12 April 2023 Morning Session Analysis

US Dollar dived as IMF downgraded its growth estimations.

The Dollar Index which traded against a basket of six major currencies dropped significantly amid the background of reducing global economic growth forecast by International Monetary Fund (IMF). According to CNBC, the IMF anticipated that the global growth for this year would reach 2.8% and 3% for the year of 2024. Nonetheless, the growth rate was slightly lower than the estimation in January by 0.1% for both years. Besides, the IMF also claimed that the prediction released was based on what has happened so far, such as aggressive tightening monetary policy by major banks, collapses of big banks from deteriorating inn financial conditions, the continuation of war between Russia-Ukraine and so on. In the point of view of IMF, the banking crisis would likely to exacerbate and it might lead to a hard landing for global growth, which prompting major banks to reconsider their monetary policy. Investors were once again in the dark about the state of America’s banks, as the IMF indirectly pointed out that their failures were caused by sharp interest rate rises. With that, it might influence Fed to take back its rate hike in the next meeting. Though, it is note-worthy that decision of interest rate would highly depend on today’s CPI data. As of writing, the Dollar Index edged down by 0.01% to 101.83.

In the commodity market, the crude oil price rose by 0.01% to $81.58 per barrel as of writing ahead of announcement of CPI data. On the other hand, the gold price raised by 0.08% to $2005.14 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 GBP BoE Gov Bailey Speaks

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

2:00 USD FOMC Meeting Minutes (13th April)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Mar) | 0.40% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Mar) | 6.00% | 5.20% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.739M | -2.329M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

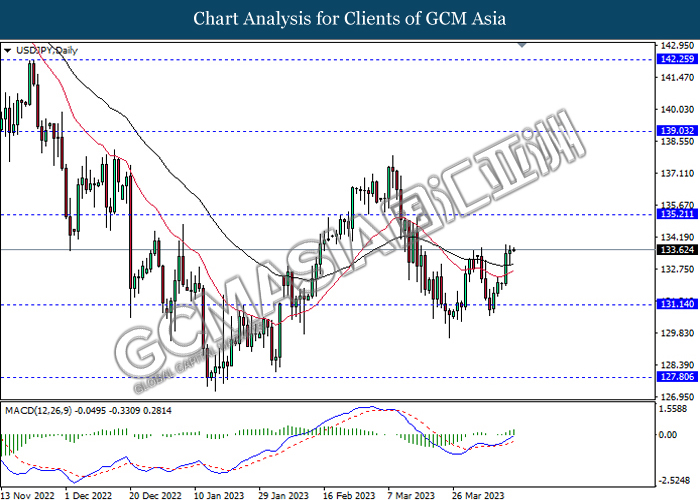

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

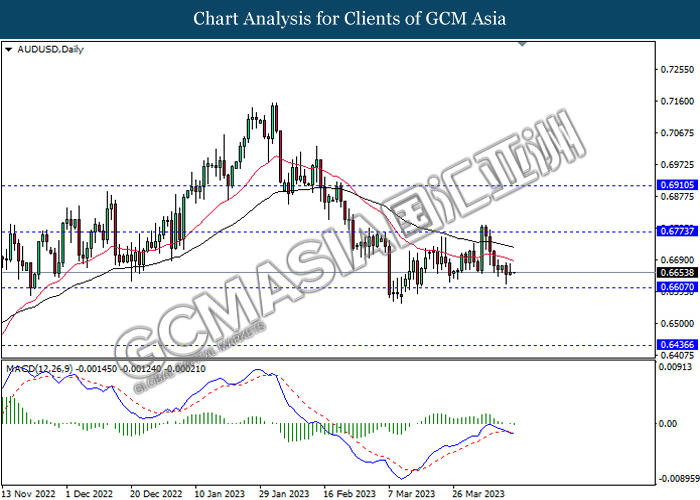

AUDUSD, Daily: AUDUSD was traded lower following prior retracement form the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

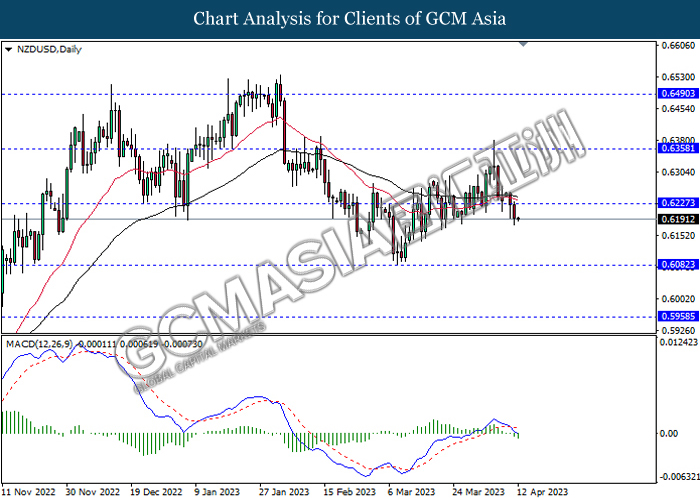

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

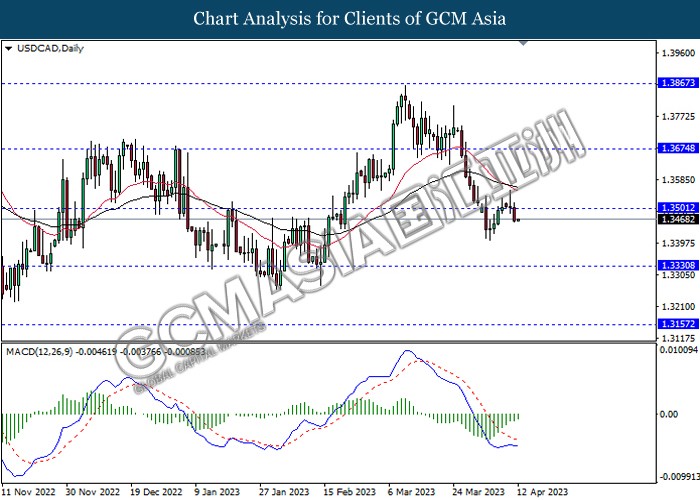

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to traded higher as technical correction.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

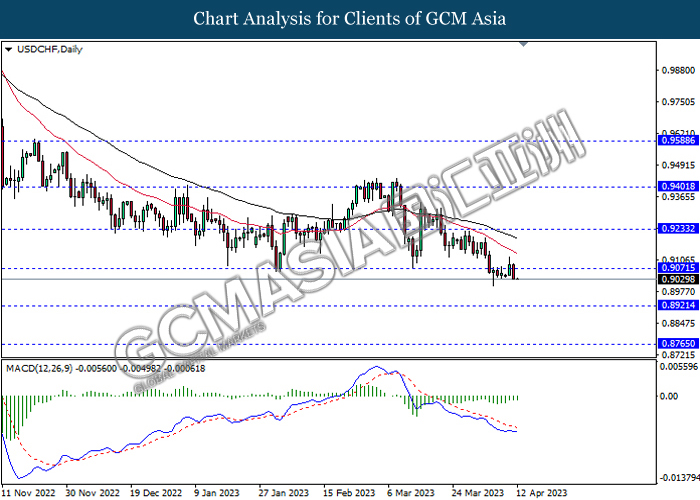

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

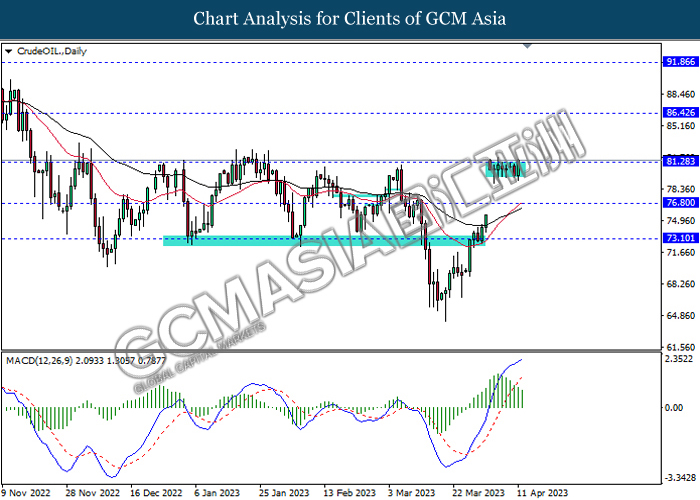

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.40, 91.85

Support level: 81.30, 76.80

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50