17 April 2023 Morning Session Analysis

US dollar surged amid hawkish statement from Fed’s Waller.

The dollar index, which is traded against a basket of six mainstream currencies, managed to hold its ground and regained some luster after the Fed’s member revealed his stance of point regarding the tightening policy. Last Friday, Fed’s Board Governor Christopher Waller said that the US cash rate needs to move higher despite a year of aggressive rate hikes to bring down the inflation rate back to 2%. He also highlighted that there is no clear sign of improvement in the underlying inflation, where the inflation is still high from his point of view. With regards to the recent fallout of the banking sector, he commented that it still remains unclear whether bank stress would lead to the further economic slowdown, but the stability of the financial market proved that the Fed was doing right to hike rates in order to cool the inflation rate. The unexpected hawkish statement from Fed’s Waller spurred the dollar index, as a 25 basis point a rate hike is likely to be brought onto the table in the upcoming meeting. Prior to that, the disappointing March retail sales data exerted huge selling pressures in the US dollar market. According to the Census Bureau, the US Retail Sales came in at -1.0%, weaker than the consensus forecast at -0.4%, as the consumers cut back on purchases of cars and other big-ticket items. As of writing, the dollar index rose 0.07% to 101.60.

In the commodities market, crude oil prices edged down by -0.22% to $82.45 per barrel as OPEC monthly report highlighted that the oil demand may be dampened by the challenges of facing rising inventories and global economic growth. Besides, gold prices were traded down by -0.03% to $2003.65 per troy ounce following the Fed’s Waller hawkish statement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

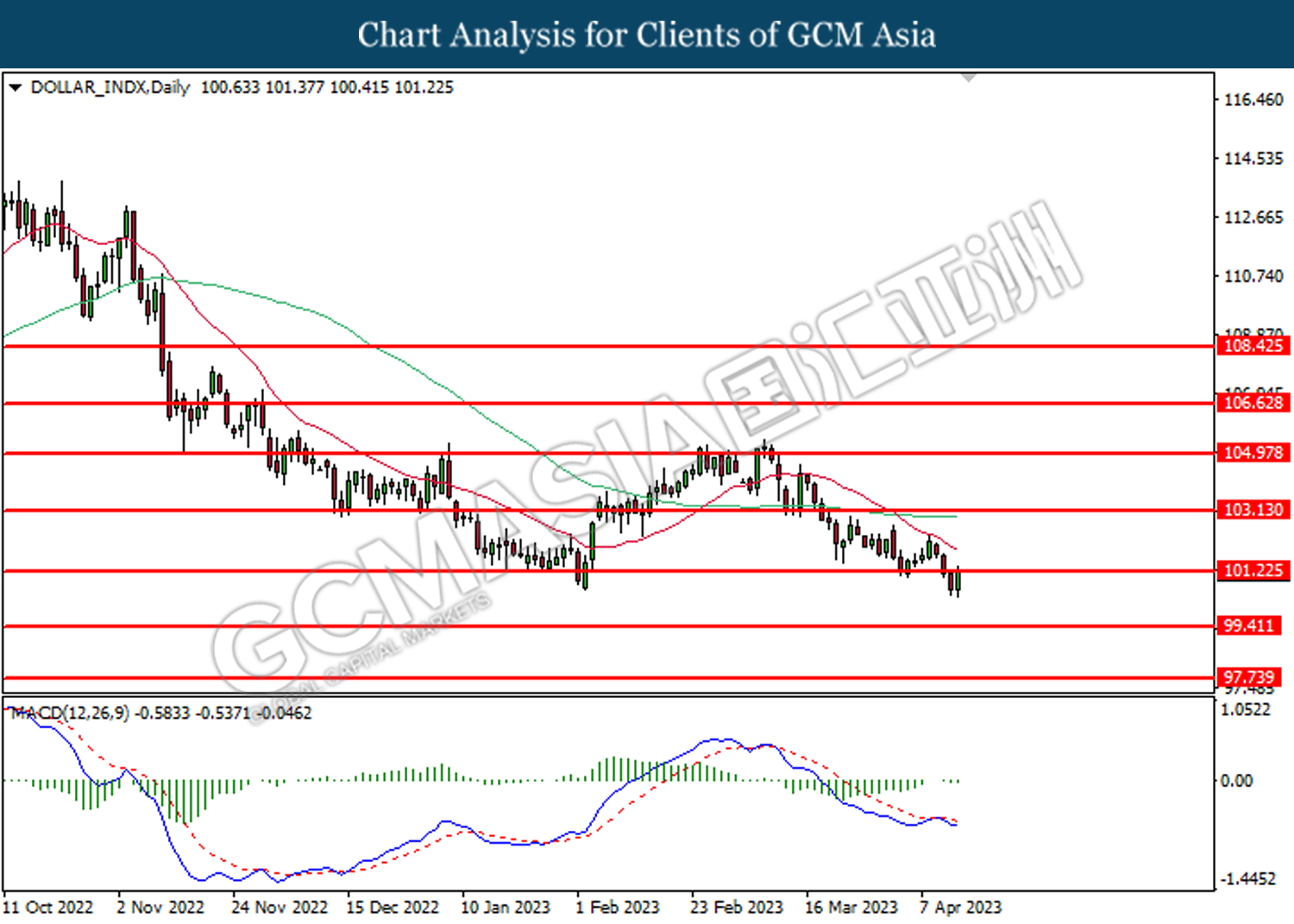

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.25, 103.15

Support level: 99.40, 97.75

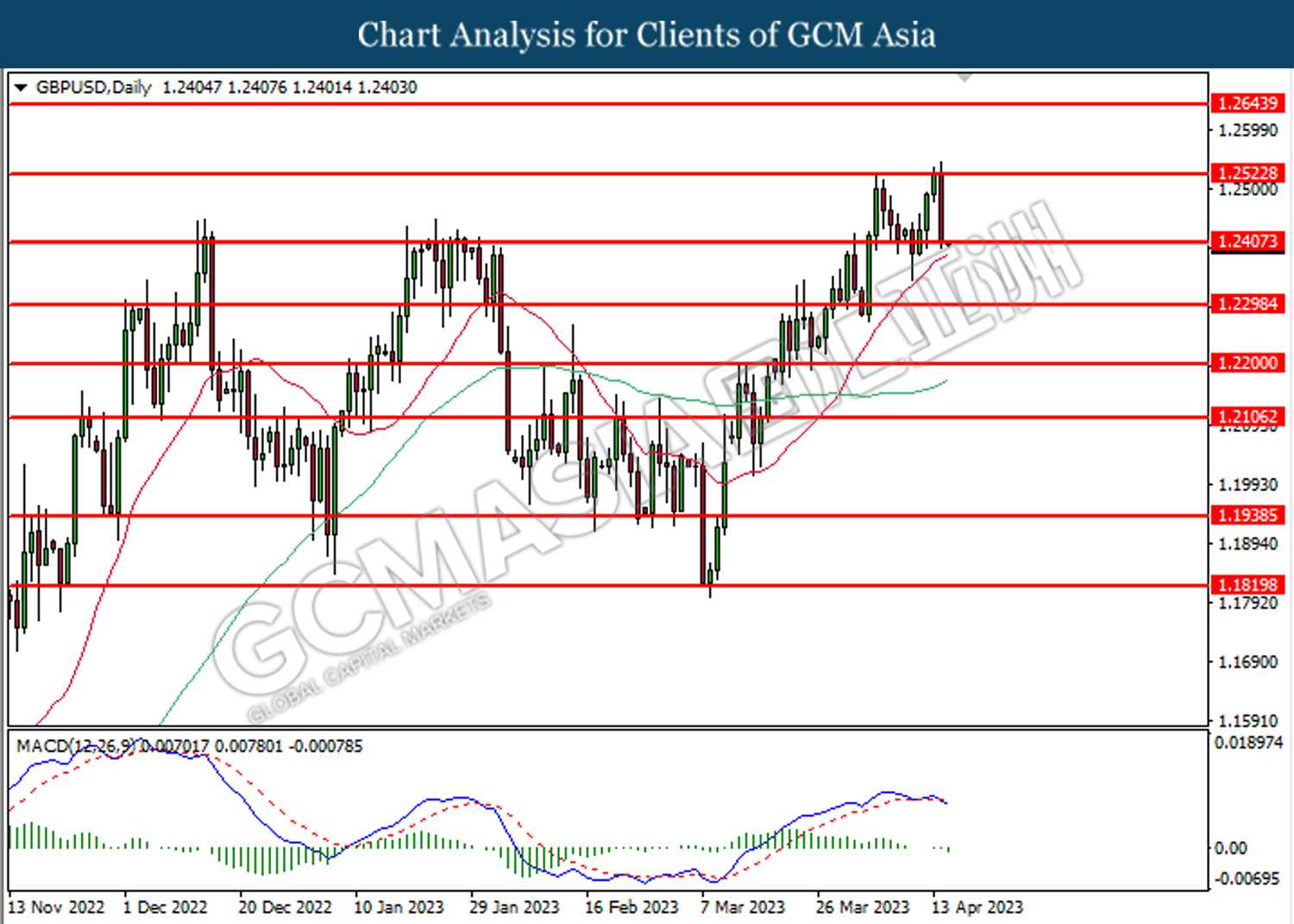

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

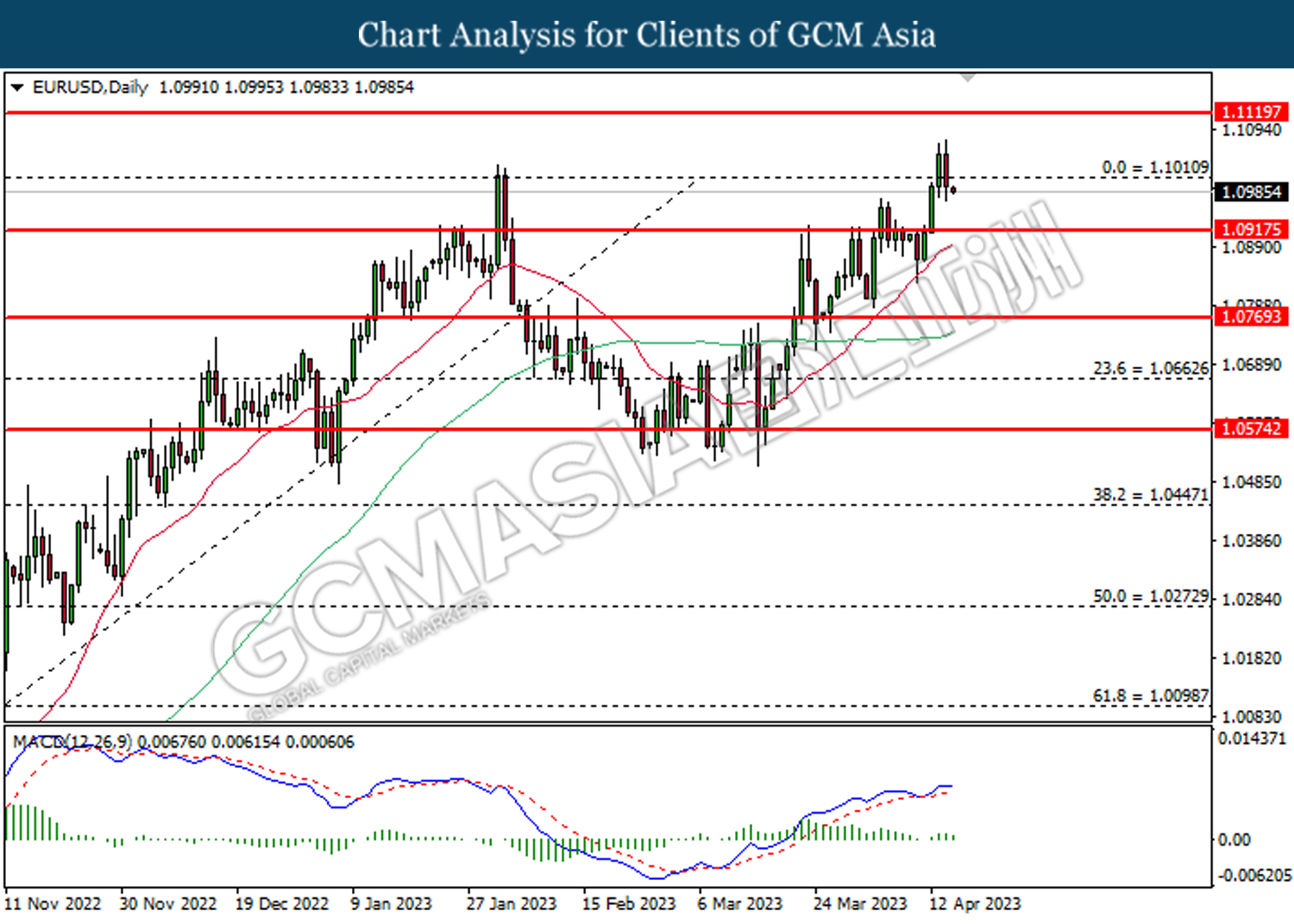

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated diminishing bullish momentum suggest the pair to extend its extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

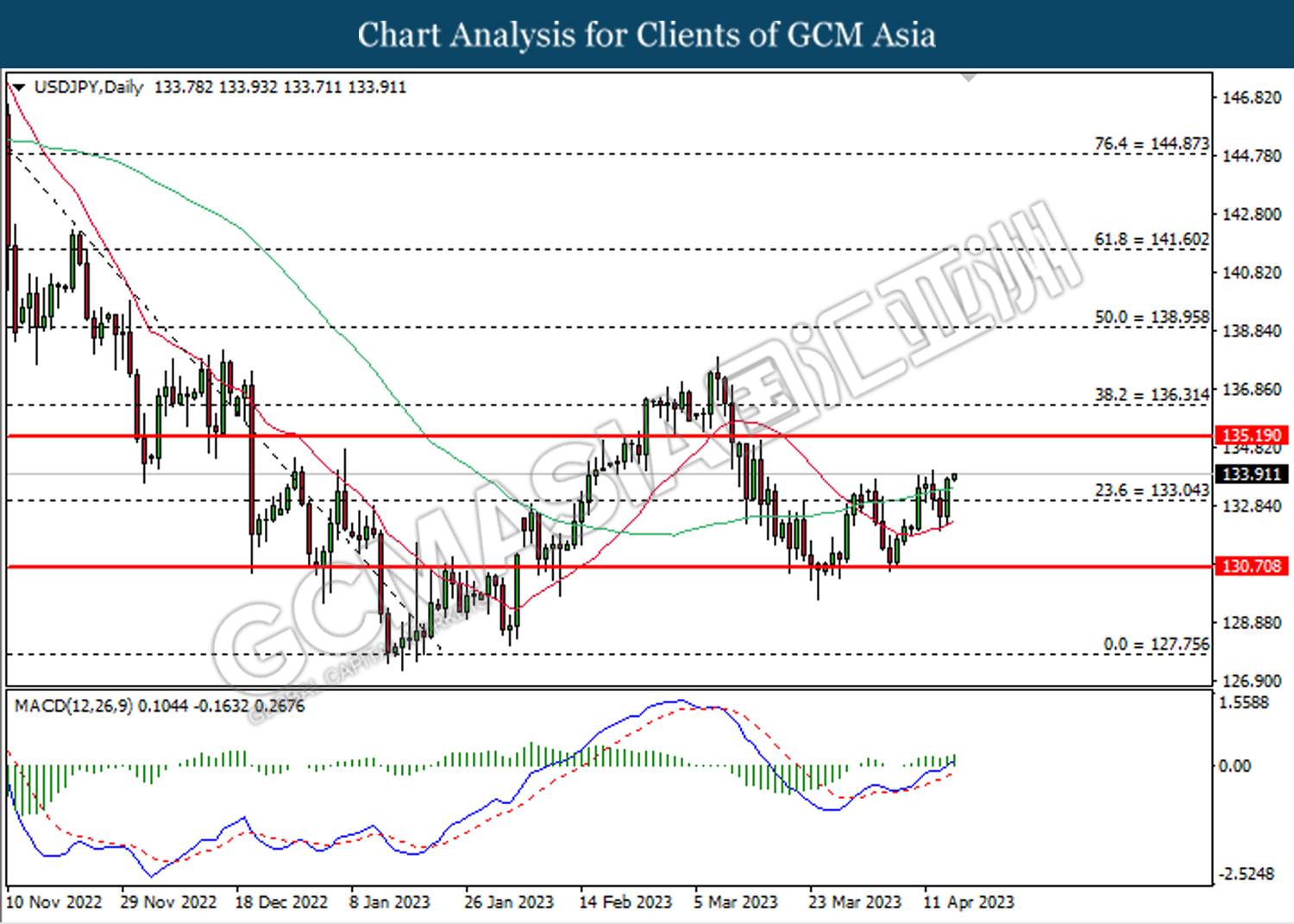

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

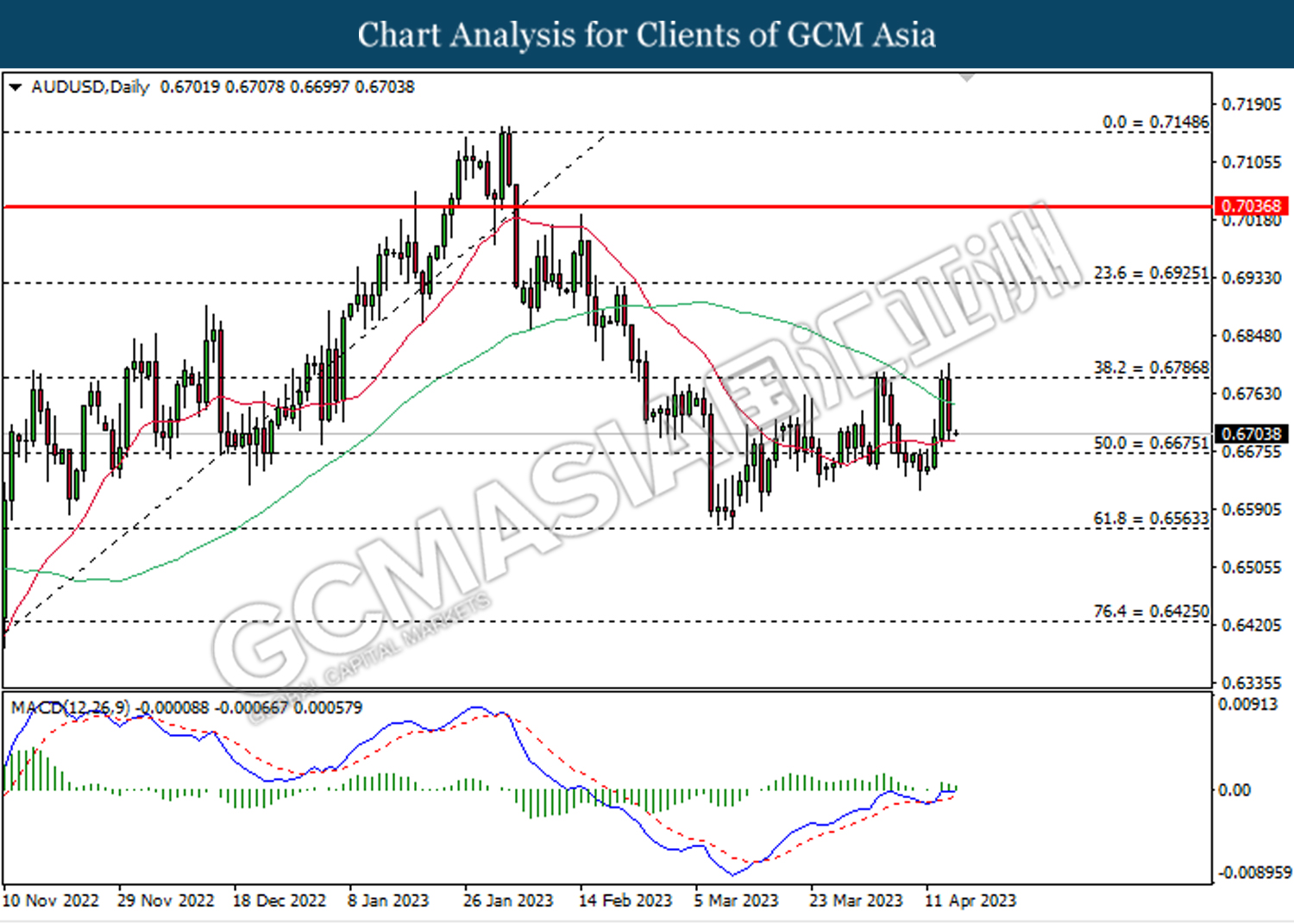

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

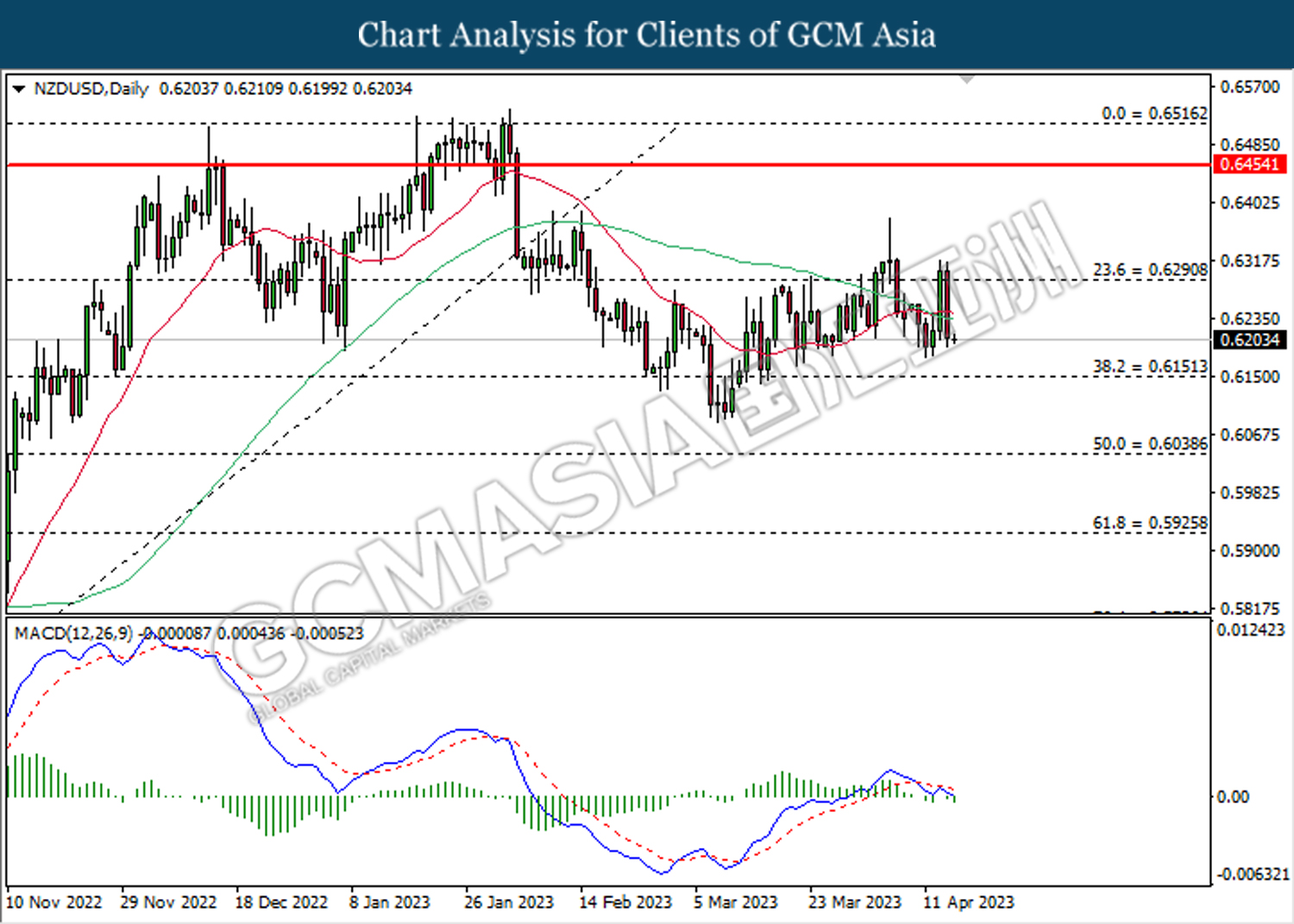

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

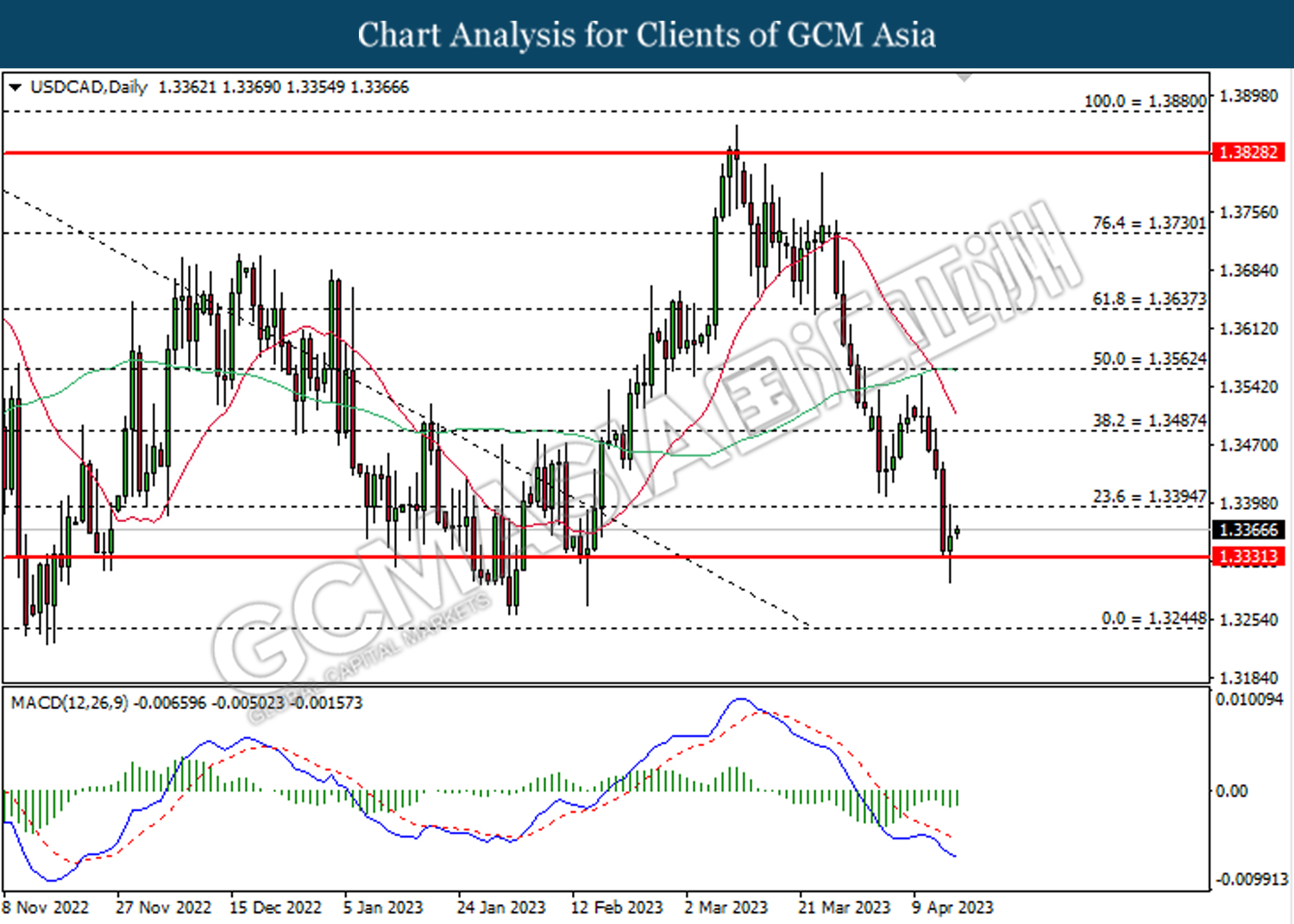

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3330. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3395.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

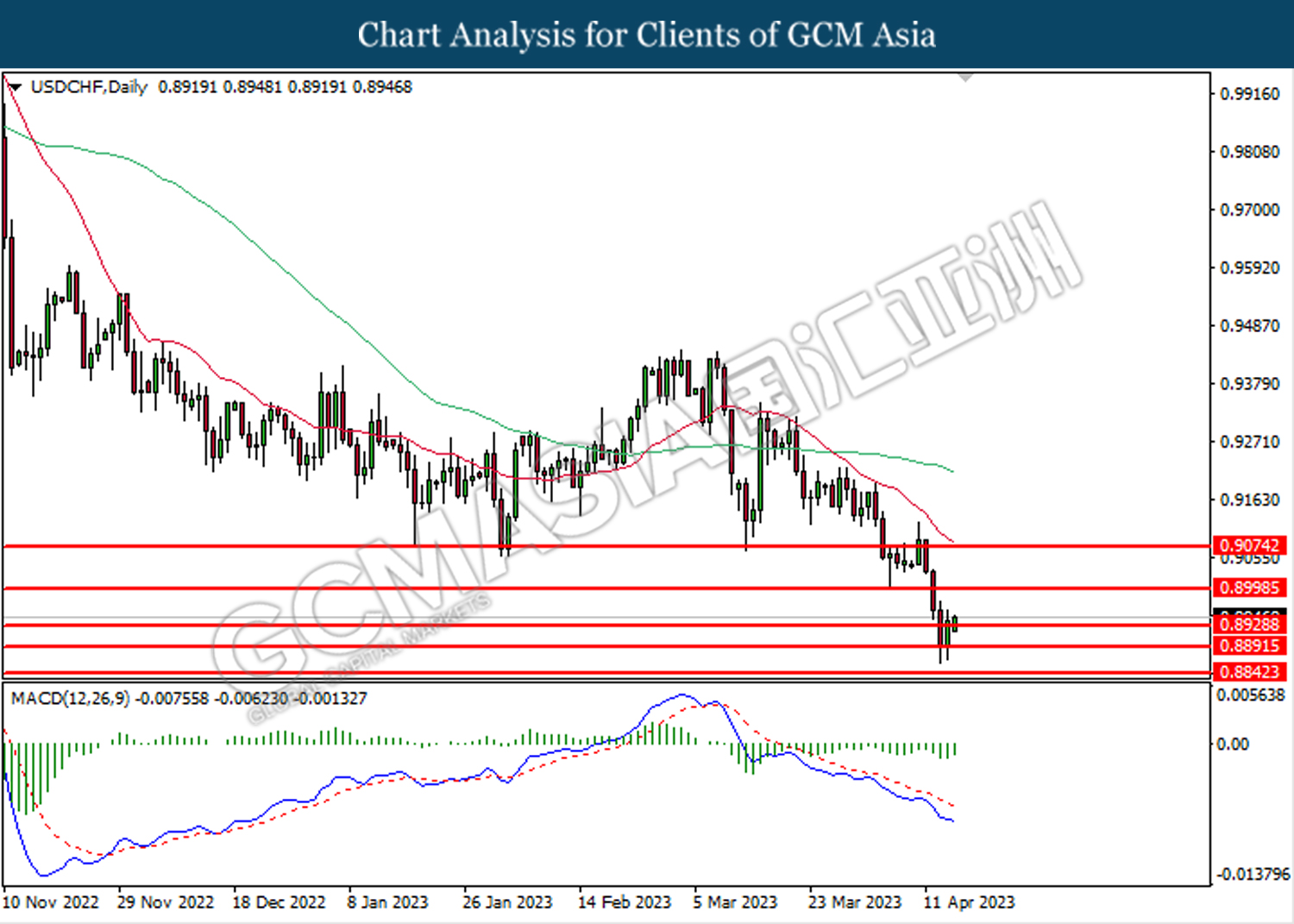

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.8930.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

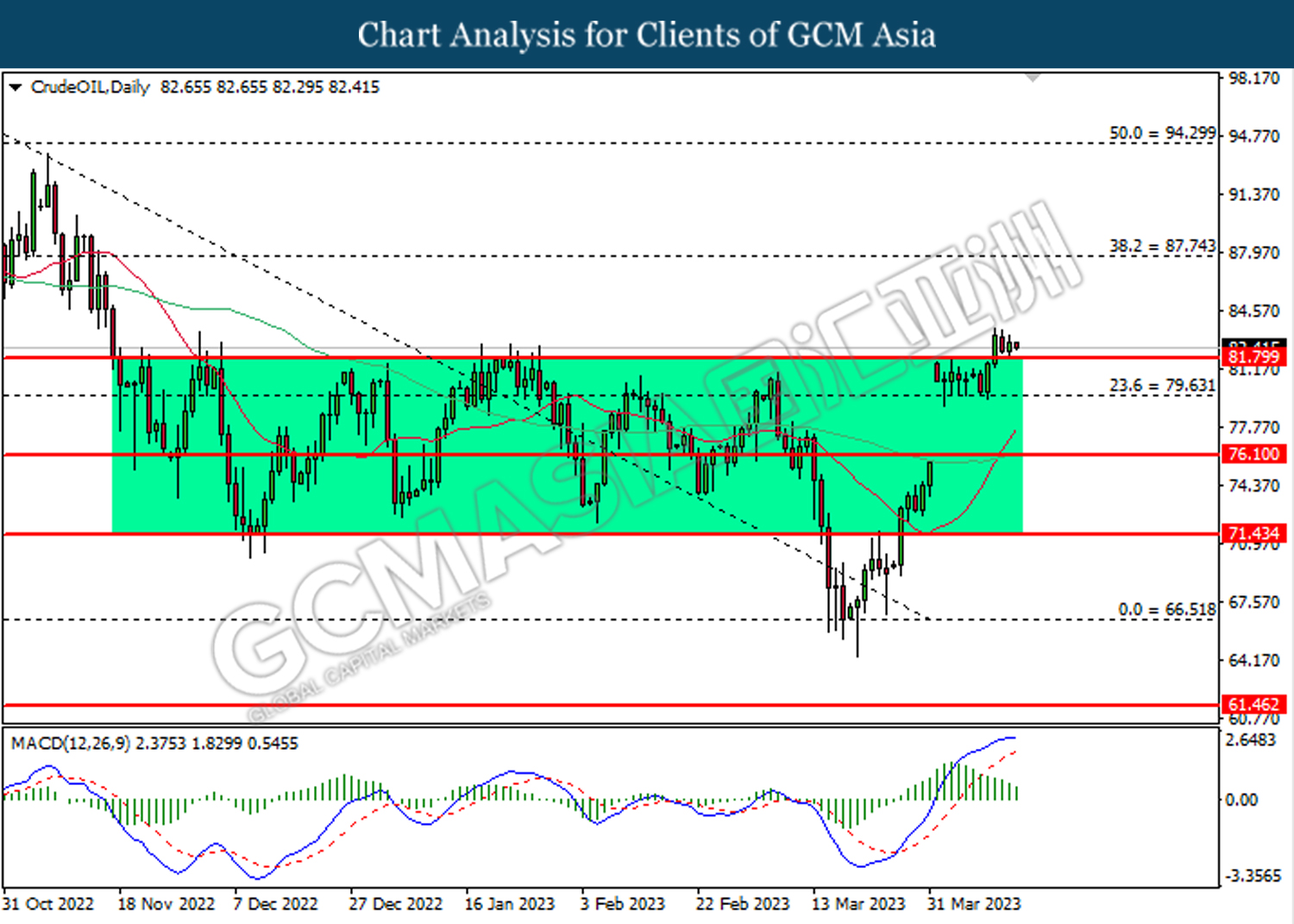

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 81.80. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the next resistance level at 87.75.

Resistance level: 87.75, 94.30

Support level: 81.80, 79.65

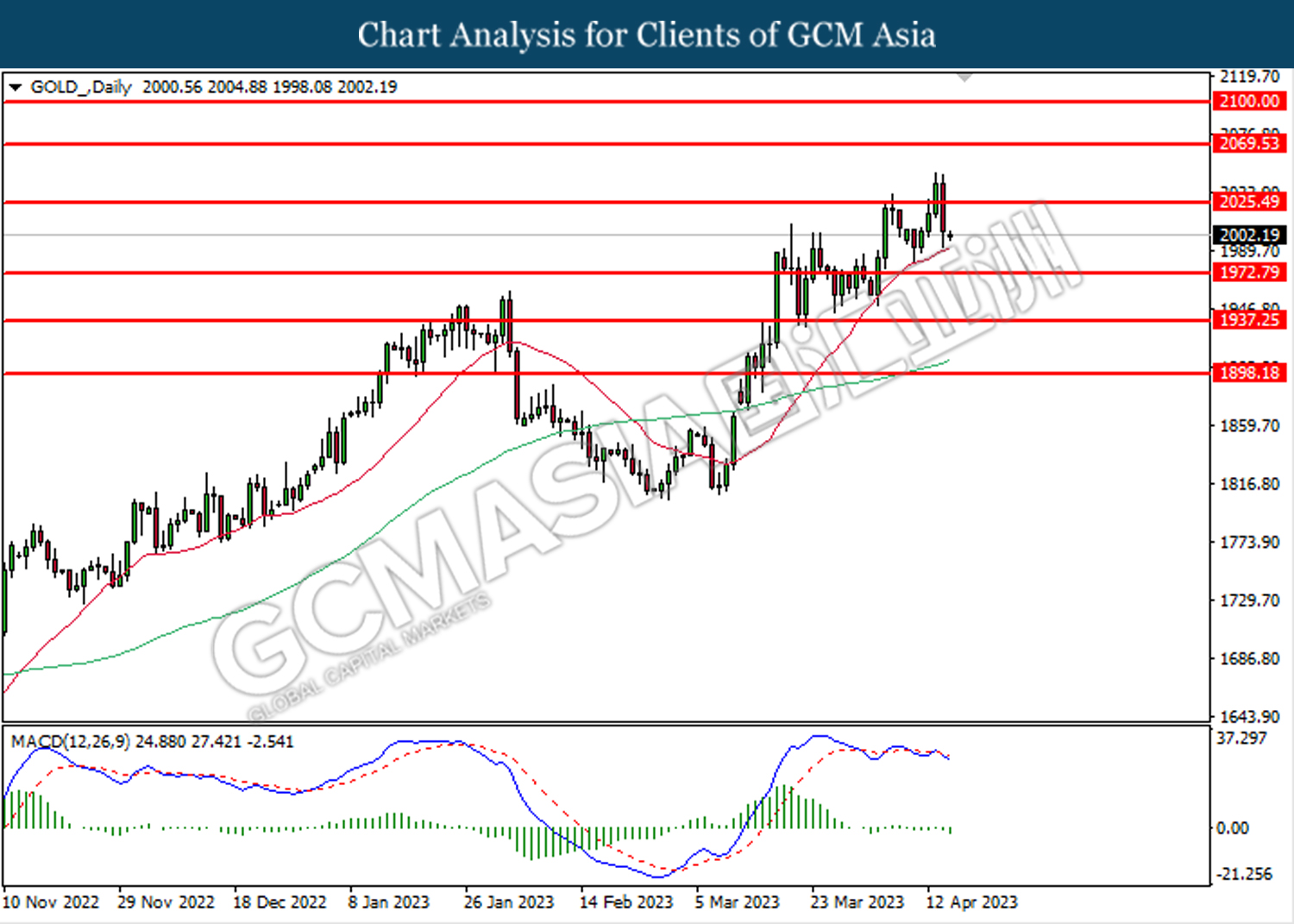

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25