3 May 2023 Morning Session Analysis

US dollar slumped amid disappointing job data.

The dollar index, which was traded against a basket of six major currencies, received some bearish pressures after hitting the 3-week high as the US job data fell more than expected in March. According to the Bureau of Labor Statistics, the US JOLTs Job Openings dropped from 9.974M to 9.590M, significantly lower than the consensus forecast at 9.775M. The huge drop of job vacancies refreshed the record of the lowest level in nearly 2 years while mirroring a sign that the ultra-tight US labor market was easing. The lower-than-expected result also suggests that wage pressures have eased, thereby easing inflation and reducing pressure on the Fed to raise interest rates further in the future. Besides, the heightening of US default risk also disrupted the financial market yesterday. Treasury Secretary Janet Yellen notified US Congress that the US could default on its debt once it ran out of measures to repay its debt on the 1st of June 2023. At this point in time, the impasse of passing the bill to increase the debt ceiling continues amid head-butting between the Republicans and Democrats over the spending cuts issue. Without raising the debt ceiling, it is expected to spark a 2008-style economic catastrophe that would wipe out millions of jobs and sets the US in a recession for an unforeseen period of time. As of writing, the dollar index edged down -0.22% to 101.95.

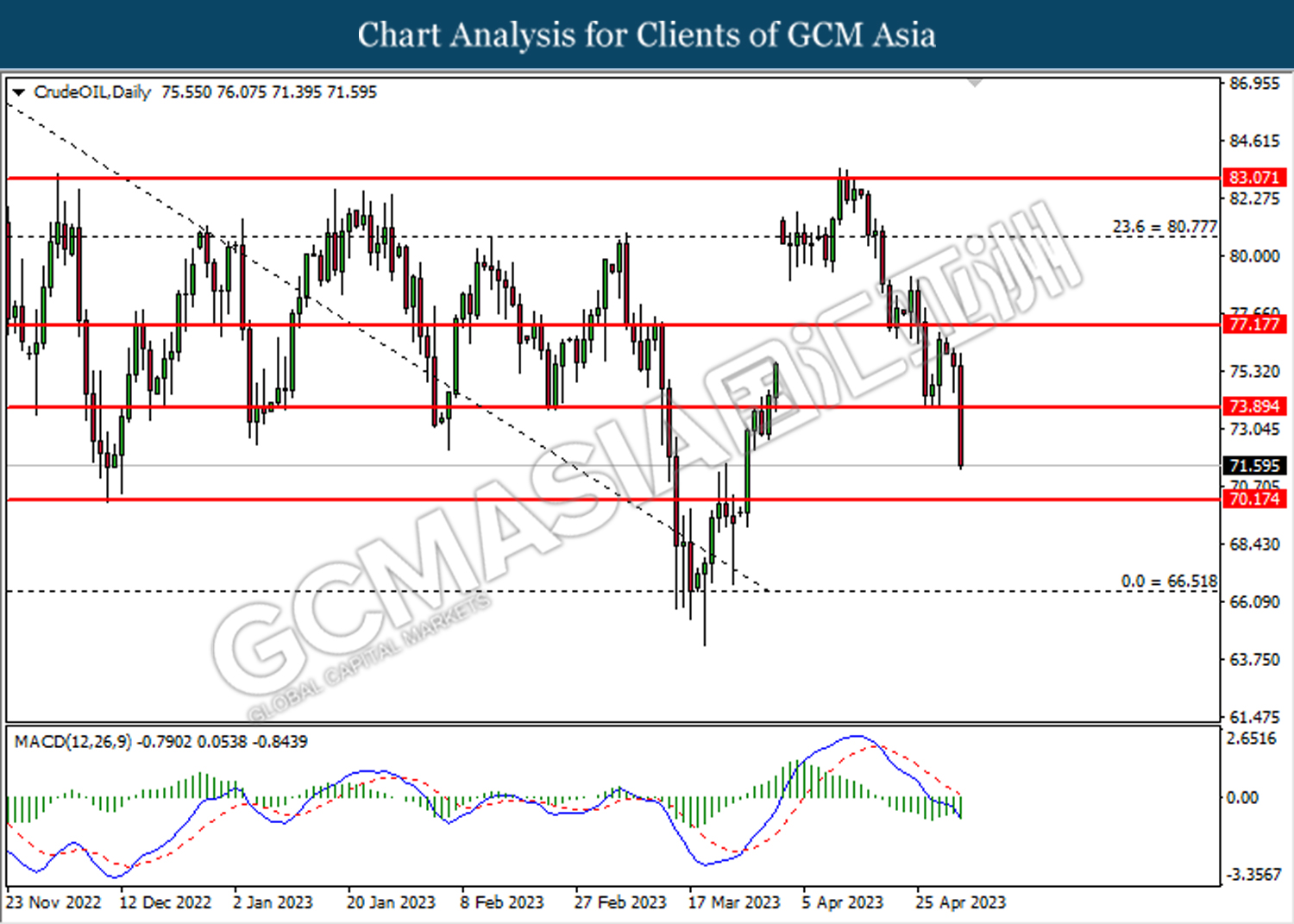

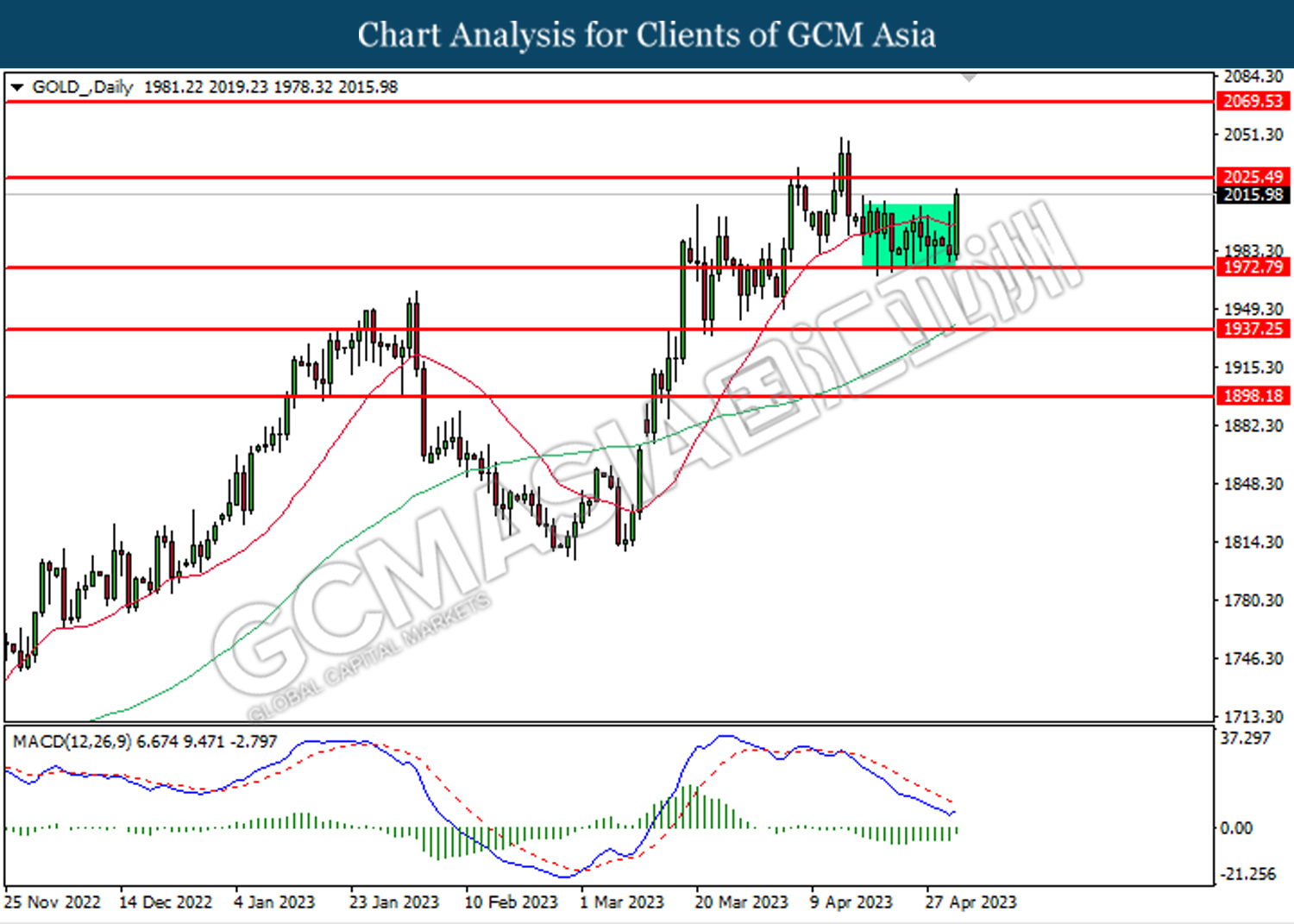

In the commodities market, crude oil prices were down by -4.55% to $71.55 per barrel, with the backdrop of Iranian oil production surpassing 3 million barrels per day. Besides, gold prices ticked down by -0.03% to $2016.20 per troy ounce after jumping significantly yesterday amid the risk of US default heightened.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

All Day JPY Constitution Day

Today’s Highlight Events

Time Market Event

Tentative GBP BoE Quarterly Bulletin

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – Unemployment Rate (Mar) | 6.6% | 6.6% | – |

| 20:15 | USD – ADP Nonfarm Employment Change

(Apr) |

145K | 150K | – |

| 21:45 | USD – S&P Global Composite PMI (Apr) | 52.3 | 53.5 | – |

| 21:45 | USD – Services PMI (Apr) | 52.6 | 53.7 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Apr) | 51.2 | 51.8 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -5.054M | -1.486M | – |

Technical Analysis

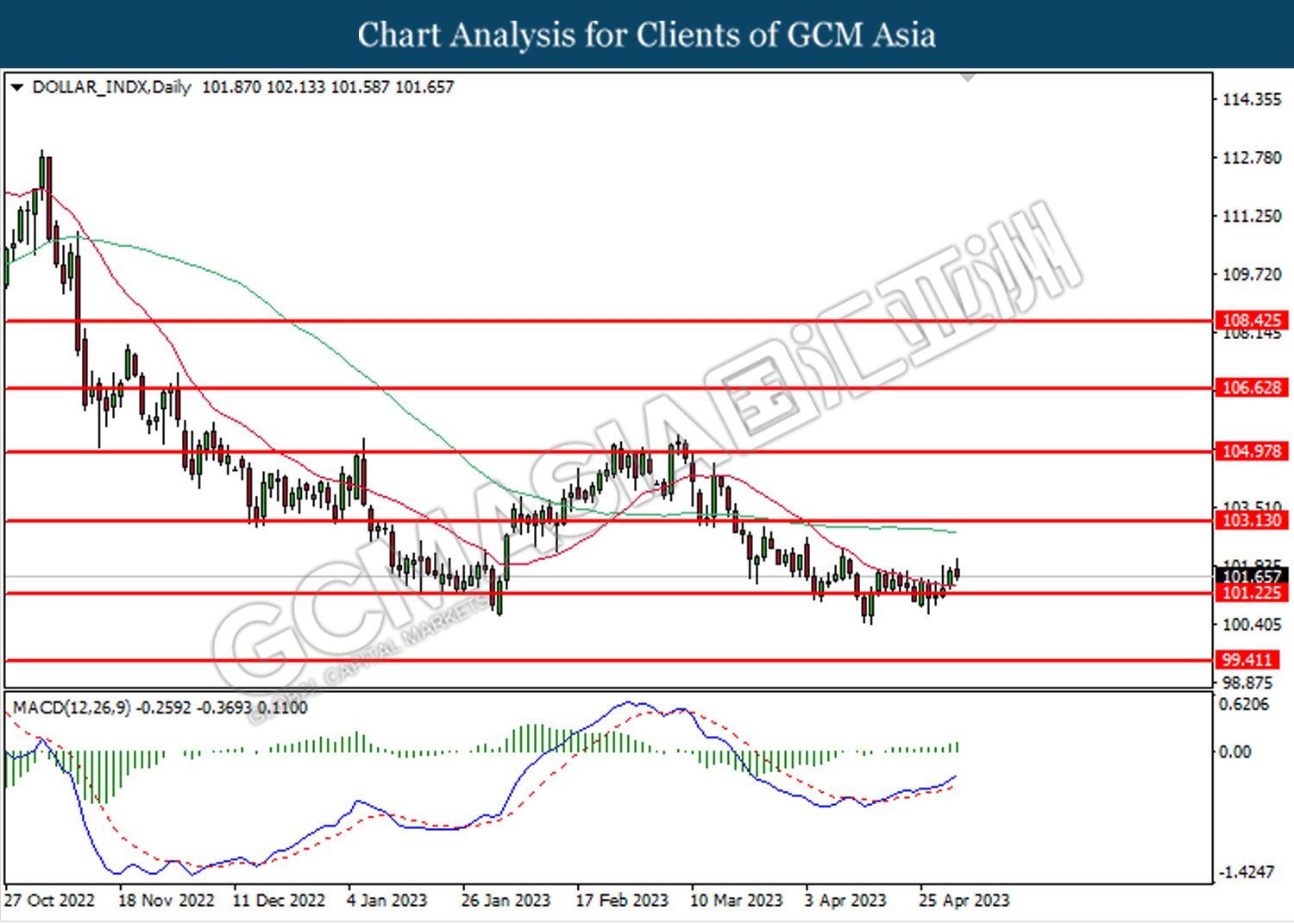

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 101.25. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

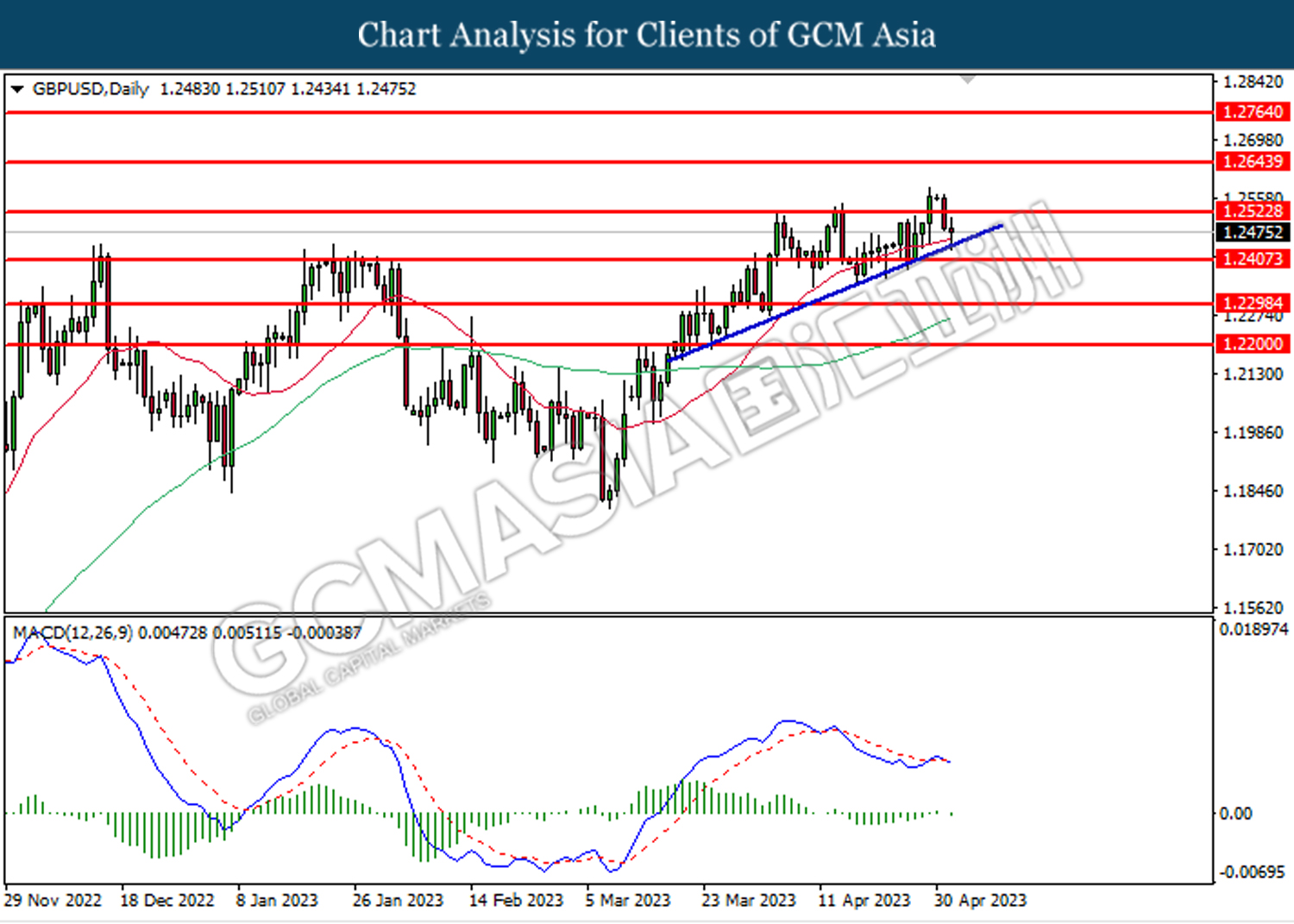

GBPUSD, Daily: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

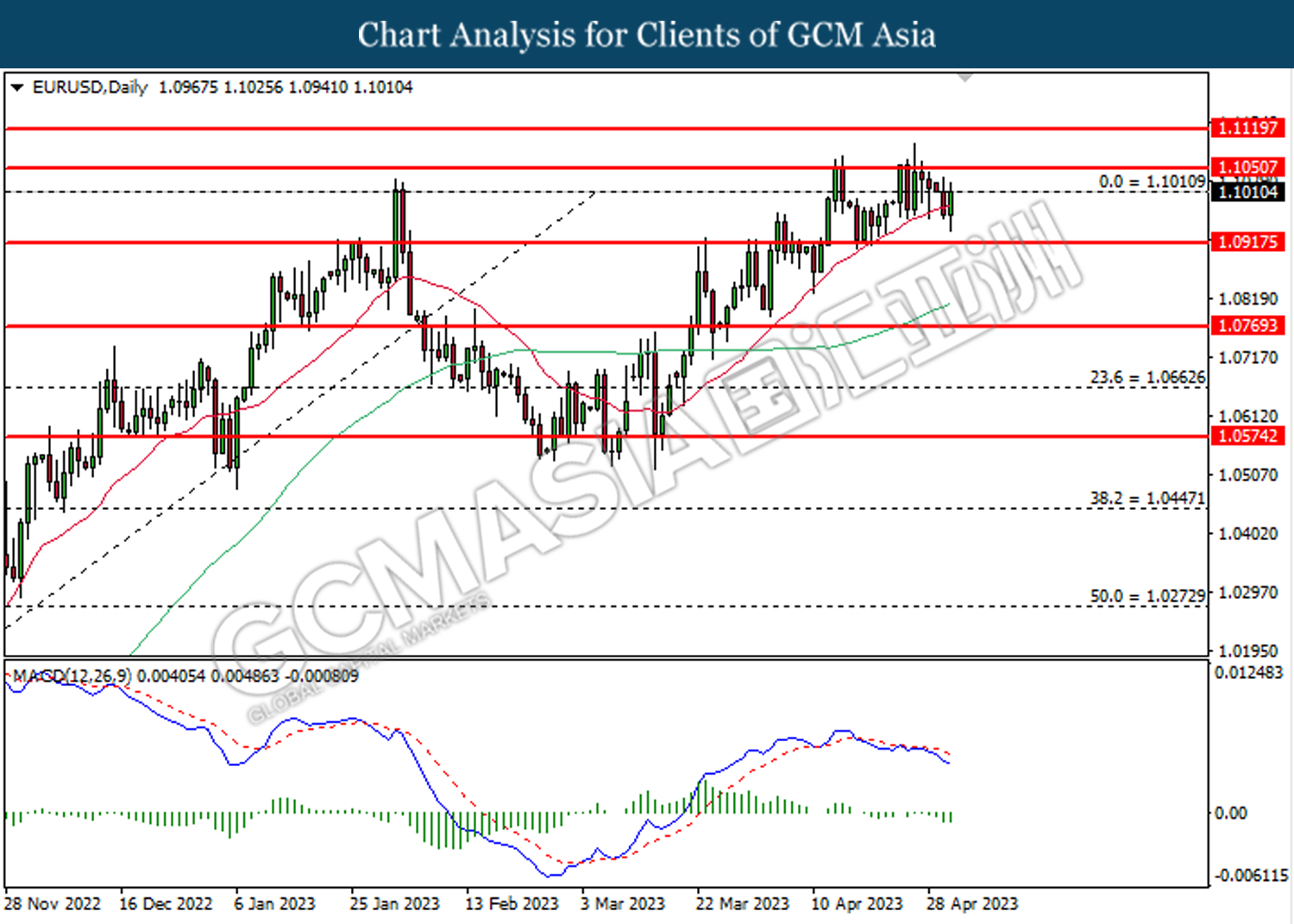

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.1010. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

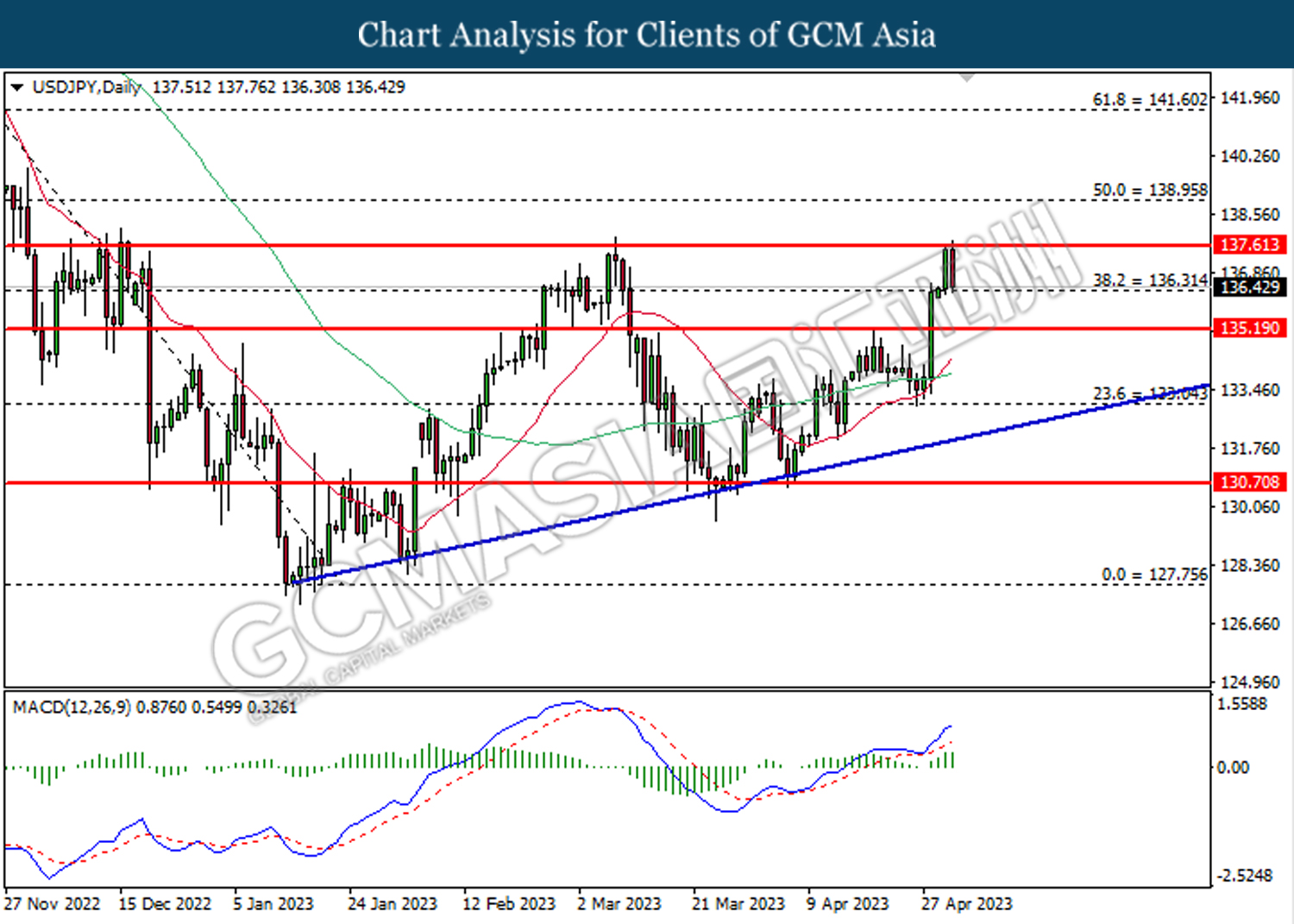

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 136.30. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 137.60, 138.95

Support level: 136.30, 135.20

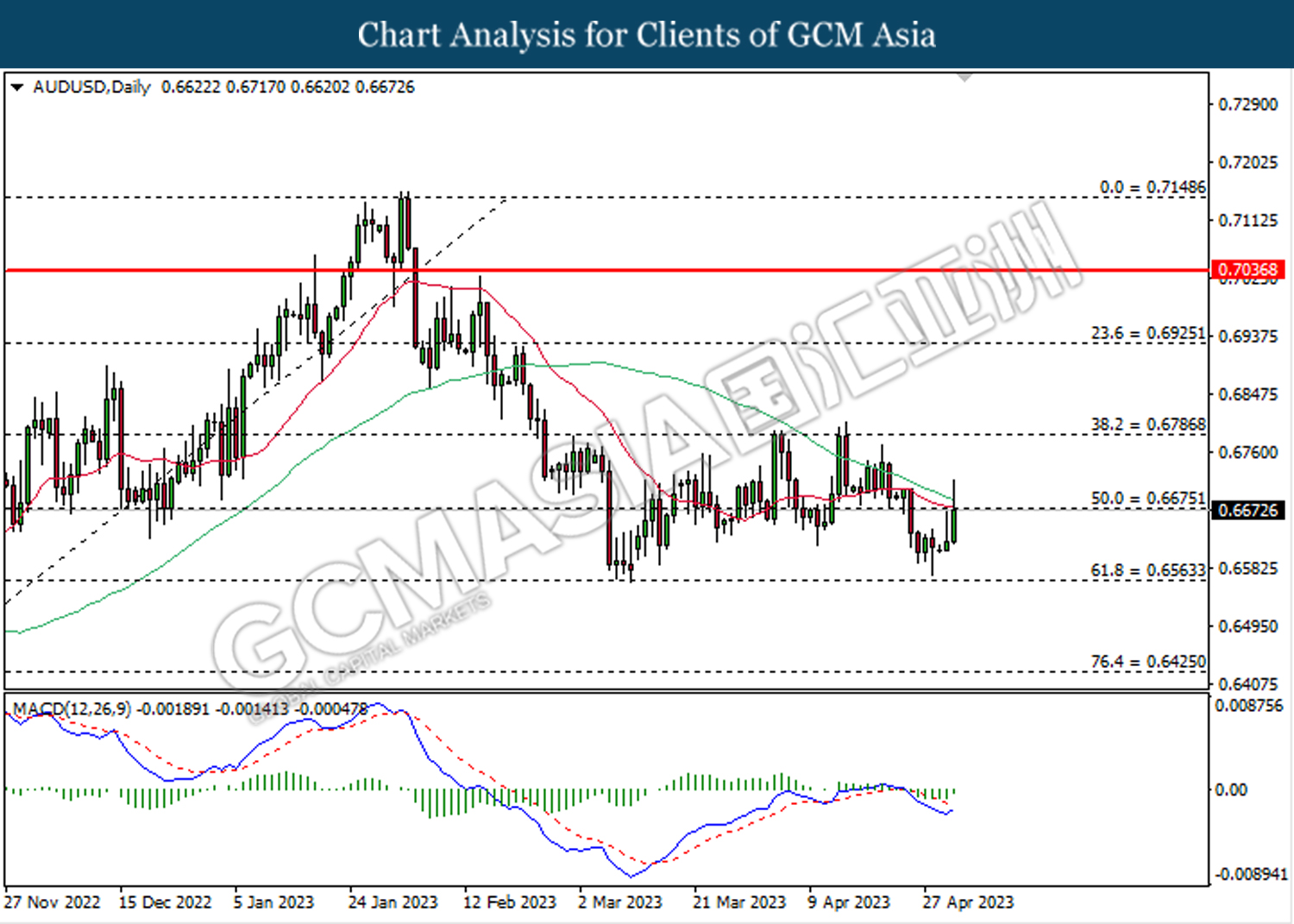

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

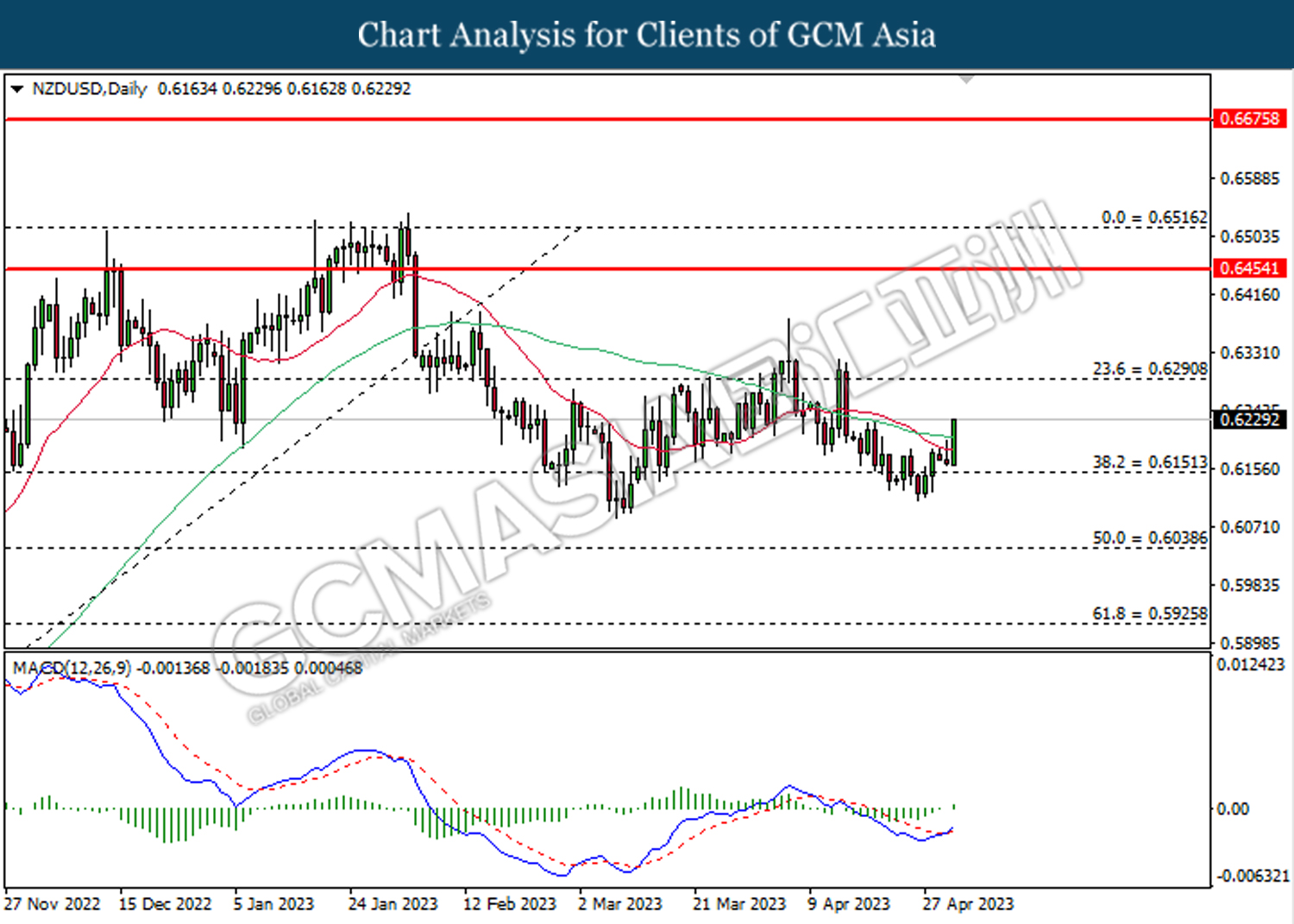

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

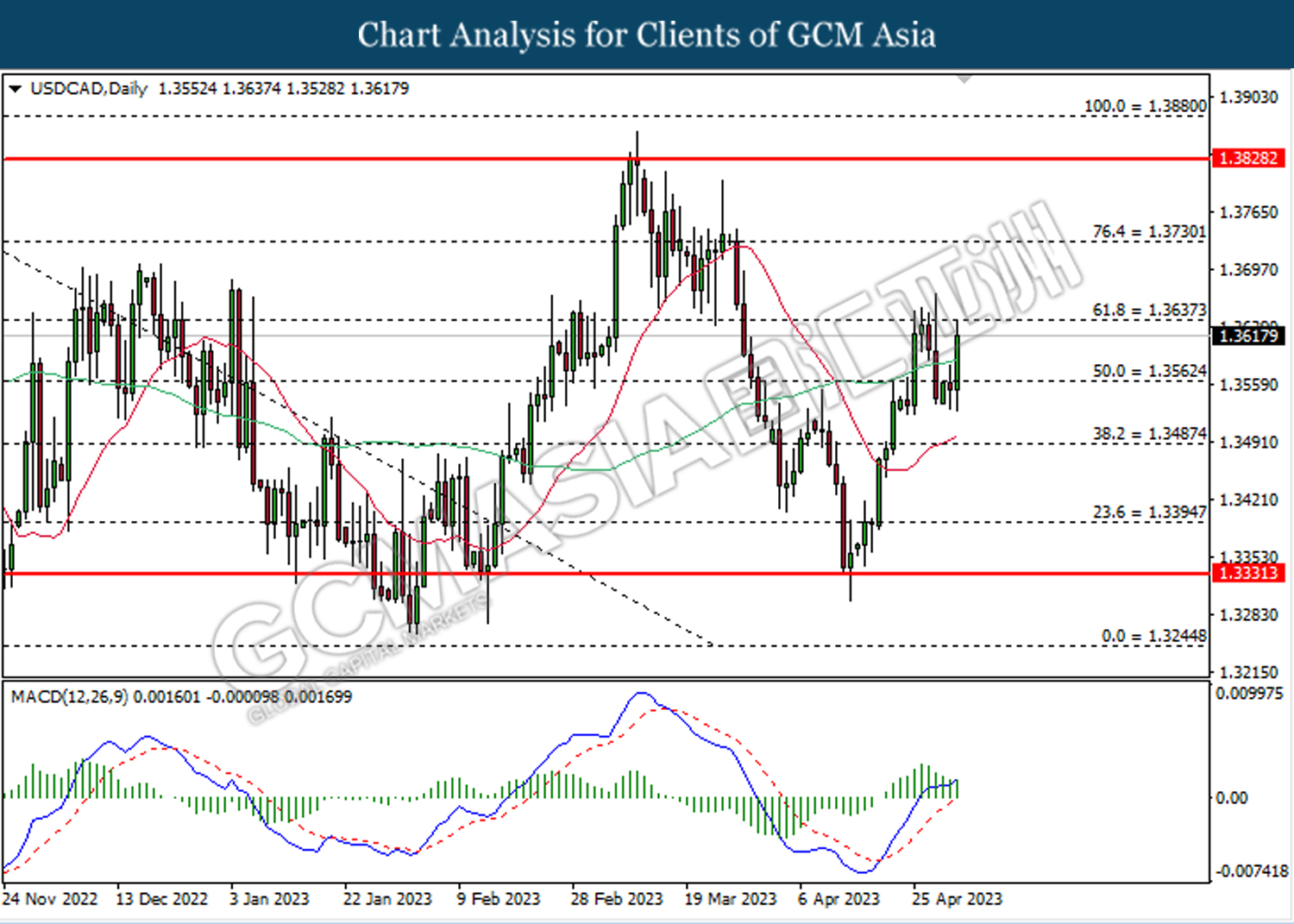

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3635. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

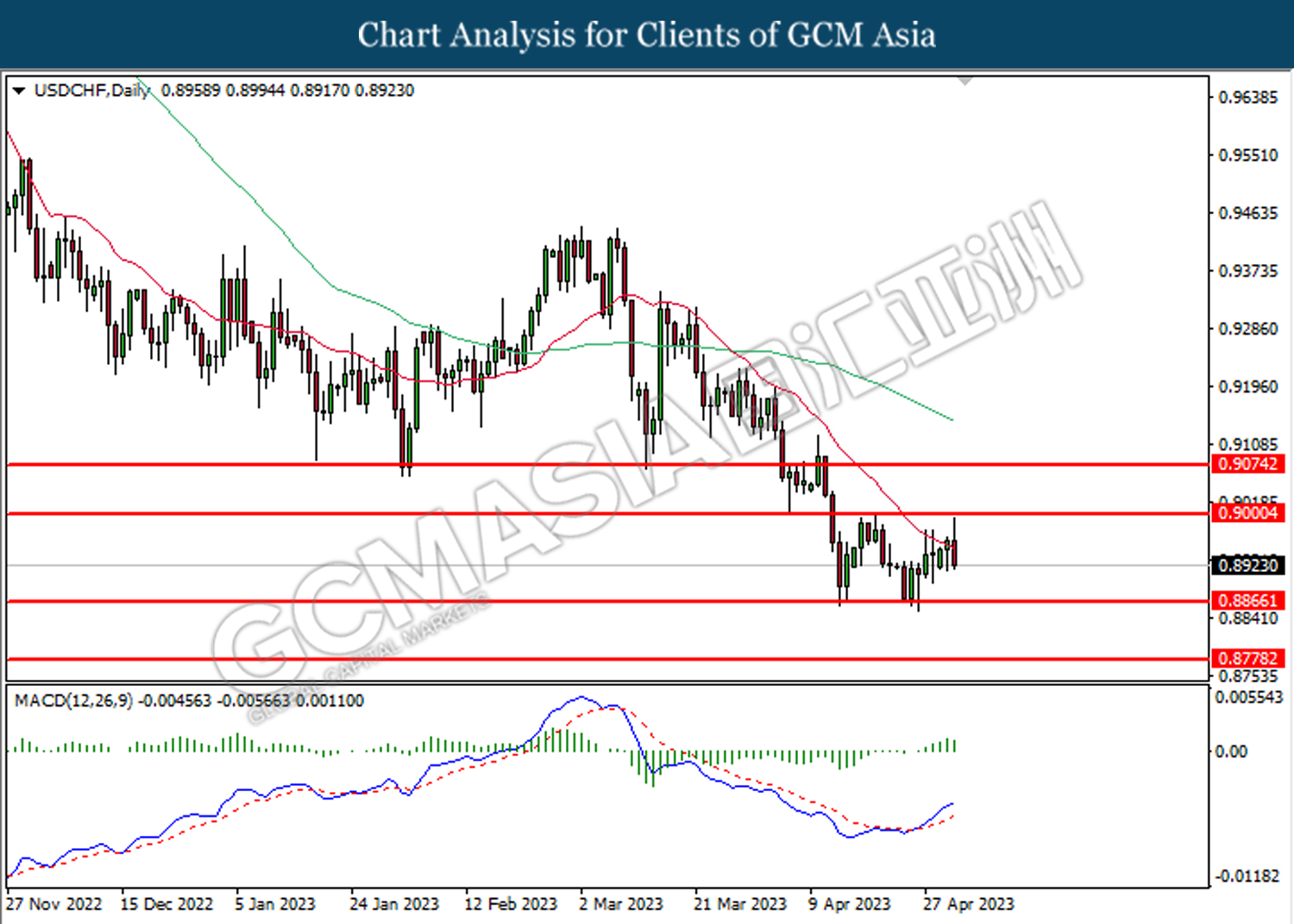

USDCHF, Daily: USDCHF was traded lower following the prior retracement from the resistance level at 0.9000. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8865.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 73.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 70.15.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1972.80. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 2025.50.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25