16 March 2023 Afternoon Session Analysis

The Aussie nudged higher after upbeat economic data.

The Aussie dollar, which is one of the most traded currencies, nudged higher after positive economic data released. The Feb employment changes grew positively from -11.0k to 64.6k versus the market expectation of 48.5k. According to the labor data released by the Australian Bureau of Statistics (ABS), the Australian unemployment rate slightly reduced by 0.2% to 3.5%, recorded as the lowest unemployment rate since the 1970s. Both upbeat data allows Reserve Bank of Australia to increase its cash rate further, although the Governor Philip Lowe signaled a rate hike pause recently. The positive labor data boosted the value of Aussie dollar, as the market expects strong consumer spending to keep inflation steadily at a higher level, and RBA will continue to hike rate to curb the high inflation figure. Besides, the Aussie also benefited from its largest trading partner China, after China released its economic data. In China, the asset investment jumped to 5.5%, highlighting a remarkable improvement in construction project investments. The optimistic data give support to the Aussie dollar by a way of hopefulness in commodity exports. As of writing, the AUD/USD was traded up to 0.30% to $0.6635.

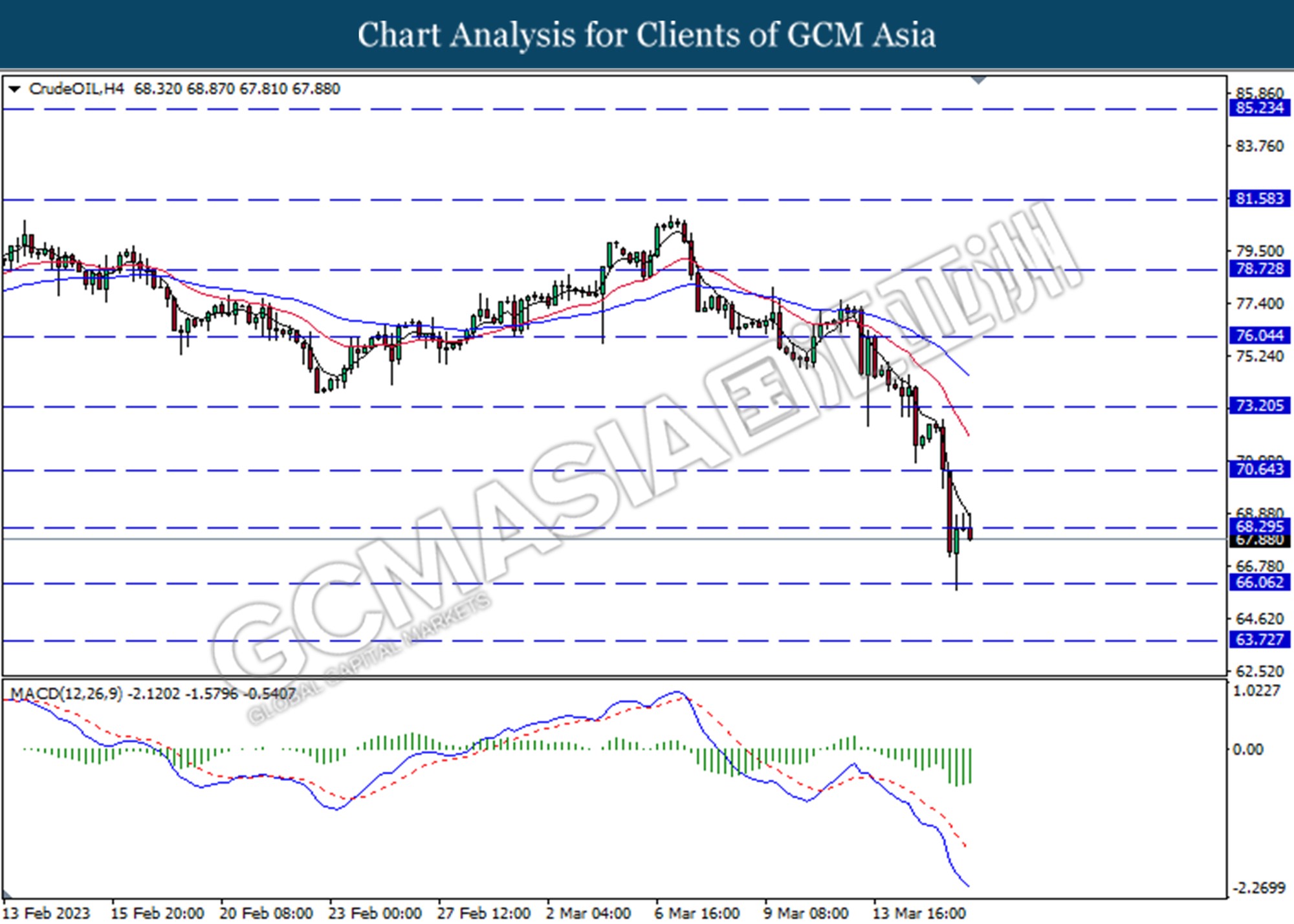

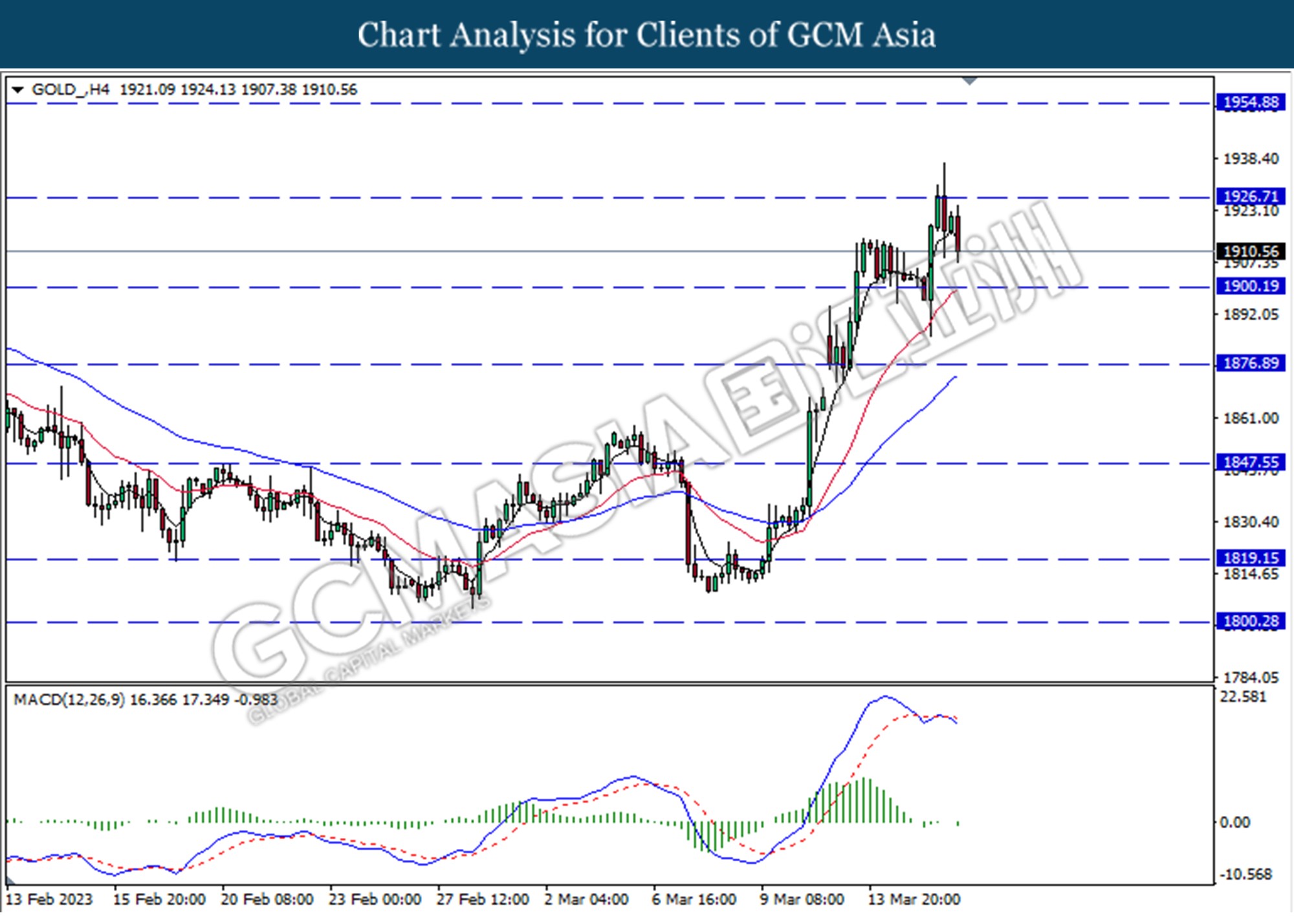

In the commodities market, crude oil prices rebounded by 0.87% to $68.19 per barrel after Credit Suisse secured a lifeline from the Swiss Central Bank up to $54 billion. Besides, gold prices was traded lower by -0.39% to $1923.65 per troy ounce following the investor locked in recent profits.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:15 EUR ECB Monetary Policy Statement

21:45 EUR ECB Press Conference

23:15 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Feb) | 1.339M | 1.340M | – |

| 20:30 | USD – Initial Jobless Claims | 211K | 205K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Mar) | -24.3 | -15.6 | – |

| 21:15 | EUR – Deposit Facility Rate (Mar) | 2.50% | 3.00% | – |

| 21:15 | EUR – ECB Marginal Lending Facility | 3.25% | – | – |

| 21:15 | EUR – ECB Interest Rate Decision (Mar) | 3.00% | 3.50% | – |

Technical Analysis

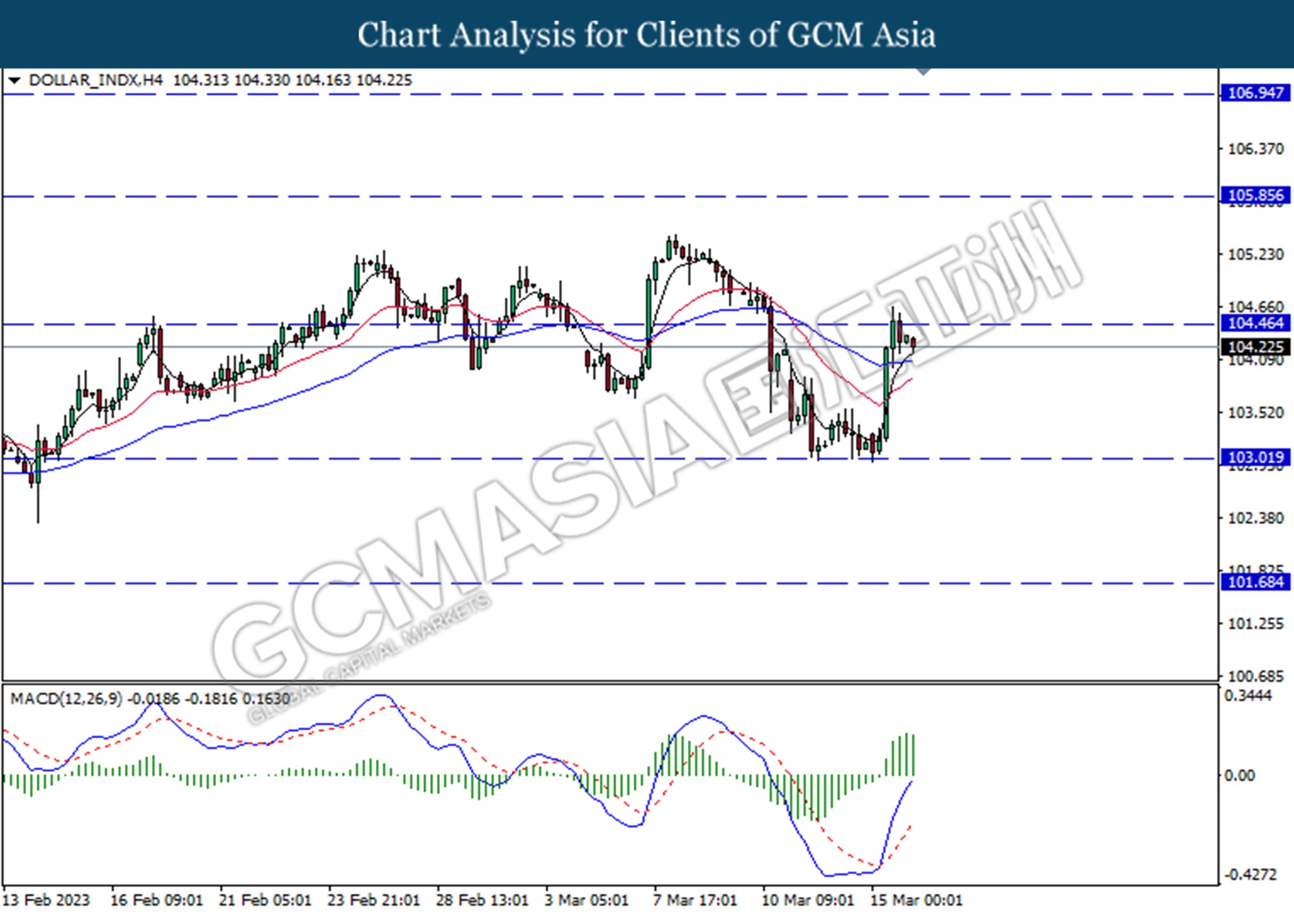

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the previous support level at 104.45. However, MACD which illustrated bullish momentum suggests the index to traded higher as technical correction.

Resistance level: 104.45, 105.85

Support level: 103.00, 101.70

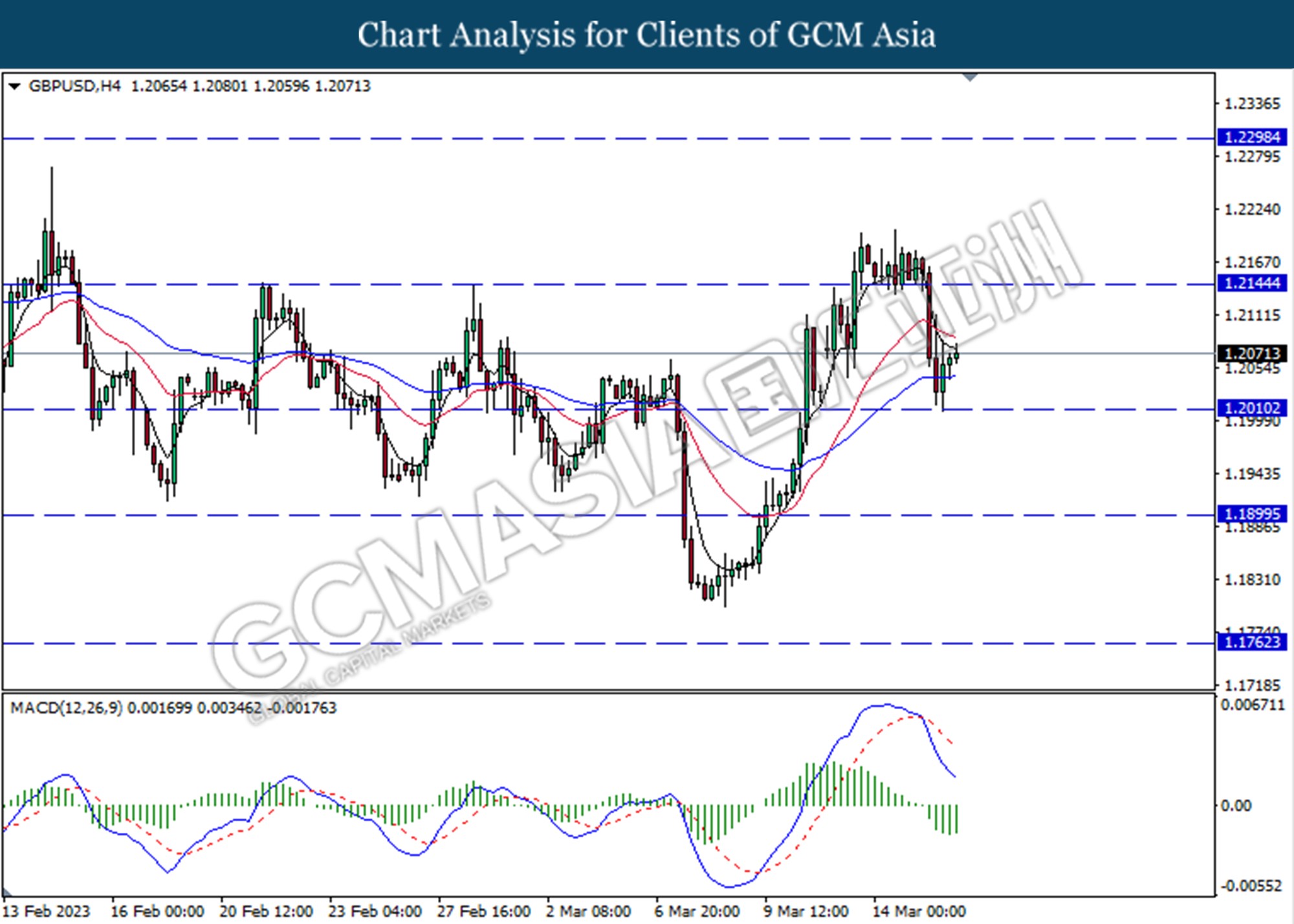

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the support level at 1.2010. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.2145.

Resistance level: 1.2145, 1.2300

Support level: 1.2010, 1.1900

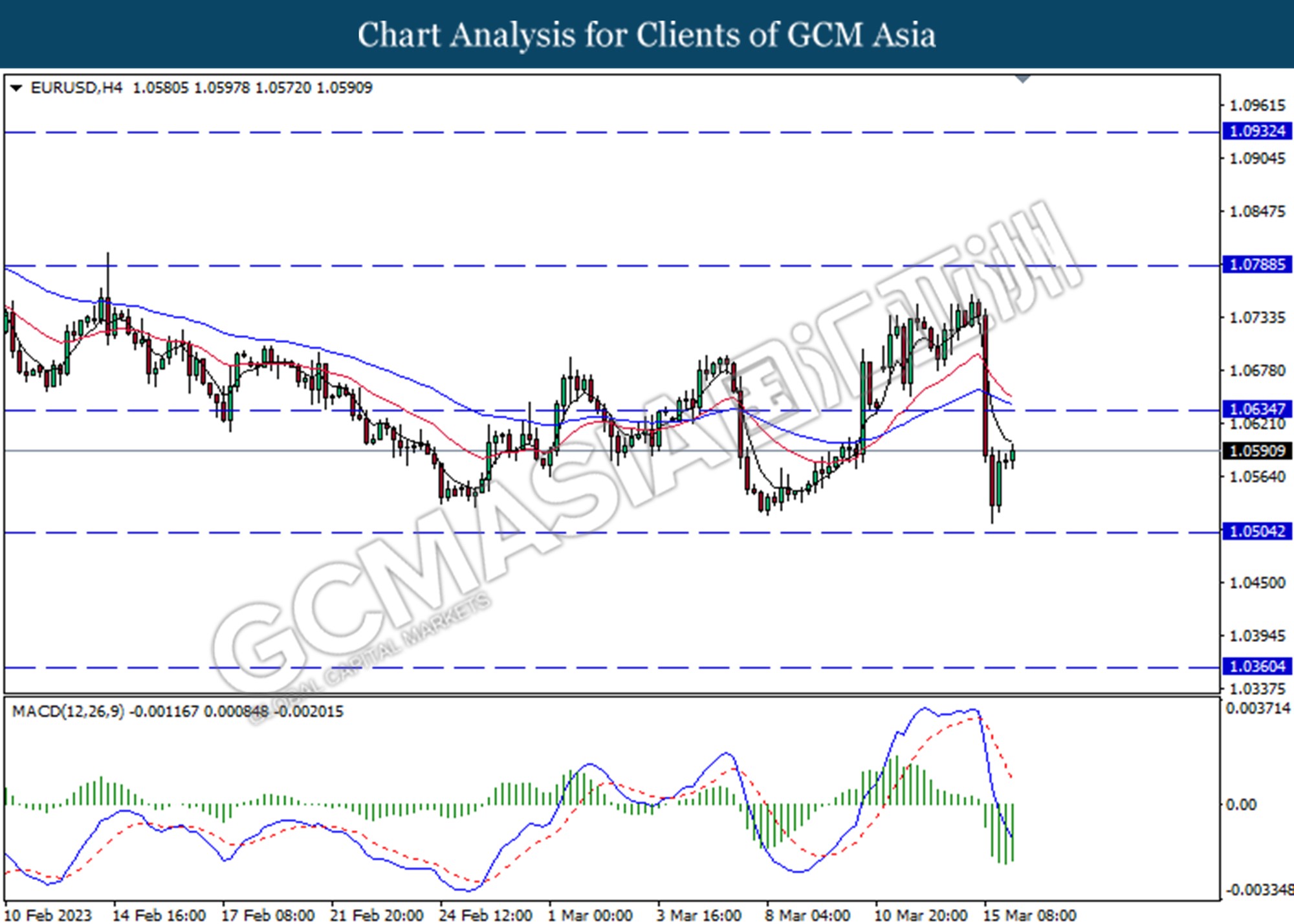

EURUSD, H4: EURUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level 1.0635.

Resistance level: 1.0635, 1.0790

Support level: 1.0505, 1.0360

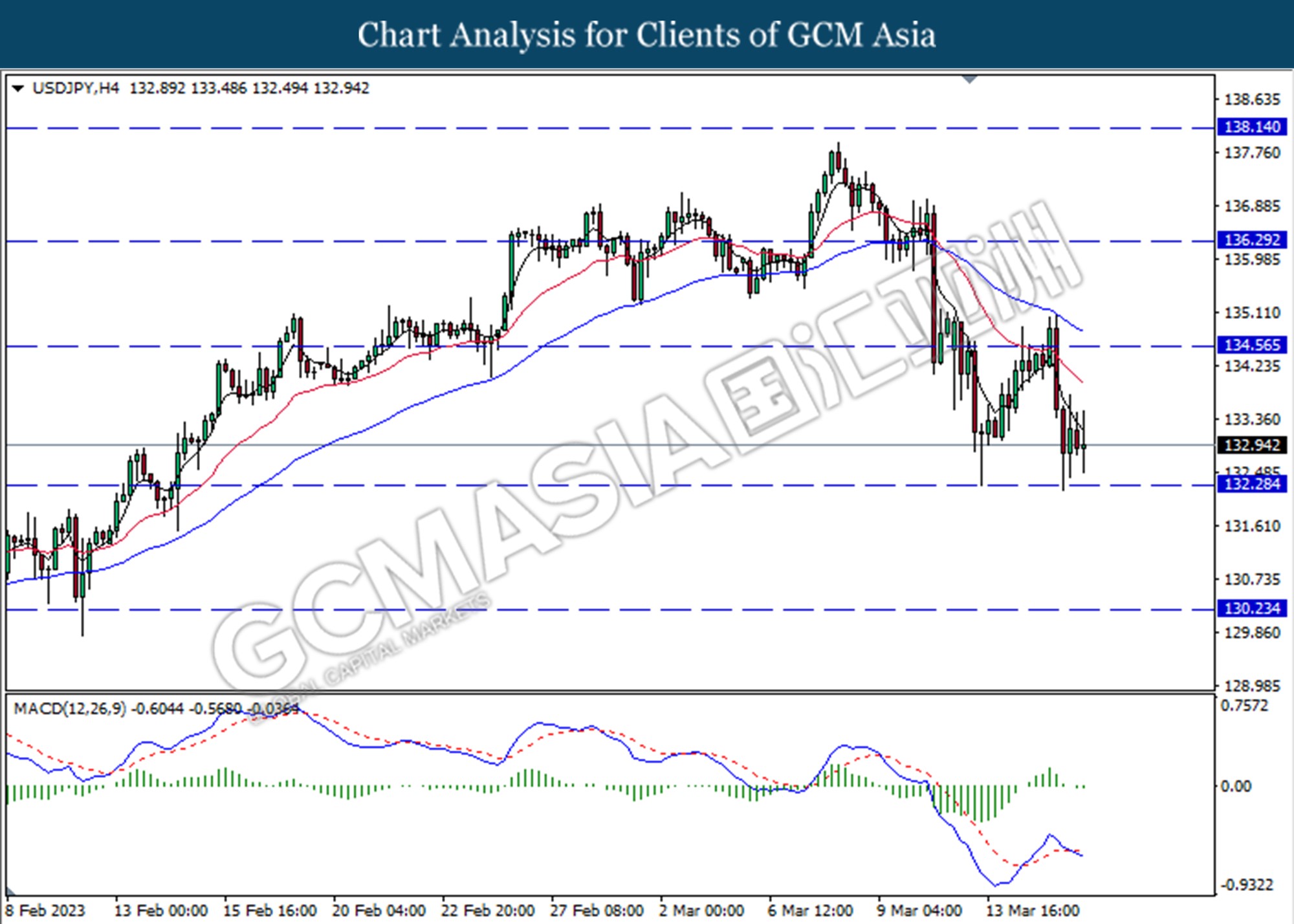

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 132.30.

Resistance level: 134.60, 136.30

Support level: 132.30, 130.25

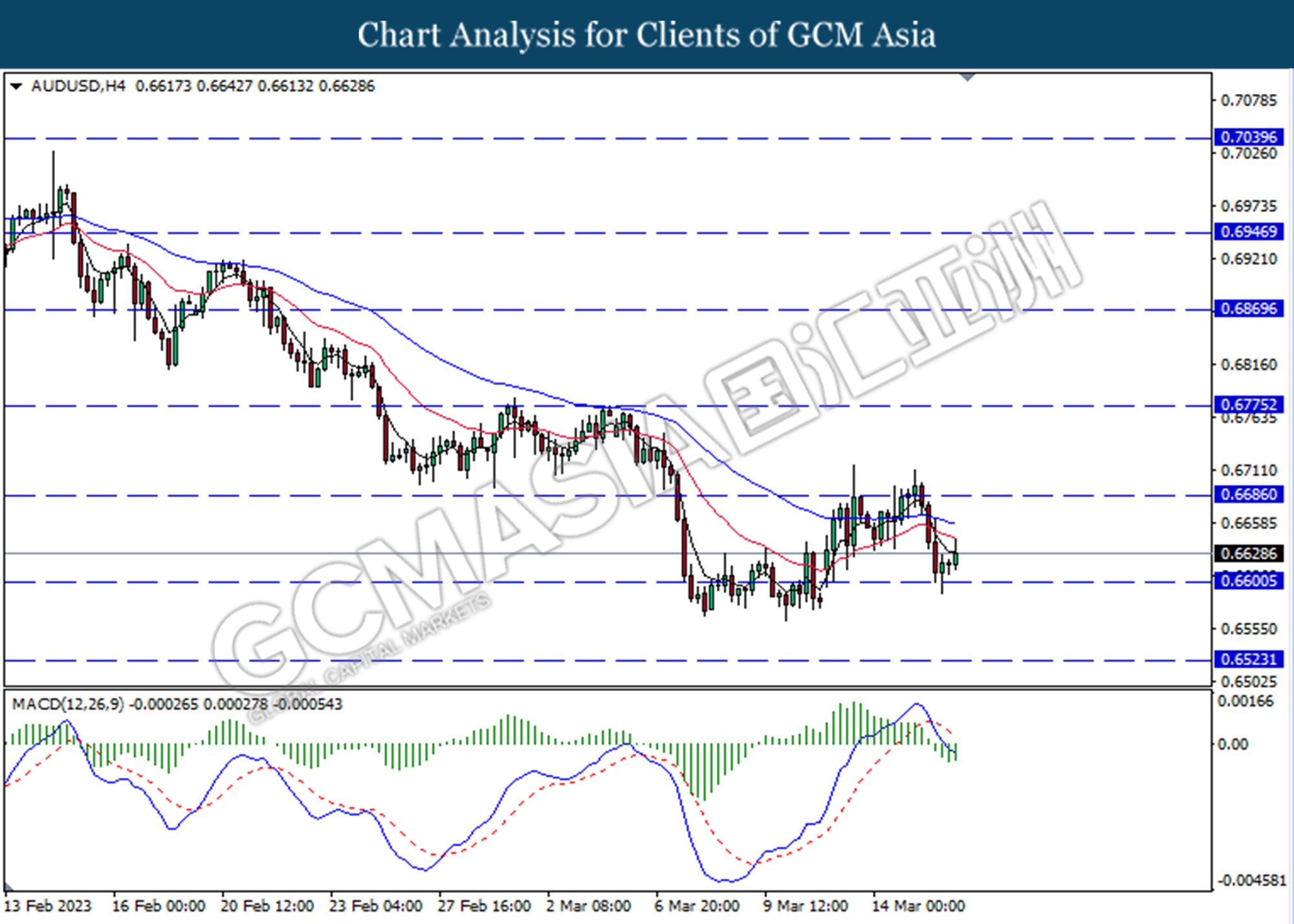

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

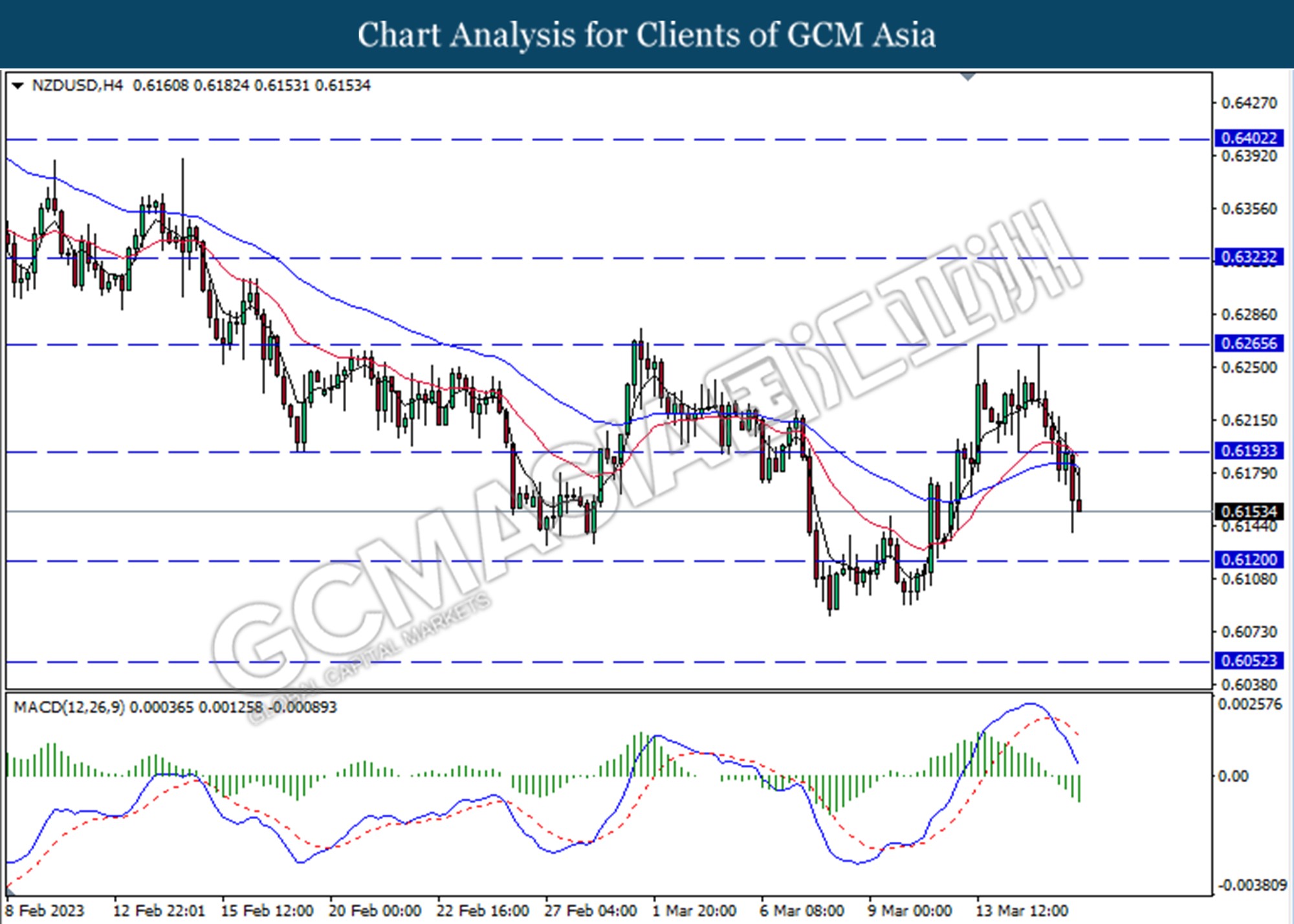

NZDUSD, H4: NZDUSD was traded lower following a prior break below the previous support level at 0.6195. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

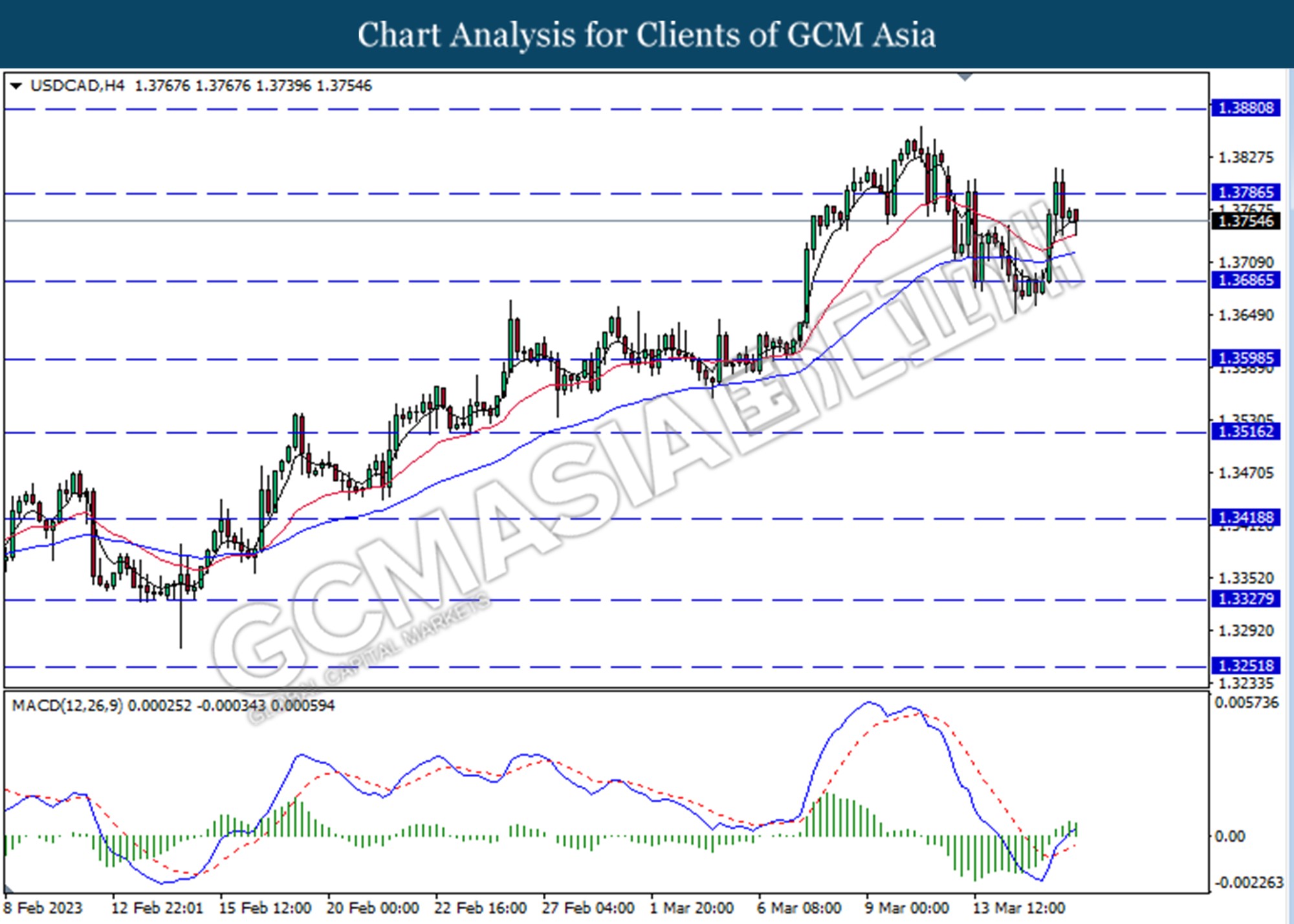

USDCAD, H4: USDCAD was traded lower following a prior break below the previous support level at 1.3785. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3685.

Resistance level: 1.3785, 1.3880

Support level: 1.3685, 1.3600

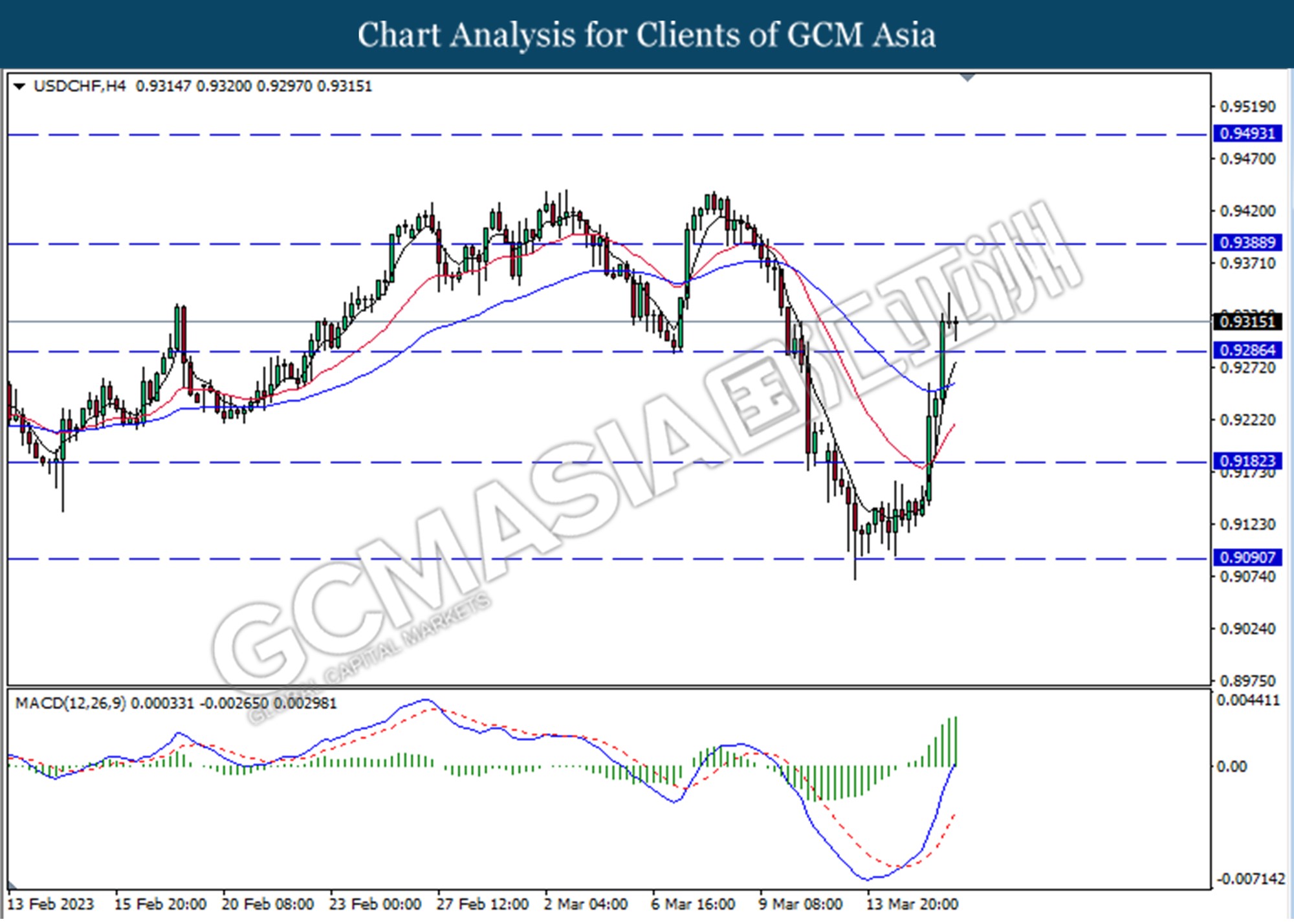

USDCHF, H4: USDCHF was traded higher following a prior break above a previous resistance level at 0.9285. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level at 0.9390.

Resistance level: 0.9390, 0.9495

Support level: 0.09285, 0.9180

CrudeOIL, H4: Crude oil price was traded lower following a break below the previous support level at 68.30. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 68.30, 70.65

Support level: 66.05, 63.70

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the commodity to extend it loses toward the support level at 1900.20.

Resistance level: 1926.70, 1954.90

Support level: 1900.20, 1876.90