10 April 2023 Morning Session Analysis

US Dollar climbed amid upbeat job report.

The Dollar Index which traded against a basket of six major currencies received some spotlight on last Friday following the economic data shown the labor market in the US remained resilient. According to Bureau of Labor Statistics, the US Nonfarm Payrolls for March posted at the reading of 236K, as well as it slid from the previous reading of 326K. Nonetheless, the actual reading of NFP was close to economists’ forecast. Besides, the US Unemployment Rate that released at the same time, notched down from the prior 3.6% to 3.5%, which providing more spaces to Fed for rate hike implementation. Currently, the possibility of 25 basis point hike in May meeting has reached 68.3%, according to CME Fed Watch Tool. However, the gains experienced by the Dollar Index was limited, as the market are anticipating that multiple rate cuts have been factored in by the end of the year. Going back to what the Fed Chairman Jerome Powell said at the March meeting, there would likely to have one more rate hike in this year, and the central bank would pause the process after that. Though, he emphasized that the decision was data-dependent. Consequences, the essential inflation data – CPI that would be announced on this week might be the main key to influent the Fed’s interest rate decisions. As of writing, the Dollar Index edged down by 0.02% to 101.71.

In the commodity market, the crude oil price rose by 0.40% to $81.02 per barrel as of writing following the India’s oil import has reached a new high. On the other hand, the gold price dropped by 0.23% to $2003.21 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day AUD Australia – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

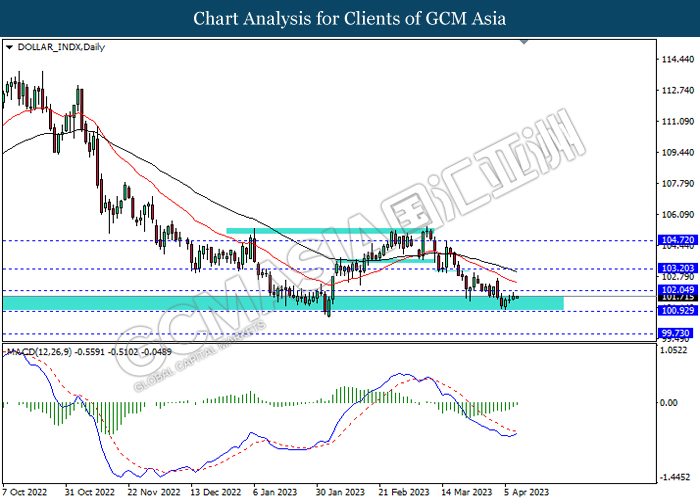

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

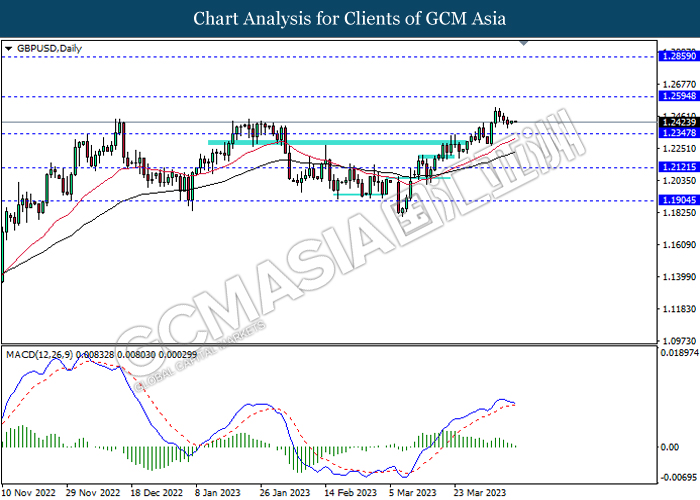

GBPUSD, Daily: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

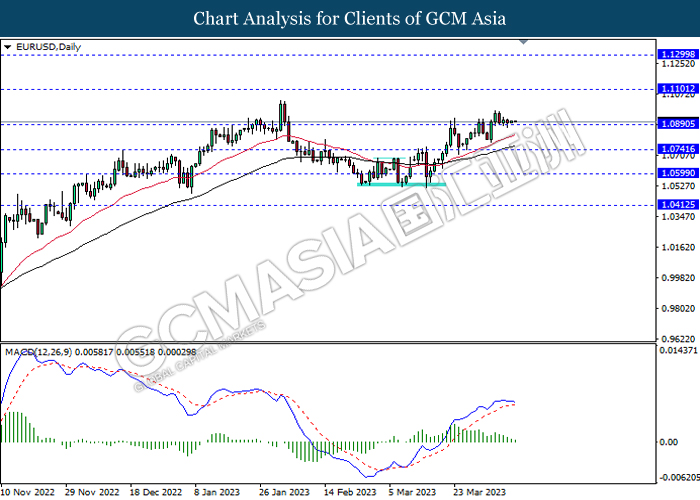

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

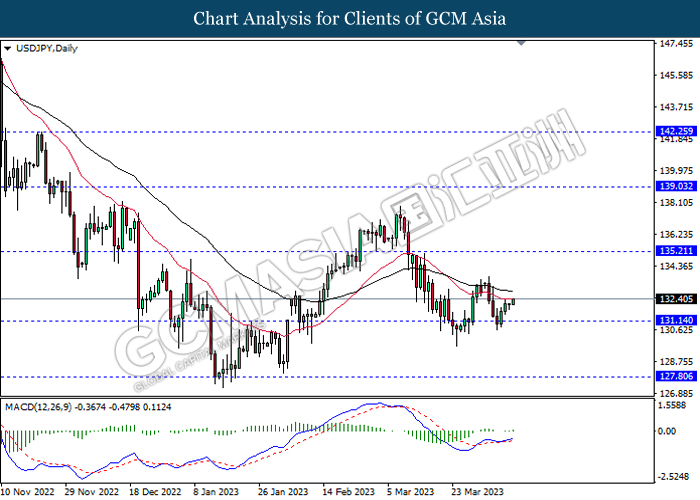

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

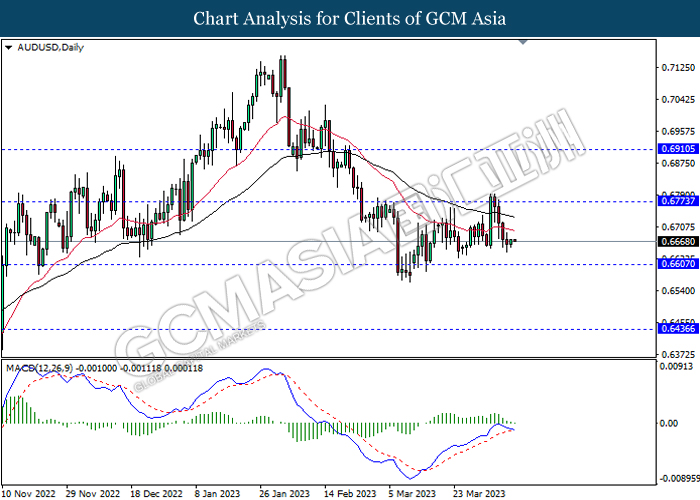

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

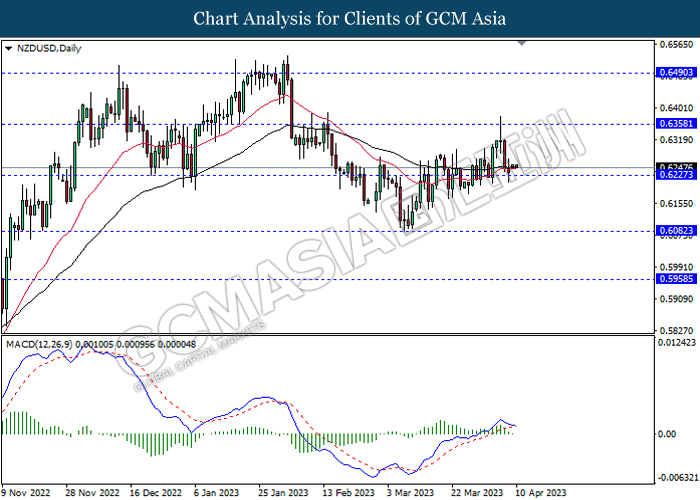

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

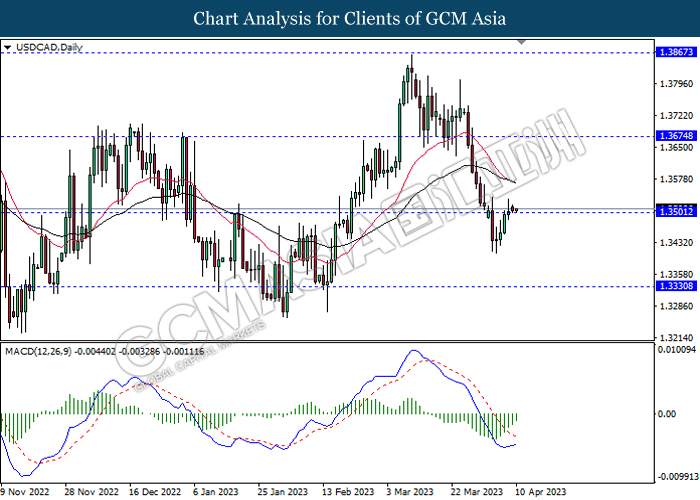

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3675, 1.3865

Support level: 1.3500, 1.3330

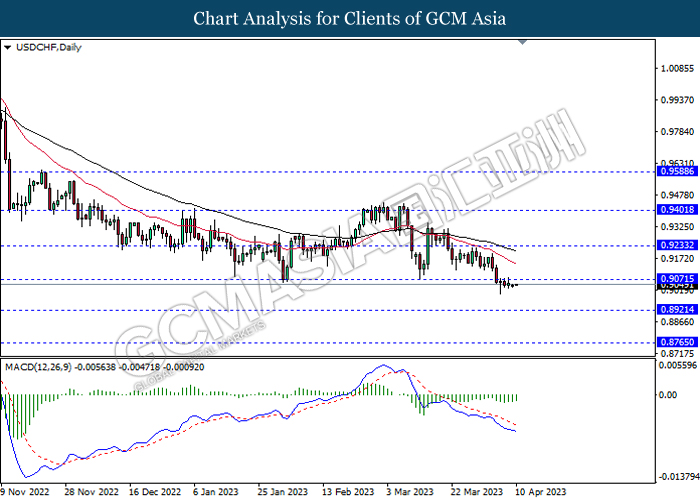

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

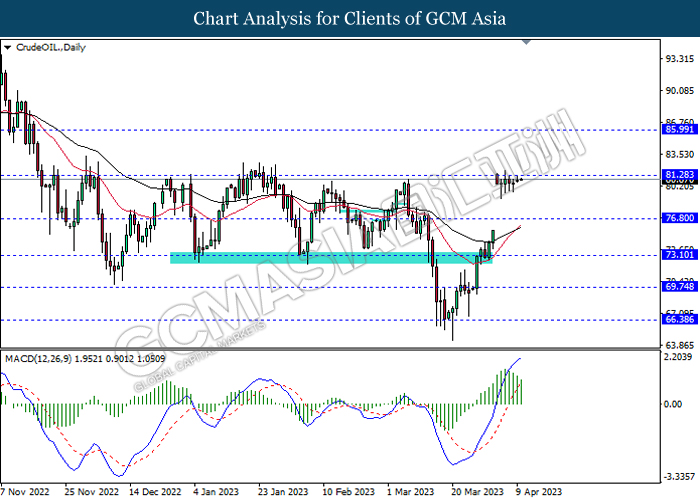

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 81.30, 86.00

Support level: 76.80, 73.10

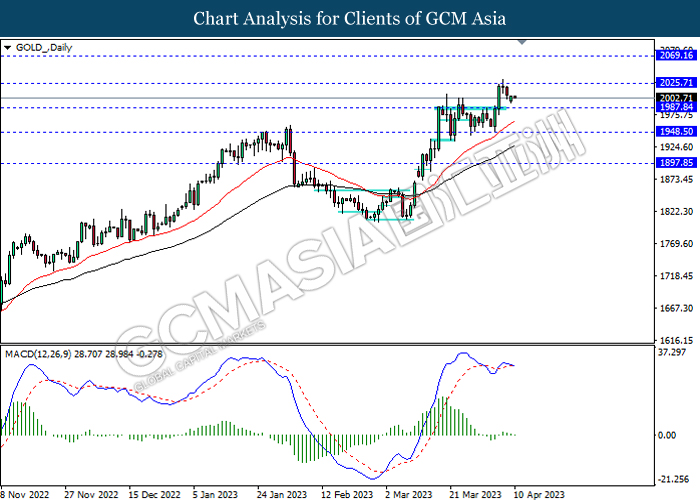

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50