8 May 2023 Morning Session Analysis

Greenback dipped despite upbeat Nonfarm Payroll.

The dollar index, which was traded against a basket of six major currencies, lingered near the lowest level in one month as the investors worried about the renewed banking turmoil as well as the unsolved debt ceiling issue. At this point in time, the PacWest Bancorp are still in the midst of exploring strategic options, which includes fund raising and potential sale. On the other side, the market participants are eyeing on the latest development of US debt ceiling’s negotiation. According to the latest news, Mr. Biden will host House Speaker Kevin McCarthy and other congressional leaders at the White House on Tuesday, his first direct contact in months as officials grapple with the possibility of a first U.S. default as early as June 1. Prior to that, the upbeat employment data surprised the investors, prompted the investors to rush into the dollar market. According to the Bureau of Labor Statistics, the US Nonfarm Payrolls rose from 165K to 253K this month, beating the consensus forecast at 180K. Besides, the US unemployment rate dropped from 3.5% to 3.4%. With that, it indicated that the US labor market surprisingly remained resilient despite a series of aggressive rate hike since more than a year ago. As of writing, the dollar index rose 0.10% to 101.00.

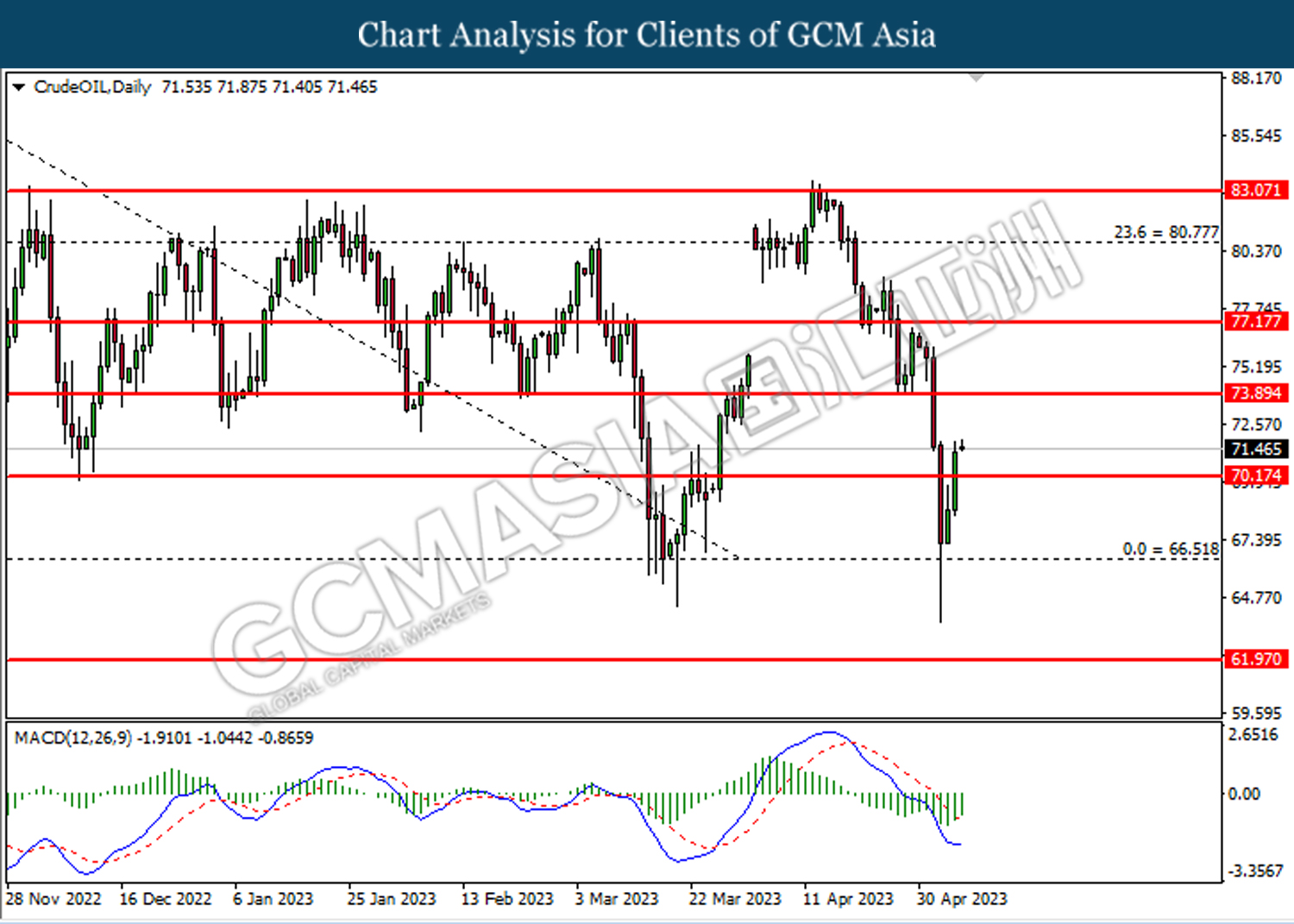

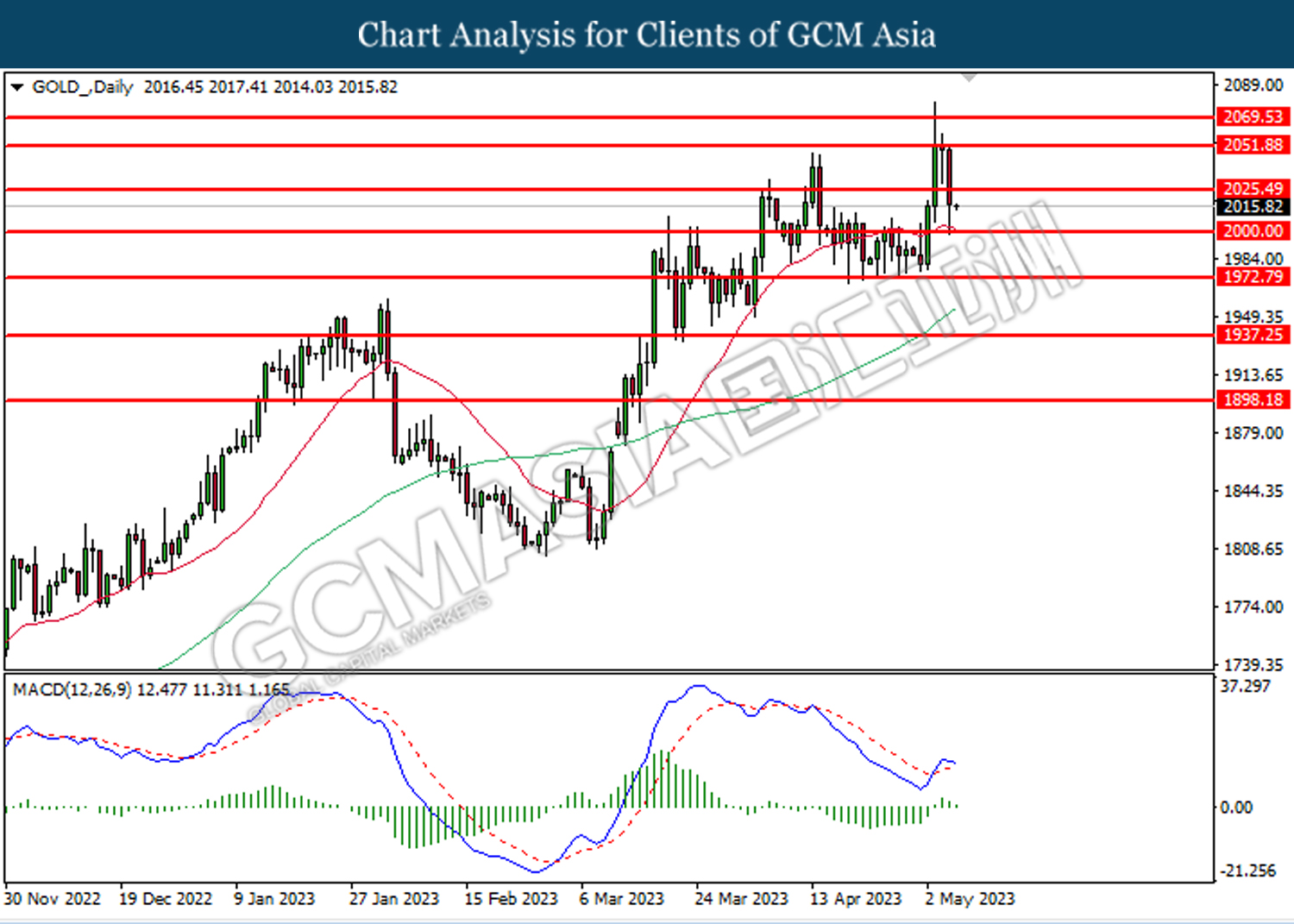

In the commodities market, crude oil prices edged up by 0.05% to $71.50 per barrel as a drone attack on the Ilsky oil refinery in southern Russia, has caused a fire. Besides, gold prices ticked down by -0.05% to $2015.85 per troy ounce as the stronger-than-expected employment data diminished the appeal of gold.

Today’s Holiday Market Close

Time Market Event

All Day GBP Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

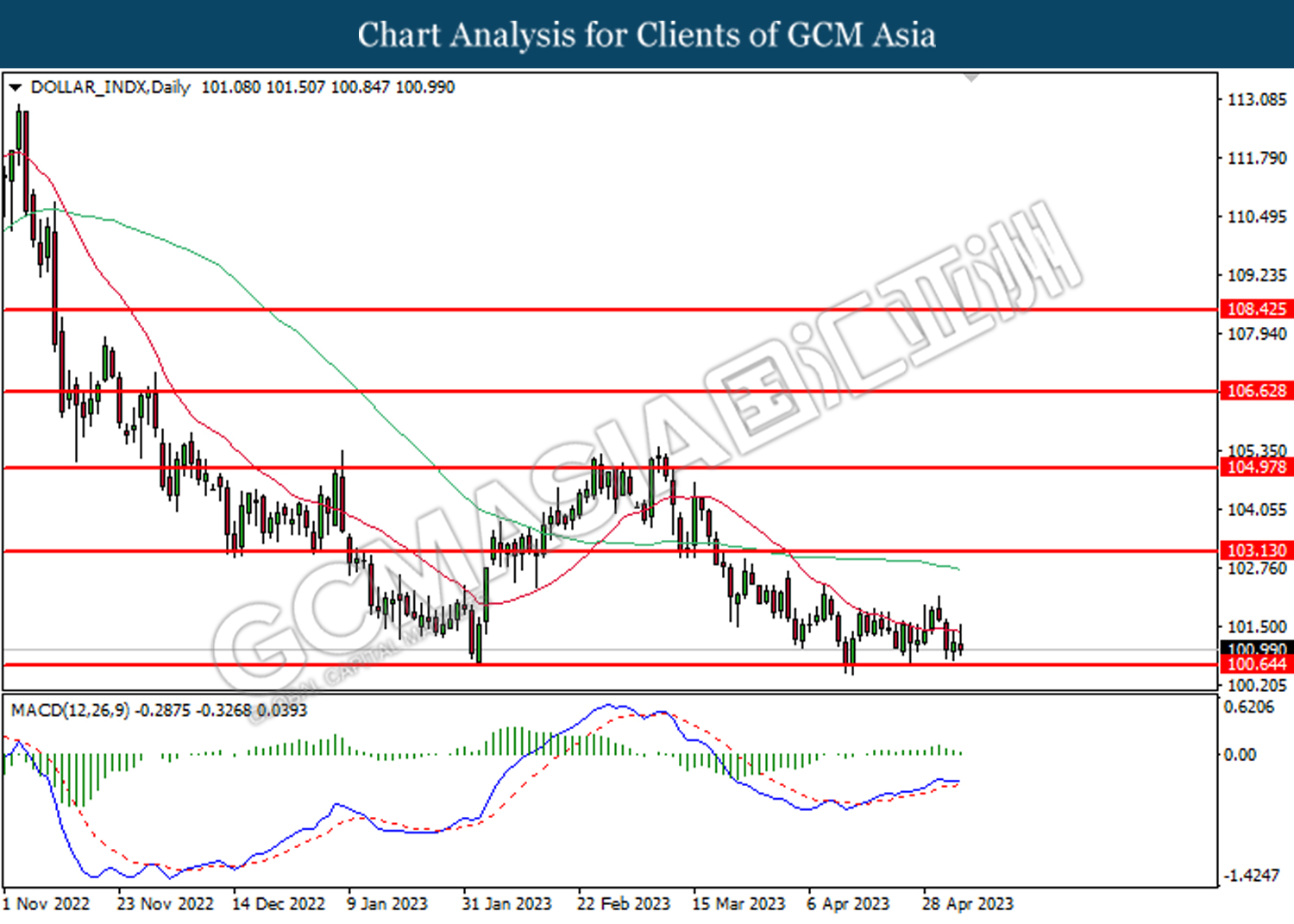

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 100.65. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

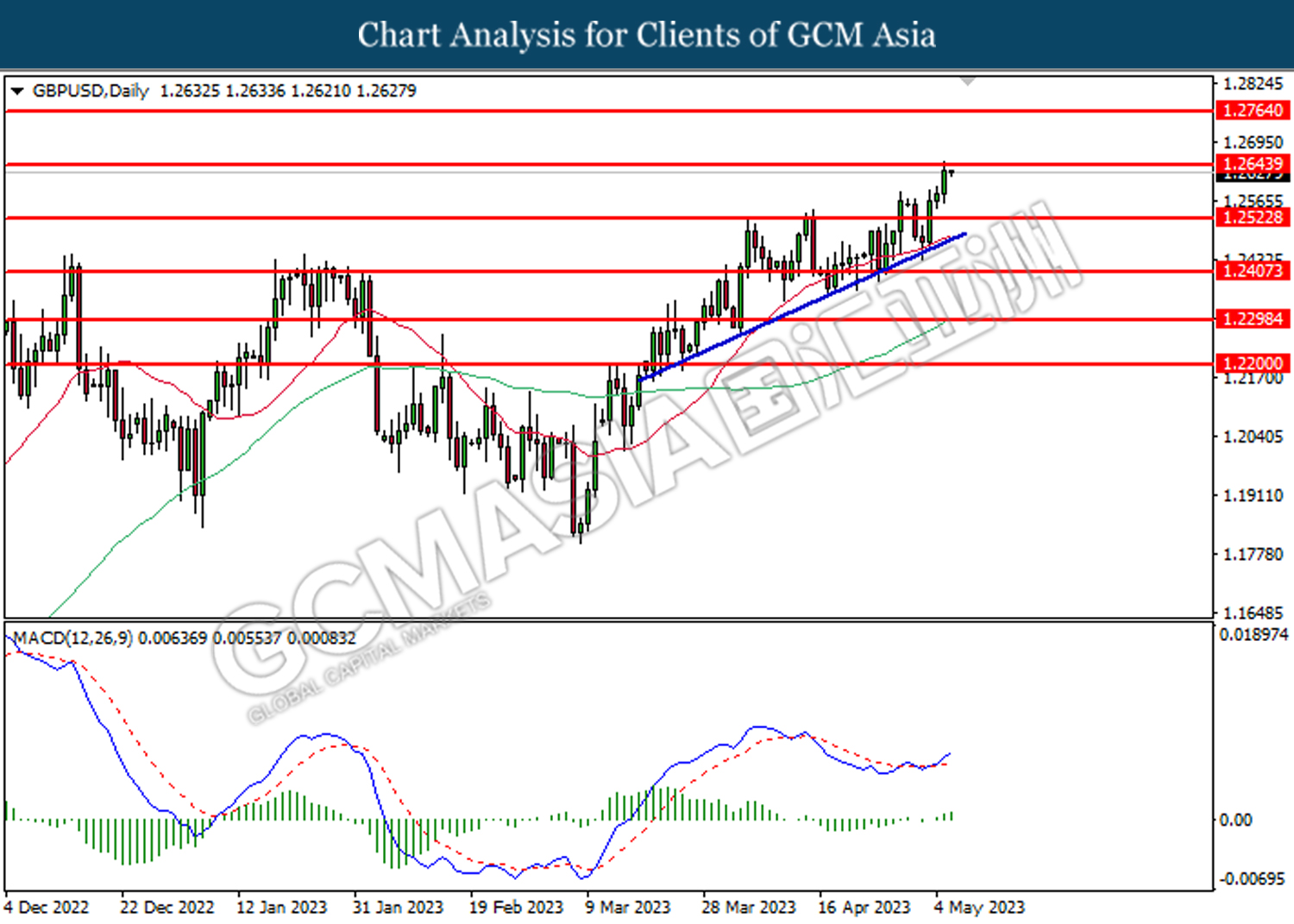

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

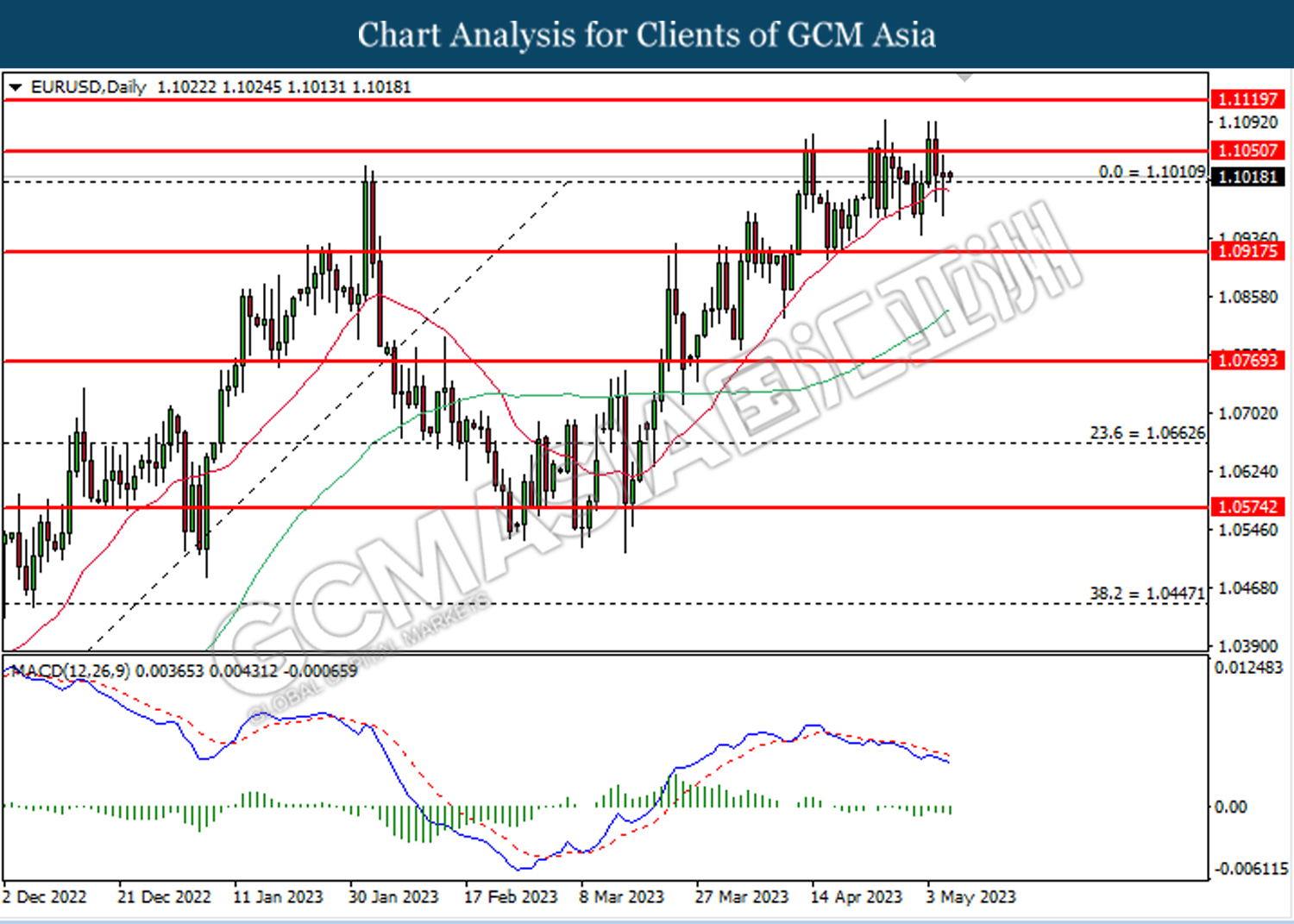

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.1050. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.1010.

Resistance level: 1.1050, 1.1120

Support level: 1.1010, 1.0915

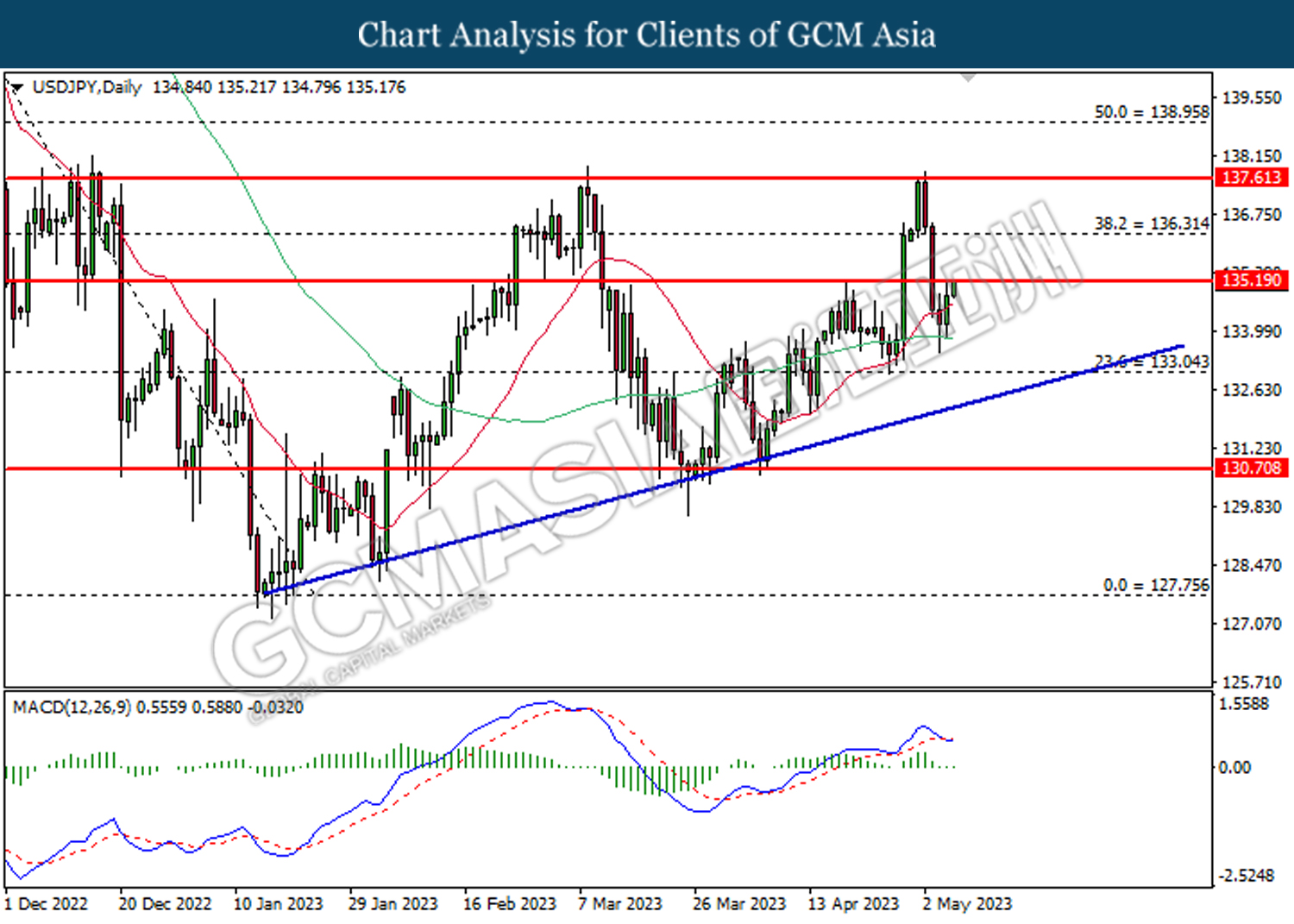

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

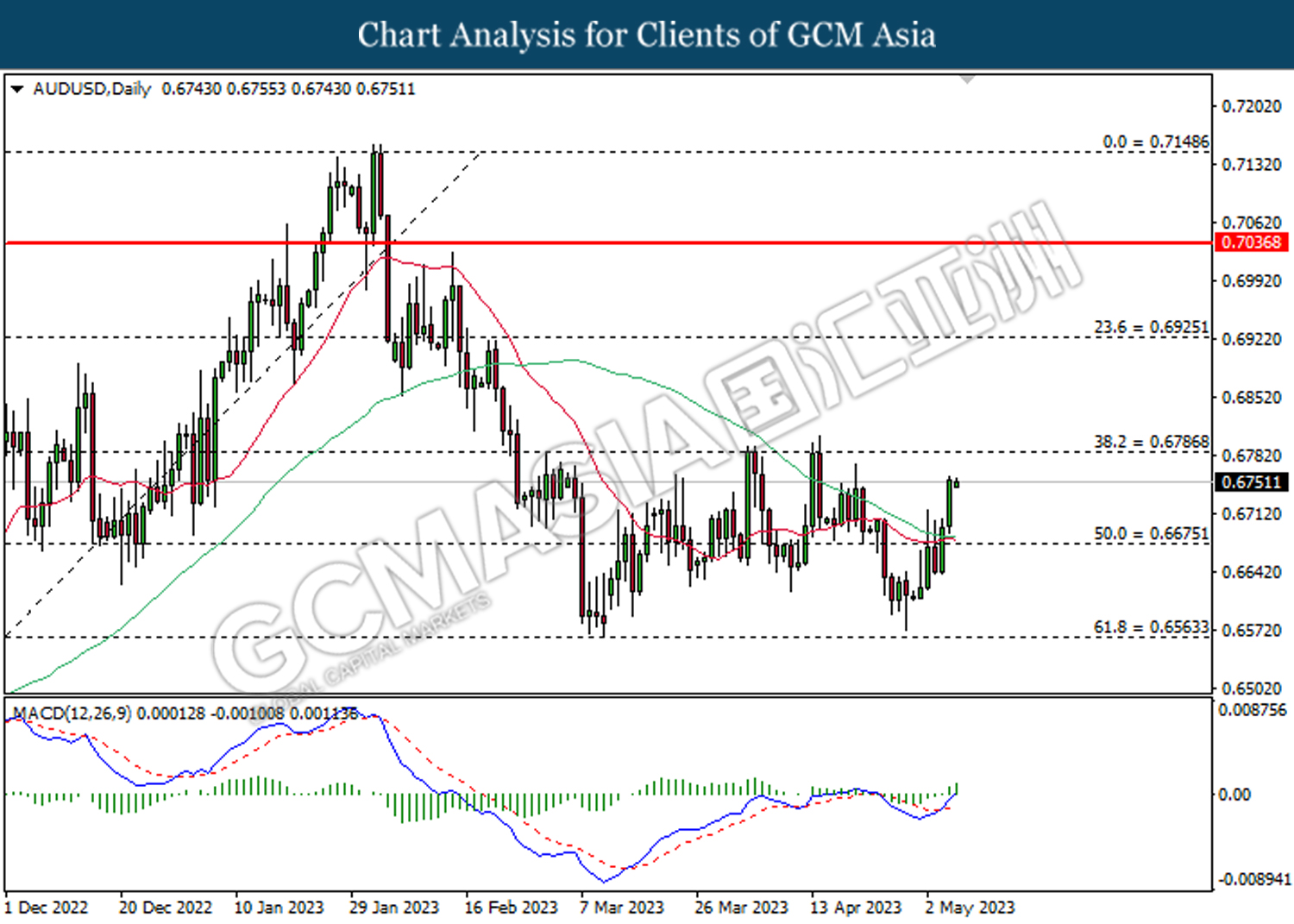

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

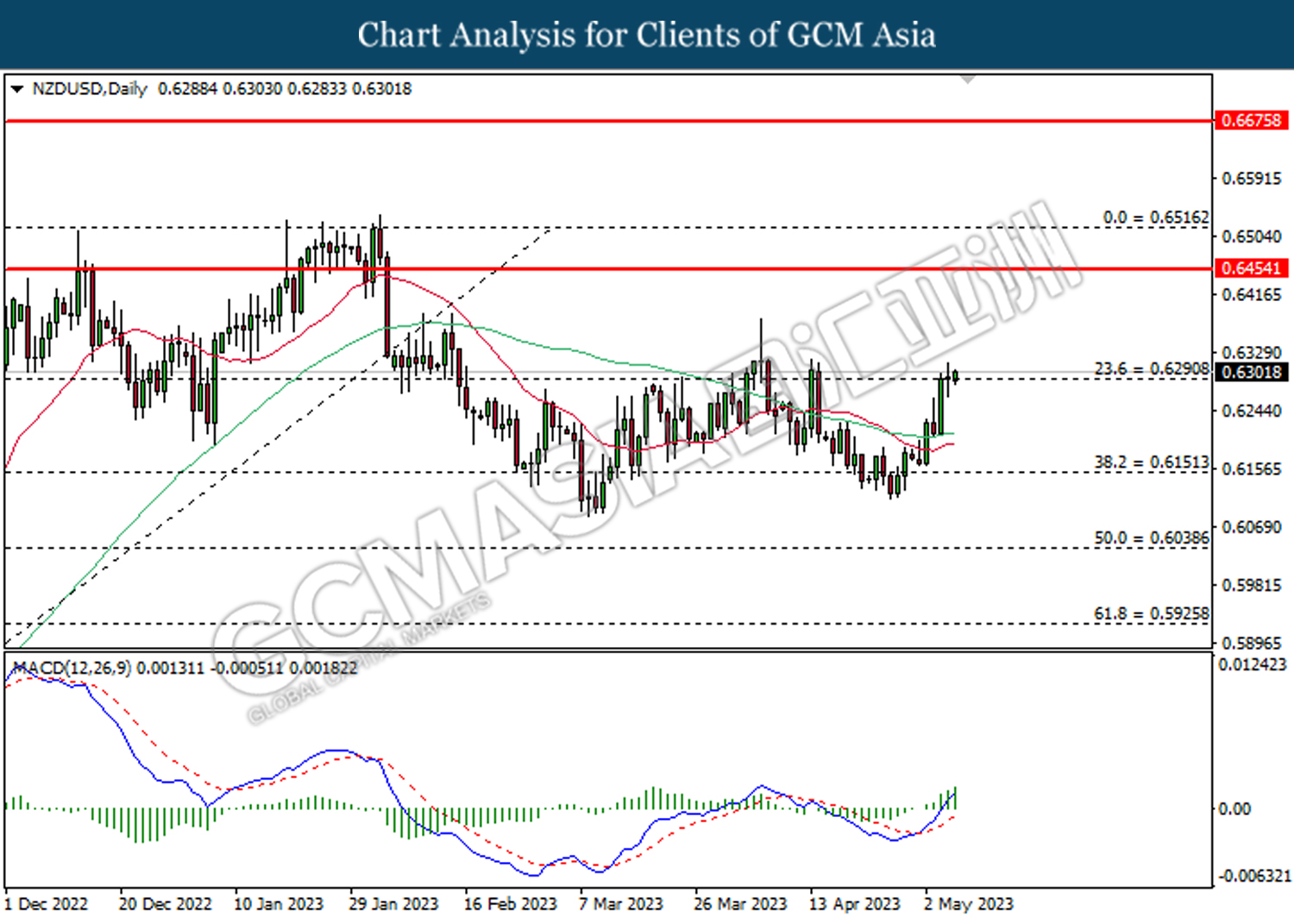

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

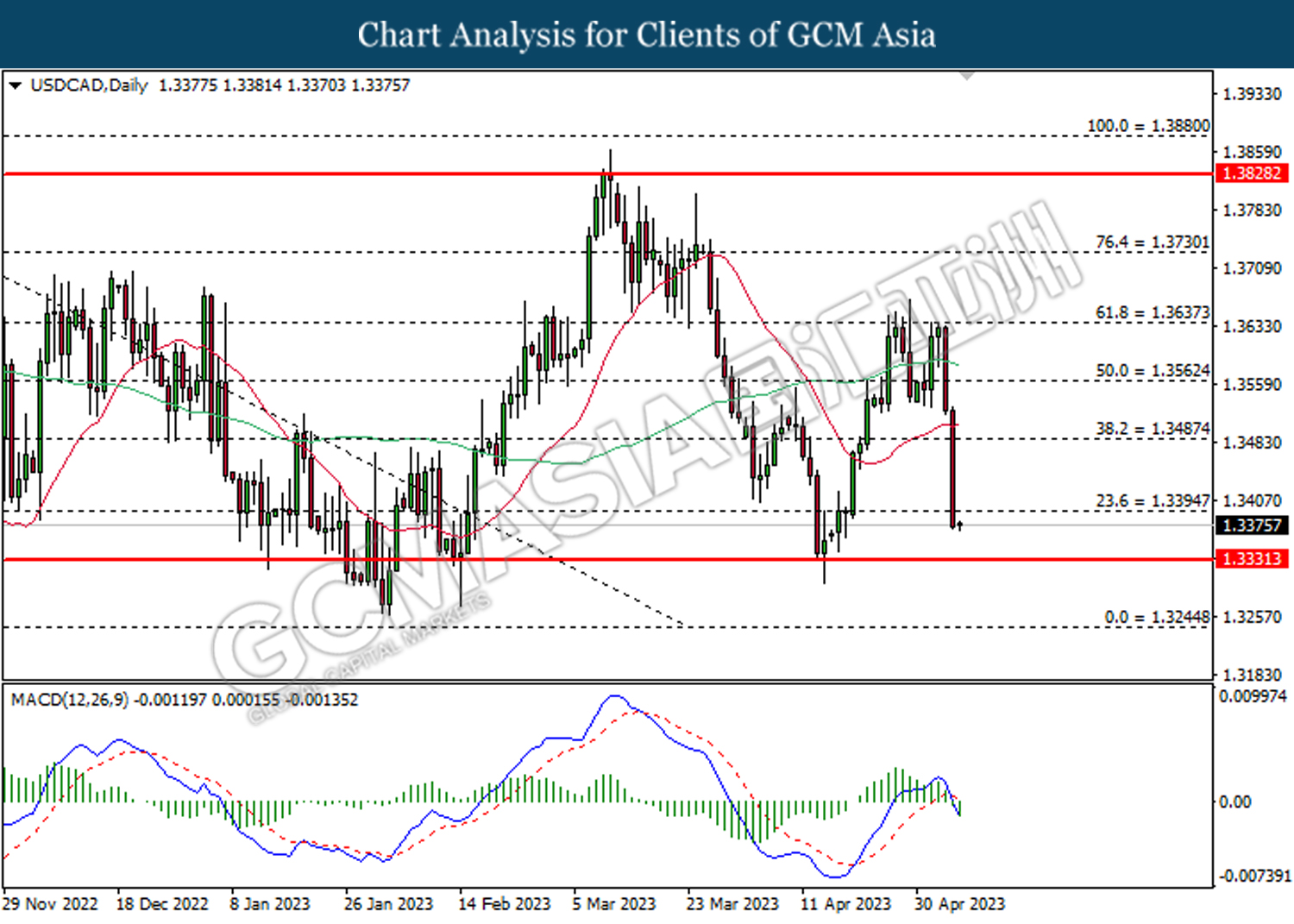

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 2025.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 2000.00.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80