3 May 2023 Afternoon Session Analysis

The Kiwi jumped after upbeat economic data was released.

The New Zealand dollar, commonly knowns as the Kiwi, jumped to the highest level in three weeks’ time at 0.6230. The reason the Kiwi pair soared up as the investors were cheering for an upbeat quarterly employment data. Statistics New Zealand unveiled the first quarter 2023 employment report early today, where it showed that the quarterly employment change increased to 0.8%, beating the market expectations and previous readings at 0.4% and 0.2% respectively. The rise in employment changes could have positive implications for consumer spending and stimulate economic growth. Besides, the unemployment data’s reading stood at 3.4%, similar to the prior reading, beating the market expectation for an increase of 3.5%. A series of upbeat labor data gives the RBNZ more room to further tightening in the future. On the other hand, Reserve Bank of New Zealand (RBNZ) Deputy Governor Christian Hawkesby said the housing prices had continued to decline and close to the sustainable level, while the ongoing labor market showed resilient conditions. The central bank is currently looking at easing loan-to-value ratio restrictions for home buyers. Ongoing strength in the labor market enables borrowers to adjust their spending and repayment of their debts. As a result, the pair of NZD/USD appreciated 0.465 to $0.6236.

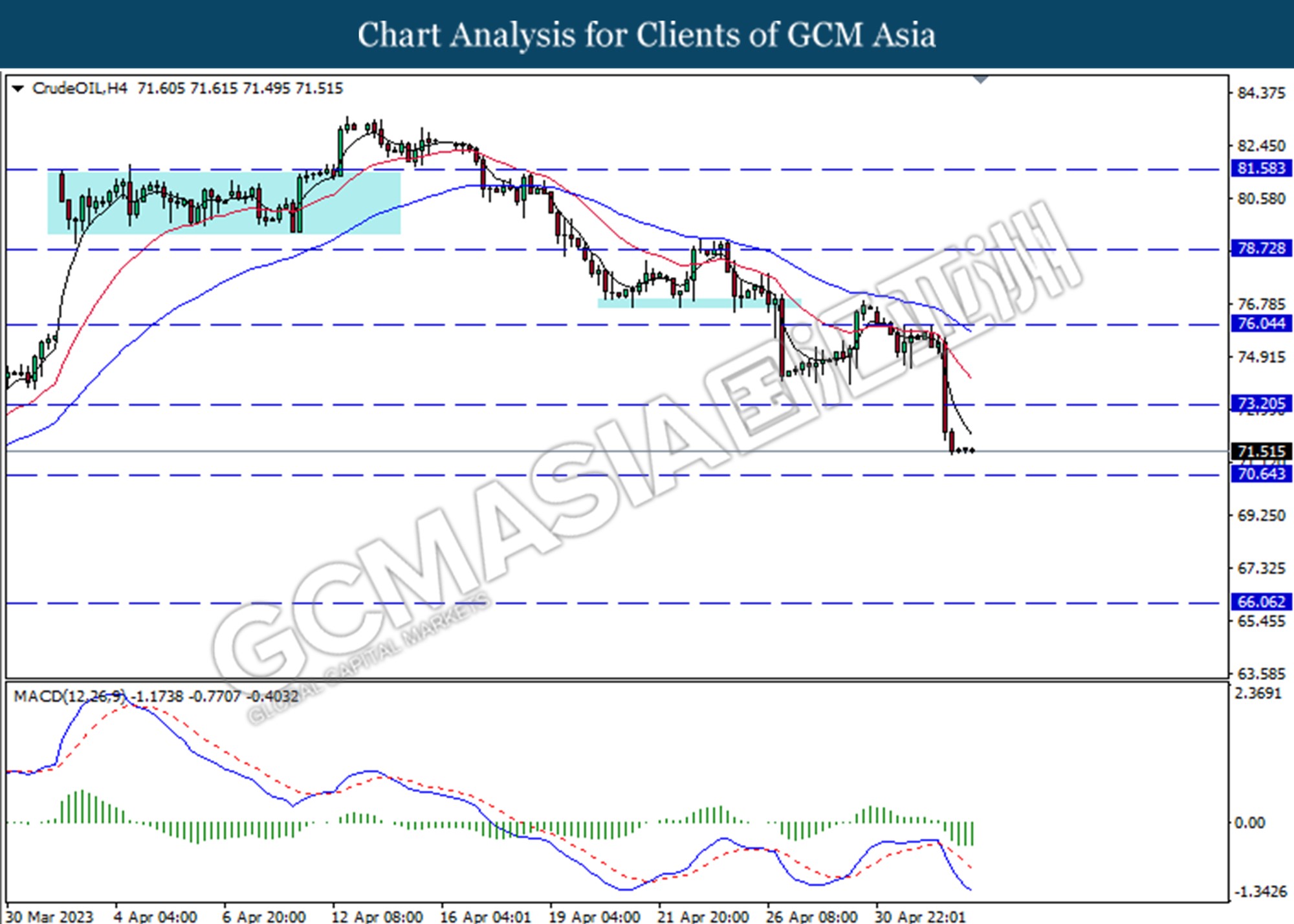

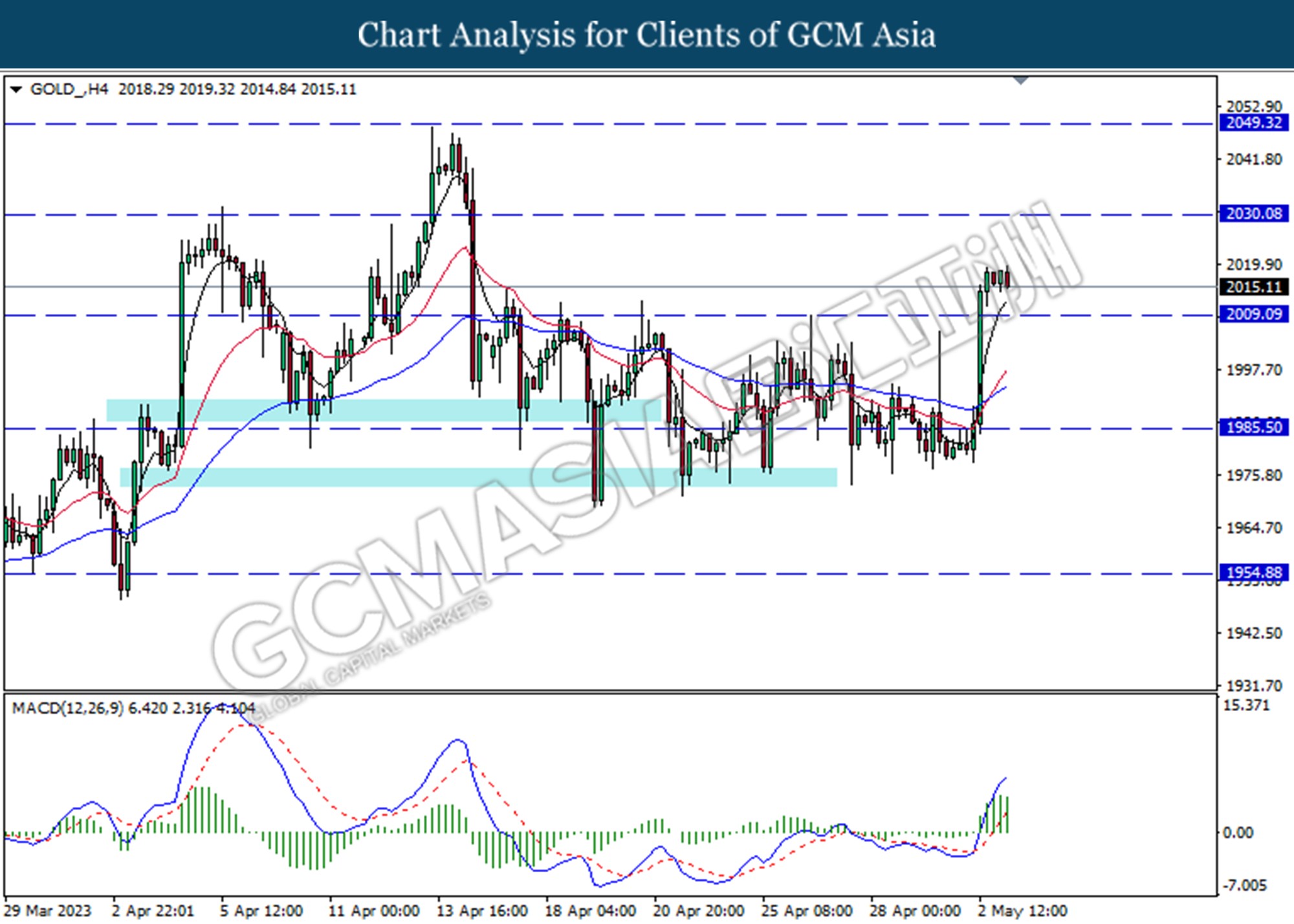

In the commodity market, crude oil prices fell -0.07% to $71.64 a barrel after the market worried that the US debt ceiling would further affect crude oil demand. Besides, gold prices edged up by 0.11% to $2018.86 per troy ounce as US anxiety boosted the demand for safe-haven assets.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

All Day JPY Constitution Day

Today’s Highlight Events

Time Market Event

Tentative GBP BoE Quarterly Bulletin

02:30 USD FOMC Press Conference

(3rd May)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – Unemployment Rate (Mar) | 6.6% | 6.6% | – |

| 20:15 | USD – ADP Nonfarm Employment Change

(Apr) |

145K | 150K | – |

| 21:45 | USD – S&P Global Composite PMI (Apr) | 52.3 | 53.5 | – |

| 21:45 | USD – Services PMI (Apr) | 52.6 | 53.7 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Apr) | 51.2 | 51.8 | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -5.054M | -1.486M | – |

| 02:00 | USD – Fed Interest Rate Decision | 5.00% | 5.25% | – |

Technical Analysis

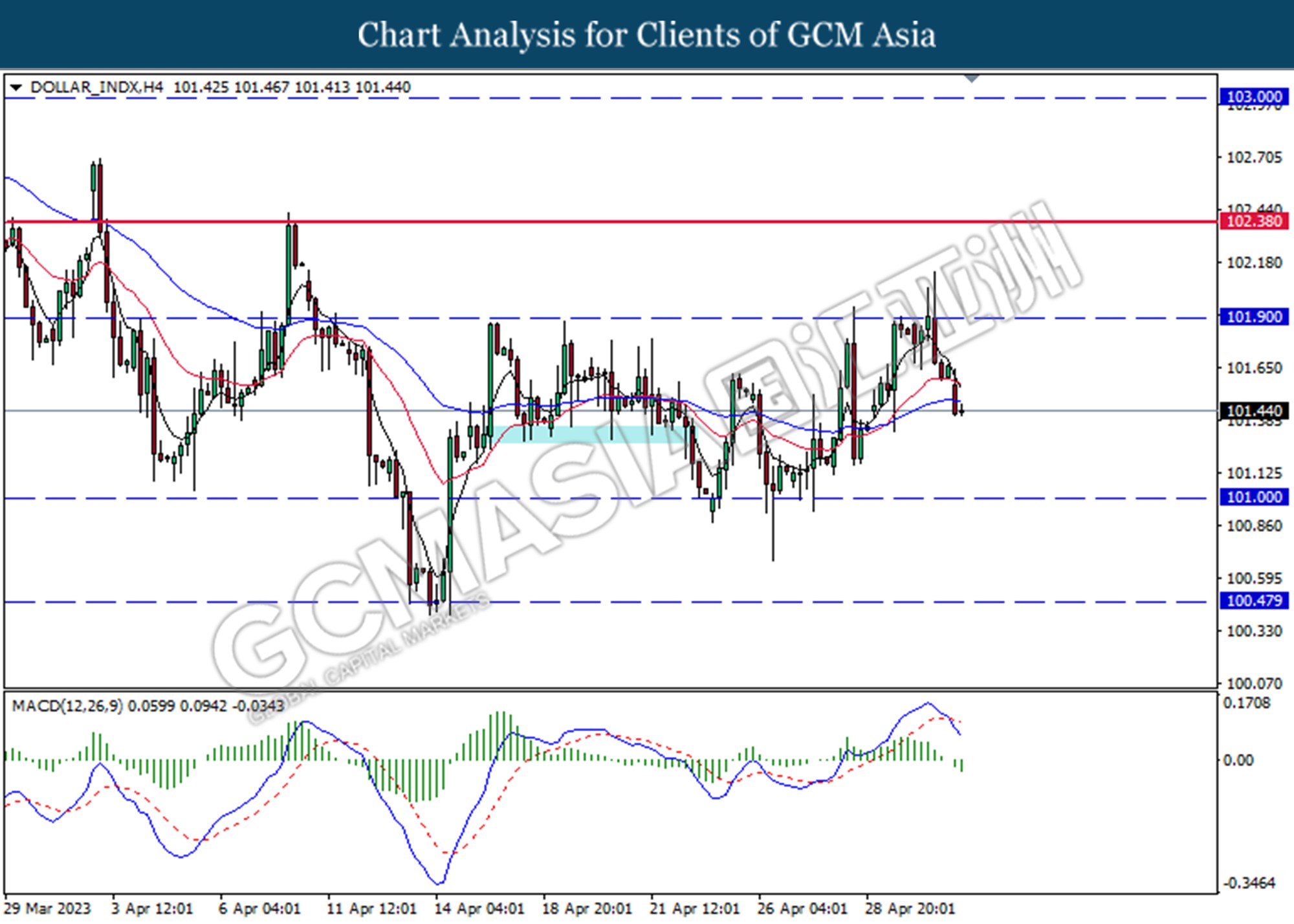

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the resistance level at 101.90. MACD which illustrated increasing bearish momentum suggests the index extended its losses toward the support level at 101.00.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

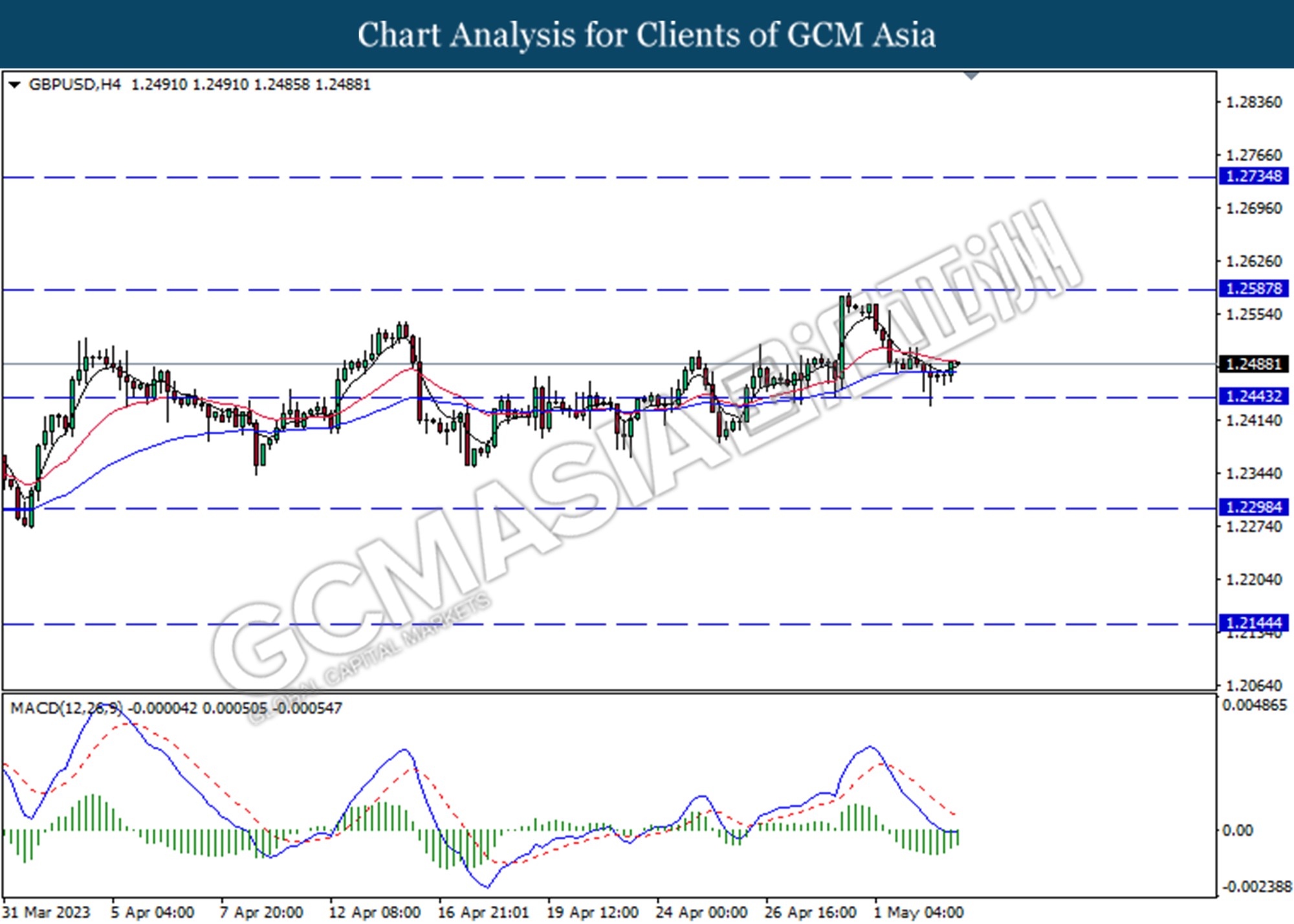

GBPUSD, H4: GBPUSD was traded lower following the prior rebound from the support level at 1.2445. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

EURUSD, H4: EURUSD was traded following the prior rebound from the support level at 1.0930. MACD which illustrated increasing bullish momentum suggests the pair extended its gains towards the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

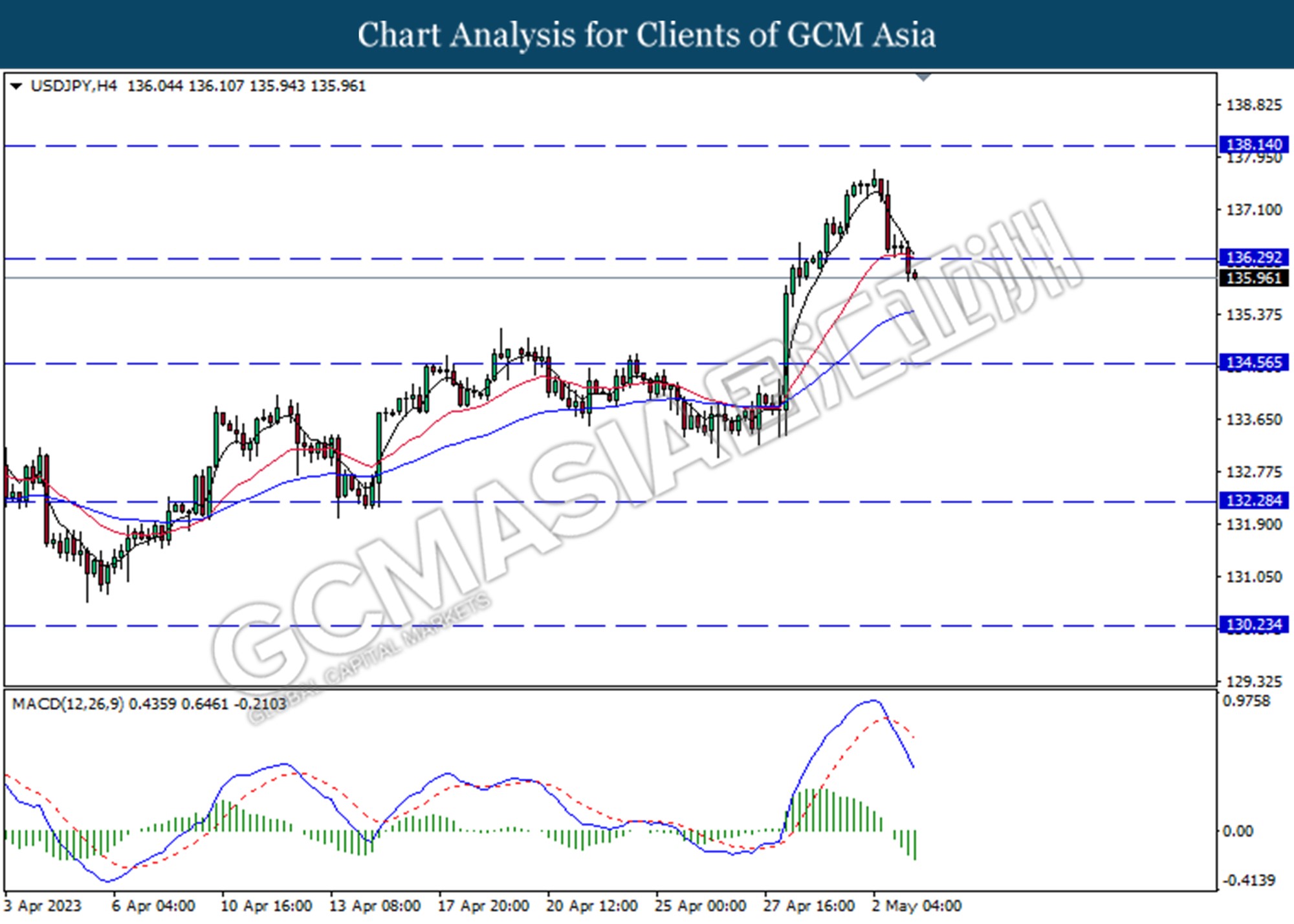

USDJPY, H4: USDJPY was traded lower following a previous break below the support level at 136.30. MACD which illustrated increasing bearish momentum suggests the pair extended its losses towards the support level.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

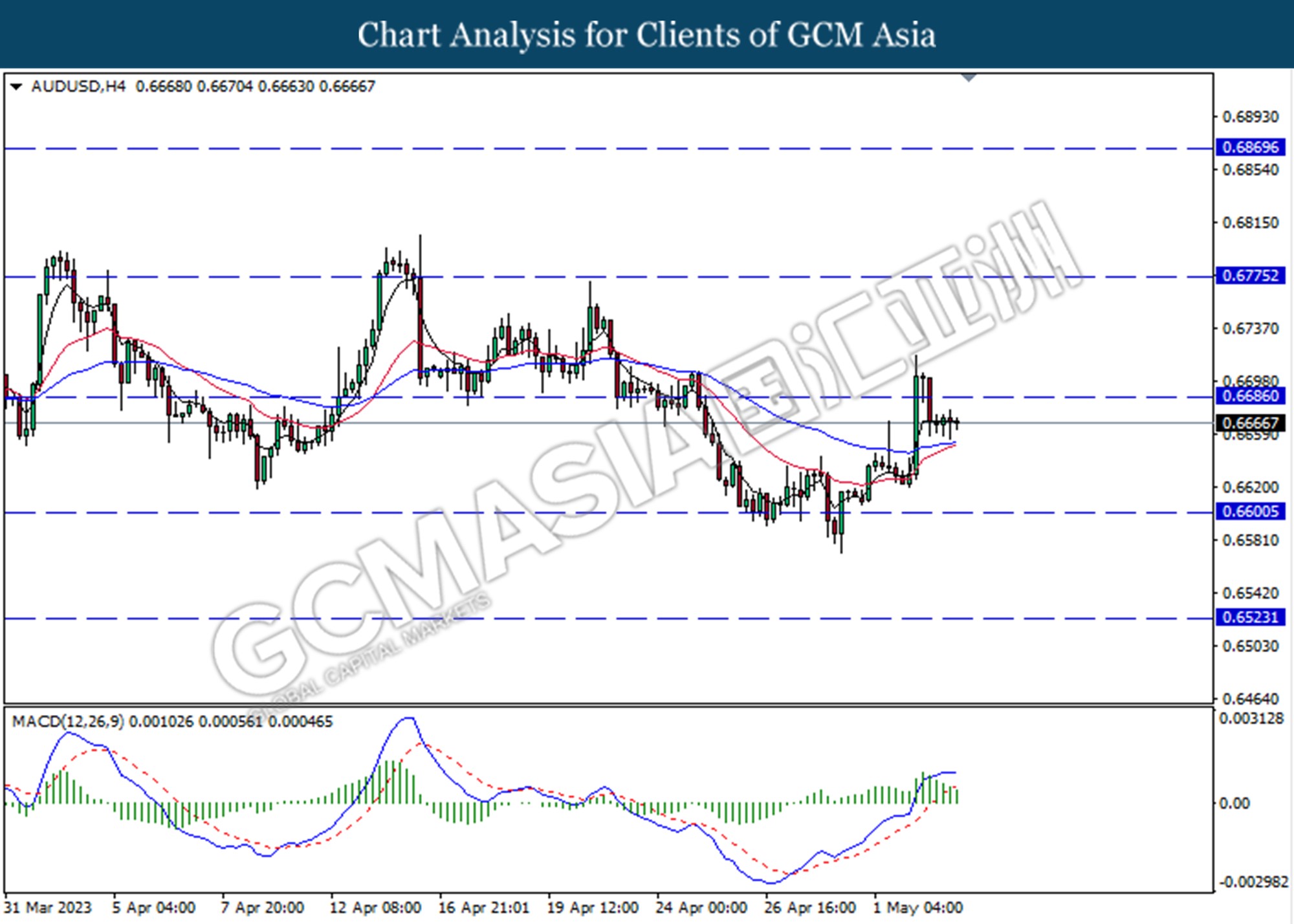

AUDUSD, H4: AUDUSD was traded higher following a prior break below from the previous support level at 0.6685. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6195. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 0.6265.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

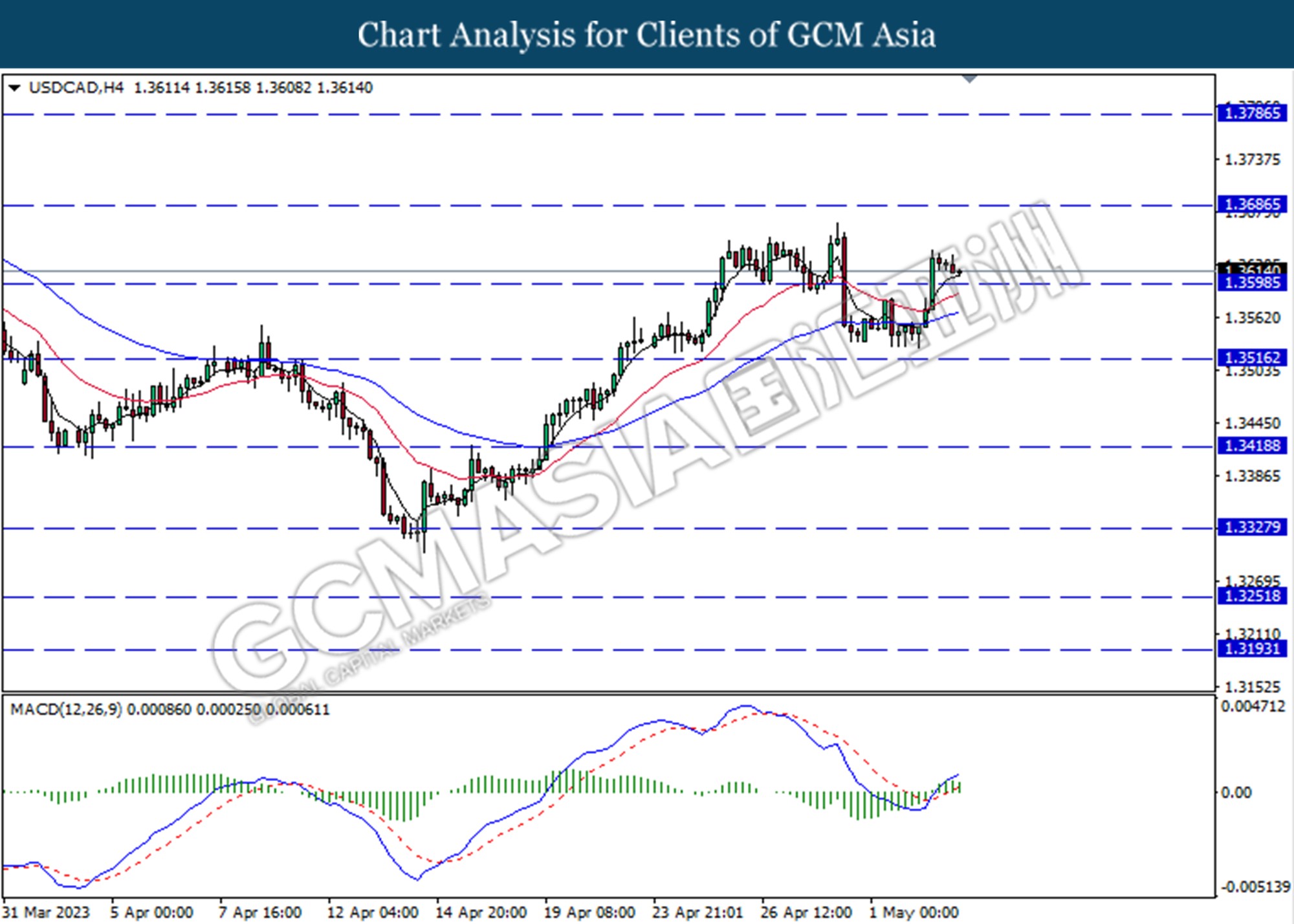

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3600.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

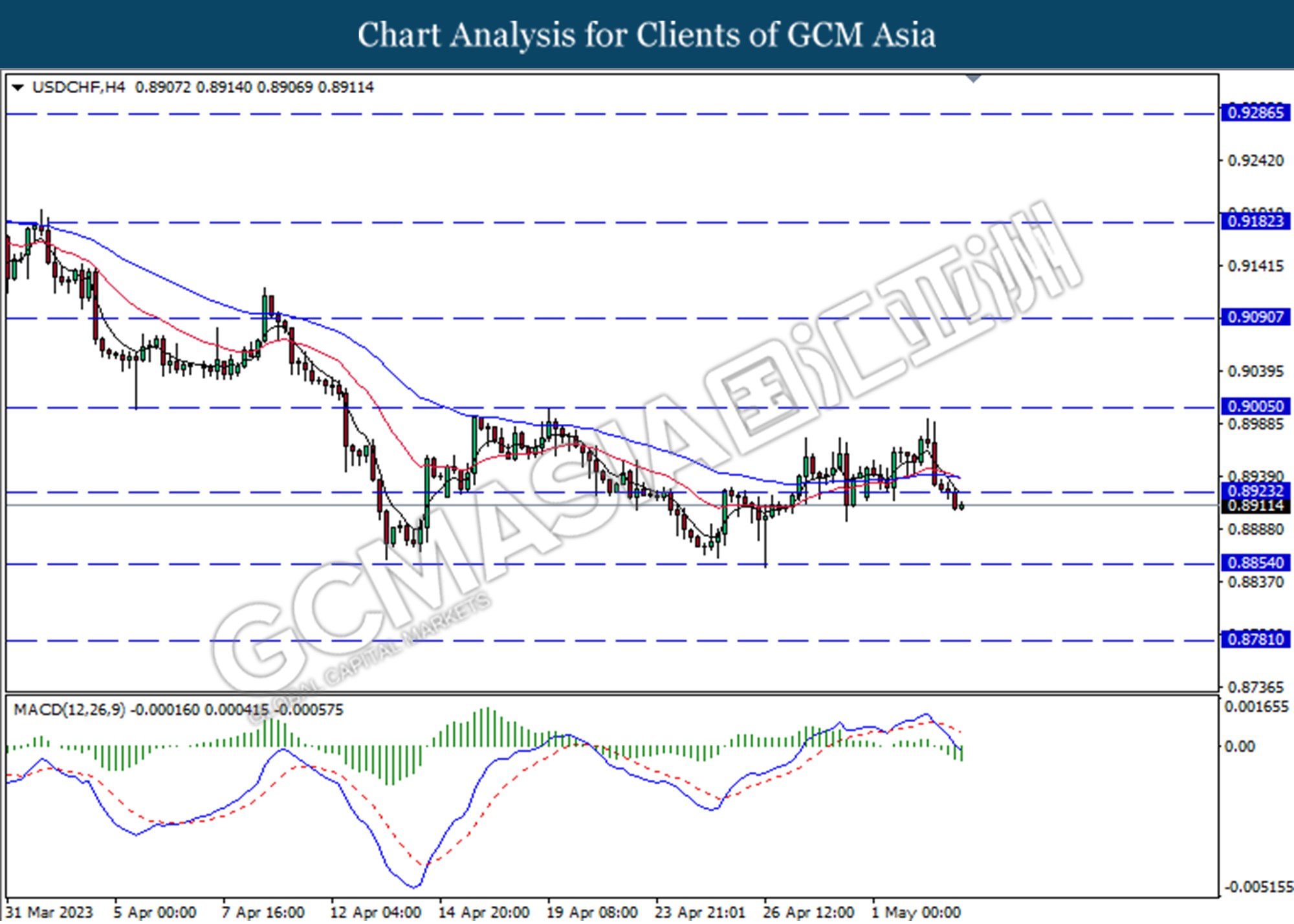

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8925. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 0.8855.

Resistance level: 0.9005, 0.9090

Support level: 0.8855, 0.8780

CrudeOIL, H4: Crude oil price was traded lower following the prior breaks below the previous support level at 73.20. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 70.65.

Resistance level: 73.20, 76.05

Support level: 70.65, 66.05

GOLD_, H4: Gold price was traded higher following the prior breaks above from the previous resistance level at 2009.10. However, MACD which illustrated diminishing bullish momentum suggests the commodity undergoes technical correction in the short term.

Resistance level: 2030.10, 2049.30

Support level: 1985.50, 1954.90