18 April 2023 Morning Session Analysis

Upbeat manufacturing data spurred the US dollar.

The dollar index, which is traded against a basket of six mainstream currencies, extended its rallies yesterday, mainly buoyed by the upbeat manufacturing data. According to the Federal Reserve Bank of New York, the US New York Empire State Manufacturing Index rose from the prior month’s reading of -24.60 to 10.80 in April, refreshing the highest record since last year’s July. The stronger-than-expected reading showed a strong improvement of business conditions in the New York state despite the recent fallout of the banking sector. Notably, the data also turned to a positive reading for the first time in 5 months, which has further cemented the possibility of further rate hike in the May’s meeting. According to the CME FedWatch Tool, the market expectations for a 25 basis-point hike at the May meeting as of Monday have risen to 86.6%, up from the 78% on Friday, while the possibility of maintaining the interest rate at current level has declined sharply from 22.0% to 13.4%. With the increasing expectation of one more rate hike in the upcoming Fed’s meeting, it exerted further bullish momentum in the dollar market, bringing the index back to the highest level in one week. As of writing, the dollar index rose 0.54% to 102.10.

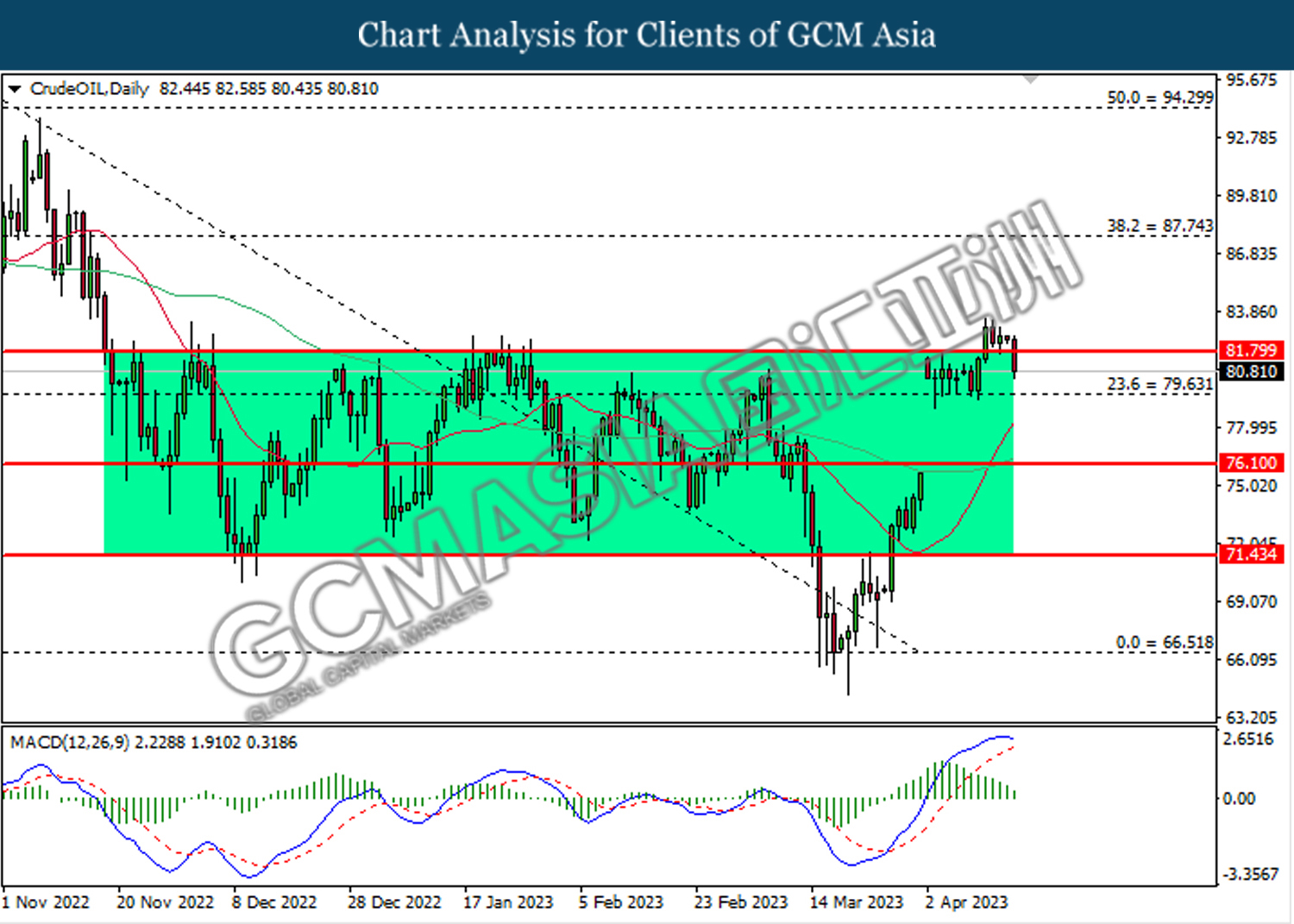

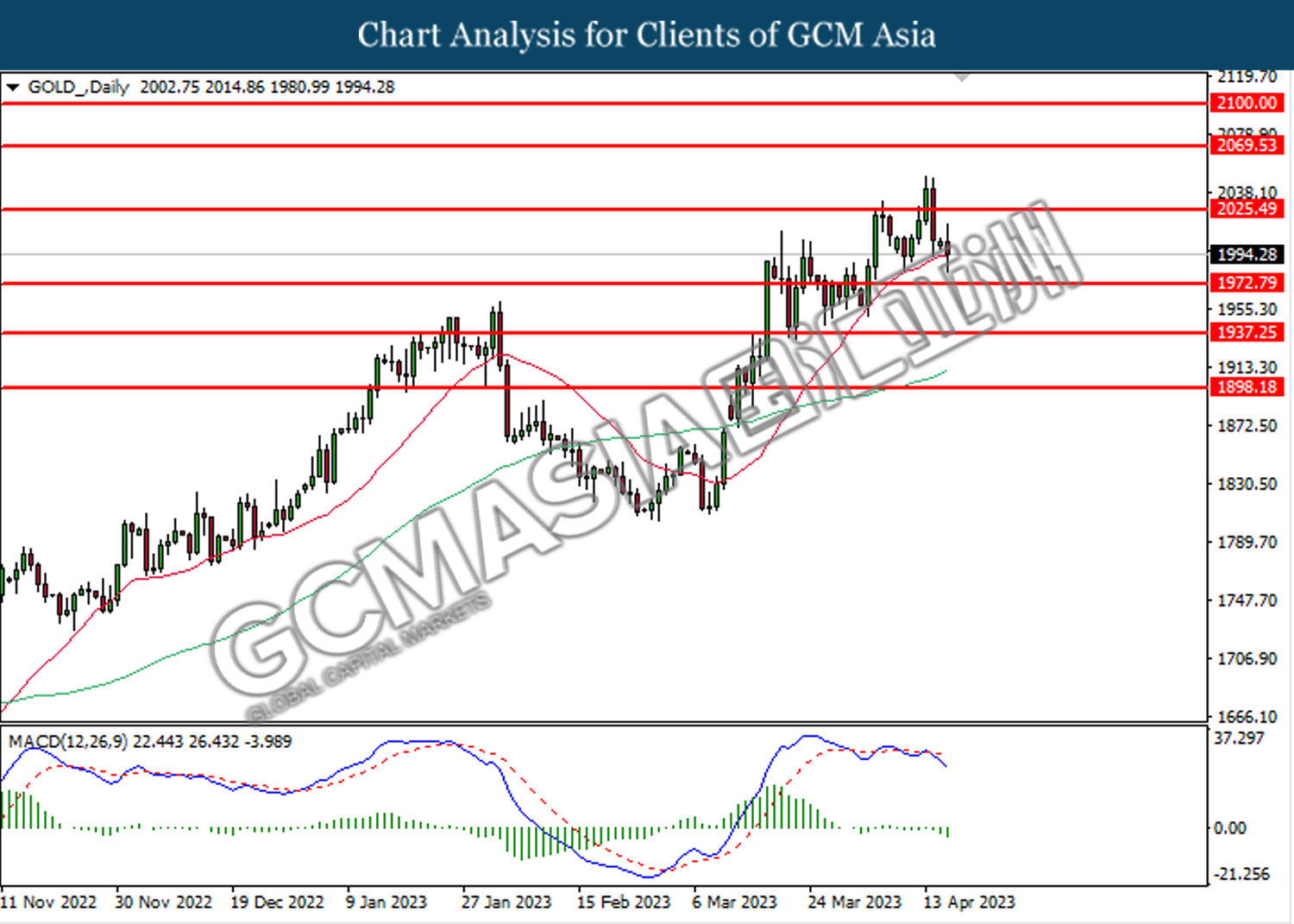

In the commodities market, crude oil prices edged down by -0.12% to $80.90 per barrel as the strengthening in US dollar diminished the appeal of the black commodity against the non-US oil buyers. Besides, gold prices were traded down by -0.01% to $1994.90 per troy ounce following the release of positive factory activity data in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 5.7% | 5.1% | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -11.2K | 10.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | 13.0 | 15.3 | – |

| 20:30 | USD – Building Permits (Mar) | 1.550M | 1.450M | – |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.5% | – | – |

Technical Analysis

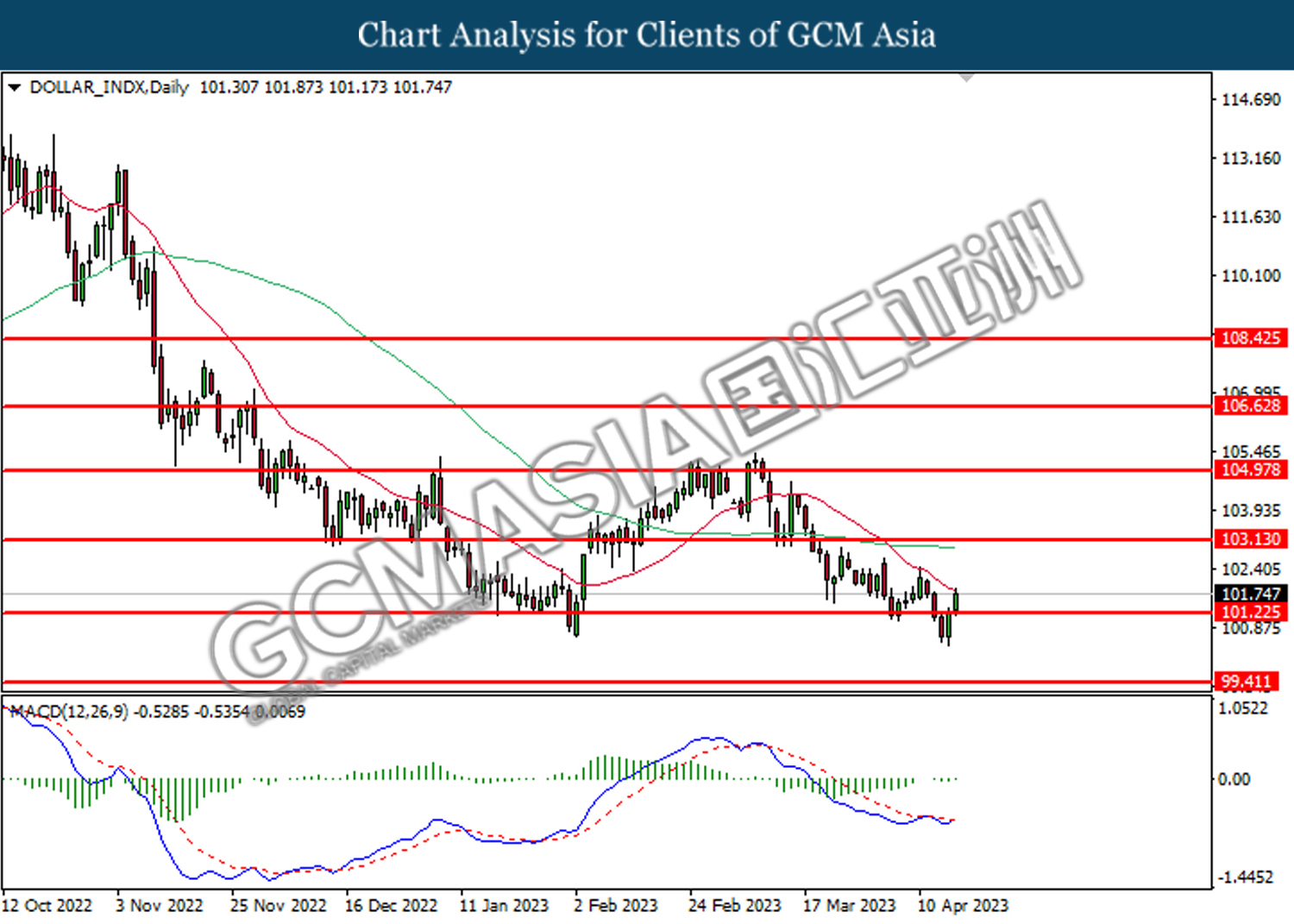

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 101.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.25, 103.15

Support level: 99.40, 97.75

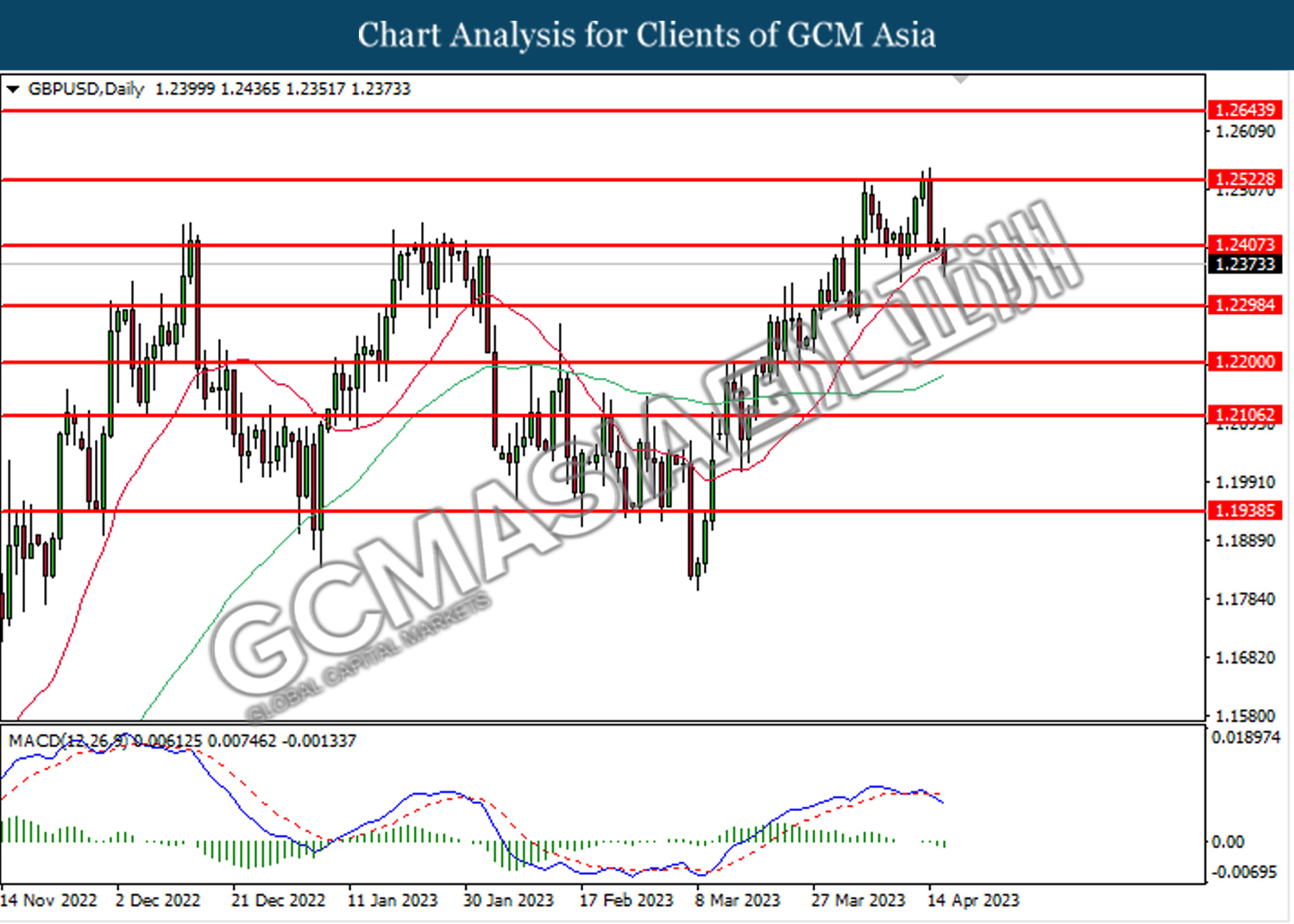

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2405. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

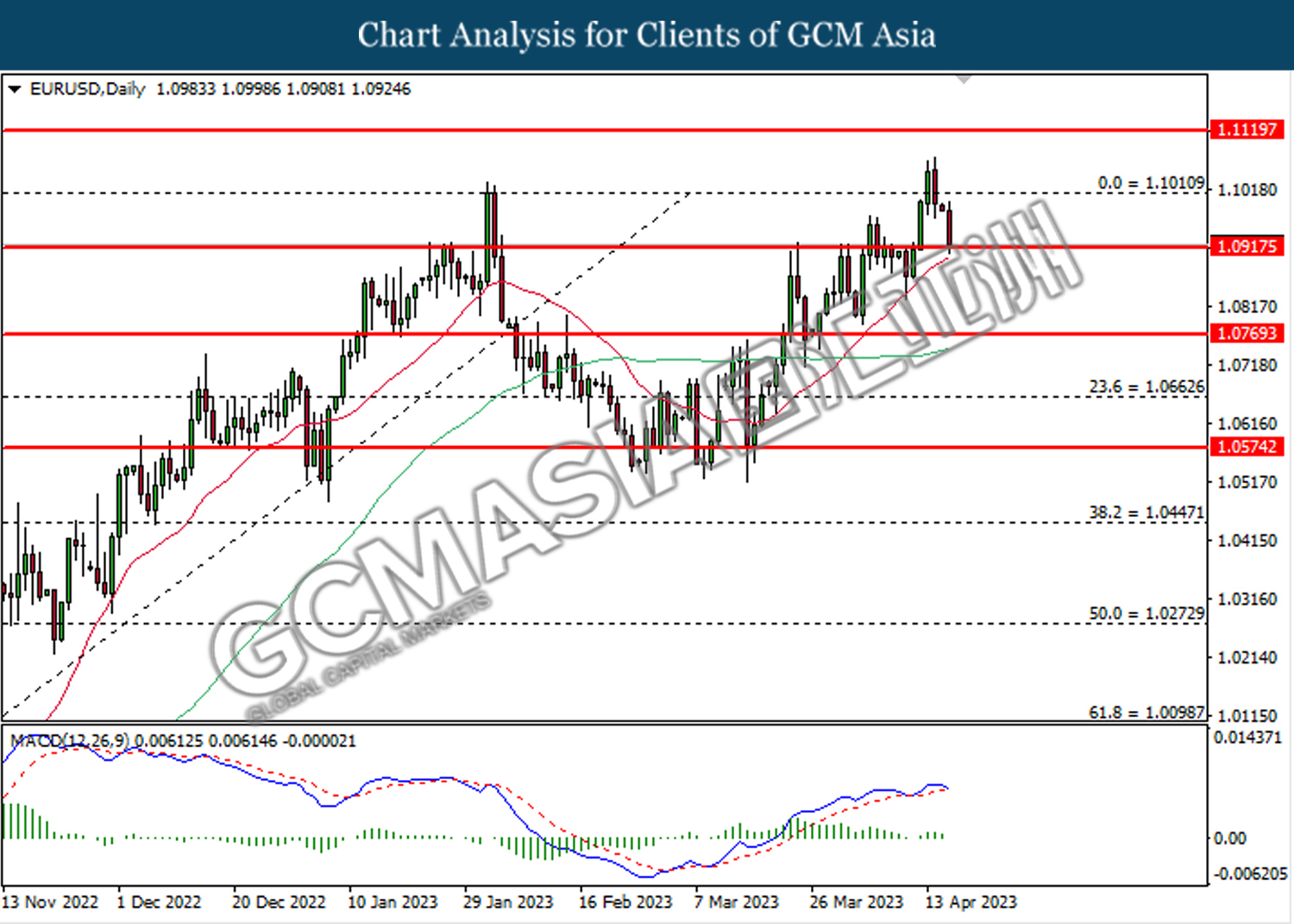

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1120

Support level: 1.0915, 1.0770

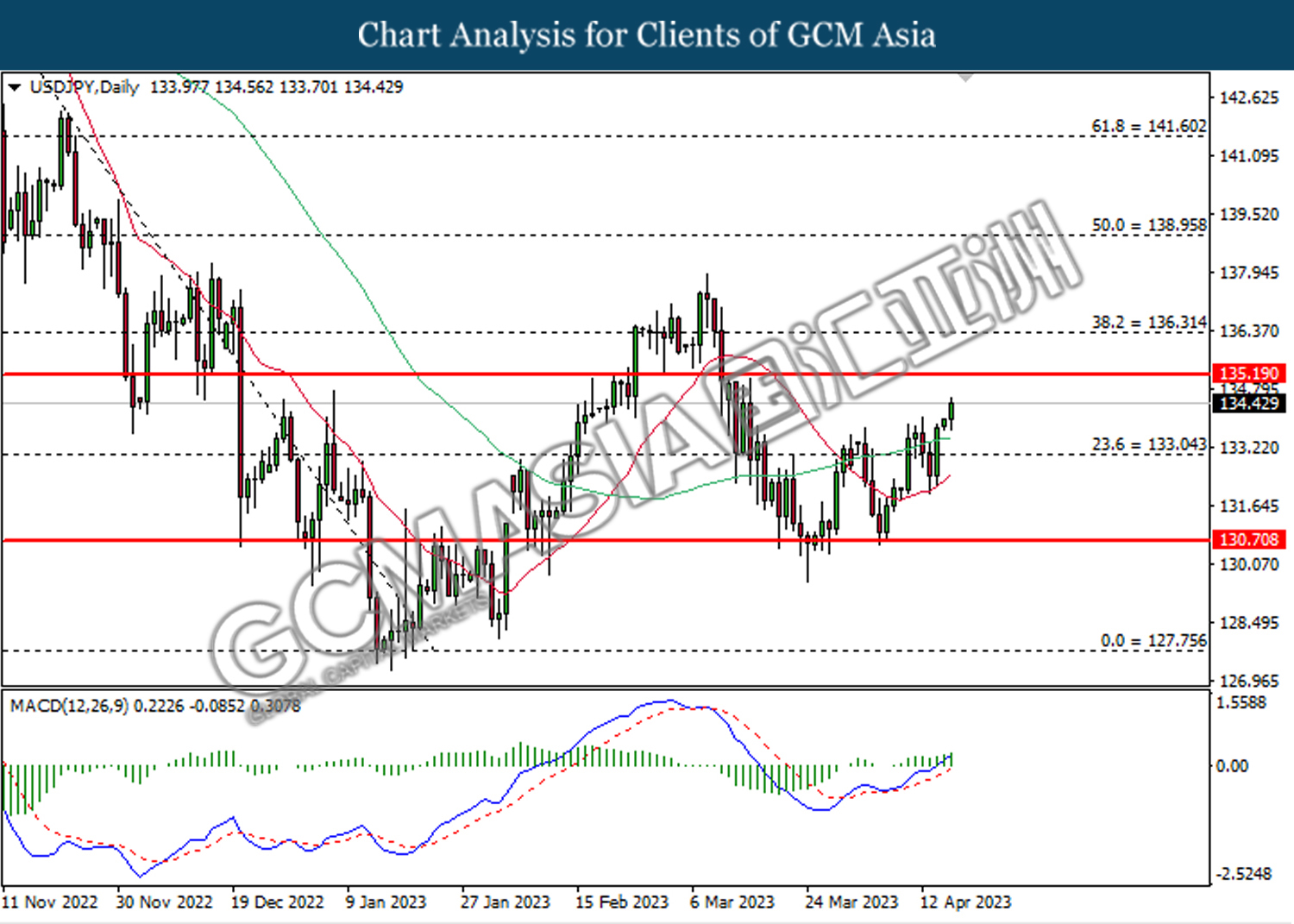

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 133.05. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 135.20.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

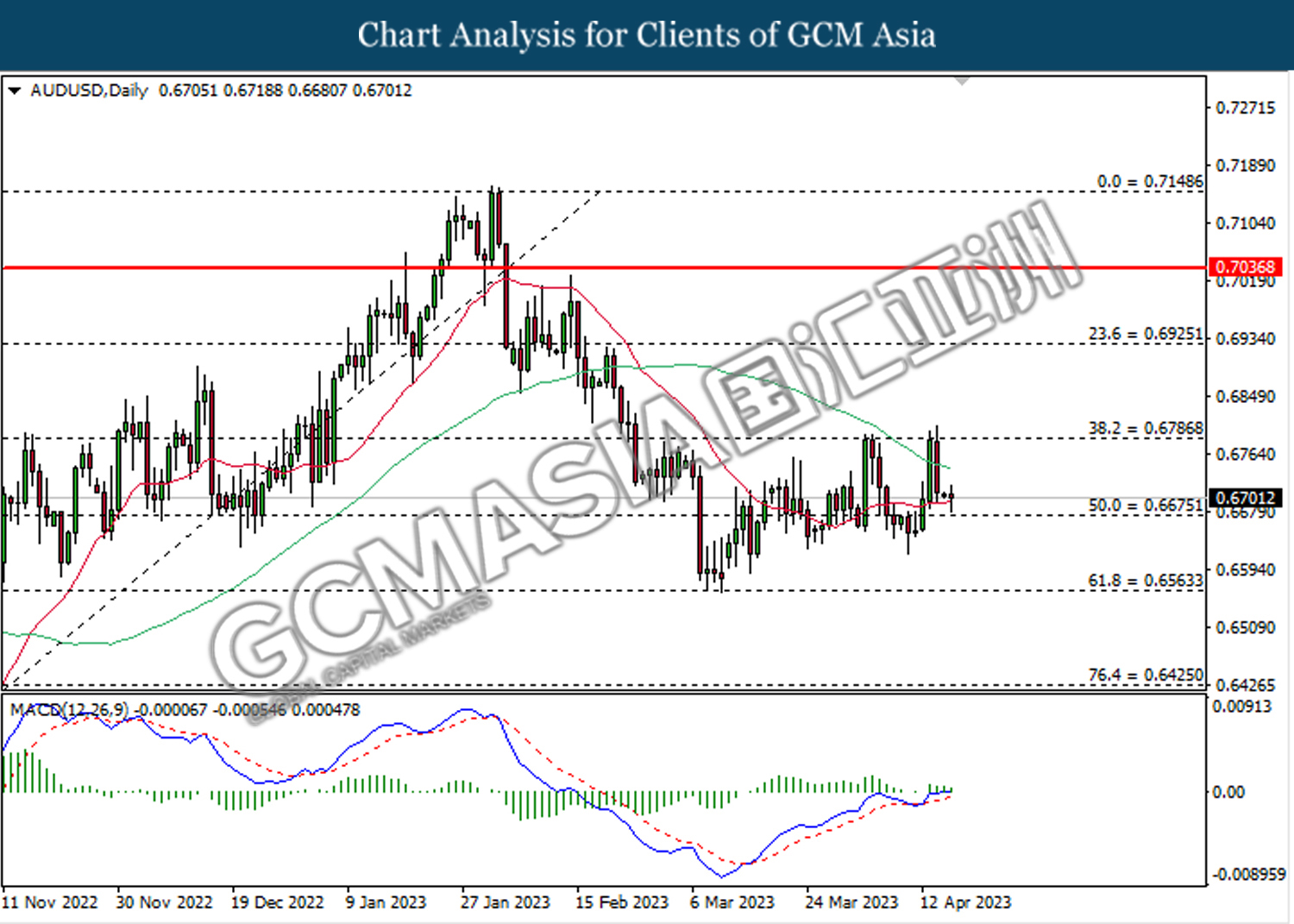

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.6785. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6675.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

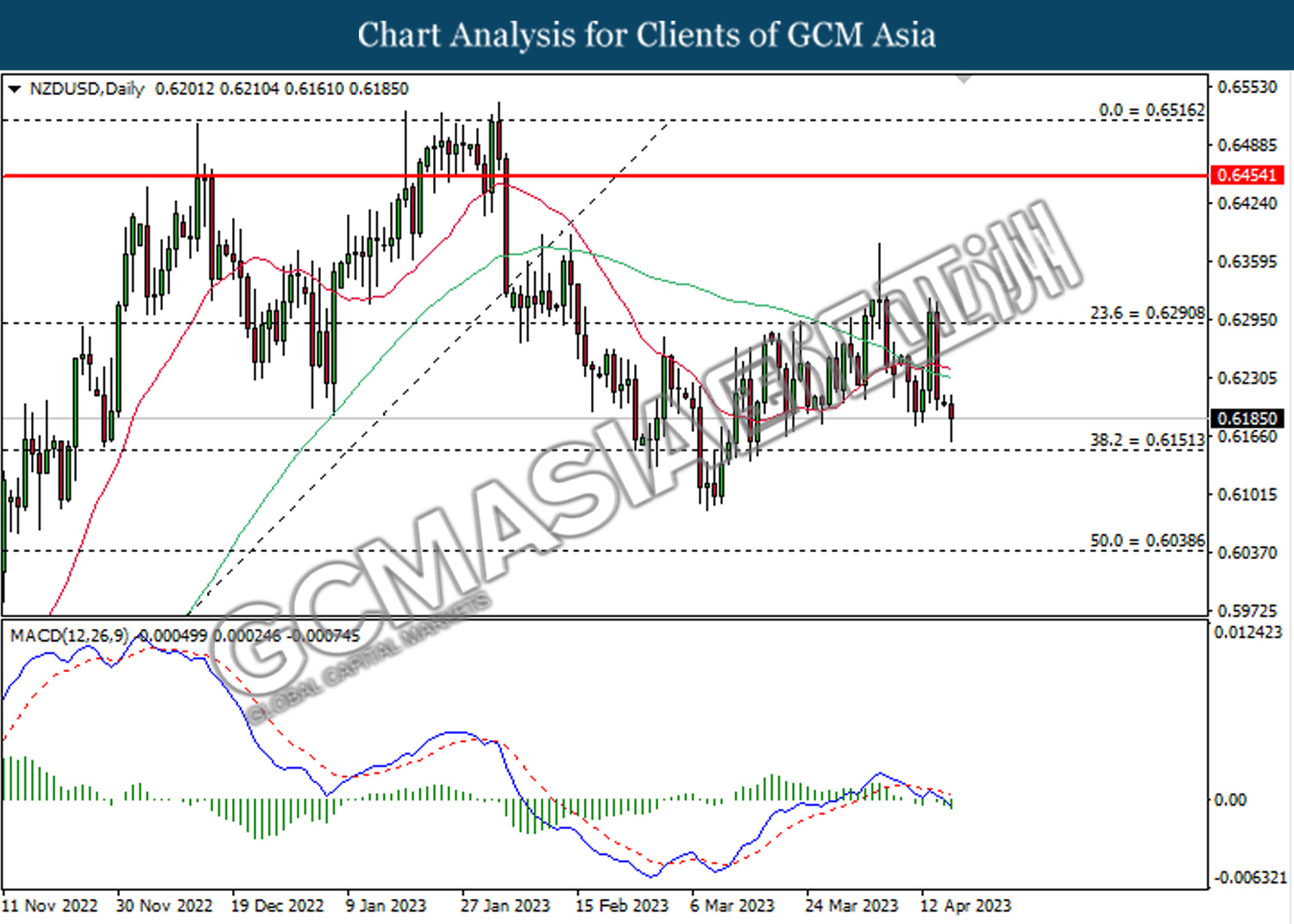

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6290. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

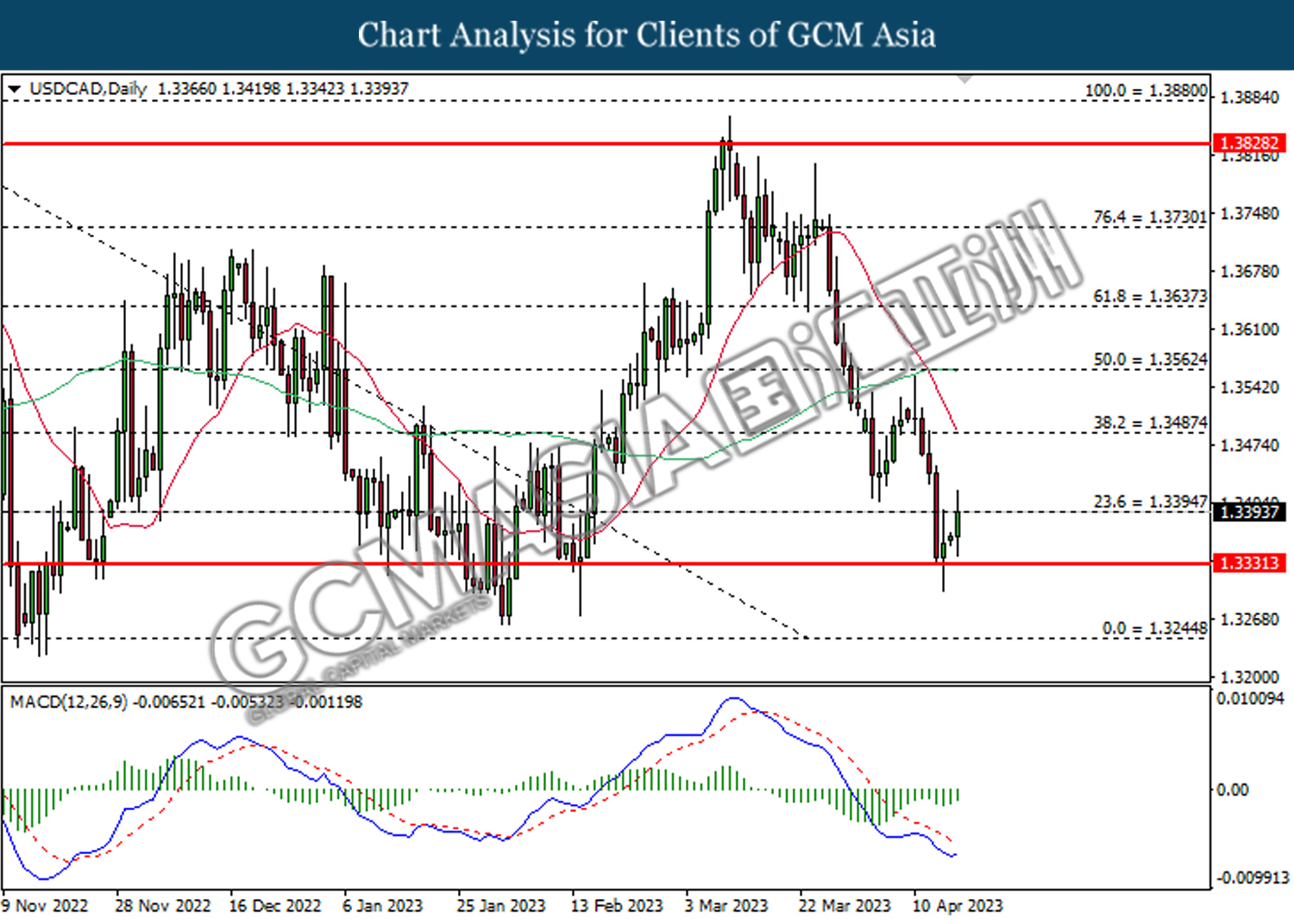

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3395. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

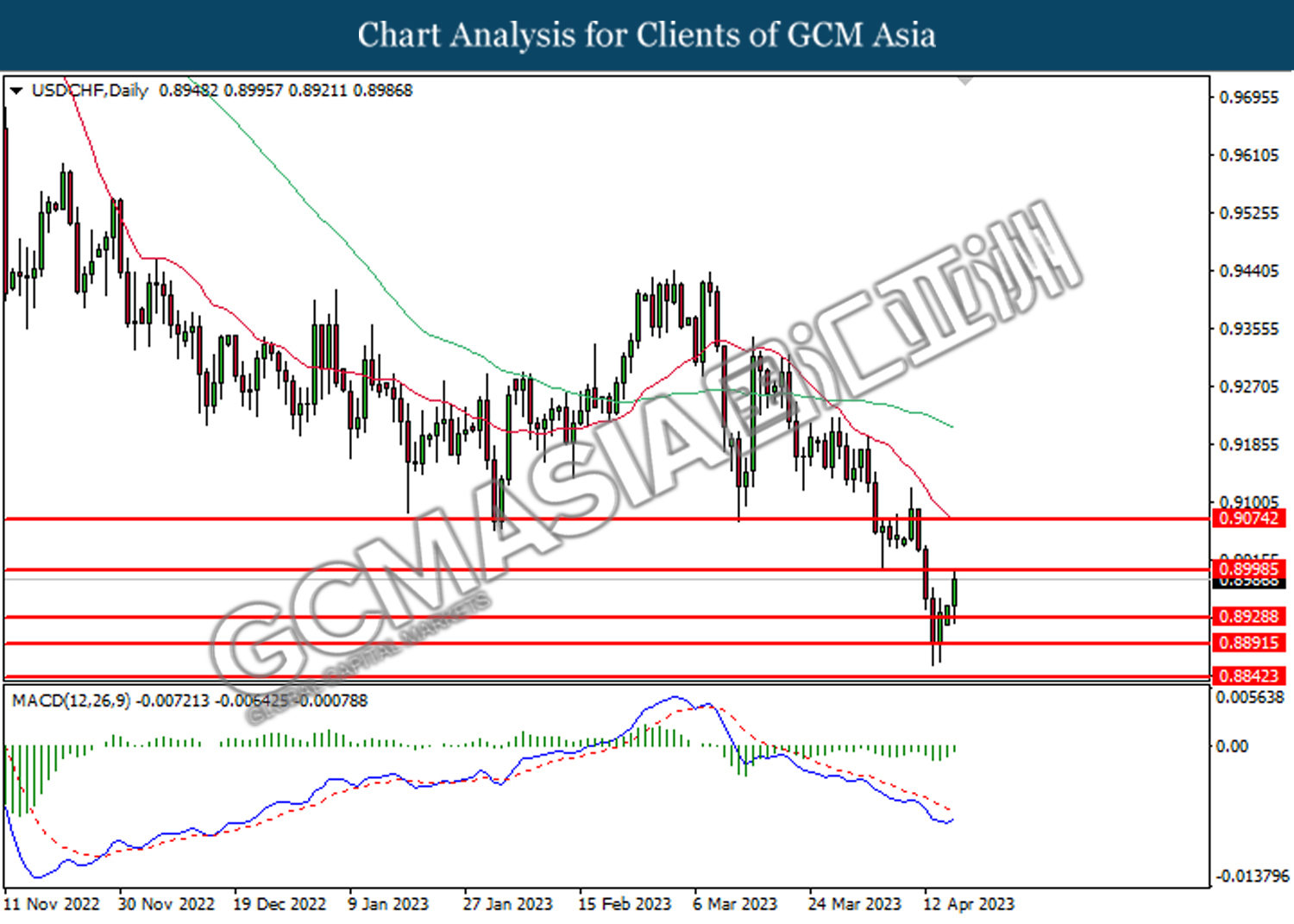

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9000. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8930, 0.8890

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 81.80. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 87.75, 94.30

Support level: 81.80, 79.65

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 1972.80.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25