12 April 2023 Afternoon Session Analysis

Loonie steady ahead of Bank of Canada interest rate decision.

The Canadian dollar strengthened against the greenback ahead of the Bank of Canada (BAC) interest rate decision. The BAC meeting on Wednesday is expected to pause, leaving the cash rate unchanged at a 15-year high of 4.50%. According to Governor Macklem’s speech, the BAC is highly like to “conditional pause” on the rate hike following the battle against inflation is moving in the right direction. The recent data showed CPI data falling from 5.9% to 5.2% in February and the labor market remains robust with the economy adding 34.7k jobs in March. However, a rate hike would hurt the consumer and businesses which are struggling under the high-interest rates. The Lonnie rises despite central bank no rate hike expectations. The Loonie appreciation was largely attributed to the optimistic outlook for crude oil as crude oil is one of the larger exports of Canada. According to the U.S. Energy Information Administration (EIA) statement, crude oil prices are expected to rise by $2 in the short term due to massive production cuts by OPEC and Russia. Besides, investors are keeping an eye on the US CPI data release today. As of writing, the USDCAD slipped -0.03% to $1.3462

In the commodity market, the crude oil price rose by 0.01% to $81.54 per barrel as of writing after the EIA report showed optimism about the short-term outlook for crude oil. On the other hand, the gold price gained by 0.66% to $2032.15 per troy ounce as of writing following investors awaited for CPI report announces.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:00 GBP BoE Gov Bailey Speaks

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

2:00 USD FOMC Meeting Minutes (13th April)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Mar) | 0.50% | 0.40% | – |

| 20:30 | USD – CPI (MoM) (Mar) | 0.40% | 0.30% | – |

| 20:30 | USD – CPI (YoY) (Mar) | 6.00% | 5.20% | – |

| 22:00 | CAD – BoC Interest Rate Decision | 4.50% | 4.50% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -3.739M | -2.329M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing for the support level at 101.70. MACD which illustrated decreasing bullish momentum suggests the index extended losses after successfully break below the support level.

Resistance level: 103.00, 104.45

Support level: 101.70, 100.50

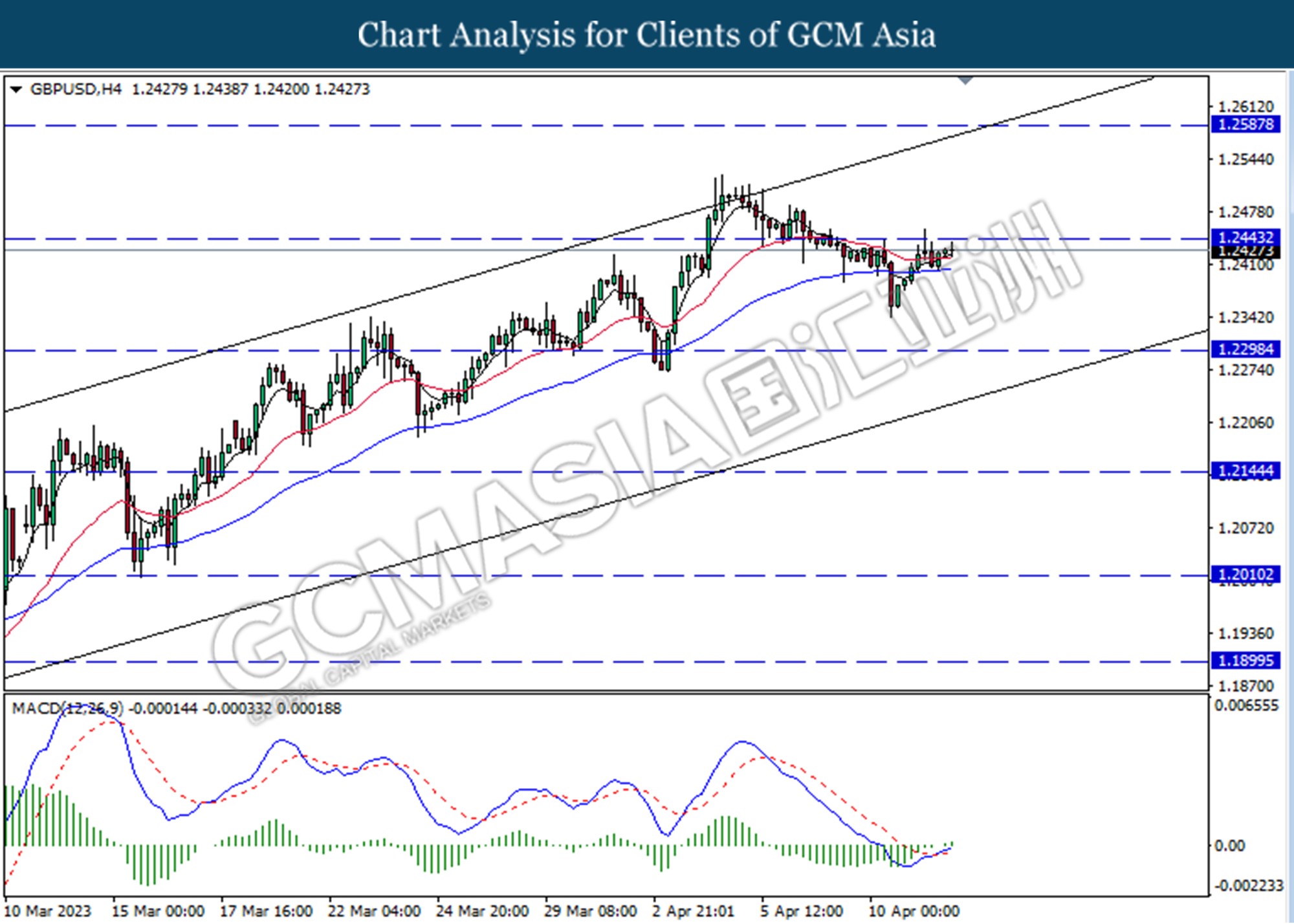

GBPUSD, H4: GBPUSD was traded higher while currently testing for the resistance level at 1.2440. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 1.2440, 1.2590

Support level: 1.2300, 1.2145

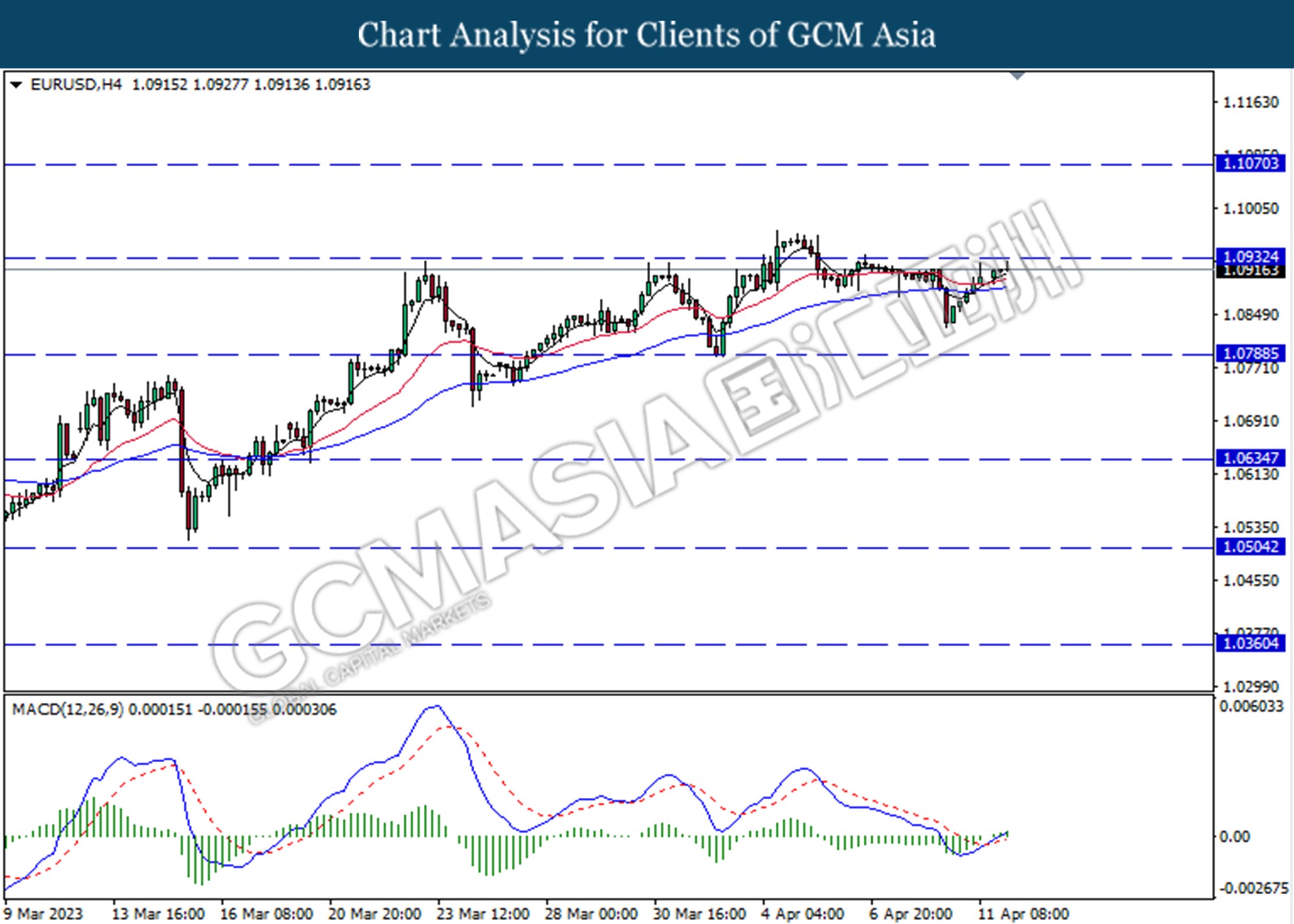

EURUSD, H4: EURUSD was traded higher while currently testing for the resistance level at 1.0930. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully break above the resistance level.

Resistance level: 1.0930, 1.1070

Support level: 1.0790, 1.0635

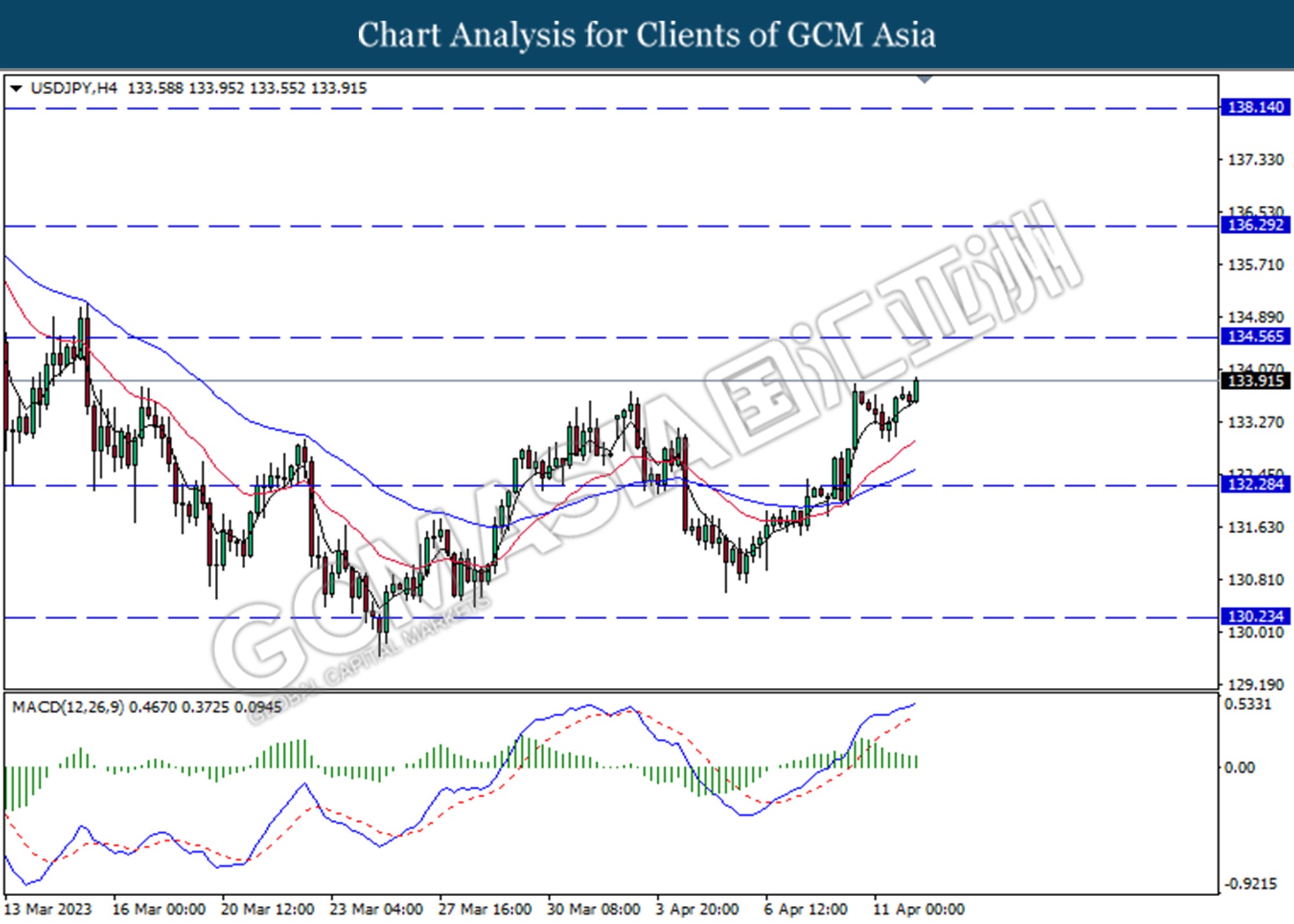

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. However, MACD which illustrated decreasing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

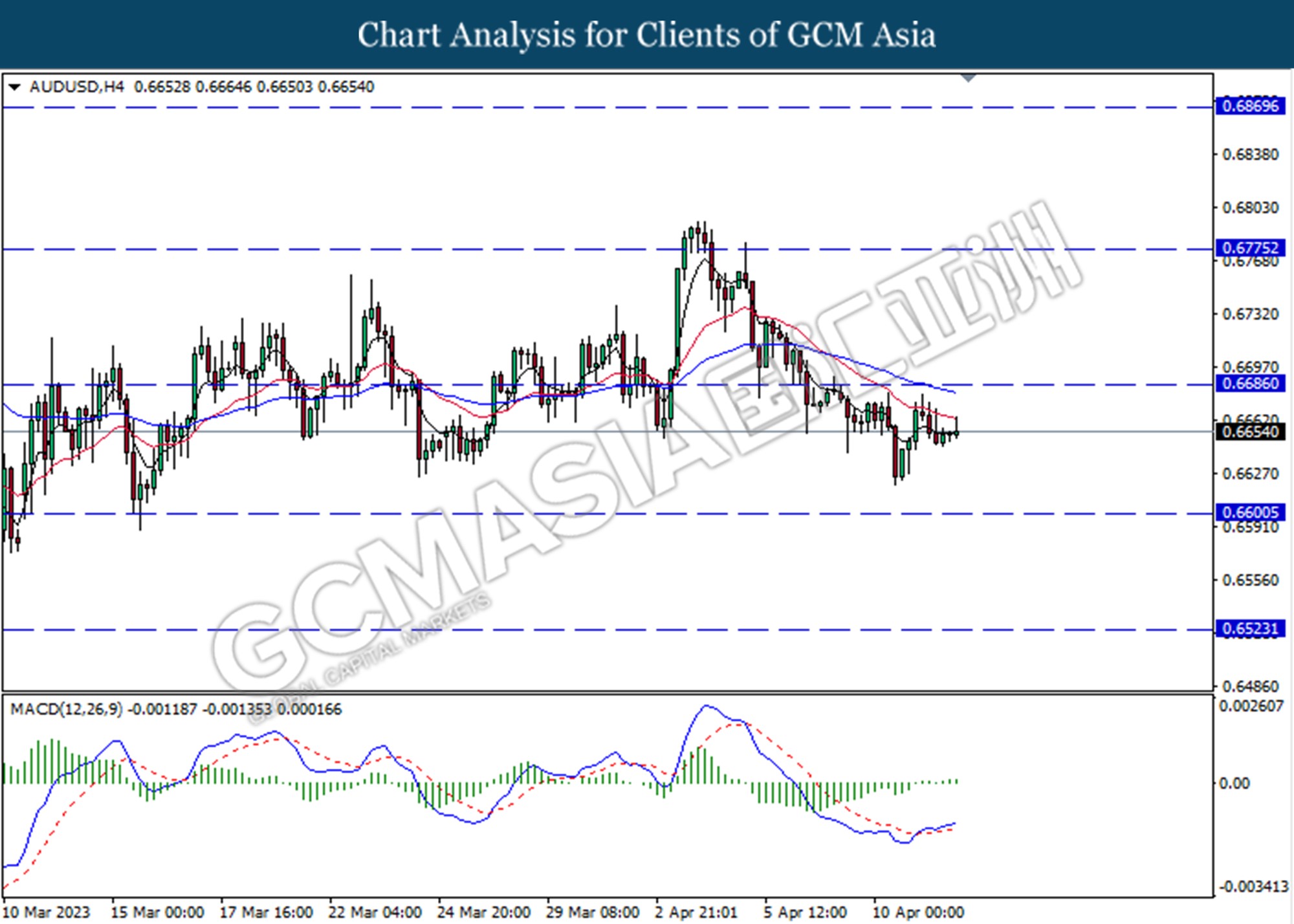

AUDUSD, H4: AUDUSD was traded higher following a prior rebound form the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

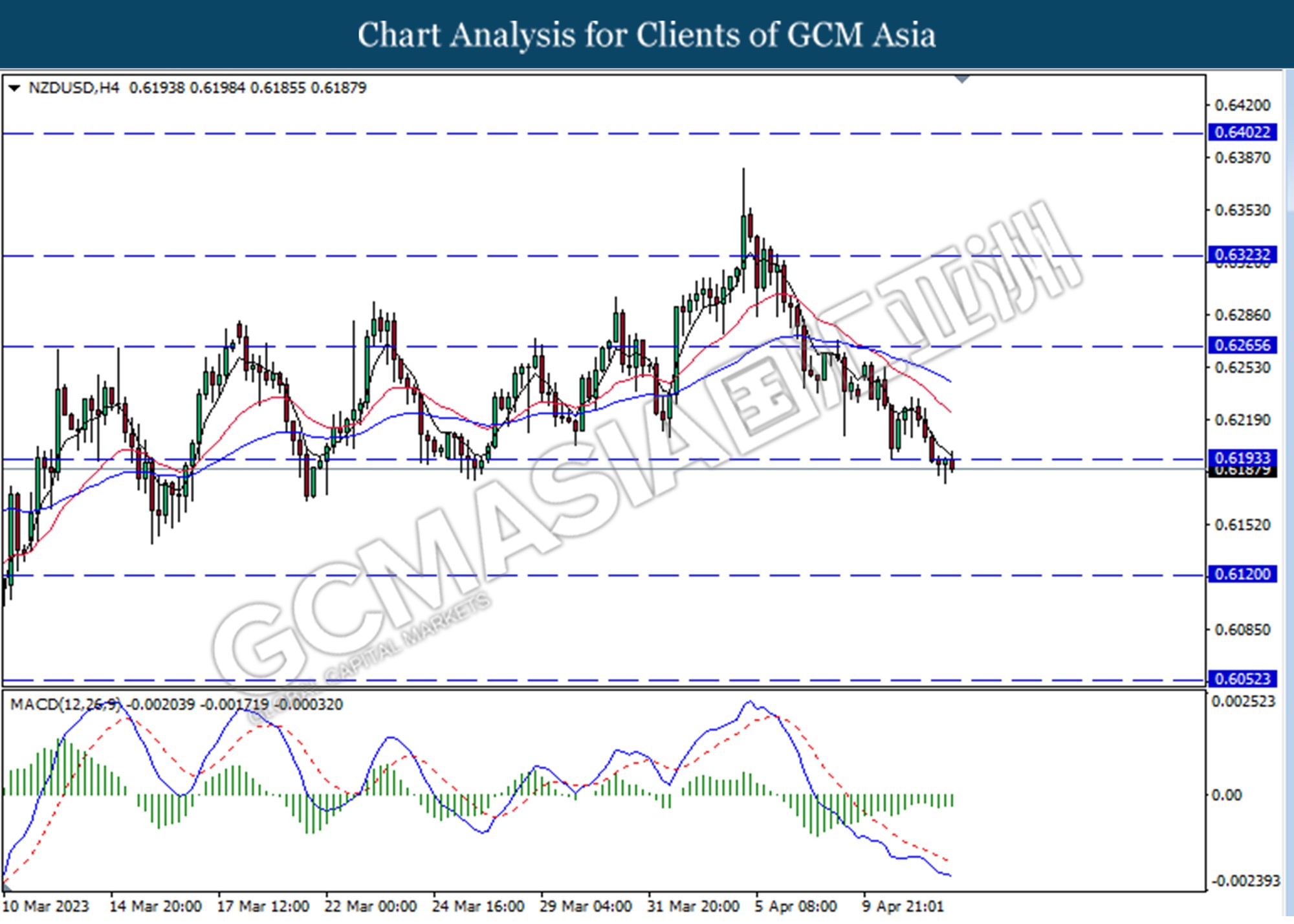

NZDUSD, H4: NZDUSD was traded lower following a prior breakout below the previous support level at 0.6195. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6120.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

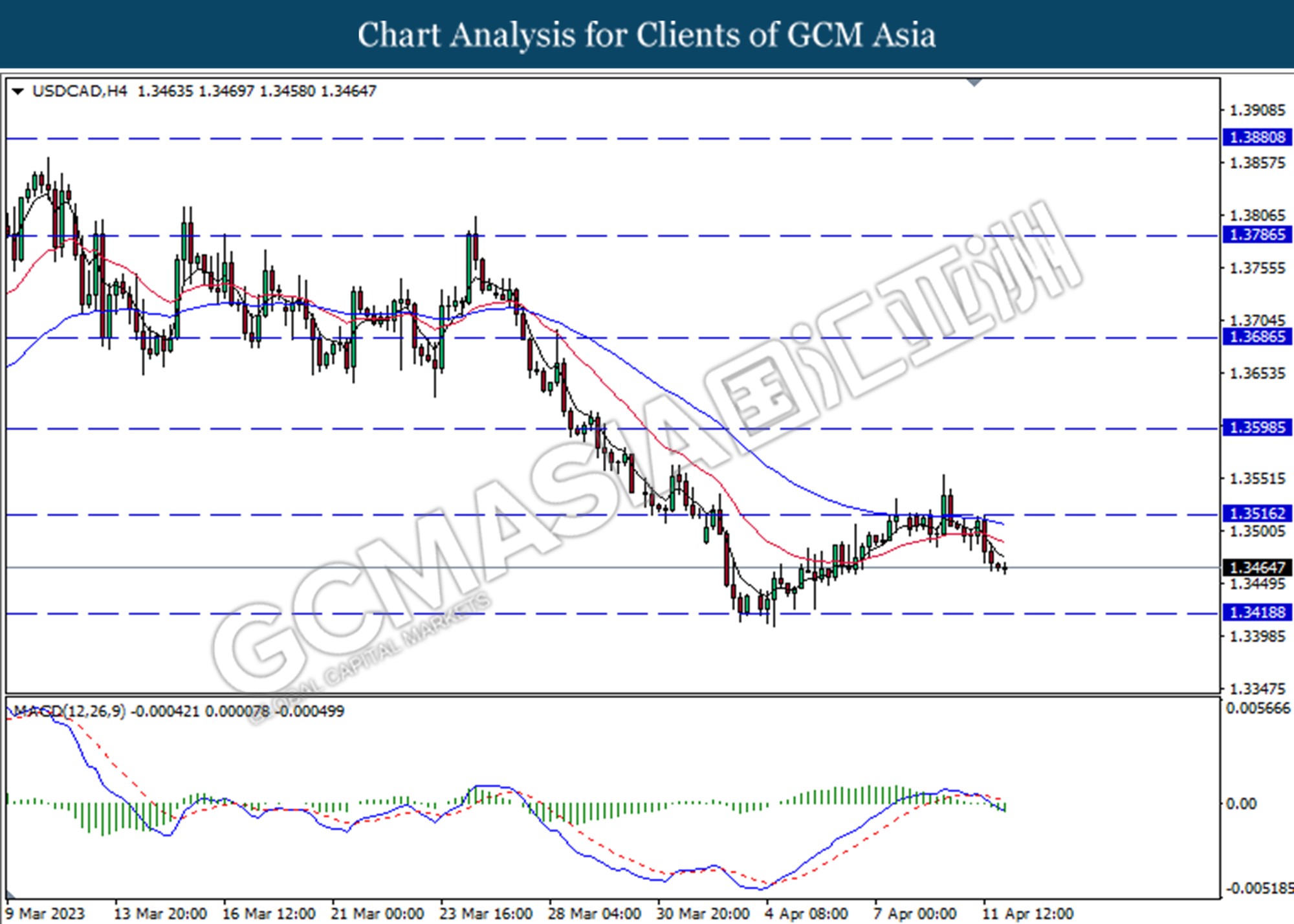

USDCAD, H4: USDCAD was traded lower following a prior retracement from the resistance level at 1.3515. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.3420

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

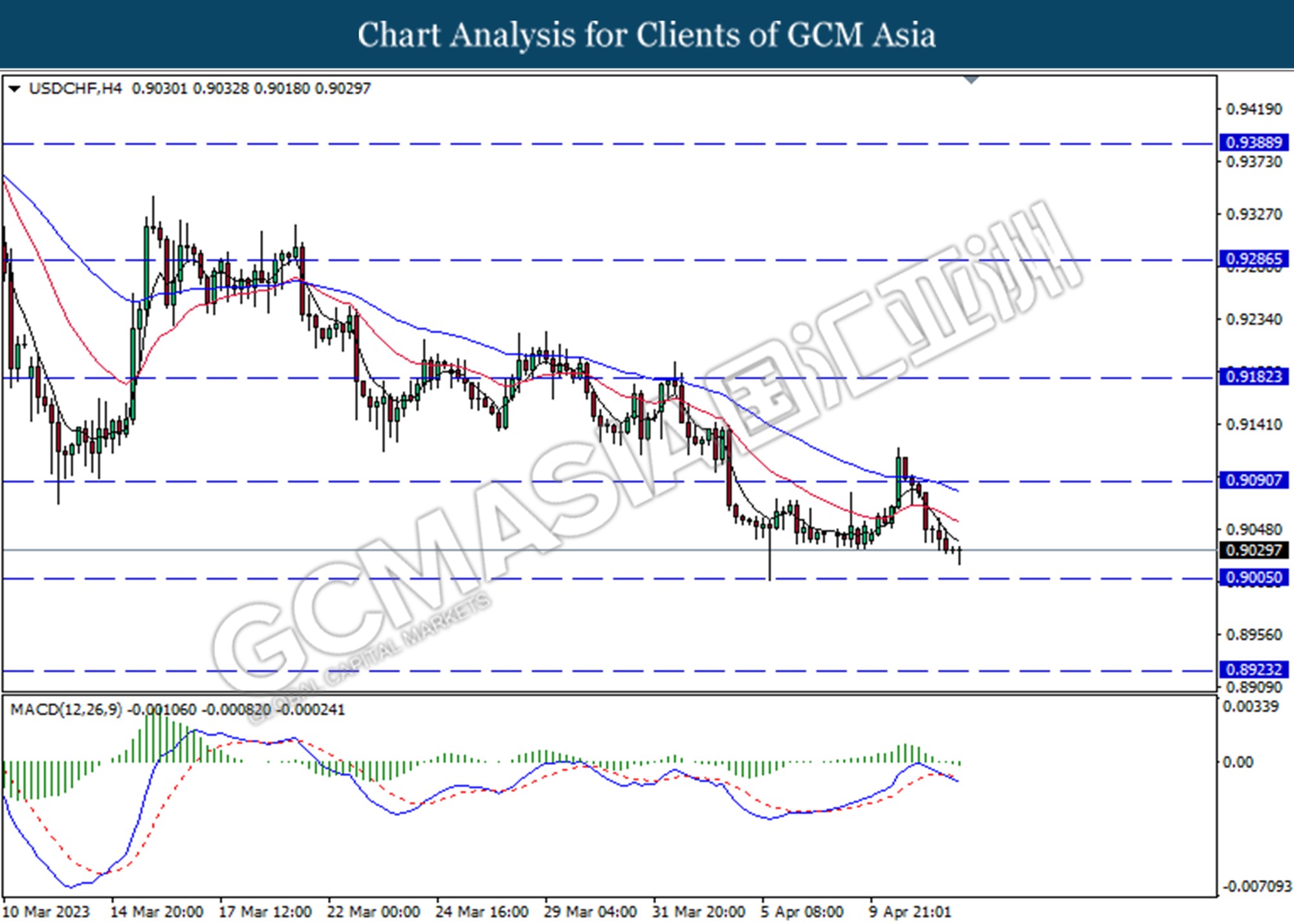

USDCHF, H4: USDCHF was traded lower following a prior breakout below the previous support level at 0.9090. MACD which illustrated increasing bearish momentum suggests the pair to extended its losses toward the support level at 0.9005.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

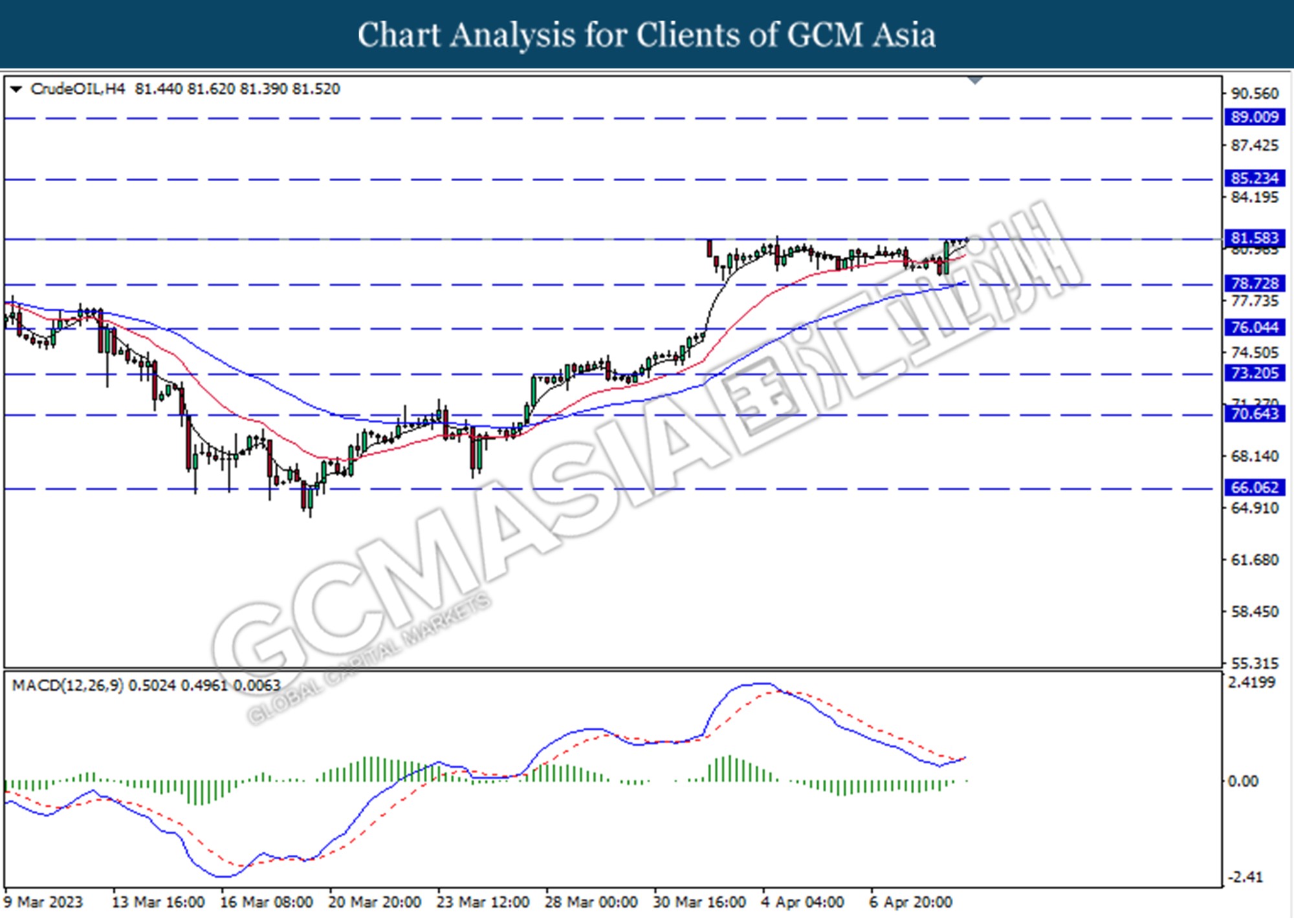

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 81.60. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains if successfully break above the resistance level.

Resistance level: 81.60, 85.25

Support level: 78.70, 76.05

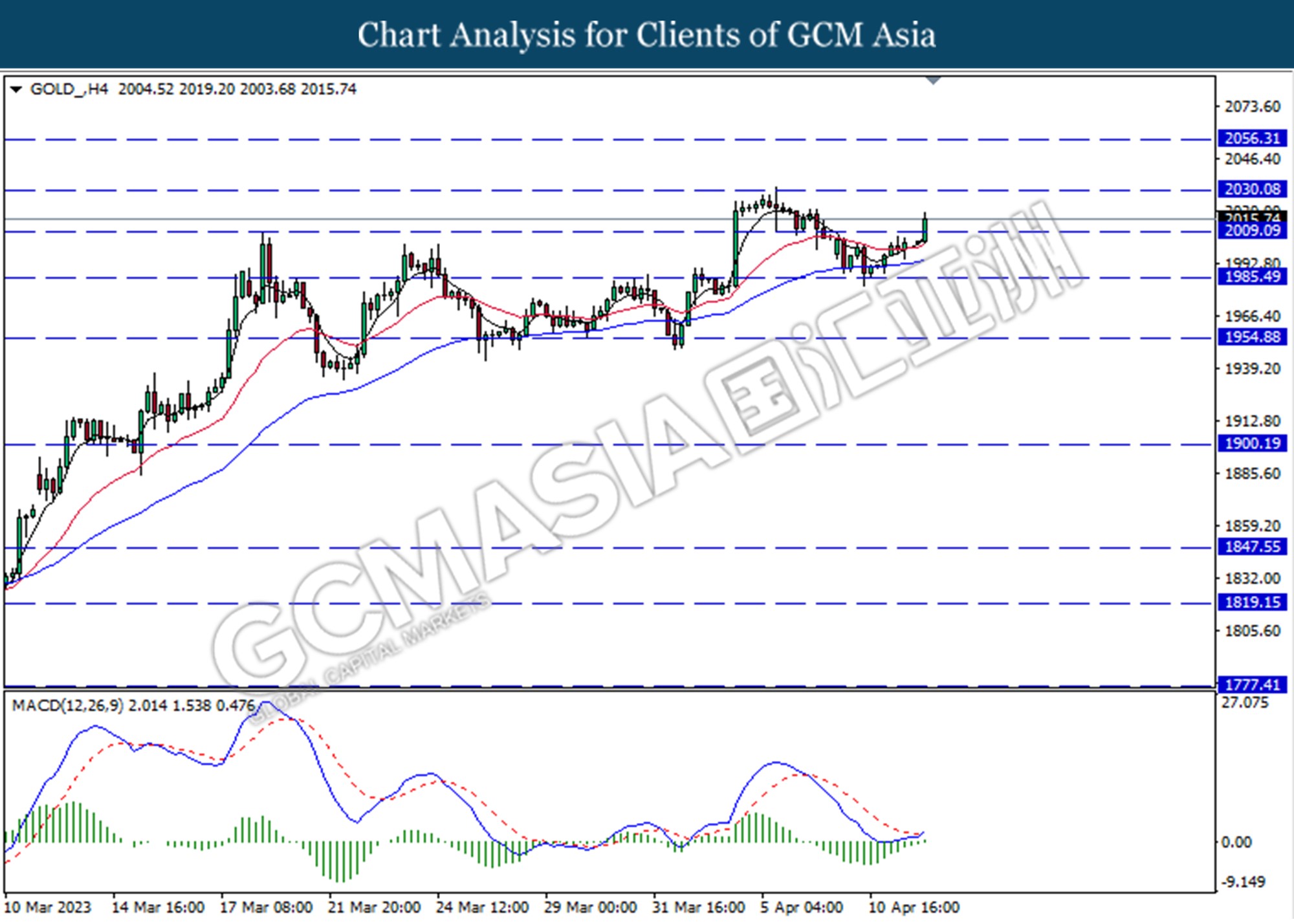

GOLD_, H4: Gold price was traded higher following a prior breakout above the prior resistance level at 2009.10. MACD which illustrated decreasing bearish momentum suggests the commodity extended its gains to the resistance level at 2030.10

Resistance level: 2030.10, 2056.30

Support level: 2009.10, 1985.50