30 July 2018 Weekly Analysis

GCMAsia Weekly Report: July 30 – August 3

Market Review (Forex): July 23 – 27

US Dollar

Greenback edged lower against other major peers last Friday despite optimistic preliminary reading of US second quarter GDP. The dollar index depreciates by 0.09%, ended the week at around 94.67.

According to US Commerce Department, US Gross Domestic Product grew at a faster pace with 4.1% during April till June, in line with economist forecast. The strong GDP reading was largely driven by a surge in consumer spending following tax cuts albeit being offset partially with negative contribution from private inventory and residential fixed investment.

Some analyst questioned the sustainability of such growth as benefits from fiscal stimulus may dial down next year. Such outlook was given as US Federal Reserve pledged to tighten their monetary policy further as inflationary pressure and job markets continues to expand at a faster rate.

USD/JPY

Pair of USD/JPY slumped 0.18% to 111.03 during late Friday trading.

EUR/USD

Euro recovered its losses by 0.13% to $1.1658 against the greenback. The single common currency received some buying support following last week’s depreciation after ECB President Mario Draghi reiterated to keep interest rates steady until next year.

GBP/USD

Pound sterling ticked down 0.02% to $1.3106 against the US dollar.

Market Review (Commodities): July 23 – 27

GOLD

Gold price recovered slightly on Friday following a slump in the greenback although US economy expands more rapidly during the second quarter. Price of the yellow metal ticked up 0.03% while ended the week at $1,223.08 a troy ounce.

Evidently, safe-haven assets which are denominated in US dollar will received some buying support in the event of a depreciation of the denominated currency. However, recovery on the precious metal remains limited as market participants places higher expectation on the US Federal Reserve to tighten their monetary policy in a more rapid fashion for the long-run.

In a setting with higher interest rates, demand for non-yielding assets such as gold will diminish as it fails to compete with high-yielding assets such as the US Treasury bonds.

Crude Oil

Crude oil price edges lower on Friday following higher US oil rig count which dials down market expectation for a slowdown in regional oil production. Price of the black commodity slipped 0.82%, closing the week at $70.07 per barrel.

According to oilfield service provider, Baker Hughes reported that the number of active oil drilling rigs in the United States were up by 3 to a total of 863. The reading marked the first rig count rise in three weeks, signaling higher possibility for further expansion in US oil production.

However, losses on the commodity remains limited as investors places their attention upon other signals which points to lower supplies in the market. Prior, Saudi Arabia temporarily paused their shipments through the Red Sea strait after two of its oil tankers were reportedly attacked by Houthi Rebels.

The disruption in the Middle East may decrease their oil exports and production, increasing market expectation for lower supply from the region that could underpin global oil prices. Furthermore, supply issue which stemmed from Libya, Venezuela and Nigeria has also further underpinned overall optimism towards a crude supply draw globally.

Weekly Outlook: July 23 – 27

For the week ahead, investors will place their attention over the highly anticipated Federal Reserve Interest Rate Decision to monitor their stance towards future monetary policy and economic outlook.

Otherwise, oil traders will place their attention over OPEC meeting which is scheduled to commence on Wednesday to obtain further signals with regards to their approach taken to tackle imminent supply shortage.

Highlighted economy data and events for the week: July 30 – August 3

| Monday, July 30 |

Data USD – Pending Home Sales (MoM) (Jun)

Events N/A

|

| Tuesday, July 31 |

Data CNY – Manufacturing PMI (Jul) CNY – Non-Manufacturing PMI (Jul) JPY – BoJ Interest Rate Decision EUR – German Unemployment Change (Jul) EUR – CPI (YoY) (Jul) USD – Core PCE Price Index (YoY) (Jun) USD – Employment Cost Index (QoQ) (Q2) USD – Personal Income (MoM) (Jun) USD – Personal Spending (MoM) (Jun) CAD – GDP (MoM) (May) USD – CB Consumer Confidence (Jul)

Events JPY – BoJ Outlook Report JPY – BoJ Monetary Policy Statement JPY – BoJ Press Conference

|

| Wednesday, August 1 |

Data CrudeOIL – API Weekly Crude Oil Stock NZD – Employment Change (QoQ) (Q2) CNY – Caixin Manufacturing PMI (Jul) EUR – German Manufacturing PMI (Jul) GBP – Manufacturing PMI (Jul) USD – ADP Nonfarm Employment Change (Jul) USD – ISM Manufacturing PMI (Jul) USD – ISM Manufacturing Employment (Jul) CrudeOIL – Crude Oil Inventories

Events CrudeOIL – OPEC Meeting

|

| Thursday, August 2 |

Data USD – Fed Interest Rate Decision GBP – Construction PMI (Jul) GBP – BoE Interest Rate Decision USD – Initial Jobless Claims

Events USD – FOMC Statement GBP – BoE Inflation Report GBP – BoE Gov Carney Speaks

|

|

Friday, August 3

|

Data AUD – Retail Sales (MoM) (Jun) GBP – Services PMI (Jul) USD – Average Hourly Earnings (MoM) (Jul) USD – Nonfarm Payrolls (Jul) USD – Unemployment Rate (Jul) CAD – Trade Balance (Jun) USD – ISM Non-Manufacturing PMI (Jul) USD – ISM Non-Manufacturing Employment (Jul) CrudeOIL – US Baker Hughes Oil Rig Count

Events N/A

|

Technical Weekly Outlook: July 30 – August 3

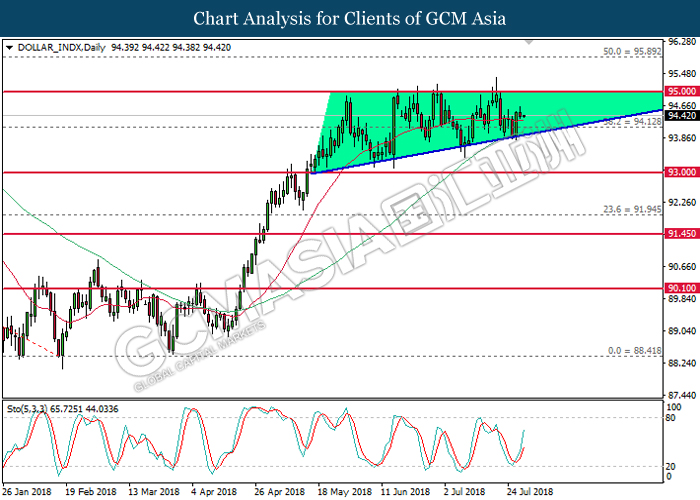

Dollar Index

DOLLAR_INDX, Daily: Dollar index remains traded within an ascending triangle following prior rebound from the bottom level. Stochastic Oscillator which illustrate rebound signal suggests the index to extend its gains, towards the upper level of the triangle.

Resistance level: 95.00, 95.90

Support level: 94.10, 93.00

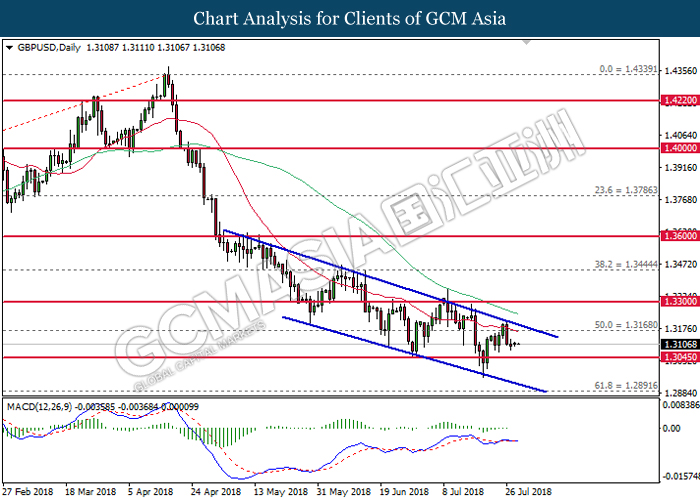

GBPUSD

GBPUSD, Daily: GBPUSD remains traded within a descending channel following prior retracement from the top level. MACD histogram which begins to form bearish signal may suggests the pair to be traded lower in short-term, towards the direction of support level near 1.3045.

Resistance level: 1.3170, 1.3300

Support level: 1.3045, 1.2890

USDJPY

USDJPY, Daily: USDJPY was traded lower following prior breakout from the upward trendline. However, MACD histogram which illustrate diminished downward momentum may suggests the pair to extend its gains in short-term after closing above the threshold of 111.00.

Resistance level: 111.00, 112.10

Support level: 110.50, 109.35

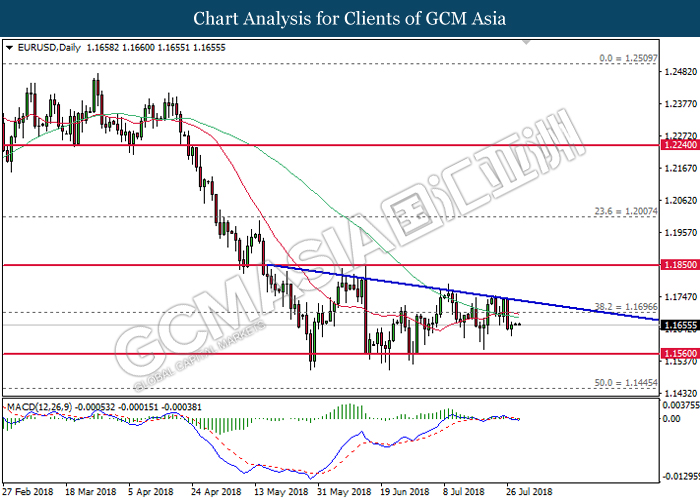

EURUSD

EURUSD, Daily: EURUSD remains traded within a descending triangle following prior retracement from the top level. MACD which has formed a death cross signal may suggest the pair to extend its losses in short-term, towards the direction of support level near 1.1560.

Resistance level: 1.1700, 1.1850

Support level: 1.1560, 1.1445

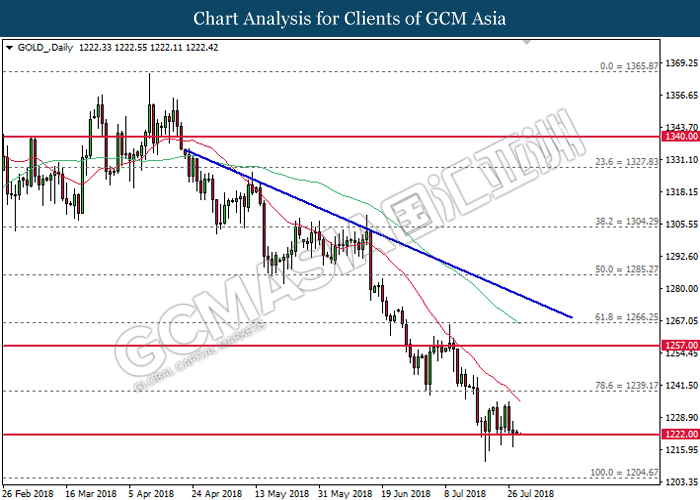

GOLD

GOLD_, Daily: Gold price extended its losses following prior retracement from the 20-MA line (red). Both MA line which continues to expand downwards suggests the commodity price to advance further down after successfully breaking the strong support near 1222.00.

Resistance level: 1239.20, 1257.00

Support level: 1222.00, 1204.70

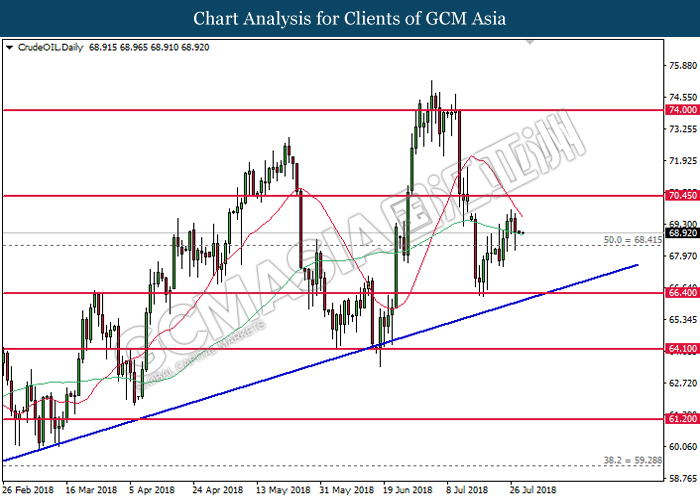

Crude Oil

CrudeOIL, Daily: Crude oil price was traded lower following prior retrace from the 20-MA line (red). Both MA line which continues to narrow downward suggests the commodity price to be traded lower in short-term after closing below the 60-MA line (green).

Resistance level: 70.45, 74.00

Support level: 68.40, 66.40