27 April 2023 Afternoon Session Analysis

Yen buoyed as US banking sector fears.

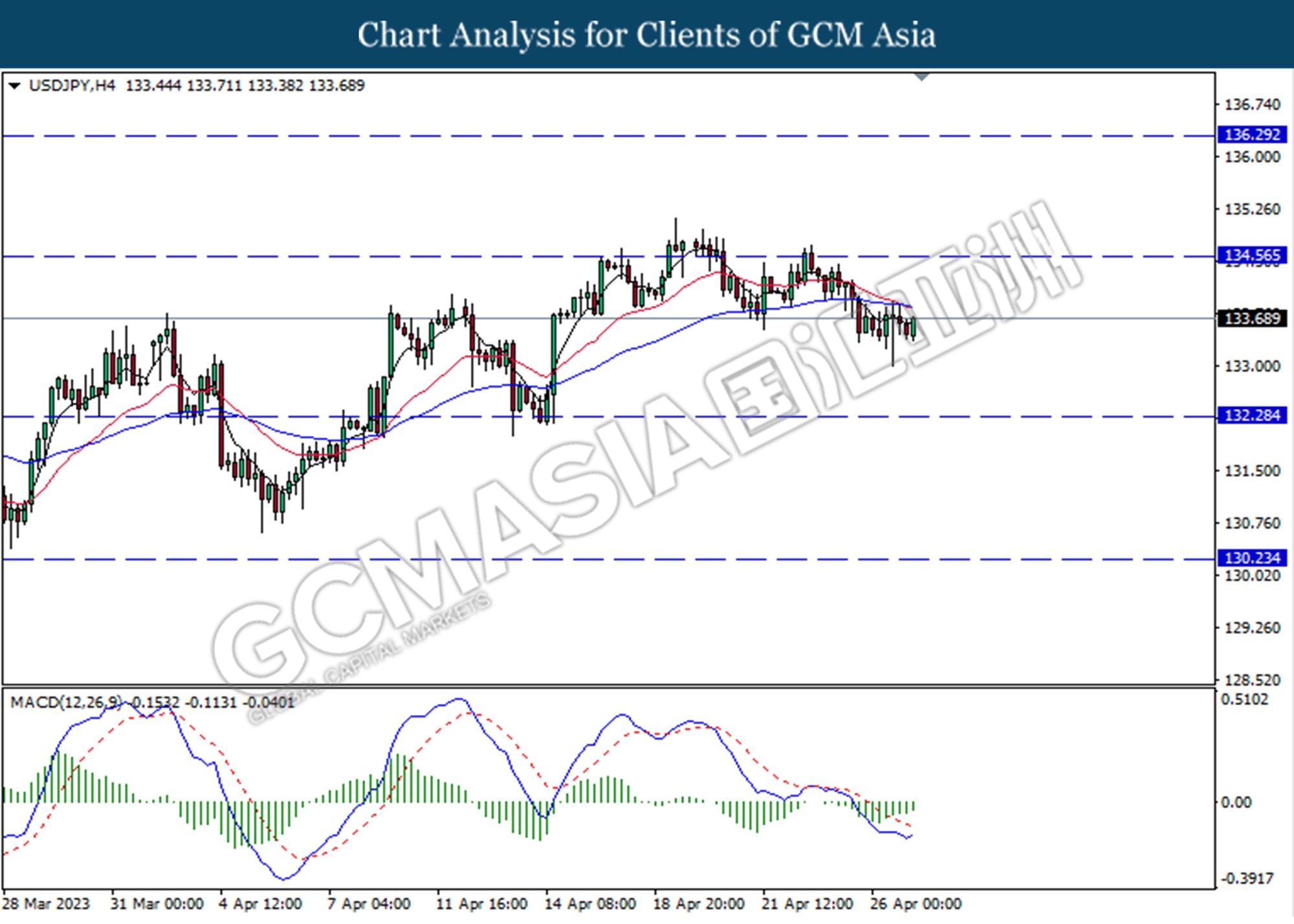

The Japanese Yen is the third most commonly traded currency in the world buoyed by US banking sector fears. The dollar fell against the yen after the yen outperformed after the panic in the US banking sector. The dollar’s decline came as First Republic Bank (RFC)’s decline accelerated after its earnings report, with the company’s stock price plummeting 66% in 3 days. As a result, investors have turned funds into traditional safe-haven assets such as the yen. However, the outlook for the yen is in mixed conditions as the Yen was under selling pressure following the inauguration of Kazuo Ueda as the new Bank of Japan Governor. The New BoJ governor reiterated to maintain its ultra-loosen policy to achieve BoJ’s 2% inflation target. The yen depreciated after BoJ gave a dovish outlook following the comments, as the value fell as the money supply in the market increased. Meanwhile, the Japanese Yen struggled as investors continued to eye on the BoJ monetary meeting on Friday. At this point in time, the majority of investors expect that the new BoJ Governor Ueda will likely maintain the bank’s monetary easing decision in the meeting. As of writing, the USD/JPY traded lower by 0.01% to $133.64.

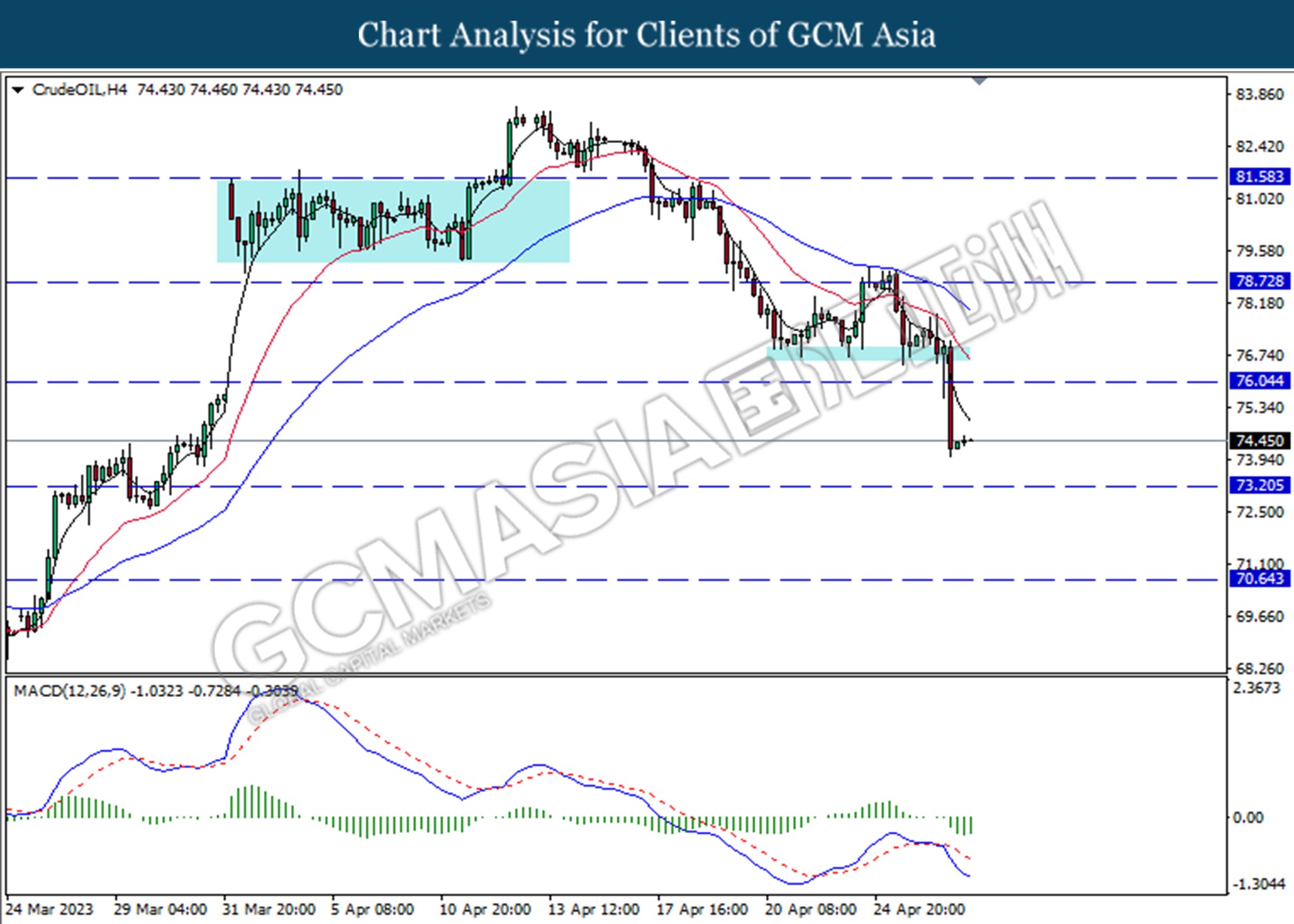

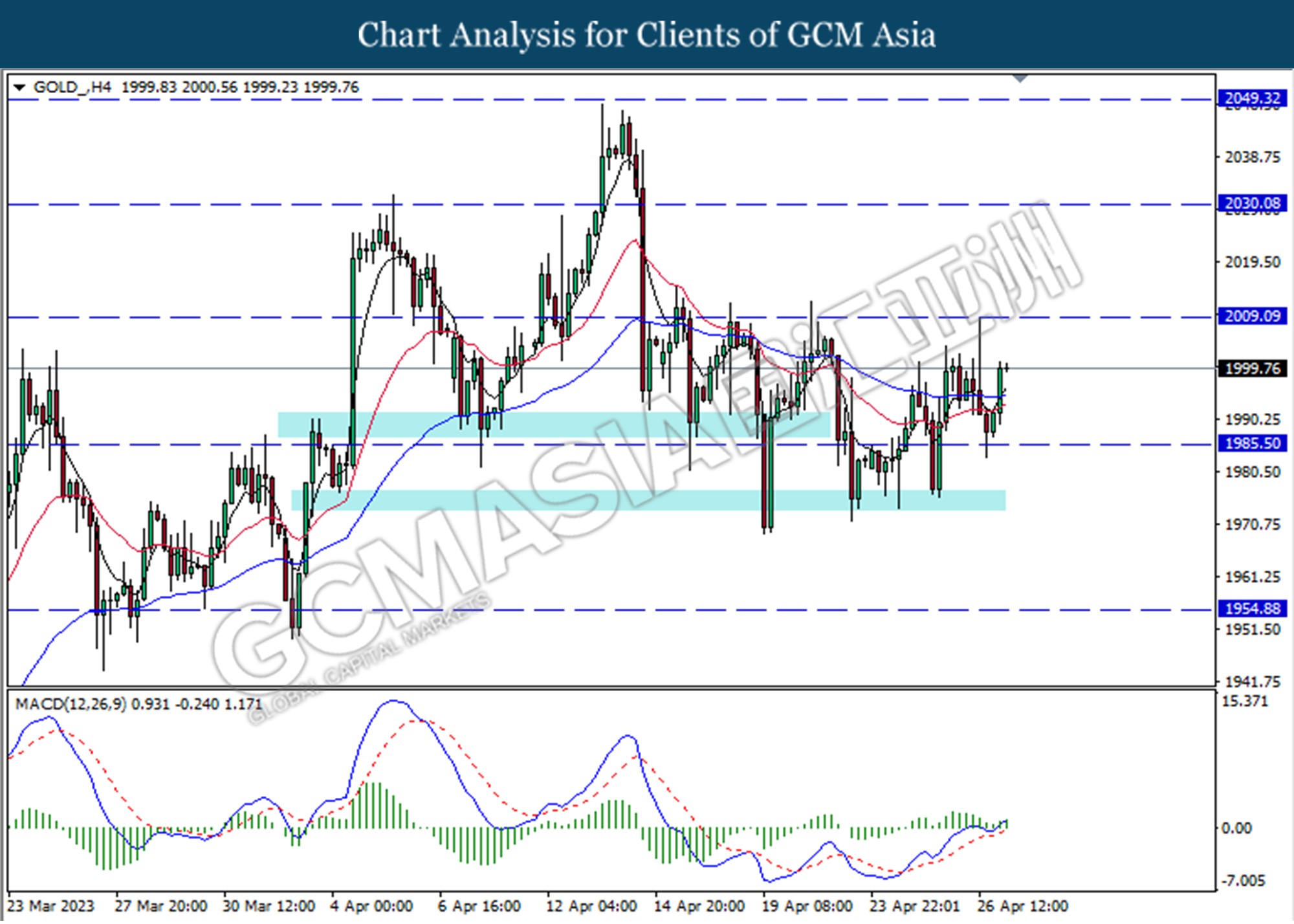

In the commodities market, crude oil prices rebounded by 0.26% to $74.49 per barrel after heavy losses on US banking sector jitters. On the other hand, gold prices edged up by 0.53% to $1999.80 per troy ounce amid the US dollar weakening.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – GDP (QoQ) (Q1) | 2.6% | 2.0% | – |

| 20:30 | USD – Initial Jobless Claims | 245K | 248K | – |

| 22:00 | USD – Pending Home Sales (MoM) (Mar) | 0.8% | 0.5% | – |

Technical Analysis

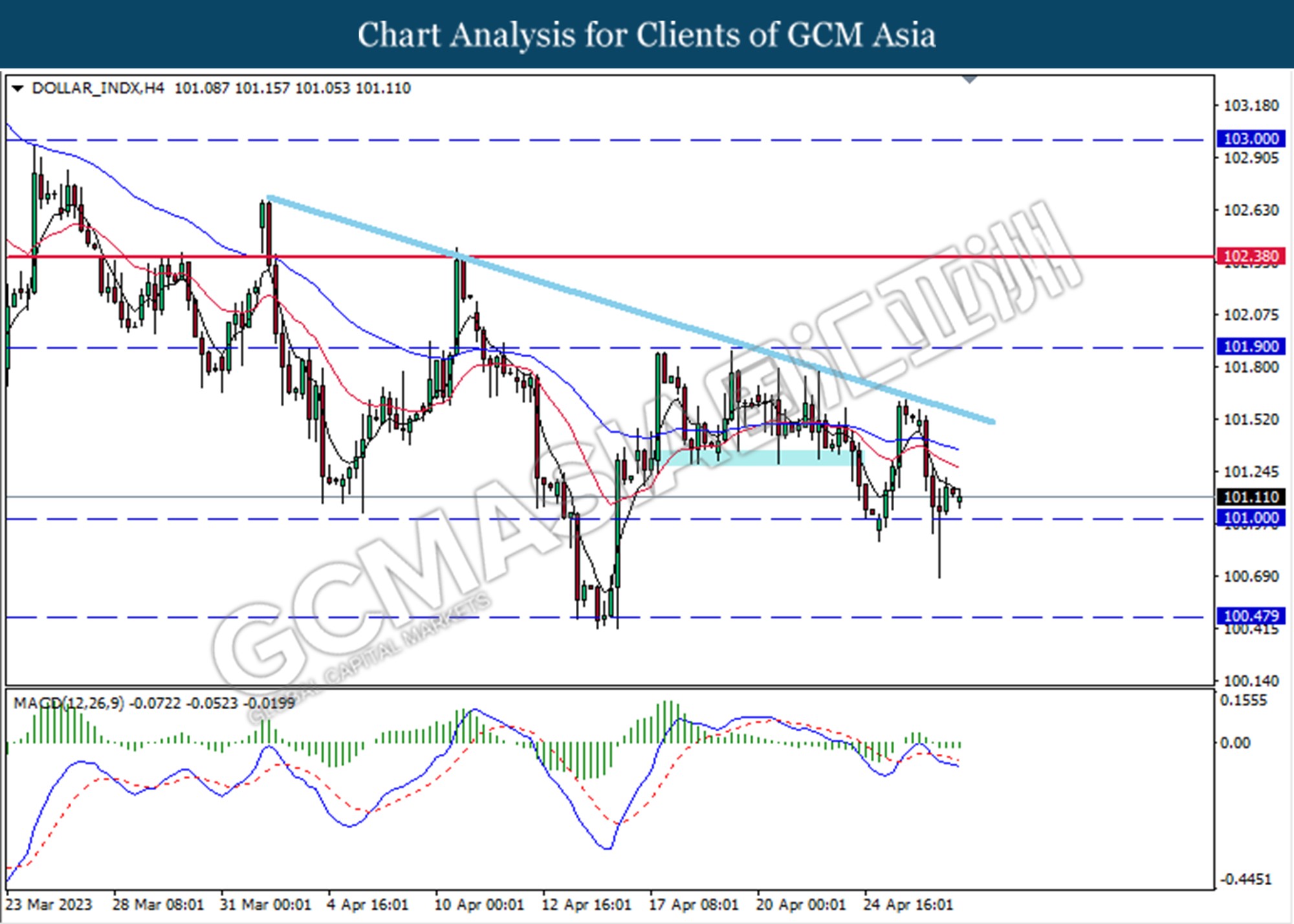

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 101.00. MACD which illustrated diminishing bullish momentum suggests the index extended its losses after it successfully breakout below the support level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

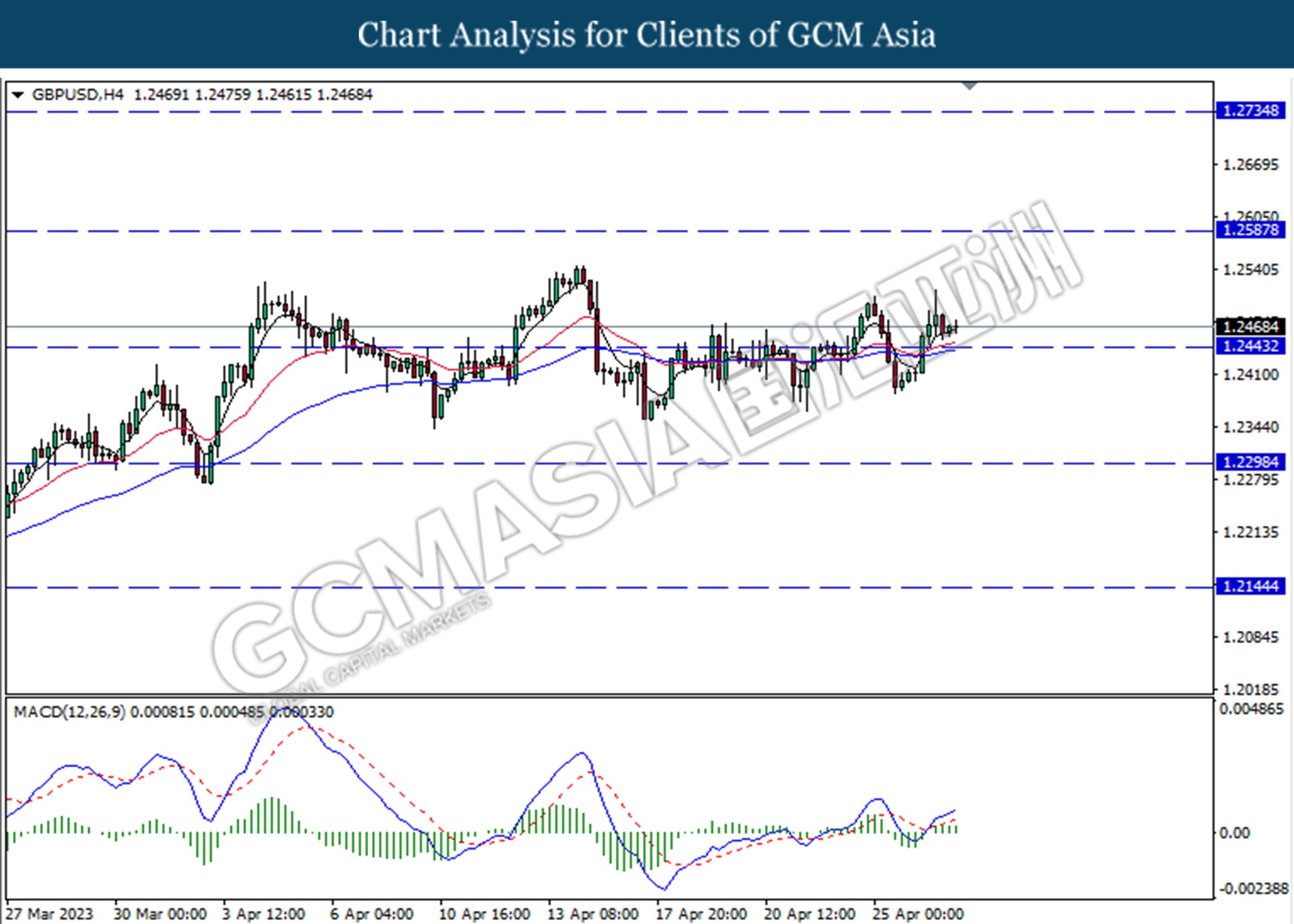

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.2590.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

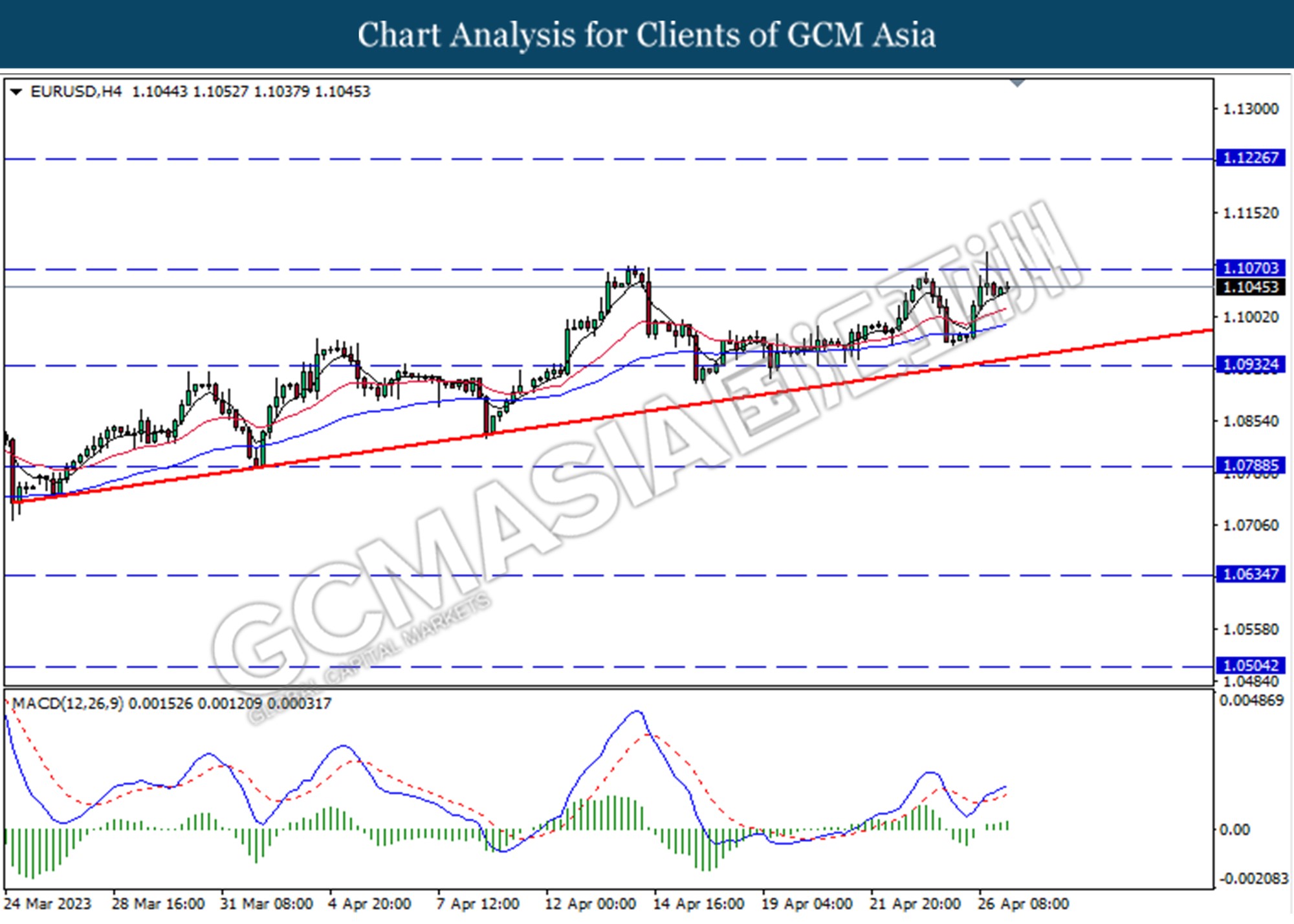

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.1070. MACD which illustrated increasing bullish momentum suggests the pair extended its gains after it successfully breakout above the resistance level.

Resistance level: 1.1070, 1.1225

Support level: 1.0.930, 1.0790

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 134.55.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

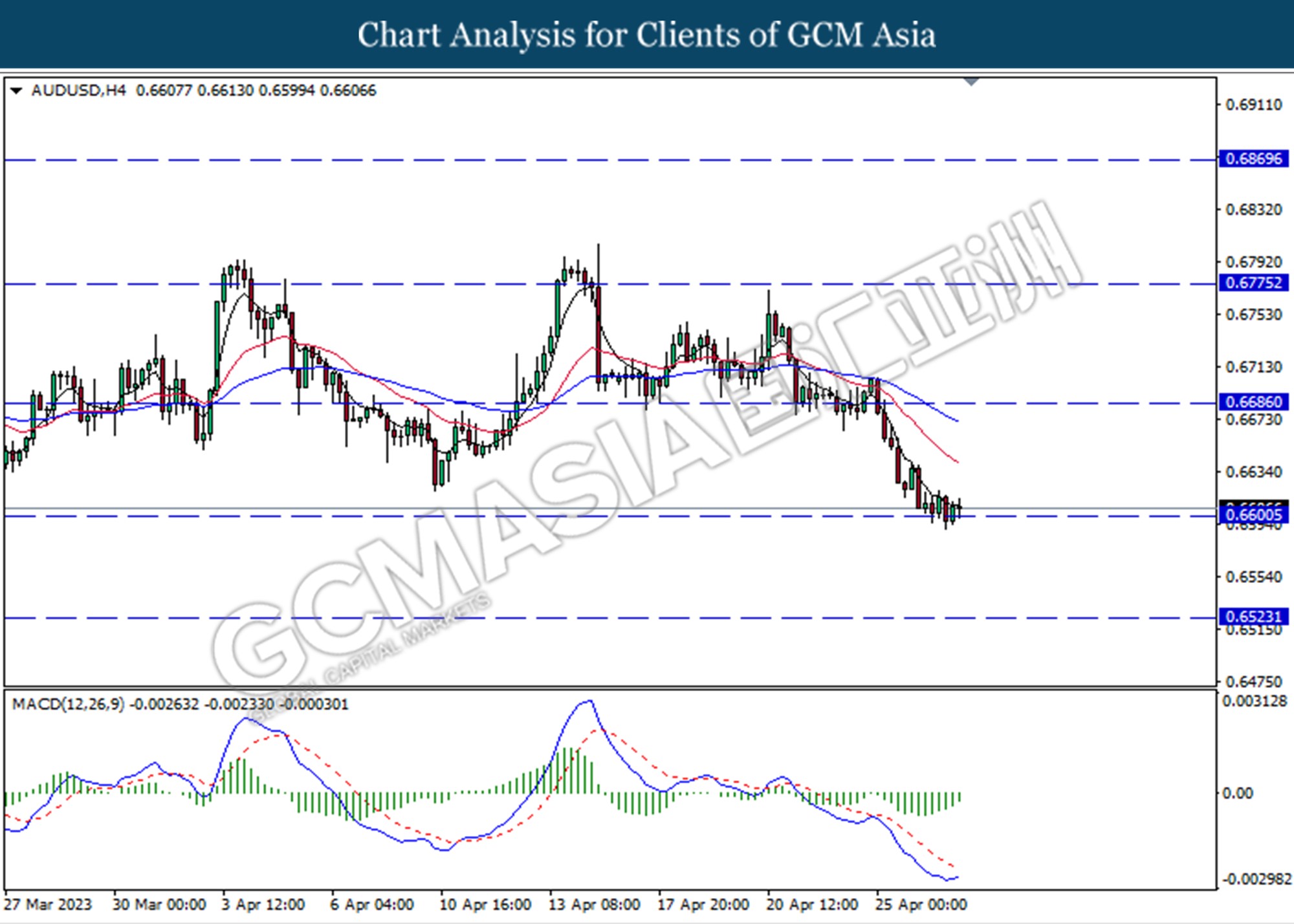

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6600. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following a prior break above the prior resistance level at 0.6120. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

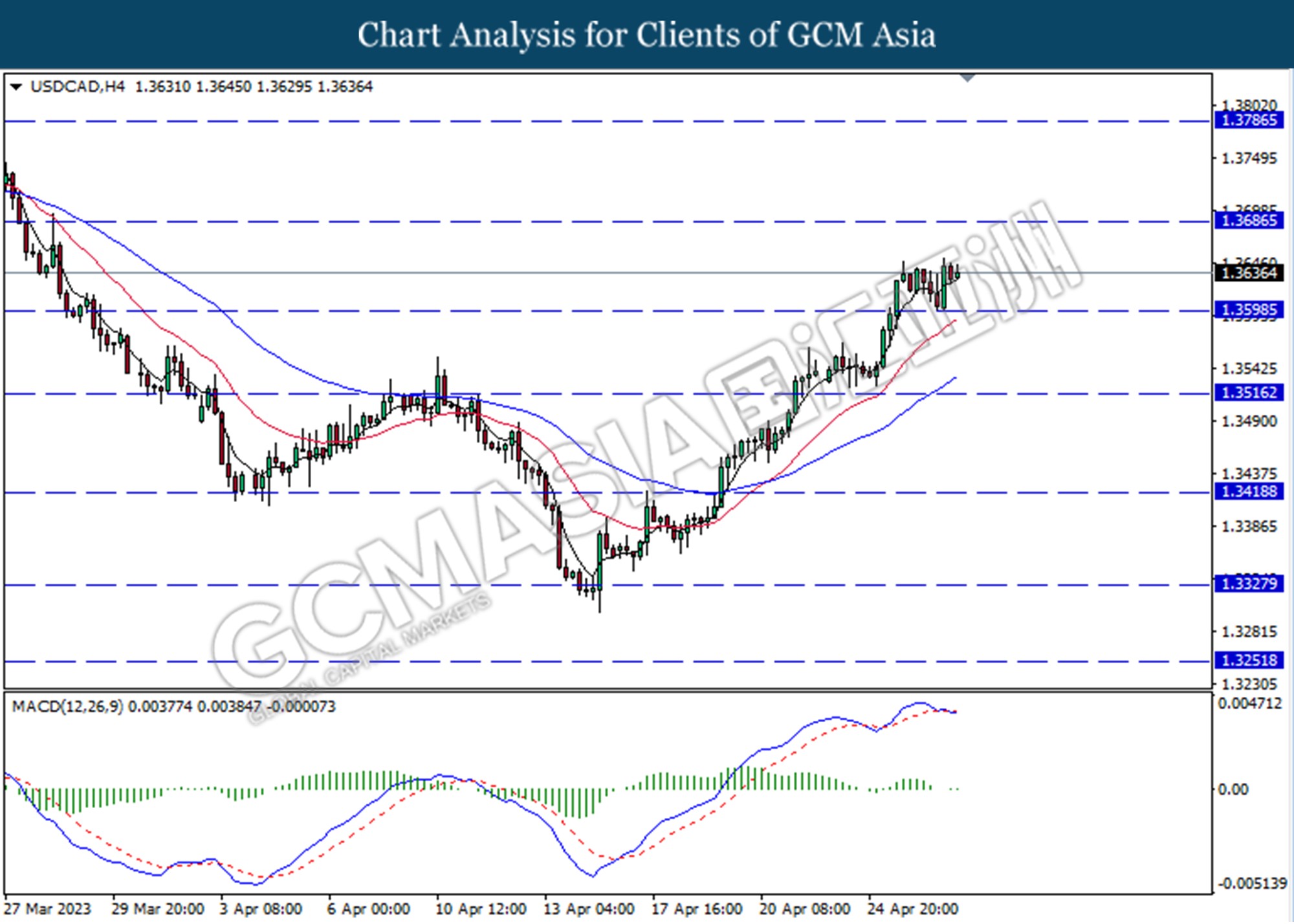

USDCAD, H4: USDCAD was traded higher following a prior rebound from the support level at 1.3600. However, MACD which illustrated diminishing bullish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 1.3685, 1.3785

Support level: 1.3600, 1.3515

USDCHF, H4: USDCHF was traded higher following a prior rebound from the support level at 0.8855. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.8925

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded lower following a prior break below the previous support level at 76.05. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level at 73.20.

Resistance level: 76.05, 81.60

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1985.50. MACD which illustrated increasing bullish momentum suggests the commodity extended its gains toward the resistance level at 2009.10.

Resistance level: 2009.10, 2030.10

Support level: 1985.50, 1954.90