18 April 2023 Afternoon Session Analysis

Canada wholesale sales weakened, which sent Canadian Dollar lower.

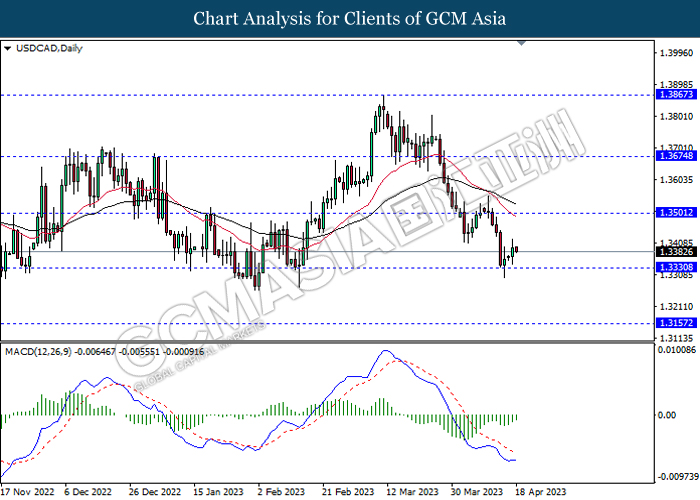

The USD/CAD, which traded by majority of global investors found its ground on Monday following the bearish Canada economic data has been released. According to Statistics Canada, the Canada Wholesale Sales MoM for February notched down significantly from the previous reading of 6.1% to -1.7%, which is lower than the consensus expectation of -1.6%. The reducing of wholesale was indicated that the slip in consumer spending in Canada, leading the commercial firms to reduce order from wholesalers. Besides, it also cut the spaces for Bank of Canada (BoC) to hike its rate further. Not only that, the upbeat US economic data has also dialed up the market demand for US Dollar. However, it is note-worthy that the BoC official was still discussing another rate hike in the next meeting. Prior to that, the BoC Governor Tiff Macklem emphasized the needs to keep high interest rate for longer time in order to stabilize the price volatility to 2% target. Last week, BoC remained its interest rate at 4.5% for second consecutive time. By now, investors would continue to scrutinize the Canada Core CPI data which would be unleashed tonight to gauge the likelihood movement of Canadian Dollar. As of writing, the USD/CAD appreciated by 0.03% to 1.3396.

In the commodities market, the crude oil prices rose by 0.28% to $81.06 per barrel as of writing following the China’s economy development was stronger than the market expectations, stimulating the demand of oil. On the other hand, the gold price rallied by 0.25% to $2000.16 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Feb) | 5.7% | 5.1% | – |

| 14:00 | GBP – Claimant Count Change (Mar) | -11.2K | 10.2K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Apr) | 13.0 | 15.3 | – |

| 20:30 | USD – Building Permits (Mar) | 1.550M | 1.450M | – |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.5% | – | – |

Technical Analysis

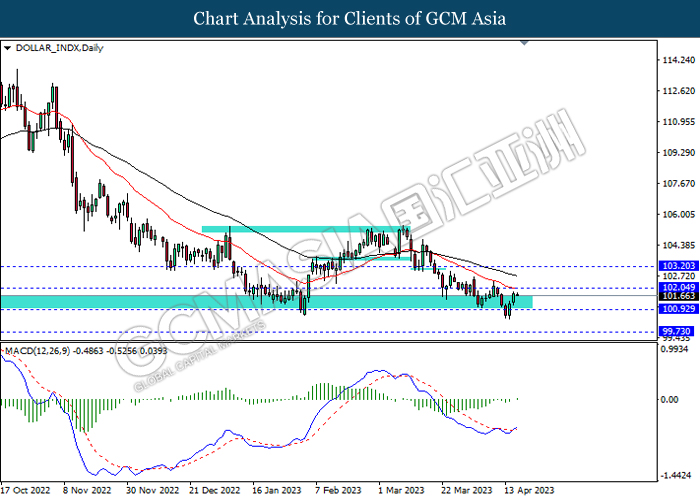

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

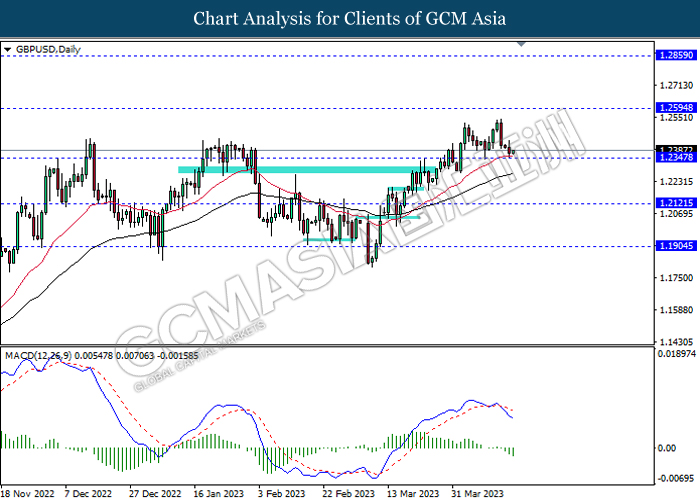

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

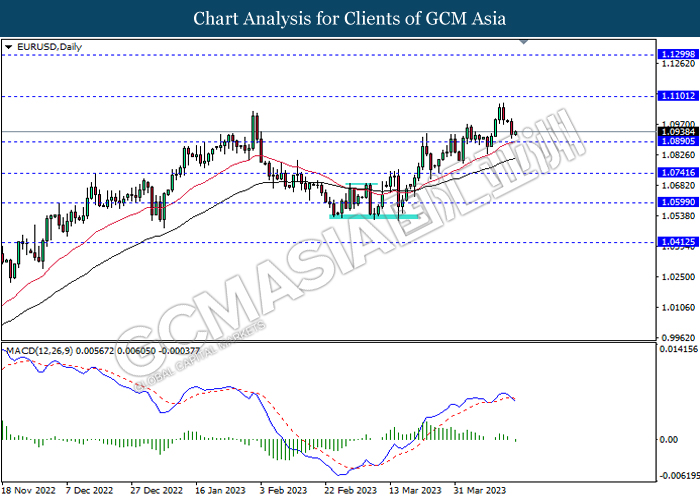

EURUSD, Daily: EURUSD was traded lower following prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

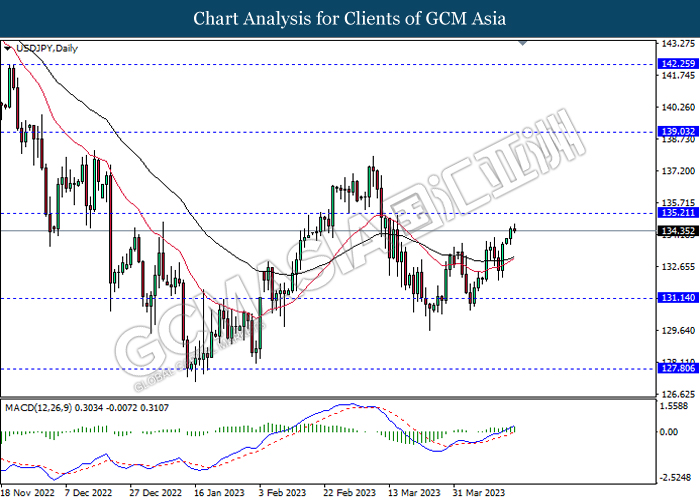

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

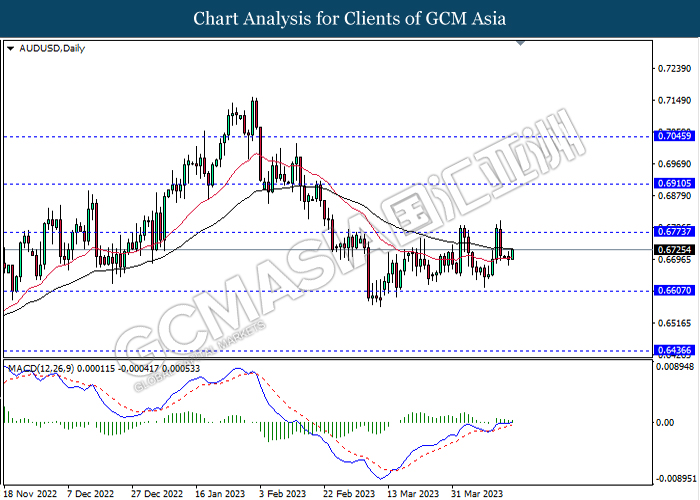

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

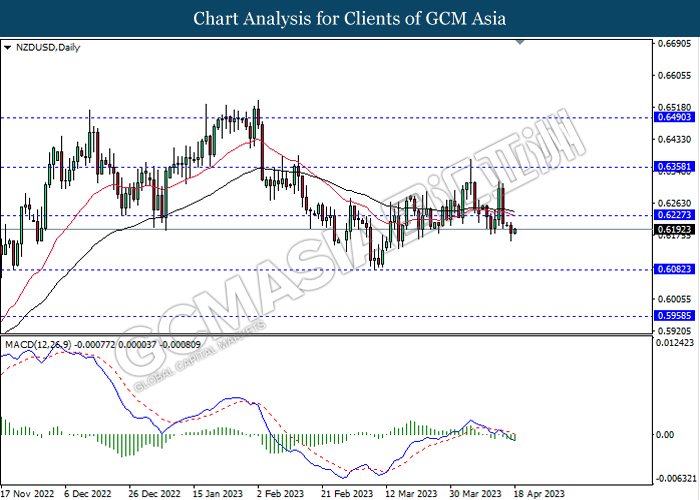

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

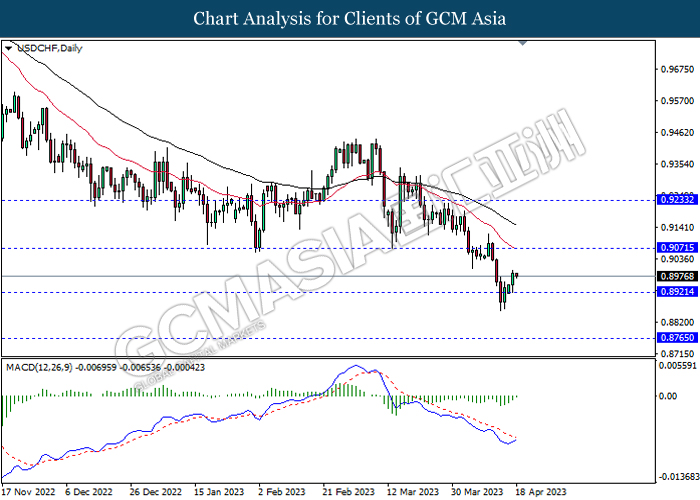

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

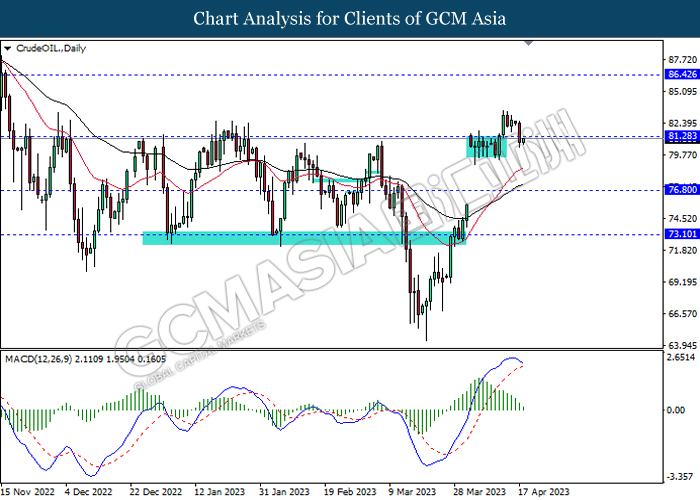

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.40

Support level: 76.80, 73.10

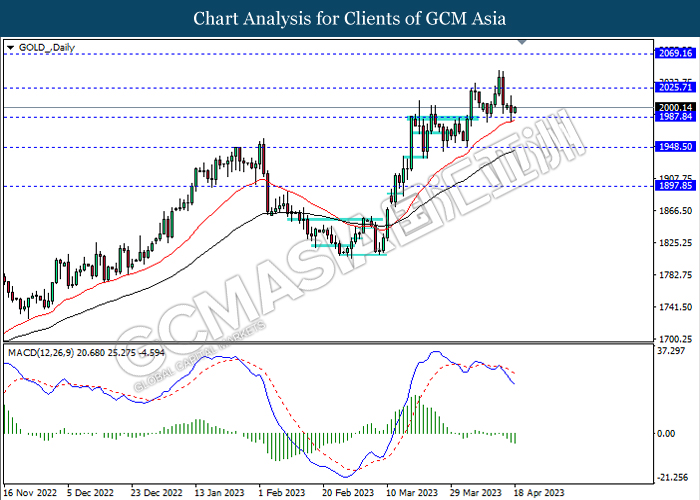

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50