10 April 2023 Afternoon Session Analysis

Euro dipped despite ECB’s Knot hawkish speech.

The single currency in the Eurozone, which is majorly traded by global investors, failed to extend its rally last Friday despite ECB’s Knot hawkish statement. Klaas Knot, the Dutch central bank governor and a leading policy hawk, commented in the NRC newspaper’s interview that the ECB is certainly not done with interest rate hikes at this point in time. It brings a thought that the European Central Bank (ECB) has to continue raising the cash rate to cool down the still-high inflation. He added that the current 3% interest rate is far from the level to bring down the 6% of core inflation, therefore, the upcoming rate hike needs to be 25 basis points or 50 basis points. Besides, he also highlighted that the chance of a rate cut this year is almost impossible, whereby hinted that the cash rate would be stayed at a high level for an extended period of time, possibly until the end of this year. As of writing, the pair of EUR/USD rose 0.03% to 1.0900.

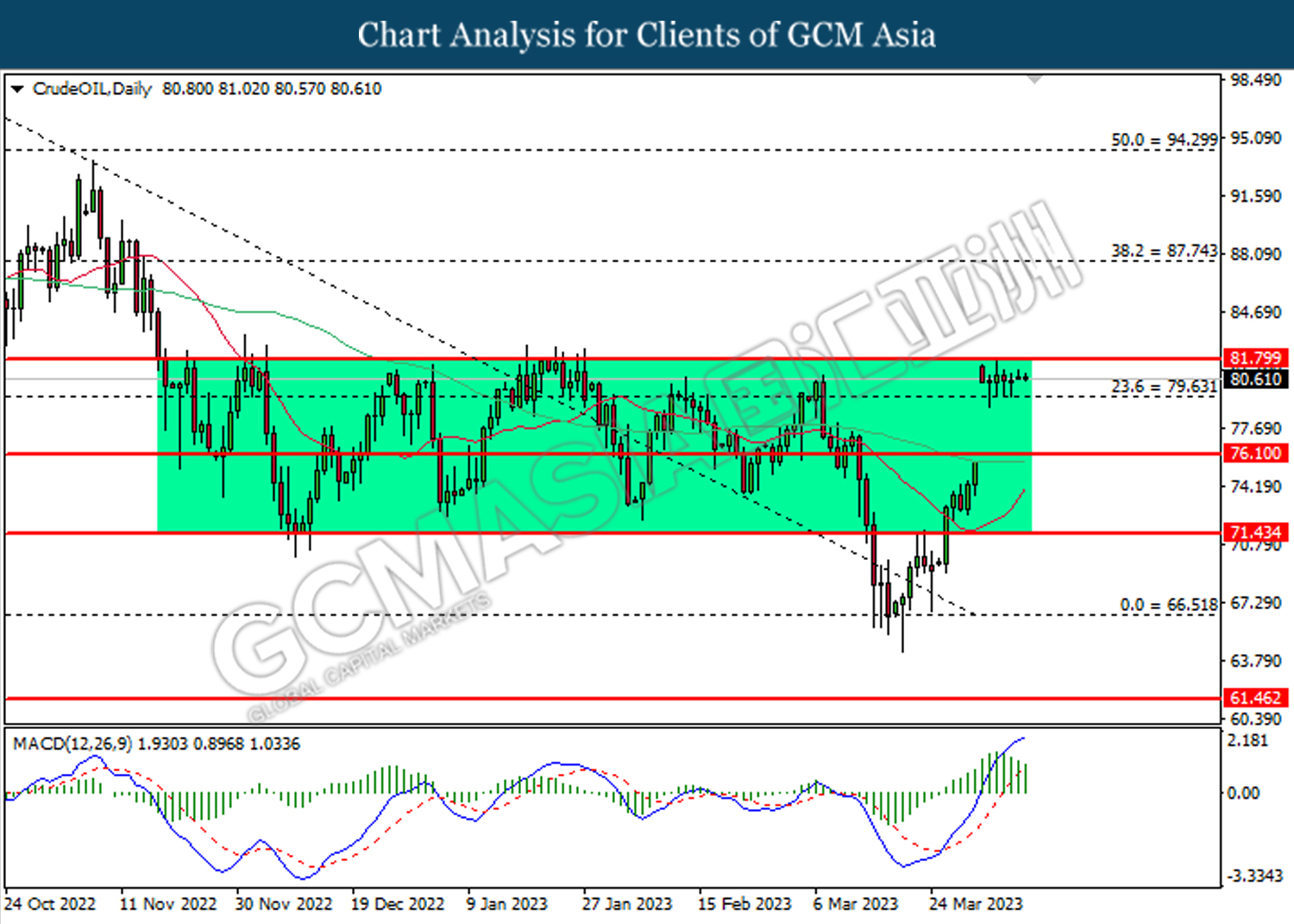

In the commodities market, crude oil prices edged up by 0.32% to $80.60 per barrel as the oil supply remained tight, especially after the extra oil cut plan by OPEC+ last week. Besides, gold prices edged down by -0.92% to $1989.45 per troy ounce as the US unemployment rate dropped below the expectation.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day AUD Australia – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 101.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

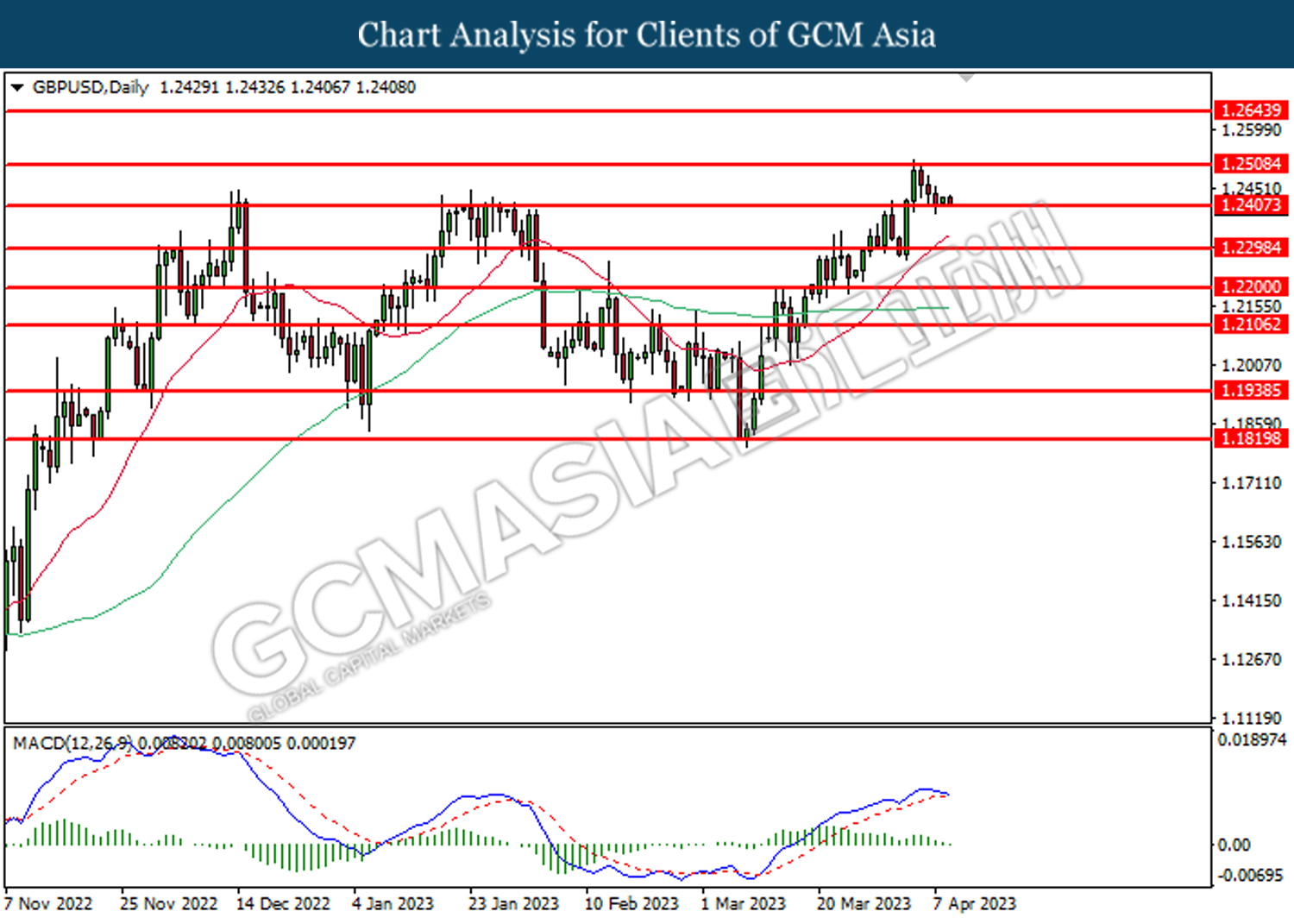

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2510, 1.2645

Support level: 1.2405, 1.2300

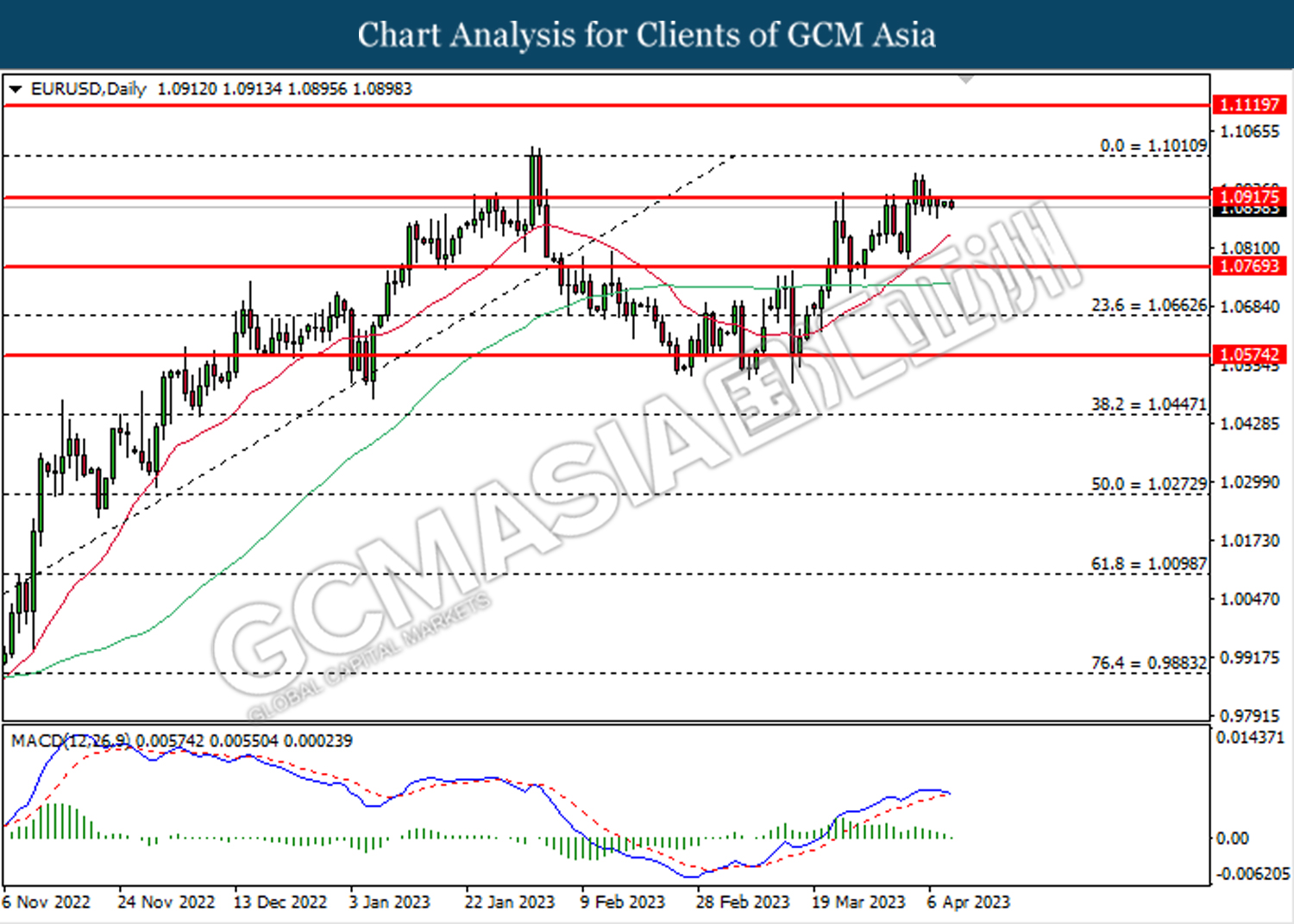

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0770.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

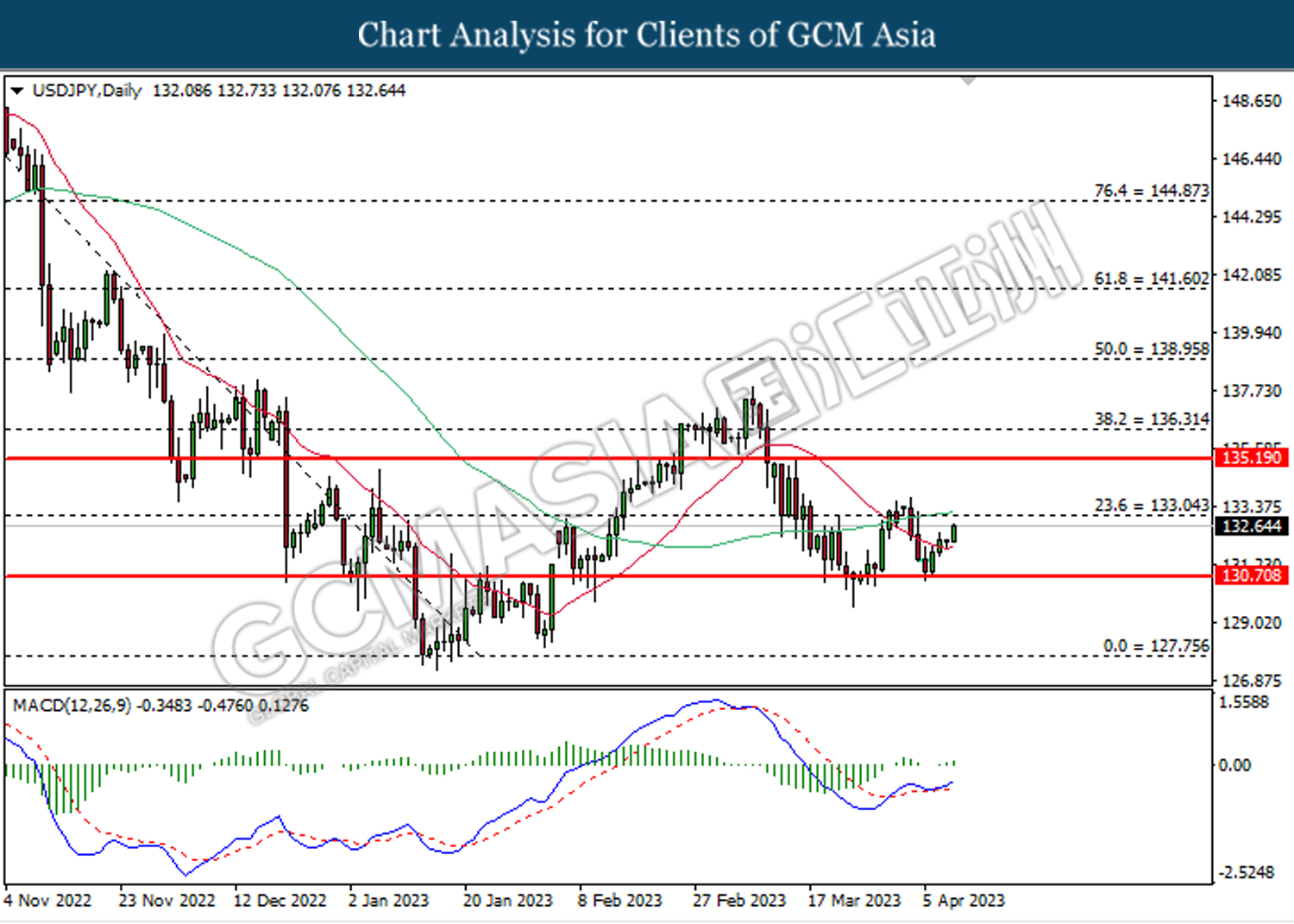

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 130.70. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 133.05.

Resistance level: 133.05, 135.20

Support level: 130.70, 127.75

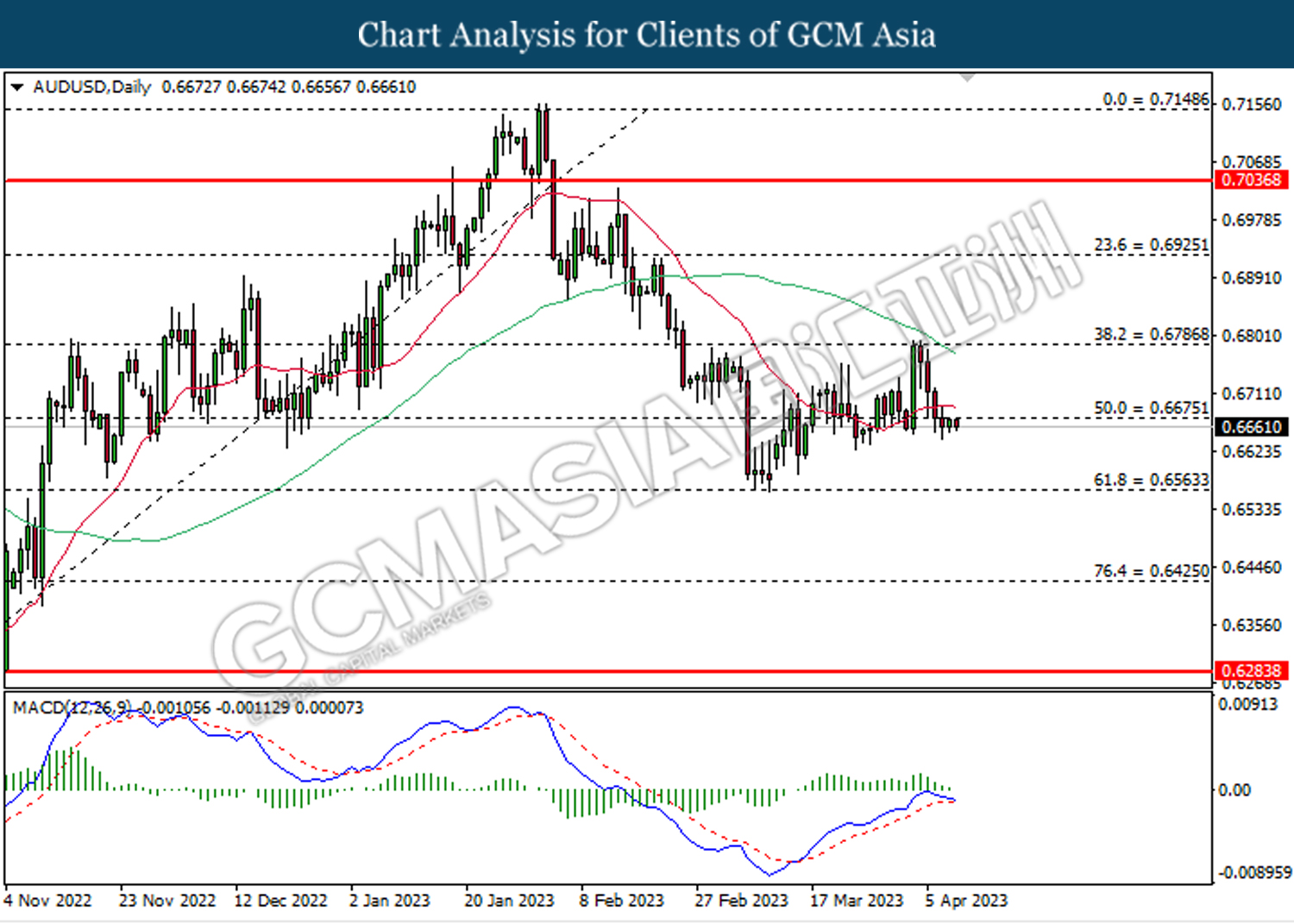

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6675. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

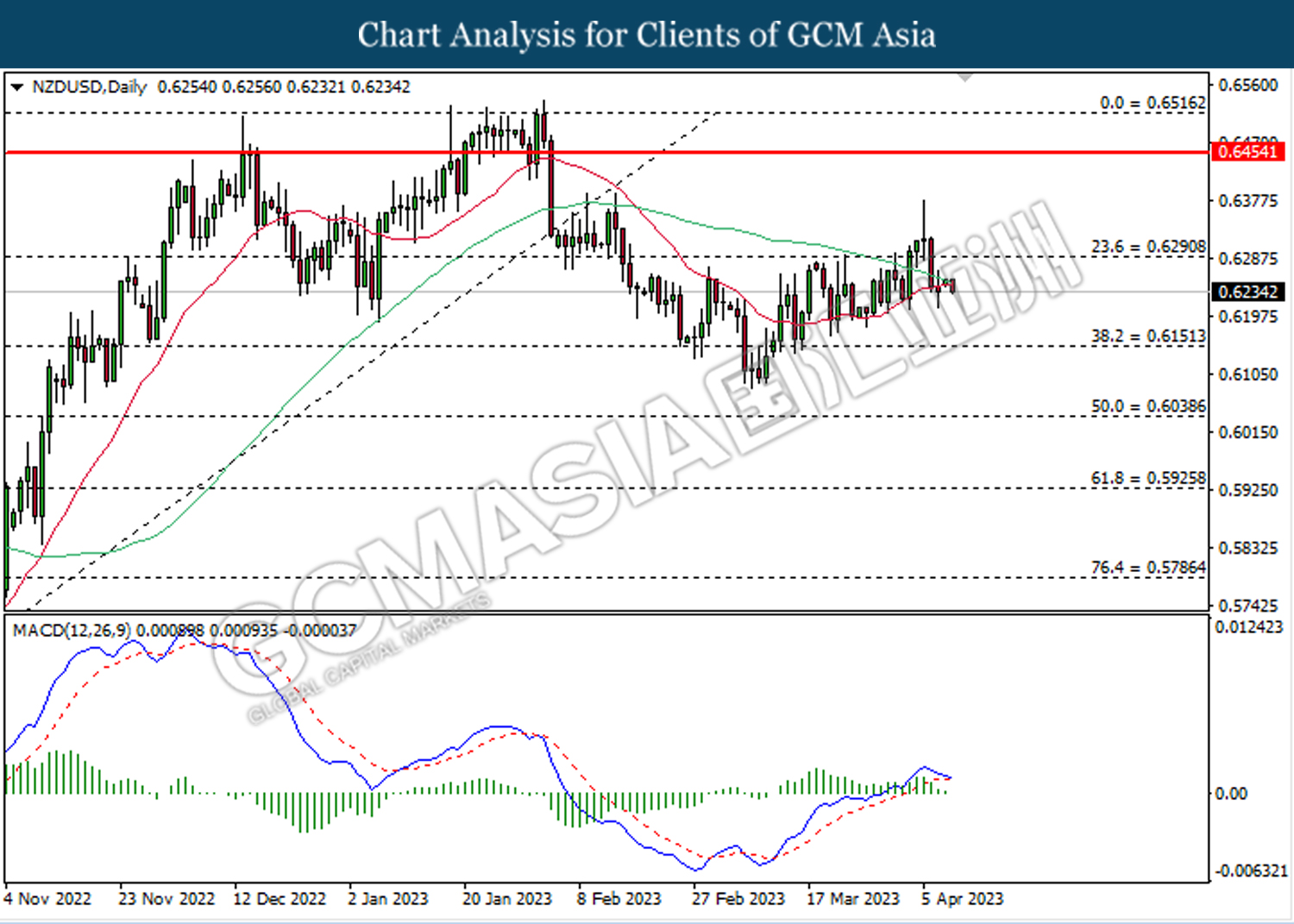

NZDUSD, Daily: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6290. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

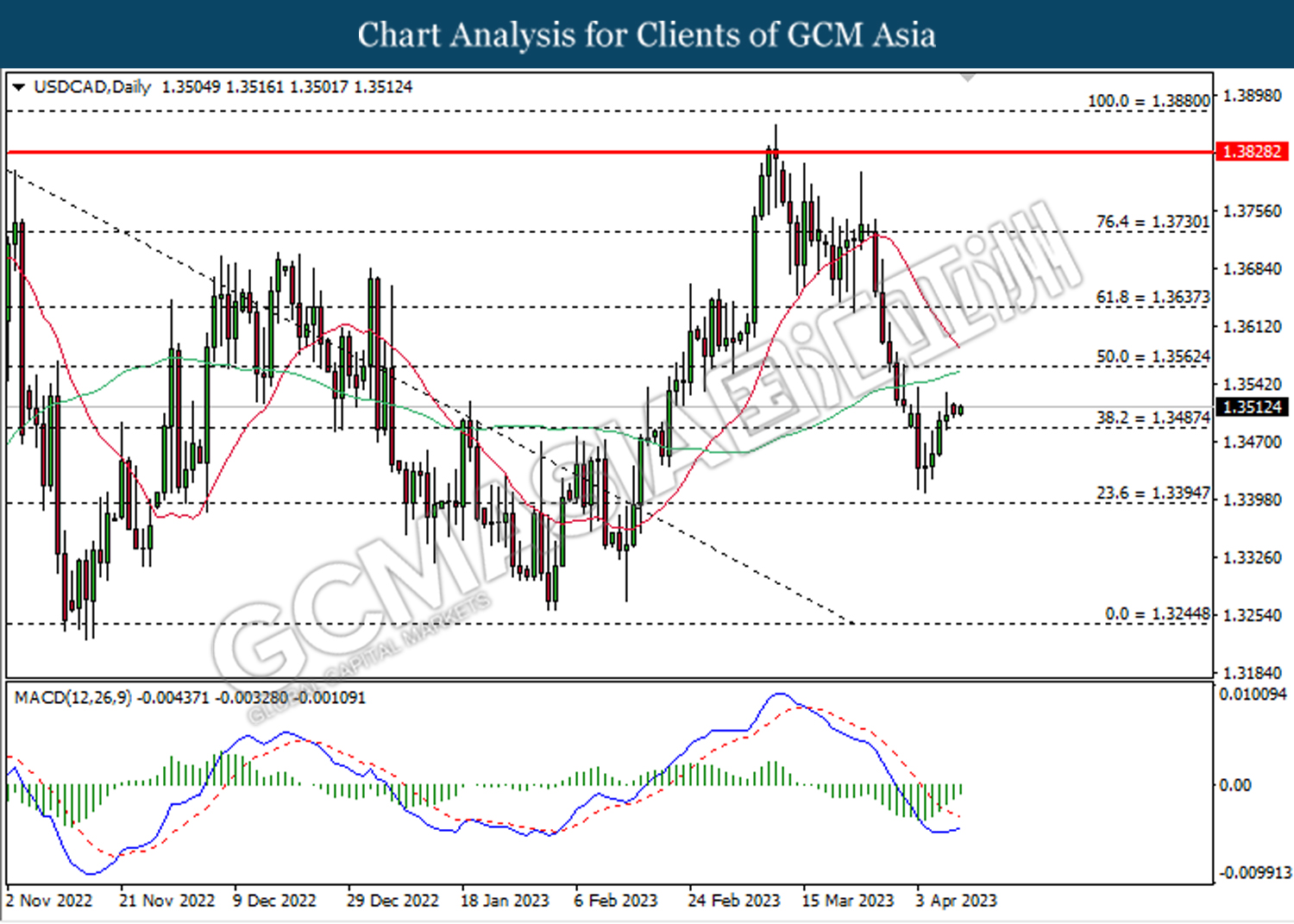

USDCAD, Daily: USDCAD was traded higher following the prior breakout above the previous resistance level at 1.3485. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3565.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

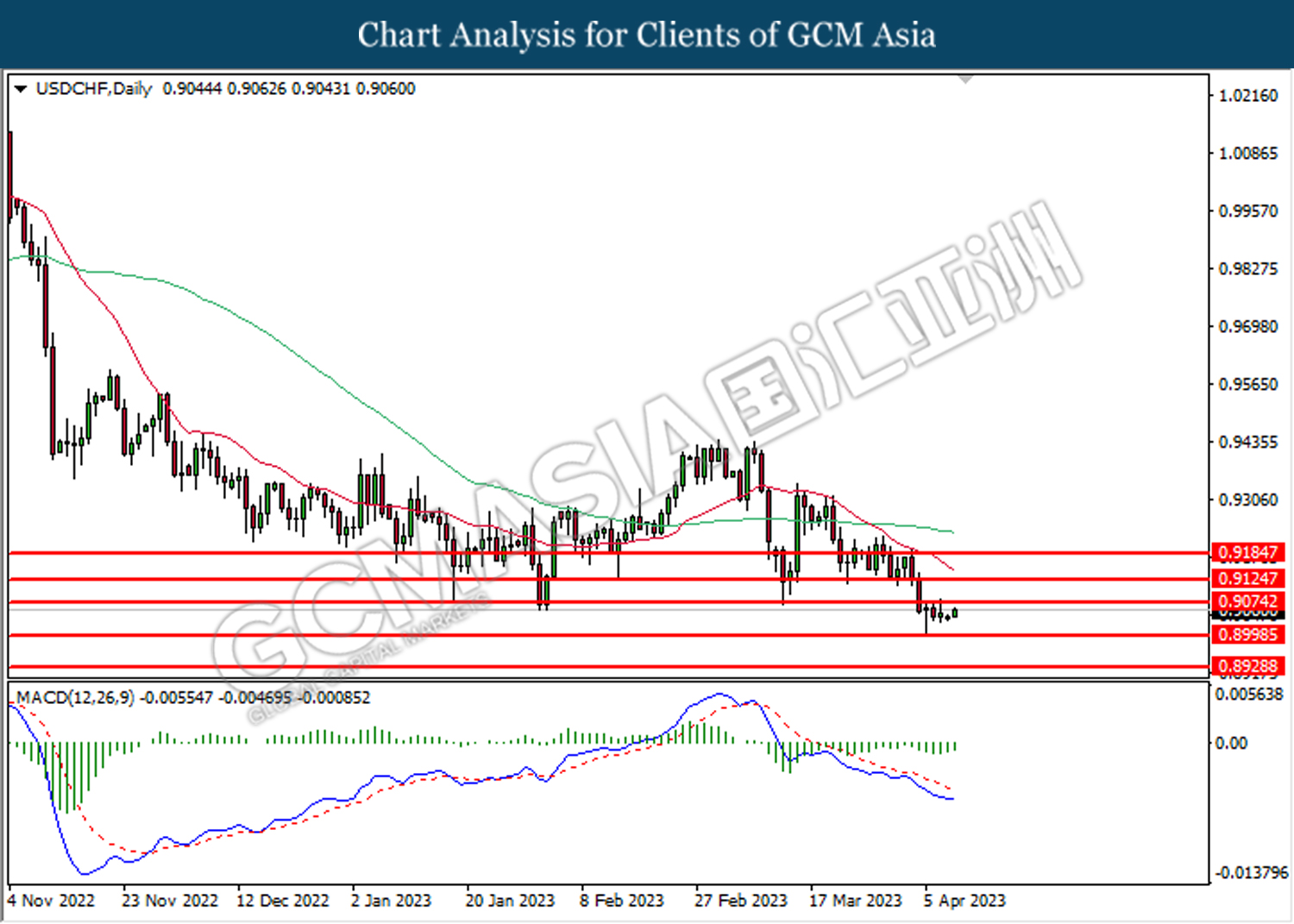

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9075, 0.9125

Support level: 0.9000, 0.8930

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 81.70. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 81.70, 87.75

Support level: 79.65, 76.10

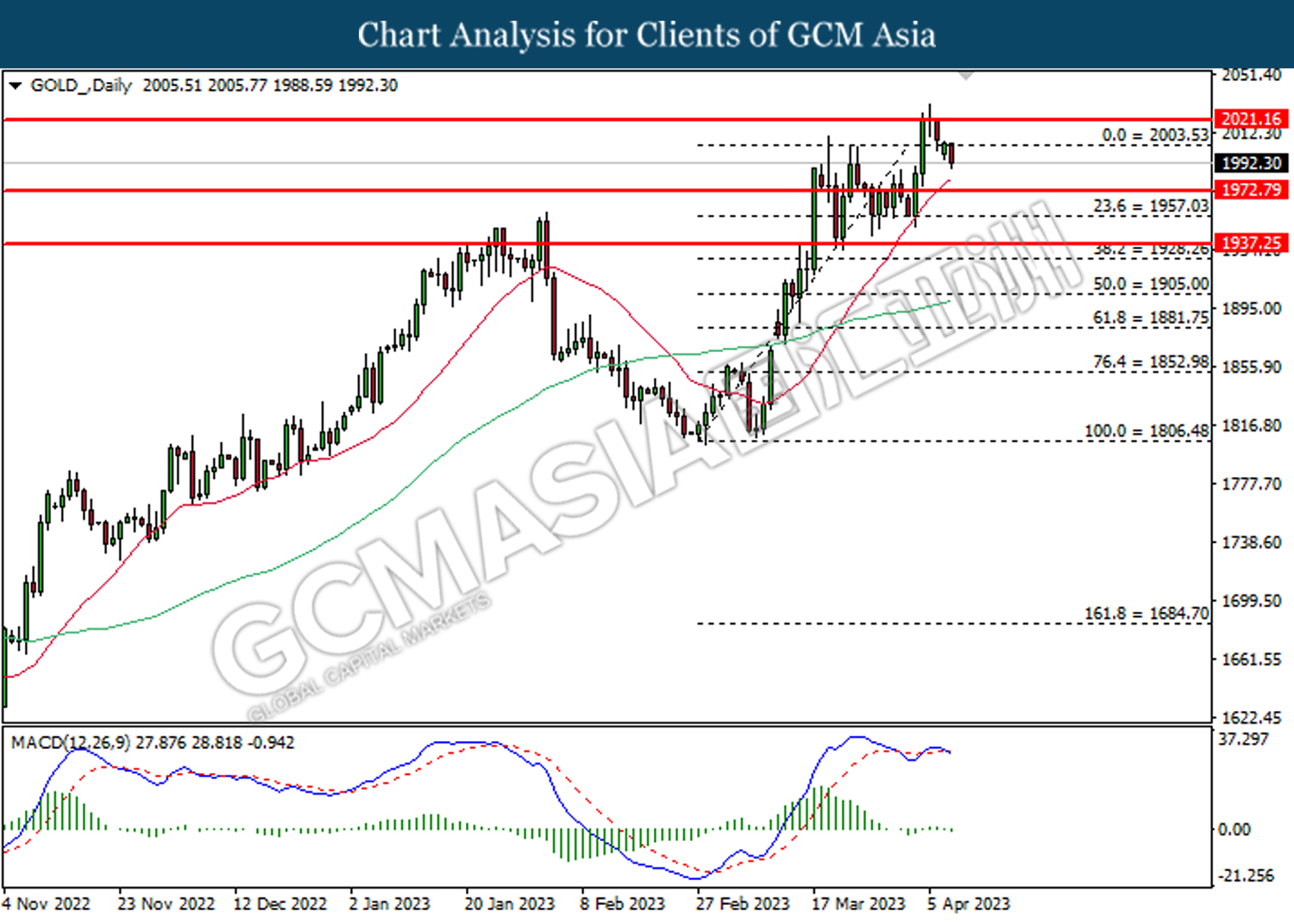

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2003.55. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2003.55, 2021.15

Support level: 1972.80, 1957.00