28 April 2023 Morning Session Analysis

Greenback wobbled amid mixed economic data.

The dollar index, which was traded against a basket of six major currencies, experienced a relatively mixed trading session yesterday as the economic data delivered unclear signs to the investor. According to the Bureau of Economic Analysis, the US Gross Domestic Product (GDP) posted a reading at 1.1% to round up the first quarter of 2023, far weaker than the consensus forecast at 2.0%. The downbeat data showed that the growth of economy started to decelerate during the first 3 months of the year, which largely attributed to the impact of rising interest rate as well as solid inflation in the nation. However, the unexpected drop in the number of Americans filed for unemployment claims managed to hold the dollar index from falling sharply. Based on the data from Department of Labor, US Initial Jobless Claims dropped from 246K to 230K this week, lower than the consensus forecast at 248K, mirroring a still-tight labor market in the US. Nonetheless, the mixed economic data did not deter the market expectation of a further rate hike in the May meeting. As of writing, the dollar index edged up 0.02% to 101.50.

In the commodities market, crude oil prices were up by 0.23% to $74.50 per barrel as the black commodity price stabilized after dropping sharply during the prior trading session. Besides, gold prices ticked down by -0.04% to $1987.10 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

13:00 JPY BoJ Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (Apr) | 16K | 10K | – |

| 16:00 | EUR – German GDP (QoQ) (Q1) | 0.9% | 0.3% | – |

| 20:00 | EUR – German CPI (MoM) (Apr) | 0.8% | 0.6% | – |

| 20:30 | USD – Core PCE Price Index (MoM) (Mar) | 0.3% | 0.3% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.5% | 0.2% | – |

| 22:00 | USD – Michigan Consumer Sentiment (Apr) | 63.5 | 63.5 | – |

Technical Analysis

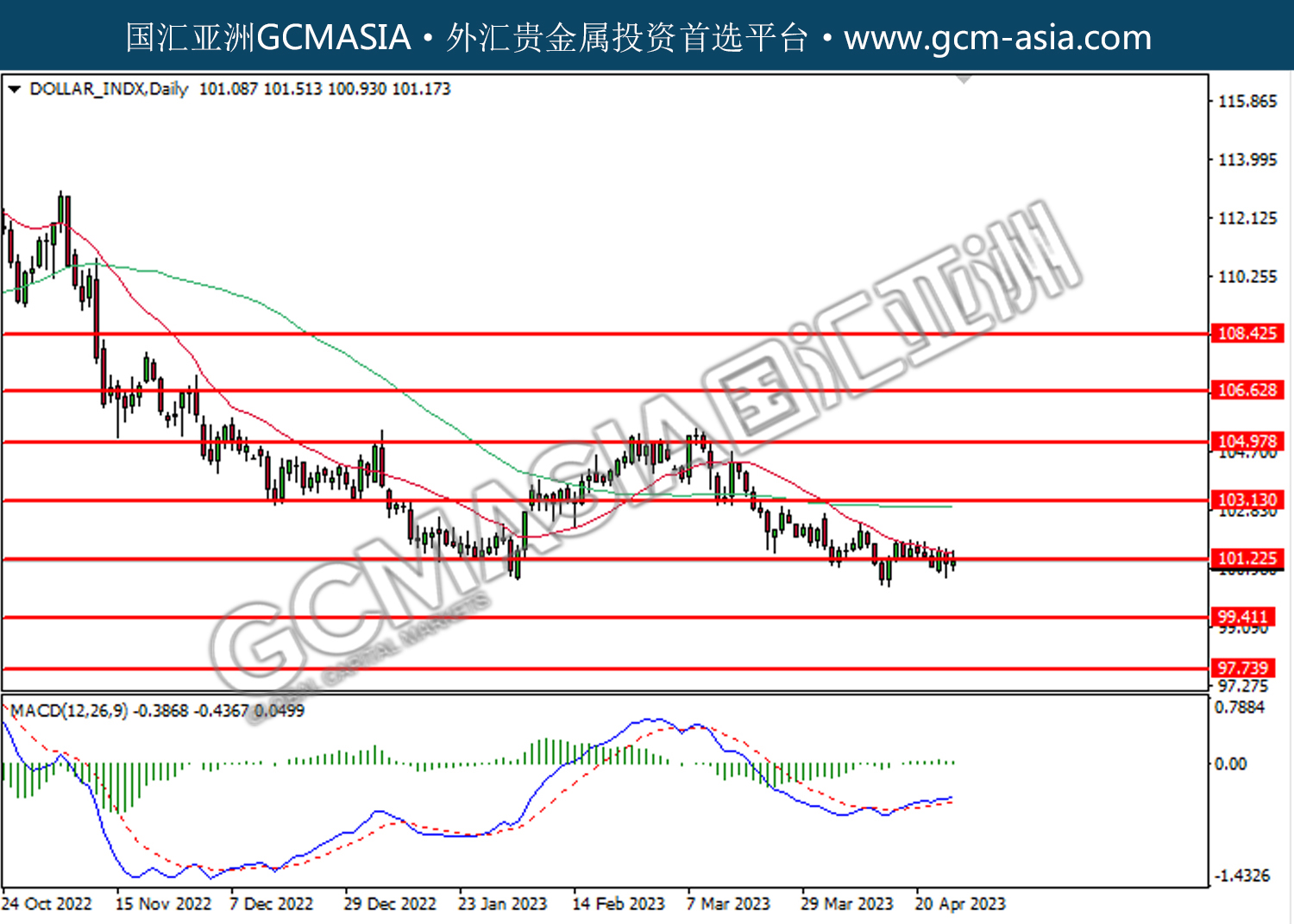

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 101.25. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

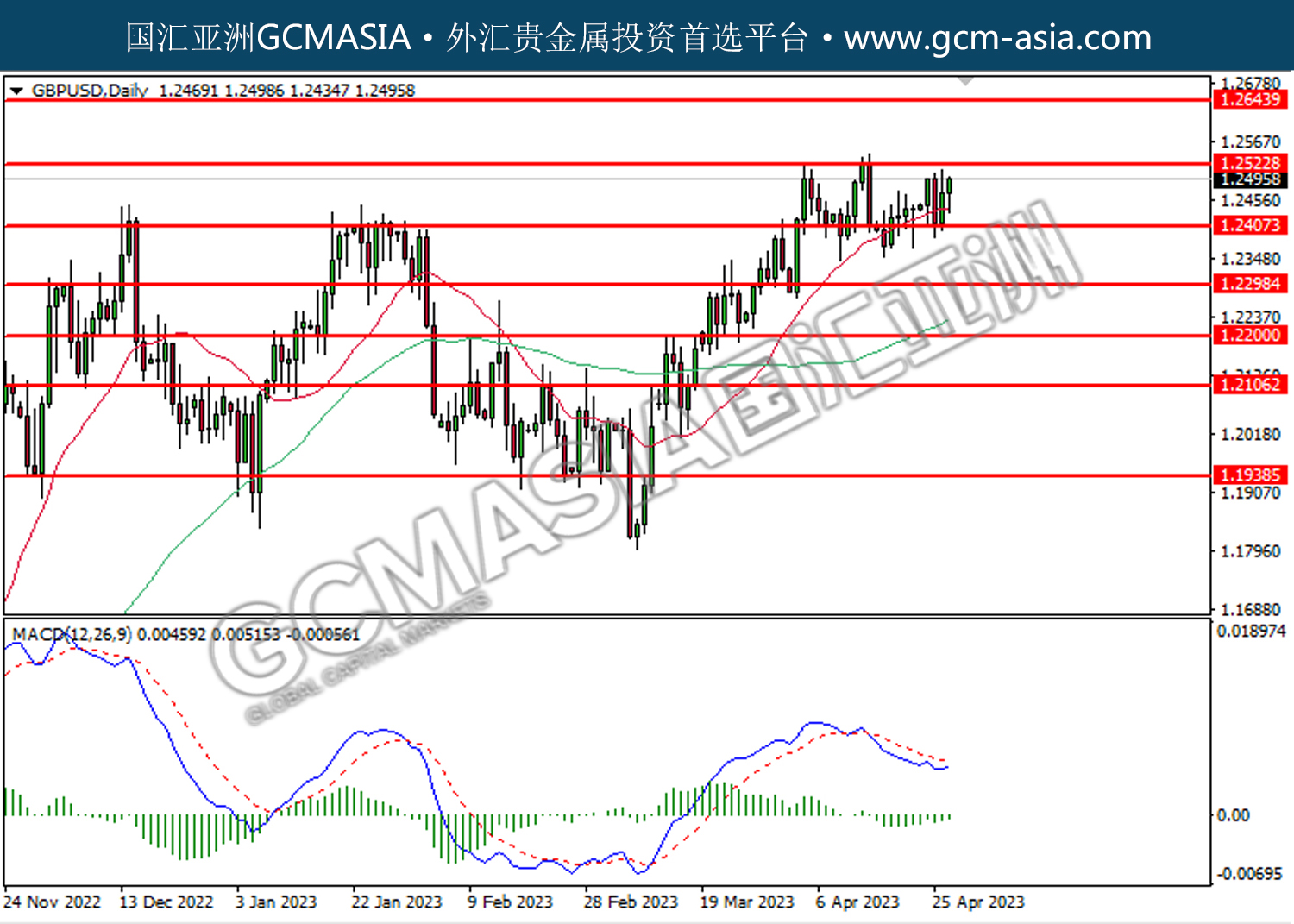

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2405. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2525.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

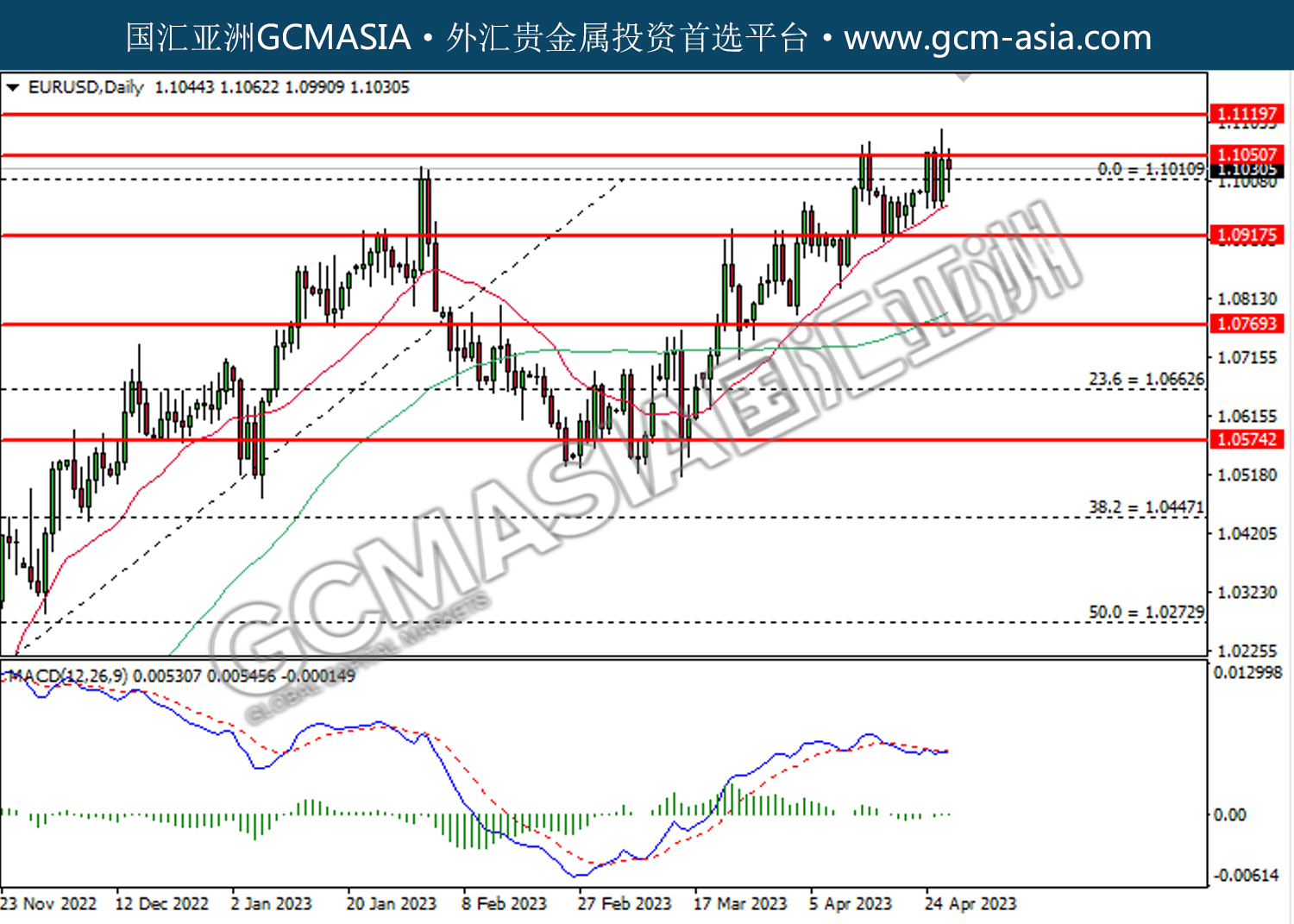

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1050. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

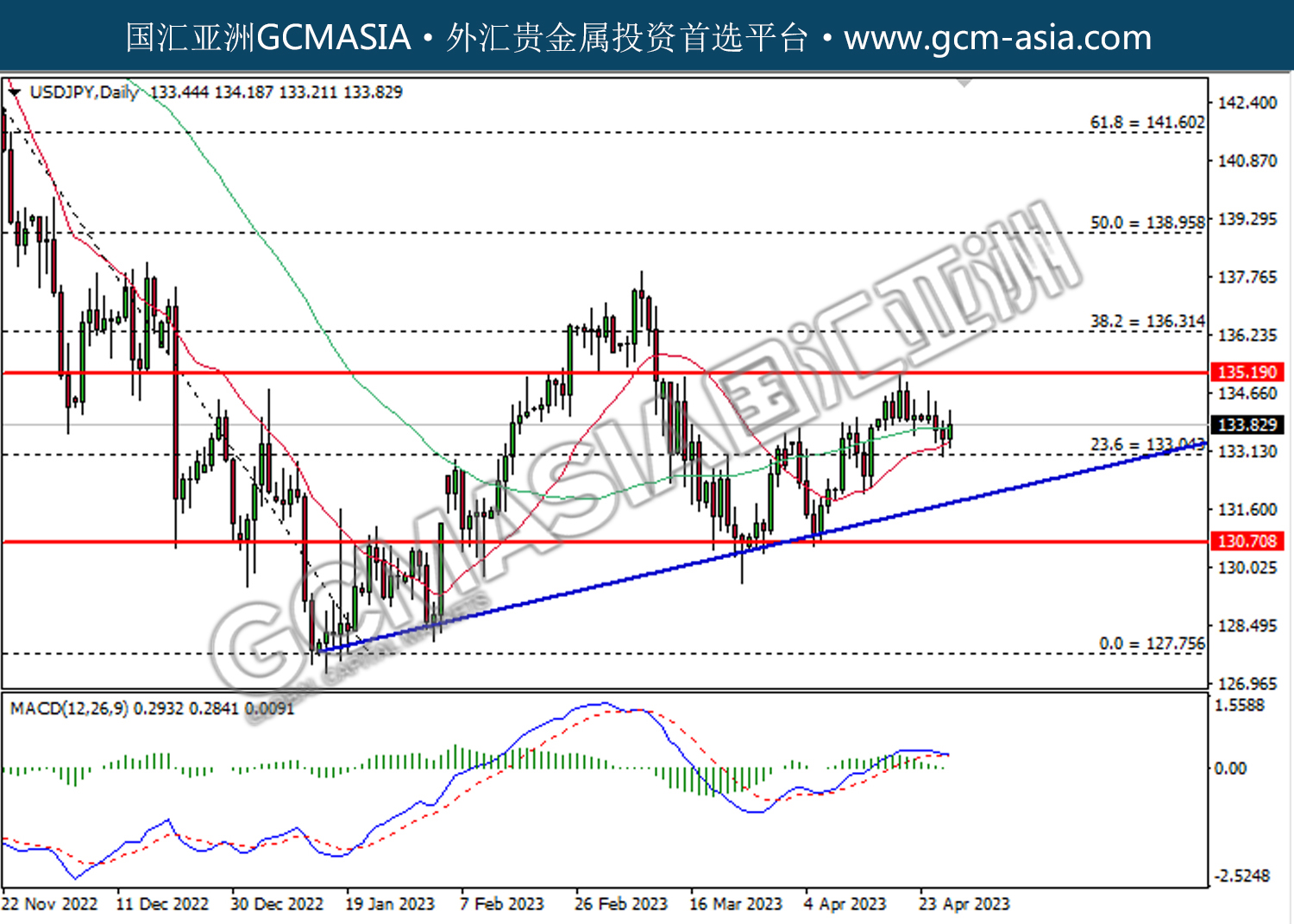

USDJPY, Daily: USDJPY was traded lower following the prior retracement from the resistance level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

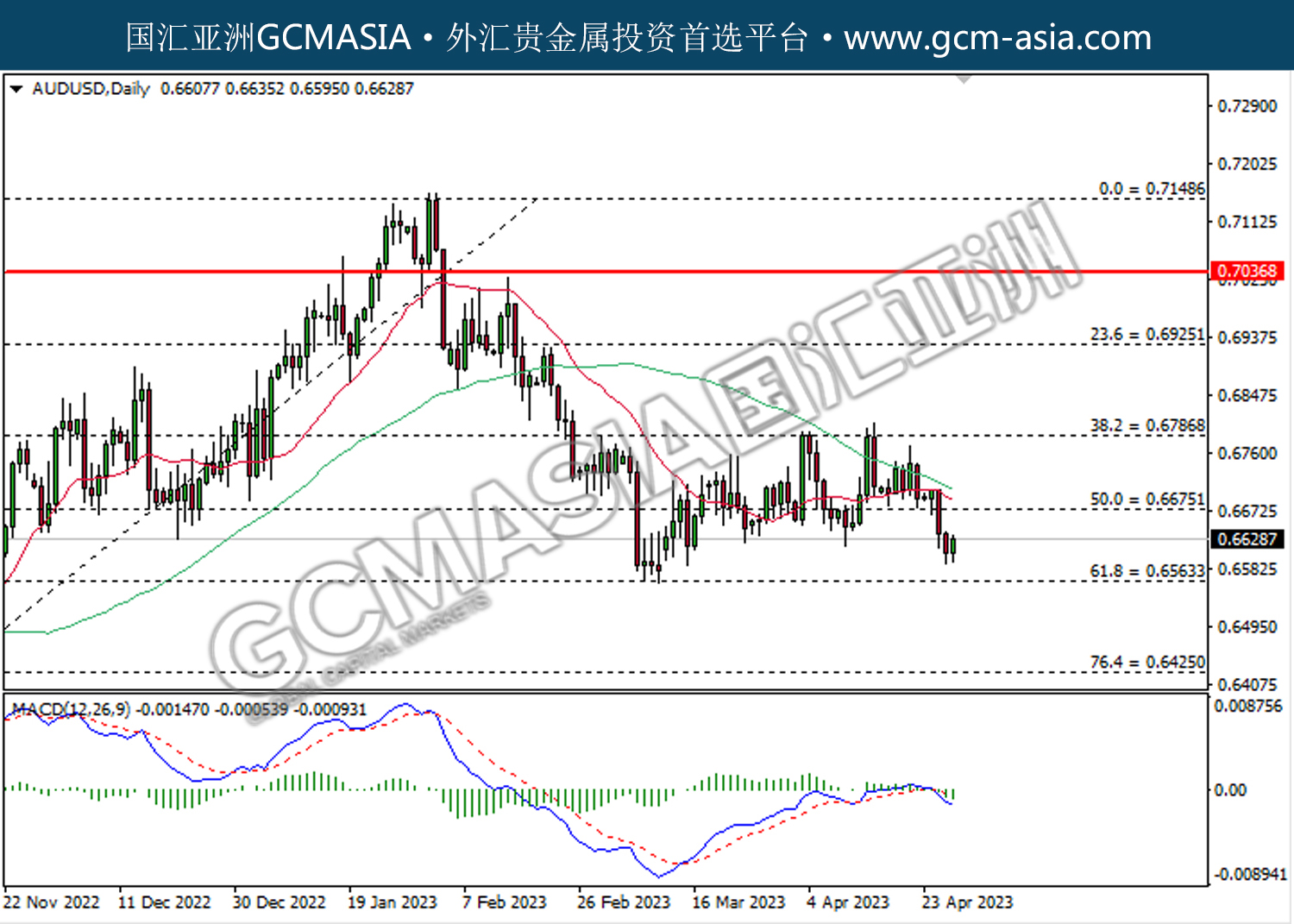

AUDUSD, Daily: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6675. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6565.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

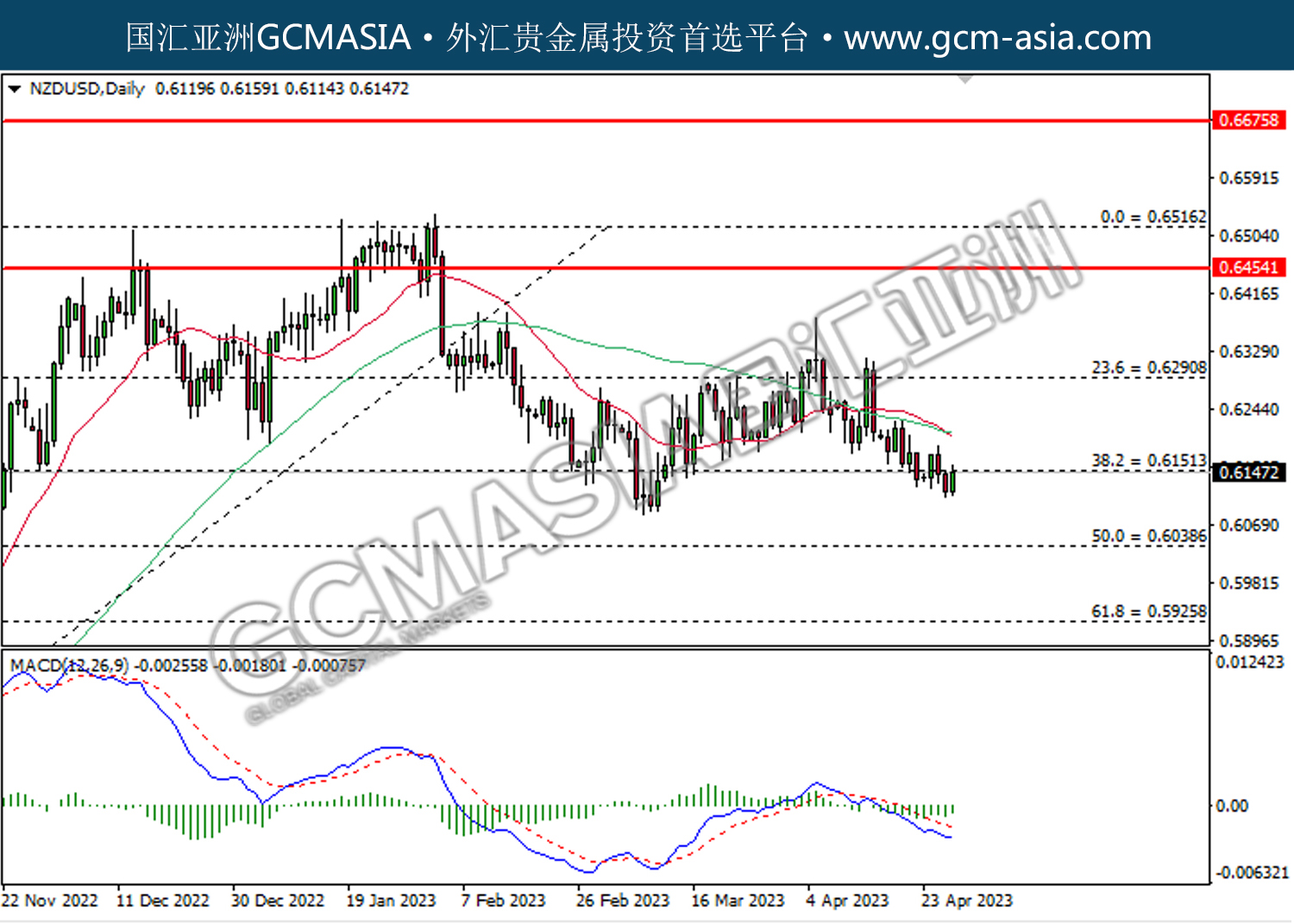

NZDUSD, Daily: NZDUSD was traded higher while currently retesting the resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

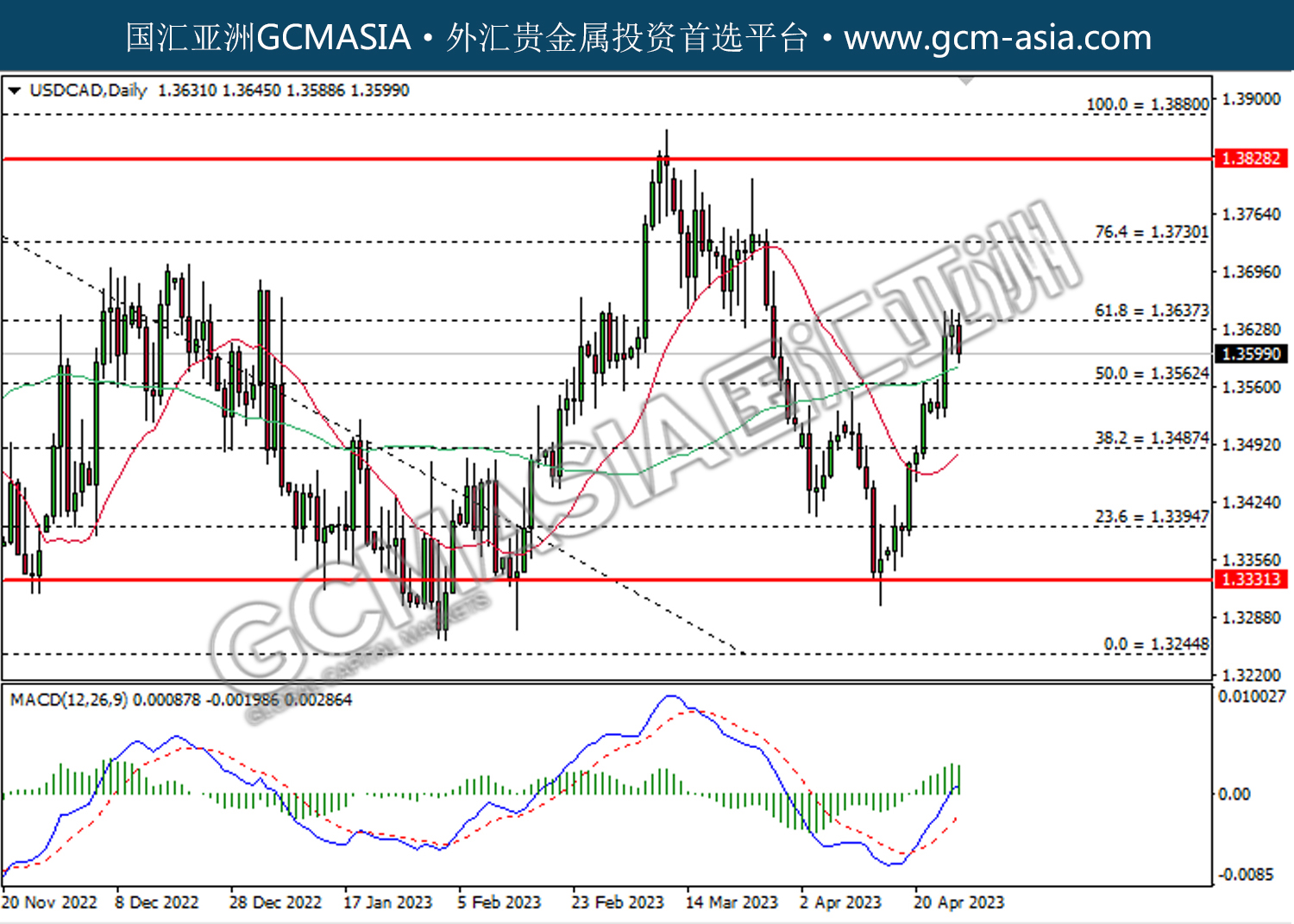

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3635. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3560.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

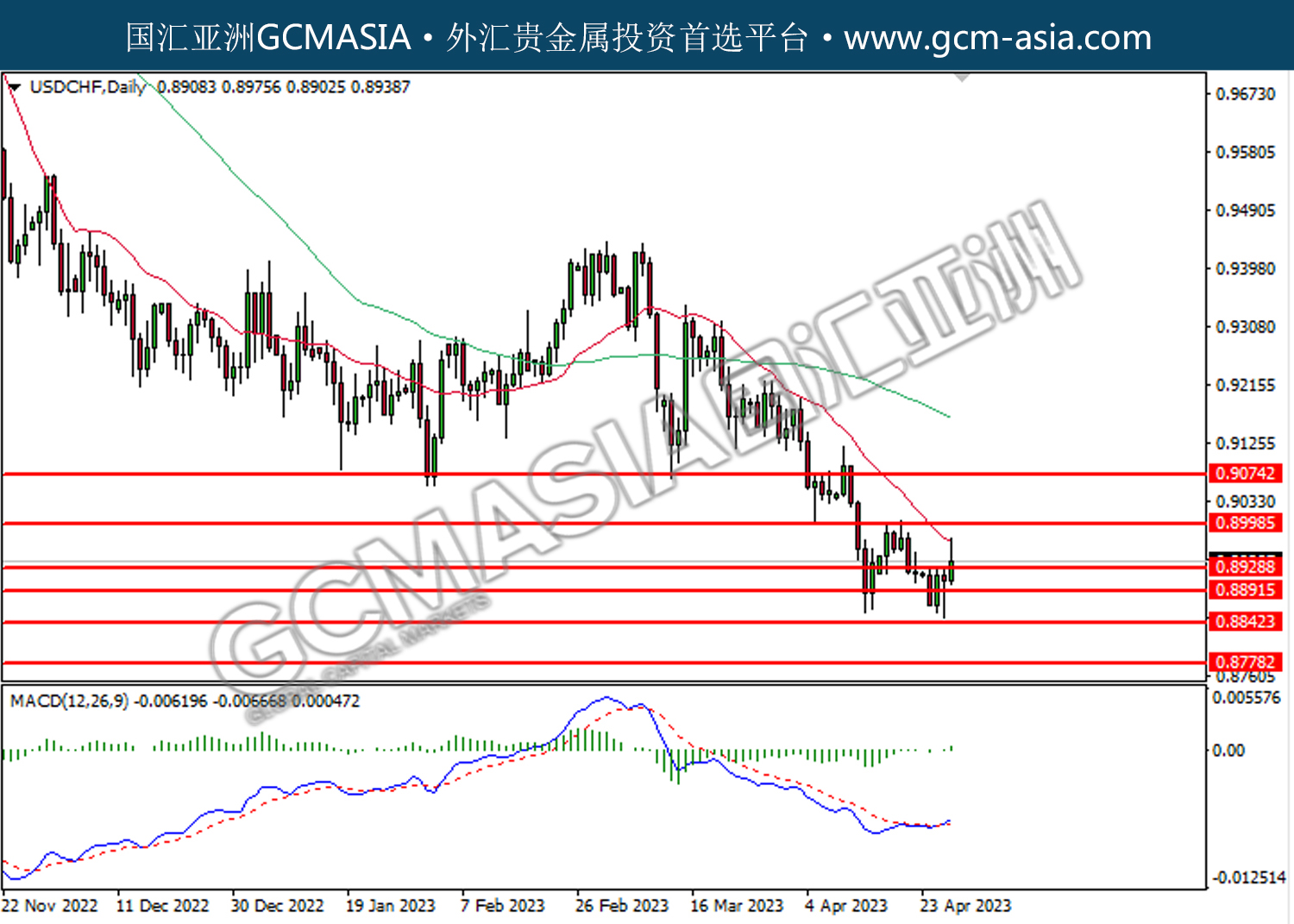

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8930. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8930, 0.9000

Support level: 0.8890, 0.8845

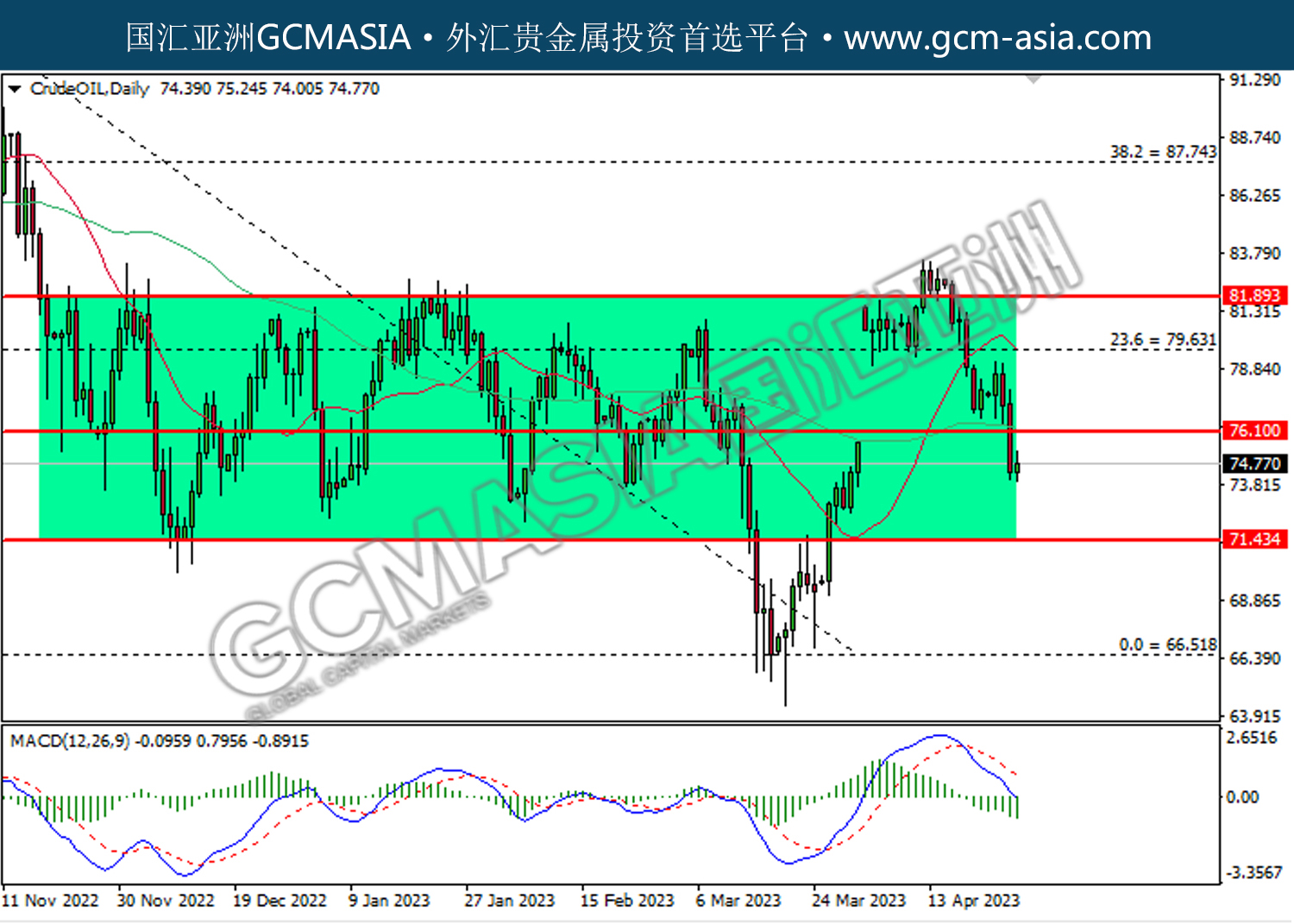

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 76.10. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 71.45.

Resistance level: 76.10, 79.65

Support level: 71.45, 66.50

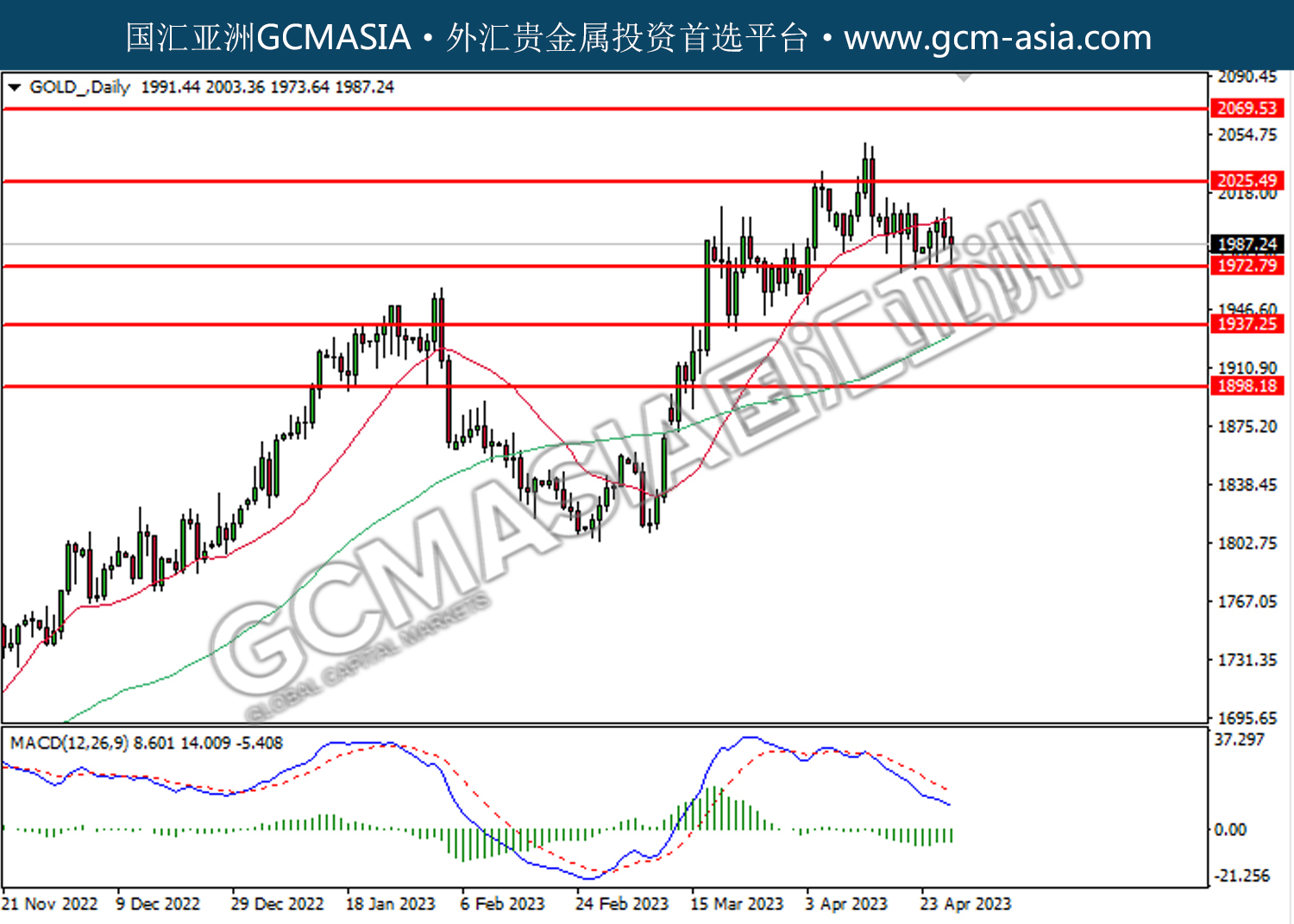

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1972.80. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25