20 April 2023 Afternoon Session Analysis

Pound Sterling boosted following inflation risk heightened.

The GBP/USD, which traded by majority of global investors surged significantly on Wednesday after the inflationary data has been unleashed. According to Office for National Statistics, the UK Consumer Price Index (CPI) YoY for March came in at the reading of 10.1%, exceeding the market forecast of 9.8%. With that, it might lead the UK central bank to raise its rate further in order to cool down the double-digit inflation, which prompting investors to shift their capitals toward UK market. As of now, Deutsche Bank anticipated that there are two more rate hike would be taken by Bank of England (BoE). Besides, other banks such as Morgan Stanley has also provided similar views. Thus, investors would highly eye on the statement from BoE members to gauge the interest rate decisions of the central bank. On the other hand, the gains experienced by Pound Sterling was extended as the Fed claimed in its report yesterday that the price of goods and services was easing. By the way, the Eurostat had also declared its CPI data, but the figures of data did not decreased more than consensus expectation. With such background, it signaled that the inflation was not dampen very well, which driving to the appreciation of EUR/USD. As of writing, the GBP/USD dropped by 0.06% to 1.2428, while the EUR/USD rose by 0.04% to 1.0960.

In the commodities market, the crude oil prices depreciated by 1.07% to $78.39 per barrel as of writing following the oil exports from Russia’s western ports in April would likely to reach a new high since 2019. In addition, the gold price eased by 0.10% to $1992.81 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | Initial Jobless Claims | 239k | 240k | – |

| 20:30 | Philadelphia Fed Manufacturing Index (Apr) | -23.2 | -20.0 | – |

| 22:00 | Existing Home Sales (Mar) | 4.58M | 4.50M | – |

Technical Analysis

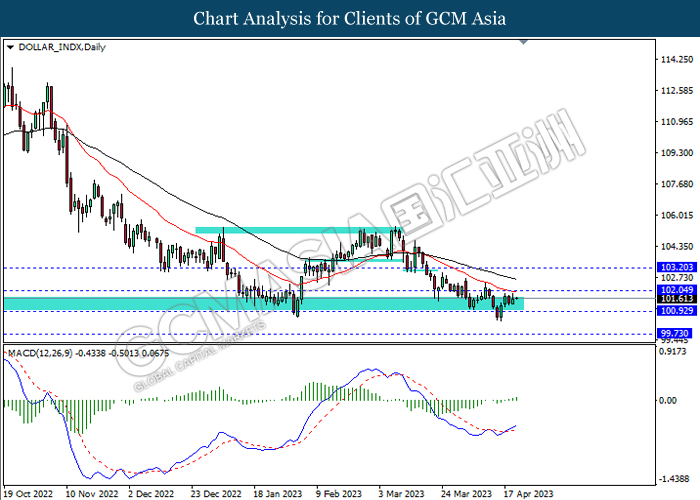

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 102.05, 103.20

Support level: 100.90, 99.75

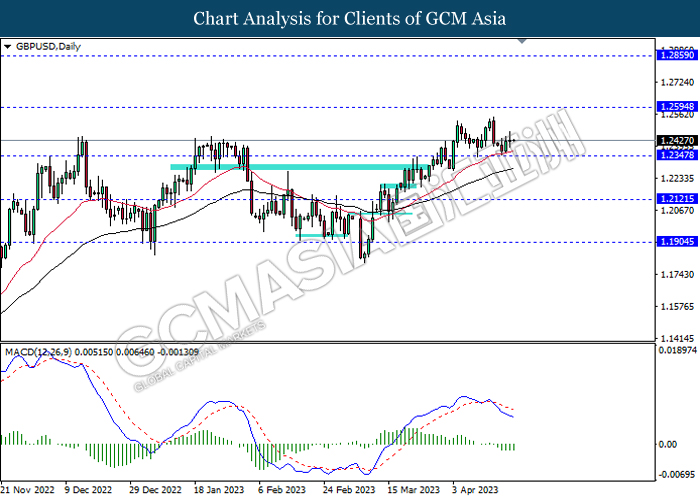

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2595, 1.2860

Support level: 1.2345, 1.2120

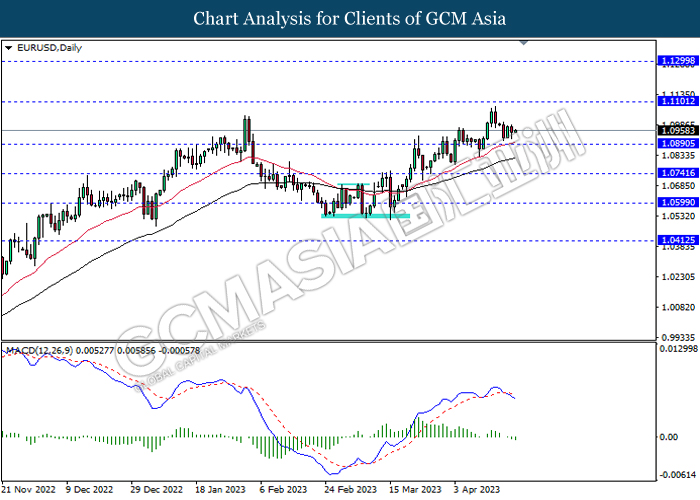

EURUSD, Daily: EURUSD was traded higher following prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.1100, 1.1300

Support level: 1.0890, 1.0740

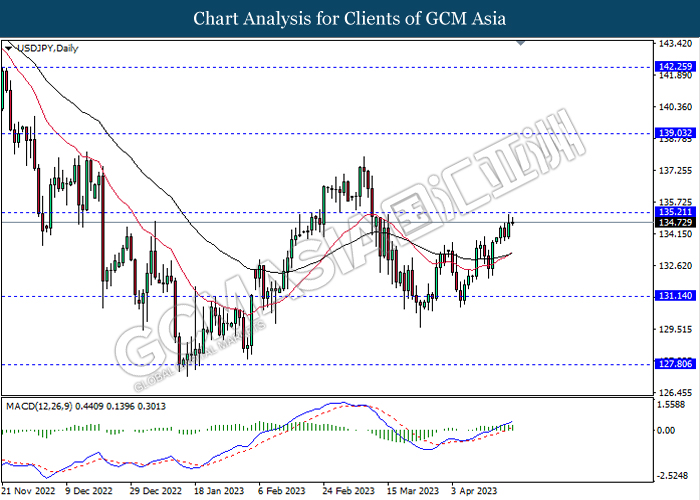

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 135.20, 139.05

Support level: 131.15, 127.80

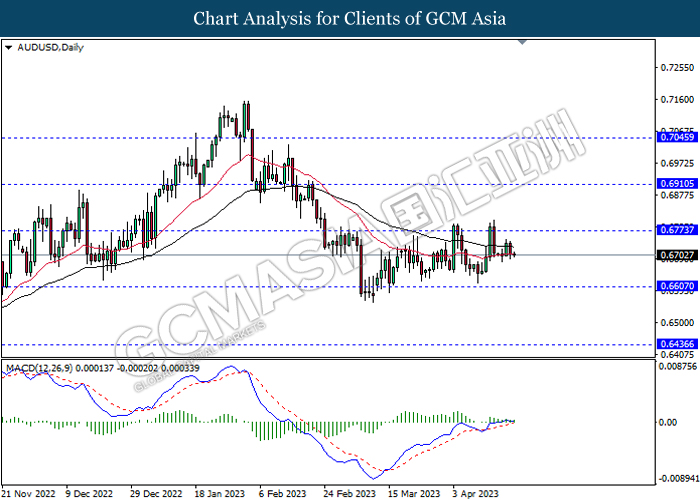

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6775, 0.6910

Support level: 0.6605, 0.6435

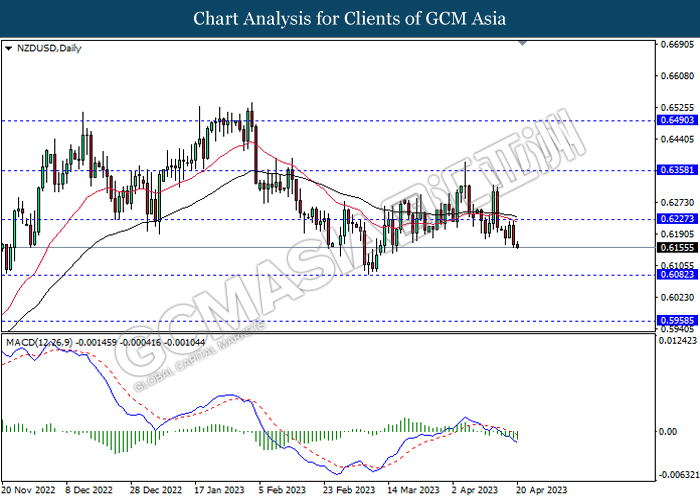

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6225, 0.6360

Support level: 0.6080, 0.5960

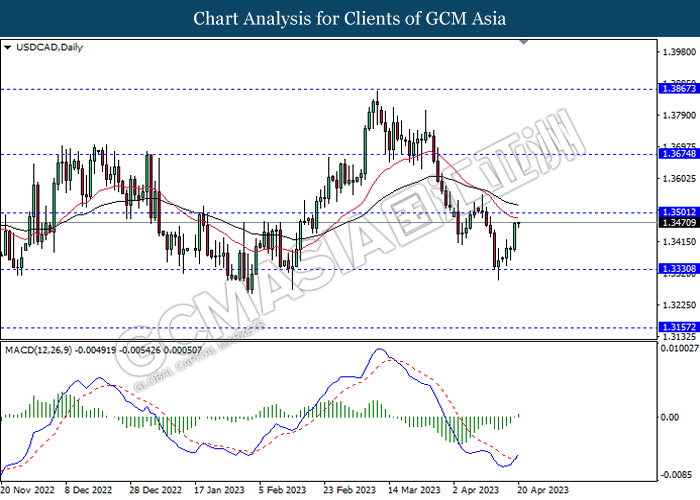

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3500, 1.3675

Support level: 1.3330, 1.3155

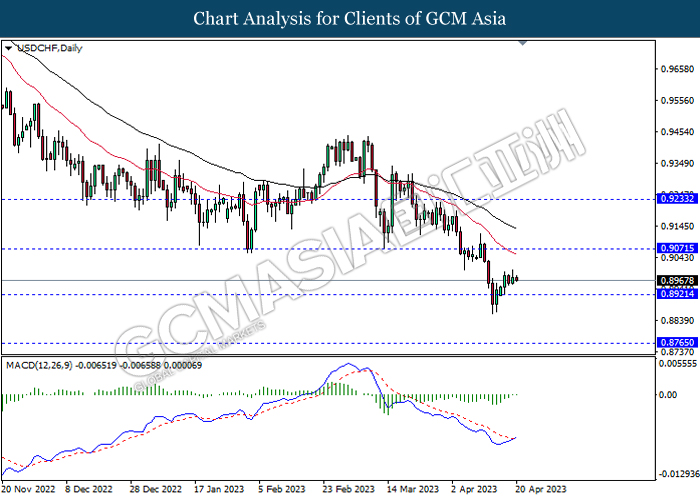

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9070, 0.9235

Support level: 0.8920, 0.8765

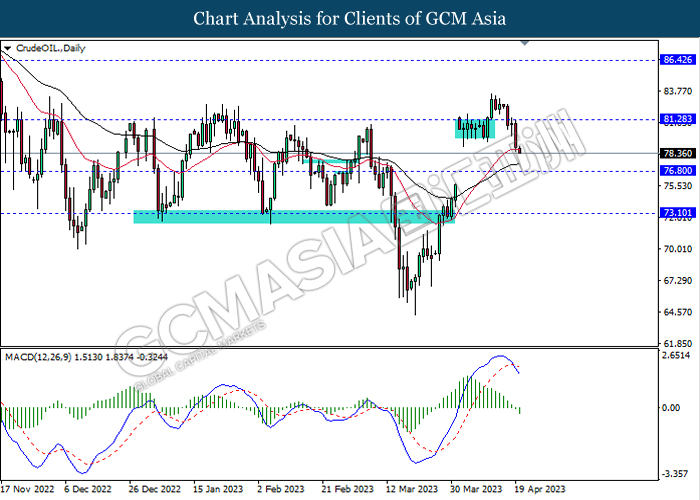

CrudeOIL, Daily: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 81.30, 86.40

Support level: 76.80, 73.10

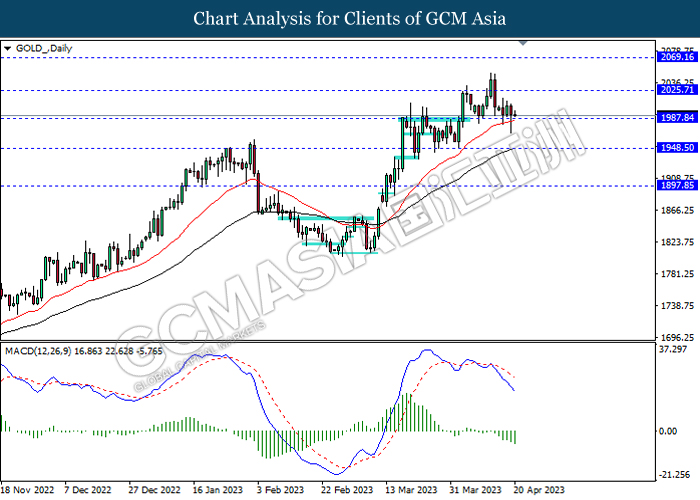

GOLD_, Daily: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 2025.70, 2069.15

Support level: 1987.85, 1948.50