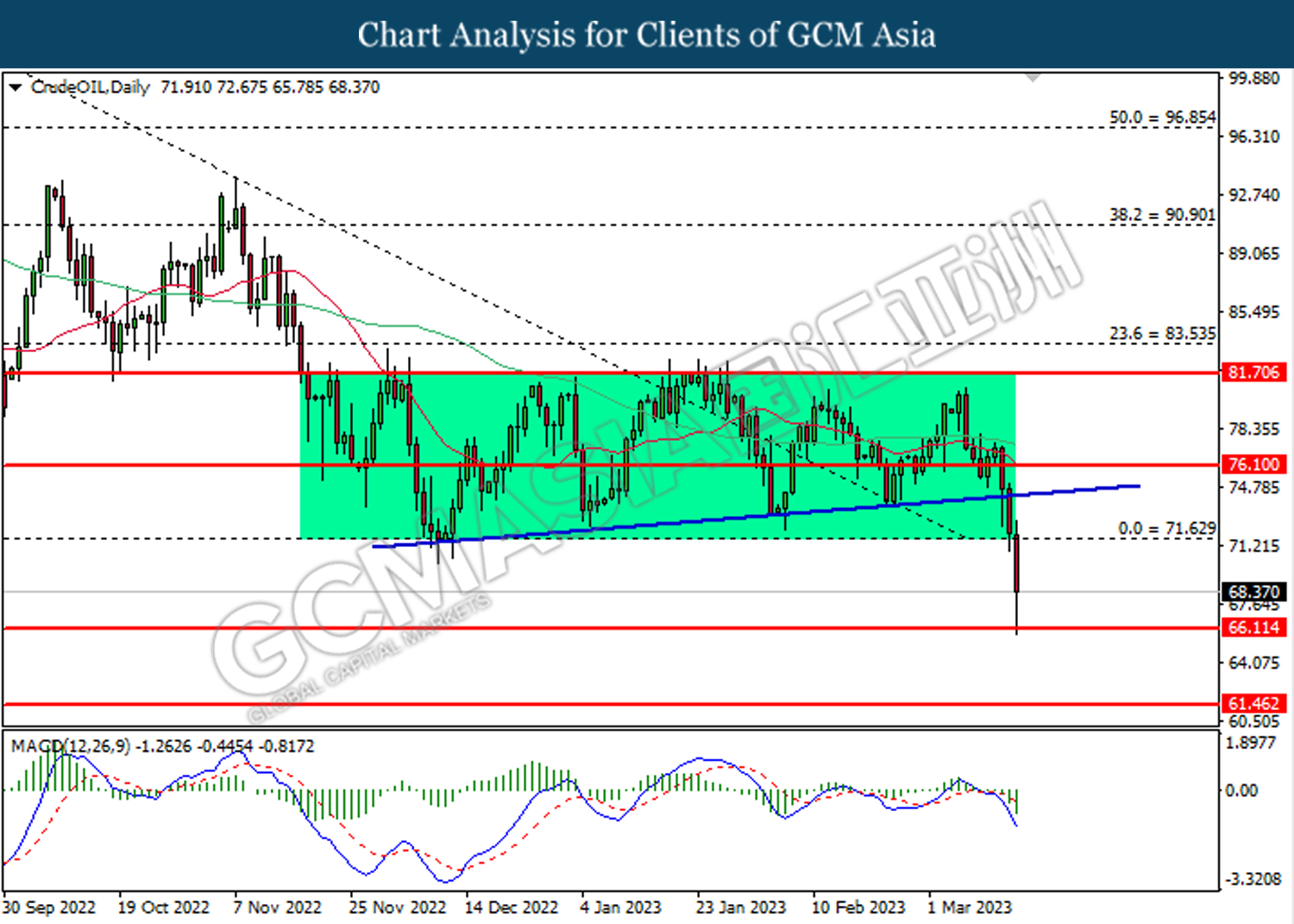

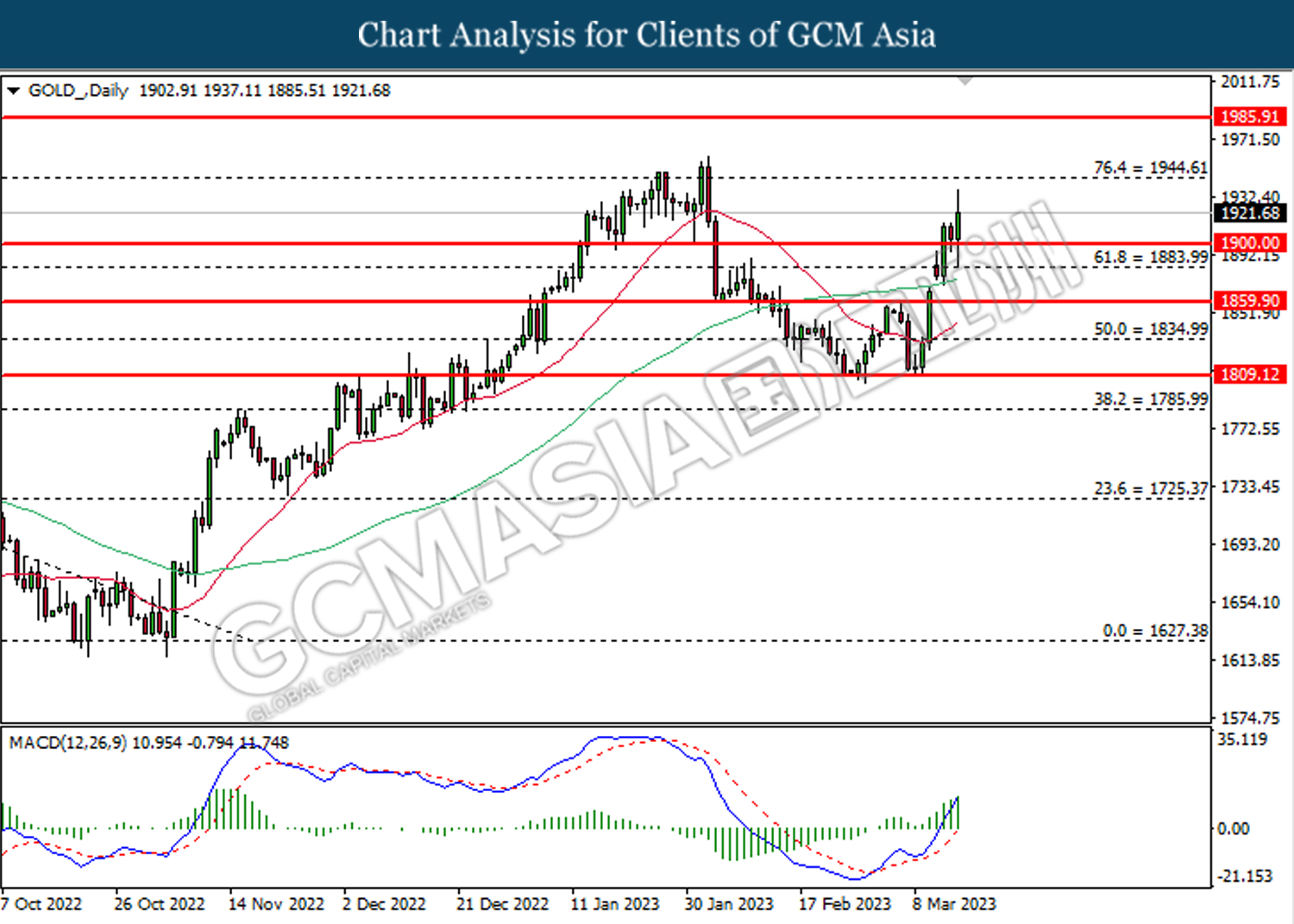

In the commodities market, crude oil prices were down by -4.55% to $68.30 per barrel as the renewed banking turmoil in Europe weighed on the oil demand’s prospect further. Besides, gold prices jumped by 0.10% to $1920.25 per troy ounce following the renewed contagion fears over the banking sector around the world.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Feb) | 1.339M | 1.340M | – |

| 20:30 | USD – Initial Jobless Claims | 211K | 205K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | -24.3 | -15.6 | – |

| 21:15 | EUR – Deposit Facility Rate (Mar) | 2.50% | 3.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 3.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Mar) | 3.00% | 3.50% | – |

Technical Analysis

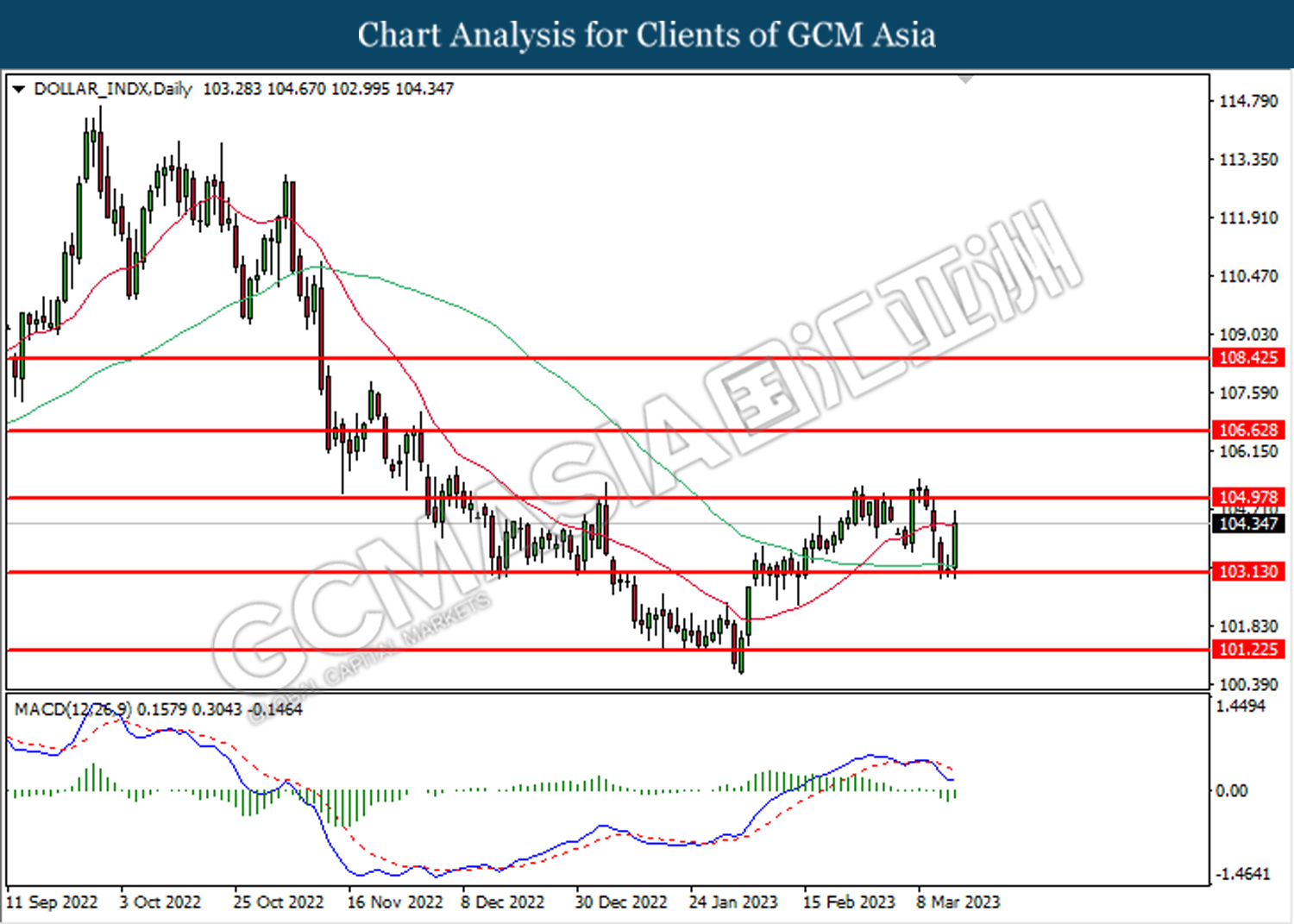

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 103.15. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 105.00.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

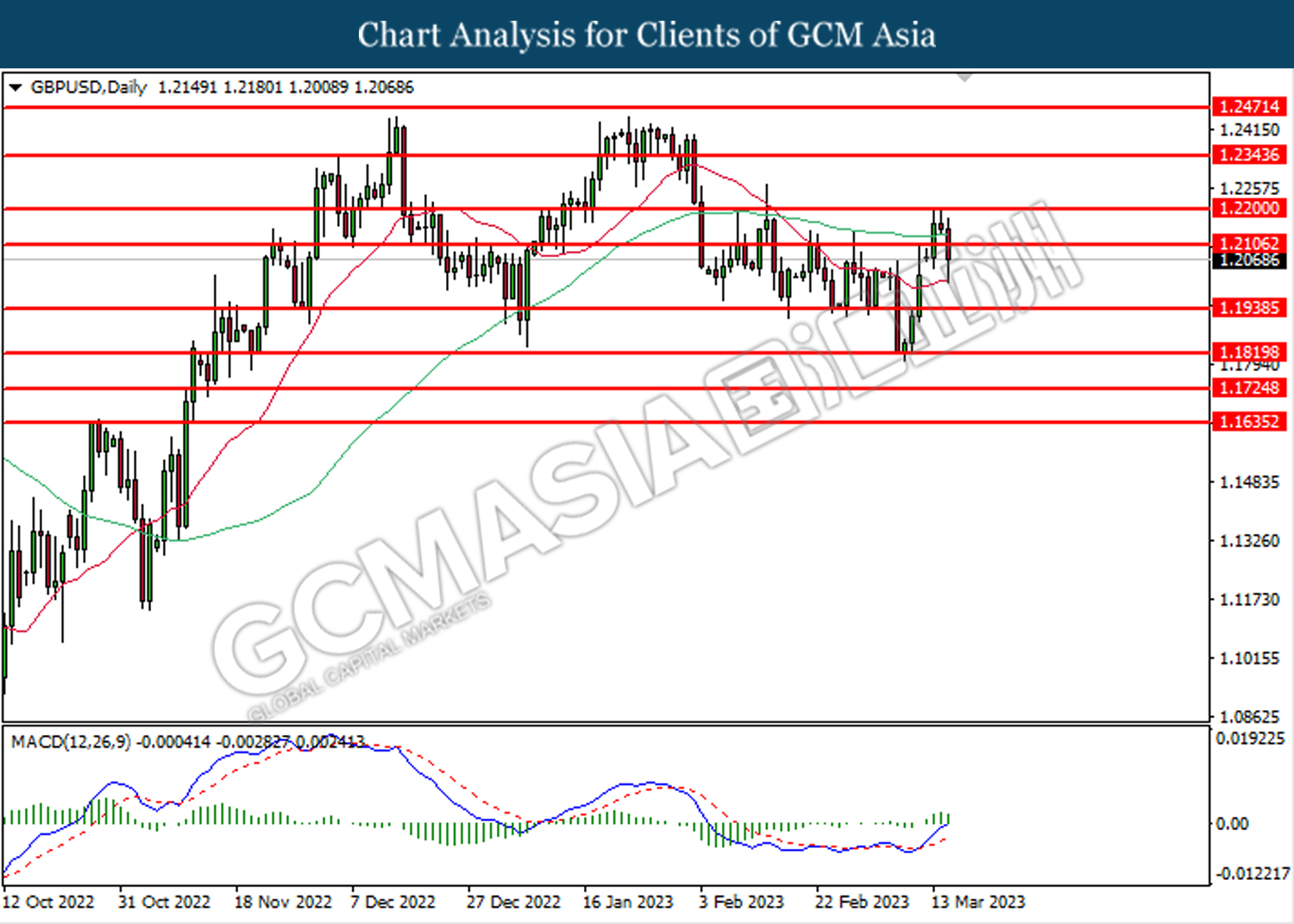

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2105. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2200, 1.2345

Support level: 1.2105, 1.1940

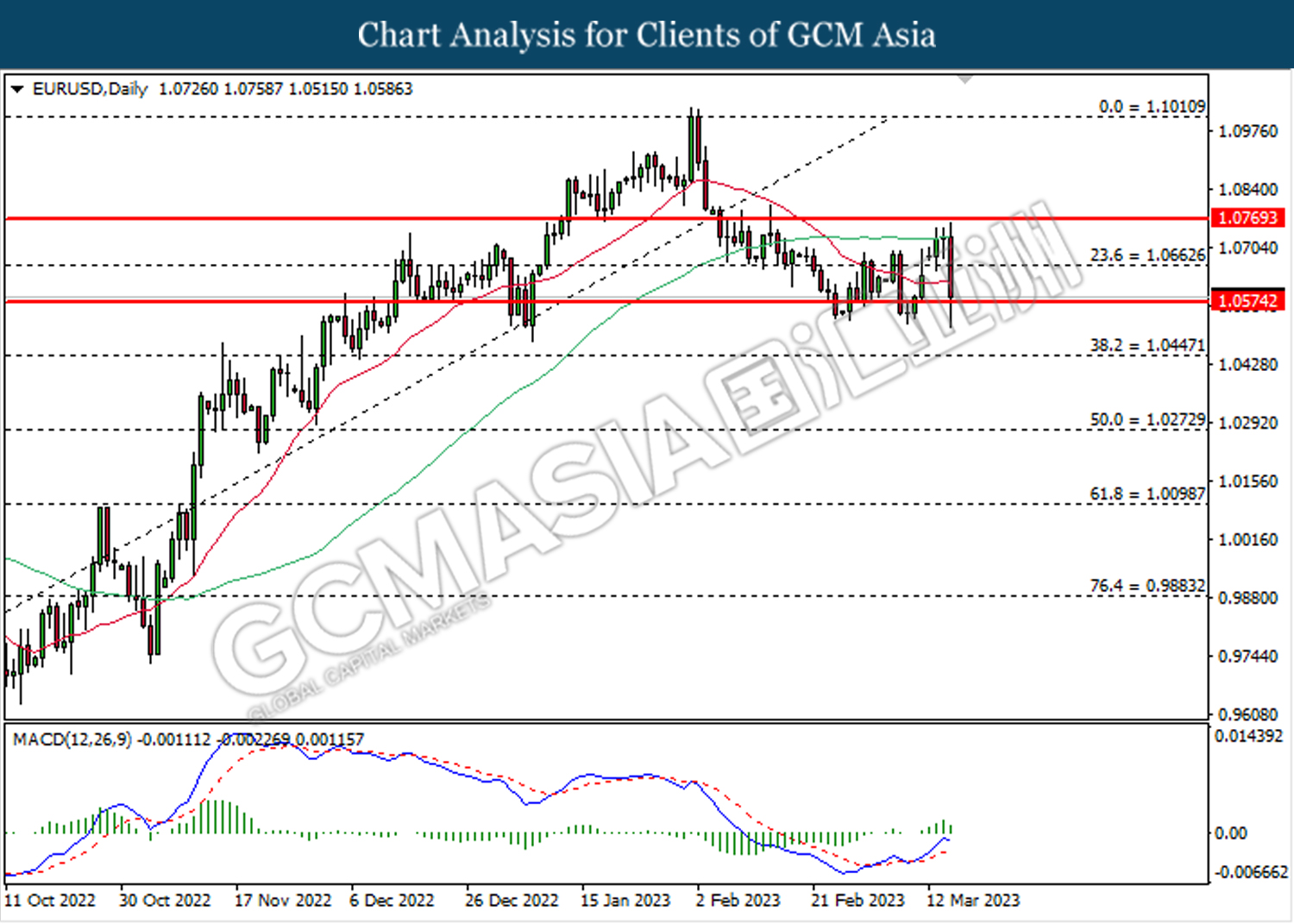

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0575. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0575, 1.0445

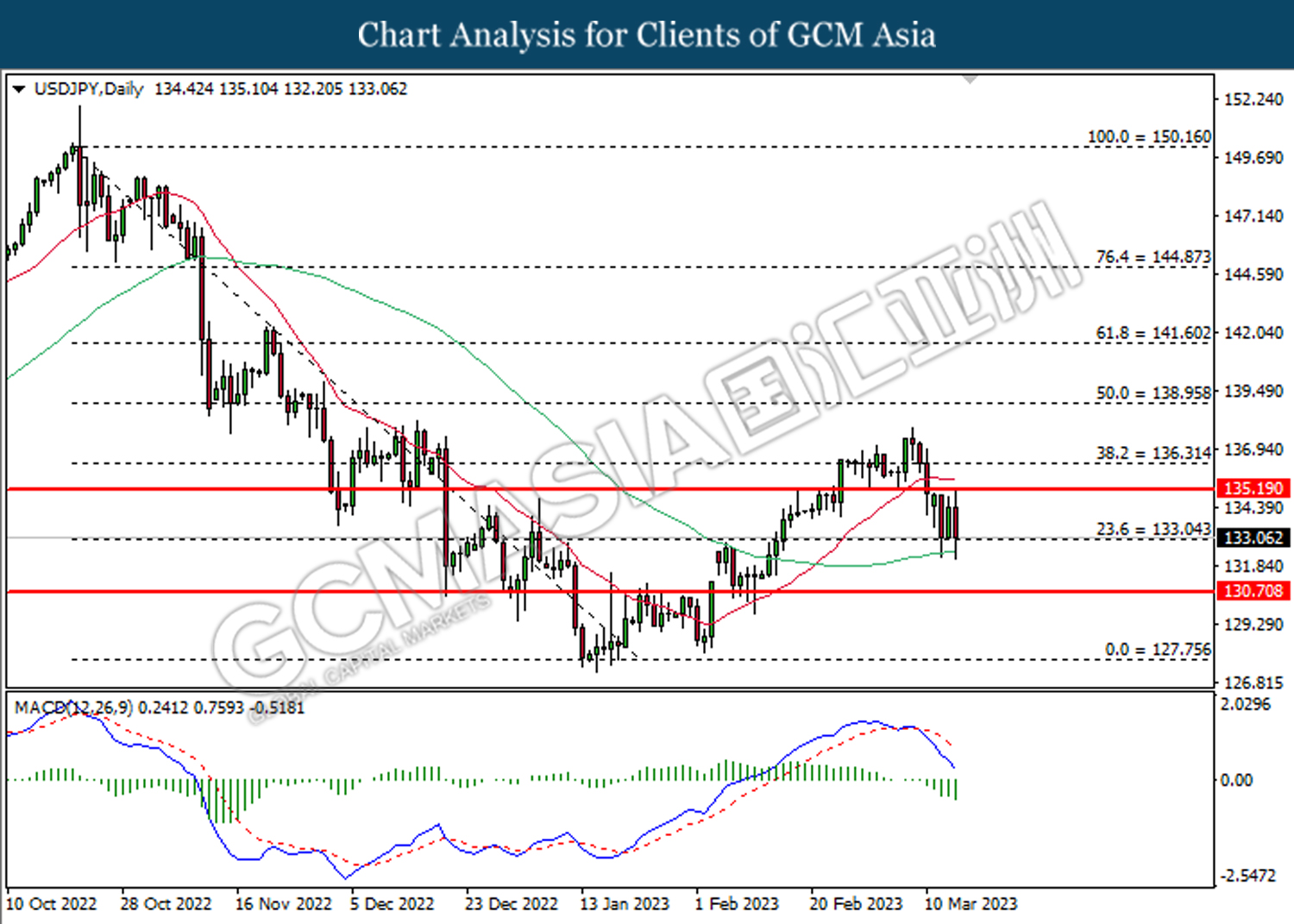

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.05. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

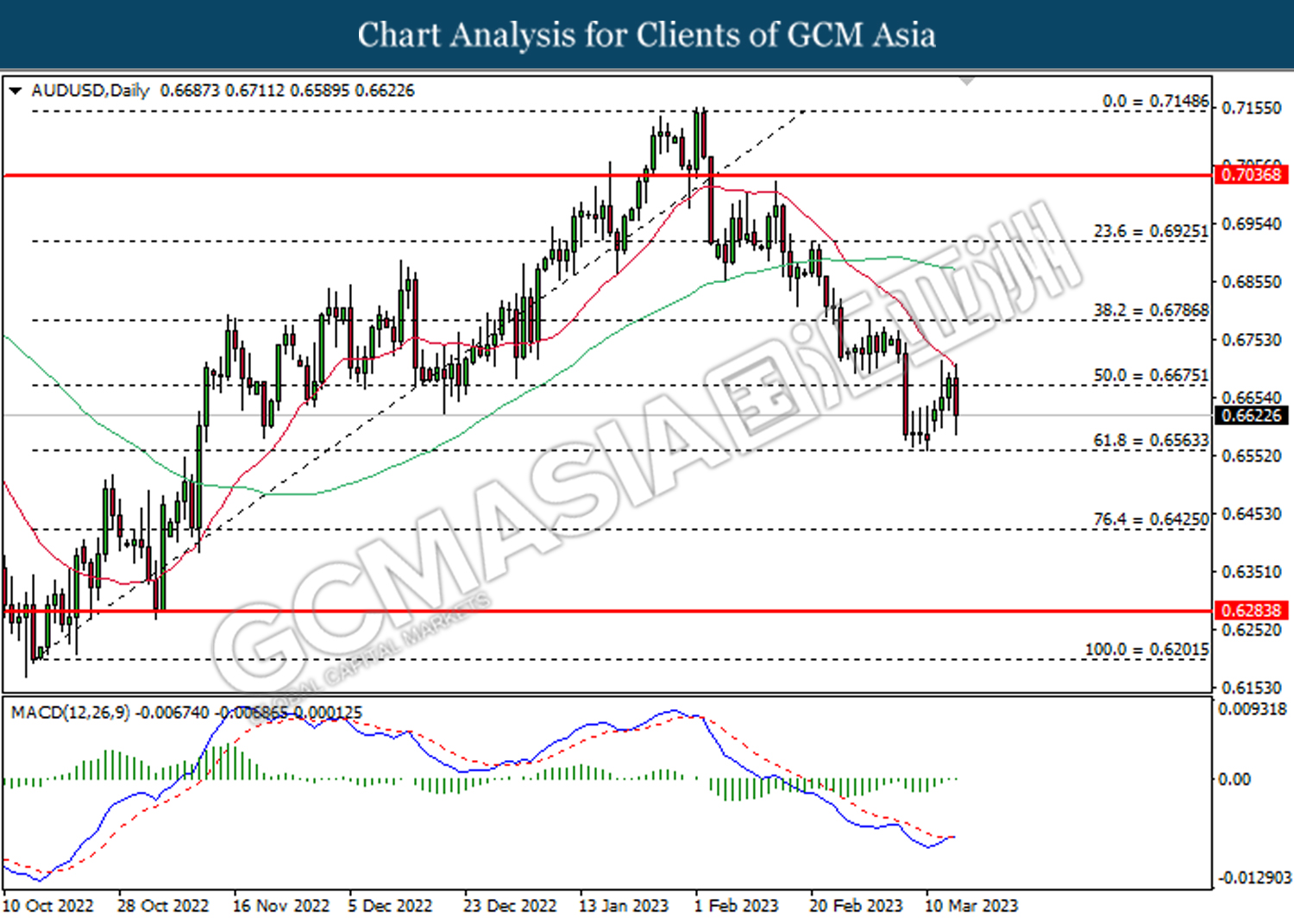

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

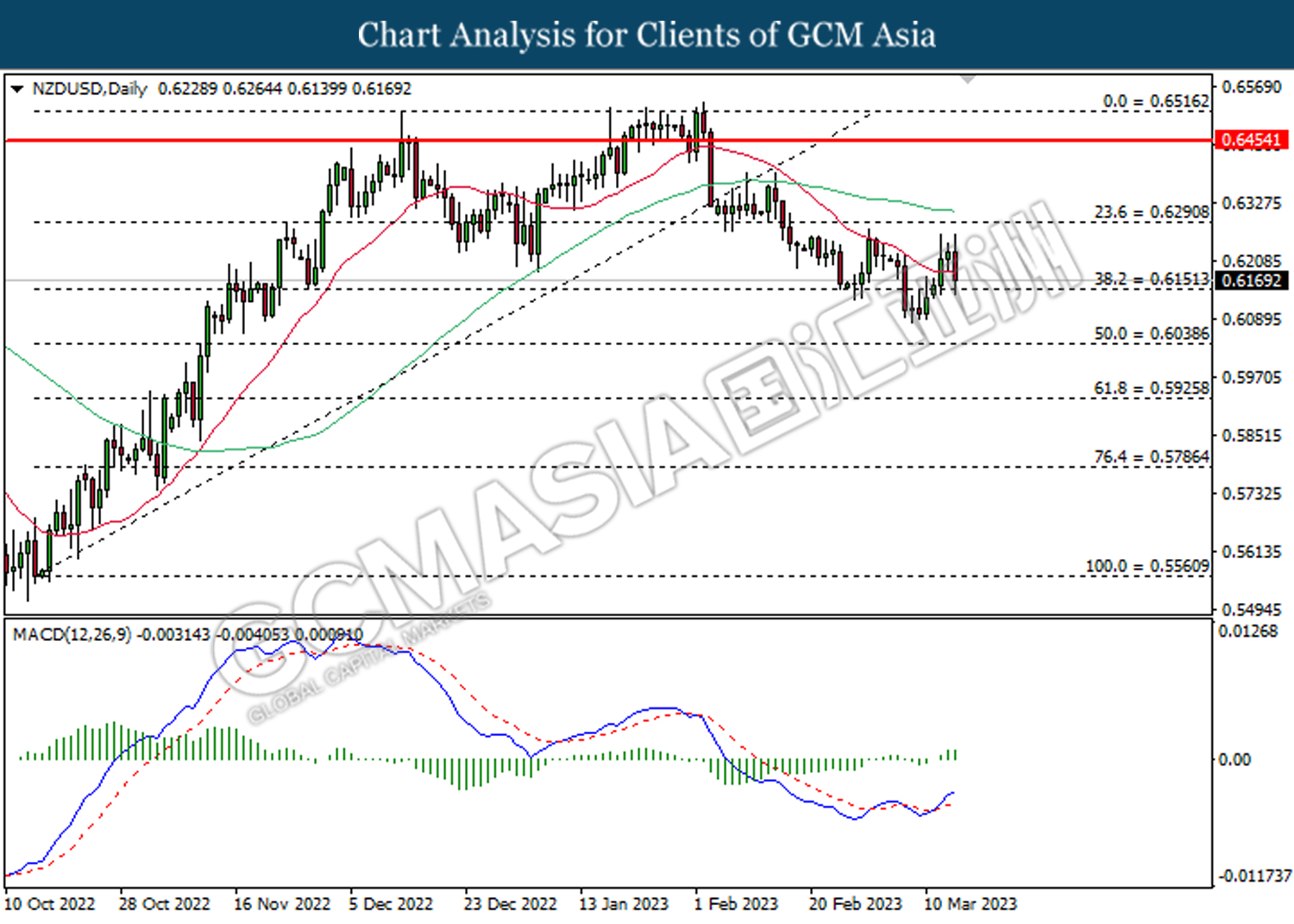

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6150. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

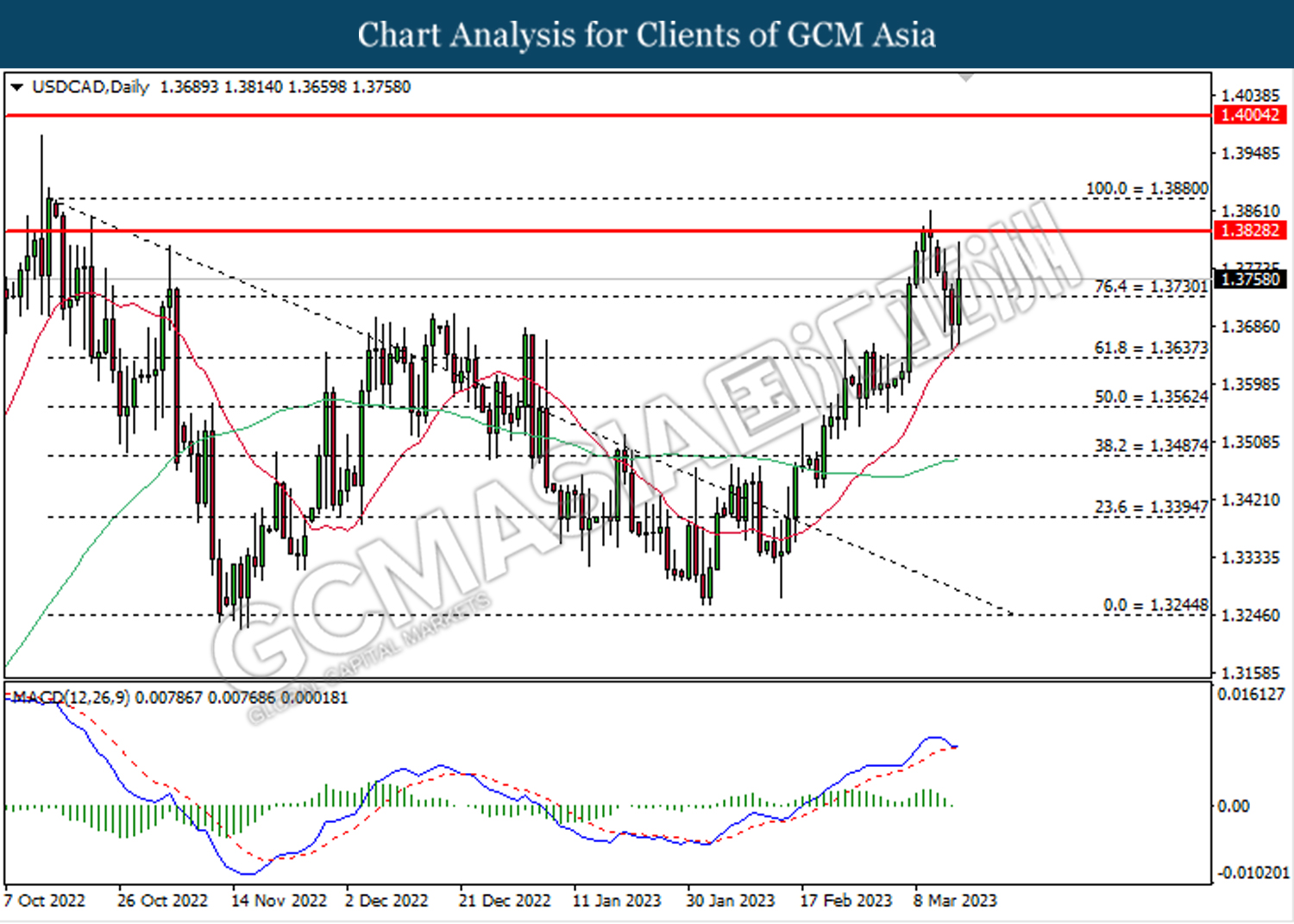

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3730. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3730, 1.3830

Support level: 1.3635, 1.3565

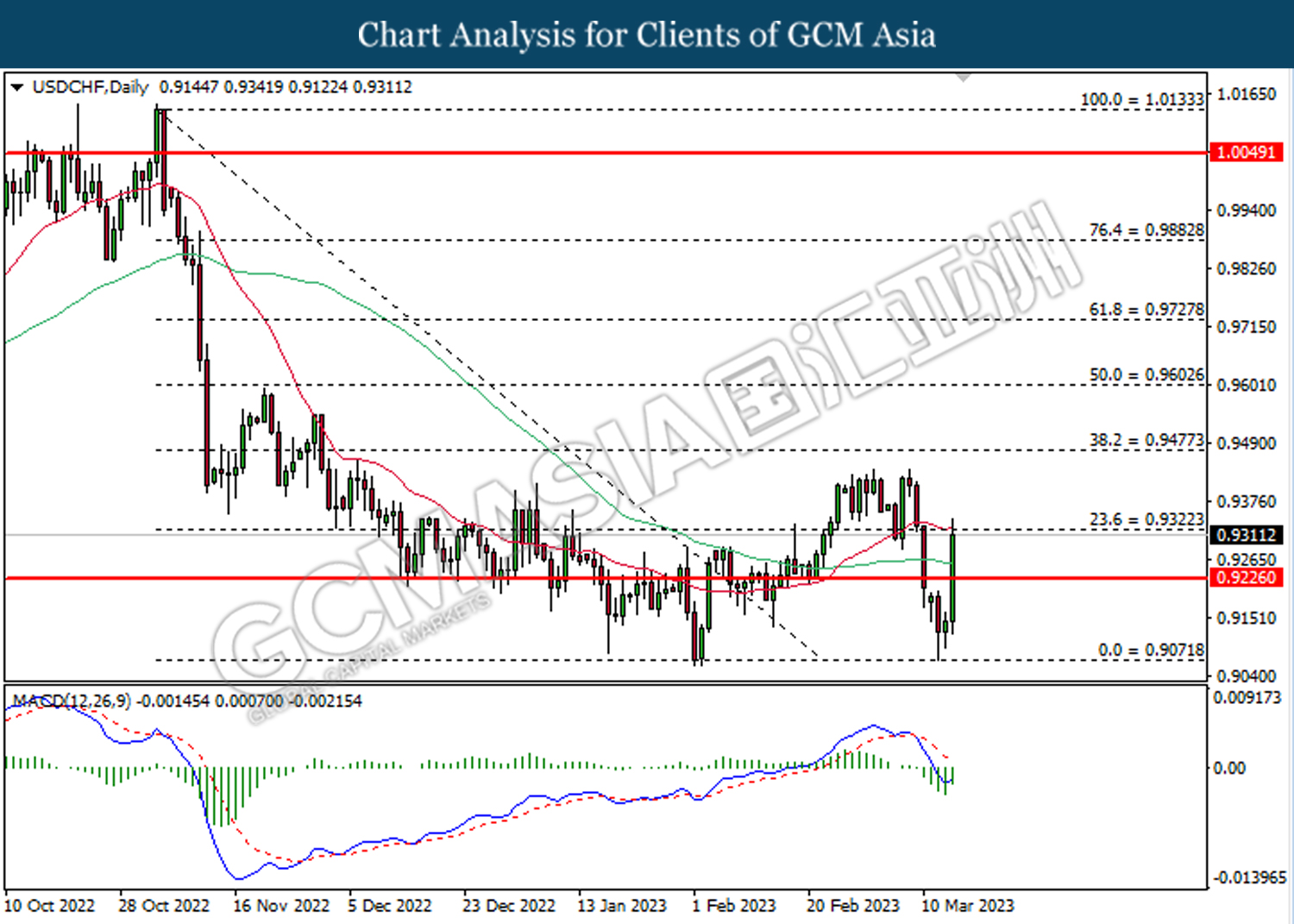

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9325. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9325, 0.9475

Support level: 0.9225, 0.9070

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 66.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 71.65, 76.10

Support level: 66.10, 61.45

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1900.00. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00