17 August 2018 Daily Analysis

Dollar subdued amid mixed economic data release.

The dollar index has retreat following the release of mixed economic data last night. From economic factors, the Philadelphia Fed Manufacturing Index released yesterday had provide a bleak result with 11.9 against market expectations of 22.00. However, economic data for housing has improved where the Building Permi for July has increased by 1.311 million compared to the forecast reading of 1.310 million. However, sentiment in dollars remain subject to major headlines in the US conflict with countries in the world especially China where it has recently confirmed to continue trade talks with the US. Investors will remain focus their attention on US next move to determine its trend further. The dollar index has dropped by 0.13% to 96.37 as of writing. Meanwhile, the GBPUSD has slipped 0.05% to 1.2719 at the time of writing following the release of inflation data CPI that met expectations overnight. Based on the data released by National Statistics in the UK, the rate of change in prices for consumer goods remained unchanged with a reading of 0.0% that is in line with economist forecasts. But the data could not attract bullish momentum long-term where sentiment in sterling pound as a whole is still subjected to fears in the Brexit plan which could not reach any agreement between the UK and the EU.

In the commodity market, the price of crude oil has increased 0.04% to $65.42 a barrel following with confirmations from the US and China to begin new discussions to resolve conflicts between two countries that could provide optimistic views on crude demand. On the other hand, the price of gold has rebounded by 0.30% to $1176.90 per troy ounce after yesterday sell-off due to a booming dollar with good economic data recently and also optimistic views on US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15.30 AUD RBA Assist Gov Ellis Speak

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17.00 | EUR – CPI (MoM) (Jul) | 0.1% | -0.3% | – |

| 20.30 | CAD – CPI (MoM) (Jul) | 0.1% | 0.1% | – |

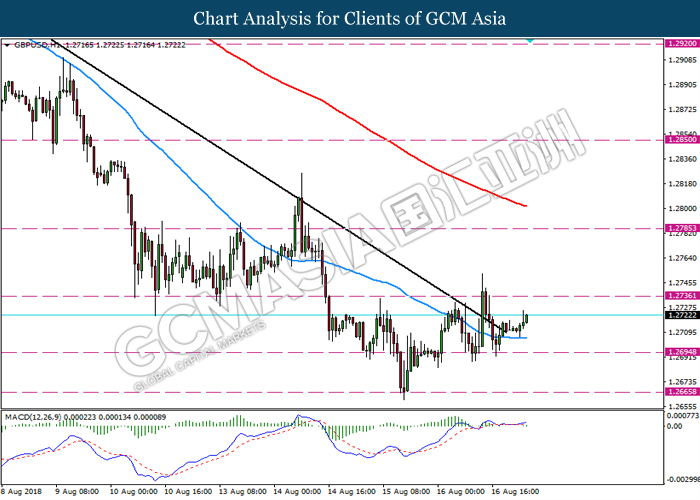

GBPUSD

GBPUSD, H1: GBPUSD was traded higher following recent rebound from the support level 1.2695. Recent price action and MACD which display starting signal of bullish momentum suggest the pair may extend its gains towards the resistance level 1.2735.

Resistance level: 1.2735, 1.2785

Support level: 1.2695, 1.2665

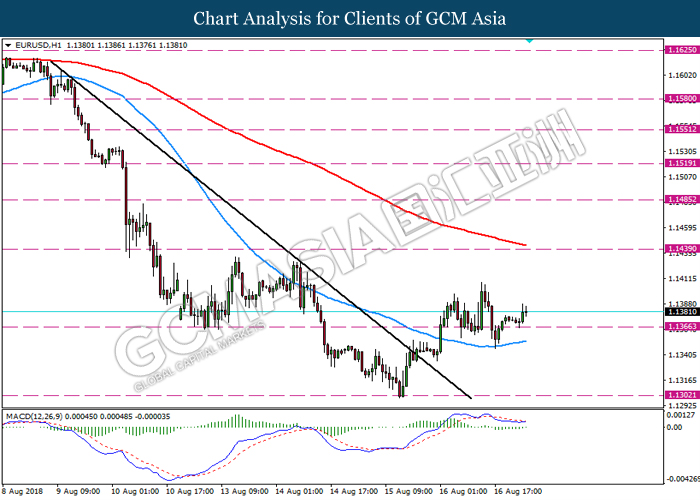

EURUSD

EURUSD, H1: EURUSD was traded higher following prior rebound from the support level 1.1365. Recent price action and MACD which illustrate signals that is remain subjected to bullish momentum suggest the pair to extend its gains towards the resistance level 1.1440.

Resistance level: 1.1440, 1.1485

Support level: 1.1365, 1.1300

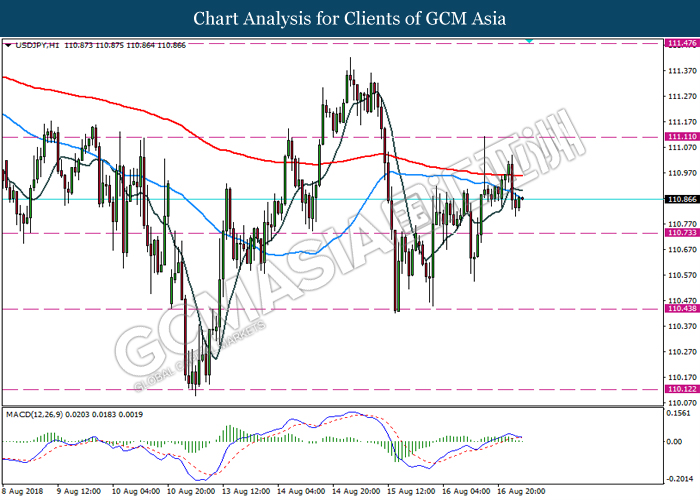

USDJPY

USDJPY, H1: USDJPY was traded lower following prior retracement near the resistance level 111.10. Price action and MACD which display starting bearish signal suggest the pair to extend its losses towards the support level 110.75.

Resistance level: 111.10, 111.45

Support level: 110.75, 110.45

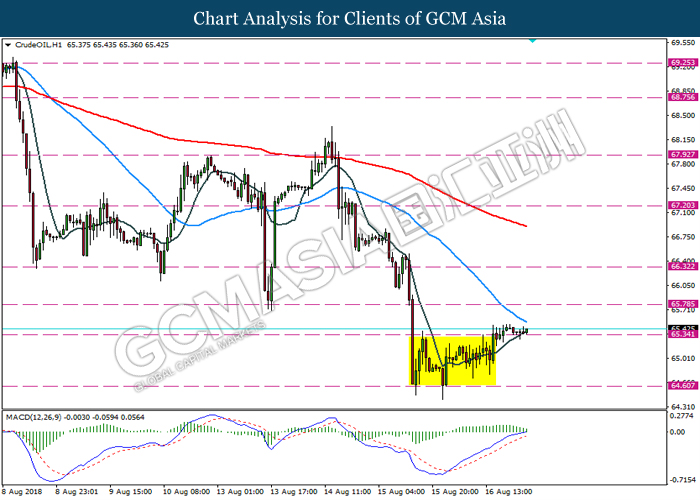

CrudeOIL

CrudeOIL, H1: Crude oil price was traded higher following recent breakout above the resistance level 65.35. Recent price action and MACD which illustrate clear bullish momentum suggest the commodity could be extend its gains towards the resistance level 65.80

Resistance level: 65.80, 66.30

Support level: 65.35, 64.60

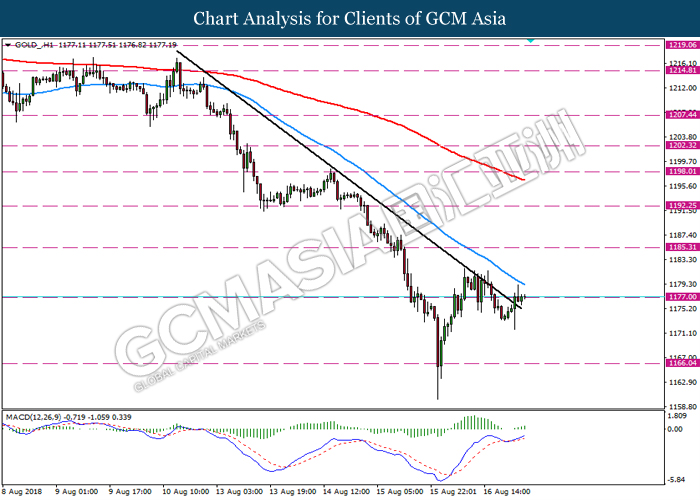

GOLD

GOLD_, H1: The price of gold was traded higher following prior breakout above the trend line and currently testing the resistance level 1177.00. MACD which display bullish momentum suggest the pair to extend its gains after it breaks above the resistance level 1177.00.

Resistance level: 1177.00, 1185.00

Support level: 1166.00, 1155.00