05 April 2023 Afternoon Session Analysis

RBNZ lifted cash rate, kiwi soared up.

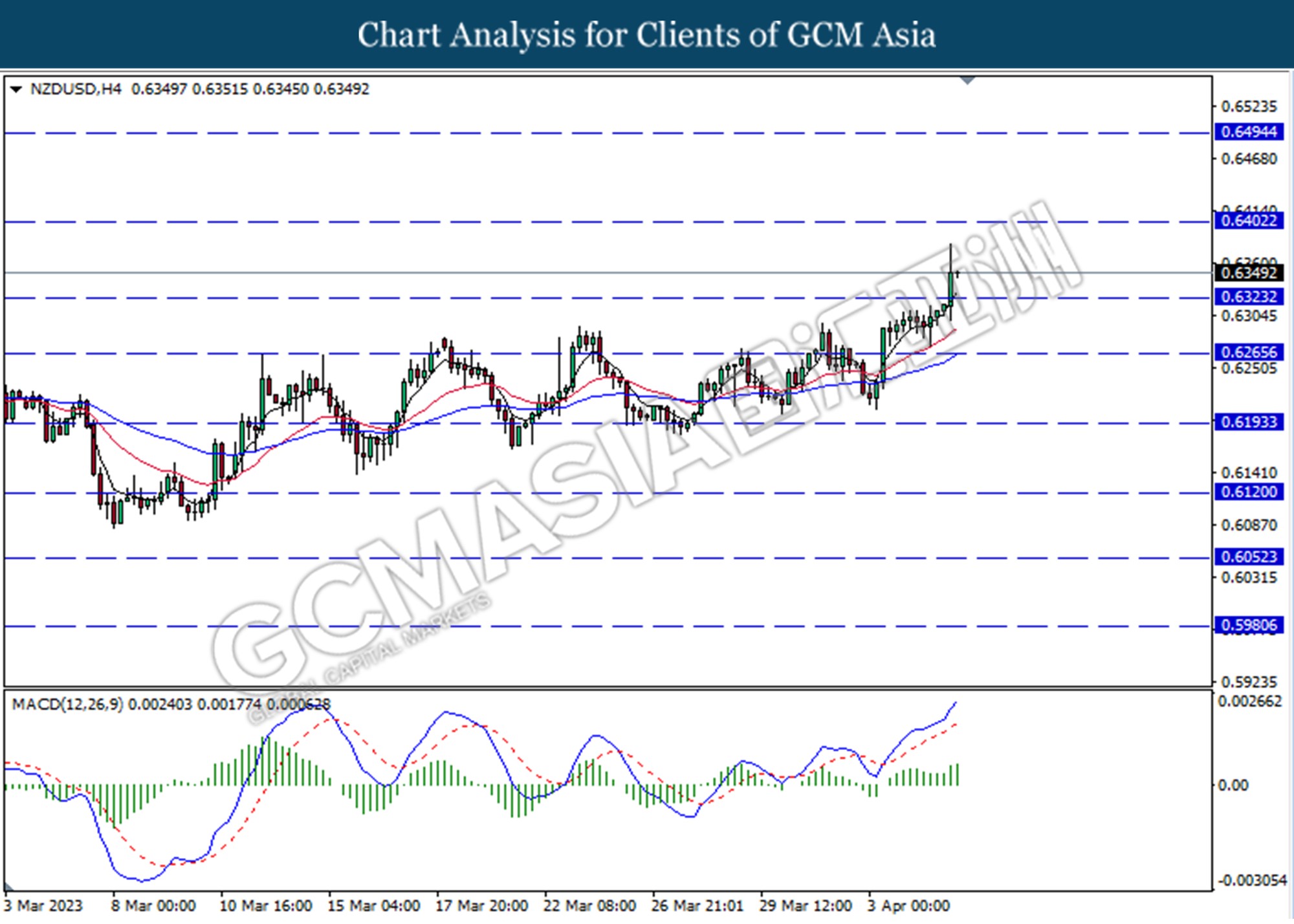

The Reserve Bank of New Zealand (RBNZ) unexpectedly life the Official Cash Rate (OCR) by 50 basis points, and the Kiwi soared up. The board member agreed to increase the cash rate by 50 basis points from 4.75% to 5.25% as inflation is high and persistent. The RBNZ’s interest rate decision beat investors’ expectations as investors had been pricing in a 25-basis point hike. The strength of the Kiwi supported the strong buying momentum on the pair of NZDUSD from investors. Before that, goods and services were disrupted as severe storm weather hit the North Island. As a result, inflation in New Zealand will remain high for a long time due to the reduction in supply. In addition, the board recognizes that the labor market is beyond the maximum suitable level as the recent data showed unemployment rate stood at 3.4%. The strong labor market gives the RBNZ more room to raise interest rates sharply, bringing inflation back to its target range of 1% to 3%. As of writing, the NZDUSD appreciated 0.67% to $0.6352.

In the commodities market, crude oil prices edged up by 0.50% to $81.11 per barrel as the US API crude oil inventory signs of shrinking inventory. Besides, gold prices traded up by 0.03% to $2038.90 per troy ounce amid slowing global economic growth fed into safe-haven demand for gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Composite PMI (Mar) | 52.2 | 52.2 | – |

| 16:30 | GBP – Services PMI (Mar) | 52.8 | 52.8 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Mar) | 242K | 242K | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Mar) | 55.1 | 55.1 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -7.489M | -7.489M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following the previous break below the previous support level at 101.70. However, MACD which illustrated diminishing bearish momentum suggests the index to traded higher as technical correction.

Resistance level: 101.70, 103.00

Support level: 100.35, 99.35

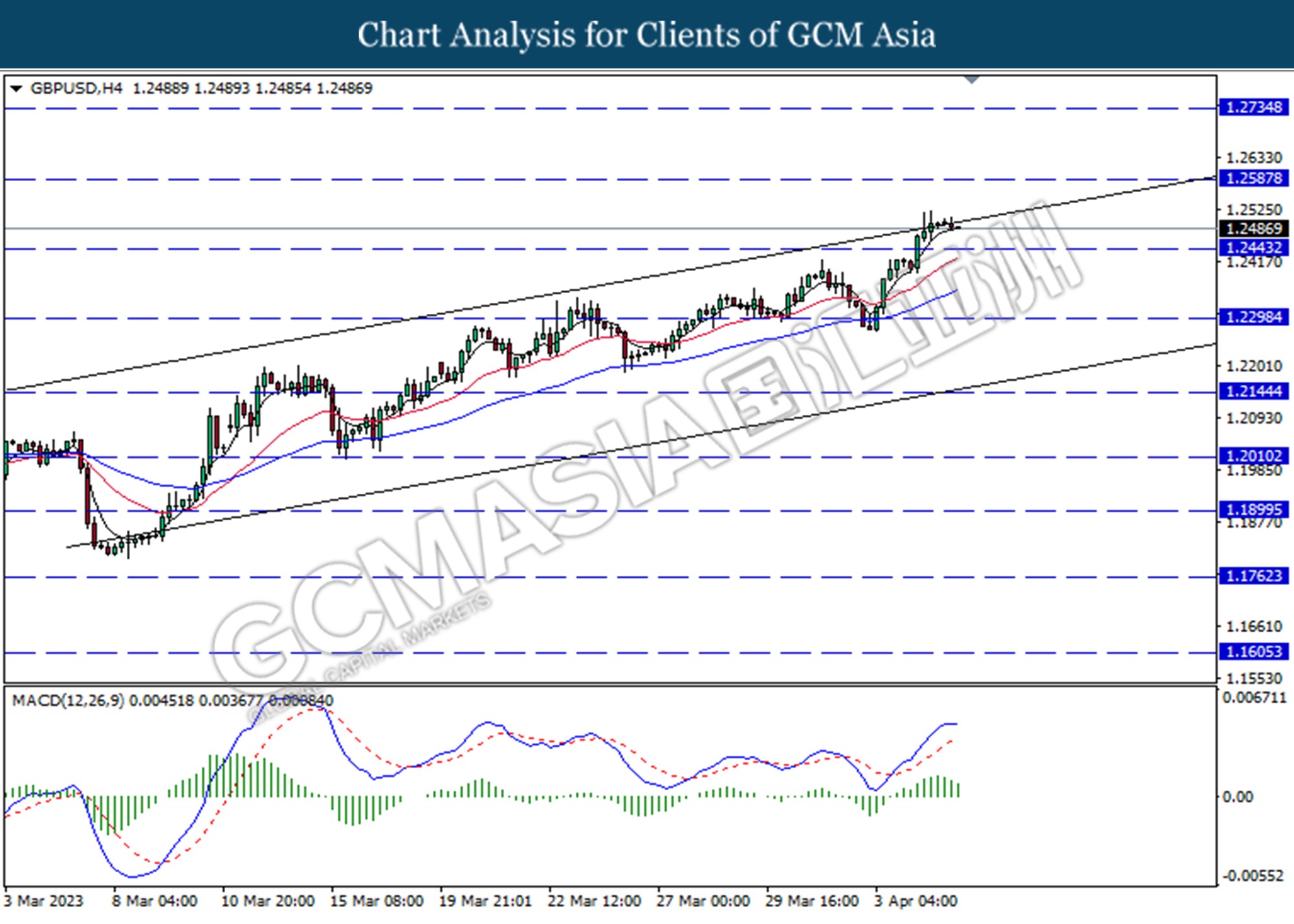

GBPUSD, H4: GBPUSD was traded lower following a prior retracement from the higher level . MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.2445.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded lower following a prior retracement from the higher level . MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the support level at 1.0930.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

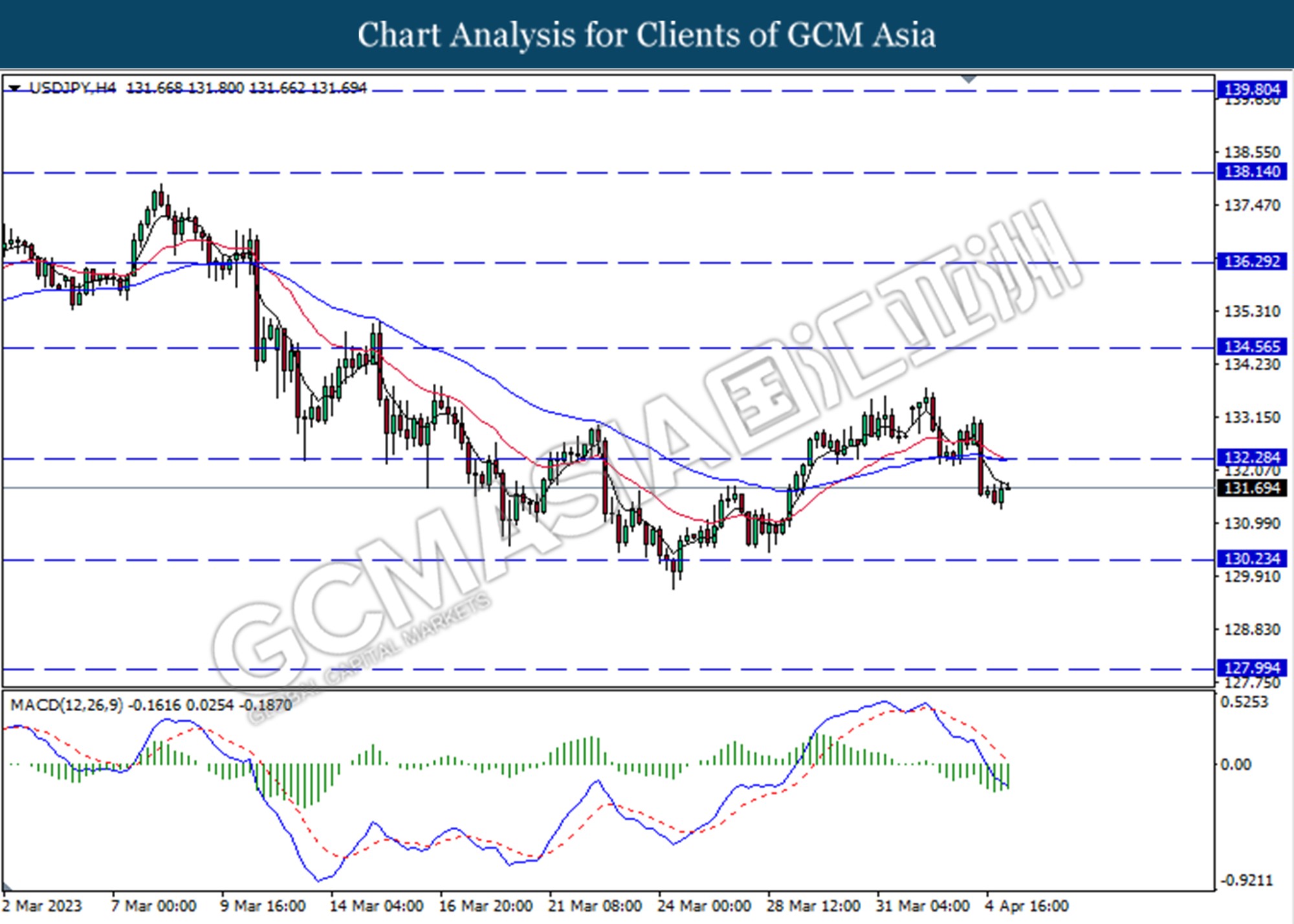

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 132.30.

Resistance level: 132.30, 134.55

Support level: 130.25, 128.00

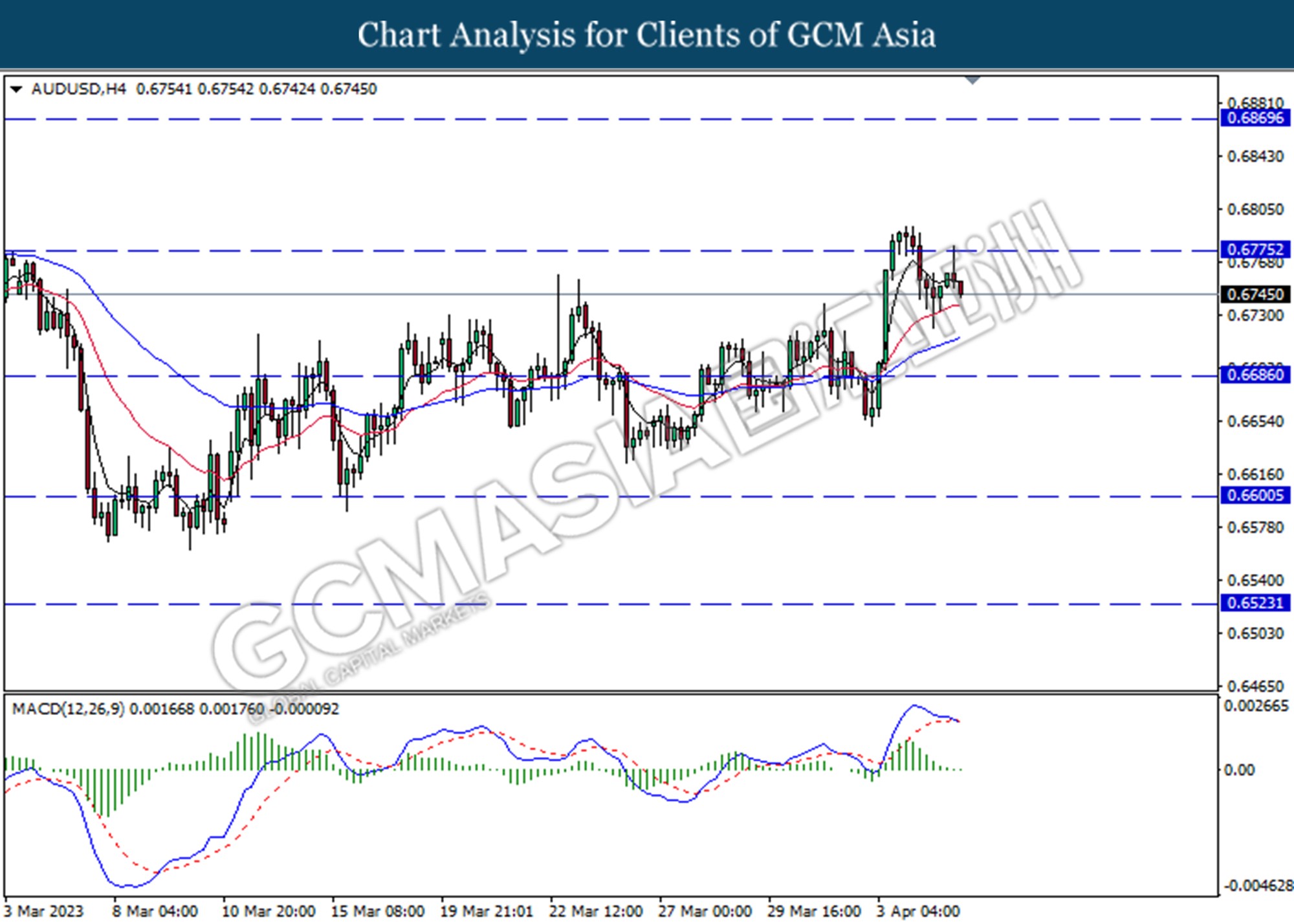

AUDUSD, H4: AUDUSD was traded lower following retracement from resistance level at 0.6775. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the resistance level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following breaks above the previous resistance level at 0.6325. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6400.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

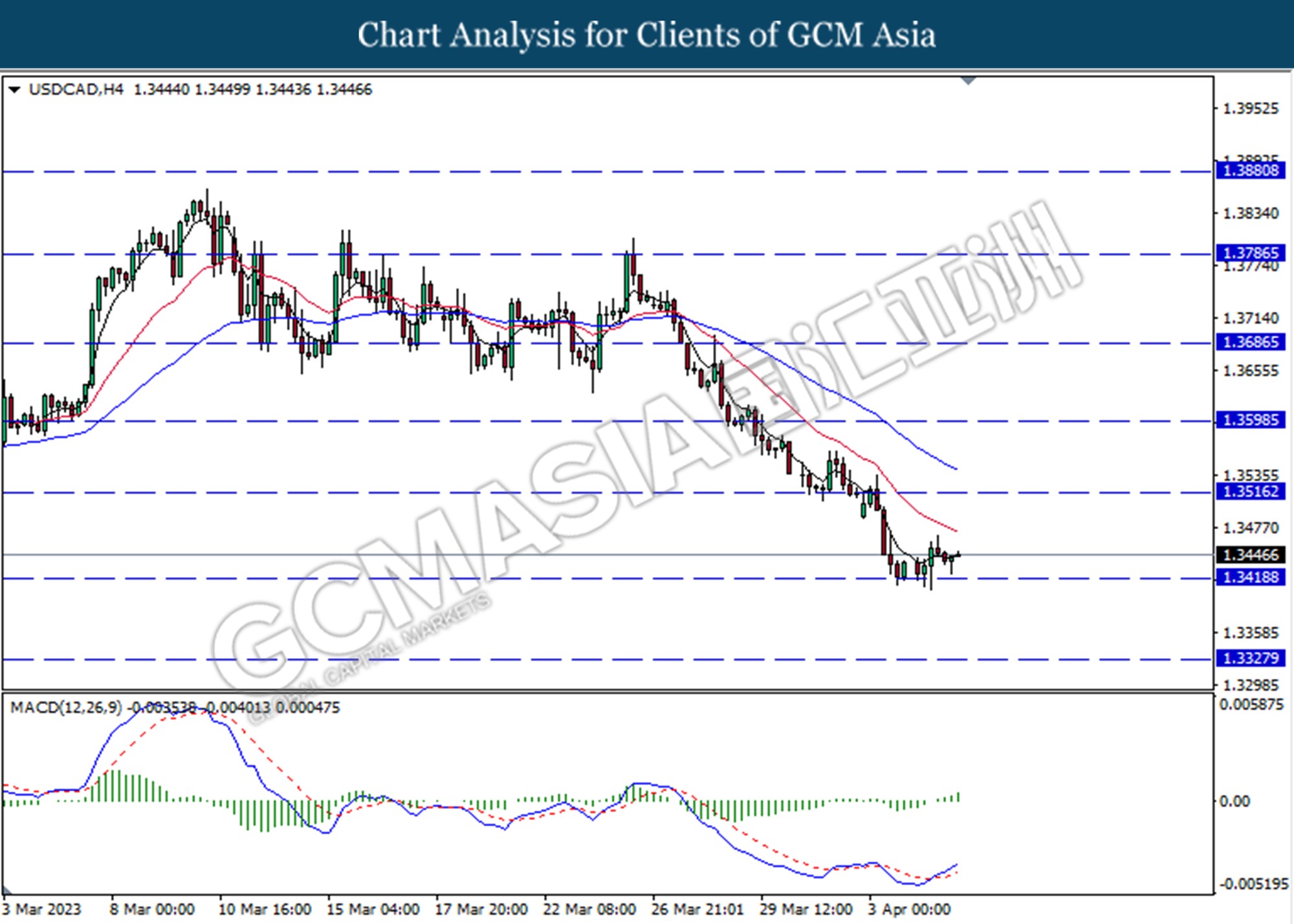

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3420. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3515.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

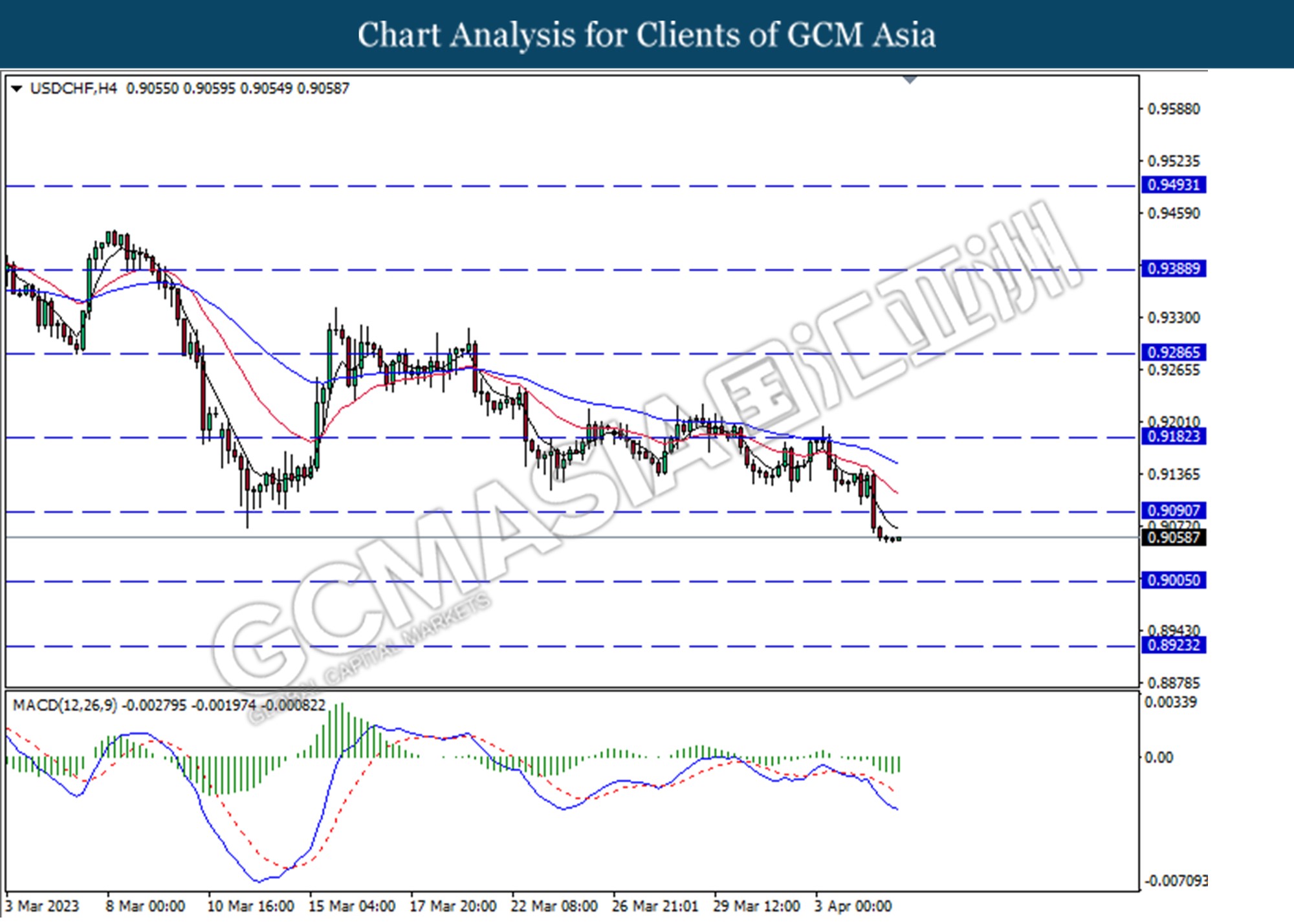

USDCHF, H4: USDCHF was traded lower following a prior break below from the previous support level at 0.9090. However, MACD which illustrated diminishing bearish momentum suggests the pair to traded higher as technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

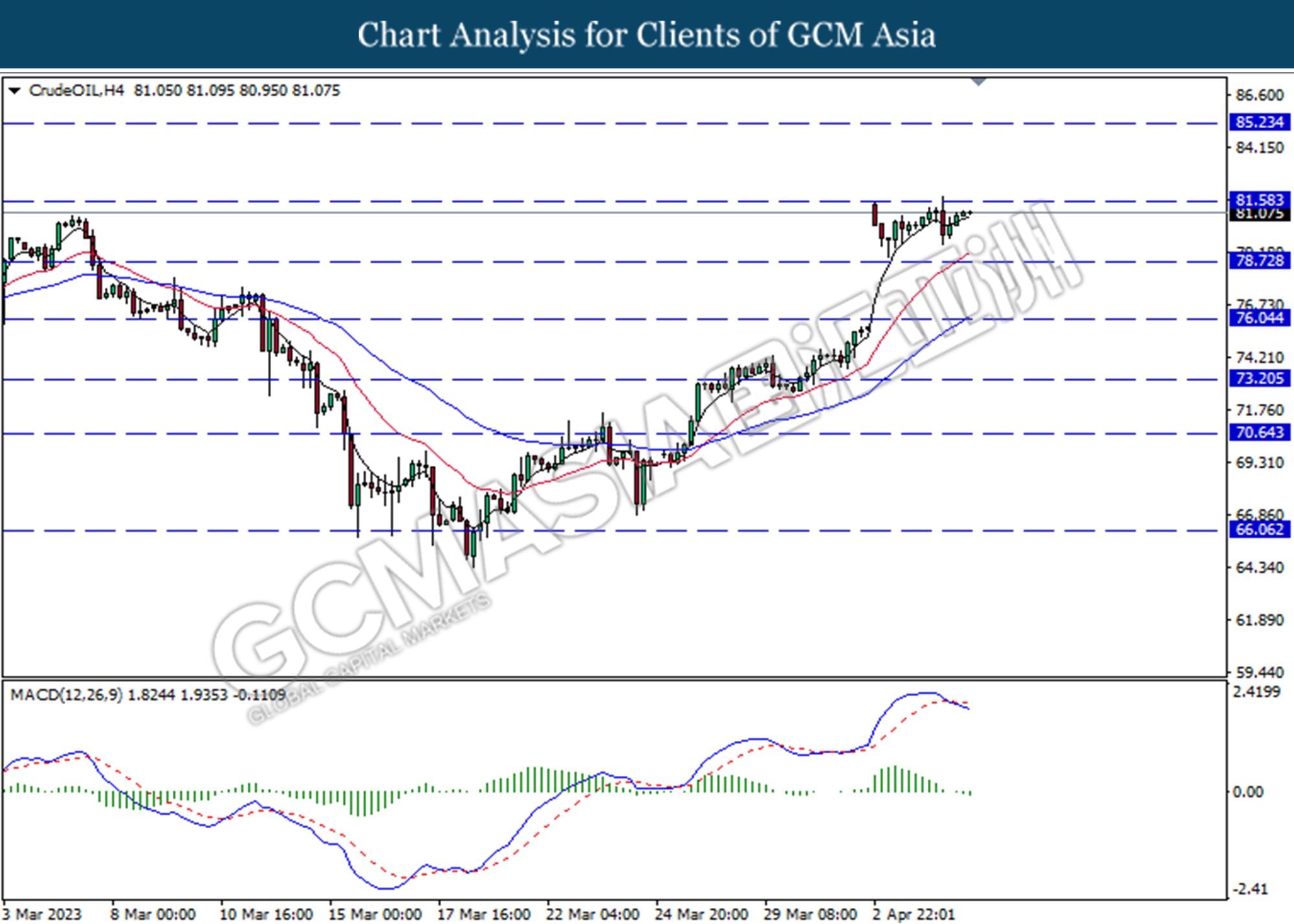

CrudeOIL, H4: Crude oil price was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair to traded lower as technical correction in the short term.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

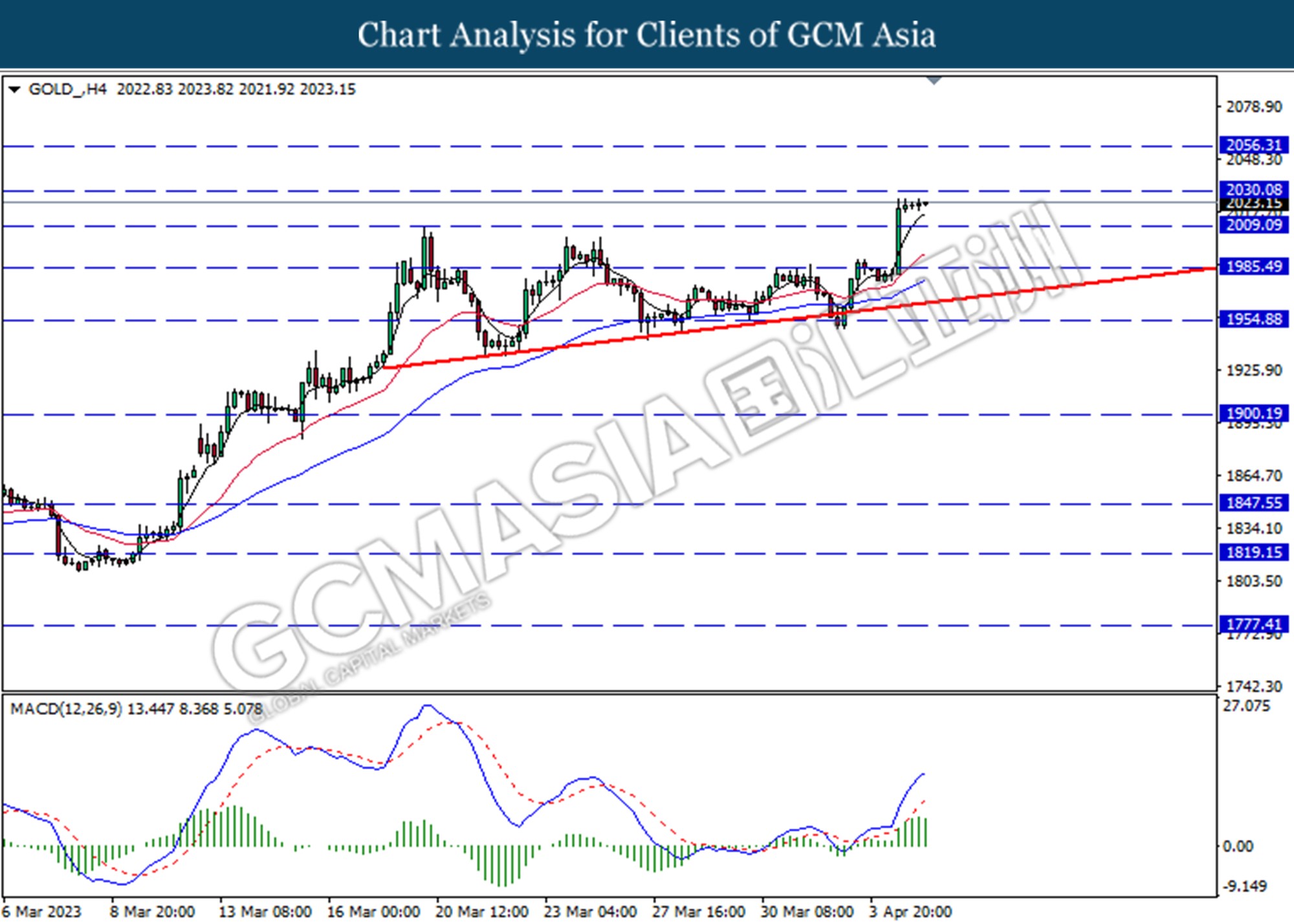

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 2009.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains after it successfully breakout above the resistance level.

Resistance level: 2030.10, 2056.31

Support level: 2009.10, 1985.50