13 April 2023 Afternoon Session Analysis

Loonie lifted after BAC kept the interest rate steady.

The Canadian dollar rose for a fifth straight day, despite the Bank of Canada (BAC) keeping interest rates at a 15-year high of 4.5%. The central bank’s move was widely expected by economists after it had signaled a pause in raising rates after eight hikes since March 2022. One of the reasons the BAC paused its rates is that the effects of its previous rate hikes are starting to filter through the economy. The BAC paused rate hike was also supported by inflation data after falling for the fourth consecutive month, falling to 5.2% from 5.9% in February. Besides, Investors also increase the expectation that the inflation data for March, due next week, is expected to show that inflation has cooled. The BAC mentioned that the bank is confident of keeping rates on hold amid mounting evidence that inflation data has cooled. Besides, USD/CAD weakened further as yesterday’s US CPI data showed cooling. The U.S. Bureau of Labor Statistics data showed that the CPI data fell from 6.0% to 5.0%, higher than market expectations of 5.2%, further weighing on the dollar. It also prompted investors to think the Fed might pause its tightening efforts. As a result, the dollar faced a massive sell-off after the market raised the possibility of a pause in Fed tightening. As of writing, the USD/CAD edged down -0.055 to $1.3432.

In the commodities market, crude oil prices traded down by -0.35% to $82.97 per barrel after rising concern about recession fears. Besides, gold prices were appreciated by 0.22% to $2019.12 per troy ounce as the inflation eased and recession fears rise.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 CrudeOIL OPEC Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 228K | 232K | – |

| 20:30 | USD – PPI (MoM) (Mar) | -0.1% | 0.1% | – |

Technical Analysis

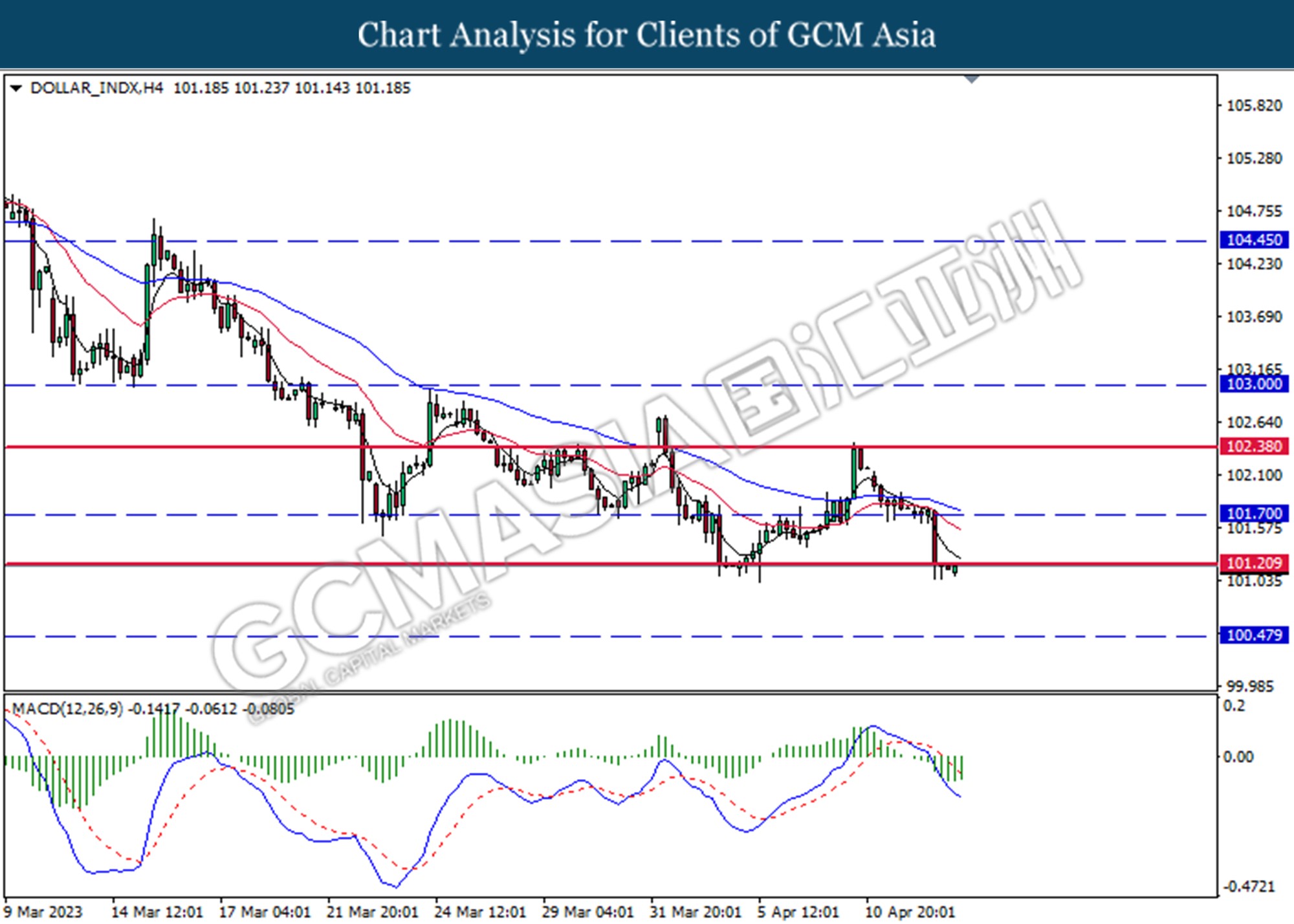

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.20. MACD which illustrated decreasing bearish momentum suggests the index extended its gains after it successfully breakout above the resistance level.

Resistance level: 101.70, 102.40

Support level: 101.20, 100.50

GBPUSD, H4: GBPUSD was traded higher following the prior break above the previous resistance level at 1.2445. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

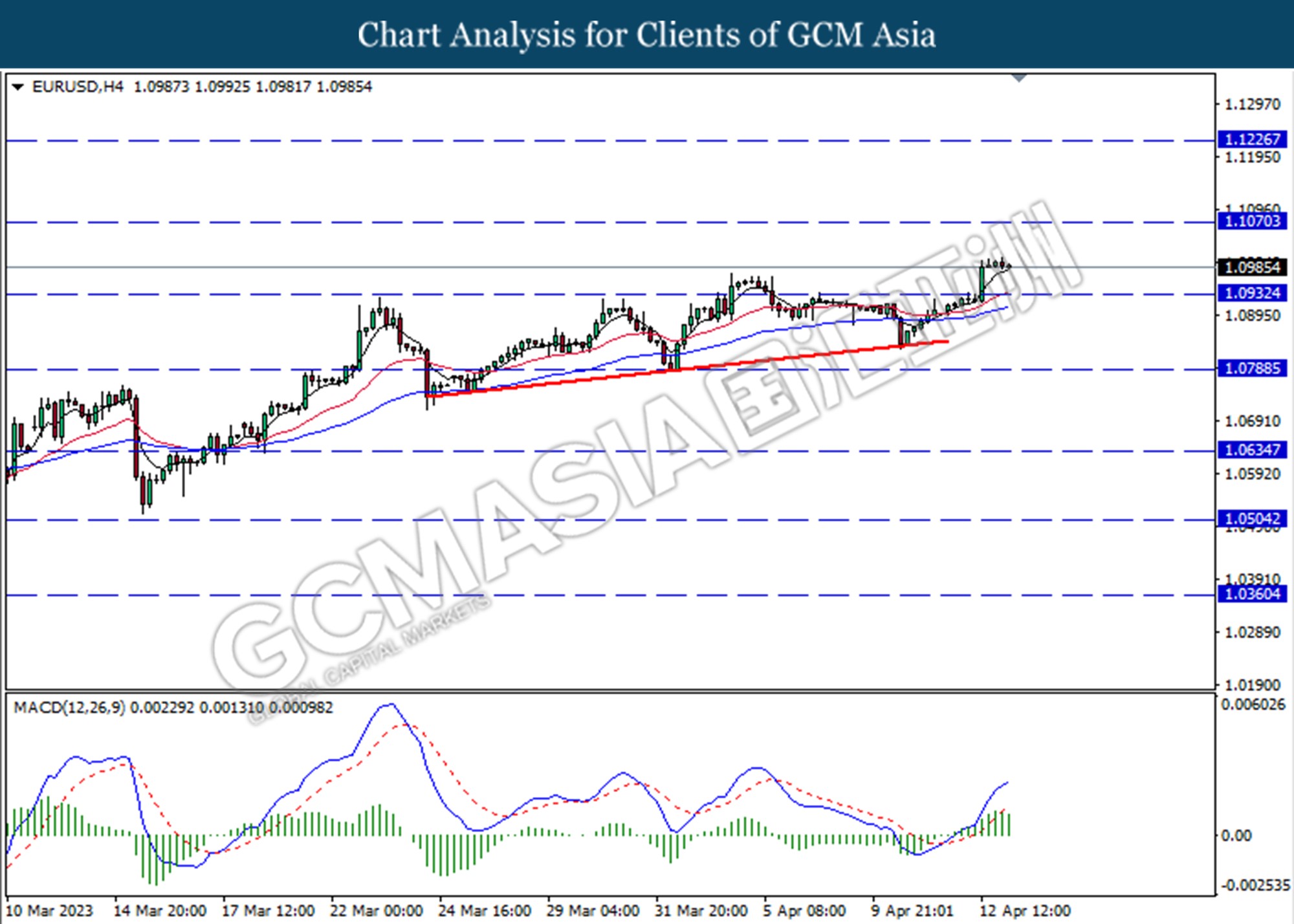

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated decreasing bullish bias momentum suggests the pair extended its losses toward the support level at 1.0930.

Resistance level: 1.1070, 1.1230

Support level: 1.0930, 1.0790

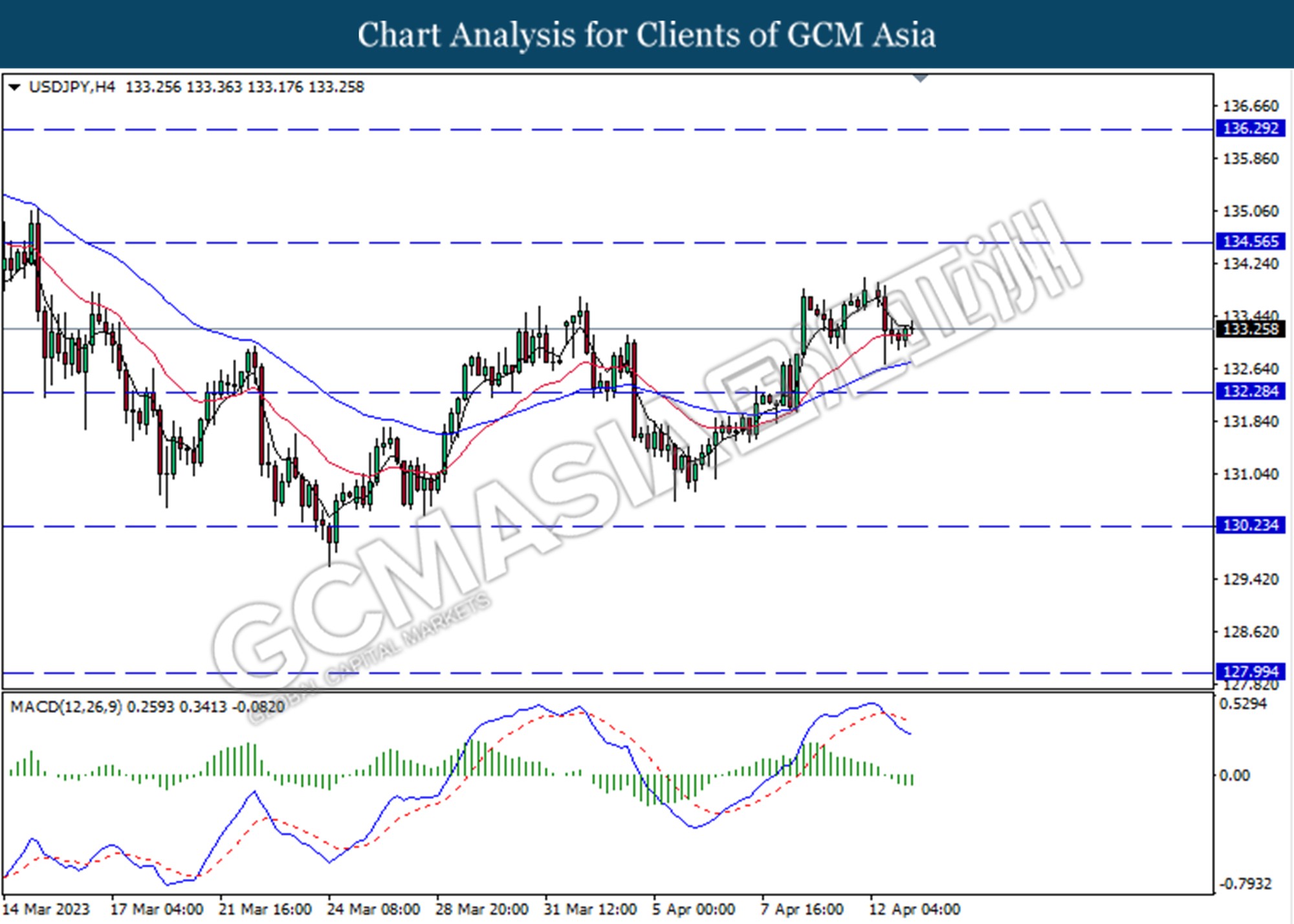

USDJPY, H4: USDJPY was traded higher following a prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the pair to undergo technical correction in the short term.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

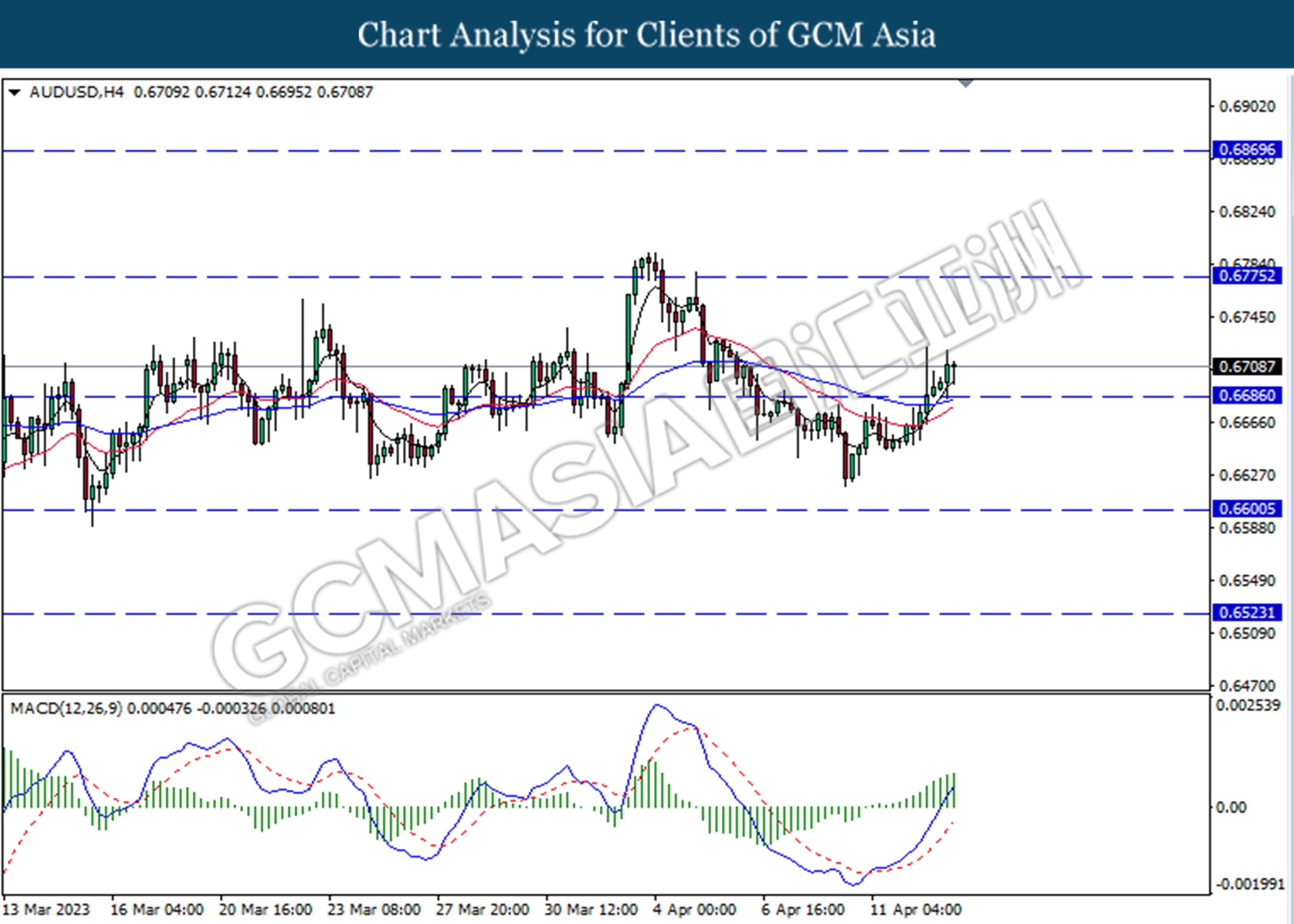

AUDUSD, H4: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6685. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0. 6775.

Resistance level: 0.6775, 0.6870

Support level: 0.66685, 0.6605

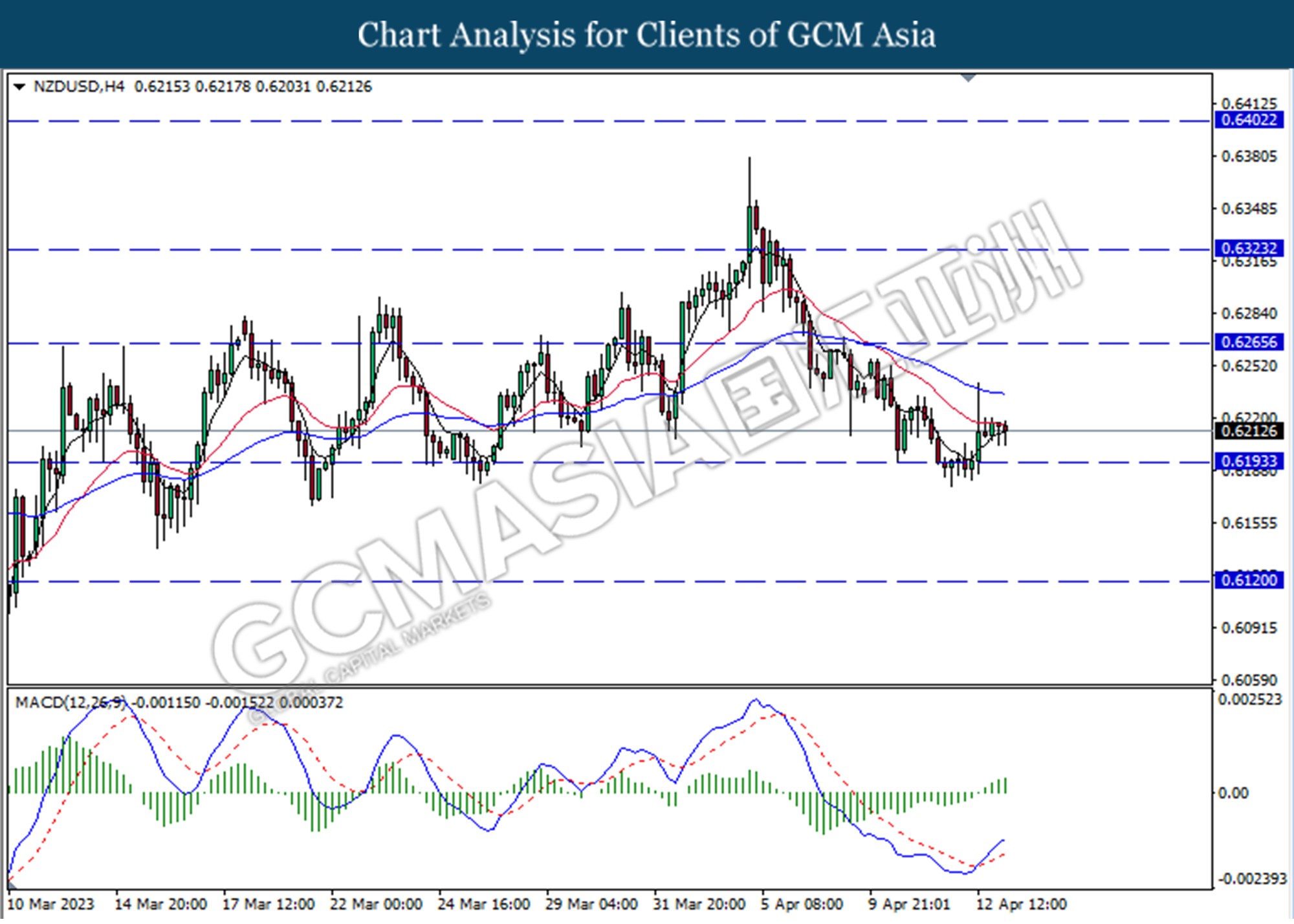

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6195. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

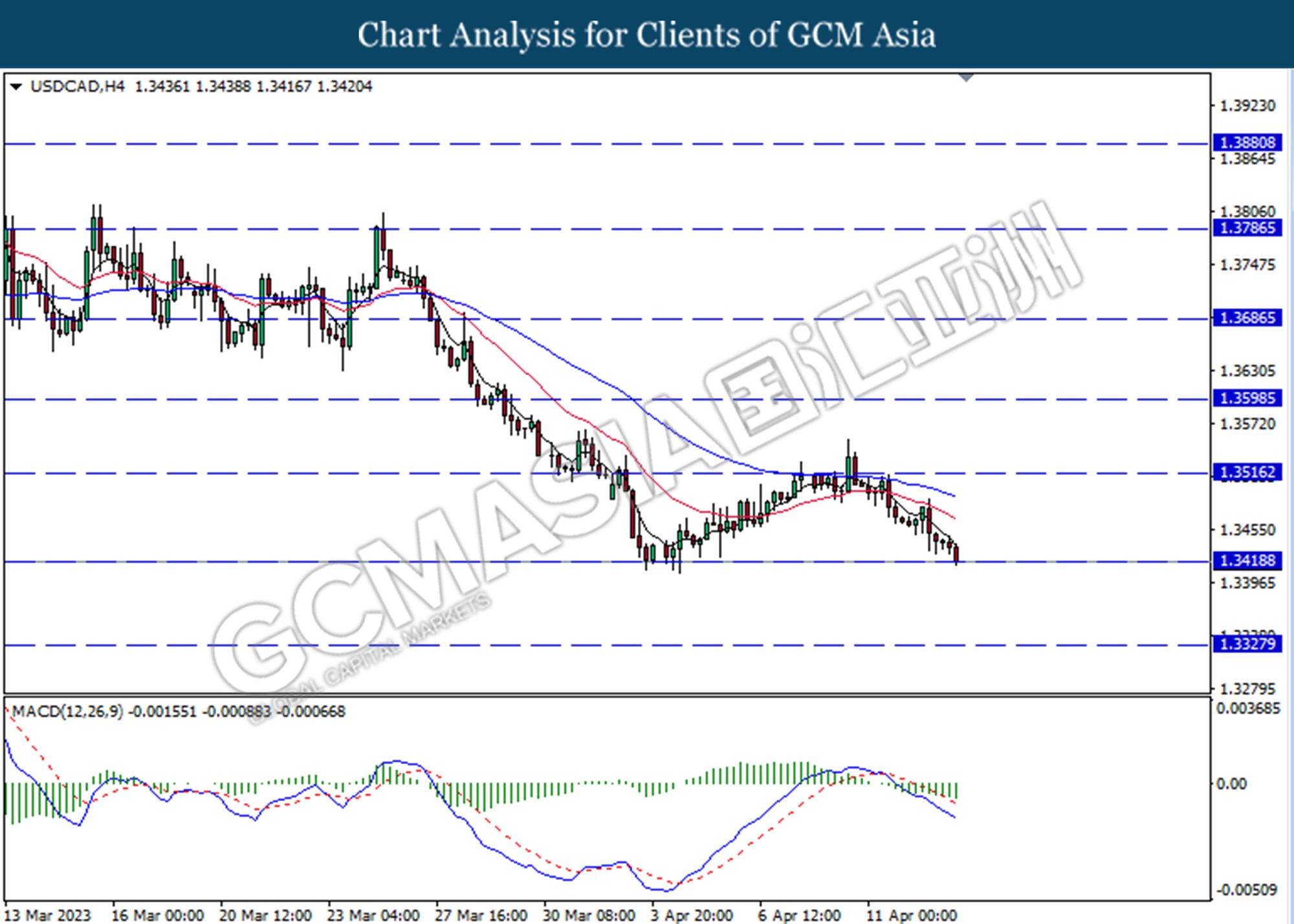

USDCAD, H4: USDCAD was traded lower while currently testing for the support level at 1.3420. MACD which illustrated increasing bearish momentum suggests the pair extended its losses if successfully break below the support level.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

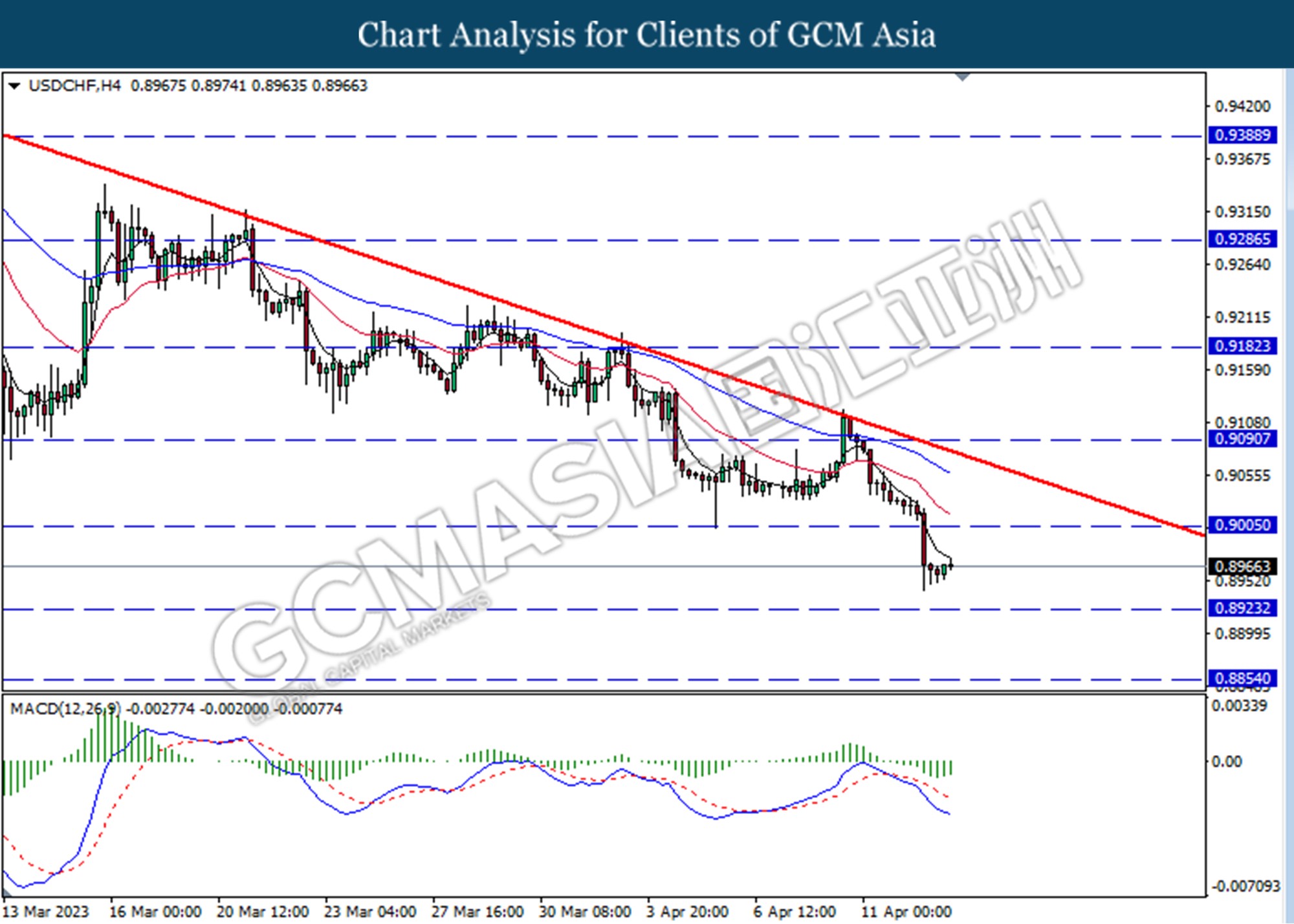

USDCHF, H4: USDCHF was traded higher following a prior rebound from the lower level. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level at 0.9005.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

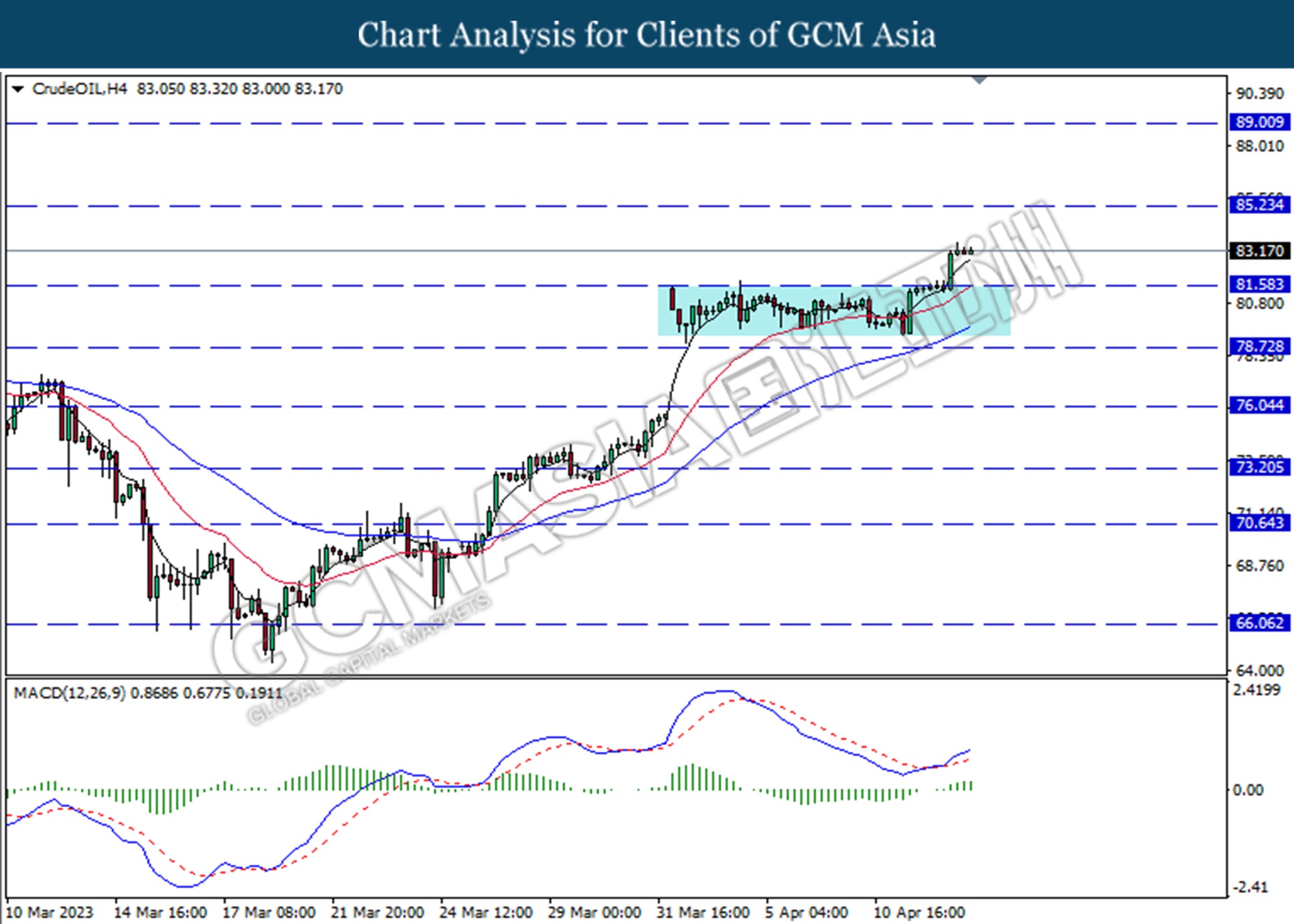

CrudeOIL, H4: Crude oil price was traded higher following a prior break above the previous resistance level at 81.60. MACD which increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 85.25.

Resistance level: 85.25, 89.00

Support level: 81.60, 78.70

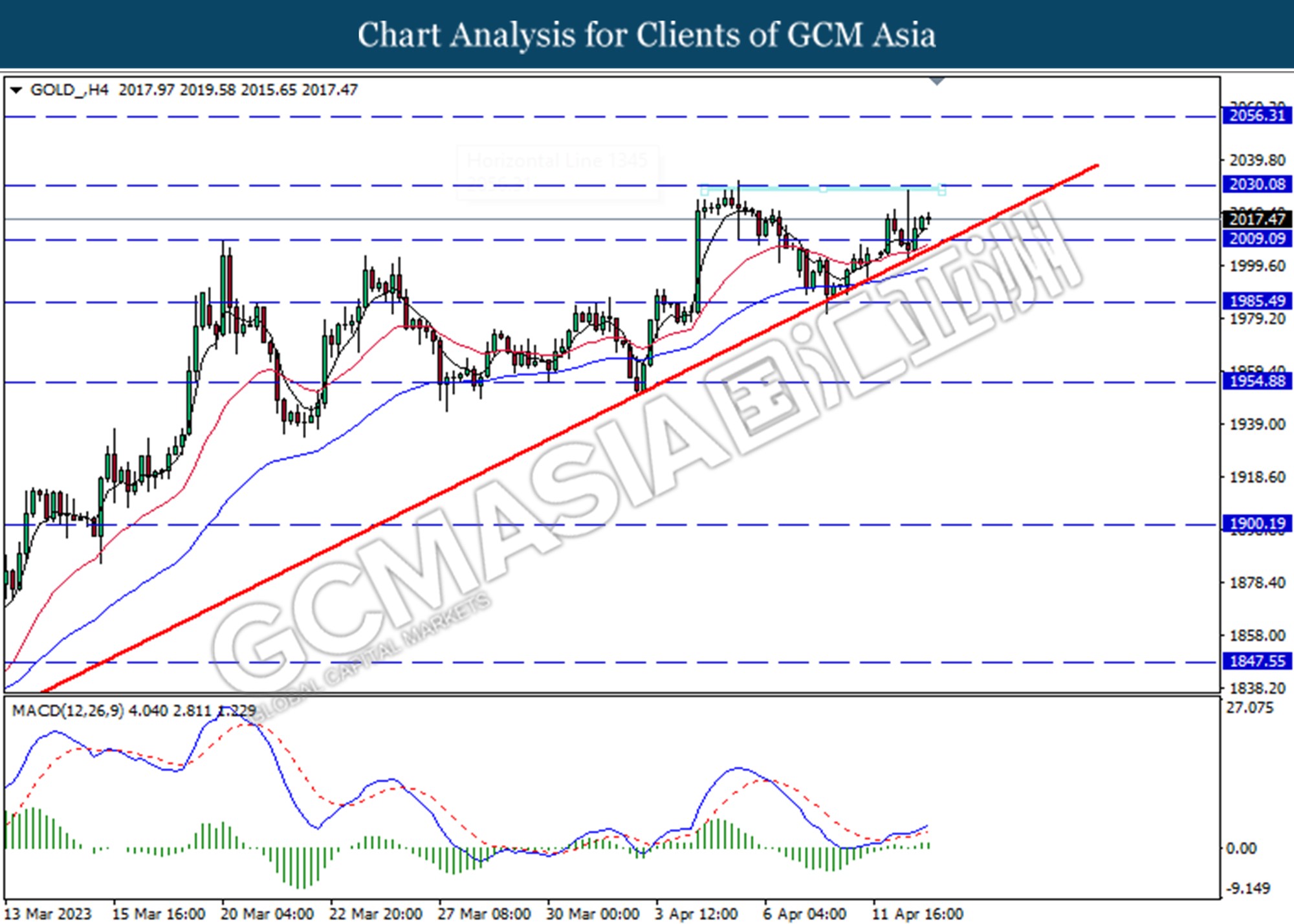

GOLD_, H4: Gold price was traded higher following a prior break above the previous resistance level at 2009.10. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 2030.10.

Resistance level: 2030.10, 2056.30

Support level: 2009.10, 1985.50