14 April 2023 Morning Session Analysis

US Dollar plunged amid the easing price background.

The Dollar Index which traded against a basket of six major currencies slumped on Thursday after the economic data showed the inflationary risk in the US was easing. According to the US Bureau of Labor Statistics, the US Producer Price Index (PPI) MoM in March notched down from the previous reading of 0.0% to -0.5%, missing the consensus expectation of 0.1%. Prior to that, the CPI data that released on Wednesday slipped significantly, which indicated the Fed is really making good progress in its fight against inflation, and the decline in PPI adds to that. Thus, it increased the bets that the US interest rate would likely to reach its peak, whereas Fed could step back from its aggressive tightening policy. On the other hand, the fragile labor market in the US had also extended the losses of Dollar Index. The US Initial Jobless Claims unexpectedly rose to 239K from the prior 228K, signaling the number of unemployment raised in the past week. Consequences, it restricted the room for further rate hike by Fed. By now, the next vital US economic data release will be retails sales data, which will be analyzed for how inflation is affecting consumer spending. As of writing, the Dollar Index depreciated by 0.49% to 100.68.

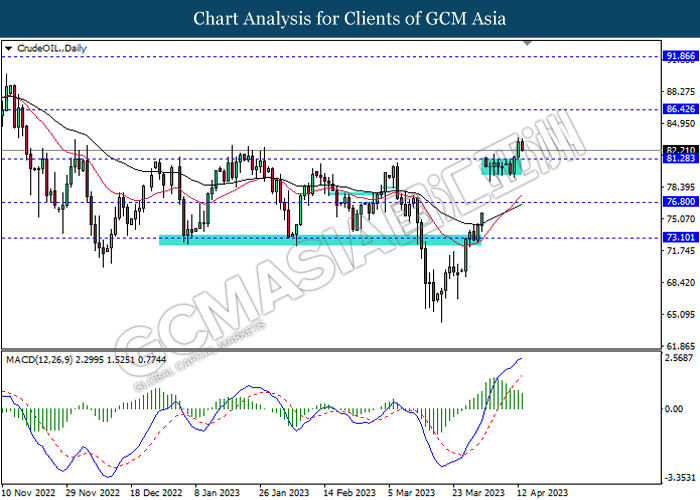

In the commodity market, the crude oil price rose by 0.21% to $82.33 per barrel as of writing following the easing inflation risk in the US had dialed up the demand for oil. In addition, the gold price dropped by 0.05% to $2039.12 per troy ounce as of writing over the slightly rebound of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | -0.10% | -0.30% | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | -0.40% | -0.40% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 100.90, 102.05

Support level: 99.75, 98.35

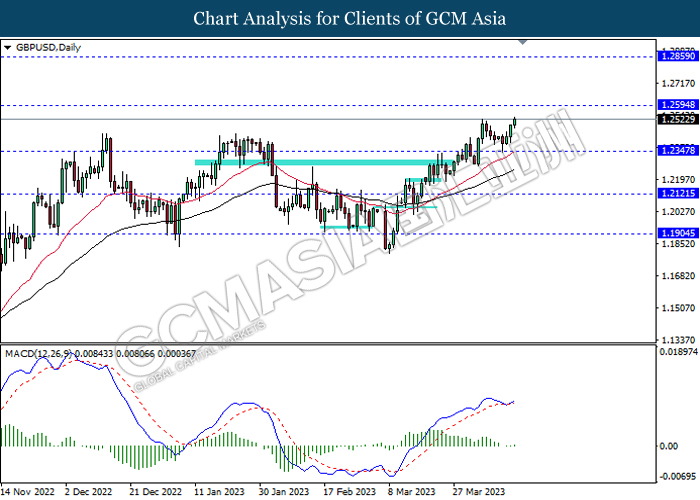

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

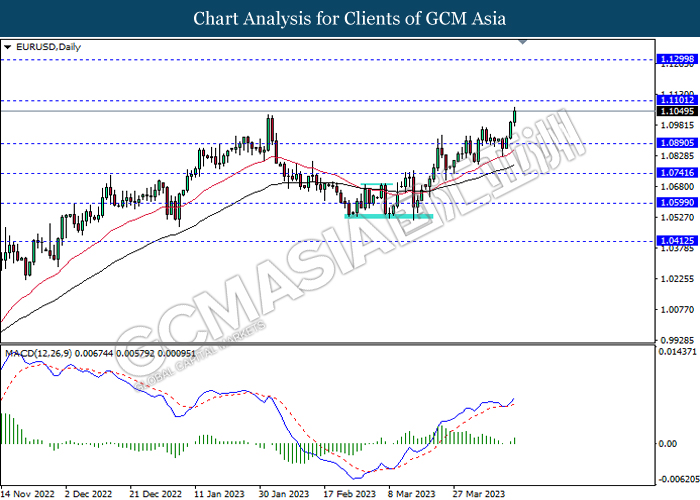

EURUSD, Daily: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

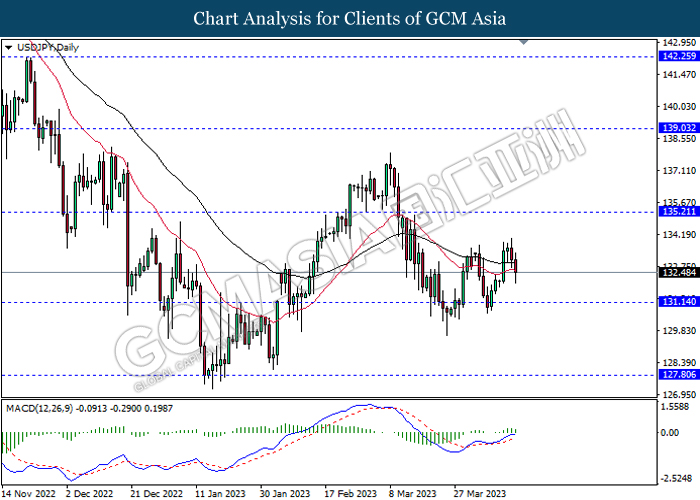

USDJPY, Daily: USDJPY was traded lower following prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

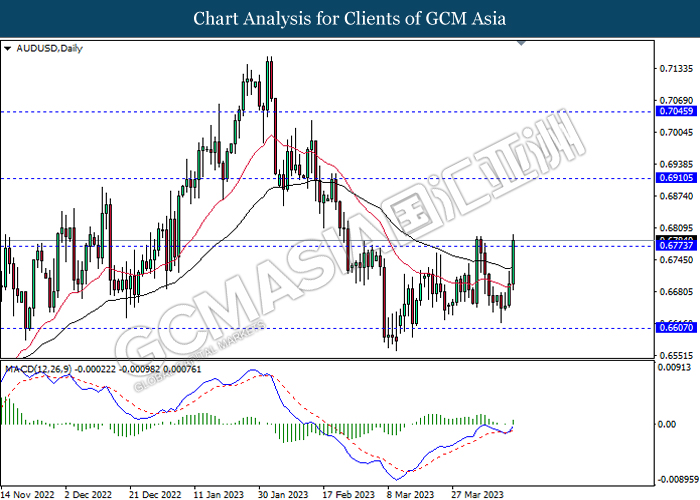

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6910, 0.7045

Support level: 0.6775, 0.6605

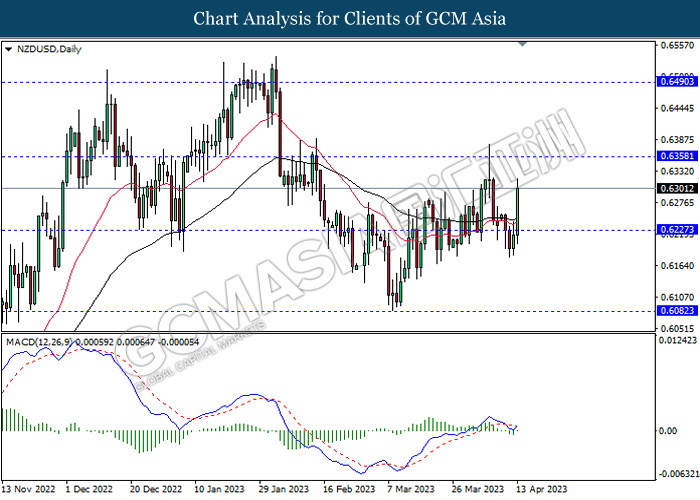

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6360, 0.6490

Support level: 0.6225, 0.6080

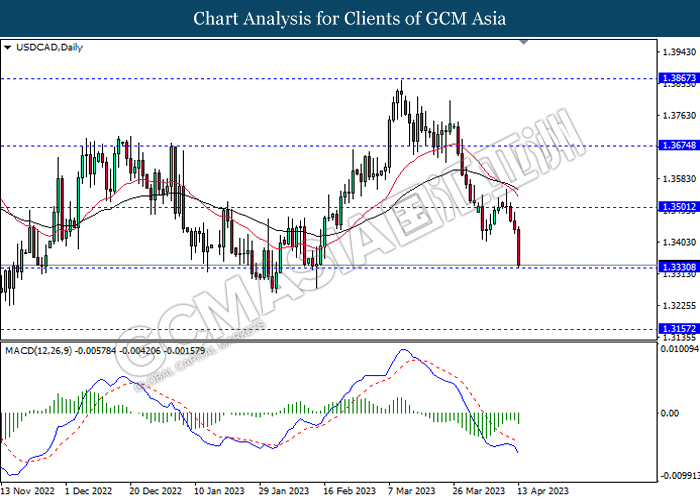

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

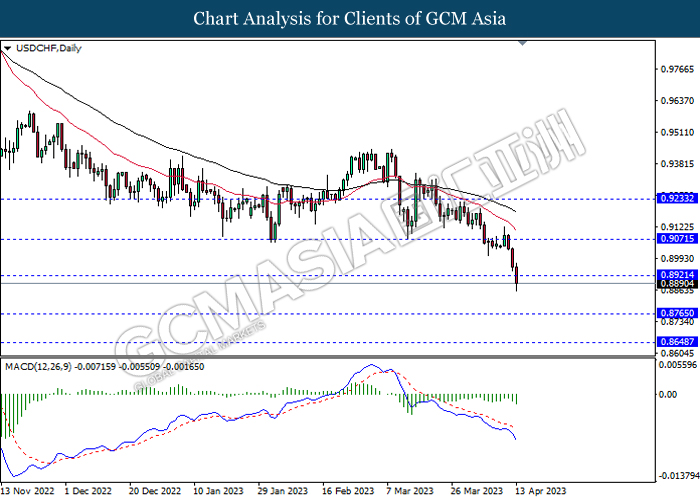

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.8920, 0.9070

Support level: 0.8765, 0.8650

CrudeOIL, Daily: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 86.40, 91.85

Support level: 81.30, 76.80

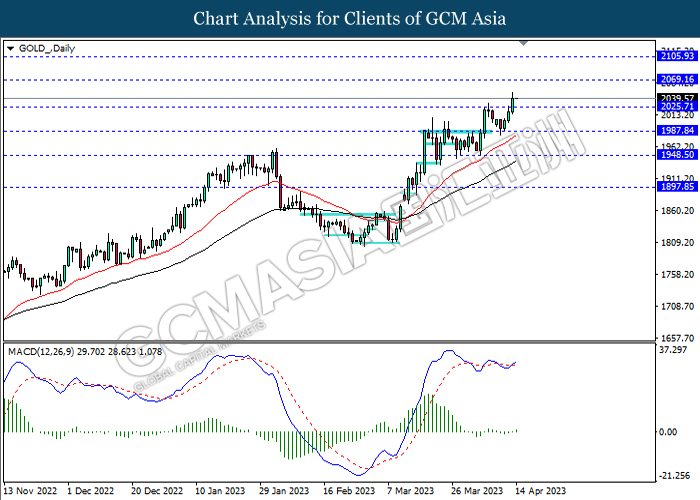

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 2069.15, 2105.95

Support level: 2025.70, 1987.85