3 April 2023 Afternoon Session Analysis

Euro slided following easing inflation risk.

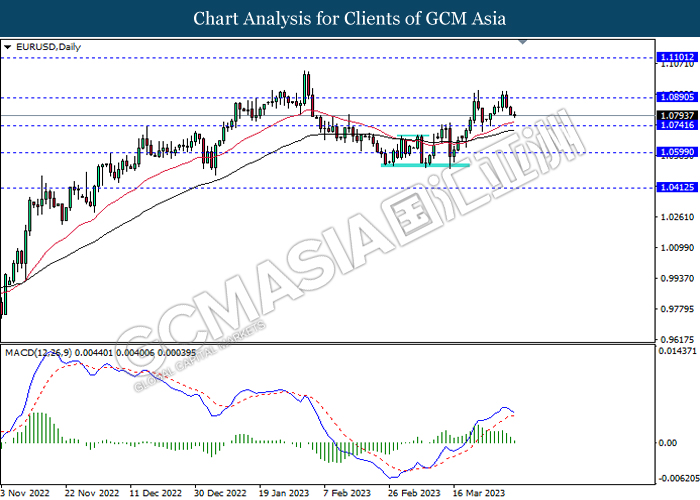

The EUR/USD, which traded by majority of global investors slumped on last Friday following the inflationary risk in the Eurozone has diminished. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY dropped significantly from the previous reading of 8.5% to 6.9%, which is lower than the consensus forecast of 7.1%. The main factor of easing inflation was the decline of energy price such as crude oil, whereas reducing the pressure on the living cost of European residents. Though, CNBC reported that the food price in Eurozone remained stubbornly high, as well as the likelihood aggressive rate hike by European Central Bank (ECB) still exist. On the other hand, the losses of Euro was limited amid the hawkish statement of ECB President. ECB President Christine Lagarde claimed on Friday that there is some room to raise its interest rate, as the core inflation in the Eurozone still remained in a high level. With that, it reflected the ECB’s determination to keep inflation down to 2%. Another ECB member, Francois Villeroy de Galhau also echoed the standpoint of ECB, as he deemed that there is a long way to tamp down the inflation risk. As of writing, the EUR/USD depreciated by 0.31% to 1.0793.

In the commodities market, the crude oil prices rose significantly by 5.56% to $79.88 per barrel as of writing following the positive speech toward the US economy has dialed up the market optimism on oil demand. In addition, the gold price dropped by 0.94% to $1951.06 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day CNY China – Ching Ming Festival

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 44.4 | 44.4 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 48.0 | 48.0 | – |

| 22:00 | USD – ISM Manufacturing PMI (Mar) | 47.7 | 47.5 | – |

Technical Analysis

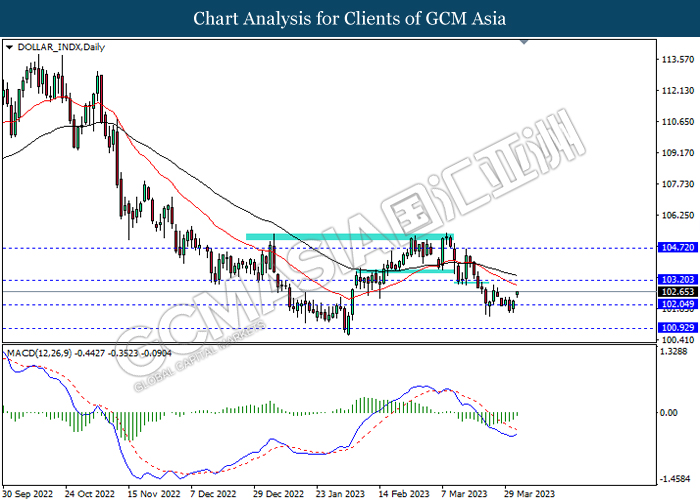

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 103.20, 104.70

Support level: 102.05, 100.90

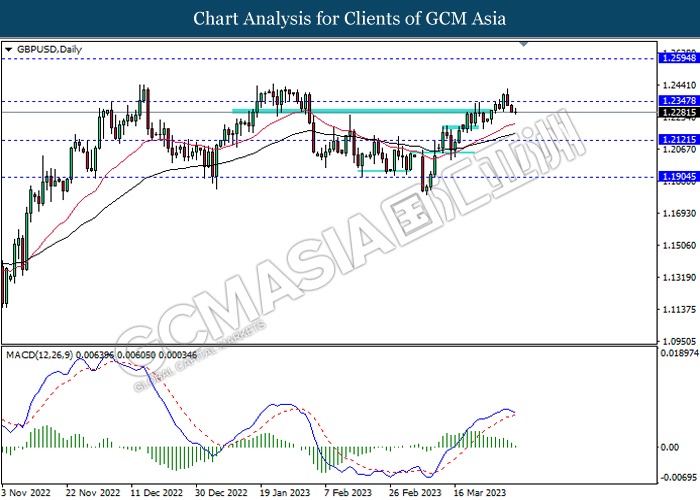

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2345, 1.2595

Support level: 1.2120, 1.1905

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0890, 1.1100

Support level: 1.0740, 1.0600

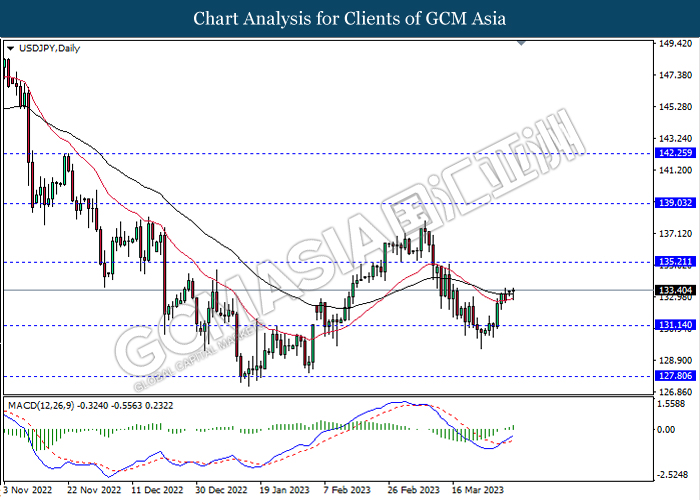

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

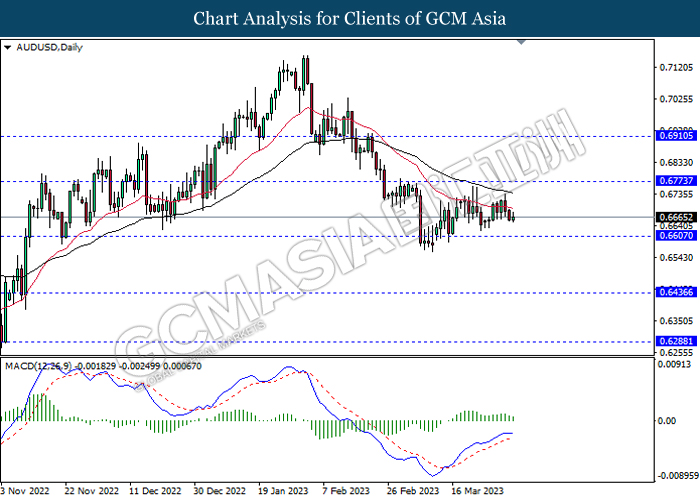

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

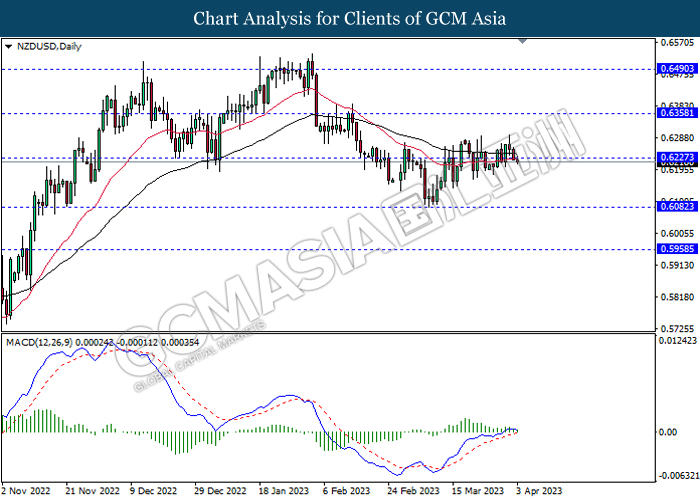

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

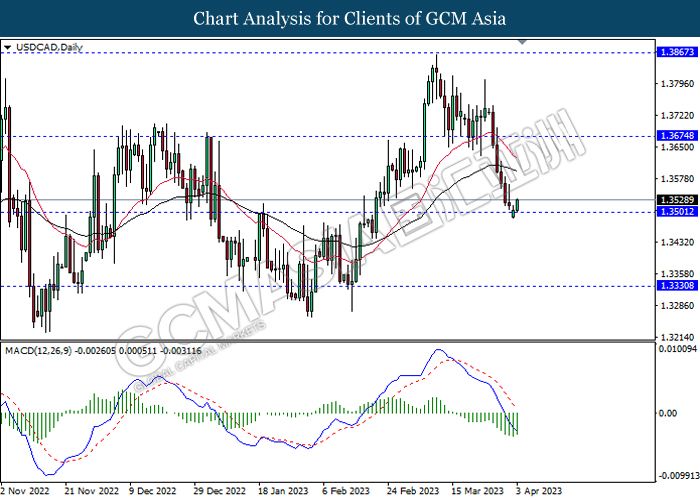

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

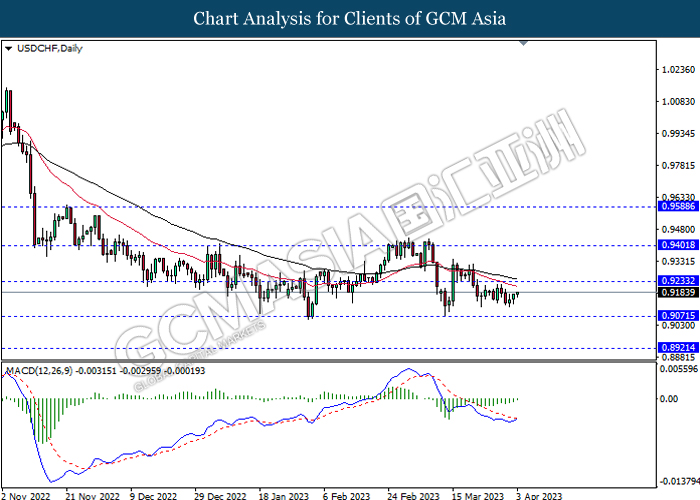

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9235, 0.9400

Support level: 0.9070, 0.8920

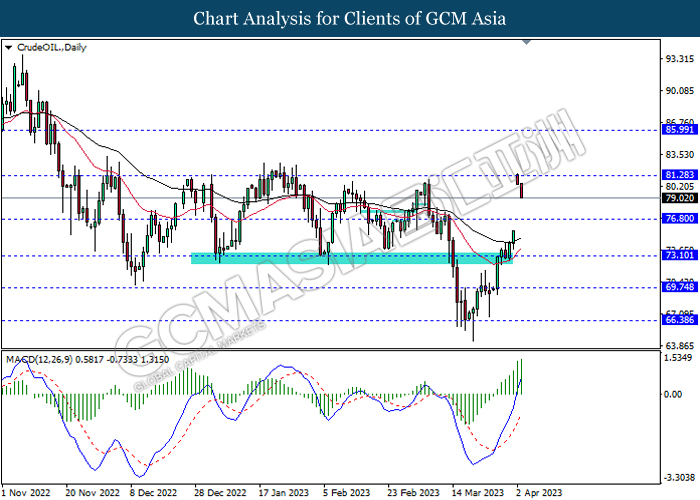

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

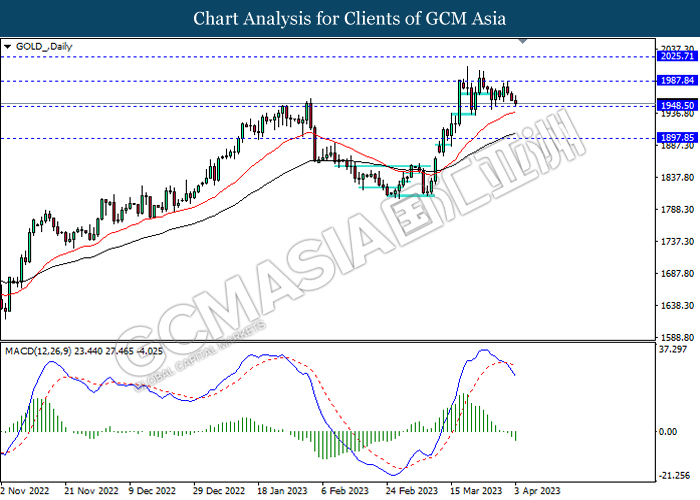

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1987.85, 2025.70

Support level: 1948.50, 1897.85