5 May 2023 Morning Session Analysis

US dollar steadied against the backdrop of other currencies’ weakness.

The dollar index, which was traded against a basket of six major currencies, managed to hold its ground following a tremendous sell-off in the previous trading session amid the renewed worries over the US banking sector. Early yesterday, PacWest Bancorp experienced a huge drop following the news that the bank was exploring strategic options, including a potential sale. With such a backdrop, it had wiped off the appeal of US dollar and putting the currency on the edge of cliff. Despite, the US dollar still recorded some gains in the last trading session as the European Central Bank (ECB) raised interest rates by 25 basis points to 3.25% in May’s meeting, in line with market expectations, and signaled more rate hikes in the future in order to combat the stubbornly high inflation. It is noteworthy to highlight that the ECB adjusted its interest rate upward by an unprecedented series of 75 and 50 basis point increases in the prior meetings. With this month’s smaller rate hike, it disappointed the investors and hence exerted huge selling pressures in the Euro market. At this point in time, the attention of the investors are all over the upcoming labor data, which is the NonFarm Payroll, as it could provide further hint if Fed would have sufficient space for another rate hike. As of writing, the dollar index rose 0.10% to 101.45.

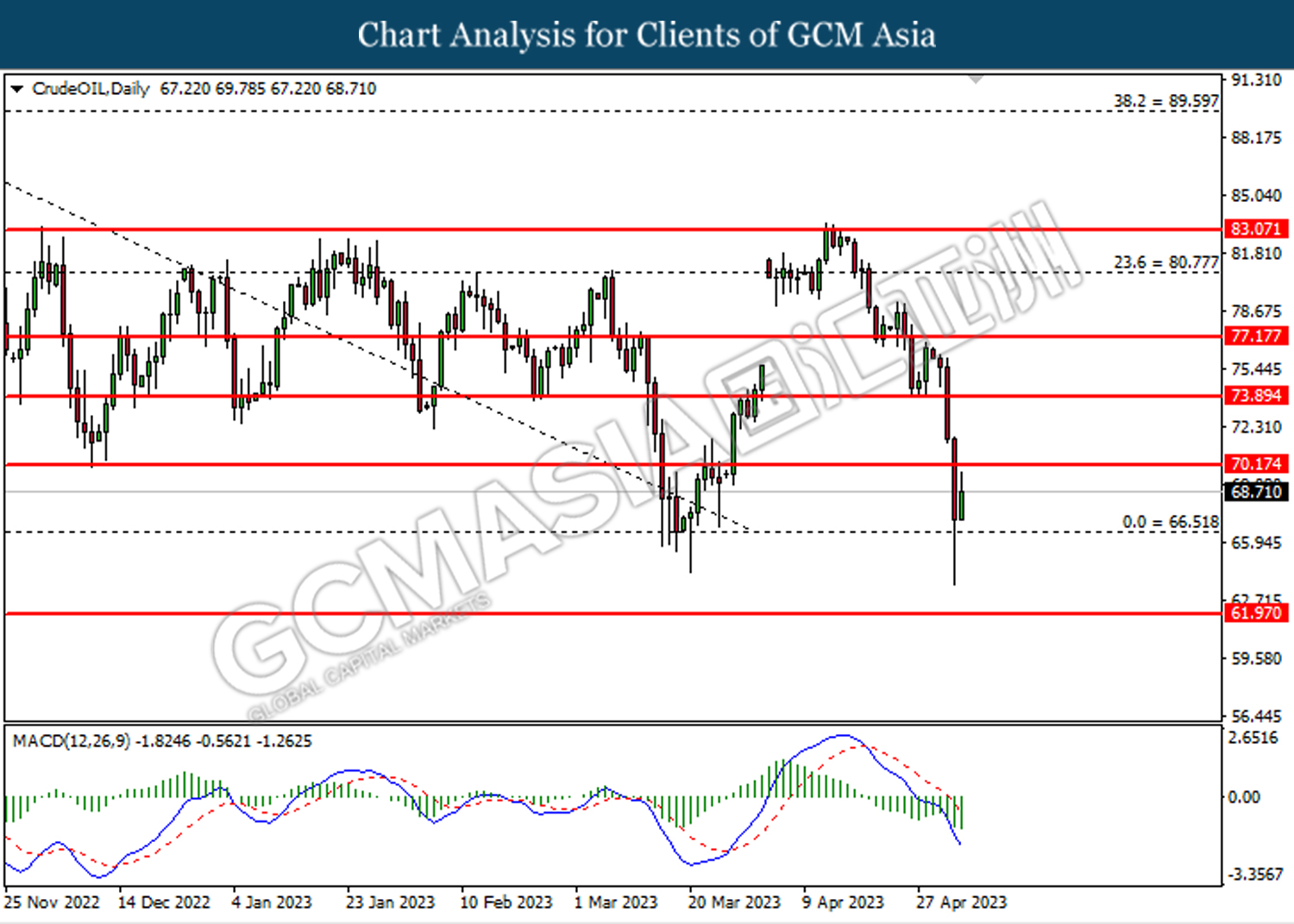

In the commodities market, crude oil prices edged up by 0.98% to $68.75 per barrel amid the heightening of geopolitical tension is expected to disrupt the oil supply chain. Besides, gold prices ticked down by 0.04% to $2049.50 per troy ounce as dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day JPY Children’s Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (Apr) | 50.7 | 51.0 | – |

| 20:30 | USD – Nonfarm Payrolls (Apr) | 236K | 180K | – |

| 20:30 | USD – Unemployment Rate (Apr) | 3.5% | 3.6% | – |

| 20:30 | CAD – Employment Change (Apr) | 34.7K | 20.0K | – |

Technical Analysis

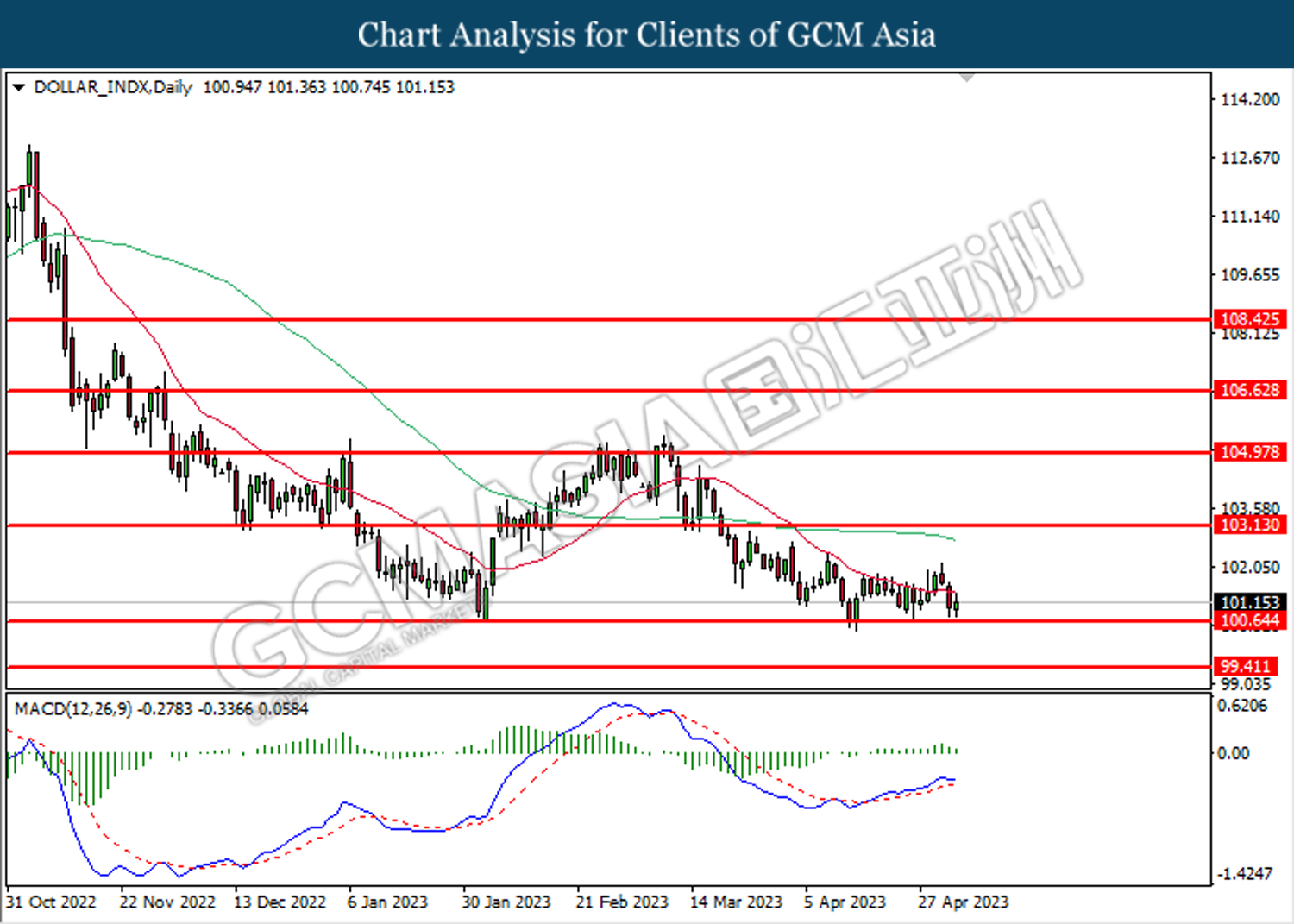

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

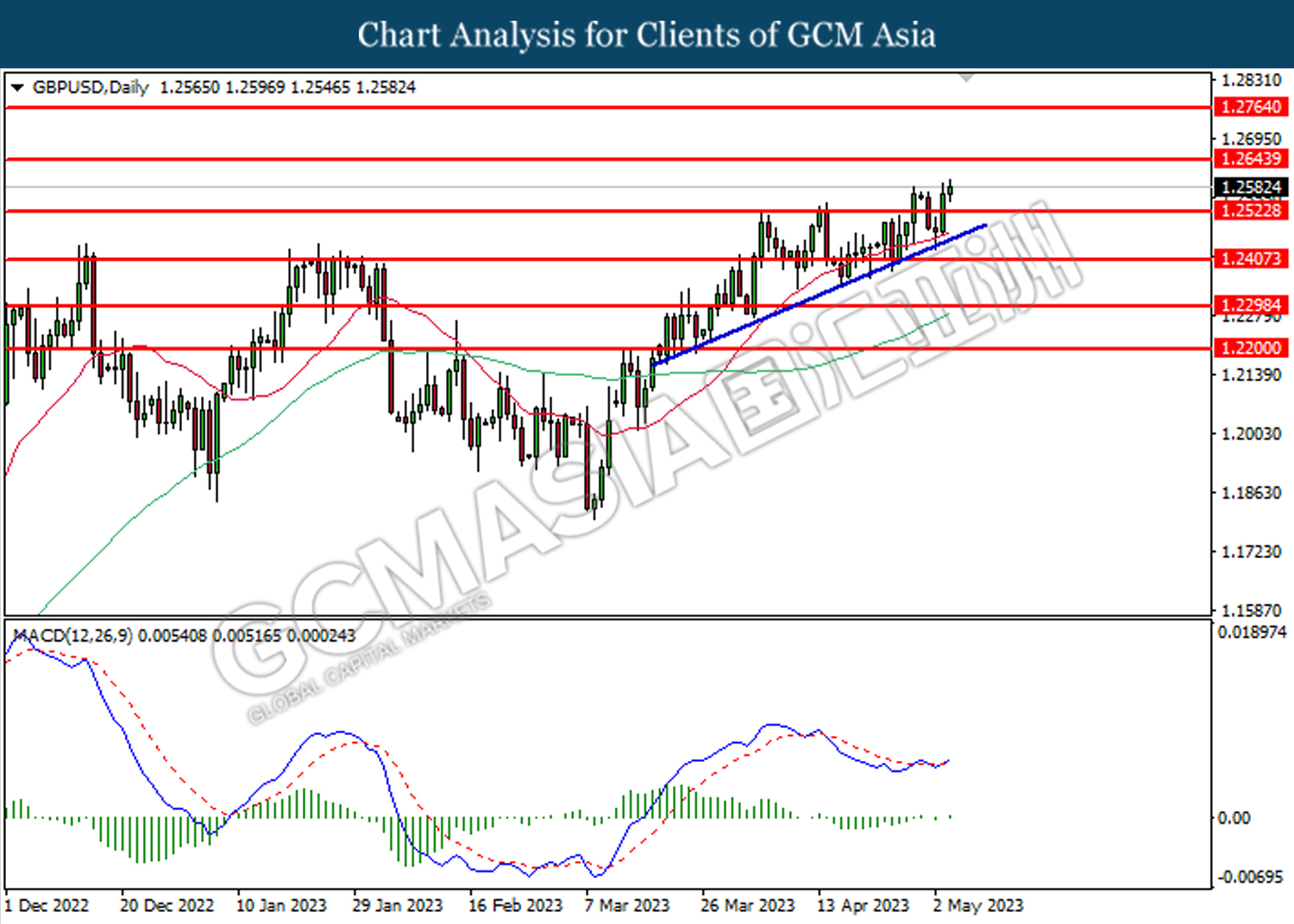

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

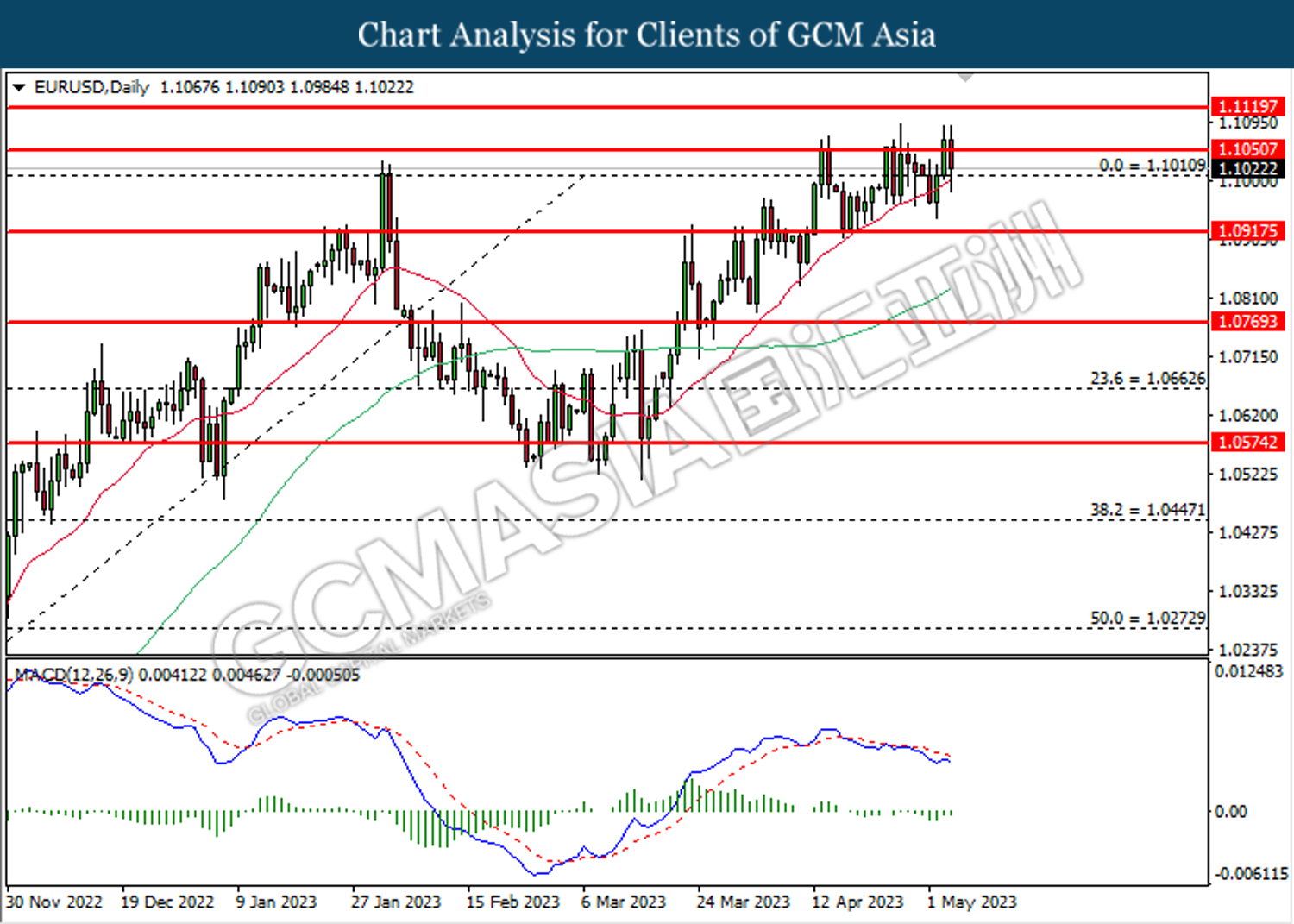

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.1050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

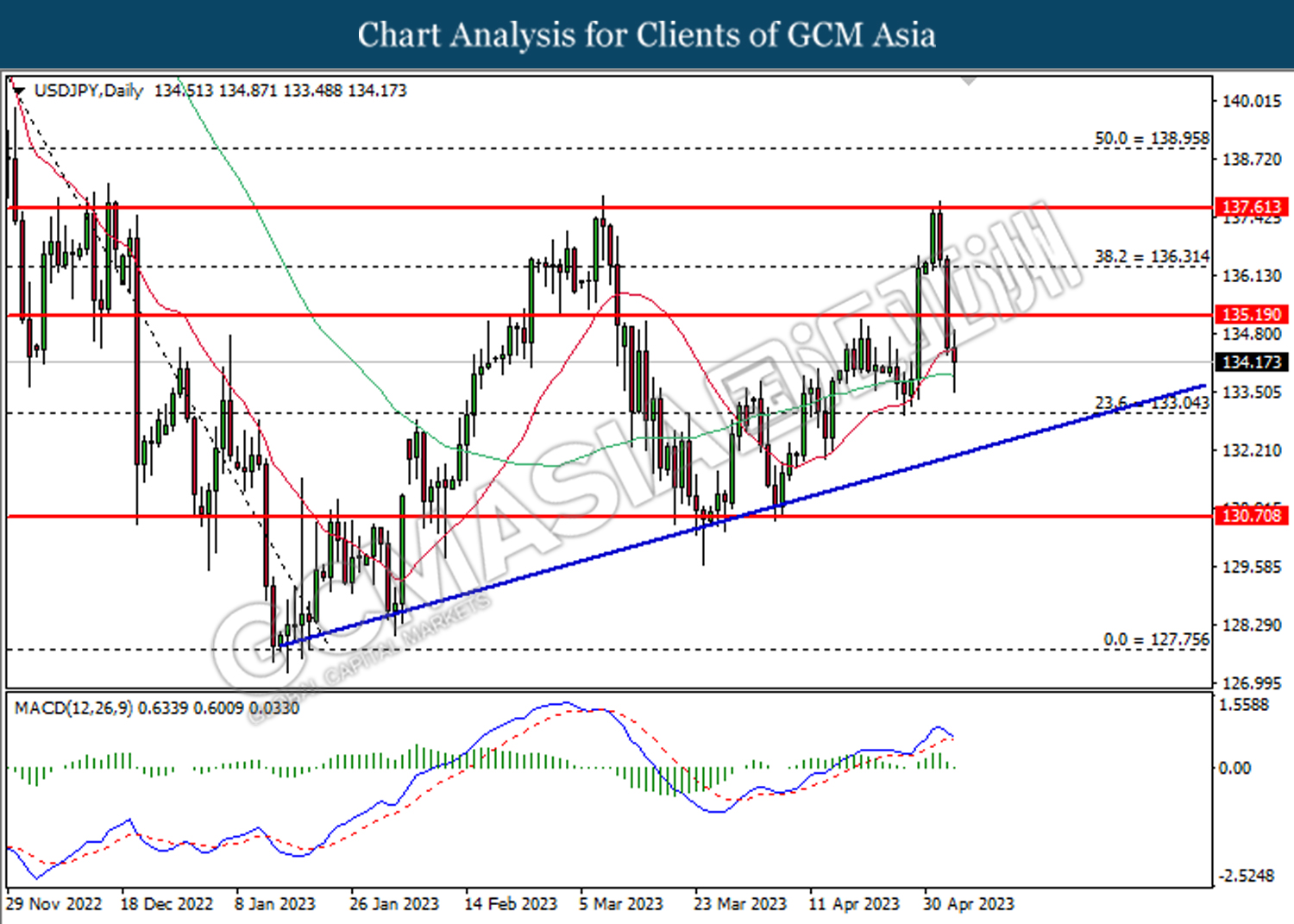

USDJPY, Daily: USDJPY was traded lower following the prior breakout below the previous support level at 135.20. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 133.05.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

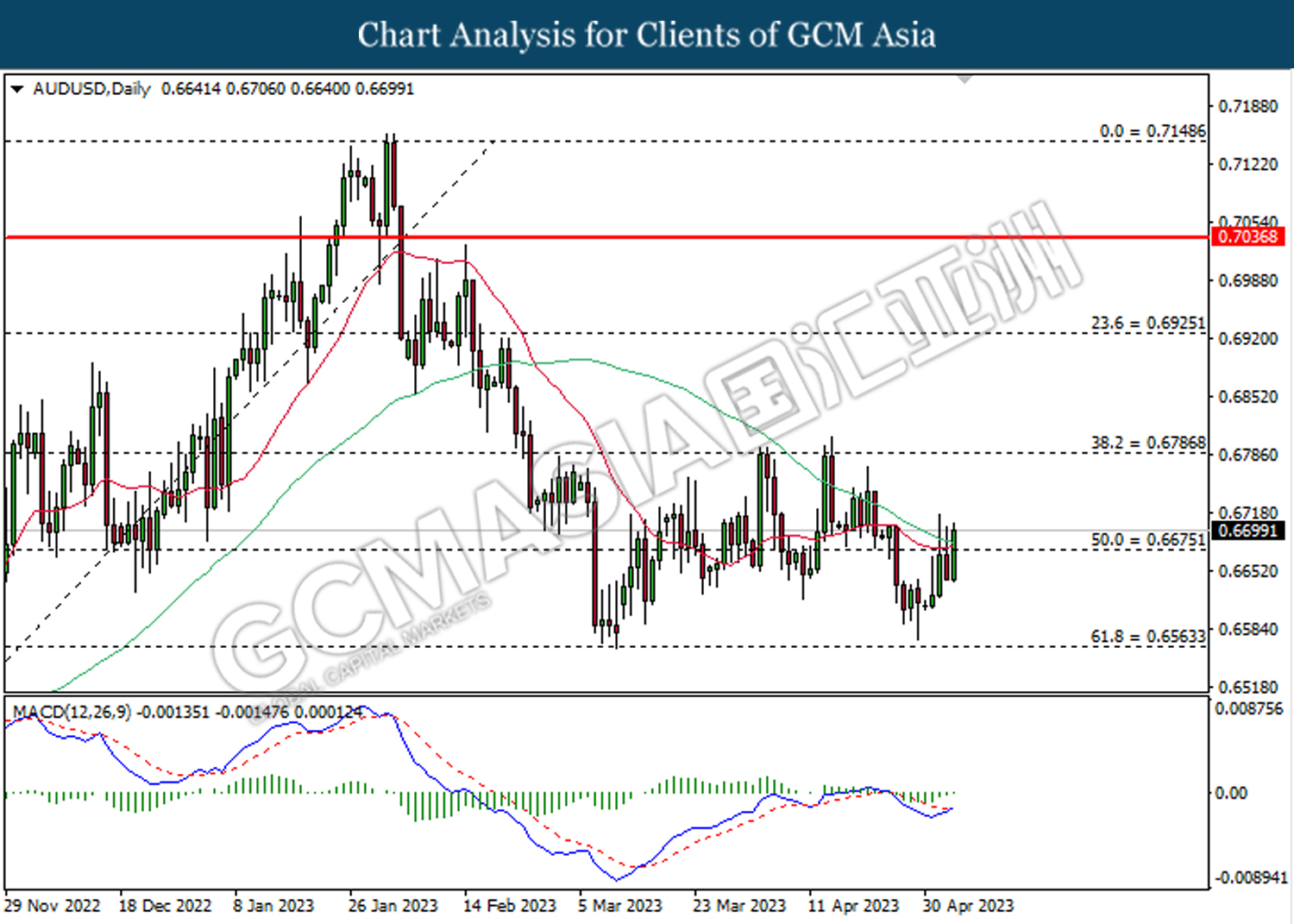

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

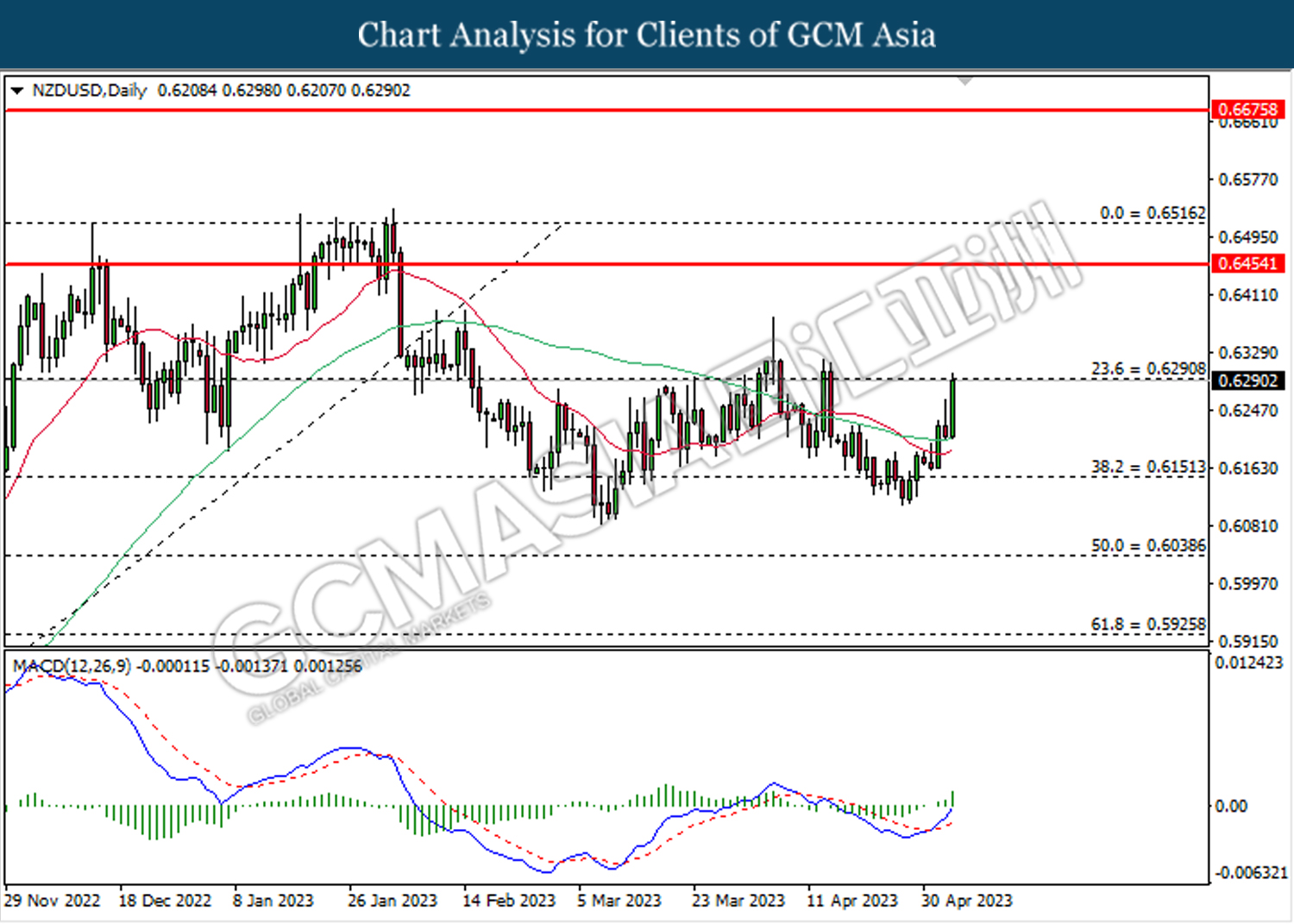

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

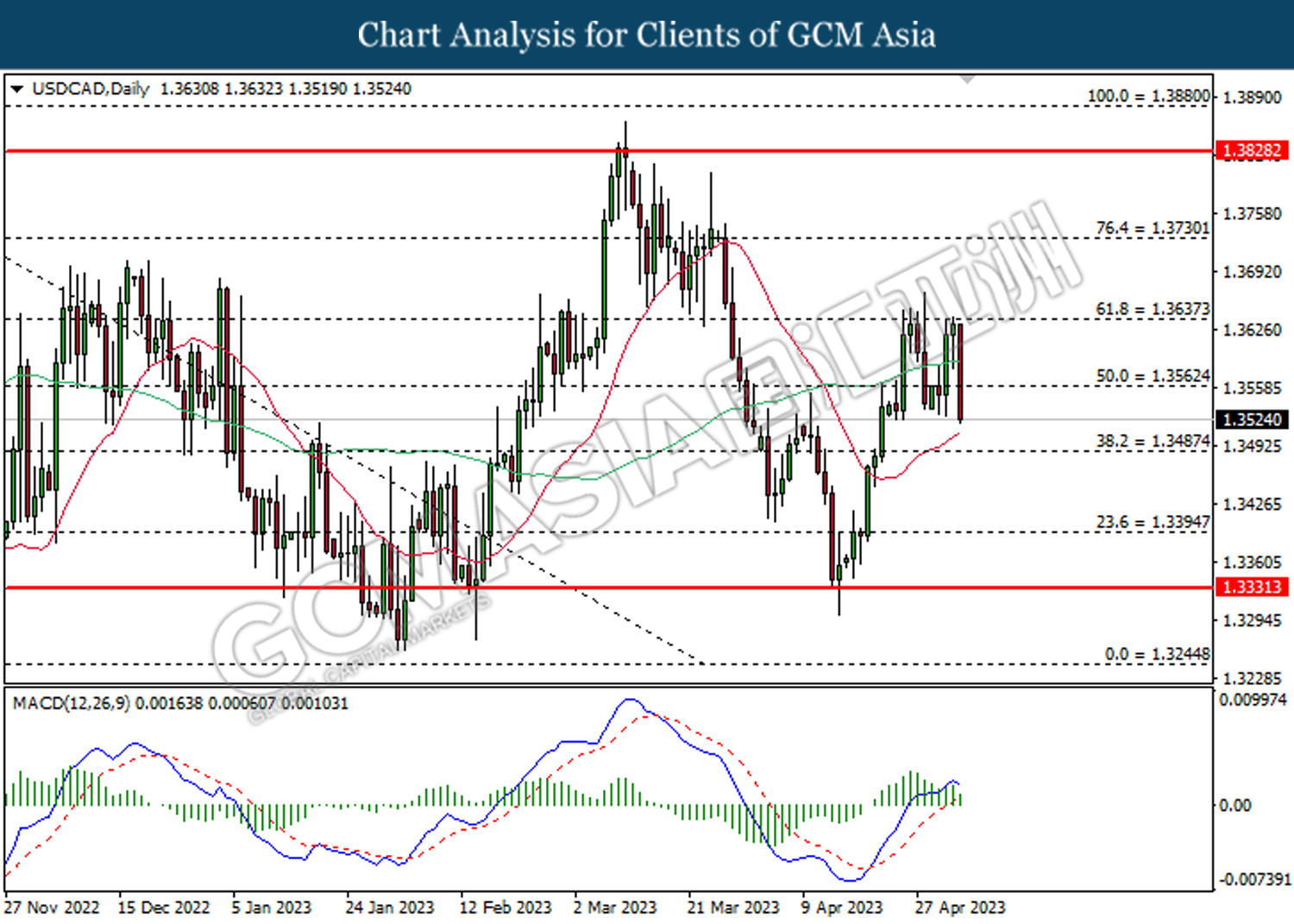

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3565. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3635, 1.3730

Support level: 1.3565, 1.3485

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8865. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.8780.

Resistance level: 0.8865, 0.9000

Support level: 0.8780, 0.8670

CrudeOIL, Daily: Crude oil price was traded lower following the prior breakout below the previous support level at 70.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 66.50.

Resistance level: 70.15, 73.90

Support level: 66.50, 61.95

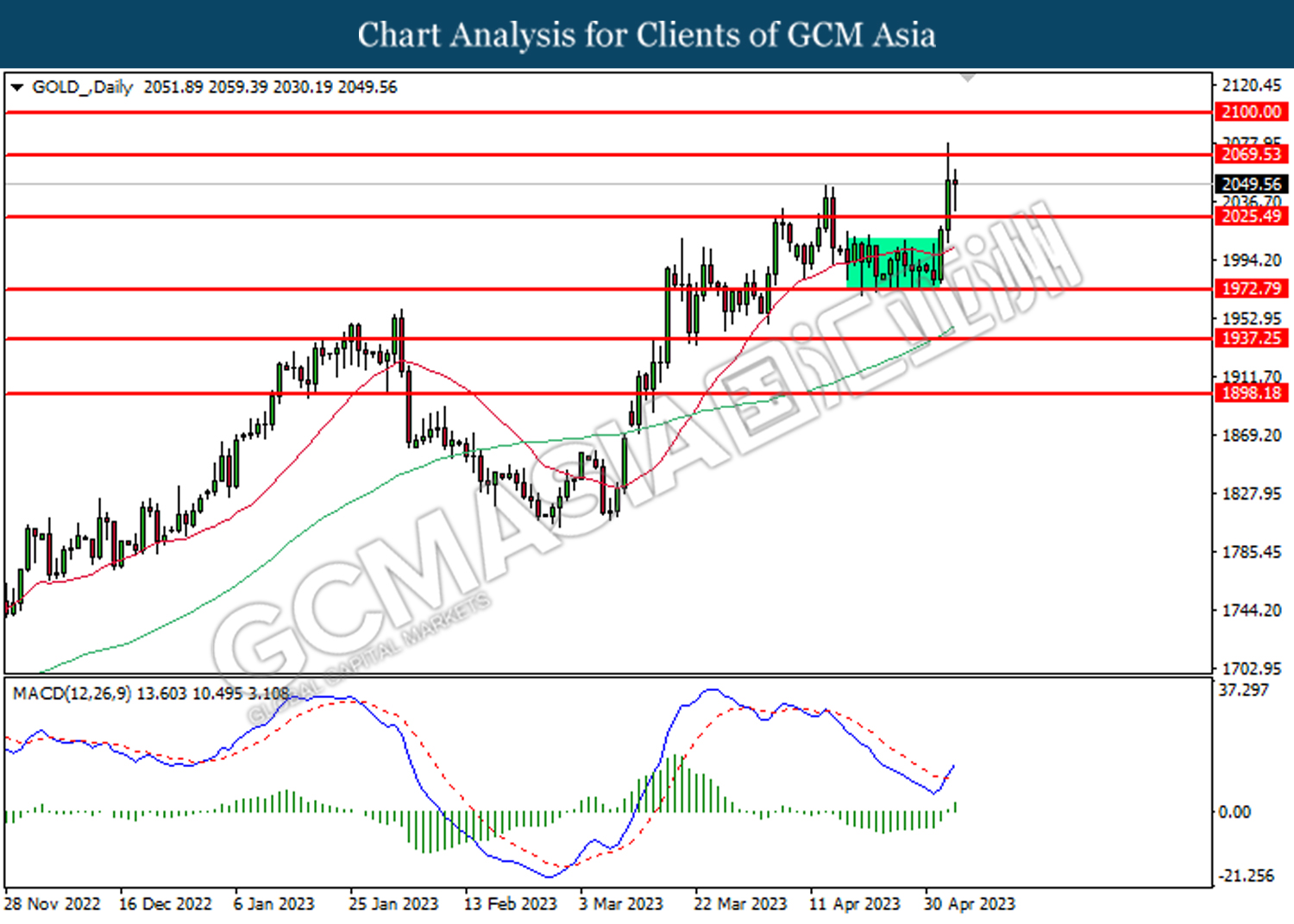

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 2069.55. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2069.55, 2100.00

Support level: 2025.50, 1972.80